Positioning

ahead of the weekend, inflation concerns and risk off in grains created a mixed trade in US agriculture futures. We revised our US balance sheet to reflect a lower yield. It’s attached after the text (PDF).

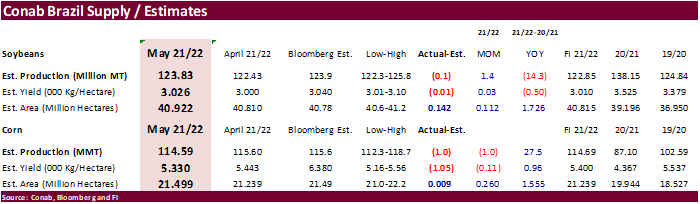

Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year. Conab late yesterday corrected their Brazil 2021-22 production forecast to 114.6 million tons, not 116.2

previously reported. That is down from 115.6 million tons previous month (not up).

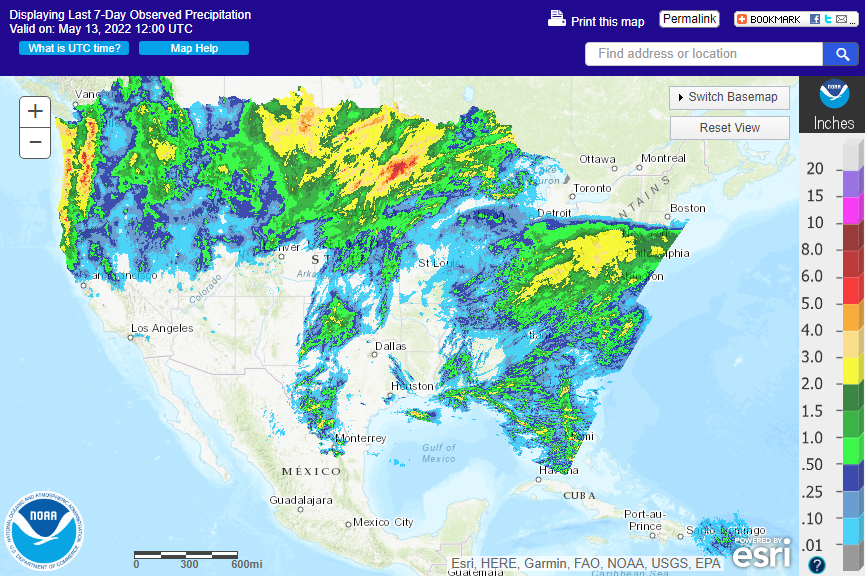

The

morning US weather forecast is still wetter for this week for the US Midwest and unchanged for the Great Plains. Rains are expected to fall across parts of the northern Great Plains today and central GP bias NE and KS over the weekend. Follow up rain will

occur for the northern Great Plains early next week. Hot temperatures are expected for the southern Great Plains. Southern Brazil could see light frost events late next week. Unfavorable weather in France is starting to impact crops

Past

7-days

WEATHER

EVENTS AND FEATURES TO WATCH

- Rain

delays in spring cereal, corn and canola areas of eastern Canada will continue over the next ten days due to periods of rain (today and Saturday wettest) and periods of cool temperatures - Northern

U.S. Plains weather may be a little less wet in the next ten days, but not dry enough to get fieldwork under way in an aggressive manner in any of the wettest areas in North Dakota or Minnesota - Welcome

rain has occurred in Montana and western North Dakota today lifting soil moisture that was still quite low previously - This

is especially true for Montana, but more rain is needed - Canada’s

southwestern Prairies and neighboring areas of the northwestern U.S. Plains still need significant moisture to support spring planting and early season crop development - Ontario

and Quebec weather warmed up nicely this week and net drying occurred to induce some fieldwork and better winter crop development - U.S.

Midwest corn and soybean production areas had a relatively good few days for drying and fieldwork this week and the eastern Midwest will continue dry and warm today - Showers

and thunderstorms are expected to resume this weekend through the next ten days slowing farming activity once again - The

storm systems advertised in this first week of the outlook are not very great and the rainfall should not seriously delay farming activity - Warm

temperatures between rain events will help to bring on some better drying conditions, but rain frequency will be great enough to limit some of the field progress - A

more prolonged period of dry and warm weather is still needed - Southern

U.S. Plains, Delta and southeastern states will experience warm temperatures and restricted rainfall during the next ten days allowing field work to advance relatively well, but some notable drying is anticipated as well. - West

Texas rain potentials will be low for the coming week, but some increased potential for showers and thunderstorms may increase in the second week of the forecast - Spotty

showers over the next seven days will fail to produce enough rain to counter evaporation with daily highs in the 80s and some 90s Fahrenheit - Western

U.S. coolness will dominate the next ten days with some expansion from the west into the north-central states and a part of Canada’s Prairies during the week next week and into the following weekend - The

cool conditions will slow crop development and drying rates - GFS

model continues to “play around” with the idea of a tropical system evolving in the Caribbean Sea late next week and into the following weekend.

- The

model has come up with many different forecast solutions for this event, but confidence in the event is still very low and it may not even evolve

- However,

the mere presence of this feature in the forecast model will interfere with some of the forecasts for the southern United States in the coming week to ten days and some caution is advised when using the model - Brazil’s

Mato Grosso and Goias corn and cotton areas will continue to dry down, although a few brief showers will occur Sunday into Monday as cooler air pushes into the region - None

of the rain will have a lasting impact on crops or soil conditions - Dry

weather will dominate the remainder of the next two weeks – which is normal - Safrinha

crop stress will continue and some yield decline for the late season crops will continue - Argentina

precipitation will continue restricted over the next ten days and temperatures will be cooler than usual in the coming week

- Frost

is still possible in southern grain areas of Brazil in the second half of next week and in the following weekend - Temperatures

in the 30s Fahrenheit are expected from Parana southward into Rio Grande do Sul - A

few readings near and slightly below freezing cannot be ruled out, but the potential for widespread hard freezes seems low based on the latest weather forecast data - Corn

and other late season crops in southern Brazil are far from being mature enough to handle frost or freeze conditions and if a significant freeze event occurs there would be a significant negative impact on crop production and conditions - Brazil

coffee, citrus and sugarcane areas are not likely to see damaging cold temperatures next week or into the following weekend, despite some notably cool weather for this time of year.

- Europe

continues to dry down, but some shower activity expected next week and into the following week should be favorably timed to slow the drying trend and induce some pocket of improved topsoil moisture - Germany

and France are both advertised to receive some of this rain - Other

areas in Europe will continue to dry down and the situation will still need to be closely monitored - Western

and central Europe is expected to be warmer than usual over the next week with some cooling expected in the following week - The

warm conditions will keep drying rates higher than usual making the necessary watch on soil moisture and dryness all the more important - Western

and northern Russia will experience abundant precipitation over the next week to ten days slowing fieldwork in many areas - Some

crop areas may become a little too wet - The

moisture will be good for long term crop development, although fieldwork will be slowed or stalled at times - East-central

China will continue to dry down through the end of this month - The

area to be most impacted will include; Shandong, Henan, Anhui, Jiangsu where soil conditions may become very short of moisture by the last week of this month - Rapeseed

harvesting in China is proceeding well and little change is expected except in southern production areas (south of the Yangtze River) where rain is expected to fall a little too often - Flooding

in far southern China this week has likely damaged a few crops - Rice,

sugarcane and minor corn production areas have been included in the excessive moisture and drier weather is needed - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - South

Korea rice production areas are too dry and little change is expected over the next ten days - Some

of this dryness will expand northward into North Korea - India’s

monsoon season will begin early this year with some heavy rain expected along the lower west coast next week and into the final days of this month - Excessive

rain and flooding will also impact India’s far Eastern States and a part of eastern Bangladesh in the coming ten days - Myanmar

coastal flooding is expected in the next ten days due to a strong southwest monsoon flow

- Torrential

rainfall of 10.00 to 20.00 inches will be possible and possibly more - Wet

weather is also expected in the coming ten days in other mainland areas of Southeast Asia, eastern Indonesia and parts of the Philippines - Eastern

Australia’s wet weather pattern this week is expected to wind down today - Too

much rain fell for a while this week delaying summer crop harvesting, but the moisture was great in bolstering soil moisture for improved range and pastureland - The

moisture was also great for future wheat, barley and canola planting - Water

supply was also improved in some areas this week - Damage

to unharvested cotton quality was suspected, though - Western

Australia will get some beneficial rain the far southwest over the next week to ten days - The

moisture will help improve planting for some areas, but more rain will be needed - The

precipitation will not be very great through early next week, but some rain already fell earlier this week

- Rain

is needed in South Australia and western parts of Victoria where it has been driest for the long period of time - North

Africa is drying out, but mostly to the benefit of winter crop filling, maturation and early harvesting - The

region will be dry for a while - South

Africa will experience net drying over the next week in many areas and that will prove ideal for summer crop maturation and harvest progress.

- Some

winter crop planting is also expected during this period of drier weather - Rain

will return to the west during the middle and latter part of next week just in time to support autumn wheat, barley and canola planting - Mexico

rainfall is expected to support isolated to scattered showers and thunderstorms in southern and eastern parts of the nation over the coming week with some increase in rain for eastern areas in the May 20-26 period.

- Most

of the rain in this first week is not expected to be enough to counter evaporation and more rain will be needed in time - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- West-central

Africa will experience frequent rainfall over the next ten days supporting coffee, cocoa, sugarcane and rice development - Some

northern cotton areas need greater rain - East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +20.30 and it continues near its peak of intensity, but will remain strongly positive for a while

- New

Zealand weather will trend a little wetter over the next ten days easing dryness that has recently evolved.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Monday,

May 16:

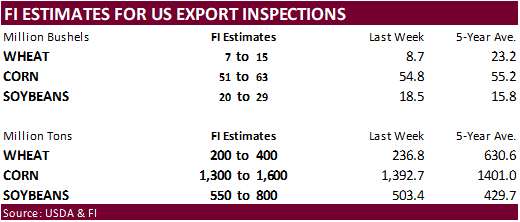

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop progress and planting data for corn, soybeans, spring wheat and cotton; winter wheat conditions, 4pm - HOLIDAY:

India, Indonesia, Malaysia, Singapore, Thailand

Tuesday,

May 17:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - GrainCom

conference in Geneva, May 17-19

Wednesday,

May 18:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

second batch of April trade data, incl. corn, wheat, sugar and pork imports - USDA

total milk production, 3pm - HOLIDAY:

Argentina

Thursday,

May 19:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

red meat production, 3pm - International

Grains Council’s monthly report

Friday,

May 20:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

third batch of April trade data, including soy, corn and pork imports by country - FranceAgriMer

weekly update on crop conditions - Malaysia’s

May 1-20 palm oil export data - U.S.

cattle on feed - EARNINGS:

IOI Corp

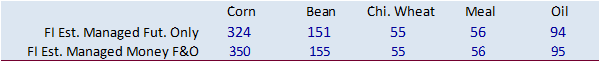

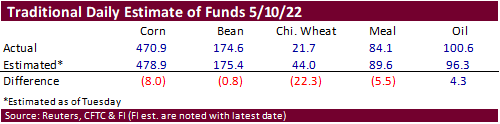

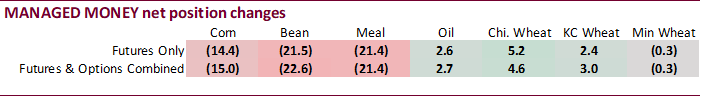

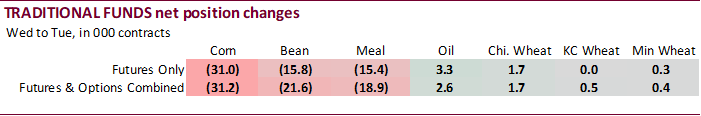

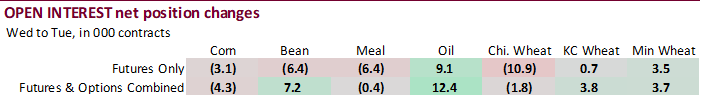

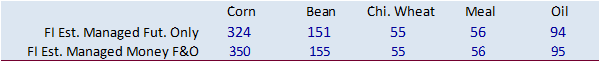

Funds

were less long for all major agriculture commodities with exception of soybean oil. The combined net position for managed money futures and options combined is down again this week, along with the combined net index fund position. Funds still hold a good amount

of net long positions.

Reuters

table via CFTC

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

249,332 -27,498 481,763 -422 -685,043 34,568

Soybeans

65,867 -14,734 189,643 -5,367 -227,032 22,279

Soyoil

64,251 2,864 113,797 -735 -196,475 -6,175

CBOT

wheat -35,703 2,237 153,752 -1,663 -114,302 -2,443

KCBT

wheat 9,473 1,340 64,561 -1,775 -76,925 -186

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

338,562 -14,956 282,389 -3,828 -671,654 41,699

Soybeans

130,661 -22,591 116,655 3,455 -229,394 20,334

Soymeal

52,314 -21,437 93,407 -2,234 -190,527 17,636

Soyoil

88,376 2,732 85,588 654 -201,836 -7,345

CBOT

wheat 15,547 4,641 66,449 -1,734 -88,786 -1,817

KCBT

wheat 42,913 2,964 27,755 -1,567 -68,899 411

MGEX

wheat 18,257 -309 737 -12 -30,349 -561

———- ———- ———- ———- ———- ———-

Total

wheat 76,717 7,296 94,941 -3,313 -188,034 -1,967

Live

cattle 29,949 -8,948 69,330 -3,625 -116,036 12,255

Feeder

cattle -2,920 610 5,357 31 2,763 257

Lean

hogs 20,608 -8,934 49,918 -1,698 -68,759 8,830

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

96,756 -16,267 -46,053 -6,648 2,168,588 -4,310

Soybeans

10,557 978 -28,478 -2,176 895,823 7,150

Soymeal

18,169 2,536 26,637 3,499 409,858 -423

Soyoil

9,445 -88 18,427 4,047 437,582 12,397

CBOT

wheat 10,537 -2,958 -3,746 1,868 424,000 -1,804

KCBT

wheat -4,660 -2,429 2,891 620 197,589 3,789

MGEX

wheat 6,266 684 5,089 198 77,191 3,696

———- ———- ———- ———- ———- ———-

Total

wheat 12,143 -4,703 4,234 2,686 698,780 5,681

Live

cattle 25,545 -1,474 -8,789 1,791 373,592 722

Feeder

cattle 386 -273 -5,585 -624 55,543 1,528

Lean

hogs 4,053 2,284 -5,820 -483 286,010 -4,957

Macros

US

Import Price Index (M/M) Apr: 0.0% (est 0.6%; prev 2.6%)

US

Import Price Index Ex Petroleum (M/M) Apr: 0.4% (est 0.7%; prev 1.1%)

US

Import Price Index (Y/Y) Apr: 12.0% (est 12.3%; prev 12.5%)

US

Export Price Index (M/M) Apr: 0.6% (est 0.7%; prev 4.5%)

US

Export Price Index (Y/Y) Apr: 18.0% (est 19.2%; prev 18.8%)

US

Univ. Of Michigan Sentiment May P: 59.1 (est 64.0; prev 65.2)

–

Current Conditions: 63.6 (est 69.3; prev 69.4)

–

Expectations: 56.3 (est 61.5; prev 62.5)

–

1-Year Inflation: 5.4% (est 5.5%; prev 5.4%)

–

5-10 Year Inflation: 3.0% (prev 3.0%)

·

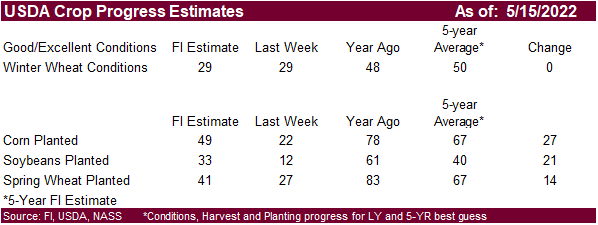

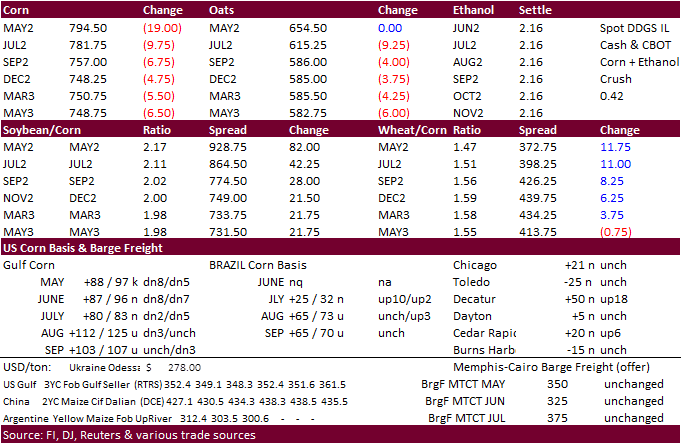

Corn traded lower on profit taking and favorable US planting progress and lower Chicago wheat. Bear spreading was a feature. Soybean/corn spreading also could have pressured prices. News was light.

·

The US weather forecast continues to call for additional rain this weekend for the Midwest, but plantings should move along.

·

Spot Midwest corn basis was steady to firmer on Friday due to lack of producer selling.

·

Conab late yesterday corrected their Brazil 2021-22 production forecast to 114.6 million tons, not 116.2 previously reported. That is down from 115.6 million tons previous month (not up).

·

Funds sold an estimated net 8,000 corn contracts.

Export

developments.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US and/or SA on May 18 for August shipment.

·

Today China planned to buy 40,000 tons of pork for reserves.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range