PDF Attached

Calls:

Wheat 10-15 higher, soybeans 4-8 higher and corn 2-5 higher.

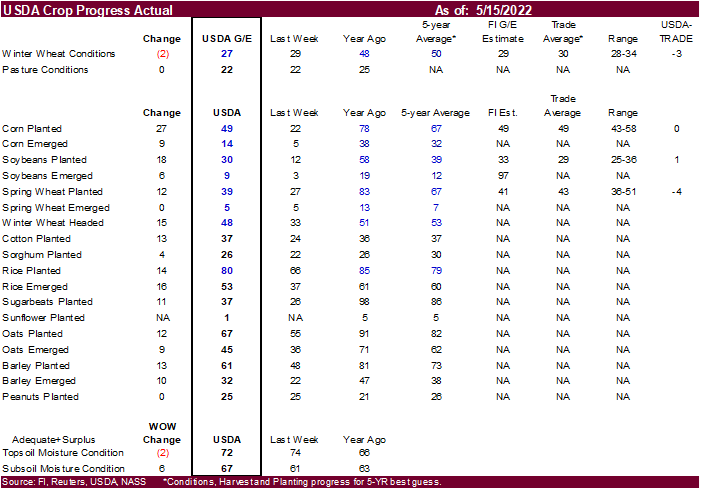

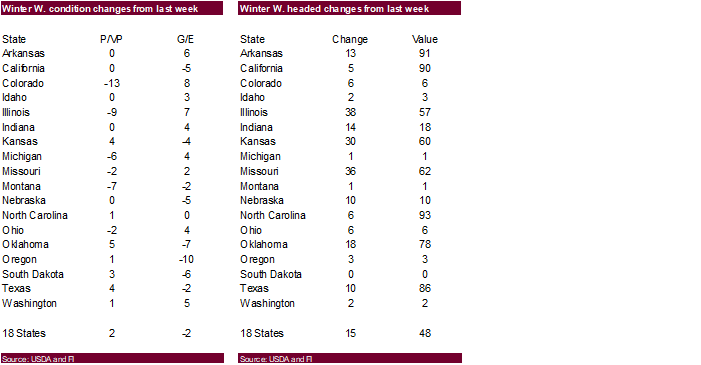

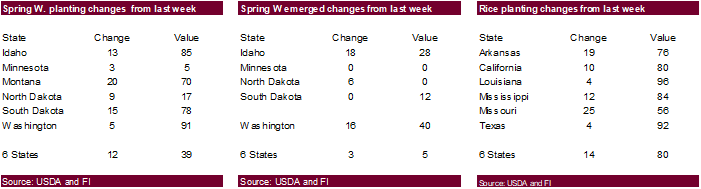

Winter

wheat conditions declined 2 points to 27 percent for the combined good and excellent conditions and were three points below expectations. US spring wheat plantings were 4 points below expectations, corn at expectations and soybeans one point above expectations.

US

agricultures futures traded sharply higher (exception soybean oil) led by a surge in wheat.

India

announced an export ban on wheat, excluding selected countries such as Egypt. NOPA US April crush came in below expectations. The USD was 30 points lower as of 1:35 pm CT and WTI reversed to traded $3.36 higher.

The

morning and midday weather forecast turned slightly unfavorable from Friday with a wetter bias for the northern Great Plains Tuesday through Friday. The Midwest saw good planting weather over the weekend despite rains across many states. Rain this week for

the Midwest will slow planting progress but some areas will be able to get plantings done.

Kansas

State University provided the following

WEATHER

EVENTS AND FEATURES TO WATCH

- Frosty

weather is still possible in southern Brazil this week - Permanent

crop damage is not expected until late this week and then temperatures will slip into the 30s Fahrenheit in Parana grain areas resulting in the development of frost which may have some negative impact on immature summer crops - There

is still time for the airmass to change its character and the situation will need to be closely monitored.

- Frost

without a hard freeze would likely have a low impact on production potentials for Safrinha and other late season crops; however, if a hard freeze evolves the impact could be quite serious.

- Early

indications suggest a low impact, but frost is probable. - A

better forecast over the potential for freezes will evolve later this week, but today’s forecast downplays the potential for a hard freeze - Do

not turn your back on this potential yet, though - Minor

Brazil coffee, citrus and sugarcane areas will be vulnerable to a few pockets of soft frost late this week, but no seriously threatening cold temperatures are expected - Saturday

will be coldest, but the period from Wednesday through Sunday will be cooler than usual - Windy

conditions Tuesday and Wednesday in coffee areas could knock a few ripe coffee beans to the ground, but not many - The

crop will be recoverable since there will not be much rain after the wind arrives, but extra labor will be needed to get the beans collected.

- Rain

will precede the wind, but the ground should dry quickly in the wind and that will help protect the beans from rotting before being collected – assuming the necessary labor for collection is available.

- Rain

in Brazil during the weekend stayed mostly south of Mato Grosso and Goias leaving those two states quite dry

- Safrinha

corn and cotton continued stressed by the lack of rain and mild to warm temperatures - A

few showers will linger today as cooler air spreads across the region, but resulting rainfall will not change the soil moisture or the level of crop stress impacting the region - Argentina

will continue to receive restricted rainfall during the next ten days, but some rain fell lightly Saturday and early Sunday with northern Cordoba and southern Santa Fe getting 0.05 to 0.30 inch except in northwestern Cordoba where up to 1.30 inches resulted - Most

of the rain in Argentina during the weekend was not generalized enough in key winter crop areas to change soil moisture

- The

need for precipitation in the west remains high for support of winter wheat, barley and canola planting this autumn - U.S.

rainfall in key summer grain and oilseed areas during the weekend was scattered leaving many areas with good drying conditions while others received enough rain to disrupt fieldwork

- U.S.

temperatures were warm late last week and early in the weekend with some cooling late in the weekend - The

warmth and relatively dry conditions should have allowed a little more fieldwork to advance - This

week’s weather in the Midwest will be favorably mixed with periods of sunshine and rain - It

will not provide an ideal environment for aggressive fieldwork, but progress should occur around the precipitation

- Temperatures

will be warm enough to stimulate favorable drying conditions between rain events suggesting some field progress will be possible - Daily

high temperatures in the Midwest this week will be in the in the 60s and 70s Fahrenheit in the north and the 70s and 80s in the south - The

next wave of more significant warming is expected briefly in the second half of this week when 80-degree highs are common once again with a few 70s in the north - Cooling

is expected from northwest to southeast Friday into the coming weekend dropping temperatures below average in some areas for a while - The

cool down will result in widespread rain and thunderstorm activity that will disrupt farming activity.

- The

greatest rainfall to impact the eastern half of the Great Plains and Midwest will occur during the middle to latter part of next week and into the following weekend which may result in a greater disruption to fieldwork - GFS

operational model continues to promote a tropical cyclone that will develop late this week and into the weekend near the Caribbean Coast of Central America. - This

storm is then intensified while turning northeast toward the southeastern United States Sunday through Tuesday of next week - The

GFS intensifies the storm into a viable tropical cyclone with landfall in the southeastern states early to mid-week next week - Confidence

in this storm is still very low with no other medium range computer weather forecast model predicting such an event - World

Weather, Inc. does not believe the storm will evolve as indicated, although a tropical disturbance is possible near the Central America coast producing enhanced rainfall there during mid- to late week this week - U.S.

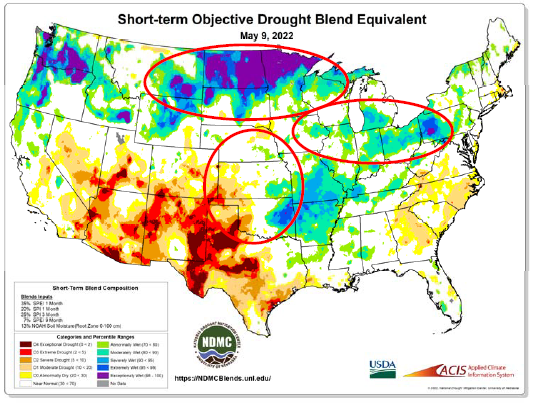

west-central and southwestern Plains rainfall is still advertised to be minimal during the next ten days, although completely dry weather is not likely - Most

of the precipitation from western Texas to eastern Colorado and western Kansas will not be enough to counter evaporation and drought status will continue - West

Texas rain potentials are greatest for tonight into Tuesday and Tuesday night into Wednesday - Resulting

rainfall will be greatest in the Texas Panhandle while leaving the key cotton, corn and sorghum areas of West Texas with very little significant rain. - Western

and northern U.S. coolness will dominate the coming week along with much of south-central and southwestern Canada locations - The

cool conditions relative to normal will shift to the north-central parts of the U.S. next week - U.S.

northern Plains and Canada’s Prairies will experience restricted rainfall through mid-week this week, but totally dry conditions re unlikely - Canada’s

eastern Prairies received significant rain late last week and into the weekend with significant rain falling in eastern Saskatchewan and northern Manitoba Friday into Saturday after occurring in Manitoba and southern Saskatchewan Thursday night into Friday - Canada’s

drier areas in the southwestern Prairies may get some rain Thursday into Friday with rainfall of 0.20 to 0.80 inch possible - That

may be sufficient to ease some of the region’s dryness, but much more precipitation will be needed - The

rain will be erratic, but some improved planting and crop emergence conditions are expected - Another

chance for rain will evolve in the southwestern Canada Prairies late next week, but confidence is low - Cold

air will evolve in Canada’s Prairies late this week through the coming weekend with frost and freezes likely Friday through Sunday - Some

snowfall may precede the coldest weather especially in the eastern Prairies - The

cold should not seriously impact very many early season crops because of late planting and the fact that many crops have not emerged well enough to be seriously impacted by the cold - With

that said, there may be need for some replanting - Ontario

and Quebec rainfall will be light and intermixed with periods of sunshine and mild to warm weather through the next two weeks - The

environment will be good for crop development - Europe

rainfall continued restricted during the weekend and rainfall this week will be slow to evolve, but some showers are expected this week - Europe

rainfall over the next ten days will continue to be pocketed meaning some areas will get enough to bolster soil moisture while other areas fail to get enough for a big change in soil moisture - Southwestern

France, Spain and Portugal will be driest over the next ten days and rain that falls in Germany, the U.K., Poland and Czech Republic may not be enough to fully restore soil moisture to normal, but any rain would be welcome - Europe

temperatures will be warmer than usual during the next ten days to two weeks in the west and a little more seasonable in the east - The

warmth will make it more difficult for western parts of the continent to see a serious lift in soil moisture over the next week to ten days leaving some areas a little too dry and crop stress on the rise.

- Western

CIS precipitation will continue often enough in the next two weeks to maintain moisture abundance in many areas, although some decrease in topsoil moisture may occur in Ukraine for a while this week - Net

drying will also occur in western Kazakhstan where beneficial moisture occurred last week - North

Africa will continue seasonably dry and warm supporting winter crop filling, maturation and harvesting - Turkey

will be the only Middle East nation getting above normal rainfall during the next week to ten days - A

boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest hurting winter grain production and raising some worry over irrigated cotton and rice development - East-central

China and the Korean Peninsula are still advertised to be dry over the next full week - Temperatures

will be warmer than usual leading to moisture shortages - South

Korea is already too dry and needs rain for its rice crop - Some

computer forecast model runs have attempted to bring rain back into the some of these areas next week, but confidence is low - World

Weather, Inc. believes dryness could easily become a festering event in this region; including Shandong, Henan, northern Anhui, Jiangsu, the Korean peninsula and in a few areas of the Yellow River Basin - Flooding

in far southern China late last week continued into the weekend and likely damaged a few crops - Rice,

sugarcane and minor corn production areas in the southern coastal provinces have been included in the excessive moisture and drier weather is needed - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - India’s

rainfall this week will be greatest in the far Eastern States and in the extreme south with a few pre-monsoonal showers in between these two areas - Winter

crop harvest progress will continue to advance favorably. - Excessive

heat continued during the weekend with extreme highs to 118 degrees Fahrenheit (48C) - Australia

rainfall will be restricted through Thursday of this week after rain last week came to an end - Last

week’s rainfall disrupted cotton and sorghum harvesting and may have reduced the quality of unharvested crops - Rain

should increase this weekend and especially next week in eastern and western parts of the nation - The

moisture will be great for winter crop planting - South

Africa weather was dry during the weekend and more of the same was expected through mid-week this week favoring summer crop maturation and harvest progress - Winter

crop planting will also advance favorably - Rain

will increase in the central and south this weekend into next week slowing some harvest progress, but the rain will be great for winter crop planting - West-central

Africa will receive frequent rainfall during the next ten days to two weeks supporting a normal coffee, cocoa and sugarcane development environment - Cotton

areas will also benefit from the pattern, although greater rain is needed in the more northern production areas - Excessive

rain and flooding will also impact India’s far Eastern States and a part of eastern Bangladesh this week - Myanmar

coastal flooding is expected in the next ten days due to a strong southwest monsoon flow

- Torrential

rainfall of 10.00 to 20.00 inches will be possible and maybe more - Much

of that will occur this weekend through all of next week - Wet

weather is also expected in the coming ten days in other mainland areas of Southeast Asia, eastern Indonesia and parts of the Philippines - Mexico

rainfall is expected to be restricted through most of this workweek - A

boost in rainfall is expected over central and eastern states this weekend into next week - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +19.81 and it is expected to begin a steady weakening trend this week - New

Zealand weather will trend wetter over the next ten days easing dryness that has recently evolved.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop progress and planting data for corn, soybeans, spring wheat and cotton; winter wheat conditions, 4pm - HOLIDAY:

India, Indonesia, Malaysia, Singapore, Thailand

Tuesday,

May 17:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - GrainCom

conference in Geneva, May 17-19

Wednesday,

May 18:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

second batch of April trade data, incl. corn, wheat, sugar and pork imports - USDA

total milk production, 3pm - HOLIDAY:

Argentina

Thursday,

May 19:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

red meat production, 3pm - International

Grains Council’s monthly report

Friday,

May 20:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

third batch of April trade data, including soy, corn and pork imports by country - FranceAgriMer

weekly update on crop conditions - Malaysia’s

May 1-20 palm oil export data - U.S.

cattle on feed - EARNINGS:

IOI Corp

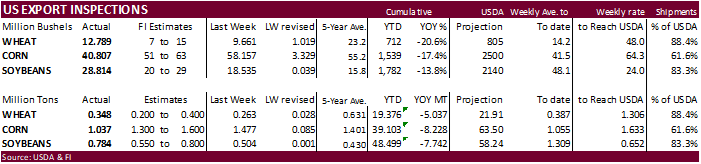

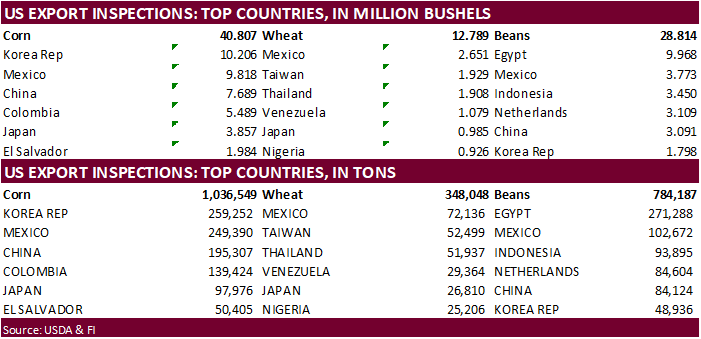

USDA

inspections versus Reuters trade range

Wheat

348,048 versus 100000-400000 range

Corn

1,036,549 versus 750000-1750000 range

Soybeans

784,187 versus 250000-800000 range

Soybeans

came in at the upper end of a Reuters trading range although China shipments are slowing. Corn and wheat were within expectations.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAY 12, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 05/12/2022 05/05/2022 05/13/2021 TO DATE TO DATE

BARLEY

0 0 0 10,156 33,143

CORN

1,036,549 1,477,246 1,994,436 39,102,991 47,330,954

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 600 6,514

RYE

0 0 0 0 0

SORGHUM

199,012 270,492 59,949 5,776,425 5,805,427

SOYBEANS

784,187 504,441 310,408 48,498,581 56,240,493

SUNFLOWER

0 0 0 2,260 96

WHEAT

348,048 262,919 660,298 19,376,283 24,412,996

Total

2,367,796 2,515,098 3,025,091 112,767,620 133,830,132

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

CME

price limits

https://www.cmegroup.com/trading/price-limits.html

Macros

US

TO EXTEND COVID PUBLIC HEALTH EMERGENCY BEYOND JULY

US

Empire Manufacturing May: -11.6 (est 15.0; prev 24.6)

Canadian

Manufacturing Sales (M/M) Mar: 2.5% (est 2.0%; prev 4.2%; prevR 5.1%)

Canadian

Wholesale Trade Series (M/M) Mar: 0.3% (est -0.3%; prev -0.4%; prevR -0.3%)

CREA:

Canada Benchmark Home Prices Fall 0.6% In April

CREA:

Its Canadian Home Price Index Down 0.6% In April From March, Up 23.8% Year-Over-Year

Canada

Benchmark Home Prices Post First Decline In Two Years

·

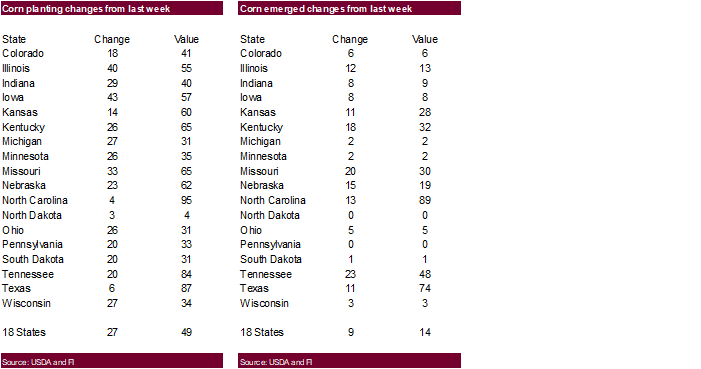

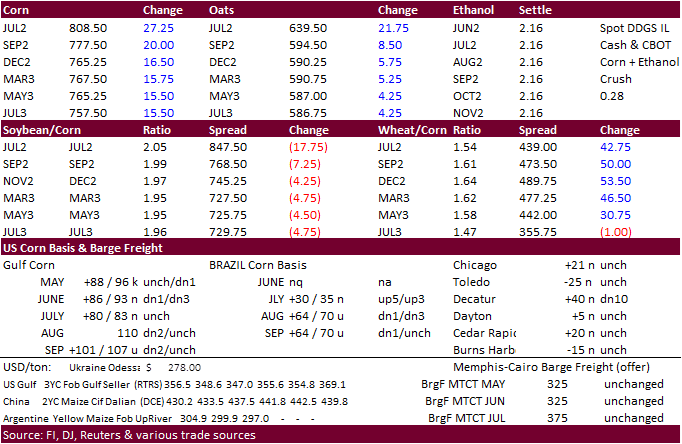

Corn futures were sharply higher from influence in the wheat futures after India announced a near complete ban on wheat exports.

·

Funds bought an estimated net 20,000 corn contracts.

·

US corn plantings were 49 percent, as expected. This compares to 78 year ago and 67 average.

·

The CN/CZ spread widened by a good amount, by 10.75 cents today to 43.00/43.75 (CN premium). China could have been asking around for corn today. That spread was under pressure last week.

·

USDA announced $6 billion in emergency relief payments for US producers impacted by natural disasters in 2020 and 2021.

·

Late planted Brazil second crop corn is seeing stress from lack of rainfall and the forecast will remain mostly dry this week.

·

(Bloomberg) — Agricultural areas in Brazil seen getting widespread frost this week, starting Tuesday in Parana’s coffee and corn areas, according to Celso Oliveira, a meteorologist at Climatempo in Sao Paulo.

·

Mexico will temporarily exempt import duties on selected commodities. The list includes corn oil, rice, tuna, pork, chicken, beef, onion, jalapeño pepper, beans, corn flour, wheat flour, egg, tomato, milk, lemon, white corn, apple

, oranges, wheat, and carrots.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US and/or SA on May 18 for August shipment.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range