PDF Attached

Another

impressive upside run in CBOT agriculture markets, with exception of oats declining on the day. When will this market peak? We think it still has some upside early next week up through the USDA May 12 S&D report, at least. Statistics Canada released March

31 stocks and the data was a little friendly.

Private

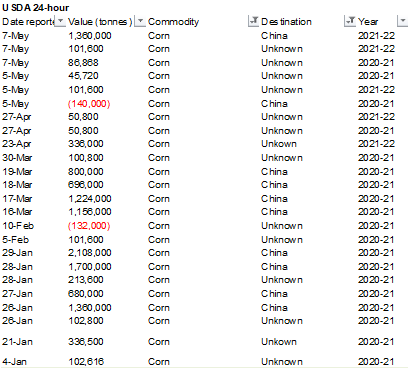

exporters reported to the U.S. Department of Agriculture the follow activity:

Export

sales of 1,360,000 metric tons of corn

for delivery to China during the 2021/2022 marketing year; and

Export

sales of 188,468 metric tons of corn for delivery to unknown destination. Of the total, 86,868 metric tons is for delivery during the 2020/2021 marketing year and 101,600 metric tons is for delivery during the 2021/2022 marketing year.

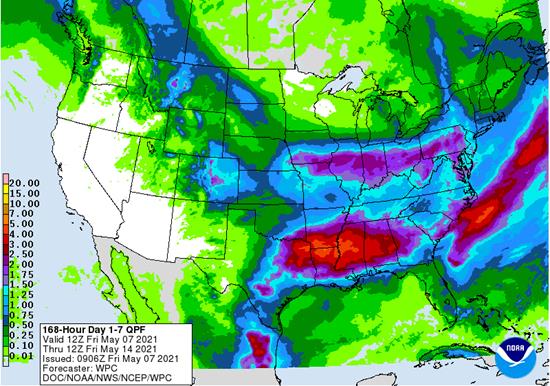

Next

7 days

World

Weather, Inc.

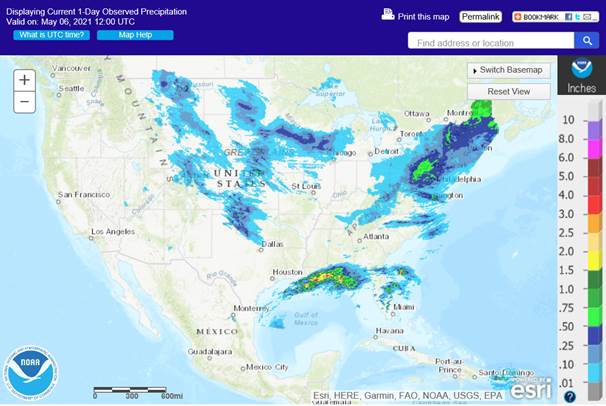

WEATHER

TO WATCH THIS WEEKEND

-

Rain

and snow will develop in northwestern U.S. Plains and western Canada’s Prairies -

Significant

moisture will impact central and southwestern Alberta with light to locally moderate precipitation from southern Alberta and far southwestern Saskatchewan into central and western South Dakota, including the southwest one-third to one half of North Dakota

and Montana -

Moisture

totals of 0.20 to 0.80 inch with local totals to 1.25 inches is expected except in west-central and southwestern Alberta where some 1.00 to 2.00-inch amounts of moisture is possible -

Some

significant snow will accumulate, but only briefly -

The

moisture will be extremely welcome and helpful to spring planting, seed germination and plant establishment as warming evolves

-

The

remainder of Saskatchewan, Manitoba, the northeast half of North Dakota, Minnesota, northern Iowa, Wisconsin and parts of Michigan will be dry for the next week to 8 or 9 days -

Totally

dry weather is not likely, but resulting precipitation will not be very great -

Improved

rain chances in these areas should begin late in the second weekend of the two week outlook

-

Temperatures

will be cool in these areas for much of the coming five days with some warming late next week and into the following weekend -

Frequent

frost and freezes are expected with Tuesday morning of next week coldest in the northern Midwest

-

West

and South Texas rain potentials may improve as time moves along during the next week to ten days -

The

GFS model is too wet, but the trend toward more instability in the atmosphere is good and “some” moisture intrusion from eastern Mexico and the Gulf of Mexico is possible as time moves along -

No

general soaking, but at least some potential for more frequent showers and thunderstorms especially in South Texas and the Texas Coastal Bend -

West

Texas rainfall will be sporadic and too light for serious change in soil moisture through mid-week next week, but there may be a few greater thunderstorms in the following weekend – confidence is low, though -

Lower

U.S. Midwest, Delta and Tennessee River Basin may be a little too wet for ideal field working conditions and more sunshine and warming would be welcome -

A

better mix of rain and sun will impact the U.S. southeastern states over the next two weeks -

Drought

remains a concern for the western United States -

Soil

moisture is already restricted in unirrigated areas of the Pacific Northwest where some winter crop production is threatened -

Water

supply for irrigation remains good, though -

Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for eastern parts of the nation during the next two weeks -

The

precipitation will begin erratically and then increase over time -

Brazil’s

Safrinha crops will continue to dry down over the next two weeks -

The

pattern is normal for this time of year, but what is not normal was the early demise of soil moisture in April that has left late planted crops without sufficient moisture to support good yields – production cuts are inevitable

-

A

few showers are suggested for late next week and the following weekend in the interior south including some southern Safrinha crop areas, but the precipitation will be too brief and light to counter evaporation -

Temperatures

will be warm enough to add more stress during the coming week with highs in the 80s and lower 90s in southern Safrinha corn areas and more in the lower the middle 90s in the north -

Some

cooling is expected in the second week, but the change will be slight -

Argentina

weather will be favorably mixed over the next two weeks with brief bouts of precipitation and more significant periods of dry weather -

Crop

maturation and harvest progress should advance well -

Europe

will receive waves of rain for the next ten days bolstering soil moisture for many areas including France and the U.K. which have been driest -

Temperatures

will be near to below average for a while -

Temperatures

will trend warmer in eastern Europe next week -

Some

heavy rain is possible in southeastern France, parts of southern Germany and the Alps during the next couple of days -

Several

waves of rain will impact western Russia, Belarus, the Baltic States and in a few areas of northern Ukraine during the coming week maintaining wet field conditions

-

Farming

activity will remain restricted in these areas with rising concern over delayed spring planting in Russia -

Less

frequent and less significant rain is expected late next week through May 20, although it will not be completely dry -

Good

field progress will occur farther to the south where much less precipitation is expected and temperatures will be more seasonable; including southern and central Ukraine and Russia’s Southern Region -

Temperatures

will be cooler than usual in the wetter areas of the northwest this week and then a little more seasonable May 14-20 -

Eastern

Russia New Lands will experience a dry and warm bias through the next ten days -

The

environment will eventually be great for spring planting -

North

China Plain weather will be limited on precipitation for the next week and temperatures will be warming -

A

steady decline in soil moisture is expected with temperatures trending warmer

-

A

rising need for rain is expected later this month -

Excellent

planting progress is anticipated for a while until dryness becomes more of an issue -

Northeastern

China will experience frequent rain and mild to cool weather over the next week resulting in farming delays, but soil moisture will be bolstered for use later this spring -

Warming

and less rain is expected in the following week, May 14-20 -

Southern

China rain will fall abundantly and frequently over the next couple of weeks limiting some farming activity and keeping the region saturated or nearly saturated -

Some

local flooding will be possible at times -

Australia

precipitation over the next two weeks will be sporadic and mostly light. -

The

moisture will support some early season wheat, barley and canola planting, but follow up moisture will be needed -

A

few sporadic showers may occur in other areas, but resulting rainfall will not likely be very great except in the Great Dividing Range of the east

-

Temperatures

will be near to above average -

South

Africa will receive some late season showers again today and Saturday -

Next

week will trend drier once again -

Most

of the showers will not be significant rain producers -

The

environment will be good for harvesting and late season crop maturation -

Production

this year has been very good for nearly all crops -

Winter

wheat and barley planting should benefit from the moisture, although rain will soon be needed in the west -

India

weather will remain good for winter crop maturation and harvest progress, although showers will continue periodically in some areas -

Portions

of far southern India will be wetter than usual over the next couple of weeks and rain will also fall frequently from Bangladesh into the far Eastern States -

Delays

to harvest progress will be greatest in the south -

Showers

in northern India will not be great enough to be much of a factor to crop maturation or harvesting -

No

tropical cyclones are present in the world today -

Southern

Oscillation Index is mostly neutral at +2.60 and the index is expected to move a little higher over the next few days -

Xinjiang

China’s cotton areas experienced seasonable temperatures and dry conditions Thursday with mostly warm weather expected through the weekend -

Cooling

is expected next week with a few showers likely in the northeast -

Crop

development and additional planting are occurring favorably -

North

Africa rainfall will receive erratic rainfall over the next two weeks with net drying expected -

Temperatures

are trending warmer than usual -

West-central

Africa will see a mix of rain and sunshine during the next ten days -

Crop

conditions will stay good -

East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall is coming to Kenya, Ethiopia and northern Tanzania during the coming week -

Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks -

Greater

rain is needed in the northern and western Philippines and in southern parts of central Vietnam and other mainland crop areas -

Sulawesi

also needs a boost in rainfall -

New

Zealand precipitation for the next two weeks will be increasing across North Island while staying wet in western portions of South Island

-

Temperatures

will trend cooler with the increasing rainfall

Source:

World Weather, Inc.

Friday,

May 7:

- China

customs publishes trade data, including imports of soy, edible oils, meat and rubber - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC

monthly report on Chinese grains & oilseeds - Canada’s

StatsCan to issue wheat, canola, barley and durum stockpile data - FranceAgriMer

weekly update on crop conditions

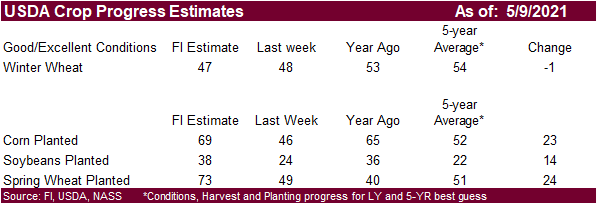

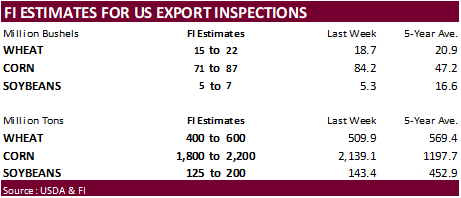

Monday,

May 10:

- Malaysian

Palm Oil Board data on April stockpiles, output, exports, 12:30pm local - Malaysia

May 1-10 palm oil export data - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - USDA

export inspections – corn, soy and wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - HOLIDAY:

Russia

Tuesday,

May 11:

- Agrana

full-year earnings - France

agriculture ministry monthly crops outlook

Wednesday,

May 12:

- China

farm ministry’s CASDE outlook report - FranceAgriMer

monthly grains report - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - EIA

weekly U.S. ethanol inventories, production - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Brazil’s

Unica data on cane crush and sugar output (tentative)

Thursday,

May 13:

- New

Zealand April food prices, 10:45am local - Port

of Rouen data on French grain exports - USDA

net-export sales for corn, soy, wheat, cotton, pork, beef, 8:30am - HOLIDAY:

Indonesia, Malaysia, Singapore, India, Dubai, France, Germany

Friday,

May 14:

- ICE

Futures Europe weekly commitments of traders report, 6:30pm London - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Indonesia, Malaysia, Dubai

Source:

Bloomberg and FI

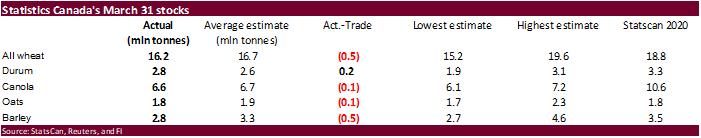

StatsCan

released March 31 stocks

and some of the main commodity inventories fell slightly below expectations.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3210000701

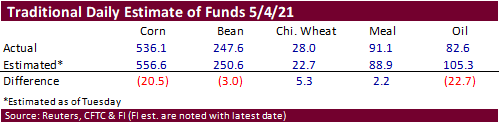

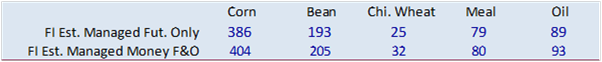

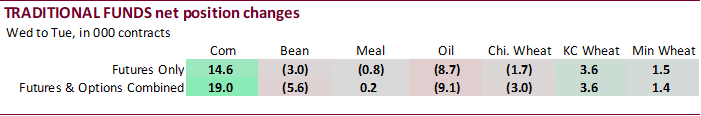

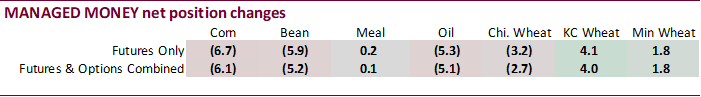

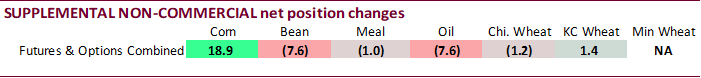

No

records as of Tuesday and it looks like there is room for more longs to enter the market by the investment funds. We are pleased the net positions came in near expectations as over the past two weeks the estimated fund position for corn was well from what

was reported by CFTC. Estimates were less long in corn and soybean oil, but that can be overlooked after three solid days of higher prices. Current position estimates below.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

354,564 18,933 415,765 1,934 -747,827 -14,166

Soybeans

126,299 -7,612 186,986 3,932 -311,142 9,127

Soyoil

49,670 -7,637 124,621 3,826 -193,385 3,642

CBOT

wheat -19,723 -1,214 159,157 -1,174 -130,895 425

KCBT

wheat 14,929 1,401 68,750 85 -81,668 -517

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

372,548 -6,115 239,526 -247 -722,640 -12,043

Soybeans

174,799 -5,215 82,482 11,336 -283,920 -296

Soymeal

54,150 63 77,788 3,131 -187,651 899

Soyoil

87,505 -5,082 106,969 1,212 -211,095 7,736

CBOT

wheat 10,723 -2,675 79,382 -1,442 -103,412 2,516

KCBT

wheat 34,000 3,961 43,111 -2,293 -75,020 -300

MGEX

wheat 15,906 1,826 3,871 391 -30,864 -2,429

———- ———- ———- ———- ———- ———-

Total

wheat 60,629 3,112 126,364 -3,344 -209,296 -213

Live

cattle 48,865 -6,031 86,685 1,142 -151,608 6,389

Feeder

cattle -913 -1,592 6,808 -955 -1,072 1,502

Lean

hogs 71,577 460 60,900 1,764 -140,802 -4,349

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

133,068 25,105 -22,502 -6,699 2,438,342 39,113

Soybeans

28,783 -377 -2,145 -5,448 1,139,988 -27,115

Soymeal

26,589 165 29,125 -4,258 457,234 -2,061

Soyoil

-2,472 -4,035 19,094 169 585,496 13,306

CBOT

wheat 21,847 -362 -8,540 1,963 544,240 -4,126

KCBT

wheat -78 -399 -2,013 -969 241,762 4,547

MGEX

wheat 2,900 -402 8,187 613 82,141 -2,346

———- ———- ———- ———- ———- ———-

Total

wheat 24,669 -1,163 -2,366 1,607 868,143 -1,925

Live

cattle 23,800 -763 -7,741 -737 375,020 -2,075

Feeder

cattle 3,822 -111 -8,646 1,156 55,296 -258

Lean

hogs 14,130 285 -5,804 1,841 358,691 15,043

Macro

US

Change In Nonfarm Payrolls Apr: 266K (est 1000K; prevR 770K; prev 916K)

US

Unemployment Rate Apr: 6.1% (est 5.8%; prev 6.0%)

US

Average Hourly Earnings (M/M) Apr: 0.7% (est 0.0%; prevR -0.1%; prev -0.1%)

US

Average Hourly Earnings (Y/Y) Apr: 0.3% (est -0.4%; prev 4.2%)

US

Change In Private Payrolls Apr: 218K (est 933K; prevR 708K; prev 780K)

US

Change In Manufacturing Payrolls Apr: -18K (est 54K; prevR 54K; prev 53K)

US

Average Weekly Hours All Employees Apr: 35.0 (est 34.9; prev 34.9)

US

Labour Force Participation Rate Apr: 61.7% (est 61.6%; prev 61.5%)

US

Underemployment Rate Apr: 10.4% (prev 10.7%)

Canadian

Net Change In Employment Apr: -207.1K (est -150.0K; prev 303.1K)

Canadian

Unemployment Rate Apr: 8.1% (est 8.0%; prev 7.5%)

Canadian

Participation Rate Apr: 64.9% (est 65.2%; prev 65.2%)

Canadian

Part Time Employment Change Apr: -77.8K (prev 127.8K)

Canadian

Full Time Employment Change Apr: -129.4K (prev 175.4K)

Canadian

Hourly Wage Rate Permanent Employees (Y/Y) Apr: -1.6% (est -1.1%; prev 2.0%)

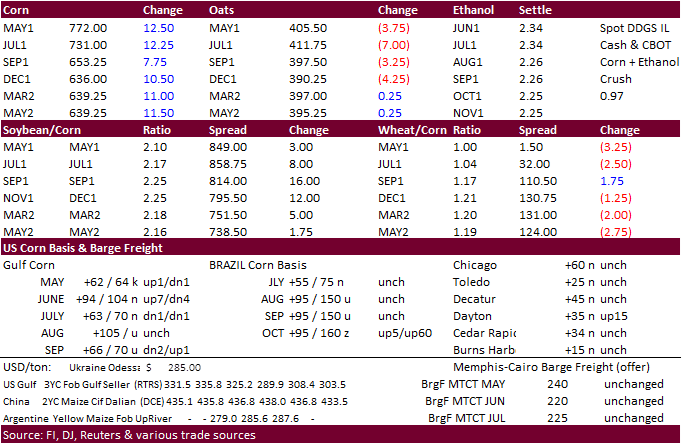

- A

sharply lower USD, China new-crop corn buying, and ongoing bullish sentiment including rising inflation lifted corn futures higher. The USD was down 66 points by 1 pm CT.

The

US jobs report came in well below expectations. Strong US cash prices and good meat imports by China for the month of April added to the positive undertone. China imported 922,000 tons of meat during April, up nearly 7 percent from year ago and slightly below

the record 1.02 million tons during March. USDA is due out on Wednesday.

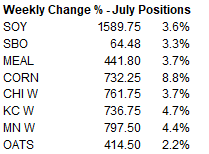

- CBOT

July corn settled up 13.50 cents at $7.3225/bu, at an 8-1/2 year high. July was up 8.8% this week. - December

was up 11 cents to $6.3625. - Call

option volume was very good with a lot of players rolling up call positions.

- Dips

today in corn were welcomed by long traders looking to add onto their positions.

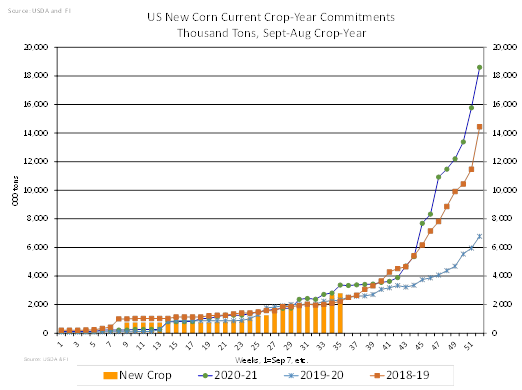

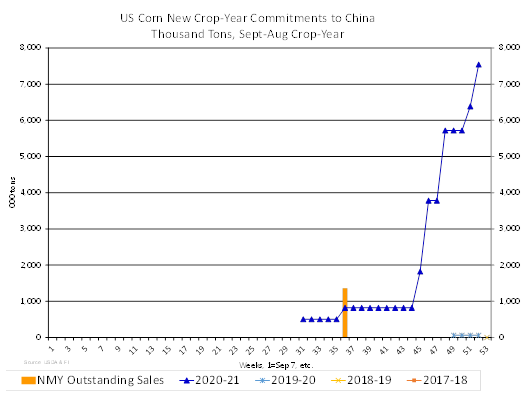

- China

kicked off buying new-crop US corn by committing to 1.360 million tons for 2021-22 delivery as announced under the 24-hour system. Prior to this, 2021-22 US corn commitments have been mostly for unknown and Mexico destinations. As of April 29, new crop corn

commitments were running at nearly 3 million tons, just above this time year ago.

- China

National Grain & Oils Information Center (CNGOIC) estimated 2020 China corn production up 4.3% to 272 million tons and soybean production at 18.4 million tons, a 6.1% decrease from 2020.

- FranceAgriMer

reported conditions of the French winter barley edged down to 76% from 77%, and corn plantings were 89% of the expected area, up from 74% the previous week and 76% a year ago. - Buenos

Aires Grains Exchange – Argentina corn collected +3 points to 23%.

April

2021 Agricultural Options Update

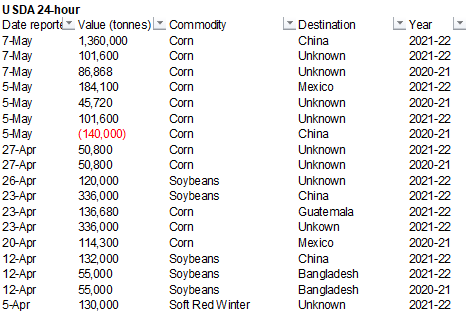

Export

developments.

- Under

the 24-hour announcement system, private exporters reported 1,360,000 tons of corn for delivery to China during the 2021-22 marketing year, 188,468 tons of corn for delivery to unknown destination (86,868 tons 2020-21 and 101,600 tons for 2021-22).

New

crop corn commitment season is starting to ramp up. (as of late April)

US

2021-22 corn commitments for China, including 1.360 million tons sold this morning

2021

China + Unknown Corn Sales

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range. (up 75, up 50)

The

US needs to see a massive crop to pull new-crop futures below $4.00, which could happen for 2022 contracts if the export campaign for Q1 (SON) does not end up a record . Keep an eye on new-crop corn commitments this summer.

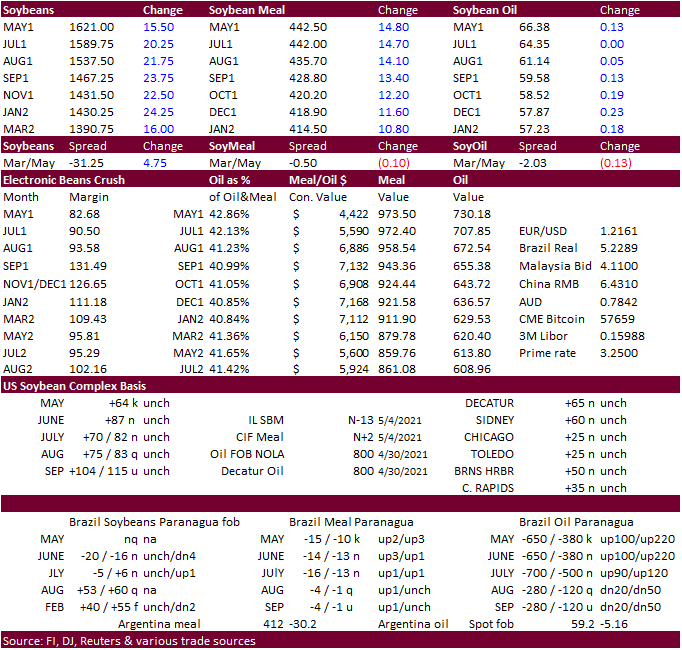

- The

CBOT soybean complex traded higher again with demand and stocks in focus. US crush margins are good enough to keep demand for soybeans at a strong level. StatsCan reported March 31 Canadian canola stocks down 38 percent from the same period a year ago.

Additional details over China April import data were viewed bullish. China imported 922,000 tons of meat during April, up nearly 7 percent from year ago and slightly below the record 1.02 million tons during March. China soybean imports were 7.45 million

tons during April, up 11 percent year ago, with most originating from Brazil. Jan-Apr China soybean imports were 28.63 million tons, up 17% from same period during 2020.

- CBOT

July soybeans were up 20.50 cents at $15.8975, a price not seen since October 2012. For the week July increased 3.6%. November soybeans climbed 24.50 cents to $14.3350 (hit a contract high today). July soybean meal surged $14.50/short ton. That market has

been overshadowed by the rise in soybean oil and it was only a matter of time to see it pop. July meal remarkably ended the week 3.7% higher while July soybean oil was up 3.3%.

- $16.50

soybeans is not out of reach. - In

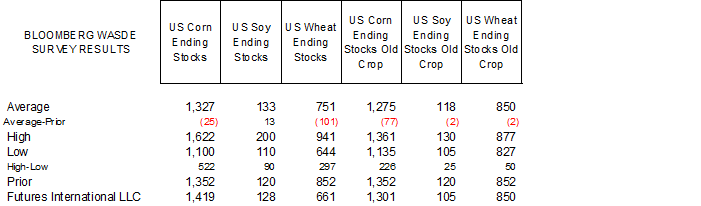

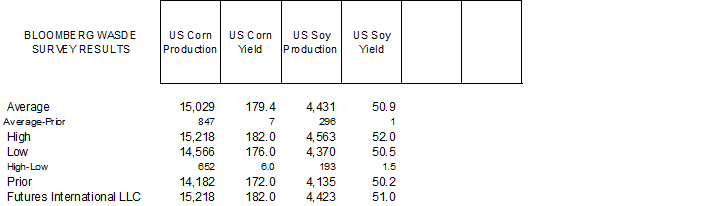

a Reuters poll, US 2021-22 soybean ending stocks were seen at 138 million bushels, and 2020-21 stocks at 117 million bushels from 120 million last month.

- Brazilian

soybean export premiums slid this week with the rally in Chicago and stronger real against the USD.

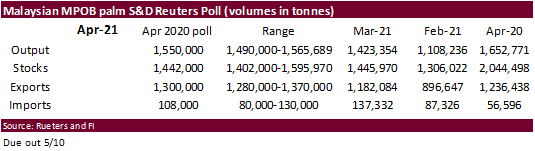

- Malaysian

palm oil futures closed at a 13-year high, up 212 MRY and cash was up 4.2% or 45.00$/ton to $1,112.50. For the week palm futures are up 14.4%. There is still concern India vegetable oil imports will decline sharply during the May through June period because

of Covid-19 concerns. Daily cases continue to climb and three times this week topped 400,000. But remember that number represents people with access to tests.

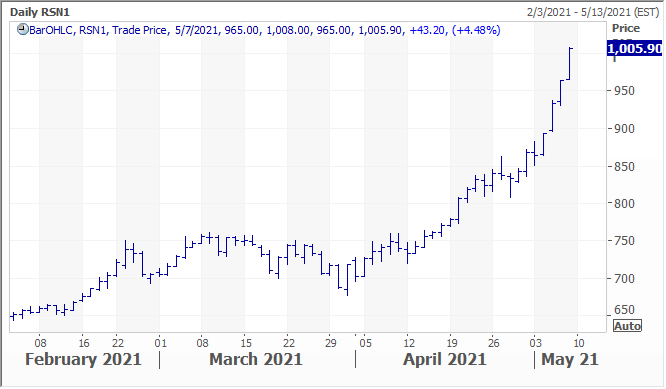

- July

ICE canola futures rose its daily limit yesterday and today it was nearly 45 higher. It was last at $1,005.90, above the $1,000 mark for the first time. Canadian canola stocks were reported slightly below expectations and we would not be surprised stocks

at the end of the season reach near a decade low. Attached is our balance sheet. March 31 stocks were 6.6 million tons vs. a trade average of 6.7 million tons, and down from 10.6 million a year earlier. - ICE

raised their canola futures initial margin for July to 1,120 CAD. - Meanwhile

we are hearing the EU rapeseed crop may fall short of expectations. We will know more as harvest advances.

- China

cash crush margins on our analysis were 214 cents (215 previous) vs. 178 cents late last week and compares to 132 cents year earlier.

- Buenos

Aires Grains Exchange – Argentina soybeans collected +20 points to 53%. - Ciara

– Argentina to crush 40.5 MMT of soybeans this year, up from 36 MMT last year. That leaves about 10 percent left for export.

ICE

July Canola Futures

- None

reported

MPOB

SND poll April – Reuters Poll

April

stocks seen down 0.27% m/m at 1.44 mln T

Output

seen up 8.9% at 1.55 mln T – survey

Exports

seen up 10% at 1.3 mln T – survey

Updated

4/26/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 56-70; December 48-60 cent range

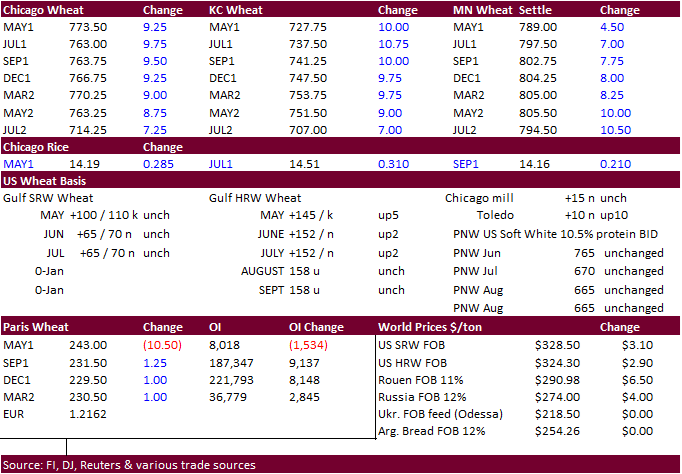

- Higher

trade in US wheat futures despite Thailand passing on wheat and barley. A sharply lower USD underpinned prices along with crop concerns for the dry areas of the Great Plains (HRW wheat) and northern spring growing areas. Decline in French wheat ratings was

also bullish. Selected Black Sea and European cash wheat prices appreciated this week.

- CBOT

July wheat finished at $7.6175, up 8.50 cents and for the week was up 3.7%. July KC was up 10.00 cents and for the week up 4.7%. MN July was up 7.00 cents and up 4.4% for the week.

- A

Reuters poll looks for the 2021-22 US all-wheat carryout to end up near 730 million bushels and 2020-21 stocks at 846 million bushels from 852 million in April.

- FranceAgriMer

reported a 2-point decline in French soft wheat conditions to 79% for the week ending May 3. - IKAR

lowered their 2021 Russian wheat production forecast to 79 million tons from 79.5 million tons.

- September

milling wheat settled up 1.75 euros, or 0.8%, at 232.00 euros ($281.97) a ton. The contract rose 5.8% this week.

Export

Developments.

- Thailand

passed on 455,000 tons of animal feed wheat and 420,000 tons of feed barley for shipment between June and December. The barley was to be sourced from Australia only for shipments between June and December. - Taiwan

Flour Millers’ Association seeks 89,425 tons US milling wheat on May 13. One consignment of 42,505 tons is sought for shipment between July 2 and July 16. A second consignment of 46,920 tons is sought for shipment between July 19 and Aug. 2.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/07/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.50-$8.25

(up 35, up 25)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.