PDF Attached

Early

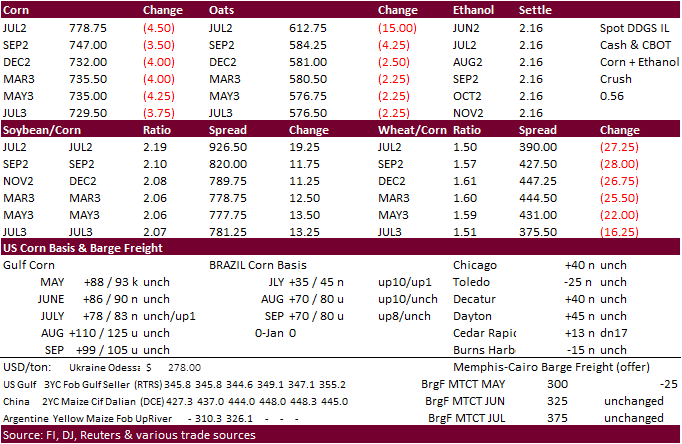

calls: Grains lower and soybean complex steady. Will need to monitor the USD, equities and WTI crude oil later this afternoon. Those markets could have influence on soybean oil in turn spill over into soybeans.

Indonesia

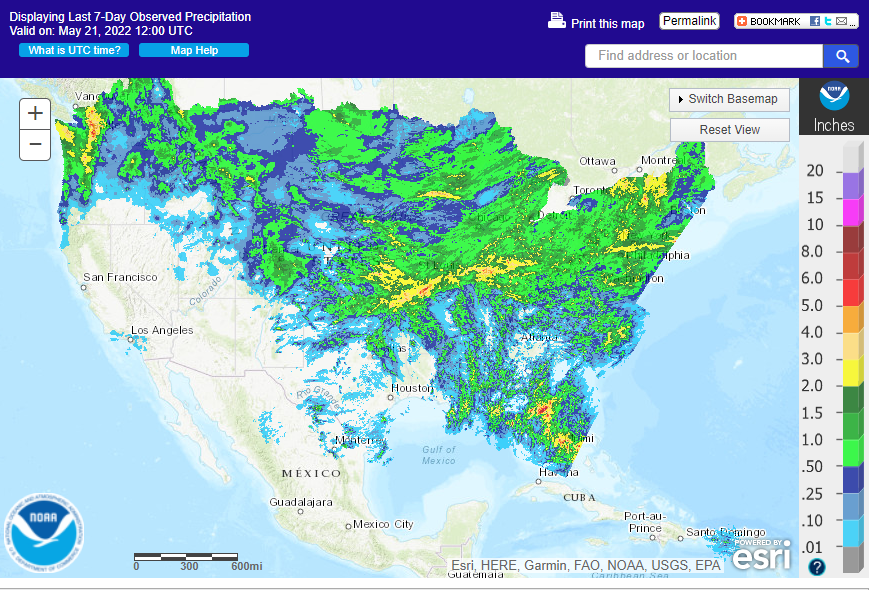

will now limit the amount of palm exports after announcing earlier this week that they were lifting the export ban. Rain fell across the Midwest over the weekend and more rain is seen this week bias eastern TX & OK, Delta, heart of the Midwest and Southeast.

Grains were lower on Friday and soybean complex higher. Argentina increased its cap on corn exports.

The USD was 30 points higher and WTI crude ended nearly 50 cents higher. USDA cattle on feed was slightly supportive for corn.

Last

seven days

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

-

Frost

and freeze conditions occurred in southern Brazil this morning with most of the hard freezes in Santa Catarina and parts of Rio Grande do Sul -

Lighter

freezes occurred in southern Parana – mostly in wheat country where the impact was minimal.

-

No

Safrinha crop area was negatively impacted -

Frost

was reported in a few Sul de Minas coffee production areas this morning, but the impact should have been minimal -

One

location north of Tres Pontas reported a near dawn temperature of -1 Celsius or 30 degrees Fahrenheit -

Most

lows were 2 to 6 Celsius or 35-43F -

Cool

weather will continue in Brazil through the weekend, but temperatures should not be any cooler than they were today except in a couple of Parana locations where readings may be a degree or two lower Saturday -

No

freeze will occur in Safrinha corn areas Saturday, but there could be a few patches of frost in minor production areas.

-

Argentina’s

second week outlook has potential for rain in wheat areas, but the latest model run of the GFS this morning minimized some of that potential once again -

The

00z GFS and 00z European model runs had more moisture for the last days of May and first days of June -

World

Weather, Inc. believes some rain will fall, but it is questionable how generalized and beneficial it will be

-

Follow

up moisture will be imperative -

No

relief from dryness is expected in Mato Grosso or Goias Safrinha corn production areas during the next two weeks – which is normal for this time of year, but crop stress while grain filling is expected to continue threatening some of the late season yields

-

West

Texas rainfall Monday through Wednesday of next week may vary from 0.35 to 1.00 inch with local totals of 1.00 to 2.00 inches;

-

The

lighter amounts will occur in the west near the New Mexico border. -

The

precipitation will be welcome, but not uniform and mostly light leaving a big need for more moisture -

The

Rolling Plains will be much wetter than the high Plains -

Significant

rain will fall in the Texas Blacklands during mid-week next week possibly resulting in some local flooding -

The

moisture will be good for developing corn, sorghum and cotton, although if the GFS mode is correct flooding could damage a few fields -

The

GFS model is likely overdoing some of the predicted rain -

U.S.

Midwest rainfall will be greatest during the middle part of next week slowing or stalling fieldwork for a little while -

A

better mix of rain and sunshine should occur before and after that period of time supporting some fieldwork during the drier days -

Southeastern

portions of the U.S will see some timely rainfall, to prevent dryness from festering into a problem during the next ten days -

U.S.

Delta weather will be favorable for summer crops, although there will be enough rain to slow farming activity for a while next week -

U.S.

northern and west-central Plains will experience frost and freezes this weekend with temperatures falling to the upper 20s and 30s Fahrenheit -

Permanent

crop damage is possible in a few early planted spring crop areas, but most of those early crops can handle the cold without a problem for no further advanced than they are -

U.S.

hard red winter wheat areas in western Nebraska, northwestern Kansas and northeastern Colorado will see frost and freezes Saturday and Sunday that may burn back some of the crop and could negatively impact production in a few of the more advanced counties

-

Northwestern

Kansas reports 14% of the wheat headed as of last Sunday and low temperatures there may slip near or slightly below freezing along the Colorado and southwestern Nebraska border -

Snow

is still expected to fall in eastern Colorado tonight with some significant accumulations in east-central parts of the state – mostly near the mountains -

Cold

in Canada’s Prairies and the U.S. northwestern Plains should not seriously impact any crop this weekend -

U.S.

spring wheat and Canada’s eastern Prairies will see instability showers of rain and snow today and Saturday before dry weather finally settles in

-

Other

showers of limited significance will occur next week, but the moisture will slow or completely disrupt the region’s drying trend -

World

Weather, Inc. believes net drying will occur for about ten days in the eastern Canada Prairies, northern North Dakota and northern Minnesota, despite the showers suggested and “some” farming activity will eventually take place -

Returning

stormy weather in the last days of May or early days of June will impact planting once again -

Drought

in the southwestern Canada Prairies will prevail over the coming week, but there will be “some” potential for rain in the last days of May and first days of June -

Light

rain this week has temporarily moistened the topsoil for crop support, but dryness deep in the ground remains a big concern and significant rain must fall soon -

Ontario

and Quebec weather will be mostly well mixed for spring and summer crop planting and winter crop development -

U.S.

Pacific Northwest crops need greater precipitation to improve dryland crop development potentials -

Northern

France, Germany and Poland are poised to receive rain periodically in the coming ten days -

The

moisture will help ease long term dryness, but other areas in Europe will not likely get enough rain to counter evaporation and net drying may continue -

Crop

moisture stress has already been rising across the continent and there is a drier bias for June in western areas similar to that which has been occurring recently -

Russia,

Ukraine and northern Kazakhstan are expecting waves of light precipitation during the next ten days supporting spring fieldwork and crop development -

Ukraine

could run a little drier than usual in June and should be closely monitored, but the outlook currently is not bad for the nation -

Eastern

China dryness in the North China Plain will continue for the next ten days, but there will be some shower activity and that will translate into a better environment for a few crops -

The

situation is not critical today, but another ten days of drying for some areas might lead to greater stress for unirrigated spring and summer crop -

Most

of the winter crop is irrigated, but any dryland crop might run a risk of lower production -

Southern

China will trend much wetter next week and into the early days of June resulting in some potential for additional flooding -

Guangxi,

Guangdong, Fujian and a few bordering areas to the north will be vulnerable to flooding eventually, but drier biased conditions will occur through the weekend -

Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

-

Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas -

Southern

India, southern Myanmar, other portions of mainland Southeast Asia and the northwestern Philippines will receive frequent rain this weekend through all of next week resulting in a rising potential for flooding.

-

This

precipitation is associated with a strong southwest monsoon flow -

The

lower coast of Myanmar will receive 10-20 inches of rain over the next ten days beginning this weekend -

Thailand

may not be included in the wetter weather that other Southeast Asia nations experience for a while -

A

tropical cyclone “may” evolve in South China Sea next week and could bring a risk of heavy rain, flooding and windy conditions to portions of Taiwan and indirectly to Luzon Island, Philippines -

The

storm forms around mid-week and may threaten Taiwan at the end of the week -

Australia

precipitation will be restricted through the weekend allowing autumn planting of wheat, barley and canola to advance along with the harvest of cotton and sorghum -

A

wetter second week of the forecast will slow fieldwork, but improve winter crop emergence and establishment potentials -

Rain

in South Africa over the next few days will disrupt fieldwork, but the moisture will be ideal for wheat, barley and canola planting and establishment -

Drier

weather will return next week favoring fieldwork once again -

West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

-

There

is need for greater rainfall farther north in cotton areas where recent rain has been a little restrictive at times -

East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably -

North

Africa weather will be mostly dry and warm for wheat and barley maturation and harvest progress -

Turkey

will be the only Middle East nation getting rainfall during the next week to ten days -

A

boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest hurting winter grain production and raising some worry over irrigated cotton and rice development -

Mexico

rainfall is expected to increase in the east next week as pre-monsoonal moisture builds up

-

Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

-

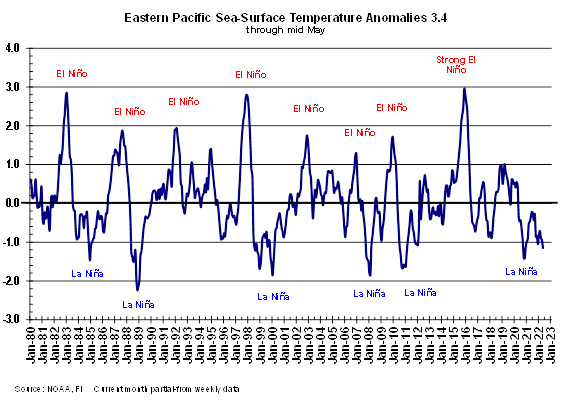

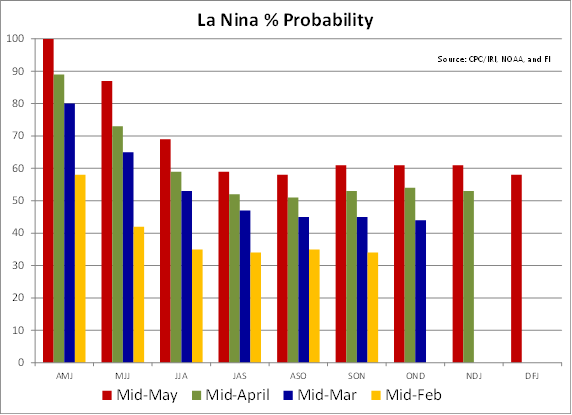

Today’s

Southern Oscillation Index was +19.18 and it will remain near its peak intensity for a little while longer, but there is strong evidence for weakening soon -

New

Zealand weather will trend drier for a while

Source:

World Weather Inc.

Bloomberg

Ag Calendar

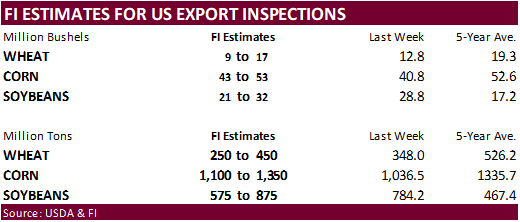

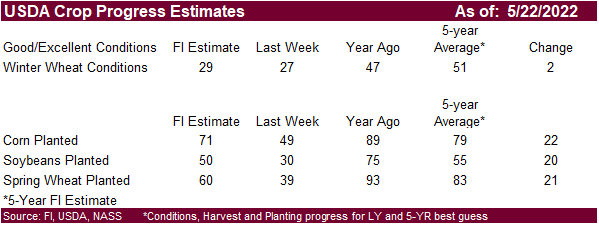

- USDA

export inspections – corn, soybeans, wheat, 11am - MARS

monthly EU crop conditions report - U.S.

crop planting data for corn, soybeans, spring wheat and cotton; winter wheat conditions, 4pm - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Canada

Tuesday,

May 24:

- Grain

& Maritime Days conference in Istanbul, May 24-25 - Russian

Meat & Feed Industry conference in Moscow - EU

weekly grain, oilseed import and export data - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative)

Wednesday,

May 25:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

May 1-25 palm oil export data - U.S.

poultry slaughter, 3pm - HOLIDAY:

Argentina

Thursday,

May 26:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

releases World Sugar Markets and Trade outlook - Russian

grain forum starts in Sochi - HOLIDAY:

France, Germany, Indonesia

Friday,

May 27:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

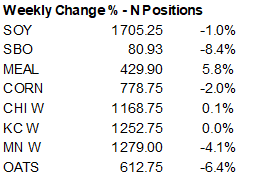

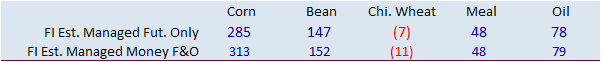

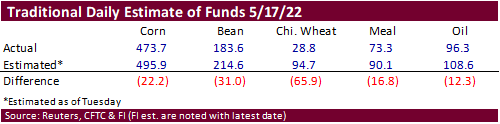

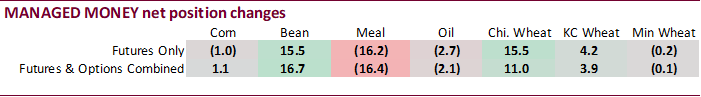

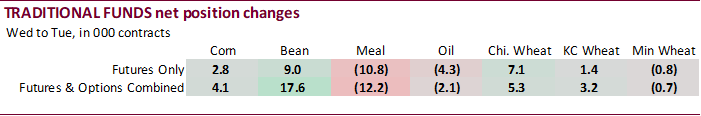

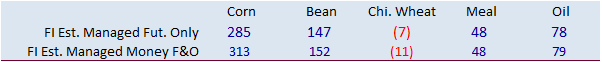

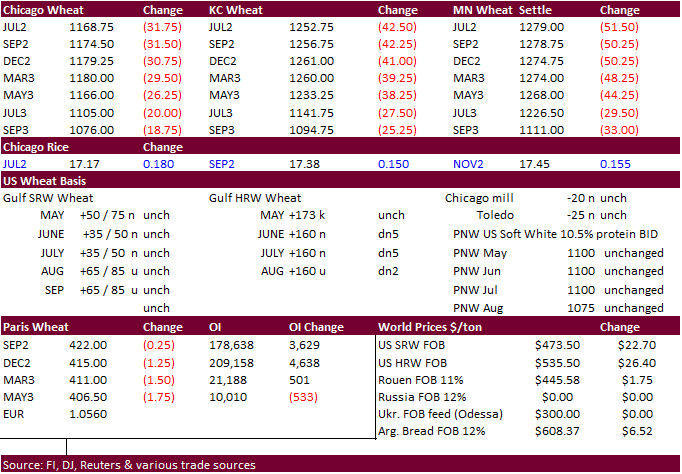

Chicago

wheat fell way short of expectations, and after Friday, traditional funds are thought to be net short! All other major commodity net long positions were also less than expected, an indication funds were not as aggressive in buying for the week ending May

17 than expected.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

250,724 1,392 482,949 1,186 -698,130 -13,087

Soybeans

82,242 16,375 181,425 -8,219 -236,558 -9,527

Soyoil

62,398 -1,853 112,592 -1,205 -196,493 -18

CBOT

wheat -32,072 3,631 156,203 2,451 -121,245 -6,943

KCBT

wheat 12,322 2,849 65,140 579 -79,718 -2,793

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

339,711 1,149 289,662 7,273 -693,535 -21,881

Soybeans

147,335 16,674 101,780 -14,874 -233,528 -4,133

Soymeal

35,923 -16,391 90,914 -2,494 -180,077 10,450

Soyoil

86,237 -2,139 85,501 -87 -202,683 -847

CBOT

wheat 26,586 11,038 66,852 404 -95,392 -6,607

KCBT

wheat 46,790 3,876 27,807 52 -71,495 -2,596

MGEX

wheat 18,175 -82 763 26 -30,162 187

———- ———- ———- ———- ———- ———-

Total

wheat 91,551 14,832 95,422 482 -197,049 -9,016

Live

cattle 25,628 -4,320 70,022 692 -112,439 3,597

Feeder

cattle -6,734 -3,813 5,315 -42 4,286 1,523

Lean

hogs 10,563 -10,045 50,578 661 -60,689 8,070

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

99,706 2,950 -35,543 10,508 2,256,288 87,700

Soybeans

11,521 964 -27,109 1,369 920,248 24,425

Soymeal

22,400 4,232 30,840 4,203 413,267 3,408

Soyoil

9,441 -4 21,503 3,076 447,084 9,502

CBOT

wheat 4,840 -5,697 -2,886 861 483,434 59,434

KCBT

wheat -5,357 -697 2,256 -634 204,633 7,044

MGEX

wheat 5,687 -579 5,538 449 78,982 1,790

———- ———- ———- ———- ———- ———-

Total

wheat 5,170 -6,973 4,908 676 767,049 68,268

Live

cattle 24,728 -818 -7,940 849 366,741 -6,851

Feeder

cattle -847 -1,233 -2,021 3,565 61,143 5,600

Lean

hogs 4,557 504 -5,009 810 274,130 -11,880

Macros

China’s

Beijing reported 94 new local covid cases on Sunday.

·

Argentina is going to raise export availability of corn by 5 million tons to 35 million tons that could cut into US exports.

·

Brazil saw mild frost events last week, easing trade concerns over the late planted Brazil second corn crop currently in the pollination stage.

·

Kenya will allow duty free corn imports of 540,000 tons.

·

Baltic Dry Index increased 1.7% or 55 points on Friday to 3,344 points, up 7.7% for the week. It’s up six consecutive days.

·

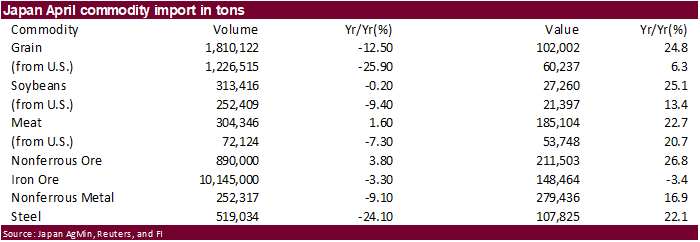

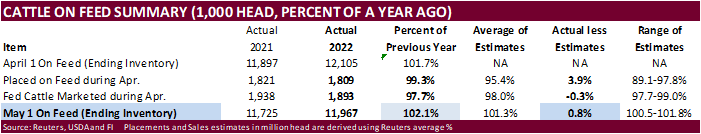

USDA Cattle on Feed was seen slightly supportive for corn feed demand and bearish for cattle based on higher than expected May 1 cattle on feed.

·

Turkey’s TMO seeks 175,000 tons of feed corn on May 26 for shipment between June 7 and June 30.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range

·

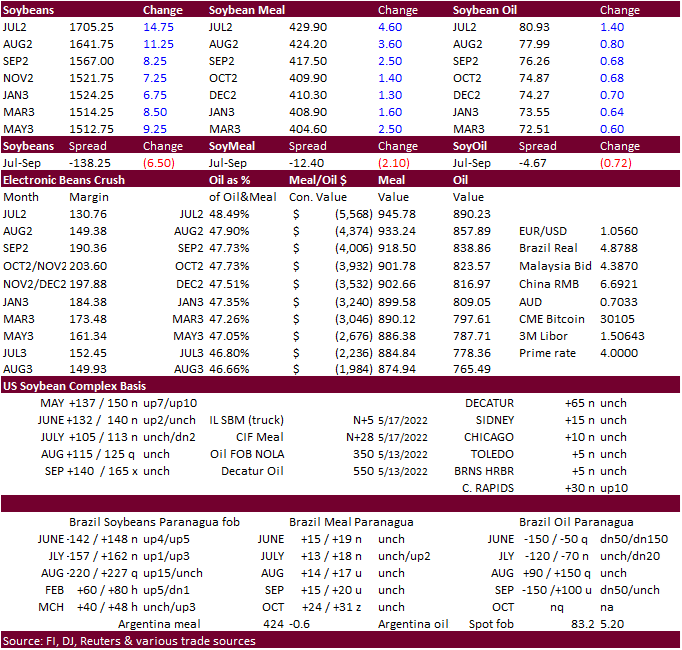

The soybean complex ended the week on a higher note on talk of China buying US soybeans and Indonesia announcing requirements to fulfill the domestic market for palm oil, leading some to think exports will again be curtailed.

Vegetable oil traders took note and bought soybean oil. Meal ended higher and soybeans rallied led by the nearby contracts.

·

Indonesia will start exporting palm oil on May 23, but don’t expect a surge in shipments. According to AgriCensus, Indonesia will reinstate the Domestic Market Obligation (DMO) and Domestic Price Obligation (DPO) scheme to ensure

continued supply of domestic cooking oil. This was introduced earlier this year and dropped March 17. Eight million tons of cooking oil will be set aside for the domestic market and another 2 million tons for reserves.

·

July Board soybean crush settled 8.50 cents higher at $1.2850, but well off its April 29th high of $2.15.

·

The USD was stronger on Friday that could have limited gains in soybeans.

·

SGS: Malaysian 1-20 palm exports 838,692 tons versus 632,588 tons same period month earlier.

·

Malaysia’s June crude export duty will remain at 8 percent.

·

Attended FastMarkets biofuel conference last week.

So many uncertainties for the expansion of renewable fuel was largely talked about. Uncharted territory is what I would describe it. The general consensus was renewable fuel production will expand, but how we get there over the next

few years remains challenging. For example, the renewable diesel price is currently high, and a hard sell for current trucking companies. And will the government cut mandates to ease prices for food end users? Stay tuned.

Very impressed over the amount of oil companies breaking into this space.

·

China sold about 34 percent out of the 500,000 tons of soybeans offered from reserves on May 20.

·

China plans to offer to sell another 500,000 tons of soybeans from reserves on May 27.

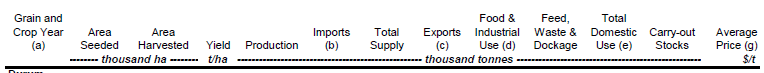

Canada:

Outlook For Principal Field Crops – May 20, 2022

Updated

5/17/22

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $350-$450

Soybean

oil – July 78-86

·

CBOT wheat fell sharply lower on Friday, for the third day in a row, on talk of improving global grain flows, higher USD, and improving US weather outlook. Technical selling was a key feature over the past few business sessions,

and we now estimate the funds net short (by a small amount) as of the end of Friday.

·

India is studying requests from wheat traders to allow for more exports.

·

The White House is looking into increasing grain shipment aid for countries in need of food commodities.

·

The French wheat crop was rated 73 percent G/E versus 82% previous week and 89% two weeks ago.

·

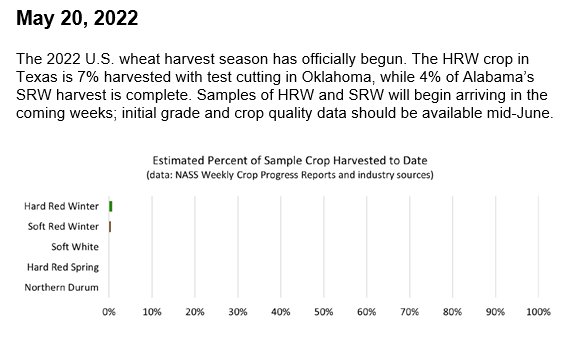

The Wheat Quality Council 2022 Hard Red Winter Wheat Tour on Thursday reported the KS yield at 39.7 bushels per acre, down from 58.1 bushels in 2021 and compares to a five-year average of 47.4 bushels per acre. This was the lowest

yield since 2018. Production was estimated at 261 million bushels, below USDA’s 271 May estimate. We were looking for a yield of 38.0 bushels and 262.2 million bushel production.

·

CBIT wheat abandonment and OTM exercise: 157 June 1170 puts were abandoned, and 500 June 1170 calls were exercised.

https://www.cmegroup.com/delivery_reports/OptionExceptionSummaryReport_OPINS_CME_7.pdf

·

September Paris wheat closed down 0.25 euro at 420.75 euros a ton.

·

Again, Paris wheat option activity was large at the end of the week, with 33,857 lots trading hands.

·

Egypt’s local wheat procurement hit 2.5 million tons so far for this year’s harvest, a signal imports are not immediately needed over the short term.

Canada:

Outlook For Principal Field Crops – May 20, 2022

·

Bangladesh seeks 50,000 tons of wheat on May 23 for shipment within 40 days of contract signing.

·

Jordan issued a new import tender for 120,000 tons of wheat set to close May 24 for Aug/Sep shipment.

·

Pakistan seeks 500,000 tons of wheat on May 25. Bulk shipment is sought to Pakistan in June to July 2022.

·

Jordan seeks on 120,000 tons of barley on May 26 for Aug/Sep shipment.

·

Bangladesh seeks 50,000 tons of wheat on May 29 for shipment within 40 days.

Rice/Other

·

None reported

Updated

5/17/22

Chicago

– July $11.00 to $13.50 range, December $8.50-$12.50

KC

– July $12.00 to $14.50 range, December $8.75-$13.50

MN

– July $12.00‐$15.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.