PDF Attached

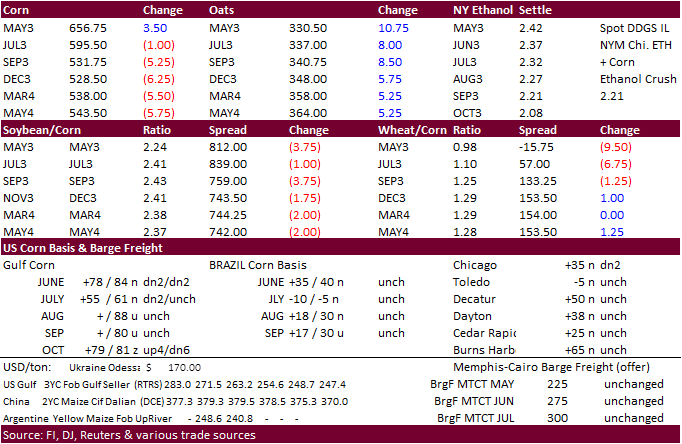

Calls:

(planting progress, polls for USDA and weather are drivers)

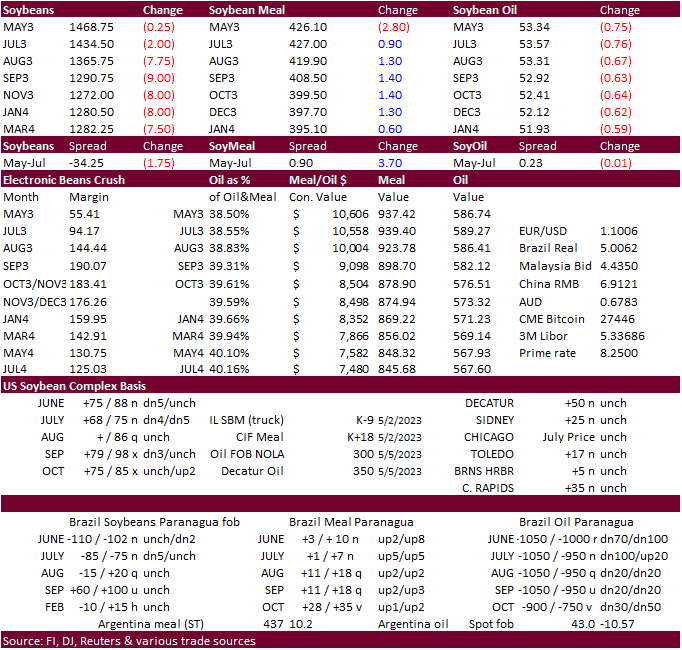

Soybeans

unchanged to 3 lower

Corn

unchanged to 2 lower

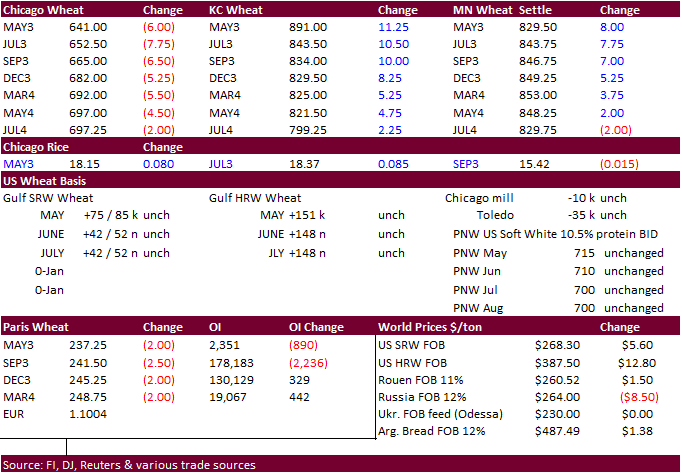

Wheat

down 2-4 (predicated on good rain for US WW areas)

Quiet

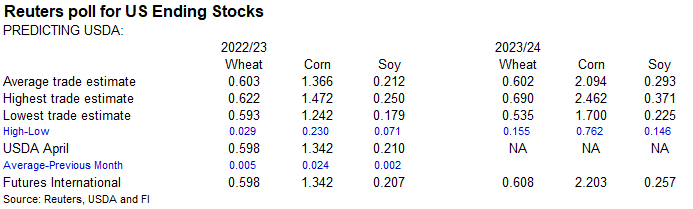

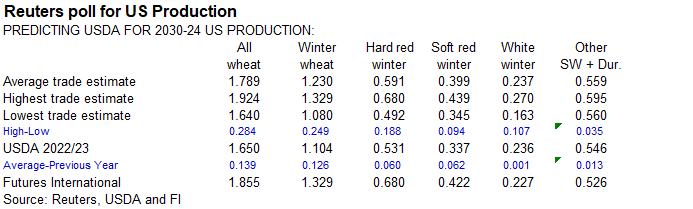

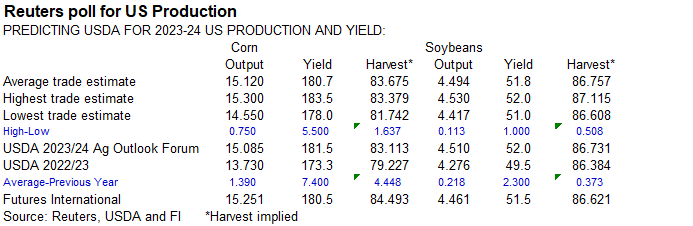

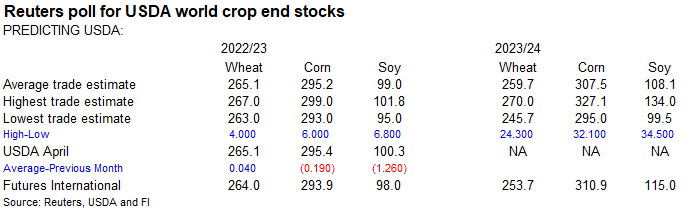

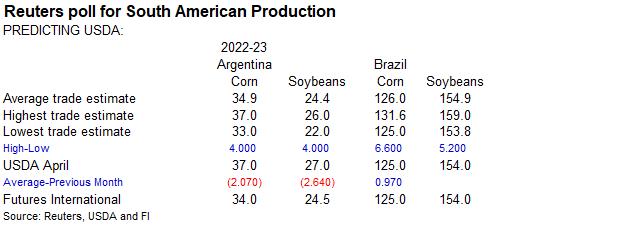

session with selected countries on holiday. Choppy trade occurred for the CBOT agriculture markets, in part to profit taking from a few rallied late last week (SBO for example) and positioning ahead of many reports due out this week. Reuters and other polls

are expected to show a large discrepancy for the low and high end of trade expectations. This could create some volatility when new-crop USDA numbers are released on Friday. US CPI will be updated on Wednesday. StatsCan Canadian stocks will be updated Tuesday.

There was some chatter over ENSO patterns today with heat waves rolling across Asia. Something to monitor long term.

El

Nino versus La Nina – North American Northern Hemisphere refresher:

WEATHER

TO WATCH

-

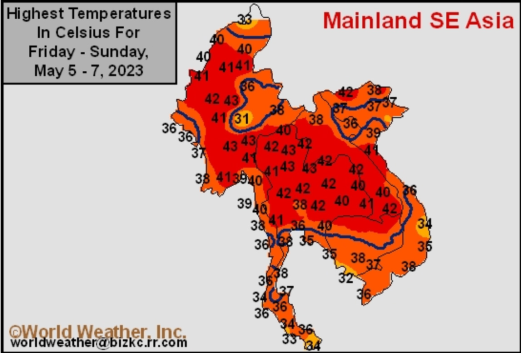

Excessive

heat occurred in Thailand, Vietnam, Laos and Cambodia during the weekend with extreme highs of 36 to 111 degrees Fahrenheit -

Records

were set because of the heat and stress to many crops (including coffee, citrus, sugarcane and corn) resulted

-

Mainland

areas of Southeast Asia are expected to see frequent rainfall over the next five days improving topsoil moisture as pre-monsoonal precipitation slowly increases -

A

tropical cyclone passing through Myanmar to southwestern China may lead to another bout of drier and warmer weather briefly during the weekend and early next week -

India

weather is expected to be mostly normal over the next ten days with a few pre-monsoonal showers and thunderstorms expected in the south and extreme east while most other areas are dry -

A

tropical cyclone will evolve in the Bay of Bengal this week and could impact Myanmar and/or Bangladesh and a part of India’s Far Eastern States late this week and into the weekend -

Very

poor model agreement on this system is present today and the forecast should be closely monitored for changes -

Indonesia/Malaysia

weather is still favorably wet through the next ten days -

Recent

rainfall was most significant in Indonesia and Malaysia while the Philippines dried down for a while -

This

trend may be perpetuated over the next couple of weeks -

China

weekend rainfall was abundant to excessive in areas south of the Yangtze River where flooding resulted.

-

One

location in northwestern Fujian reported 28.50 inches of rain since Friday and another in Jiangxi reported 27.32 inches while most other areas in Hunan, Jiangxi, Fujian and western Zhejiang reported 3.00 to 8.00 inches.

-

Damage

to maturing rapeseed and some early season rice likely resulted -

Rain

also fell from eastern Sichuan and far western Hubei through Shaanxi to Shanxi where 2.00 to more than 5.16 inches resulted in some areas.

-

Limited

rainfall occurred elsewhere in China with Yunnan and much of the North China Plain dry or mostly dry as were Heilongjiang, central and northern Jilin and much of Inner Mongolia. -

Drought

in Yunnan, China will finally be eased late this week and into the weekend as moderate rain finally falls -

Rice,

corn and sugarcane among other crops will benefit, though it has been dry enough for a long enough period of time for production to be hurt -

Additional

rain will be needed -

China’s

greatest rain over the next ten days will be in the southwest where 2.00 to 6.00 inches and locally more than 8.00 inches will result -

Some

flooding is expected -

Rapeseed

areas will see less frequent and less significant rain which may help stop the damage that has occurred recently from excessive rainfall and flooding -

Xinjiang,

China was unusually cool during the weekend -

Northeastern

areas reported highs in the 40s western areas reported highs in the 50s and 60s with a few readings to 73 Fahrenheit -

Summer

crop conditions are not very good because of the cool start to the planting season; both cotton and corn need much warmer weather -

Xinjiang,

China temperatures will trend warmer during the middle to latter part of this week with temperatures returning to normal by the weekend

-

A

meld to warm temperature regime is likely thereafter through most of next week -

Drought

relief is expected in northeastern Algeria and Tunisia this week with rainfall of 0.50 to 1.50 inches and local totals over 2.00 inches -

Dryness

has already hurt production this year, but there might be a few crops that can still benefit from the moisture boost -

Other

areas in North Africa and in much of Spain will be dry -

Eastern

Spain may get a few showers of benefit this week while most key crop areas stay dry -

Europe’s

greatest precipitation through May 20 will be from southeast to northwest where 1.00 to 3.00 inches will impact many areas with a few areas from Italy and the Alps into the western Balkan Countries getting 3.00 to more than 5.00 inches

-

Some

local flooding is possible -

Northeastern

Europe will not receive nearly as much rain -

Northwestern

Kazakhstan and neighboring southern areas of Russia’s eastern New Lands will get some rain this week with 1.00 to nearly 2.50 inches possible in a few areas, but most of the precipitation will be lighter leaving some need for more moisture -

A

close watch on this region is warranted because of decreasing topsoil moisture recently and additional warm and dry biased weather expected in the same areas again this weekend into most of next week -

Other

western CIS crop areas will likely benefit from a drier bias over the next week to ten days -

Canada’s

Southwestern Prairies will continue drought stricken through the next two weeks, despite a few showers periodically -

Canada’s

eastern and far western Prairies may experience some planting delay because of periodic rainfall, this week although the impact will be low -

A

new wave of heat and dryness is expected near and beyond mid-month, impacting Alberta and western Saskatchewan more than areas to the east -

Ontario

and Quebec, Canada will experience a more seasonable temperature regime this week after being cooler and wetter than usual recently -

Drier

and warmer weather is needed to induce a better environment for wheat development and spring planting that often begins around mid-month -

Warming

is expected soon -

U.S.

weekend precipitation was greatest in the northern Plains and northern Midwest as well as the Pacific Northwest, including northern California -

Rainfall

was erratically distributed with some totals of 0.50 to 1.65 inches from Nebraska to eastern and south-central South Dakota and in northwestern Minnesota -

Rainfall

of 0.50 to 2.00 inches also occurred in parts of Wisconsin, eastern Iowa and from southeastern Illinois to eastern Ohio northward into south-central Michigan -

Rainfall

of 1.00 to 2.00 inches also occurred in sugarcane areas of Louisiana and eastward into southern most Mississippi while the Blacklands of Texas reported 0.30 to 1.00 inch with one location in central Texas getting 2.19 inches -

Kansas

and Colorado through western Texas was dry along with the lower Midwest, Tennessee River Valley and northern Delta as well as the southeastern states -

Northern

California received 1.00 to 2.26 inches of moisture -

U.S.

temperatures were hot in the southern Plains with 80- and 90-degree highs from Kansas and Missouri to southern Texas -

Extreme

highs over 100 Fahrenheit occurred in a few Texas Oklahoma and readings reached 97 in southeastern wheat areas of Kansas -

U.S.

temperatures will continue above normal in the central and southern Plains and a part of the western Corn Belt for while this week -

Additional

highs in the 80s and 90s are expected and some of the heat will expand into the southeastern states -

70-

and 80-degree highs are expected in the Midwest later this week as well -

The

warmth will accelerate drying rates between rain events -

U.S.

rainfall is expected in all major crop areas at one time or another during the next ten days; including hard red winter wheat areas, West Texas and a part of the northwestern Plains all of which have been drier than usual at times.

-

Rainfall

may be heavy at times in central, eastern and southern Texas -

Sufficient

amounts are expected in the northern Plains and upper Midwest to keep farmers out of their fields for a while -

Eastern

Midwest and southeastern states rainfall may be lightest and least frequent -

No

rain is expected in the southwestern states -

Hard

red winter wheat areas will get 0.10 to 0.75 inch in the west-central Plains with some areas failing to get enough rain to counter evaporation while other areas receive 0.60 to 1.50 inches and a number of areas in the east and south will get over 2.00 inches -

Western

Nebraska and northeastern Colorado may also get some significant rain -

West

Texas rainfall may range from 1.00 to 2.00 inches and locally more with much of that occurring this coming weekend into early next week

-

Central

and eastern Argentina received some welcome rain during the weekend easing dryness -

Areas

east of a line from northwestern Cordoba to central Buenos Aires were wettest with 0.20 to 0.60 inch common and some areas from Santa Fe to northeastern Buenos Aires and Entre Rios receiving 0.60 to 1.69 inches

-

Summer

crop harvesting was disrupted, but the moisture was good for future wheat planting if there is some follow up moisture -

Southwestern

Argentina was left dry -

Argentina

will be mostly dry through May 19 favoring the resumption of summer crop harvesting and drying trend in the soil again -

Temperatures

will be near to above normal with the warmest weather likely during the weekend and next week -

Brazil

weather during the weekend was dry in much of center west and center south crop areas where it should remain dry or mostly dry over the next two weeks -

Drying

is normal for this time of year, though late planted Safrinha crops will require moisture late this month and in June to ensure the best yield potentials. -

Rio

Grande do Sul, Brazil received significant rainfall during the weekend with 1.00 to 2.83 inches reported through Sunday morning.

-

The

moisture was good for late season crops, but some drying is now needed -

Rain

will linger into Monday in Rio Grande do Sul, Brazil and then it, too, will dry out over the coming ten days -

Rain

is expected in Bahia and Tocantins during mid- to late-week this week causing a disruption to farming activity; including the harvest of cotton, sugarcane and coffee -

Most

of the rain is not likely to be heavy -

West-central

Africa will continue to experience periodic rainfall over the next two weeks maintaining a mostly good environment for coffee, cocoa, rice and sugarcane -

Mali

and Burkina Faso rainfall will remain lighter than usual, although some welcome precipitation is expected that will raise topsoil moisture.

-

East-central

Africa rainfall will continue periodic and mostly in a beneficial manner to support rice, coffee, cocoa, sugarcane and other crops -

South

Africa rainfall increased during the weekend slowing summer crop maturation and harvest progress -

Some

rain will continue early this week followed by some welcome drying -

Harvest

delays will continue for a while, though some winter crops might benefit from the moisture in Free State -

Far

western parts of the nation where most of the wheat and canola is produced will be left dry -

Australia

rainfall during the coming week will be greatest in winter crop areas near to the coast.

-

Moisture

totals will be light and a boost in rainfall will continue to be needed in interior Western Australia, interior South Australia and western New South Wales -

Drought

continues in central and western Mexico while recent rain in the east has improved crop and field conditions -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.91 and it should move erratically over the next several days

Source:

World Weather, INC.

7-day

Bloomberg

Ag calendar

Monday,

May 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - HOLIDAY:

UK, France

Tuesday,

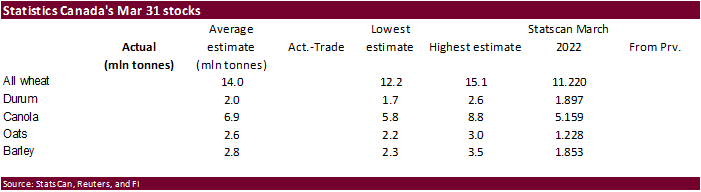

May 9:

- Canada’s

StatsCan to release wheat, soybean, canola and barley reserves data - China’s

first batch of April trade data, including soybean, edible oil, rubber and meat imports

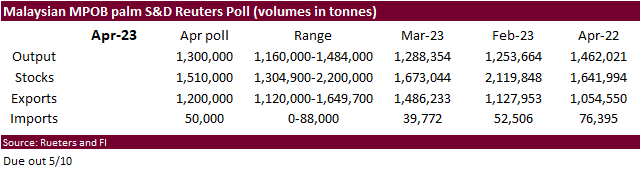

Wednesday,

May 10:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - Malaysia’s

May 1-10 palm oil exports - Sugar

production and cane crush data by Brazil’s Unica (tentative)

Thursday,

May 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab issues production, area and yield data for corn and soybeans - New

Zealand Food Prices - EARNINGS:

GrainCorp

Friday,

May 12:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm eastern - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Source:

Bloomberg and FI

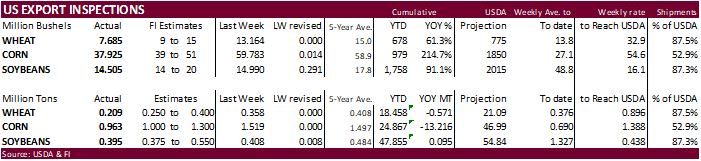

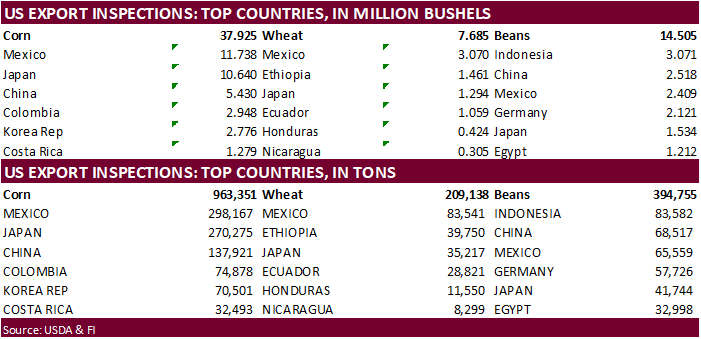

USDA

inspections versus Reuters trade range

Wheat

209,138 versus 200000-500000 range

Corn

963,351 versus 1000000-1550000 range

Soybeans

394,755 versus 300000-600000 range

Inspections

for corn fell short of expectations. China slipped to number 3 for top US corn export destination. Soybeans are starting to slow, and wheat came in lower end of a range of expectations.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAY 04, 2023

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 05/04/2023 04/27/2023 05/05/2022 TO DATE TO DATE

BARLEY

0 0 0 2,154 10,156

CORN

963,351 1,518,569 1,477,246 24,866,729 38,082,798

FLAXSEED

0 0 0 200 324

MIXED

0 0 0 0 0

OATS

100 0 0 6,586 600

RYE

0 0 0 0 0

SORGHUM

49,588 112,824 270,492 1,467,095 5,577,413

SOYBEANS

394,755 407,973 506,939 47,854,601 47,759,661

SUNFLOWER

100 0 0 2,508 2,260

WHEAT

209,138 358,273 262,919 18,458,158 19,028,658

Total

1,617,032 2,397,639 2,517,596 92,658,031 110,461,870

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

104

Counterparties Take $2.218 Tln At Fed Reverse Repo Op. (prev $2.207 Tln, 101 Bids)

Corn

·

Corn ended unchanged for July and lower for the back months despite slowing nearby US corn exports. There were no export developments over the weekend. US inspections were lower than what we projected.

·

USDA could lower US corn exports by 25 to 50 million bushels this Friday (50 bias, up from 25 million estimated last week). A Reuters trade average for 2022-23 corn stocks has a 25 million bushel reduction, on average. Slowing

inspections and commitments from the onset of a record Brazil crop and US export price premiums versus South America could be cited, when updated by USDA.

·

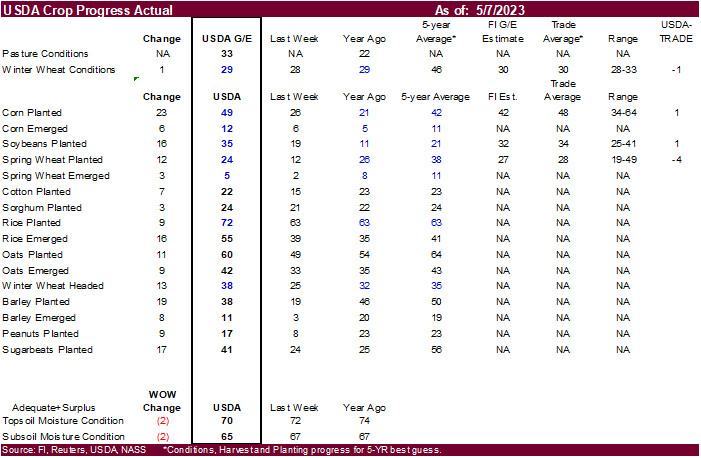

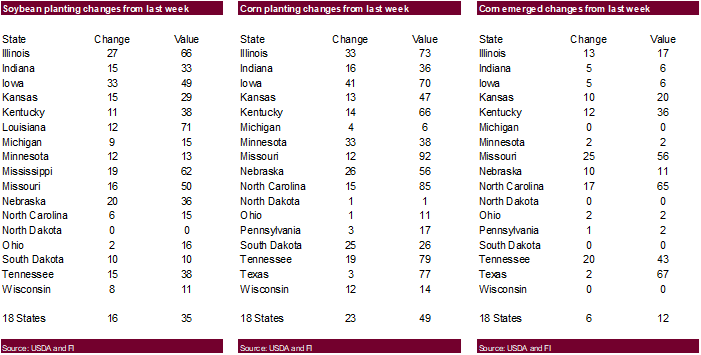

Trade estimates for corn plantings ranged from a large 34 to 64 percent (soybeans 25-41 percent). Some dry areas of the WCB saw little plantings while ECB rolled on. We are hearing southern IL is done with corn planting progress.

·

El Nino is gaining strength. We see no short-term issue now for US crops but excessive heat in Asia right now is not a good sign for the US summer growing season and the trade needs to take note.

·

Brazil’s corn area will dry down this week.

·

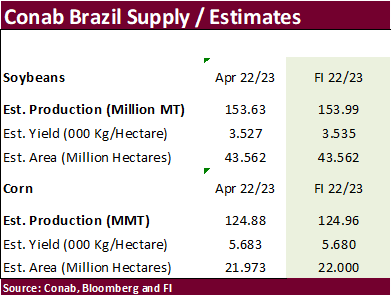

Safras & Mercado estimated Brazil producers sold 24.3% of their record large second corn crop versus 31 percent year ago. Volume is higher than a year ago. They are using a 92.2 MMT second corn crop estimate. Conab will be out

with an update this week (estimates above).

·

(Reuters) –{CME hogs finished higher Monday….} Chicago Mercantile Exchange lean hog futures sank to contract lows on Friday on concerns over anemic U.S. demand for pork, analysts said…”Retail prices for pork are still too high

to attract sustained consumer demand at a time when many families are struggling to make ends meet.”

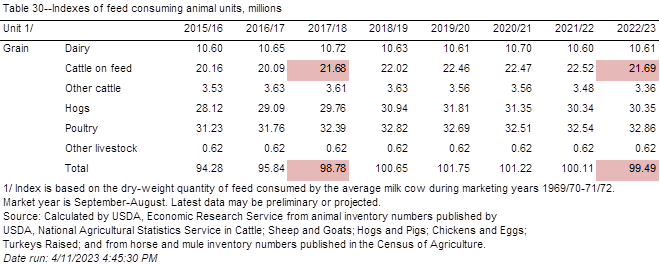

·

We suspect cattle on feed across the US is higher than USDA’s projection relative to inventories due to the ongoing drought, but cattle inventories as whole are down. Tyson noted they paid a lot more for live cattle last quarter

due to tighter supplies. Volume might not be down but margins for the meat industry are getting tighter. Look for higher US retail meat prices over the medium term, passed down to the consumer. USDA currently projects feed grains used for consuming animal

units at a 5-year low.

Export

developments.

-

Results

awaited: Algeria seeks up to 140,000 tons of corn for May through August shipment. Late last week they bought an undisclosed amount of milling wheat.

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

Short covering and higher soybean oil lifted soybeans higher overnight but prices dropped on fund selling despite a higher outside market related trade, at least for soybean oil. Note Friday prices for SBO were sharply higher.

Soybeans closed lower (non-expiring) and SBO near session lows. Meal was moderately higher as corn closed mixed.

·

There was a big drop in rapeseed futures in Euronext today just before close.

·

US soybean inspections were lower than what we projected.

·

Brazil soybean premiums were mixed, meal higher and soybean down sharply.

·

US soybean oil exports should fall short of USDA’s 500 million pound level (1.773 billion for 2021-22), based on USDA’s latest export sales report showing accumulated exports to date at a low 57.4 thousand tons, well below 528,700

tons a year ago. Outstanding sales are 60,100 tons versus 136,400 year earlier, but like corn, don’t rule out cancelations. Western soybean oil is around 500 over and Gulf SBO basis jumped about 100 to 350 over as of last Friday. US soybean oil is too expensive

relative to SA and competing overseas rapeseed oil, sunflower and palm oil. USDA may address this later rather than on Friday as the crop year ends October.

Export

Developments

-

Results

awaited: Algeria seeks up to 70,000 tons of soybean meal for June through July 15 shipment.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

-

Last

week USDA bought 260 tons of vegetable oil for export programs at $1,998.33 per tons.

Updated

05/05/23

Soybeans

– July $13.75-$15.25, November $12.00-$15.00

Soybean

meal – July $375-$475, December $325-$500

Soybean

oil – July 50-56,

December 48-58

·

US wheat futures started higher on Black Sea shipping concerns, but Chicago fell from fund selling. Improving US weather and a lower Paris wheat market pressured Chicago but did little to stop speculative buying for KC and Chicago.

·

Ukraine blamed Russia of stopping Black Sea incoming ship registrations. Meanwhile negotiations over the grain deal resumed today. Look for headline trading to continue to dominate price direction this week.

·

US all-wheat inspections were lower than what we projected.

·

90 ships are awaiting approval in Turkish waters to enter Ukraine, including 62 for loading. May 18 is the deadline for the grain deal.

·

Most of the US will see rain one time or another this week, lighter bias the west-central Plains.

·

Texas and Colorado will see most of the projected rains over the next seven days, which is welcome.

·

We speculate the rains this week are too late for some wheat areas. A Reuters story covering a southwestern KS producer cited 85% abandonment from the drought. KS, OK, and TX have been hardest hit this year. High winds this season

have not helped.

·

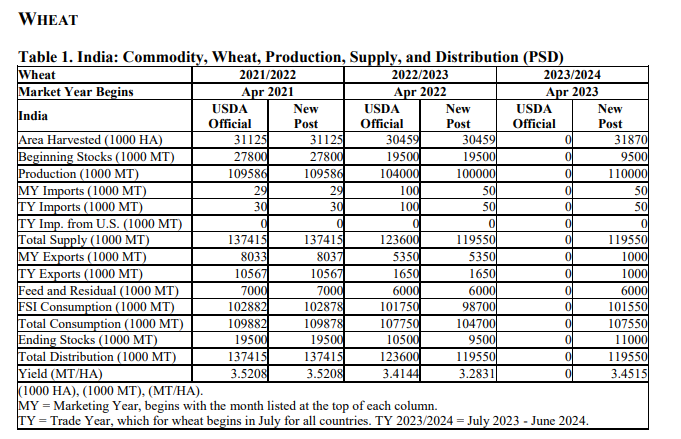

The USDA Attaché estimated India wheat production for 2023-24 at 110 million tons, up from their 100 million tons estimate for 2022-23 (USDA official 104MMT).

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_New%20Delhi_India_IN2023-0032

·

Egypt said their wheat reserves are currently at 4.1 months after securing 1.2 million tons of local wheat so far this season.

·

We look for an improvement of 2 points for the G/E categories for winter wheat when updated after the close.

·

September Paris wheat futures were 2.50 euros lower at 241.50 euros.

Export

Developments.

·

Algeria seeks at least 50,000 tons of soft milling wheat, optional origin, on May 10/11th, for July shipment. Earlier shipment if from SA and/or Australia.

·

Jordan seeks 120,000 tons of feed barley on May 10 for October 16-31 and November 1-15 shipment.

Rice/Other

·

China sold 70,936 tons of rice out of auction at an average price of 2,522 yuan per ton. This represented 7.85 percent of what was offered.

Updated

05/05/23

KC

– July $7.50-8.75

MN

– July

$7.50-9.00

#non-promo