PDF Attached

Most

CBOT ag markets traded lower led by a more than 30 cent decline in corn. US weather is good and with most of the corn in the ground, longs were liquidating early ahead of the long holiday weekend. There were also unconfirmed rumors China cancelled old crop

US corn cargoes.

Next

7 days

World

Weather, Inc.

SOME

WORLD WEATHER HIGHLIGHTS FOR MAY 25, 2021

- Not

much change occurred around the world overnight. - Frost

returned to parts of central and southern Parana, Brazil while harder freezes occurred farther south into Santa Catarina.

- Rain

will return to southern Brazil this weekend and early next week ahead of additional cool air.

- In

North America, - Weather

conditions will be trending more tranquil in Canada’s Prairies for a while.

- Recent

moisture will support better planting and emergence conditions - Frost

and freezes are still expected in northeastern Saskatchewan and Manitoba Wednesday morning with a limited amount of permanent crop damage - Rain

is expected in the northern U.S. Plains late Wednesday and Thursday - Hard

red winter wheat areas will get a little too much moisture in the coming week.

- A

good mix of weather is expected in the U.S. Midwest, Delta and southeastern states.

- West

Texas received some additional rain of significance overnight, but mostly in the north.

- Russia’s

southern New Lands and neighboring Kazakhstan will receive restricted rainfall, although temperatures will be milder for a while. - Tropical

Cyclone Yaas is expected to move into northeastern Odisha, India tonight as a weak Category One hurricane equivalent storm - Torrential

rain and flooding will accompany the storm inland, but damage due to excessive wind has been reduced by the storm’s weaker condition - Australia

will get some timely rain for its wheat, barley and canola planting, but it will need more moisture - China

will remain wettest in the northeast and far south with good planting progress elsewhere - Argentina

drying will improve harvest conditions after recent rain - Wheat

planting will advance well - Europe

weather will be favorable - Western

CIS weather will remain a little wetter than desired

Source:

World Weather, Inc.

Tuesday,

May 25:

- Monthly

MARS bulletin on crop conditions in Europe - Malaysia

May 1-25 palm oil export data

Wednesday,

May 26:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica releases cane crush, sugar output data - HOLIDAY:

Malaysia, Indonesia, Singapore, Thailand

Thursday,

May 27:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - Brazil

orange crop forecast for 2021-22

Friday,

May 28:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

US

Philadelphia Fed Non-Manufacturing Regional Business Activity Index May: 36.9 (prev 36.3)

US

New Home Sales Apr: 863K (est. 970K; prev 102.1K)

–

Median Sale Price (USD) Apr: 372.4K (prev 310K)

–

US New Home Sales (M/M): -5.9% (est. -7.0%; prev 20.7%)

US

Building Permits April Revised To -1.3% From 0.3%, Annual Rate To 1.733M Units From 1.76M Units

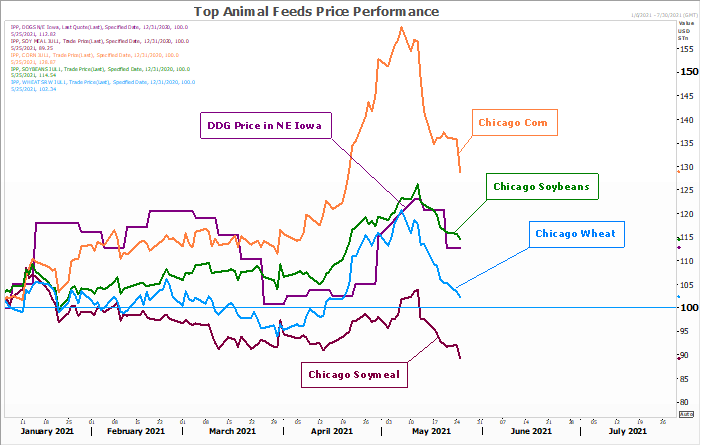

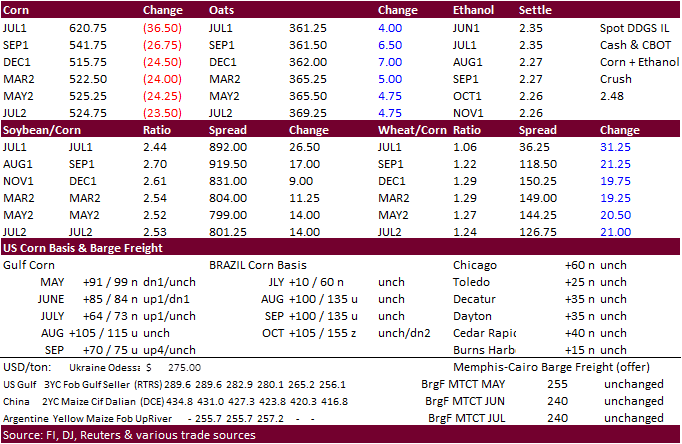

- CBOT

corn traded sharply lower with the July

taking out last week’s lows. July

corn also took out support levels of $6.33 and $6.21, before touching limit lower late in the session. We see strong support for July at $6.05. July corn over the past two days is down about 6%.

- US

weather is promoting a good start to the growing season. In

addition, long money managers are liquidating early ahead of the long US holiday weekend. There was also a rumor China cancelled old-crop corn shipments.

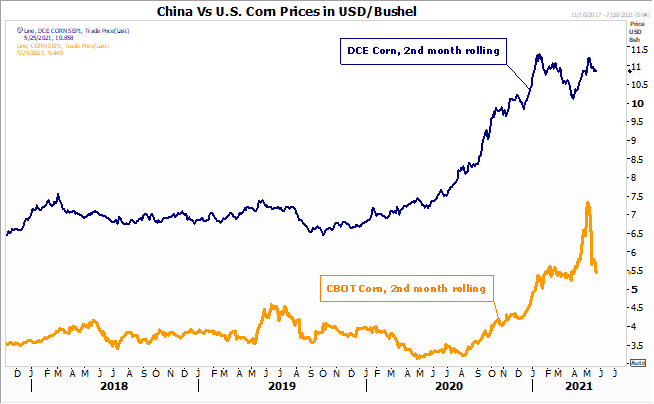

We

can not verify this but we do expect a good chunk of corn outstanding sales get rolled to new-crop this season. This is not uncommon. We believe China will continue buying US corn over the next few months to help tame domestic corn prices.

- A

Chinese official on Tuesday mentioned to reporters that they look for a bumper grain crop this season. They are currently harvesting wheat in the southwest.

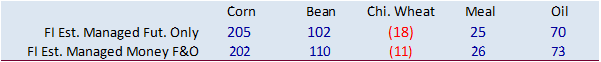

- Funds

sold an estimated 58,000 corn contracts, per Reuters. - China

plans to “strengthen” price controls on corn and other commodities during its 5-year plan (2021-2025) to tame fluctuation in prices. China also plans to build grain supplies. They also will keep wheat & rice minimum support price schemes. - Reuters

reported a Mexican federal judge ruled against a request by the National Farm Council to freeze a government plan to ban genetically modified (GMO) corn and herbicide glyphosate by 2024. We were under the impression the ban on GMO corn would exclude yellow

corn used for animal feed. - Soybean

and Corn Advisory: - 2020/21

Brazil Corn Estimate Lowered 2.0 mt to 95.0 Million Tons - 2020/21

Argentina Corn Estimate Unchanged at 46.5 Million Tons - South

Africa’s Crop Estimates Committee (CEC) will update their 2020-21 SAf corn production estimate on May 27 and a Reuters poll looks for production to expand to 16.413 million tons (9.131MMT yellow/7.287 white) from 16.095 million last month, and up from 15.300

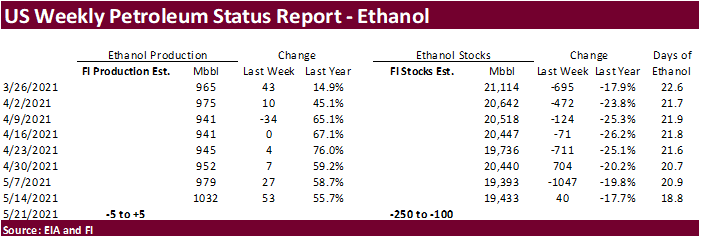

million previous season. - A

Bloomberg poll looks for weekly US ethanol production to be down 4,000 barrels (985-1054 range) from the previous week and stocks up 225,000 barrels to 19.658 million.

Export

developments.

- None

reported

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

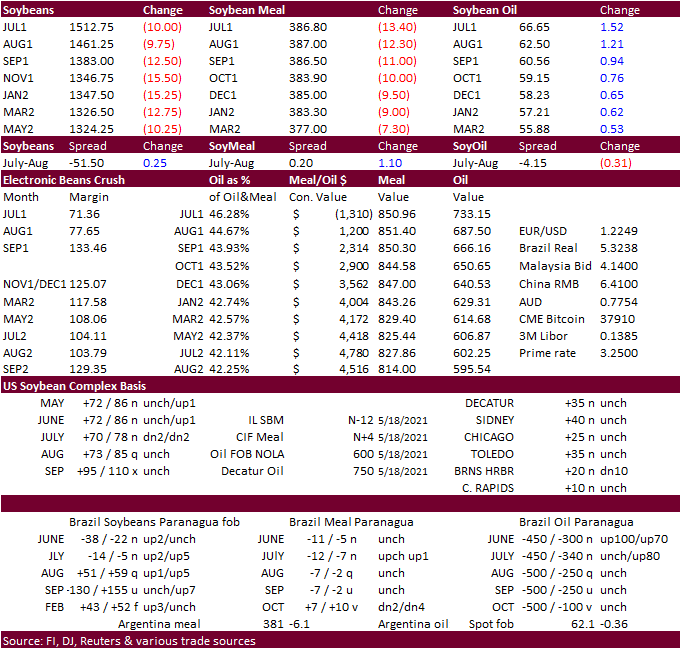

- CBOT

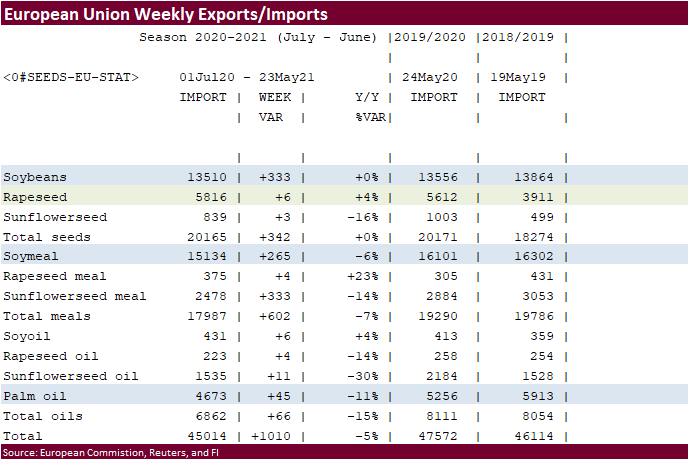

soybeans turned over following weakness in corn and soybean meal. Soybeans hit a one-month low. US planting progress is running above average, and the long-term weather forecast does not call for any adverse conditions through at least mid-June. Corn futures

had a wide influence on soybean futures. Soybean oil was mostly higher throughout the session led by strength in nearby contracts. Back month soybean oil traded two-sided. Palm futures, after dropping hard on Monday, rebounded 134 points and cash palm

was up $22.50/ton to $1,020. - November

soybeans could test $13.00 sometime in first half June if we see US rains pickup across the ECB.

- Funds

sold an estimated net 10,000 soybeans, 9,000 meal and bought 7,000 soybean oil.

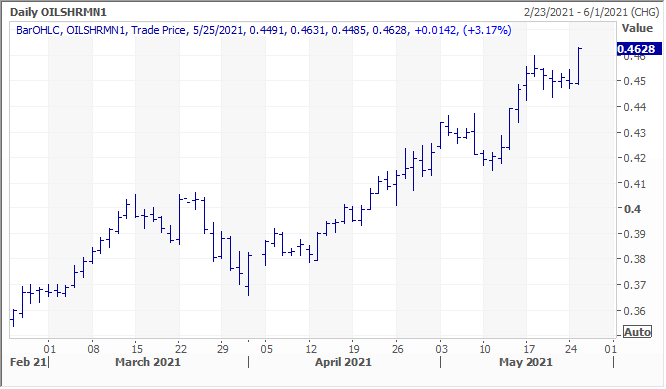

- ICE

canola fell for the 6th consecutive session. - Soybean

oil has been in a bull market since early November, and we do not see 2021-22 crop-year contract prices setting back below 58 cents through September. The September futures contract did trade at 58.21 yesterday but we think there is upside in this position

based on heavy interest for SBO by renewable fuel end users. Note US renewable end users still can not use canola oil as a feedstock, unlike biodiesel plants, as canola is still not approved by the US EPA. This could change soon, but for now we assume at

least 50 percent of the total renewable feedstock will be comprised of soybean oil.

- Another

Canadian canola construction facility was announced this morning. Ceres Global Ag Corp plans to build a $350 million canola-crushing facility near in Northgate, Saskatchewan, for 2024 opening. Annual capacity is planned at 1.1 million tons, yielding 500,000

tons of canola oil (1.1 billion pounds). The plant will be near a BNSF rail line. Earlier this year Cargill, Viterra and Richardson announced plans to expand crushing in Saskatchewan.

- US

soybean plantings are running above average at 75 percent. We look for June plantings to expand 1.9 million acres to 89.5 million from March, and for the final area to end up higher than that figure.

- Soybean

and Corn Advisory: - 2020/21

Brazil Soybean Estimate Unchanged at 134.0 Million Tons - 2020/21

Argentina Soybean Estimate Unchanged at 45.0 Million Tons - Cargo

surveyor SGS reported month to date May 25 Malaysian palm exports at 1,086,676 tons, 30,243 tons below the same period a month ago or down 2.7%, and 42,559 tons above the same period a year ago or up 4.1%. - Cargo

surveyor AmSpec reported Malaysian May 1-25 palm exports at 1.108 million tons, nearly from the same period a month ago.

- Cargo

surveyor ITS reported Malaysian palm exports at 1.106MMT, also nearly unchanged from the same period a month ago.

- USDA

last week bought 4,970 tons of packaged vegetable oil for the educational program under the PL480 program at mostly $2,107.86 to $2,643.01/ton.

July

oil share

Updated

5/25/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

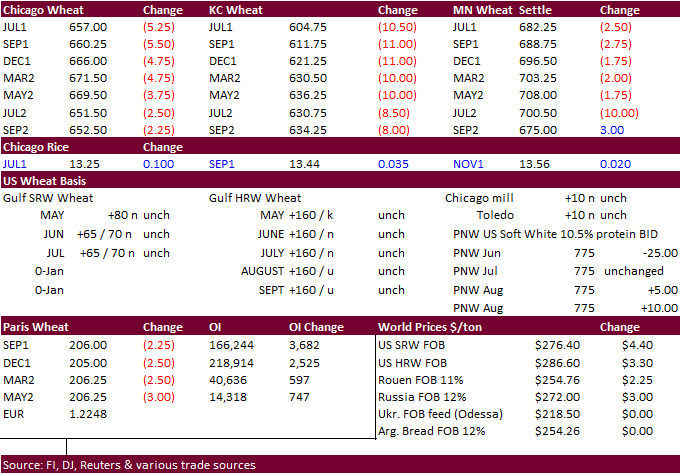

- Wheat

started mixed to higher led by the spring wheat contract to the upside after USDA reported a much lower than expected spring wheat crop rating, but prices collapsed following sharply lower corn. Competitive Black Sea export prices and an upward revision to

the EU soft wheat yield by MARS added to the negative sentiment. We see support at $6.35 for July Chicago wheat. The contract traded below its 100-day MA of $6.5550 ended around that level. EU wheat futures hit a one-month low.

- At

45 good/excellent for the initial spring wheat rating, this shows the dry areas of the northern Great Plains and parts of the PNW had an obvious impact on emergence this season, and a good rain soaking is still needed. Note USDA reported the initial spring

wheat rating 12 points lower than trade expectations and the winter wheat rating unexpectedly fell one point to 47 G/E, 3 points below a trade average. Parts of North Dakota will see rain over the next few days, but many parts of South Dakota could remain

on the drier side. The morning weather models did hint a touch lighter for rain across the central and northern Great Plains this week.

- Funds

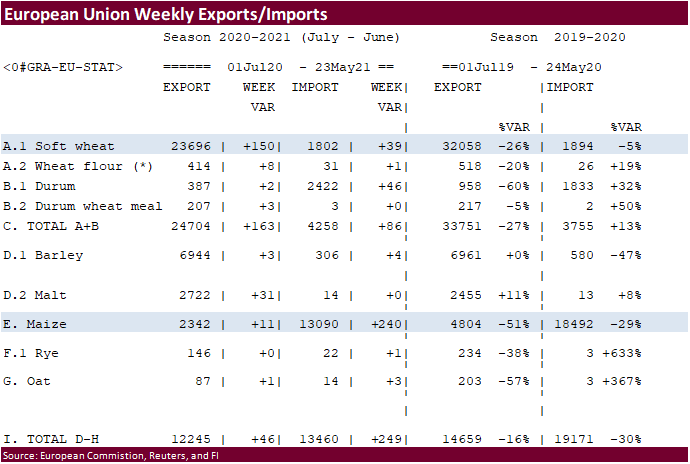

sold an estimated net 4,000 SRW wheat contracts. - MARS

in their monthly EU update increased their EU wheat yield to 5.91 tons/hectare from 5.86 projected in April, above a 5-year average.

- September

Paris wheat market basis September was down 3.00 euros at 205.25.

- Algeria

seeks 50,000 tons of durum wheat on Wednesday, valid until Thursday, for shipment between July 1-31.

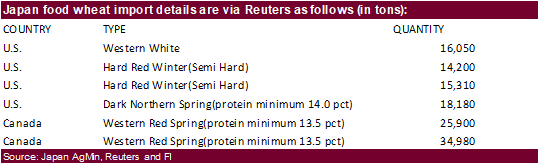

- Japan

seeks 124,620 tons of food wheat from the US and Canada later this week.

- Jordan

seeks 120,000 tons of feed wheat on May 26 for Oct-Nov shipment. - Bangladesh

seeks 50,000 tons of milling wheat on May 30. - USDA

seeks 83,000 tons of hard red winter wheat for Africa on May 25 for July 6-16 shipment.

Rice/Other

·

None reported

Updated

5/24/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $6.55-$7.40

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.