PDF Attached

Funds will be emailed when they are available.

Attached

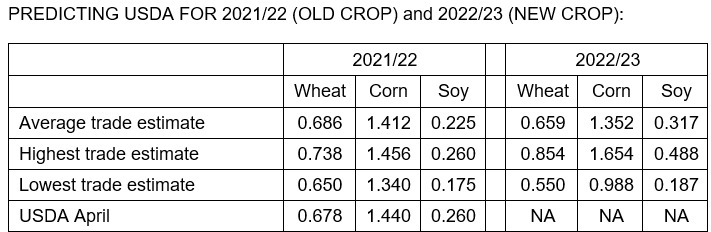

are our updated US corn and wheat balance sheets. This Thursday, we will see USDA estimating initial US and global S&D’s for 2022. Day after most US commodity and equity markets sold off (fund selling), US agriculture markets traded mostly higher on Tuesday.

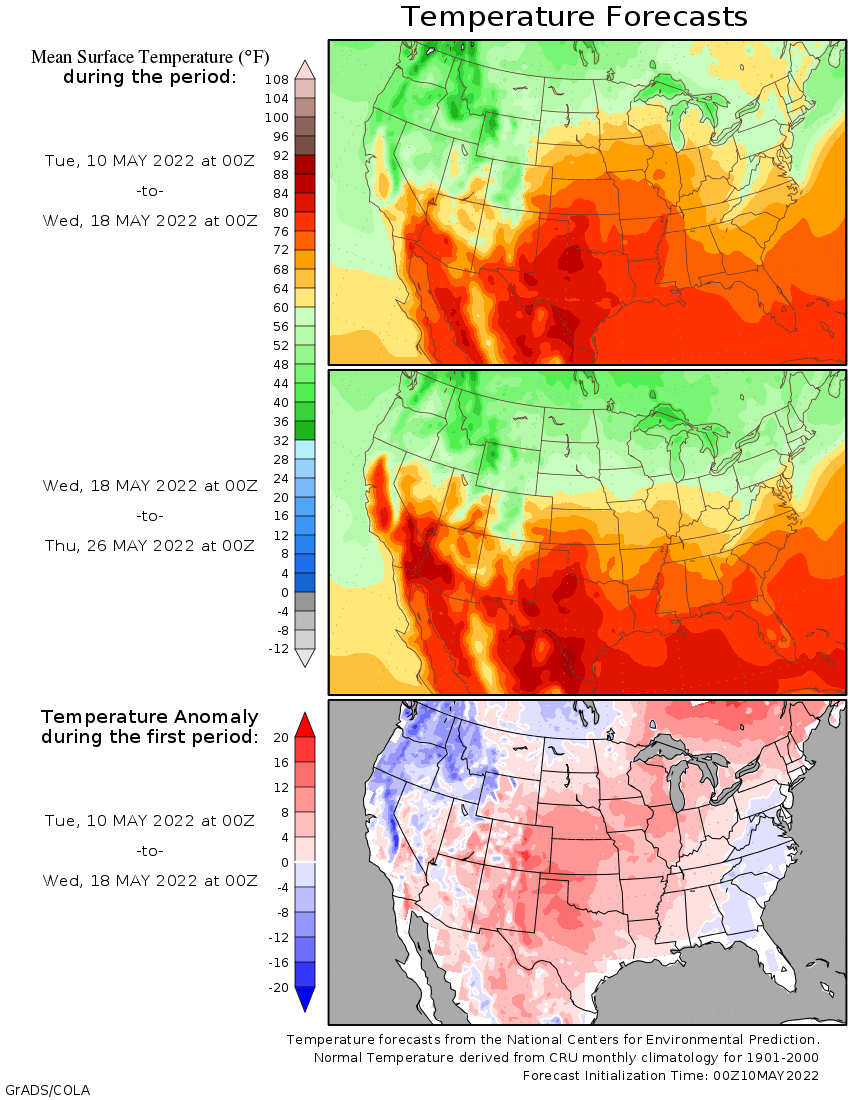

Technical buying was a factor for the price increase for wheat, corn and soybeans. Not to mention US spring crop plantings as of Sunday fell short of expectations. The US weather

outlook

has a little more precipitation for the Midwest during the back end of the seven day outlook. US temperatures will remain very warm and provide a good opportunity for producers to plant spring grains this week. The Biden Administration is looking to tame inflation

by possibly removing China import tariffs.

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

temperatures were heating up across the western Midwest Monday and stayed very warm to hot in the central and southern Plains - Warm

weather will overspread all of the U.S. Midwest and impact the Delta, southeastern states and southern Plains during the next few days - The

heat will accelerate drying rates and rainfall will be minimal in the key corn and soybean areas of the Midwest and Delta resulting in much better planting conditions later this week - Rainfall

next week in the U.S. Midwest, Delta and southeastern states will resume a more normal weather pattern with alternating periods of rain and sunshine expected favoring fieldwork and crop development - Southern

Georgia, northern Florida and parts of Alabama will continue drying out and crop moisture stress is expected over time - Subsoil

moisture is still favorable, but topsoil conditions are becoming very short of usable moisture which may impact recently planted crops.

- Repeating

thunderstorms tonight through Friday night from western Texas to the central U.S. Plains will offer some improved topsoil moisture - The

precipitation will be erratic each day and temperatures will be warm to hot keeping evaporation rates high and making it tough for a lasting increase in topsoil moisture to take place - Some

increase in dryland planting and germination may occur as a result of this week’s showers and thunderstorms, although the majority of the rain will not be great enough to seriously change the moisture profile and drought status is unlikely to change - U.S.

hard red winter wheat conditions and production potentials are unlikely to change much as a result of this week’s showers and thunderstorms or the warm bias - North

Dakota, Manitoba and eastern Saskatchewan are still facing significant field working delays during the coming week due to wet fields and additional precipitation - Some

neighboring areas will also be impacted, although the moisture situation may not be quite as serious - An

extended period of dry weather is needed to get fields to dry down so that planting can take place - Snow

fell Monday in western Alberta, Canada, although it had a low impact - Western

and some northern Alberta locations are still too wet and need to dry down to support improved planting conditions - Less

precipitation is expected, but the environment will not bring on dramatic improvement in field conditions for a while leaving spring planting progressing slowly - Brazil’s

Mato Grosso and Goias states will continue dry biased for the next ten days maintaining short to very short soil moisture and stressing Safrinha corn and cotton - Lower

production is expected because of dryness in these states this year - However,

good Safrinha crop development has occurred from Mato Grosso and parts of Paraguay into Parana and Sao Paulo where yields should be good - Argentina

will continue to see little to no rain, but the environment is great for late season crop maturation and harvest progress - Some

rain will be needed late this month and in June to support wheat, barley and canola planting - Tropical

Cyclone Asani was located 67 miles southeast of northeastern Andhra Pradesh coast or 577 miles southwest of Kolkata, India at 15.1 north, 82.1 west moving westerly at 13 mph and producing maximum sustained wind speeds of 74 mph near the center of the storm - Hurricane

force wind was occurring out 25 miles from storm center while tropical storm force wind was occurring out 135 miles - Asani

will make landfall along the central Andhra Pradesh coast Wednesday - Very

heavy rain and some coastal flooding is expected along with some damaging wind and rough seas as the storm moves inland - Rainfall

could range from 5.00 to 15.00 inches near the point of landfall and the storm’s movement once over the coast could become very sluggish allowing hear rain will prevail for a while - Winter

rice and some sugarcane could be negatively impacted - Europe

is expected to continue drying down due to limited rainfall and mild to warm temperatures - France,

Germany, southern parts of the U.K. and Spain will become driest as time moves along, although drying is also expected in Poland and Czech Republic - Any

rain that occurs after May 20 will be light and not well distributed, but a little relief is expected - Western

and northern Russia will receive waves of rain in the coming week to ten days maintaining or inducing wet field conditions and delaying spring fieldwork - Rain

in western Kazakhstan Montana and early today was ideal in lifting topsoil moisture for improved spring wheat and sunseed planting and establishment conditions - North

Africa is drying out, but mostly to the benefit of winter crop filling, maturation and early harvesting - The

region will be dry for a while - India’s

far Eastern States may get too much rain in the coming week resulting in some flooding - Most

of India will continue to experience warm to hot temperatures and sporadic rainfall during the next ten days resulting in a little less than usual pre-monsoonal rainfall - South

Africa will experience net drying over the next ten days in many areas and that will prove ideal for summer crop maturation and harvest progress.

- Some

winter crop planting is also expected during this period of drier weather - Ontario

and Quebec weather will be dry biased most of this week and the temperatures will trend warmer - This

will result in better field working opportunity for corn and other crops - Wheat

development will be accelerated as well - Next

week’s weather may trend a little wetter - Mexico

rainfall is expected to support isolated to scattered showers and thunderstorms in southern and eastern parts of the nation this week - Most

of the rain is not expected to be enough to counter evaporation and more rain will be needed in time - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Northern

South America will experience frequent rain and thunderstorms over the next ten days resulting in some local flooding

- Colombia

and Venezuela as well as Ecuador and the northern Amazon River Basin will be most vulnerable to the heavy rainfall and flooding - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - Mainland

areas of China will be wettest south of the Yangtze River during the next two weeks, although there will be some other bouts of rain periodically in other areas in the nation and all of it will be welcome - Net

drying is possible in east-central parts of the nation and in Liaoning which may raise a little concern about dryness in time - Rain

is expected in the Yellow River Basin where an improvement in winter and spring crop conditions are expected after recent drying

- South

Korea rice production areas are too dry and little change is expected over the next ten days - Some

of this dryness may expand northward into North Korea - Southeast

Asia rainfall will be abundant to excessive in the next ten days from Myanmar into Thailand, Laos and Cambodia as well as from eastern parts of Borneo into the southern Philippines and Papua New Guinea - Some

flooding is expected in many areas - Southwest

monsoon rainfall in Myanmar could become excessive later this week with 10.00 to 20.00 inches of rain possible over the southern most parts of the nation and into the northern Malay Peninsula - Tropical

Cyclone Karim poses no threat of land from a position in the central Indian Ocean - Eastern

Australia will be rainy this week - Amounts

of 1.50 to 4.00 inches will occur in central and northern New South Wales and southern Queensland by Friday while 3.00 to 12.00 inches are expected along the central and lower Queensland coast

- Damage

to sugarcane is possible and some unharvested cotton quality will decline - Sorghum

should not be harmed, although harvest delays are likely - Canola,

wheat and barley planting potentials will increase greatly following this period of rainy weather - Western

Australia will get some beneficial rain in the southwest during mid- to late week this week

- The

moisture will help improve planting for some areas, but more rain will be needed - Some

follow up rain is expected next week - South

Australia and Victoria rainfall will be most limited over the next two weeks - West-central

Africa will experience frequent rainfall over the next ten days supporting coffee, cocoa, sugarcane and rice development - Some

northern cotton areas need greater rain - East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +19.50 and it has likely peaked, but will remain strongly positive for a while this week

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in the north next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- Malaysian

Palm Oil Board’s data for April output, exports and stockpiles - EU

weekly grain, oilseed import and export data - Globoil

International 2022 in Dubai, day 2 - Innovation

Forum’s virtual Future of Food conference, May 10-12 - New

York sugar seminar hosted by StoneX Financial - France

agriculture ministry’s monthly grains report - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative) - Holiday:

Russia

Wednesday,

May 11:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Globoil

International 2022 in Dubai, day 3 - France

AgriMer monthly grains outlook - Annual

New York Sugar Conference, hosted by Datagro and International Sugar Organization

Thursday,

May 12:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - New

Zealand food prices

Friday,

May 13:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

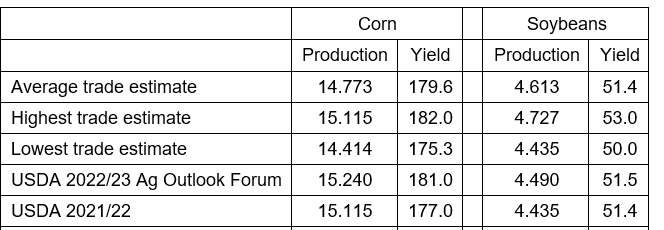

US

production

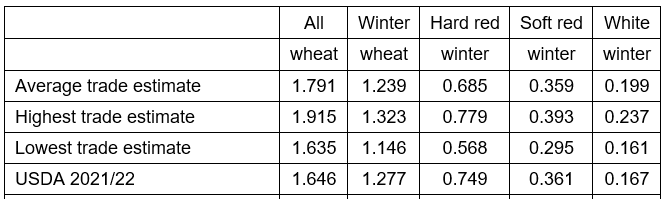

US

wheat production

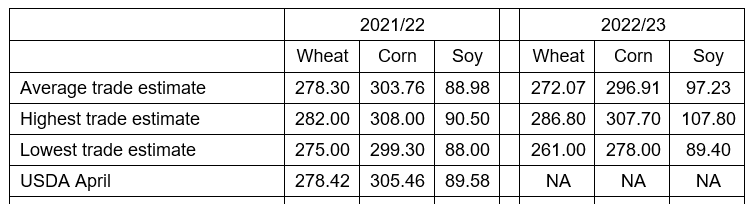

Global

stocks

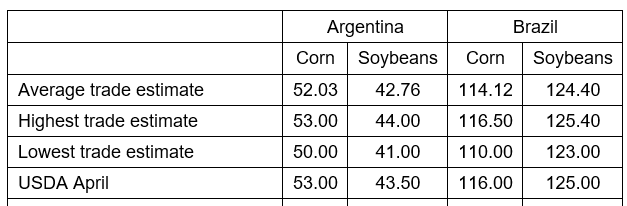

SA

production 2021-22

·

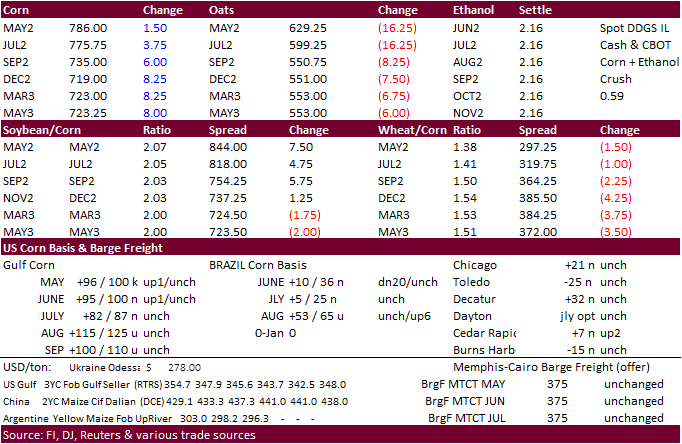

Corn futures were higher on technical buying, higher wheat and rebound in selected outside related markets. WTI traded sharply lower, but equities were higher. Only 22 percent of the US corn crop had been planted as of Sunday,

below expectations and well behind average.

·

The Baltic Dry Index increased 3.8 percent or 108 points, near a 5-month high.

·

France is projected to plant less corn this year. The AgMin estimated the corn area at 1.37 million hectares, down 6.1% from 2021.

·

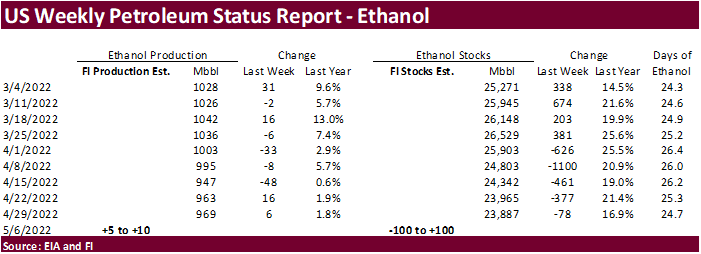

A Bloomberg poll looks for weekly US ethanol production to be up 7,000 barrels to 976 thousand (972-979 range) from the previous week and stocks down 151,000 barrels to 23.736 million.

·

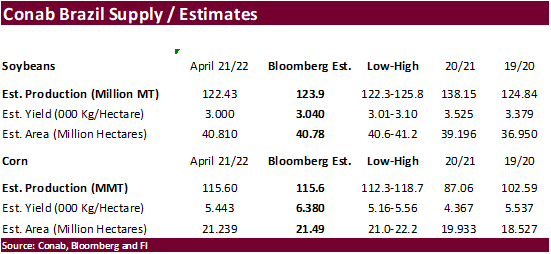

A Reuters poll calls for Brazil corn production for 2021-22 to be a record 115 million tons, up from 87.09 million for 2020-21. Note the area expanded about 7 percent from last season. Yet, traders look for Conab to reduce their

estimate when released Thursday due to recent unfavorable weather. USDA last month increased their Brazil corn estimate by 2 million tons to 116 million. It will be interesting to see what they do on Thursday. A Reuters trade guess for USDA calls for 114.12

million tons.

·

Brazil has plenty of corn supply and we look for them to export more corn and less soybeans, by mid-July, IMO.

Export

developments.

·

(New 5/10) South Korea’s KFA bought 65,000 tons of corn at an estimated $379.95 a ton c&f for arrival in South Korea around Aug. 20.

·

China plans to buy 40,000 tons of pork for reserves on May 13.

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range

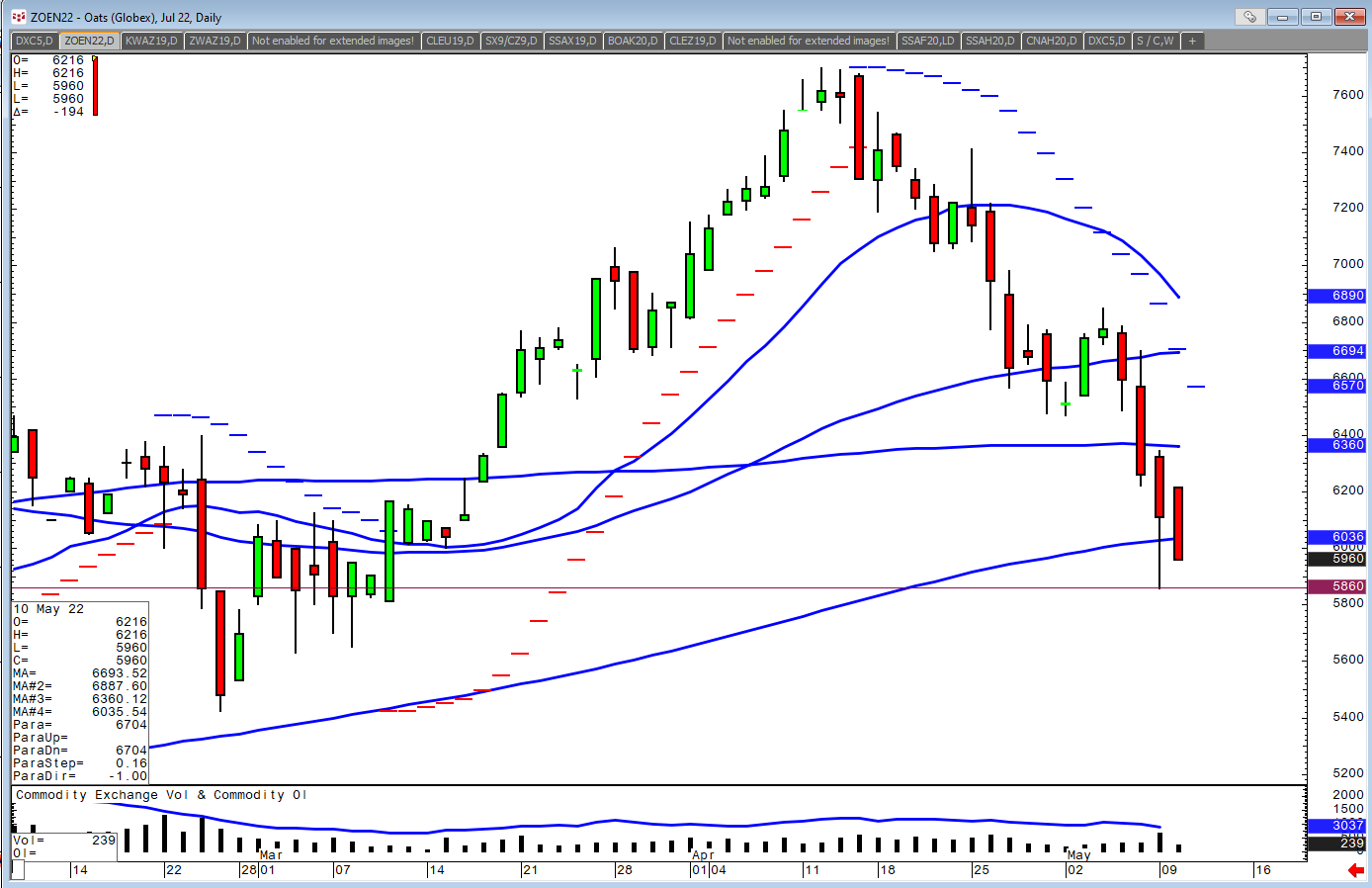

July

oats have really taken a tumble