PDF Attached

Calls

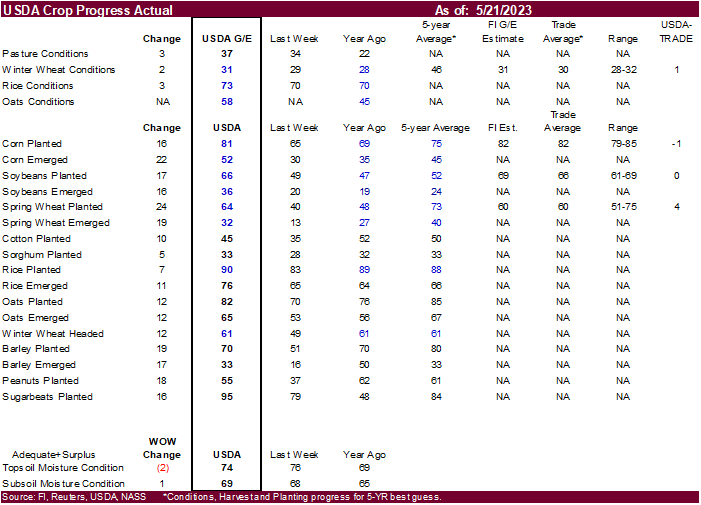

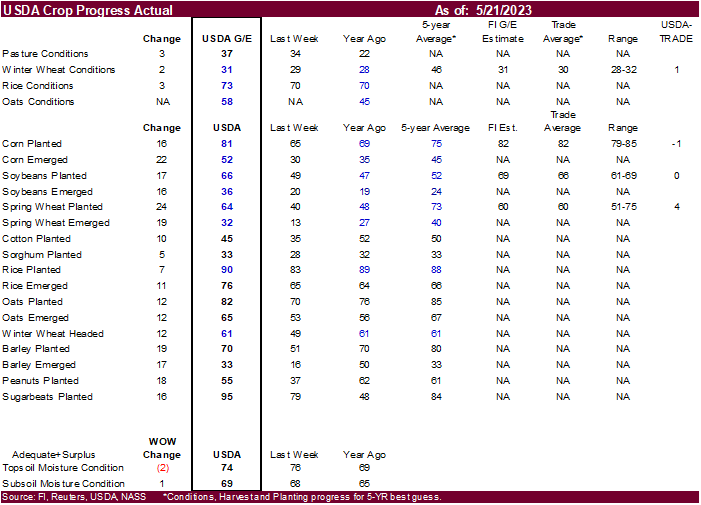

are objective. Two-sided seen. US

winter wheat conditions improved two percentage points, as expected by FI. Soybean plantings and corn were near expectations, but spring wheat needs to catch up. We don’t see a planting issue for summer crops but remain concerned over overall precip for June/July.

USDA: Private exporters reported sales of 225,000 metric tons of soybean cake and meal for delivery to the Philippines during the 2022/2023 marketing year.

US

debt ceiling talks are ongoing. Technical

buying in ags was seen today (bottom picking). Soybean and corn nearby spreads were very firm in part of lack of US producer selling. The recent drop in gain prices attracted some major importers (corn and wheat). Soybean CBOT crush margins were lower in part

to limited gains in soybean meal. Soybean oil gained ground over soybean meal from oversold oil share conditions.

Source:

Reuters and FI

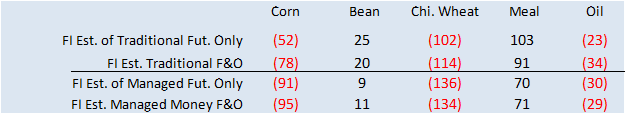

Fund

estimates as of May 22

Weather

WEATHER

TO WATCH

-

Tropical

Cyclone Mawar will overrun Guam and the southern Mariana Islands in the southwestern Pacific Ocean during mid-week this week resulting in some property damage -

The

storm will become intense and could move toward the Philippines and/or Taiwan this coming weekend into early next week -

The

storm should be closely monitored because of its intensity and quick movement -

Serious

damage is expected to Guam and a few neighboring Islands Tuesday and Wednesday due to predicted wind speeds of 127 mph and gusts to more than 150mph -

Rain

will fall significantly in western Alberta, Canada early this week with 0.75 inch to 2.00 inches common and a potential for 2.00 to 3.00 inches in a few areas near Swan Hills and the Peace River Region -

Relief

from recent drying will be welcome and should improve long term crop development potential even through fieldwork will be slowed -

Rain

is also expected in portions of central and eastern Saskatchewan and Manitoba, Canada during the middle to latter part of this week with rainfall sufficient to support recently planted seed germination, plant emergence and improved establishment -

The

moisture will also help improve future planting conditions -

Drought

in east-central and southern Alberta and western Saskatchewan, Canada may not change this week, despite a few showers -

Next

week may not be much different -

Quebec

experienced additional frost and freezes this morning and will do so again later this week, though the impact on wheat has been minimal and most of the corn and soybeans are not emerged -

U.S.

Midwest will be dry and warm this week with daily highs in the 80s Fahrenheit early this week and in the 70s and lower 80s late this week into next week

-

Rapid

planting, quick seed germination and good crop emergence conditions are likely throughout the week -

Timely

rainfall and continued seasonably warm weather is expected next week -

Overall,

weather will be very good fieldwork and crop development over the next two weeks -

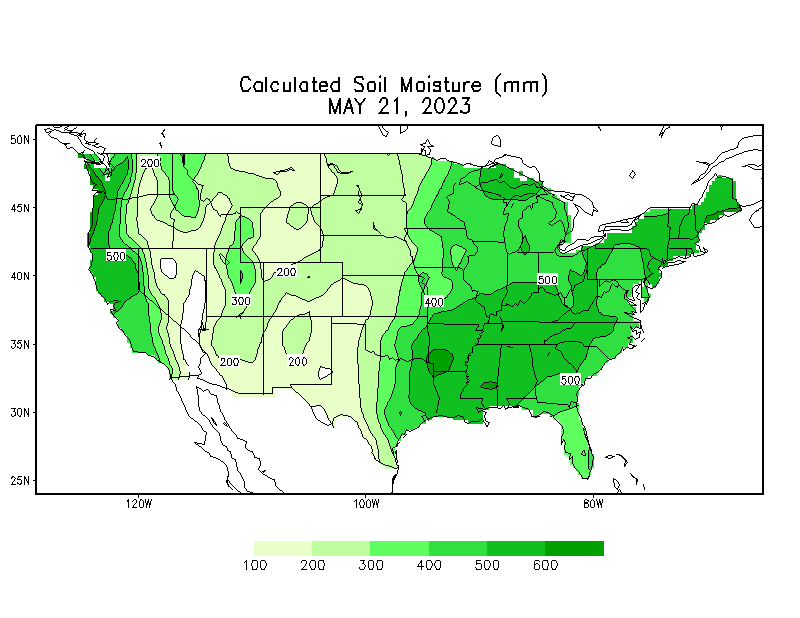

Some

pockets of dryness are expected to evolve, but they are not likely to be widespread and subsoil moisture will continue quite favorable -

Winter

crop development will continue to advance quite favorably -

U.S.

Hard Red Winter wheat and West Texas crop areas will receive routinely occurring showers and thunderstorms this week favoring crop development and fieldwork -

West

Texas crop areas near the New Mexico border will be driest; including some dryland production areas -

West

Texas rain totals for the next ten days will vary from 0.50 to 1.50 inches in the high Plains and 1.00 to 3.00 inches from the Low Plains into the Rolling Plains -

U.S.

Delta will experience net drying conditions over the coming week -

U.S.

southeastern states will experience scattered showers and thunderstorms during the next two weeks with some areas getting beneficial moisture while others will not and net drying will result -

U.S.

Pacific Northwest will be dry and warm biased during much of the forecast period in the Yakima Valley while other areas experience scattered showers and thunderstorms late this week into next week with only light rain resulting, but it will be welcome and

beneficial -

U.S.

northern Plains will get some welcome rain later this week into the weekend, though dry weather until then will be equally good for spring and summer crop progress -

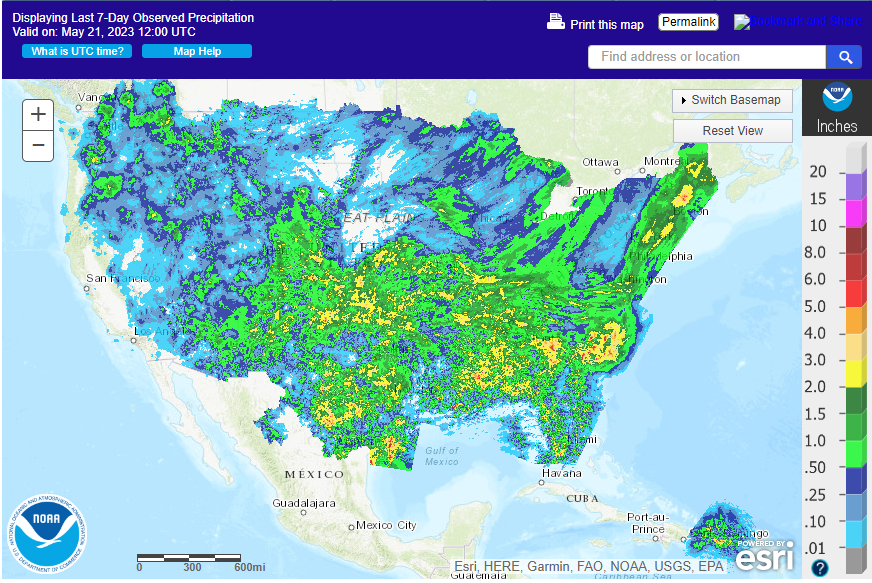

U.S.

weekend precipitation included most of the eastern and lower Midwest, Delta the southeastern states and portions of the southern Plains

-

Net

drying did occur in the lower Delta, the western high Plains region all of the northern Plains and northwestern Corn Belt as well as portions of eastern and southern Texas and the far southeastern corner of the nation -

Argentina

rain was significant enough to raise topsoil moisture in the east half of Argentina during the weekend -

Highly

varying amounts of rain resulted with only 50% of the region experiencing enough rain to notably improve soil moisture

-

Argentina

will experience additional rainfall during the coming week before dry weather resumes -

Additional

rain will be greatest in the central and east leaving some of the western most winter crop areas in need of greater planting moisture -

Fieldwork

will advance swiftly in the central and eastern wheat areas after the rain ends this week, though more rain will be needed to ensure ideal conditions later this autumn -

Concern

over western dryness may continue for a while, but the situation will not be critical unless June turns out to be drier than usual as well -

Temperatures

will trend cooler in Argentina later this week and through the weekend -

That

will conserve soil moisture through lower evaporation so that winter seed germination and plant emergence occur favorably once drier weather resumes -

Center

south Brazil weather will be dry biased through the coming week as it was during the weekend; temperatures will be warmer than usual -

Net

drying is expected and unirrigated Safrinha crops will become more stressed -

Well-timed

rain will fall in Safrinha crop areas of Mato Grosso do Sul, Sao Paul and Parana early next week resulting in a perfectly timed improvement in topsoil moisture to carry late planting corn through reproduction in a favorable manner -

Mato

Grosso and Goias may not be included in the rain event next week and crop moisture stress may continue to rise, although there is only a small amount of very late crop development in these areas relative to the remainder of the Safrinha crop region which should

limit the downside for production -

Some

recent computer forecast model runs are introducing rain for southern Mato Grosso and Goias, but confidence is not high -

Cooling

after early next week’s southern Brazil rain event may bring down temperatures into the 40s Fahrenheit, but no frost event is presently anticipated

-

Southern

Europe will continue wetter than northern Europe this week and next week as well -

Temperatures

will be seasonable to slightly warmer than usual and that may lead to some gradual drying in the north raising the need for moisture in June, but fieldwork will advance well over this next ten days while rainfall continues minimal -

Southern

Europe will need some drier days and perhaps some warmer temperatures to stimulate the best crop development -

Fieldwork

will advance slowly because of frequent rain -

The

moisture in Spain will be very helpful in easing long term dryness, but the wetter biased conditions may raise some winter crop quality issues -

CIS

New Lands will be dry and warm over the next ten days resulting in net drying and a high potential for pockets of dryness to evolve -

The

situation will be closely monitored, although no area will become critically dry in this first week of the outlook

-

Rain

prospects will improve next week with some timely moisture possible -

Western

CIS weather over the next ten days will include warm temperatures for a while and then some cooling and periods of rain -

Eastern

Ukraine and Russia’s Southern Region northward through the Volga River Basin to western Russia will receive widespread rain over the next ten days slowing fieldwork, but benefiting soil moisture and future crop development -

India

weather will be largely dry outside of a few random showers early this week -

Greater

than usual rain is expected in northern India later this week and into the weekend

-

The

wet weather will disrupt farming activity; including the harvest of winter crops -

The

moisture will support early season cotton development and help prepare the soil for summer crop planting -

Mainland

Southeast Asia rainfall will steadily increase later this week into next week bringing notable relief from early season dryness -

Improved

rice and corn planting conditions are expected -

Improved

sugarcane, coffee and other crop development is also likely as well -

Water

supply in the region is below average and concern is rising over water supply when El Nino kicks in and starts reducing summer rainfall which makes the greater rain forthcoming all the more important -

China

weather is still expected to be well mixed over the next two weeks as it has been during much of the spring season

-

Planting

of summer crops should be advancing well -

Rapeseed

and wheat production has been good, although some rapeseed quality issues may have evolved with recent rain -

Summer

crop planting in the Yellow River Basin, east-central parts of the nation, North China Plain and Northeast Provinces should be advancing well with little change likely -

Rain

will be greatest in the north this weekend into next week -

Xinjiang,

China experienced cooler weather in the west where highest weekend temperatures were in the 80s Fahrenheit down from the lower 90s last week -

Northeastern

Xinjiang warmed up to the 70s Fahrenheit after being in the 50s and 60s last week -

All

of these temperatures are still not optimum for cotton or corn -

Warming

is needed to induce the best crop development -

Cooler-than-usual

weather will continue this week and some showers will occur in the northeast.

-

An

improved environment of warmer weather is needed -

The

persistent cool conditions this spring may lead to a higher potential for crop damage in the autumn if frost and freezes occur prior to crop maturity.

-

Philippines

rain will be favorably mixed over the next two weeks -

Typhoon

Mawar poses a threat to northeastern Luzon next week -

Taiwan

may also be vulnerable to Typhoon Mawar -

Indonesia

and Malaysia rainfall will be favorably distributed in this first week of the outlook, but there may be some reduction in rain intensity and coverage next week

-

Crop

conditions should remain favorable throughout the next few weeks, although southern parts of Indonesia will begin drying out soon -

Australia

rainfall during the next ten days will be greatest and most frequent in southern parts of the nation during the next ten days -

Southwestern

Western Australia, coastal areas of South Australia, Victoria and southern New South Wales will be wettest and the moisture will be good for winter crop planting, emergence and establishment -

Anticipated

rain will be lighter than usual in many areas and the need for greater rain in interior crop areas of Western Australia, South Australia, Queensland and Northern New South Wales will be rising -

South

Africa will be dry through Friday and then some showers will begin to evolve and they will last into next week benefiting winter wheat development , but disrupting some farming activity -

North

Africa rainfall will be periodic over the next ten days, but it comes a little too late to change production for Morocco and northwestern Algeria -

Recent

rain in northeastern Algeria and northern Tunisia has been timely and sufficient to improve late season production potential, though it is unclear how much benefit has resulted -

Drier

weather will soon be needed in Morocco and northwestern Algeria to protect crop quality and support harvesting -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to fall periodically over the central and eastern parts of the nation during the next ten days improving topsoil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be periodic and sufficient to support crop needs -

Tropical

Cyclone Fabien was dissipating today over open water in the southwestern Indian Ocean posing no threat to land -

The

storm will dissipate soon -

Today’s

Southern Oscillation Index was -8.36 and it should move lower over the next several days

Source:

World Weather, INC.

Bloomberg

Ag calendar

Monday,

May 22:

- Monthly

MARS report on EU crop conditions - USDA

export inspections – corn, soybeans, wheat, 11am - US

winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - Holiday:

Canada

Tuesday,

May 23:

- EU

weekly grain, oilseed import and export data - Cane

crush and sugar production data by Brazil’s Unica (tentative)

Wednesday,

May 24:

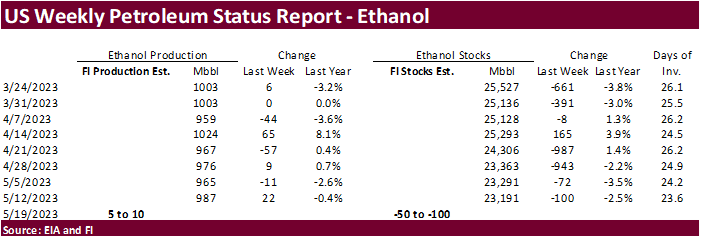

- EIA

weekly US ethanol inventories, production, 10:30am - US

cold storage data for beef, pork and poultry - EARNINGS:

Sime Darby Plantation

Thursday,

May 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Malaysia’s

May 1-25 palm oil exports - US

poultry slaughter, red meat output, 3pm - EARNINGS:

IOI - HOLIDAY:

Argentina

Friday,

May 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - EARNINGS:

Select Harvests - HOLIDAY:

Hong Kong

Source:

Bloomberg and FI

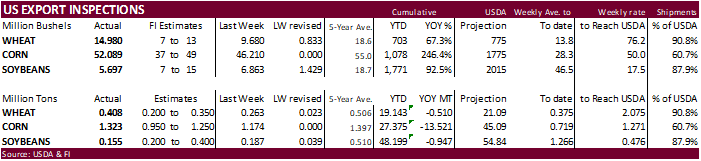

USDA

inspections versus Reuters trade range

Wheat

407,682 versus 100000-350000 range

Corn

1,323,117 versus 700000-1425000 range

Soybeans

155,051 versus 100000-500000 range

·

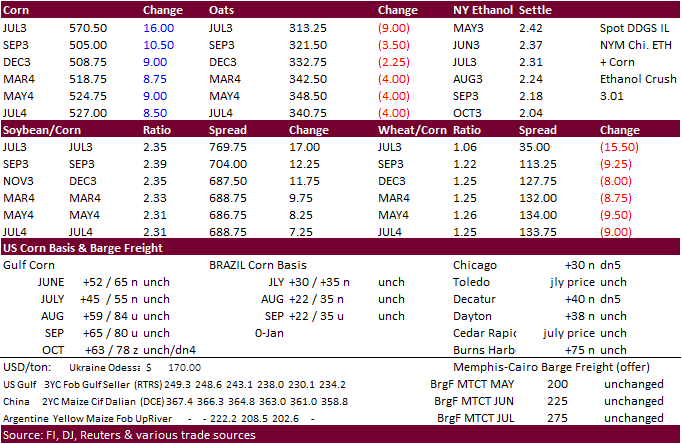

Bull spreading was in play today despite no major news that would suggest it. It could be that the July corn (and soybean) futures appreciated against the back months over lack of producer selling as US weather promotes planting

progress. Back month CBOT corn futures

were higher on technical buying and a US weather outlook calling for net drying across the majority of the central and lower Midwest. MN and surrounding areas this week will see plenty of rain.

·

N/Z gained 6.50 cents.

·

USDA is expected to release initial US corn conditions next week and we look for a rating slightly above average.

·

Brazil announced a 180 day emergency after their detection of bird flu in wild animals. The export market depends on large number of countries including China. But with the cases in wild animals we don’t expect a export/import

ban on poultry.

·

China corn imports from the US were only 53,099 tons for the month of April, down from 1.51 million tons year ago. Total China corn imports were 1 million tons, down 55 percent from a year ago.

·

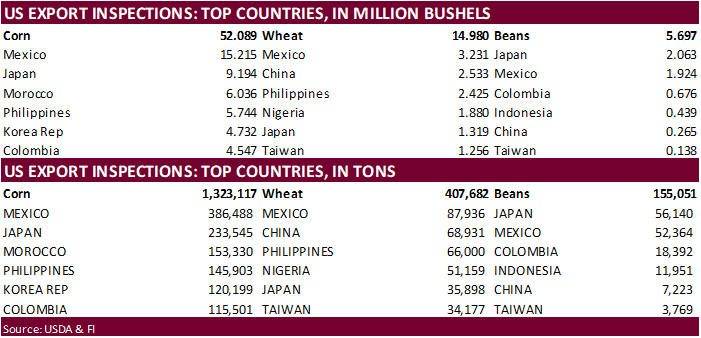

USDA US corn export inspections as of May 18, 2023 were 1,323,117 tons, within a range of trade expectations, above 1,173,783 tons previous week and compares to 1,752,461 tons year ago. Major countries included Mexico for 386,488

tons, Japan for 233,545 tons, and Morocco for 153,330 tons.

Biden

Delays Bid to Grant Electric Carmakers Renewable Fuel Credits

Export

developments.

-

Taiwan’s

MFIG is in for 65,000 tons of corn on Wednesday for Aug/early Sep shipment.

-

Today

Iran seeks 120,000 tons of South American corn for June 1 and July 15 shipment.

July

corn $5.00-$6.50

September

$4.35-$4.45 low end

December

corn $4.25-$6.00

·

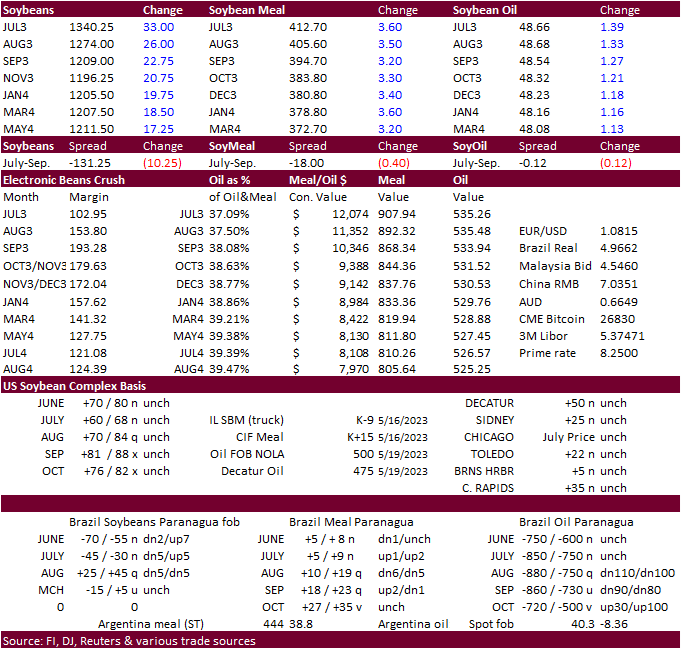

Soybeans and products traded higher on US weather concerns. The CBOT crush was down sharply (led by nearby) as product gains were limited from lower offshore values. Meanwhile spreads were very active in soybeans, with July up

about 7 cents over August as of early afternoon. Funds as of recent have been good sellers in soybeans and today they were adding longs from a US weather outlook calling for net drying bias WCB. Back to the front month strength, we did not pick up any chatter

of any major US cash shortages, so believe the spreading was a little overdone.

·

Some are attributing the rally of soybean oil over meal to biofuel feedstock demand. That will take a couple months to determine as feedstock use data is delayed.

·

USDA reported 225,000 tons of soybean meal sold to the Philippines.

·

China imported 5.3 MMT of soybeans from Brazil during the month of April, down from 6.3 MMT year ago, due to higher US arrivals (1.82 MMT April, up 11% from April 2022). We look for Brazil soybean arrivals to jump higher over

the next few months. For the first four months of the crop year, Brazil shipments to China are running 28 percent below year earlier, with 9.21 million tons for 2023 (Jan-Apr) versus 12.7 MMT year ago. An increase in Brazil shipments could undercut US soybean

exports from June-early Sep.

·

USDA US soybean export inspections as of May 18, 2023 were 155,051 tons, within a range of trade expectations, below 186,787 tons previous week and compares to 582,340 tons year ago. Major countries included Japan for 56,140 tons,

Mexico for 52,364 tons, and Colombia for 18,392 tons.

·

US exports are still seen at 2.010 billion bushels for 2022-23, five million less than USDA and compares to 2.158 billion for 2021-22.

·

An increase in Brazil shipments could undercut US soybean exports from June-early Sep.

·

US exports are still seen at 2.010 billion bushels, 5 million less than USDA and compares to 2.158 billion for 2021-22.

Export

Developments

·

USDA under the 24-hour reporting system reported 225,000 tons of 2022-23 soybean meal sold to the Philippines.

·

USDA sold 120 tons of vegetable oil for the export program last week at $1,937.23 to $2,435.09 per ton.

Soybeans

– July $12.50-$14.25, November $11.00-$14.50

Soybean

meal – July $375-$475, December $290-$450

Soybean

oil – wide July 42-50 with bias to downside, December 43-53, with bias to upside

Wheat

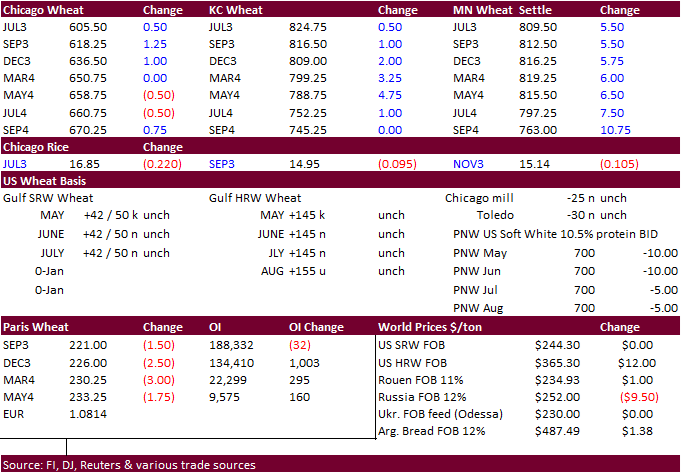

·

1.640 billion is what we are using for wheat US production. See attached.

·

US wheat traded mixed. US futures earlier were on the defensive from improving Argentina and North American weather. They gained from a rally in corn and soybeans, but poor inspections limited the rally.

·

Chicago wheat traded earlier below $6.00 and a close below that this week could attract additional shorts.

·

September Paris milling wheat officially closed 1.50 euros lower, or 0.7%, at 221.00 euros a ton (about $239.00 ton).

·

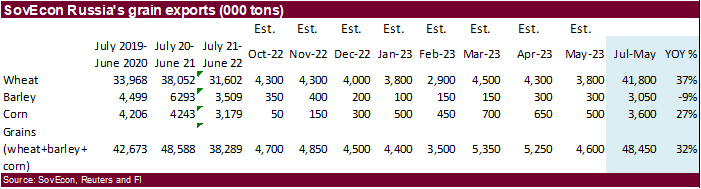

Russian wheat export prices (fob) as of late last week are lower at $242/ton, down $6.00 from the previous week, after the extension of the Black Sea grain deal.

·

A wheat analyst is comparing this year’s KS winter wheat crop to 1989, when abandonment was very high. 33 percent of KS winter wheat could be abandoned, leading many to think corn and other summer growing crops could replace acreage.

·

USDA US all-wheat export inspections as of May 18, 2023 were 407,682 tons, above a range of trade expectations, above 263,439 tons previous week and compares to 275,541 tons year ago. Major countries included Mexico for 87,936

tons, China for 68,931 tons, and Philippines for 66,000 tons.

·

France increased grain shipments last week, to 138,262 tons from 64,920 week before.

·

EU weather is mostly favorable, but parts of France and other southern regions are seeing net drying.

·

Argentina’s weather outlook still shows an improvement over the next month with rain increasing over the wheat growing areas.

Export

Developments.

·

South Korean flour millers seek 135,000 tons of wheat from US, Canada, or Australia on Tuesday for Aug shipment.

·

Reuters reported another 30,000 tons of EU wheat was shipped to the US from Poland for arrival June/July.

·

Taiwan seeks 56,000 tons of US wheat on May 26 for LF July shipment.

Rice/Other

·

China sold 87,582 tons of rice or 9.7 percent out of reserves on May 16, at an average price of 2,518 yuan per ton.

Chicago

Wheat – July $5.75-$7.30

KC

– July $7.75-9.25

MN

– July $7.50-9.00

September

– same ranges as July

#non-promo