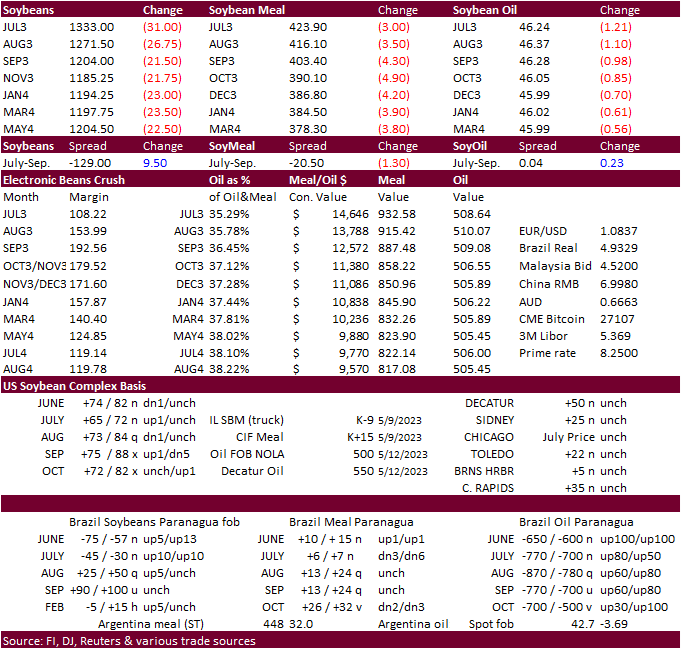

PDF Attached

Bearish

fundamental developments today. Russia, Ukraine, and Turkey all confirmed a 60-day Black Sea grain export safe passage extension deal.

We

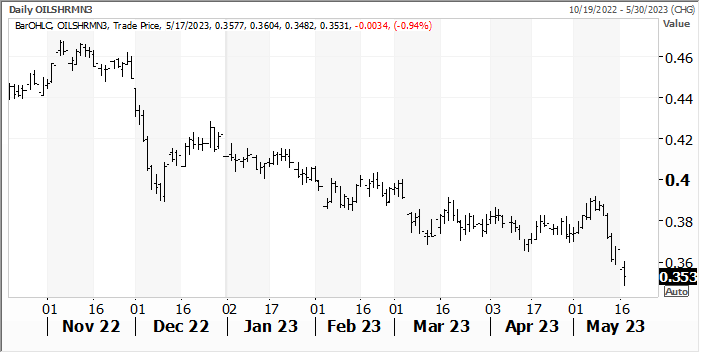

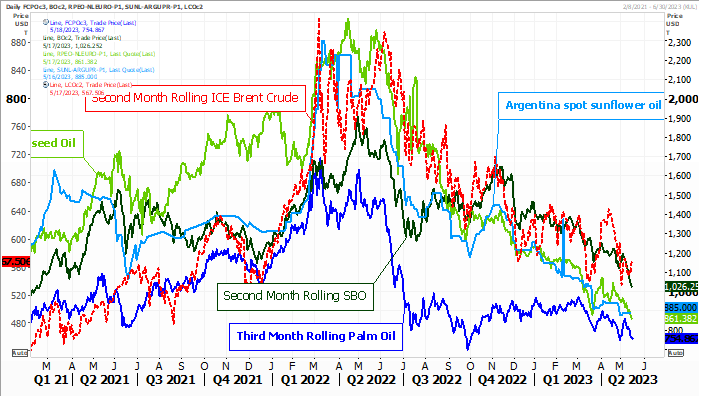

updated our price ranges for selected major markets. The deal sent the CBOT agriculture markets lower. On a weekly rolling basis, CBOT corn hit its lowest level since November 2021, Chicago wheat near a two-week low and soybean oil at a February 2021 low.

Oil share was hit hard again today from product spreading. Nearby KC wheat was on the defensive, but losses were limited from early poor results from the annual US winter wheat crop tour. The July KC contract continues to hold a large premium over July Chicago.

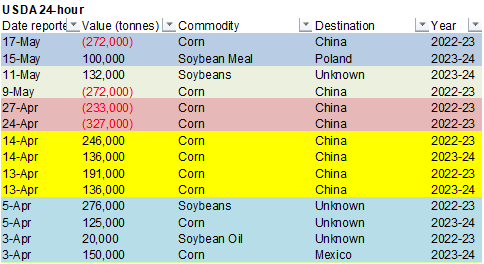

We would not fade that spread until the US crop tour data is digested in the market. Meanwhile, China cancelled

272,000

tons of corn for delivery during the 2022-23 marketing year. USDA commitments are expected to drop for China by a large amount when updated Thursday morning and could justify another 25-50 million bushel cut by USDA when they update their balance sheet next

month.

![]()

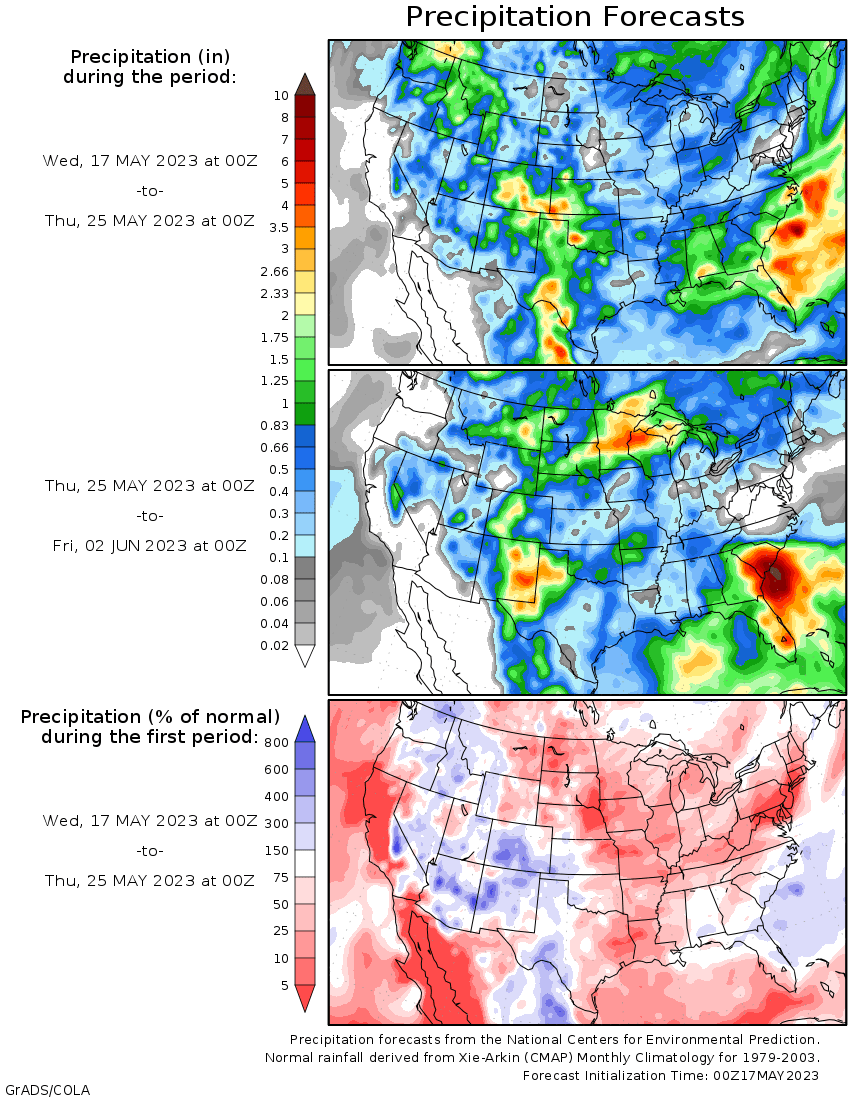

WEATHER

TO WATCH

-

Argentina

is still in a good position to receive rain for wheat planting later this week and especially next week

-

Sufficient

rain over the next ten days will occur to support fieldwork -

Brazil’s

Safrinha crop areas have no risk of crop damaging cold over the next two weeks and seasonably dry weather will prevail in all corn and cotton production areas -

Sufficient

moisture will remain in Parana, Mato Grosso do Sul and Sao Paulo to support late planted crops into the first days of June without rain -

Mato

Grosso and Goias are trending drier and will need a little rain for the latest planted crops, but conditions are mostly good for the bulk of corn -

Cotton

might end up with the greatest need for rain in Mato Grosso -

Australia

rainfall has been timely in recent weeks, although amounts have often been lighter than usual in the interior west and across most of South Australia as well as some western production areas of both Queensland and New South Wales production areas

-

Greater

rain will be needed in the drier areas, but fieldwork is advancing well -

China

weather will continue a little wetter biased in rapeseed areas of the Yangtze River valley and areas to the south where some drying might be best for maturation and harvesting -

Northern

China drying has not presented much of a problem, though some spring wheat and sugarbeet areas in eastern Inner Mongolia are too dry -

Some

of this dryness has been expanding to the west and south recently including northern Hebei -

Central

parts of Inner Mongolia and portions of the northern Yellow River Basin may become influenced by the drier bias over time, though conditions today are still very good in those areas -

Xinjiang,

China remains too cold in the northeast for ideal corn or cotton development -

Western

parts of Xinjiang where much of the cotton is produced, has had two days of very warm temperatures with highs in the upper 80s and lower to a few 90s Fahrenheit -

The

heat has begun to improve crops in the west and the warmer conditions should prevail for a while -

India

weather is quite favorable for this time of year with pre-monsoonal showers occurring in the south and east while drying occurs in many other areas supporting good harvest conditions -

Russia’s

eastern New Lands may slowly dry down over the next ten days, but crop conditions should remain mostly favorable during this period of time -

Western

Russia and eastern Ukraine will experience timely rainfall during the next ten days supporting good crop conditions -

Southern

Europe weather will continue active with frequent bouts of rain expected through the next week and possibly for ten days -

The

moisture will delay some planting and could raise a little concern over crop quality in a few areas -

Northern

Europe will be drier biased, although not completely dry -

The

environment will be good for planting, emergence and establishment -

North

Africa will receive greater than usual rainfall over the next week to ten days resulting in a possible crop quality concern for early maturing wheat and barley in Morocco and northwestern Algeria -

Crops

in northeastern Algeria and northern Tunisia are expected to benefit from their rain since crops should be in the reproductive and filling stages of development -

Philippines

and western Indonesia soil moisture firmed up a little during the past week due to more infrequent and light rainfall -

The

region is expecting to get more significant rain in this coming week -

A

tropical disturbance may help to enhance Luzon Island rainfall while Madden Julian Oscillation will help bring rain to Sumatra and other western Indonesia crop areas -

Frost

and Freezes in North America over the next week will have no permanent impact on crops -

Ontario

and Quebec will be coldest today and Thursday and again Sunday into Monday with lows in the 20s and 30s Fahrenheit -

Some

of this cold will also impact the northeastern U.S. -

Parts

of Canada’s eastern Prairies will see frost and a few light freezes Thursday and Friday with no permanent impact on crops -

most

low temperatures will be in the 30s Fahrenheit with no temperatures colder than 30 -

Patches

of soft frost cannot be ruled out in North Dakota and immediate neighboring areas Friday; although, the impact will be minimal Lows will be fall to the 30s Fahrenheit with a slight risk of a county or two getting to 28 or 29 briefly. -

Canada’s

Prairies may experience some increase in rainfall during the middle to latter part of next week, although confidence is low on how significant the moisture will be in the drought region -

Any

rain would be welcome -

Drought

remains serious in east-central and interior southern Alberta and western Saskatchewan with no rain and waves of heat likely in this first week of the outlook -

U.S.

hard red winter wheat areas of Kansas, southeastern Colorado, the Texas Panhandle and Oklahoma will have a good chance for scattered showers and thunderstorms Thursday into Friday with a few showers beginning tonight

-

Rainfall

of 0.30 to 0.90 inch and local totals of 1.00 to 2.00 inches will be possible -

Scattered

showers and thunderstorms may resume during the weekend and continue periodically through the last days of May -

These

will be erratic, near-daily, showers and thunderstorms that will slow fieldwork, but add moisture for spring and summer crops and may help improve conditions for “some” wheat -

Northern

U.S. Plains, Canada’s Prairies and much of the northwestern U.S. Corn and Soybean Belt will be drier biased over this first week of the outlook -

U.S.

crop weather in general over the next ten days to two weeks will be favorably mixed providing time for planting and moisture for emergence and establishment -

This

includes most of the Midwest, the Great Plains, Delta and southeastern states -

Soil

moisture in most of these areas is already rated favorably -

U.S.

temperatures in the coming week will be very warm in the far western states and near normal in much of the central and east, although the southwestern Plains will be cooler biased for a while -

Warmer

biased temperatures are likely many key crop areas except in the southwestern Plains and Gulf of Mexico Coast States next week

-

South

Africa weather will be trending drier in the coming week to ten days after rain fell Monday and will linger in the northeast today -

Summer

crop harvesting and winter crop planting will advance swiftly in the next two weeks with some need for greater rain in western wheat areas -

West

Africa weather continues to generate timely rainfall for coffee, cocoa, sugarcane and rice -

Rainfall

in the most recent 30 days was a little lighter than usual in southeastern Nigeria and western Cameroon as well as from northern Ivory Coast into southwestern Burkina Faso impacting cotton areas -

Crop

conditions should remain mostly good, although the drier areas would benefit from greater rain -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to steadily increase over the central and eastern parts of the nation during the next ten days improving soil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be erratic, although mostly favorable during the next two weeks -

Tropical

Cyclone Fabien in the Indian Ocean poses no threat to land -

Today’s

Southern Oscillation Index was -6.37 and it should move erratically lower over the next several days

Source:

World Weather, INC.

Thursday,

May 18:

- China’s

2nd batch of April trade data, including agricultural imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - EARNINGS:

Australian Agricultural Co. - HOLIDAY:

France, Germany, Indonesia

Friday,

May 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

Cattle on Feed, 3pm

Saturday,

May 20:

- China’s

3rd batch of April trade data, including country breakdowns for energy and commodities

Source:

Bloomberg and FI

Macros

103

Counterparties Take $2.214 Tln At Fed Reverse Repo Op. (prev 101 Counterparties, $2.203 Tln)

US

Housing Starts (M/M) Apr: 2.2% (est -1.4%; prevR -4.5%)

US

Building Permits (M/M) Apr: -1.5% (est 0.0%; prevR -3.0%)

US

Housing Starts Apr: 1401K (est 1400K; prevR 1371K)

US

Building Permits Apr: 1416K (est 1430K; prevR 1437K)

US

DoE Crude Oil Inventories (W/W) 12-May: 5040K (est -2000K; prev -2951K)

Distillate:

80K (est -1500K; prev -4170K)

Cushing

OK Crude: 1461K (prev +397K)

Gasoline:

-1381K (est -2000K; prev -3167K)

Refinery

Utilisation: 1.00% (est 0.60%; prev 0.30%)

President

Biden: Am Confident We Will Get Budget Agreement, America Will Not Default

President

Biden: Negotiators Will Be Meeting Again Today

Will

Be In Close Touch With Negotiators During Trip

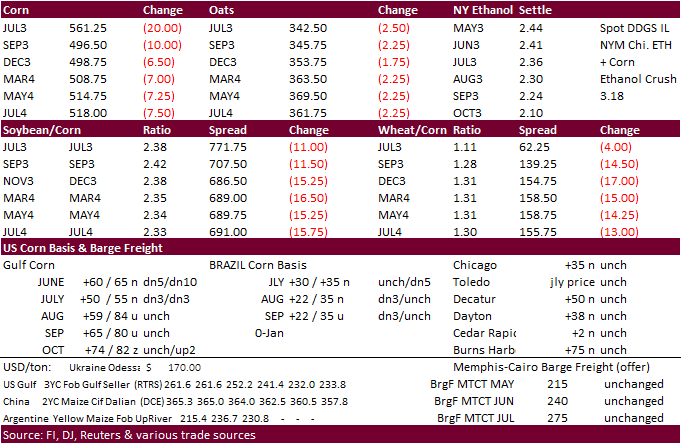

Corn

·

CBOT July corn futures

were sharply lower after China cancelled 272,000 tons of US corn commitments. Back months were also lower on follow through selling and the extension of the safe passage Black Sea grain deal.

·

Volatility was up by a large amount across CBOT commodities. Spreads were extremely active with bear spreading in focus. The China cancellation kicked that off, and the bear spreading spilled over into the Chicago wheat and soybean

markets. Today was fund driven.

·

If WCB corn cash prices fail to ease, July corn should stay above $5.25-$5.35 level. December on the other hand could see an absolute low of $4.25 if US weather stays favorable throughout the summer. We think the US corn planted

area will end up larger than USDA’s Prospective Plantings estimate. The 2023 US corn area is seen 92.396 million acres, 400 thousand above USDA. September corn is also expected to hold above $4.25, more like $4.50 during the summer months. Expiration could

be lower than $4.50 if US corn is harvested early and Brazil remains active exporting corn through at least September.

·

Bloomberg: LIVESTOCK SURVEY: US Cattle on Feed Placements Seen Falling 3.8%. April placements onto feedlots seen falling y/y to 1.75m head, according to a Bloomberg survey of ten analysts.

·

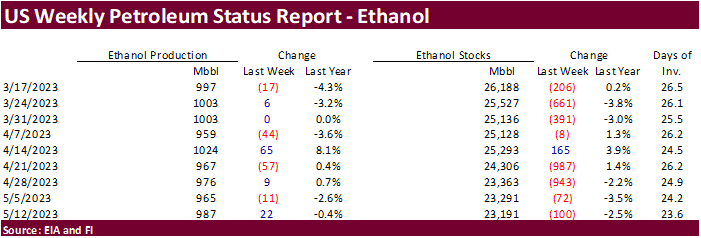

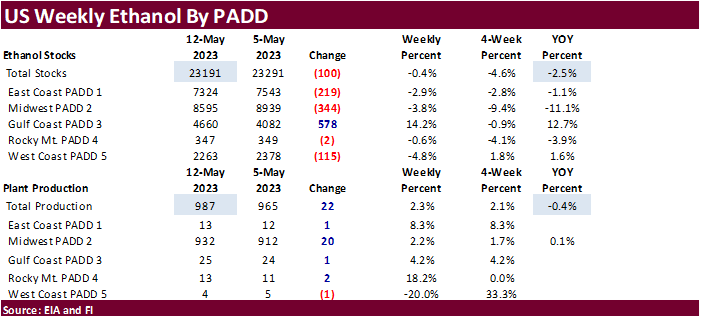

Weekly US ethanol production increased 22,000 barrels and stocks fell 100,000.

For

comparison, a Bloomberg poll looked for production to be up 16,000 barrels and stocks up 45,000 barrels. Crop year to date (early Sep-mid May) plant production is running 3.1% below same period year earlier but has improved over the past 6 weeks. US gasoline

stocks fell 1.4 million barrels to 218.3 million and implied gasoline demand fell 395,000 barrels to 8.908 million. Net production of combined finished reformulated and conventional motor gasoline with ethanol was 8.938 million barrels, up 68,000 barrels from

the previous week and represents 91.9 percent of total finished motor gasoline, down from 92.9% previous week.

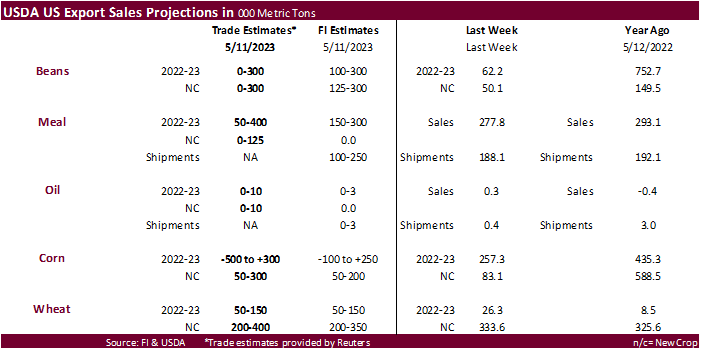

Export

developments.

-

South

Korea’s KFA bought 68,000 tons of corn at $258.75/ton for arrival around October 20. South America or South Africa was thought to be origin.

-

Private

exporters reported the cancellation of sales of 272,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

July

corn $5.00-$6.50 Western Corn Belt basis is high

September

$4.35-$4.45 low near expiration, $4.50 or higher during the summer goring season.

December

corn $4.25-$6.00

·

Soybean

futures were lower over China demand concerns and lower products.

Soybean meal ended $1.60-$4.80 short ton lower with losses limited on product spreading. There is some concern the US is not prepared to crush soybeans at the amount needed to reach biofuel feedstock requirements for renewable diesel. ADM’s CEO made a remark

on this today. We agree and think the traditional 50 to 55 percent share of soybean oil used for biofuel will shrink over the next two years as refiners increase alternative vegetables/feedstock, such as tallow. Some US policy change is needed in regard to

import tariffs and RIN generation (credit) in to address this problem, IMO.

·

The extension of the Black Sea grain deal prompted selling in the soybean oil market, as traders noted the discount of Russian sunflower oil supplies versus competing vegetable oils. Oil share was hit hard again today from product

spreading. Meanwhile, palm oil futures in general have been trending lower since May 9th.

·

Soybeans hit a 10-month low.

·

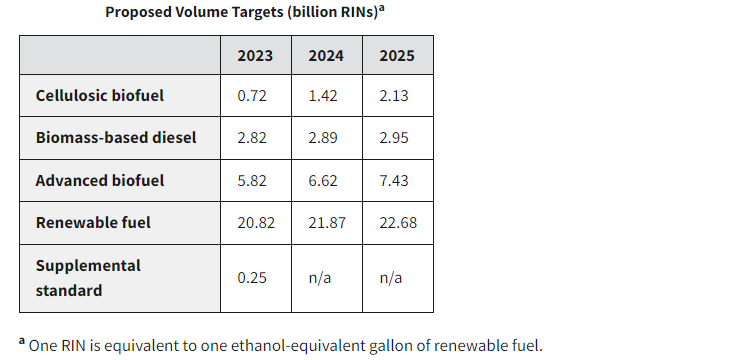

The EPA is expected to send RFS volumes to the OMB this week. Here is the link that was proposed December 2022. These mandates can be reached by 2025, but for 2023 the US needs to see an increase in renewable during the second

half of the crop year. https://www.epa.gov/renewable-fuel-standard-program/proposed-renewable-fuel-standards-2023-2024-and-2025

July

2023 soybean oil share (below 35.5%)

Export

Developments

-

None

reported

Soybeans

– July $12.50-$14.25, November $11.00-$14.50

Soybean

meal – July $375-$475, December $290-$450

Soybean

oil – wide July 42-50 with bias to downside, December 43-53, with bias to upside

Wheat

·

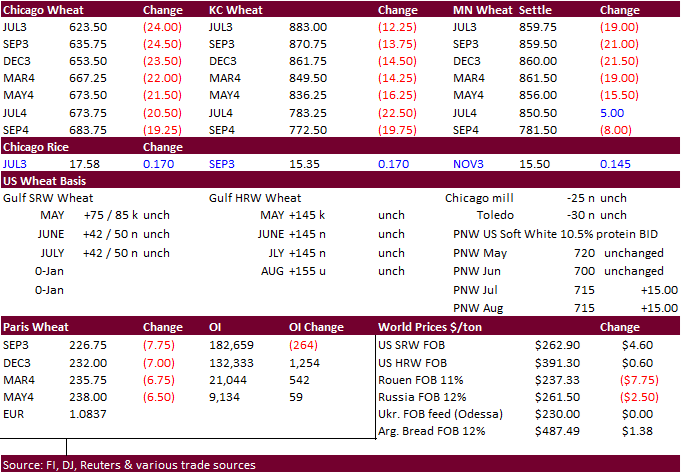

Chicago wheat fell mostly on fund selling. KC wheat saw limited losses after day one of the US winter wheat crop tour confirmed poor conditions. MN followed Paris lower.

·

September Paris milling wheat officially closed 7.75 euros lower, or 3.3%, at 225.50 euros a ton (about $244.50 ton).

·

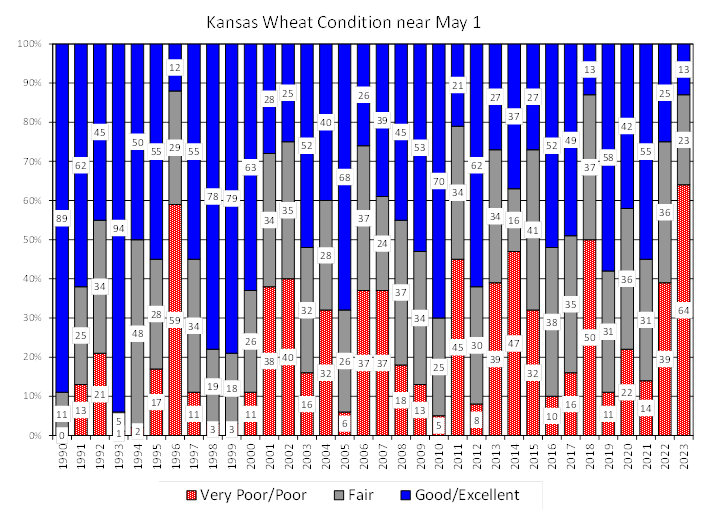

Crop tour day 1 average yield for the northern leg of Kansas was 29.8 bushels per acre, worst for the first day since at least 2003. That compares to the five-year average of 45.36 bushels per acre. Last year was 39.5 bushels

per acre. Final results will be out Thursday. See reference table after the text.

·

Note USDA is at 29.0 bushels per acre yield for Kansas. We are projecting 29.5 but have a harvested area of 6.350 million acres (USDA is at 6.600 million). Out planted area of 8.100 million acres is same as USDA. Kansas wheat

production could end lowest since 1963!

·

Ukraine sees a record 2023 spring wheat area of 285,000 hectares (192,100 for 2021 – 2022 no data) in part to a lower winter grain area and less summer corn.

Export

Developments.

·

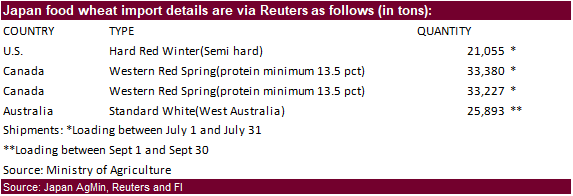

Japan in a SBS import tender bought only 380 tons of barley and passed on feed wheat, for arrival in Japan by October 26.

·

The Philippines seeks 40,000 tons of feed wheat for July shipment.

·

Japan seeks 113,555 tons of food wheat on Thursday. Original tender as follows.

Rice/Other

Chicago

Wheat – July $5.75-$7.30

KC

– July $7.75-9.25

MN

– July $7.50-9.00

September

– same ranges as July

#non-promo