PDF Attached

Attached

are our China, Brazil and Argentina corn balance sheets.

WASHINGTON,

May 18, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 1,360,000 metric tons of corn for delivery to China during the 2021/2022 marketing year.

SBO

sold off by mid-session on profit taking, pressuring old crop soybean prices while meal was mixed (bear spreading). Corn and wheat traded higher on some US weather forecasts calling for a drier outlook through Monday and ongoing Chinese demand.

World

Weather, Inc.

MOST

IMPORTANT WEATHER IN THE WORLD

- Brazil’s

Safrinha corn areas are expecting more rain in a couple of waves Friday into Sunday and again next week and possibly one more at the end of this month - World

Weather, Inc. believes the greatest losses for Mato Grosso do Sul and Parana have already occurred and the late crop could benefit from this moisture, but not so much for the early crop - Farther

north, crops in Goias, southwestern Minas Gerais and eastern Mato Grosso may not get much rain and will experience ongoing downward production potential - The

late crop will need rain to fall routinely over the next few weeks to ensure no further losses - Argentina

weather will be very good for maintaining good soil moisture for future wheat planting

- Rain

expected should not seriously delay crop maturation and harvest progress - No

crop quality issues are expected because of rain this week - Canada’s

Prairies and the northern U.S. Plains as well as the upper Midwest will receive some badly needed moisture during the next ten days, although the precipitation will not be uniformly distributed - Some

areas will get more rain than others, but every drop of moisture will be welcome and good for seed germination, crop emergence and early season growth in the Prairies and North Dakota where the driest conditions are prevailing - Excessive

heat occurred in Canada’s Prairies and the far northern Plains Monday with afternoon temperatures in the 80s and lower 90s Fahrenheit - The

heat occurred while strong wind speeds occurred and humidity was very low - Considerable

losses in soil moisture resulted - The

same will occur today, but Canada’s Prairies will trend cooler from northwest to southeast over the next few days and some cooling will eventually spread across the northern Plains, but only after a few more warm days - Rain

and snow will fall across Alberta and northwestern Saskatchewan over the next couple of days, although southern Alberta will not get much meaningful moisture - The

precipitation will maintain moisture abundance in parts of western Alberta and increase topsoil moisture in the northeast part of the province - Far

northwestern Saskatchewan will also see some relief from dryness - Friday

into the weekend will bring waves of rain and some wet snow from eastern Montana through the southeast half of Saskatchewan to Manitoba, the Dakotas and parts of Minnesota - Some

crop areas will get more rain than others, but it all will be welcome - A

second wave of rain will impact some of these areas and other locations in the Prairies next week - U.S.

southeastern states will trend much drier over the coming week to ten days, but some break from the trend will occur in a part of the region late this month - Some

crop moisture stress is expected since some areas are already a little too dry - U.S.

central and southern Plains will continue to receive rain frequently over the coming week to nearly ten days, although its intensity has been reduced today - Concern

over wet weather disease and early maturing grain quality will continue, although World Weather, Inc. does not expect much damage - Favorable

lower U.S. Midwest and Delta weather is expected over the next ten days - West

Texas rainfall is expected to erratic over the next week to ten days, but more rain is expected in the production region - Subsoil

moisture will not be restored keeping the concern about long term crop development moderately high - The

moisture has been and will continue to be good for planting, but additional rain is needed - Oregon

and a few Idaho crop areas may get some beneficial moisture soon, but the Yakima Valley in Washington will continue quite dry - Irrigated

crops are in favorable condition - Dryland

winter crops need moisture and some of that which occurs in Oregon will benefit those dryland crops - Southeast

Canada corn, soybean and wheat production areas are experiencing good crop weather - Tropical

Cyclone Tauktae moved inland Gujarat, India Monday and will move across northern India today and Wednesday producing heavy rain and windy conditions.

- Very

little crop damage is expected, but some unharvested winter crops and early season cotton will be influenced by the storm and/or its remnants - Considerable

property damage has likely occurred in southern Gujarat because of the storm and its torrential rainfall and excessive wind

The

storm was located 325 miles north northwest of Mumbai, India at 1315 GMT today and was moving northeasterly at while producing heavy rainfall and strong wind speeds from central Gujarat into southwestern Rajasthan

- Australia

will receive a few showers late this week through next week as a frontal system or two moves across the southern parts of the nation - Resulting

rainfall will be erratic and light, but all of it will be welcome and will contribute to a better future for planting - More

rain will be needed in many areas before fieldwork and crop development becomes aggressive - Late

summer crop harvesting will proceed with little delay for the next ten days - Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for southern and eastern parts of the nation during the next two weeks - The

precipitation will be erratic - Water

supply is quite low and winter crops in a few areas have not performed well - The

moisture will help improve planting, emergence and establishment conditions for most summer crops in the wetter areas, but the west-central and northwest parts of the nation will continue quite dry.

- South

Africa will be dry and warm biased over the coming two weeks - Southern

Oscillation Index is mostly neutral at +7.63 and the index is expected to fall over the next few days. - North

Africa rainfall was minimal during the weekend and is expected to be minimal for a while - Temperatures

will be warmer than usual - Winter

small grains will be rushed toward maturation faster than usual without much moisture - West-central

Africa will see a mix of rain and sunshine through the coming week. - Temperatures

will be near to above average and rainfall will be below average in this coming week

- A

boost in precipitation will be needed later this month to ensure soil moisture stays as good as possible and crop development continues normally - A

boost in rainfall is expected for some areas next week - East-central

Africa rainfall will be erratic over the next two weeks. Crop conditions are rated favorably, but greater rain will be needed in late May and June to maintain the best possible crop environment - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - However,

the mainland areas are reporting below to well below average rainfall recently and a boost in rain is needed in Vietnam’s Central Highlands and neighboring areas

- Thailand

may receive the least rain over the next ten days - Greater

rain is also needed in the northern and western Philippines - Luzon

Island, Philippines will be last to get significant rain - New

Zealand precipitation for the next week to ten days will be periodic, but a little lighter than usual while temperatures are slightly cooler biased.

Source:

World Weather, Inc.

Tuesday,

May 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and cotton - New

Zealand global dairy trade auction - Brazil’s

Conab releases cane, sugar and ethanol production data - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference

Wednesday,

May 19:

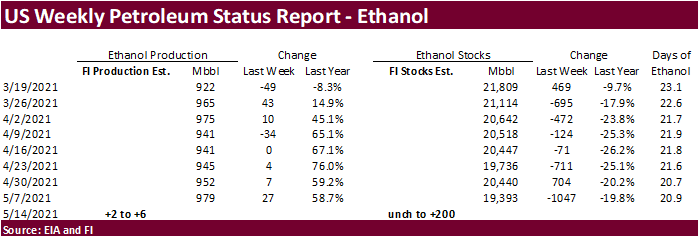

- EIA

weekly U.S. ethanol inventories, production - BMO

Farm to Market Conference, day 1 - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference - HOLIDAY:

Hong Kong

Thursday,

May 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to release trade data, including country breakdowns for commodities such as soybeans - BMO

Farm to Market Conference, day 2 - Black

Sea Grain conference - Port

of Rouen data on French grain exports - Malaysia

May 1-20 palm oil export data - USDA

total milk, red meat production, 3pm - EARNINGS:

Suedzucker

Friday,

May 21:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Black

Sea Grain conference - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

U

of I

Zulauf,

C. “On-Going World Crop Prosperity and US Crop Agriculture.” farmdoc daily (11):79, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 17, 2021.

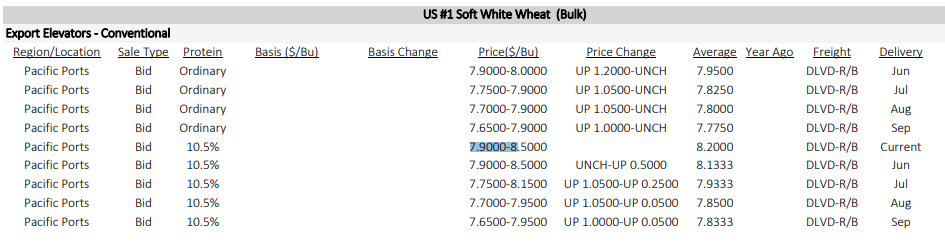

US

Housing Starts Apr 1.569M (est 1.702M; prevR 1.733M; prev 1.739M)

US

Building Permits Apr 1.760M (est 1.770M; prevR 1.755M; prev 1.766M)

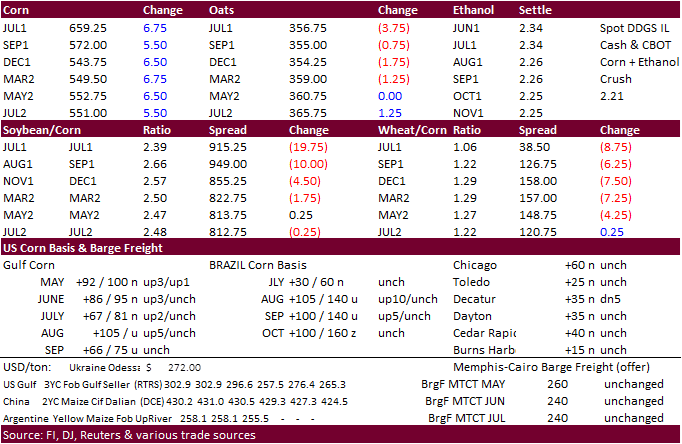

Corn

- Chinese

buying, drier than expected weather for the start of the week for the upper Midwest and drier forecast for this weekend along with slightly lower than expected US corn planting progress lifted CBOT corn higher. - A

large turnaround in WTI crude oil (lower) did little to slow the upside in US corn futures.

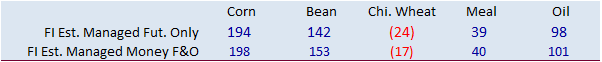

- Funds

were net buyers of 4,000 corn. - The

trade should monitor the rain event for the US Midwest across the WBC. 1-3 inches is expected to fall across eastern KS through MN and WI through the weekend.

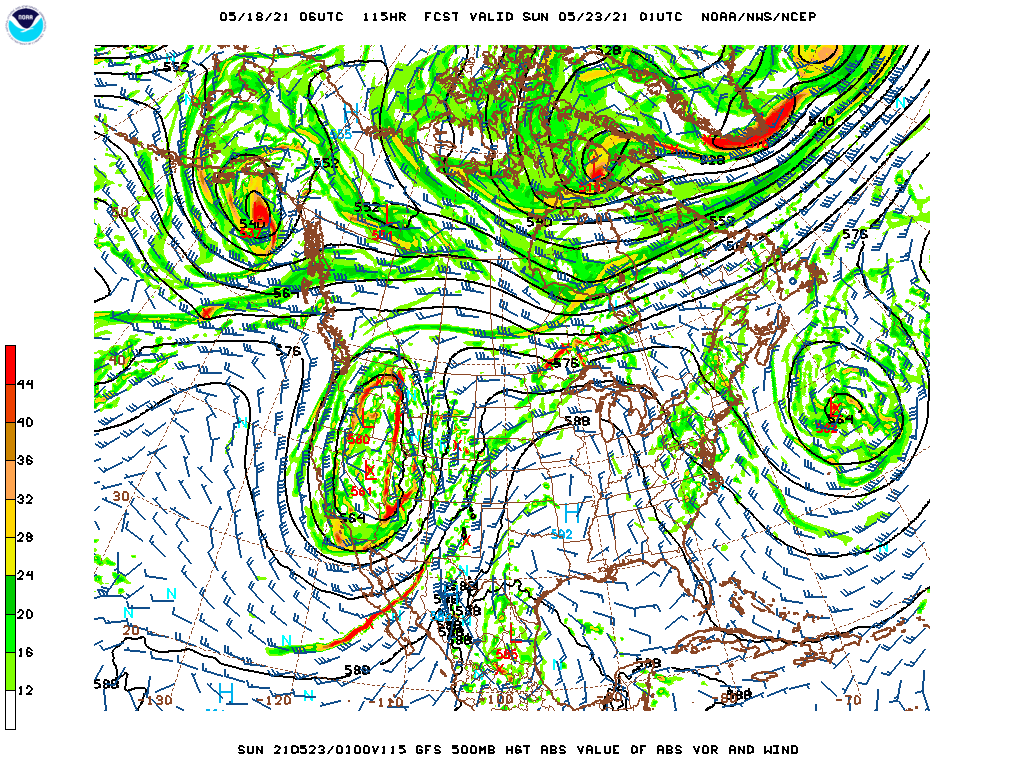

- Talk

of ridging across the US during the remainder of this month is gaining traction. It will start to build across the SE then shift west. ISO bars – 115HR valid 5/23 Sunday

- A

sharply lower USD (near a 4-month low) added to the positive sentiment. - China

bought another 1.36 million tons of corn after picking up 1.7MMT on Monday 1.36 million tons of new-crop corn per USDA on Friday. So far during the month of May China bought 8.16 million tons of new-crop corn under the 24-hour reporting system.

- April

China corn imports reached a large 1.85 million tons, up 109% from a year ago. YTD stand at 8.58 million tons, up 301% from previous year.

- Parana,

Brazil, second corn crop conditions fell again from the previous week to 23% good from 25% and compares to 62% month ago. We lowered our Brazil corn production forecast to 96.5 million tons vs. USDA of 102 million tons (see attached balance sheet). The weather

outlook for Brazil’s second corn crop is still hot and dry. - Argentina

plans to implement a 30-day ban on meat exports to cool inflation. We are unsure if they will increase export taxes on corn and wheat at this time but there is still talk of it. Argentina beef exports hit a record during the Jan-Feb period.

- US

ethanol plant margins improved from the previous week according to Iowa State University’s CARD to 50.3 cents for dry plants, up 25 cents from previous week. Average Iowa ethanol price last week was up 10 cents to around $2.53/gallon. (RFA) - Bloomberg

cattle survey: U.S. Cattle on Feed Placements Seen Up 21% Y/y & April placements onto feedlots seen rising y/y to 1.728 million head.

- A

Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels (965-1003 range) from the previous week and stocks up 120,000 barrels to 19.519 million.

Export

developments.

-

WASHINGTON,

May 18, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 1,360,000 metric tons of corn for delivery to China during the 2021/2022 marketing year.

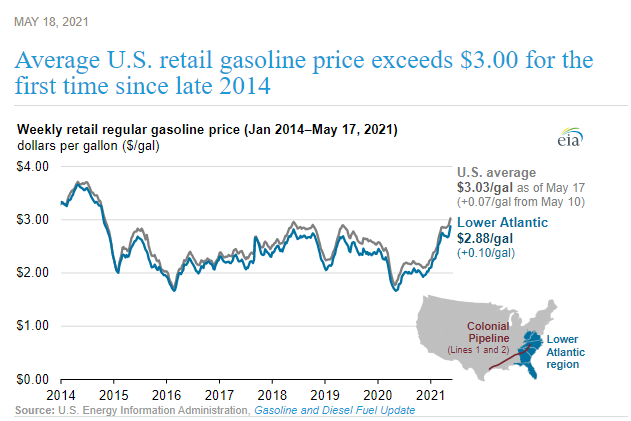

Average

U.S. retail gasoline price exceeds $3.00 for the first time since late 2014

https://www.eia.gov/todayinenergy/detail.php?id=47996&src=email

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

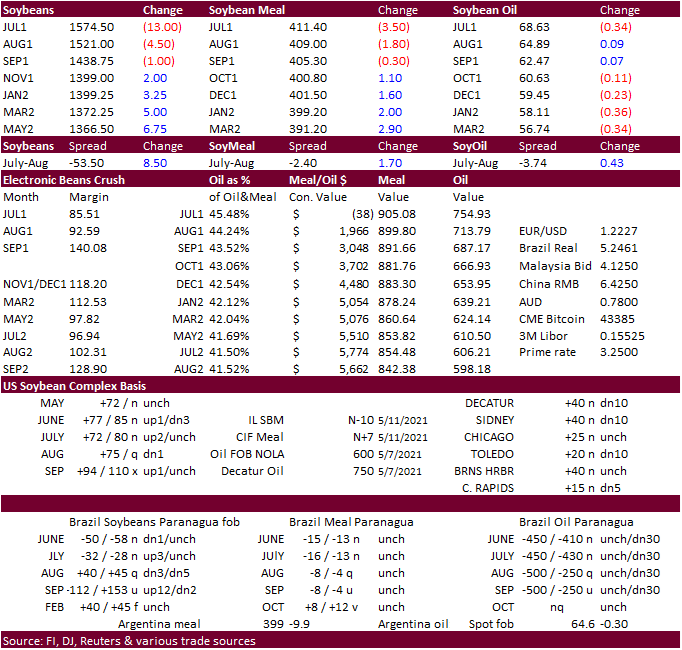

- CBOT

soybean oil flipped in part to profit taking after July topped 70 cents earlier today and large reversal (lower) in WTI crude oil. This and some talk of US soybean basis easing pressured nearby soybean spreads. Decatur, IL soybean basis fell 10 cents to

40 over the July and Sidney was off 10 cents to 40 over N. Toledo dropped 10 cents to 20 over N. We heard some crushers are well covered through the July position.

- The

earlier rally in SBO was due in part to Malaysian palm futures rallying 5 percent overnight in part to higher China futures and rally in CBOT soybean oil on Monday. Reuters noted the Southern Peninsula Palm Oil Millers’ Association estimated palm production

during the first 15 days of May in some parts of Malaysia likely fell 18% month-on-month. As Mentioned yesterday, NOPA’s April soybean oil stocks were tighter than expected in part to a good slowdown in crush rates.

- Old/new

crop soybean meal spreads were also on the defensive today. - The

USD was 37 lower, WTI crude oil lower and US equities mostly lower. - Funds

were net sellers of 9,000 soybeans, sold 6,000 meal and sold,000 soybean oil.

- Reuters:

CANOLA FUTURES DAILY PRICE LIMIT REVERTS TO $30.00 PER TONNE EFFECTIVE MAY 19, 2021 - Brazil

soybean exports for the week ending May were 4.1 million tons, higher end of expectations and above 3.4 million tons for the comparable week a year ago. FH May soybean exports are around 8.8 million tons, unchanged from year ago. Oil World looks for May

exports to fall short of last year due to slowing China imports, and for June-September arrivals to fall from year earlier. Canola arrivals during April were a new monthly high of 0.34MMT.

- Argentina

plans to vote on new biofuel legislation this week by Congress then pass to the Senate. They may cut the admixture mandate by half from current 10 percent, allowing for more SBO available for export. China and India have been large buyers of Argentina soybean

oil this year. Meanwhile there is talk Argentina could increase export taxes of grains and oilseeds & products after banning meat exports for 30 days. (Oil World).

- Reuters

– Exports of Malaysian palm oil products for May. 1-15 rose 22.3 percent to 714,014 tons from 583,875 tons shipped during Apr. 1-15, cargo surveyor Societe Generale de Surveillance said on Tuesday. The other two reporting forms showed a 17% and nearly 19%

rise. - Bloomberg

– Australia’s canola production is expected to hit a record 4.7 million tons in 2021-22 as strong global prices and “optimal” moisture profiles in some states encourage farmers to plant more, IKON Commodities.

- Record

India soybean prices may allow India producers to expand their soybean plantings by over 10%, according to a Reuters story. Indian farmers planted soybean on 11.83 million hectares in 2020 and produced 10.4 million tons, according to SOPA.

Aug

palm futures

- Today

USDA seeks a total of 4,770 tons of packaged oil for use in Title II, PL480 and the McGovern-Dole Food for Education export programs. Shipment was set for June 16-July 15 (July 1-31 for plants at ports).

Updated

5/14/21

July

soybeans are seen in a $15.00-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

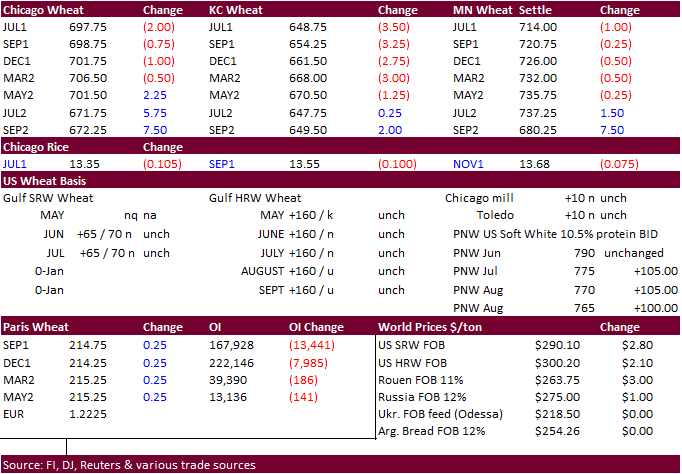

- CBOT

wheat prices tracked corn higher only to ended lost lower after the annual US wheat crop tour called for above average yields across central Kansas. Prices started the day higher after yesterday USDA reported a decline in US winter wheat conditions by one

point to 48 percent G/E. Sharply lower USD added early support. - Funds

sold an estimated 2,000 Chicago wheat contracts. - Wheat

Quality Council’s annual Kansas tour showed yields above average for central Kansas, but some fields had rust disease. 2020 tour was cancelled. Dickinson, Saline, Ottawa, Cloud, Mitchell and Osborne counties in north-central Kansas projected an average yield

of 60.5 bushels per acre (bpa). The figure compares to the tour’s 2019 average for cars of 41.5 bpa. A second car traveling another calculated an average yield of 57.6 bpa after five stops, well above the tour’s 2019 average on the same route of 47.8 bpa.

A third car traveling south of the other two routes, crossing the center of the state, made three stops and calculated yield potential at 54, 74 and 61 bpa. (Reuters) - Central

and Volga areas in Russia will see above normal temperatures this workweek but no major impact to the crop is expected.

- Coceral

raised its forecast of the EU-27 soft wheat production to 130.9 tons from 126.6 million estimated in March (10% higher than last season). Barley was raised to 55.4MMT from 54.5, corn 64.7 from 63.5, and they left rapeseed unchanged at 16.6 million tons.

- Bloomberg:

Canadian Prairies (Canola/Spring Wheat) – Alberta, Saskatchewan, Manitoba Summary: Isolated showers. Temperatures above to well above normal. Forecast: Days 1-3: Isolated showers through Wednesday. Temperatures above to well above normal Monday-Tuesday, below

normal west and above normal east Wednesday. Days 4-5: Scattered showers Thursday-Friday.

- September

Paris milling wheat settled up 0.50 euros, or 0.2%, at 215.00 euros ($262.64) a ton. - USDA

made some big upward adjustments to cash wheat quotes for the PNW.

Export

Developments.

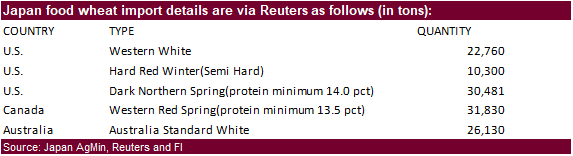

- Bangladesh

seeks 50,000 tons of milling wheat on May 30. - Japan

seeks 121,501 tons of food wheat this week.

- Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on May 19 for arrival by October 28.

Rice/Other

·

Mauritius seeks 4,000 tons of rice, optional, origin, for delivery Aug – Sep, on June 1.

·

Results awaited:

South

Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/17/21

July

Chicago wheat is seen in a $6.60-$8.00 range

July

KC wheat is seen in a $6.20-$7.25

July

MN wheat is seen in a $6.75-$7.50

(NA rains are breaking the MN market)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.