PDF Attached

Wheat

futures saw a wide trading range, ending higher on global supply concerns. Corn was lower from good US planting progress and soybeans rallied on expectations US plantings will not expand as much from March Intentions as previously thought. India announced

they will allow wheat shipments awaiting customs clearance, freeing up some of the potential 1.8 million tons of wheat at ports that could have stuck due to the export ban. The USD was sharply lower and WTI higher.

WEATHER

EVENTS AND FEATURES TO WATCH

- Very

little, if any, crop damage is expected in southern Brazil from this week’s frosty weather.

- Some

impact is possible in a minor portion of Safrinha crop country, but the impact on overall production should be low - Brazil

coffee, citrus and sugarcane areas unlikely to be threatened with any damaging cold weather this week, despite temperatures coming down to the soft frost threshold in minor coffee production areas - Drying

will continue in Brazil’s Mato Grosso and Goias Safrinha crop country through the next two weeks maintaining some stress for immature crops and pressuring yields a little lower - Argentina

continues in a dry weather mode raising concern over future wheat, barley and canola planting conditions, although there is still time for improved rainfall - Canada’s

southwestern Prairies and the northwestern U.S. Plains will see some rain and wet snow briefly Thursday and Friday of this week offering a little relief to dryness, but resulting moisture totals will be much too light for a lasting impact - Canada’s

southeastern Prairies will get additional rainfall late this week that will maintain soggy field conditions and perpetuate planting delays into next week - There

will be some potential for much needed drying this weekend and next week, although it will not be perfectly dry and temperatures may be a little mild to cool for the best drying rates for a while - Frost

and freezes in Canada’s Prairies and in a few locations in the far northern Plains late this week and into the weekend should not seriously impact agriculture since planting is well behind normal and emergence has been slow - Ontario

and Quebec, Canada will see a good mix of weather over the next two weeks supporting fieldwork and crop development - U.S.

Midwest corn and soybean crop areas will see a mix of rain and sunshine over the next two weeks with temperatures trending a little cooler than usual in this first week of the outlook - The

wetter and cool biased environment will slow farming activity, but some progress is expected since there will be a good alternating pattern of rain and sunshine - U.S.

Delta and southeastern states will see a mix of weather over the next two weeks, although there may be a need for greater rainfall in some areas - GFS

model forecasts continue to “play around” with a possible tropical cyclone, but this feature is not likely to verify from today’s forecasts and the only influence the storm is having on the U.S. is interfering with a good logical second week weather outlook.

- The

European and Canadian forecast models do not have this feature - West

Texas rainfall overnight was welcome, but too light to have much impact on soil moisture or dryland planting - Rain

is needed to improve planting, germination and emergence conditions for cotton, corn, sorghum and peanuts that are not irrigated - West

Texas rainfall advertised by the GFS model run today for early next week is too heavy and too far to the west.

- Some

showers might impact the region, but resulting rainfall is unlikely to be any more significant than that which occurred overnight last night - Drought

will prevail in California and most of the Great Basin and southern Rocky Mountain region over the next two weeks - Temperatures

will be warm biased - Cooler

than usual temperatures will impact the U.S. Pacific Northwest, the northern Plains upper U.S. Midwest and Canada’s Prairies over the coming week with moderating temperatures expected next week - Western

Europe will be influenced by a ridge of high pressure for a little while longer, but weather systems breaking through the ridge will bring timely rainfall to parts of France, the U.K. and Germany this weekend and next week - These

weather systems will occur often enough to help protect spring and summer crops from a more threatening warm and dry bias - Russia

will receive frequent bouts of rain over the next two weeks maintaining abundant soil moisture - Ukraine

precipitation is expected to be well mixed with bouts of sunshine during the next two weeks - Excessive

heat continues in India threatening some of the early season cotton and other crops planted in April and this month in northern parts of the nation - Pakistan

has also been impacted by the heat - Serious

livestock stress has occurred on the hotter days - India’s

pre-monsoonal precipitation will be greatest in this coming week from Kerala and Karnataka southward into Tamil Nadu and a part of Andhra Pradesh - Some

heavy coastal rain is expected - Bangladesh

and far Eastern States of India will also receive heavy rainfall - Central

and northern India will remain dry - China’s

North China Plain and neighboring areas are still advertised to be mostly dry and warm for the next ten days, but some rain has been advertised for days 11-15 in Liaoning, Hebei and Shandong - Confidence

is low, though - Net

drying in east-central China will deplete soil moisture over the next ten days and raise stress for some winter crops and early planted and emerging spring crops - Rain

is needed and it will become a more critical need by the end of this month - Myanmar

and other areas in mainland areas of Southeast Asia will become excessively wet this weekend and especially next week - Flooding

in central and southern Myanmar rice and sugarcane areas could have a negative impact on production - Wet-biased

conditions will also impact a part of Thailand and especially Laos and Cambodia - Stormy

weather is also expected in western Luzon Island, Philippines this weekend and most of next week as the southwest monsoon becomes enhanced - Sumatra

and peninsular Malaysia will not likely see as much rain as other areas in Indonesia and the Maritime Province of Southeast Asia over the next two weeks - Australia

rainfall is expected to be sporadic and light for a while in key winter grain and oilseed production areas - A

part of the central Queensland coast will receive heavy rainfall over the next week to ten days resulting in some flooding for a few sugarcane production areas - Rainfall

elsewhere in the nation will be welcome when it occurs, but more will be needed to better prepare for autumn wheat, barley and canola planting - South

Africa rainfall will fall in some winter wheat, barley and canola production areas during the coming week supporting a better environment for planting and establishment - Summer

crop maturation and harvest conditions will remain mostly good, although showers in the coming week could slow some of the fieldwork - North

Africa will continue seasonably dry and warm supporting winter crop filling, maturation and harvesting - Turkey

will be the only Middle East nation getting rainfall during the next week to ten days - A

boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest hurting winter grain production and raising some worry over irrigated cotton and rice development - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - West-central

Africa will receive frequent rainfall during the next ten days to two weeks supporting a normal coffee, cocoa and sugarcane development environment - Cotton

areas will also benefit from the pattern, although greater rain is needed in the more northern production areas - Mexico

rainfall is expected to be increase in the south and east parts of the nation this weekend and especially next week as pre-monsoonal moisture builds up across the nation - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - Today’s

Southern Oscillation Index was +19.99 and it will remain near its peak intensity for a little while longer, but there is strong evidence for weakening soon - New

Zealand weather will trend wetter over the next ten days easing dryness that has recently evolved.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - GrainCom

conference in Geneva, May 17-19

Wednesday,

May 18:

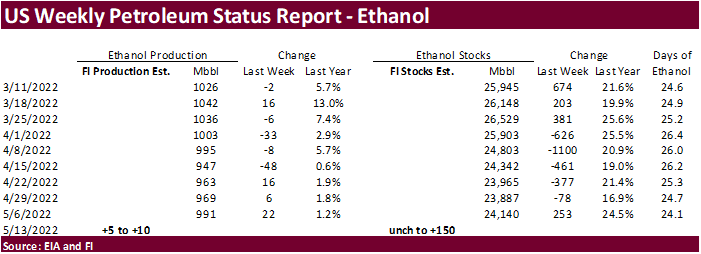

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

second batch of April trade data, incl. corn, wheat, sugar and pork imports - USDA

total milk production, 3pm - HOLIDAY:

Argentina

Thursday,

May 19:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

red meat production, 3pm - International

Grains Council’s monthly report

Friday,

May 20:

- ICE

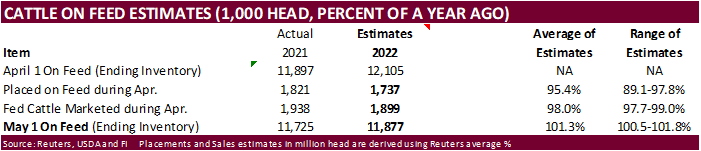

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

third batch of April trade data, including soy, corn and pork imports by country - FranceAgriMer

weekly update on crop conditions - Malaysia’s

May 1-20 palm oil export data - U.S.

cattle on feed - EARNINGS:

IOI Corp

Soybean

and Corn Advisor

2022

Brazil Corn Estimate Unchanged at 107.0 Million Tons

2022

Brazil Soybean Estimate Unchanged at 122.0 Million Tons

2022

Argentina Soybean Estimate Unchanged at 40.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

Macros

US

TO EXTEND COVID PUBLIC HEALTH EMERGENCY BEYOND JULY

US

Retail Sales Advance (M/M) Apr: 0.9% (est 1.0%; prev 0.5%; prevR 1.4%)

US

Retail Sales Ex Auto (M/M) Apr: 0.6% (est 0.4%; prev 1.1%; prevR 2.1%)

US

Retail Sales Ex Auto And Gas Apr: 1.0% (est 0.7%; prev 0.2%; prevR 1.2%)

US

Retail Sales Control Group Apr: 1.0% (est 0.7%; prev -0.1%; prevR 1.1%)

·

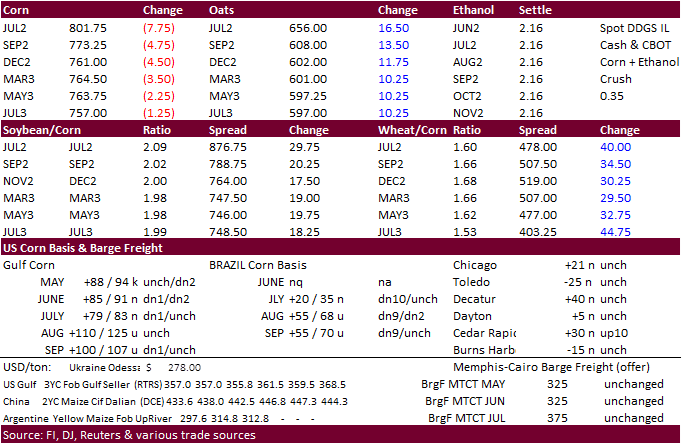

Corn futures ended lower despite a rebound in wheat. Very good US planting progress was reported for the previous week. Soybean / corn spreading was noted. US export developments are slow.

·

Funds sold an estimated net 6,000 corn contracts.

·

Ukraine Deputy Economy Minister Taras Kachka mentioned it could take years for Ukraine to restore farm production.

·

Corn planting progress in parts of Canada are very slow and some producers are shifting to other crops that don’t require a long growing season.

·

Canada – Manitoba Crop Report

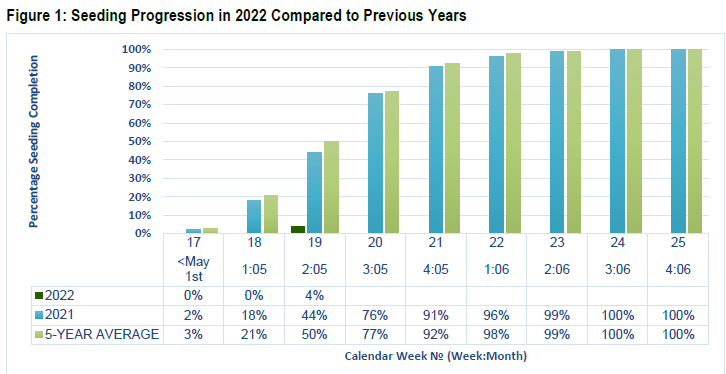

“Provincial

seeding progress sits at about 4% completion, behind the 5-year average of 50% for Week 19 (Figure 1). Pockets of the Central and Southwest regions are further ahead, while other parts of the Interlake and Northwest region, and the Red River Valley nearest

the river remain underwater.“

Corn

has begun in the Red River Valley, with 10 percent of the crop sowed.

·

Frost is still expected later this week across parts of southern Brazil.

·

ANEC – Brazil corn export for May are seen at 1.264 million tons from 927,209 tons previous.

·

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels to 995 thousand (976-1001 range) from the previous week and stocks down 77,000 barrels to 24.063 million.

·

US corn crop conditions should be initially reported by USDA around the end of the month. At least 50 percent of the corn crop should be emerged for USDA to survey. An early look at initial ratings suggest 70 percent G/E, same

as the initial 5-year average. US Midwest soil moisture is good. The western fringes of the Corn Belt could use more rain.

U

of I – Early Export Sales Commitments and New-Crop Balance Sheets for Corn, Soybeans, and Wheat

Janzen,

J. “Early Export Sales Commitments and New-Crop Balance Sheets for Corn, Soybeans, and Wheat.”

farmdoc

daily

(12):70, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2022.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US and/or SA on May 18 for August shipment.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range