PDF Attached

![]()

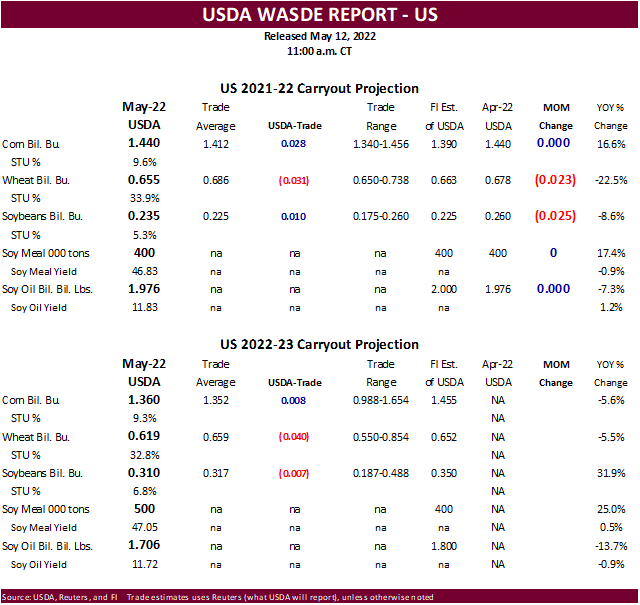

USDA

released their May supply and demand estimates

Reaction:

Neutral soybeans, bullish corn and bullish wheat

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2022/03-31-2022.pdf

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

US

2021-22 soybean stocks were lowered 25 million bushels to reflect an increase in crush, yet product production was unchanged from the previous month (puzzling). USDA did lower soybean meal exports by 200,000 short tons and increase domestic use by a like amount.

New crop soybean production was estimated at 4.640 billion bushels, 27 million above an average trade guess. The new-crop carryout was estimated at 310 million bushels, above 235 million for 2021-22.

US

2021-22 corn stocks were unchanged from the previous month. US left the 2021-22 corn balance sheet unchanged. The trade was looking for exports to be increased 25 million bushels. New-crop corn production was estimated at 14.460 million bushels, 313 million

below an average trade guess and 655 million below year ago. USDA’s implied yield is 177.0 bushels per acre, 2.6 bushels below the trade. The new-crop carryout was estimated at 1.360 billion bushels, near trade expectations.

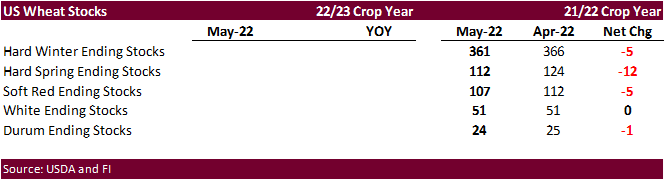

The

2021-22 US all-wheat carryout was lowered 23 million bushels. USDA took exports up 20 million bushels and food use up 3 million. The upward revision might come as a surprise to the trade but note Census exports for wheat in their latest update came in well

above our working estimate. USDA reported a much lower US winter wheat production estimate of 1.729 billion bushels (65 million below), and 103 million below 2021. HRW wheat of 590 million was reported 95 million below an average trade guess. US all-wheat

stocks of 619 million bushels were 40 million below the trade average. See US balance changes after the text.

New-crop

world numbers indicate a major shift in production estimates for soybeans and corn. Soybean production next crop-year is expected to expand 45.3 million tons while the world corn production to contract 34.9 million tons. World wheat production is expected

to decline only 4.5 million tons despite USDA estimating Ukraine wheat output to decline 11.5 million tons for the previous season to 21.5 million tons. USDA boosted 2021-22 world corn output by 5.2 million tons (smaller countries, increase 2021-22 world wheat

output by 0.5 million tons, and lowered soybean production by 1.4 million tons. Argentina 2021-22 production was lowered 1.5 million tons and Brazil was left unchanged. Attached are major country changes for 2021-22 and 2022-23.

USDA

24-hour: Private exporters reported sales of 612,000 metric tons of corn for delivery to China. Of the total, 68,000 metric tons is for delivery during the 2021/2022 marketing year and 544,000 metric tons is for delivery during the 2022/2023 marketing year.

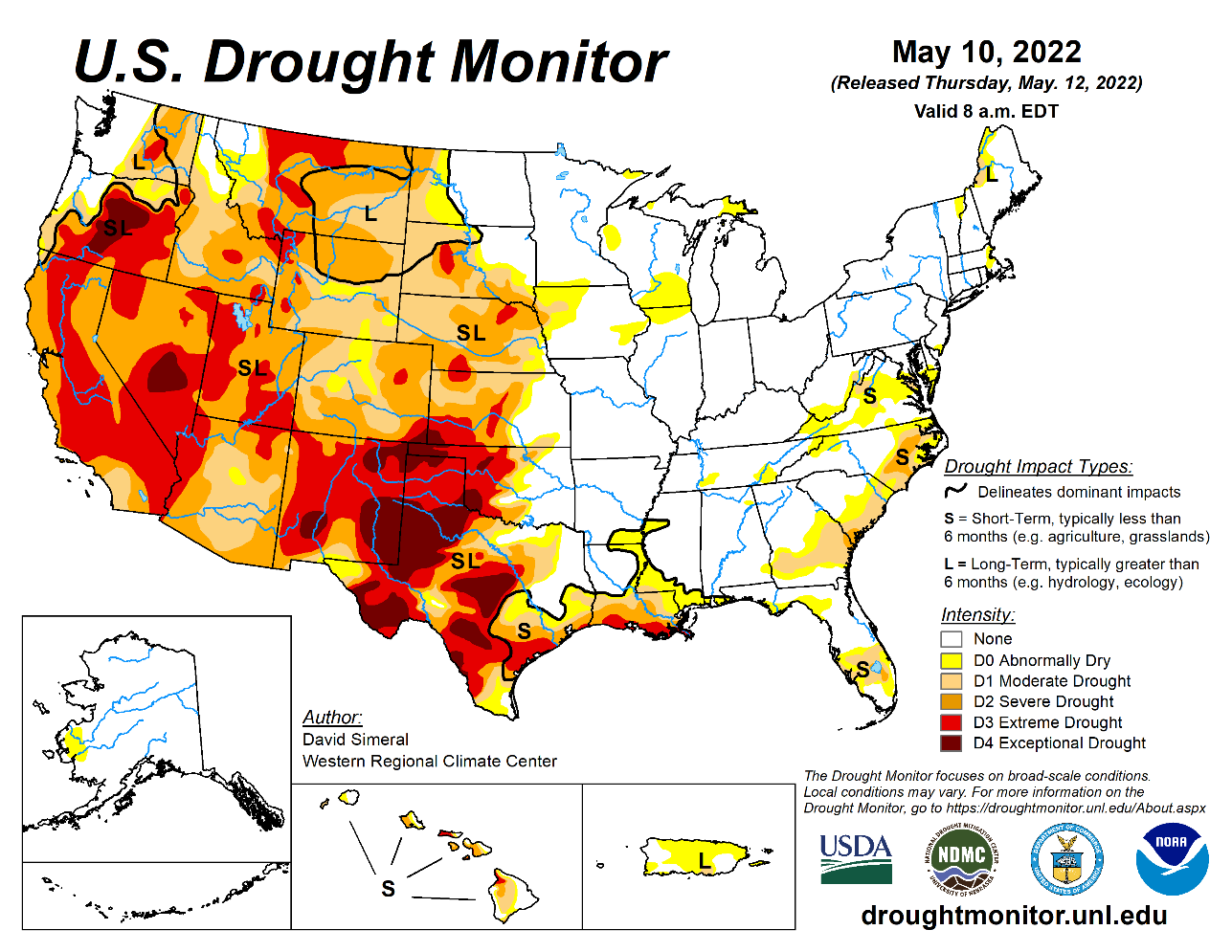

WEATHER

EVENTS AND FEATURES TO WATCH

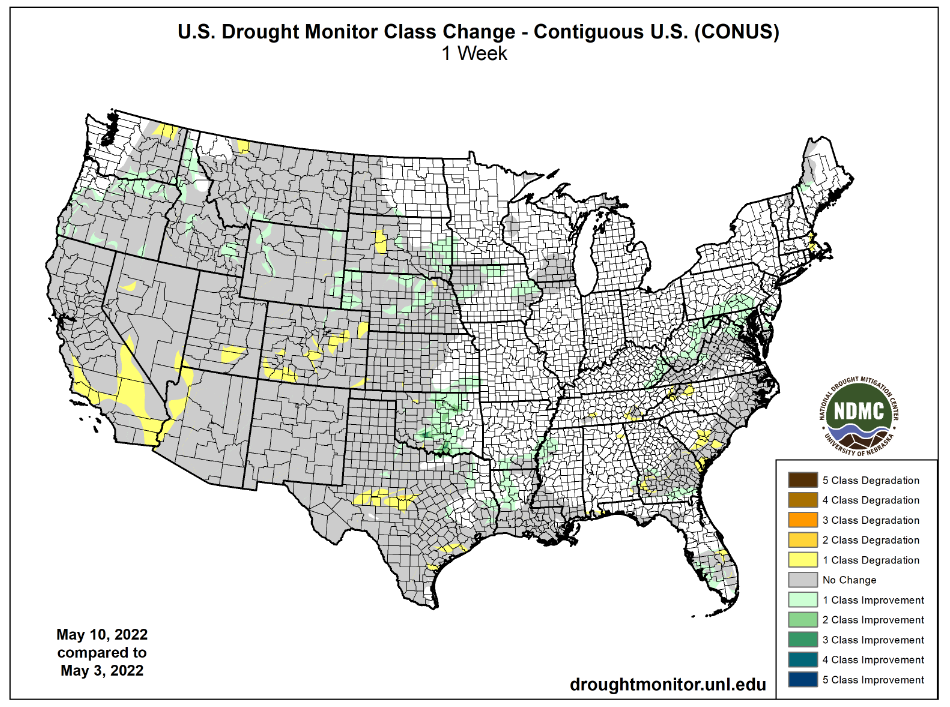

- Wetter

biased weather in the U.S. Midwest for this weekend through all of next week and into the following weekend will be driven by cooler air seeping southward from Canada and warm biased conditions in the southern U.S.

- Such

conditions as these will fuel frequent low pressure systems moving along a fast jet stream - Rain

will occur often and it will disrupt farming activity - Today

and Friday’s weather will be best for aggressive spring planting from Michigan through Indiana, Ohio and Kentucky to the Delta and Tennessee River Basin

- After

today the eastern Midwest field progress rate will slow greatly because of more frequent rainfall - Western

Midwest crop areas will already be experiencing some increase in precipitation potential later today and Friday - U.S.

northern Plains and Canada’s eastern Prairies will receive widespread rain today and Friday with lingering rain in eastern Canada’s Prairies Saturday - Moisture

totals of 1.00 to 2.50 inches will occur in eastern Saskatchewan and eastern Montana while 0.20 to 0.75 inch occurs from central South Dakota to south-central North Dakota - Rain

totals of 0.50 to 1.50 inches are likely in Minnesota and western North Dakota while 1.00 to 2.00 inches occurs in eastern Montana with a few greater amounts possible - Fieldwork

will be on hold for a while because of wet conditions in these areas - Less

precipitation will impact Canada’s Prairies and the northern U.S. Plains for a while late this weekend and early to mid-week next week

- The

next larger storm may evolve late next week - Southwestern

U.S. Plains will be drier and warmer biased over the next ten days - The

Texas Blacklands, South Texas and Coastal Bend crop areas will be dry through the next nine days and then there may be some rain potential

- Crop

moisture stress will remain high in dryland production areas of South Texas and the Texas Coastal Bend where dryness has been a long term issue this spring - U.S.

temperatures will remain warm over the next several days from the southern Plains and mid-south regions into the Midwest

- Cooling

is expected next week bringing temperatures down to a more seasonable range - Extreme

highs in the 80s and lower 90s are expected over the next few days and that will accelerate drying and stimulate greater crop development rates - Europe

weather is a little wetter in today’s forecast relative to that of earlier this week, but the change only offers a little disruption to the net drying bias that had been previously advertised - No

generalized soaking of rain is expected, but the rain that falls briefly comes in two waves offering a slowdown in the drying bias - Concern

will remain over long-term soil moisture in parts of the continent and in particular in portions of France, Spain and perhaps Poland - Eastern

Australia received rain Wednesday that was widespread and sufficient in stalling fieldwork - Rain

Tuesday had already slowed fieldwork in Queensland - The

moisture was good for future wheat, barley and canola planting, but disrupted late season cotton and sorghum harvesting - This

week’s rain was not nearly as threatening to sugarcane as once advertised to be leaving the crop wet, but not facing a serious negative impact because of too much moisture - Western

Australia will get some beneficial rain the southwest over the next few days

- The

moisture will help improve planting for some areas, but more rain will be needed - Some

follow up rain is expected next week - South

Australia and Victoria rainfall will be most limited over the next two weeks - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - Mainland

areas of China will be wettest south of the Yangtze River during the next two weeks, although there will be some other bouts of rain periodically in other areas in the nation and all of it will be welcome - Net

drying is possible in east-central parts of the nation and in Liaoning which may raise a little concern about dryness in time - Rain

is expected in the Yellow River Basin where an improvement in winter and spring crop conditions are expected after recent drying

- South

Korea rice production areas are too dry and little change is expected over the next ten days - Some

of this dryness will expand northward into North Korea

- Canada’s

southwestern Prairies will continue too dry, despite a few showers over the next ten days to two weeks - Western

and some northern Alberta, Canada crop areas are too wet and need to dry down for spring planting - Cool

weather will evolve in Canada’s Prairies and the northern U.S. Plains next week and especially in the following weekend resulting in the return to frost and freeze conditions for some areas, although the weather may trend a little drier for a while - Rain

chances may improve in the southwestern Canada Prairies after next week’s cold weather abates - A

tropical disturbance may evolve next week in the Caribbean Sea, although confidence on where the system will go and how significant it may or may not become is very low - Today’s

GFS model develops a tropical cyclone and brings it into the eastern Gulf of Mexico late this month, but confidence is poor - No

general changes were noted in South America overnight - Brazil

will receive rain this weekend from Paraguay through western and southern Mato Grosso do Sul to northern Rio Grande do Sul, Santa Catarina, Parana and Sao Paulo - The

moisture will be great for late season crops - Crop

moisture stress and dryness will prevail over the next couple of weeks in Mato Grosso and Goias as well as northeastern parts of the nation - Some

showers will develop briefly in these areas late this weekend through the first half of next week, but resulting rainfall should not be enough to seriously impact harvest progress or crop conditions - Argentina

will continue in a net drying mode except in Formosa, far northern Chaco and northernmost Corrientes over the next couple of weeks - Drying

is of little concern for now, but rain will be needed in western Argentina late this month and in June to support winter wheat, barley and canola planting

- Northern

South America will experience frequent rain and thunderstorms over the next ten days resulting in some local flooding

- Colombia

and Venezuela as well as Ecuador and the northern Amazon River Basin will be most vulnerable to the heavy rainfall and flooding - Tropical

Cyclone Asani was dissipating over the central coast of Andhra Pradesh today - The

storm has produced heavy rainfall in a part of the state this week, but crop damage to unharvested winter crops has been minimal if there has been any - Additional

rain will fall over the next couple of days while the storm center completely dissipates without much movement - Western

and northern Russia will receive waves of rain in the coming week to ten days maintaining or inducing wet field conditions and delaying spring fieldwork - Rain

in western and northern Kazakhstan earlier this week as well as that in the southeastern Russia New Lands was ideal in lifting topsoil moisture for improved spring wheat and sunseed planting and establishment conditions - North

Africa is drying out, but mostly to the benefit of winter crop filling, maturation and early harvesting - The

region will be dry for a while - India’s

far Eastern States may get too much rain in the coming week resulting in some flooding - A

part of eastern Bangladesh may also be impacted - Most

of India will continue to experience warm to hot temperatures and sporadic rainfall during the next ten days

- The

exception will be along the lower west Coast of the nation where monsoonal rainfall is expected to begin early and be greater than usual - South

Africa will experience net drying over the next week in many areas and that will prove ideal for summer crop maturation and harvest progress.

- Some

winter crop planting is also expected during this period of drier weather - Rain

will return to the west during the middle and latter part of next week just in time to support autumn wheat, barley and canola planting - Ontario

and Quebec, Canada weather will be dry biased into the weekend and the temperatures will trend warmer - This

will result in better field working opportunity for corn and other crops - Wheat

development will be accelerated as well - Next

week’s weather will trend a little wetter and a little cooler - Mexico

rainfall is expected to support isolated to scattered showers and thunderstorms in southern and eastern parts of the nation over the coming week with some increase in rain for eastern areas in the May 20-26 period.

- Most

of the rain in this first week is not expected to be enough to counter evaporation and more rain will be needed in time - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Southeast

Asia rainfall will be abundant to excessive in the next ten days from Myanmar into Thailand, Laos and Cambodia as well as from eastern parts of Borneo into the southern Philippines and Papua New Guinea - Some

flooding is expected in many areas - Southwest

monsoon rainfall in Myanmar could become excessive later this week with 10.00 to 20.00 inches of rain possible over the southern most parts of the nation and into the northern Malay Peninsula - West-central

Africa will experience frequent rainfall over the next ten days supporting coffee, cocoa, sugarcane and rice development - Some

northern cotton areas need greater rain - East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +20.34 and it continues near its peak of intensity, but will remain strongly positive for a while

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in western portions of South Island

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - New

Zealand food prices

Friday,

May 13:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Macros

OPEC

Cuts Full-Year 2022 World Oil Demand Growth Forecast To 3.36 Million Bpd (Prev. Forecast 3.67 Mbpd)

OPEC

Cites Impact Of War In Ukraine, Covid-19 Restrictions In China For Demand Downgrade

OPEC

Cuts 2022 Non-OPEC Oil Supply Forecast By 0.3 Mbpd To 2.4 Mbpd; Lowers Russia Liquids Production Forecast By 360,000 Bpd

OPEC:

Its Oil Output Rose By 153,000 Bpd In April To 28.65 Million Bpd, Lagging Pledged Increase Under OPEC+ Deal

US

PPI Final Demand (M/M) Apr: 0.5% (est 0.5%; prev 1.4%)

US

PPI Ex Food And Energy (M/M) Apr: 0.4% (est 0.6%; prev 1.0%)

US

PPI Final Demand (Y/Y) Apr: 11.0% (est 10.7%; prev 11.2%)

US

PPI Ex Energy And Food (Y/Y) Apr: 8.8% (est 8.9%; prev 9.2%)

US

Initial Jobless Claims May 7: 203K (est 193K; prev 200K)

US

Continuing Claims Apr 30: 1343K (est 1372K; prev 1384K)

·

Corn traded higher prior to the USDA report on widespread commodity buying despite bearish reports by China, Brazil, and USDA (export sales). Then USDA (S&D update) came out with supportive US and global production estimates

for new-crop. Sharply higher wheat underpinned corn futures.

·

US corn futures ended higher led by back month contracts (bear spreading). USDA didn’t make any changes to the old crop balance sheet whereas the trade was looking for 2021-22 US corn exports to be lifted higher. One point not

mentioned above (USDA section) is that USDA looks for global corn and wheat consumption to decline from the current crop year. It will be interesting to see how that plays out during the October 2022 through September period.

·

The US weather forecast now calls for additional rain this weekend for the Midwest.

·

Funds bought an estimated net 8,000 corn contracts.

·

Conab upward revised their soybean and corn area from the previous month and this reflected an increase in production by 1.4 million tons for soybeans to 123.8 million tons and 600,000 tons for corn to 116.2 million tons. The

report is viewed as slightly bearish.

·

Conab raised their 2021-22 corn export forecast to 37 million tons from 36 million.

Export

developments.

·

Private exporters reported sales of 612,000 metric tons of corn for delivery to China. Of the total, 68,000 metric tons is for delivery during the 2021/2022 marketing year and 544,000 metric tons is for delivery during the 2022/2023

marketing year.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US and/or SA on May 18 for August shipment.

·

China plans to buy 40,000 tons of pork for reserves on May 13.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range