PDF Attached

Fund

selling was a feature today across most commodity products. US

weather appears to be on track to favor spring plantings while parts of the southern and western Great Plains will see additional net drying that could impact winter wheat production potential.

WEATHER

EVENTS AND FEATURES TO WATCH

- Changes

Overnight - Precipitation

was reduced in western Saskatchewan relative to that of the weekend - Changes

since Friday - Less

rain for Mato Grosso and Goias, Brazil - Less

rain for southern Argentina - GFS

increased rain for parts of West Texas, while the European model has not changed the outlook much there - No

change of significance was suggested for net drying in the central and lower U.S. Midwest - No

change was suggested for central or southern Alberta - Western

Russia is wetter for this weekend and next week than that advertised Friday

- Europe

is still on track for net drying in many areas especially in western and northern parts of the continent - U.S.

eastern Midwest will experience net drying most of this week - The

region includes areas from Michigan southward through eastern Illinois, Indiana and Ohio to parts of the Delta and interior portions of the southeastern states - Rising

temperatures will bring daily highs Tuesday through Friday in the 80s and some lower 90s Fahrenheit - The

heat will accelerate drying that is already under way and conditions will soon become much improved for aggressive planting of corn, soybeans and other crops during the second half of this week - Monday

temperatures will be a little milder in the east relative to the remainder of this week, but certainly warming - Cooling

is expected along with a chance for showers and thunderstorms this weekend into next week

- This

will result in a general slowing of fieldwork, but the moisture will be good for recently planted and emerged crops - Frequent

rain is expected in the upper Midwest, northern Plains and eastern parts of Canada’s Prairies over the next ten days resulting in more delay to spring fieldwork - The

wet bias will be most threatening for fieldwork in North Dakota, northern Minnesota, Manitoba and eastern Saskatchewan, Canada and a few areas nearby - Rain

frequency will be too high for much, if any fieldwork through early next week

- This

will delay spring wheat, sugarbeet, corn canola and oat planting as well as other crops - Much

improved weather is possible for the middle to latter part of next week and into the following weekend - A

stationary frontal boundary lying across West Texas and extending into the central Plains Tuesday night into Friday will result in periodic showers and thunderstorms.

- Some

of the precipitation is expected to be locally heavy, but much of it will be light - Some

temporary increases in topsoil moisture are possible, but temperatures will be warm enough to evaporate much of the moisture within a short period of its fall - Winter

wheat will benefit most from this environment – at least in areas with favorable soil moisture and/or have irrigation - Dryland

crop areas in the southwestern Plains may benefit from some of this moisture, but it may not be enough for a lasting break from dryness - West

Texas cotton areas will get some relief from dryness this week that might improve dryland crop planting conditions in “some” areas; however, more rain will be needed and it much occur frequently to benefit crop areas for more than a day or two

- Drier

weather will return this weekend and much of next week, but there may be another chance for rain May 21-23 - Areas

near the New Mexico border will be driest with little moisture of benefit - The

bottom line for West Texas has not changed much. There is still concern about long term soil moisture and crop development potential.

- Ridge

building is expected later this month and especially in June which “may” cut out the periodic opportunities for rain

- Southwestern

Canada’s Prairies will continue to miss the greater rain events for the next ten days, but some brief showers of light intensity are expected.

- Dry

weather will continue in the U.S. southwestern desert region; including much of central and southern California - Dry

weather will dominate the Texas Coastal Bend and South Texas and rainfall in the Texas Blacklands will be quite restricted over the next ten days - Crop

stress may eventually develop in unirrigated areas in this region - Net

drying is expected in the U.S. southeastern states from parts of Florida into southern Georgia, Alabama and a few neighboring areas over the next ten days - This

will lead to drying soil - Parts

of the southeastern states are already drying down with South Carolina, Georgia and northern Florida most impacted so far

- Ontario

and Quebec weather will be dry biased most of this week and the temperatures will trend warmer - This

will result in better field working opportunity for corn and other crops - Wheat

development will be accelerated as well - Next

week’s weather may trend a little wetter - Brazil

Safrinha corn and cotton areas were dry during the Friday through Sunday period

- Temperatures

were seasonable - Brazil

Safrinha crops in Mato Grosso and Goias are no longer looking at significant precipitation during the next ten days

- The

forecast turned drier during the weekend for the next ten days and very little precipitation is advertised for corn and cotton production areas in Mato Grosso and Goias

- Rain

will fall from Mato Grosso do Sul into Parana and Sao Paulo and that will be welcome rain and good for crops in those areas - The

precipitation will be greatest in Paraguay this weekend and other areas from the southeast Sunday into early next week - The

bottom line will continue to stress corn in Goias and Mato Grosso and cotton will have an increasing amount of stress as well. Crops farther to the southeast, though, will see well timed precipitation benefiting Safrinha corn, late season rice, sugarcane,

coffee and other crops. Some cotton harvesting in center south Brazil will be disrupted.

- Gradual

cooling is expected in Brazil over the coming ten days as a succession of frontal systems moves through the far south and center south - The

coolest weather will follow the next ten days of unsettled weather - There

is no threatening cold for any crop area through May 18 - Argentina

was dry during the weekend and will continue that way in many areas over the next couple of weeks - A

few showers and thunderstorms will impact Formosa and immediate neighboring areas early this week and again during the weekend and early next week

- Some

rain may also impact southern Buenos Aires and La Pampa, although this event is not nearly as great as that advertised Friday - Mexico

rainfall is expected to support isolated to scattered showers and thunderstorms in southern and eastern parts of the nation this week - Most

of the rain is not expected to be enough to counter evaporation and more rain will be needed in time - Central

America will see frequent rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Northern

South America will experience frequent rain and thunderstorms over the next ten days resulting in some local flooding

- Colombia

and Venezuela as well as Ecuador and the northern Amazon River Basin will be most vulnerable to the heavy rainfall and flooding - Europe

weather is expected to be drier than usual in western and northern parts of the continent during the next ten days to two weeks - France,

the U.K. Germany, western Poland and parts of Spain will dry out most significantly - Temperatures

will be a little warmer than usual - The

environment will be good for winter crop development and spring planting as long as soil moisture remains adequate; however, net drying is expected and there may be an eventual shortage of moisture threatening some of agricultural areas - Russia

weather is expected to turn wetter this weekend and all of next week resulting in some planting delay - The

wettest conditions are likely next week and some of this will also reach into Ukraine next week as well - Western

Kazakhstan is getting some significant rain early this week that will improve topsoil moisture for spring planting and winter crop development - Follow

up rain is expected late this week expanding the wetter bias into northern Kazakhstan

- The

moisture will be great for planting of spring crops which is getting under way now.

- Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - Mainland

areas of China will be wettest south of the Yangtze River during the next two weeks, although there will be some other bouts of rain periodically in other areas in the nation and all of it will be welcome - Net

drying is possible in east-central parts of the nation and in Liaoning which may raise a little concern about dryness in time - Rain

is expected in the Yellow River Basin where an improvement in winter and spring crop conditions are expected after recent drying

- South

Korea rice production areas are too dry and little change is expected over the next ten days - Some

of this dryness may expand northward into North Korea - Southeast

Asia rainfall will be abundant to excessive in the next ten days from Myanmar into Thailand, Laos and Cambodia as well as from eastern parts of Borneo into the southern Philippines and Papua New Guinea - Some

flooding is expected in many areas - Southwest

monsoon rainfall in Myanmar could become excessive later this week with 10.00 to 20.00 inches of rain possible over

- Tropical

Asani formed during the weekend west of the Andaman Islands - The

storm was expected to move toward the central India east coast with landfall possible Wednesday.

- Some

forecast models have tried to turn to the storm to the northeast without reaching land, but that is looking less likely today

- The

storm was 519 miles south southwest of Kolkata, India at 14.6 north, 85.3 east moving west northwesterly at 10 mph and producing maximum sustained wind speeds of 69 mph with tropical storm force wind occurring o0ut 115 miles from the center of the storm.

- Tropical

Cyclone Karim poses no threat of land from a position in the central Indian Ocean - India

weather will remain tranquil most of this week - Restricted

rainfall is expected with a few showers along the lower west coast and in the far eastern states - Pre-monsoonal

precipitation is expected to increase during the weekend and especially next week in the central and south - Winter

crop harvesting is advancing well - Eastern

Australia will be rainy this week - Amounts

of 1.50 to 4.00 inches will occur in central and northern New South Wales and southern Queensland by Friday while 3.00 to 12.00 inches are expected from central Queensland to the middle and lower coast of the state - Damage

to sugarcane is possible and some unharvested cotton quality will decline - Sorghum

should not be harmed, although harvest delays are likely - Canola,

wheat and barley planting potentials will increase greatly following this period of rainy weather - Western

Australia will get some beneficial rain the southwest during mid- to late week this week

- The

moisture will help improve planting for some areas, but more rain will be needed - Some

follow up rain is expected next week - South

Australia and Victoria rainfall will be most limited over the next two weeks - South

Africa rainfall will be restricted over the next ten days supporting favorable summer crop maturation and harvest progress - North

Africa will experience less rainfall over the next ten days to two weeks favoring grain filling and maturation - The

drier bias will be welcome - West-central

Africa will experience frequent rainfall over the next ten days supporting coffee, cocoa, sugarcane and rice development - Some

northern cotton areas need greater rain - East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +18.86 and it has likely peaked, but will remain strongly positive for a while this week

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in the north next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

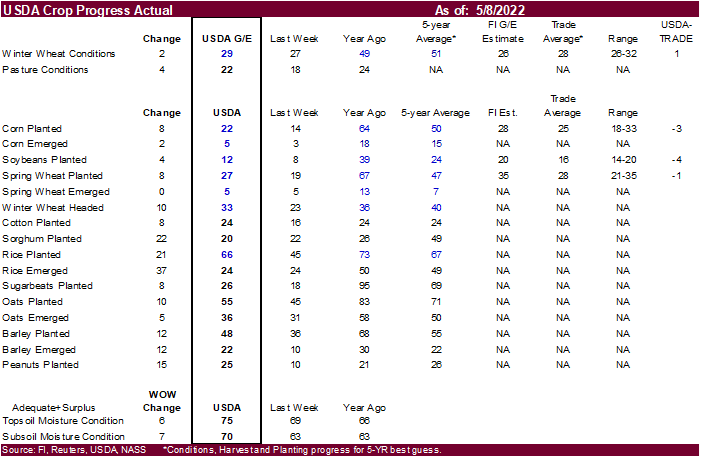

- USDA

export inspections – corn, soybeans, wheat, 11am - China’s

first batch of April trade data, including soybeans, edible oil, rubber and meat imports - U.S.

crop progress and planting data for corn, soybeans and cotton; winter wheat condition, 4pm - Vietnam’s

customs dept releases April coffee, rice and rubber export data - Globoil

International 2022 conference on vegetable oils and oilseeds in Dubai, day 1 - HOLIDAY:

Hong Kong, Russia

Tuesday,

May 10:

- Malaysian

Palm Oil Board’s data for April output, exports and stockpiles - EU

weekly grain, oilseed import and export data - Globoil

International 2022 in Dubai, day 2 - Innovation

Forum’s virtual Future of Food conference, May 10-12 - New

York sugar seminar hosted by StoneX Financial - France

agriculture ministry’s monthly grains report - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative) - Holiday:

Russia

Wednesday,

May 11:

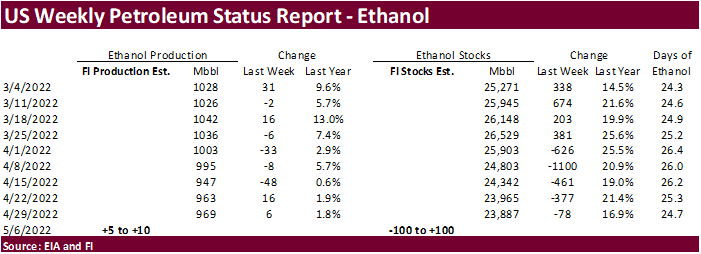

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Globoil

International 2022 in Dubai, day 3 - France

AgriMer monthly grains outlook - Annual

New York Sugar Conference, hosted by Datagro and International Sugar Organization

Thursday,

May 12:

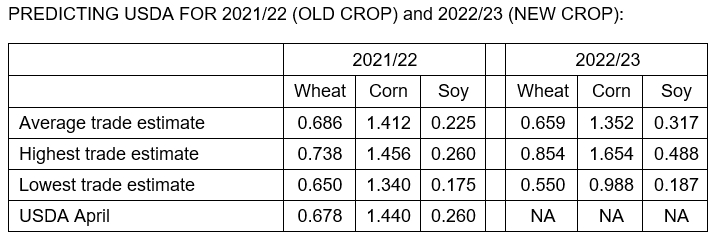

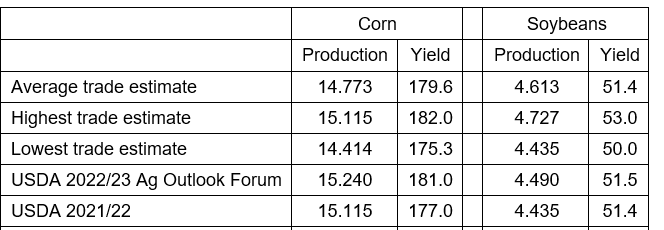

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - New

Zealand food prices

Friday,

May 13:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

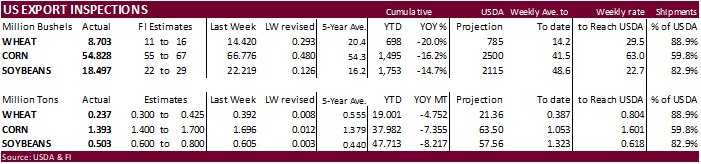

USDA

export Inspections

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAY 05, 2022

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 05/05/2022 04/28/2022 05/06/2021 TO DATE TO DATE

BARLEY

0 73 0 10,156 33,143

CORN

1,392,685 1,696,181 1,716,299 37,981,881 45,336,518

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 600 6,514

RYE

0 0 0 0 0

SORGHUM

270,492 217,881 125,111 5,577,413 5,745,478

SOYBEANS

503,414 604,711 277,090 47,713,343 55,930,085

SUNFLOWER

0 288 96 2,260 96

WHEAT

236,847 392,443 563,598 19,000,508 23,752,698

Total

2,403,438 2,911,577 2,682,194 110,286,485 130,805,041

—————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

Canadian

Building Permits (M/M) Mar: -9.3% (prev 21.0%)

·

The Baltic Dry Index hit a 7-week high on Friday of 2,718 points, up 2.8% from the previous day and up 13.1 percent for the week. Attached are a few graphs.

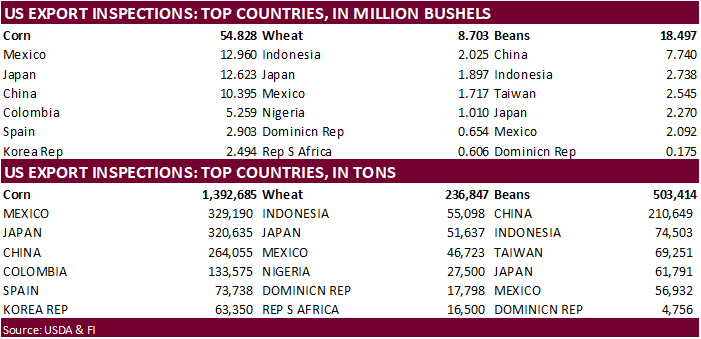

·

USDA US corn export inspections as of May 05, 2022 were 1,392,685 tons, within a range of trade expectations, below 1,696,181 tons previous week and compares to 1,716,299 tons year ago. Major countries included Mexico for 329,190

tons, Japan for 320,635 tons, and China for 264,055 tons.

Export

developments.

·

South Korea’s KFA bought 65,000 tons of corn at an estimated $384.21 a ton c&f for arrival in South Korea around Aug. 10. On Friday FLC bought 65,000 tons of corn at an estimated $384.39 a ton c&f for arrival in South Korea around

Aug. 30.

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range