PDF Attached

US

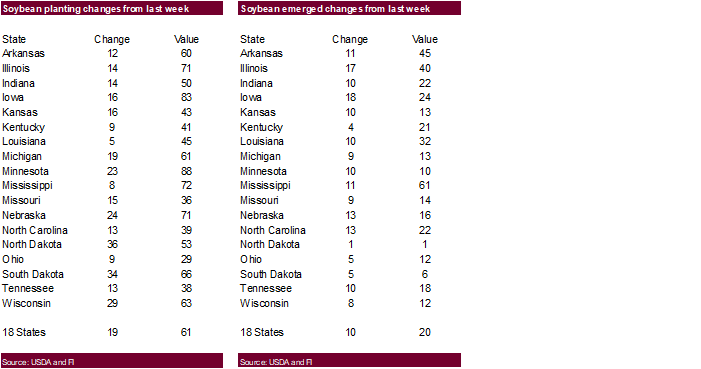

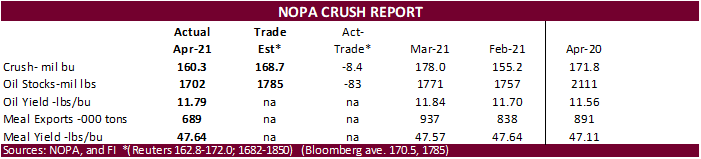

soybean rationing is now a reality with April NOPA crush lower than expected. New crop US plantings and conditions are running at favorable levels. Expect some selloff this week amid good weather.

USDA

24-Hour

—

Export sales of 1,700,00 metric tons of corn for delivery to China during the 2021/2022 marketing year; and

—

Export sales of 128,000 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

US

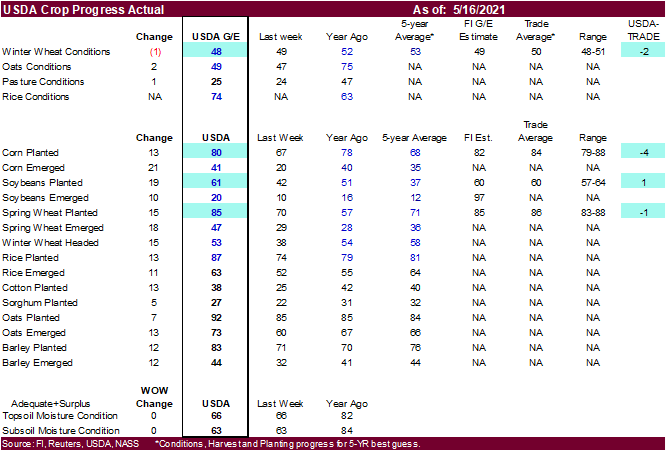

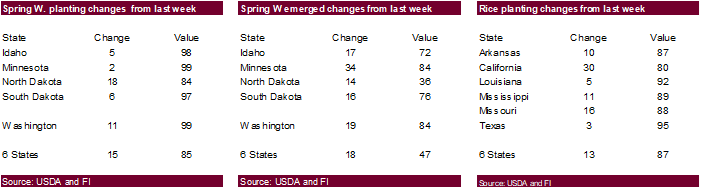

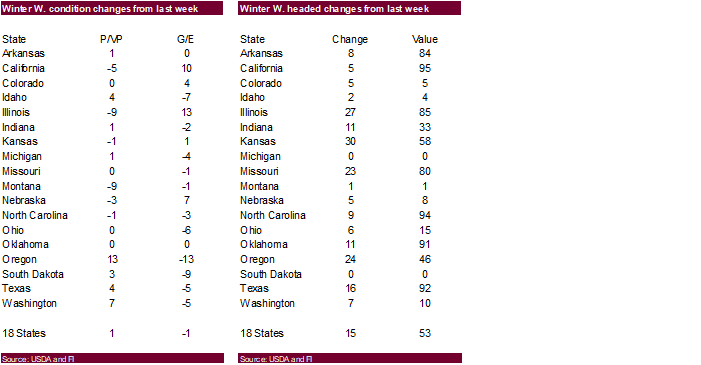

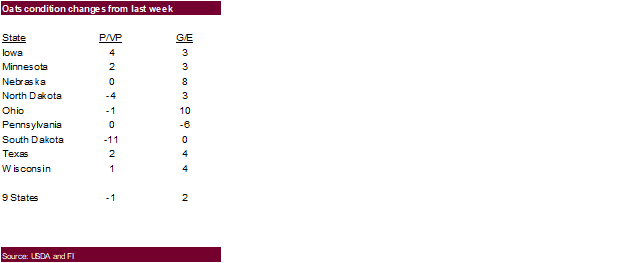

WINTER WHEAT – 48 PCT CONDITION GOOD/EXCELLENT VS 49 PCT WK AGO (52 PCT YR AGO) -USDA

US

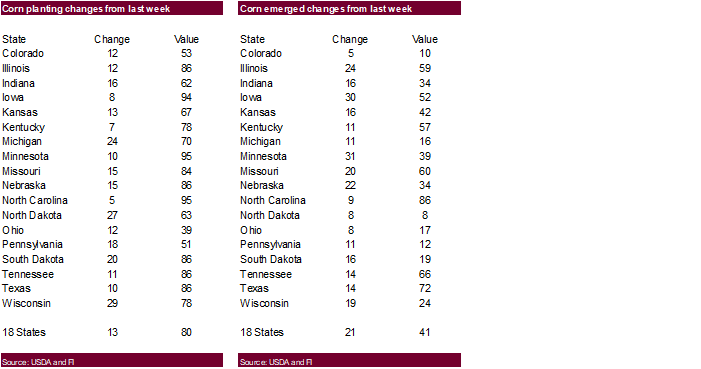

CORN – 80 PCT PLANTED VS 67 PCT WK AGO (68 PCT 5-YR AVG) -USDA

US

COTTON – 38 PCT PLANTED VS 25 PCT WK AGO (40 PCT 5-YR AVG) -USDA

US

SOYBEANS – 61 PCT PLANTED VS 42 PCT WK AGO (37 PCT 5-YR AVG) -USDA

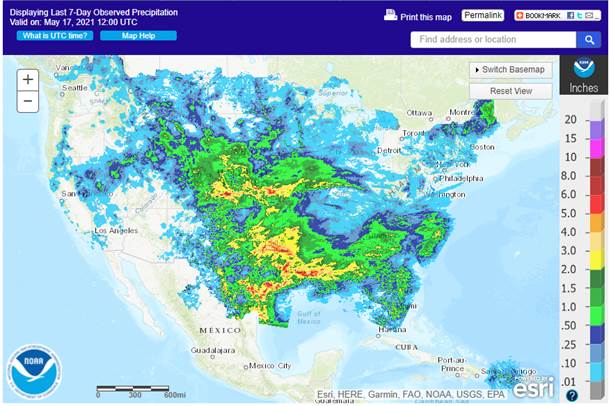

Last

7 days

World

Weather, Inc.

Today’s

Most Important Weather

Tropical

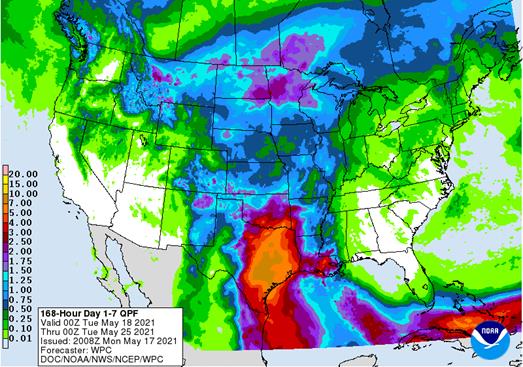

Cyclone Tauktae is bearing down on Gujarat India today and will bring considerable property damage to the south part of that state. Wind speeds were to 133 mph at 0600 GMT, but will drop to 108mph near the time of landfall. Rain fell in West Texas during the

weekend improving cotton planting conditions, although more is needed. Rain also fell excessively in China’s Yangtze River Basin during the weekend causing some flooding and more rain is expected there. In North America, rain is expected in a part of Canada’s

Prairies and the northern U.S. Plains this week improving planting conditions there while too much rain falls in Oklahoma wheat areas. Brazil Safrinha crop areas will get some additional moisture Thursday into Friday.

TODAY’S

HIGHLIGHTS

- Northern

U.S. Plains, upper Midwest and Canada’s eastern and southern Prairies will get rain later this week with some follow up moisture early next week - Improved

planting and emergence conditions are likely - U.S.

southeastern states will dry out over the next ten days - West

Texas weekend rain was extremely good for planting and follow up rain is expected in the Rolling Plains periodically into next week - The

high Plains region will dry down until Friday into Saturday when more rain is expected and some showers will continue into early next week - Improved

planting conditions will extend into next week - Too

much rain in Oklahoma will impact early maturing wheat conditions and drier weather is needed - Recent

rain in other wheat areas of the central Plains has been good for the crop and for summer crops as well - China

received excessive rain during the weekend in the Yangtze River Basin and more rain is expected, but only after a little break - Weekend

rain in China’s Yellow River Basin was ideal in bolstering soil moisture - Dryness

remains in eastern Hebei, northeastern Shandong and Liaoning and these areas will remain drier biased for a while - Safrinha

corn areas will get rain from Parana to Mato Grosso do Sul and Paraguay Thursday and Friday with some additional showers next week - Crop

areas to the north are unlikely to get very much rain, but the southern areas will see some improvement - Cooling

in southern Brazil during late May and early June will likely help conserve soil moisture a little better possibly making early this week the peak of the most stressful conditions for some of that southern corn

- Too

much rain will continue to fall in western Russia this week and early next week leaving winter crops in poor condition and needing drier and warmer weather - Russia’s

New Lands will be very warm to hot and dry for the coming week and similar conditions occurred during the weekend with extreme high temperatures reaching into the 80s and lower 90s Fahrenheit

- Relief

is not very likely in this region for the coming week to ten days - Thailand

and Vietnam are still receiving less than usual rain along with Laos and Cambodia and a boost in rainfall is needed - Indonesia

and Malaysia rainfall is expected to diminish for a while, but crop development will continue normally - Rain

is still needed in northern Philippines

Source:

World Weather, Inc.

Monday,

May 17:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – soybeans, cotton; winter wheat condition, 4pm - U.S.

Green Coffee Association releases monthly green-coffee stockpiles - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

crude palm oil export tax for June (tentative)

Tuesday,

May 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and cotton - New

Zealand global dairy trade auction - Brazil’s

Conab releases cane, sugar and ethanol production data - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference

Wednesday,

May 19:

- EIA

weekly U.S. ethanol inventories, production - BMO

Farm to Market Conference, day 1 - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference - HOLIDAY:

Hong Kong

Thursday,

May 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to release trade data, including country breakdowns for commodities such as soybeans - BMO

Farm to Market Conference, day 2 - Black

Sea Grain conference - Port

of Rouen data on French grain exports - Malaysia

May 1-20 palm oil export data - USDA

total milk, red meat production, 3pm - EARNINGS:

Suedzucker

Friday,

May 21:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Black

Sea Grain conference - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

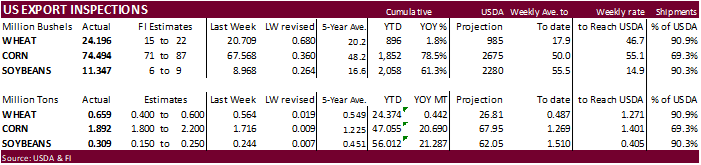

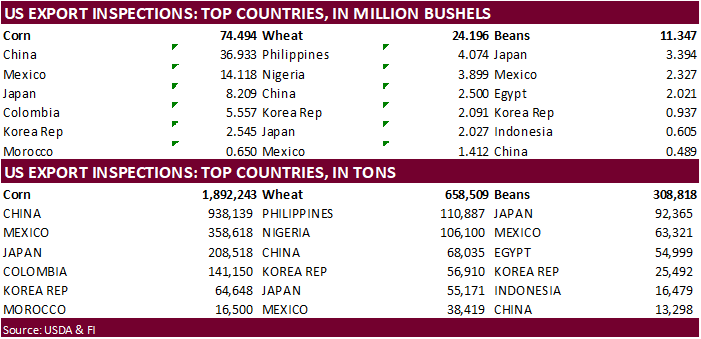

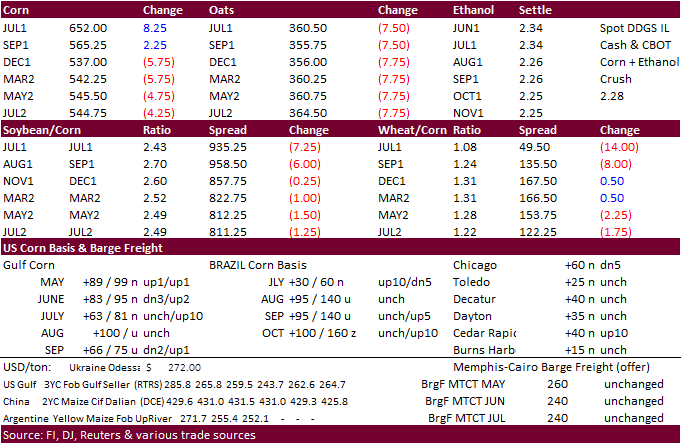

Corn

- Not

much change in the weather outlook was deemed a negative outlook for new-crop corn futures but good demand and tight stocks for the spot months supported prices, despite Chinese new-crop buying. With July up 8.75 cents and December down 5.50 cents, we are

a little baffled when looking at spread action. Prices vary between crop years but at some point, the trade needs to relook at the new-crop US carryout of 1.5 billion bushels, which we consider tight relative to past years.

- China

bought another 1.7 million tons of new-crop corn on Monday after picking up 1.36 million tons of new-crop corn per USDA on Friday. So far during the month of May China bought 6.8 million tons of new-crop corn under the 24-hour reporting system.

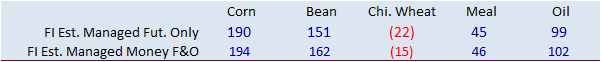

- Funds

on Monday were flat for corn. - The

USD was down about 10 points as of 3:00 pm CT.

Export

developments.

- Under

the 24-hour announcement system, US exporters sold 1,700,000 tons of corn for delivery to China during the 2021-22 marketing year.

- Exporters

also announced 128,000 tons to Mexico for new-crop delivery.

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

The

US needs to see a massive crop to pull new-crop futures below $4.00, which could happen for 2022 contracts if the export campaign for Q1 (SON) does not end up a record. Keep an eye on new-crop corn commitments this summer.

- CBOT

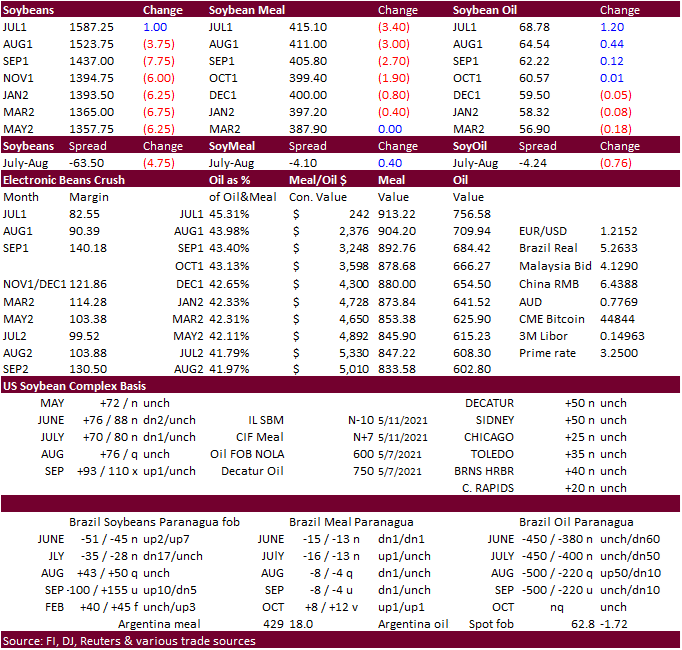

soybeans started higher at the expense of an strength in SBO but dropped (except July) by close from a good US weather outlook and lower back month corn futures resulting in a pressure on soybean prices. SBO was an interesting market to follow today. Commercial

hedging was active. July soybean oil jumped 139 points and August was up 70. With a lower trade in meal, this tells us the US SBO cash market remains firm, or at least of interest, with vegetable oil inventories extremely tight. Then NOPA came out later

with a tighter than expected SBO inventory for the month ending April, at around 1.7 billion pounds. This translates to NASS stocks aiming below 1.85 billion. We hear downtime in May will not be as large than April, but still will be down greatly from a

year ago. Look for a snug soybean oil inventory by the end of August. September we should see US crush rates increase on a daily rate due to timely plantings across the lower US. We like SBO over meal.

- NOPA

US April soybean meal exports fell to a 22-month low. - Funds

on Monday were flat for soybeans, sold 5,000 meal and bought 7,000 soybean oil.

- Reuters

– Exports of Malaysian palm oil products for May 1 – 15 rose 17.1 percent to 685,114 tons from 585,280 tons shipped during April 1 – 15, cargo surveyor Intertek Testing Services said on Saturday. - Reuters

– Exports of Malaysian palm oil products for May 1-15 rose 18.83% to 695,764 tons from 585,510 tons shipped during April 1-15, according to independent inspection company AmSpec Agri Malaysia on Monday.

- On

May 18 USDA seeks a total of 4,770 tons of packaged oil for use in Title II, PL480 and the McGovern-Dole Food for Education export programs. Shipment was set for June 16-July 15 (July 1-31 for plants at ports).

Updated

5/14/21

July

soybeans are seen in a $15.00-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

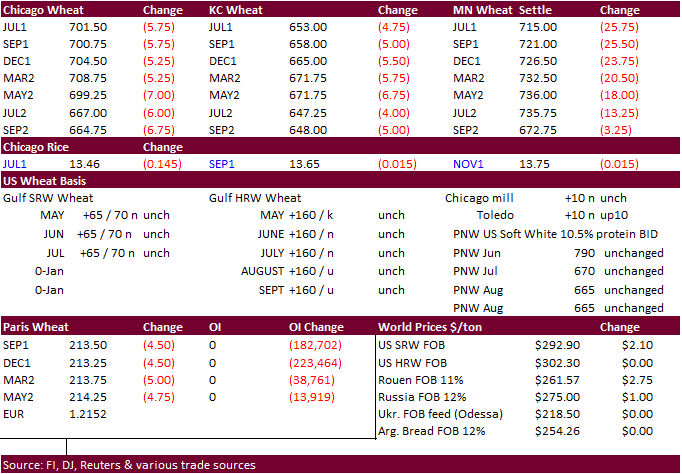

- Improving

Black Sea and European weather coupled with rain across the North American continent pressured global wheat futures. Wheat is cheap relative to corn. Rains across Canada and upper US Great Plains are pressuring the MN market.

- Funds

sold an estimated 5,000 Chicago wheat contracts. - September

Paris wheat market basis September was down 3.5 euros at 214.50.

Export

Developments.

- Algeria

seeks at least 50,000 tons of wheat on Wednesday, optional origin. - Taiwan

Flour Millers’ Association bought 89,425 tons US milling wheat, at various prices, set to close last week on May 13. One consignment of 42,505 tons was sought for shipment between July 2 and July 16. A second consignment of 46,920 tons was sought for shipment

between July 19 and Aug. 2. - Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on May 19 for arrival by October 28.

Rice/Other

·

Mauritius seeks 4,000 tons of rice, optional, origin, for delivery Aug – Sep, on June 1.

Updated

5/17/21

July

Chicago wheat is seen in a $6.60-$8.00 range

July

KC wheat is seen in a $6.20-$7.25

July

MN wheat is seen in a $6.75-$7.50

(NA rains are breaking the MN market)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.