PDF Attached

Very

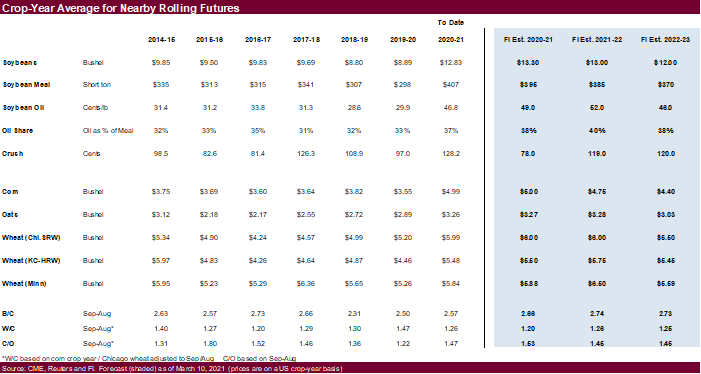

choppy trade with a wide swing in corn futures. Soybeans and wheat also traded two-sided. Talk of China old crop corn cancelations pressured corn early, dragging other commodities lower, but this provided an opportunity for bottom picking. Look for positioning

on Thursday & Friday ahead of the long holiday

weekend.

Attached

includes seasonal price charts and updated US corn balance.

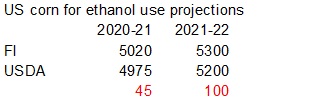

- Old

crop corn for ethanal use seen at 5.020 billion, 45 above USDA - We

raised the 2021 yield to 180 from 176 - New

crop corn exports were raised 50 and feed up by 50

Next

7 days

World

Weather, Inc.

MOST

IMPORTANT WEATHER OF THE DAY

- Tropical

Cyclone Yaas was located 115 miles west southwest of Kolkata, India this morning with its peak wind speeds diminishing from 63 mph

o

Landfall occurred as expected with the storm a weak Category One hurricane equivalent storm

- Peak

wind speeds were suspected of being between 80 and 100 mph in gusts when landfall occurred - Heavy

rainfall of 3.00 to 8.00 inches is expected from northeastern Odisha and southwestern West Bengal into southeastern Uttar Pradesh over the next few days

o

Damage to rice and sugarcane is possible, although not likely to be extensive

- Cold

temperatures occurred in Canada’s Prairies this morning with frost and freezes in many areas

o

Most of the hard freezes were in areas where early season canola and other frost sensitive crops had either not been planted or were not emerged yet

o

Other areas with light freezes and frost do have canola up and a few fields might have to be replanted, but most of the crop will survive the cold

- Restricted

precipitation in Canada’s Prairies this week along with warming temperatures will provide a perfect environment for aggressive fieldwork to take place after recent rain - Southeastern

Canada corn and soybean production areas are experiencing a mostly good mix of weather for spring planting and winter wheat development

o

The region will trend a little cooler and be mostly dry for a while allowing good field progress to continue

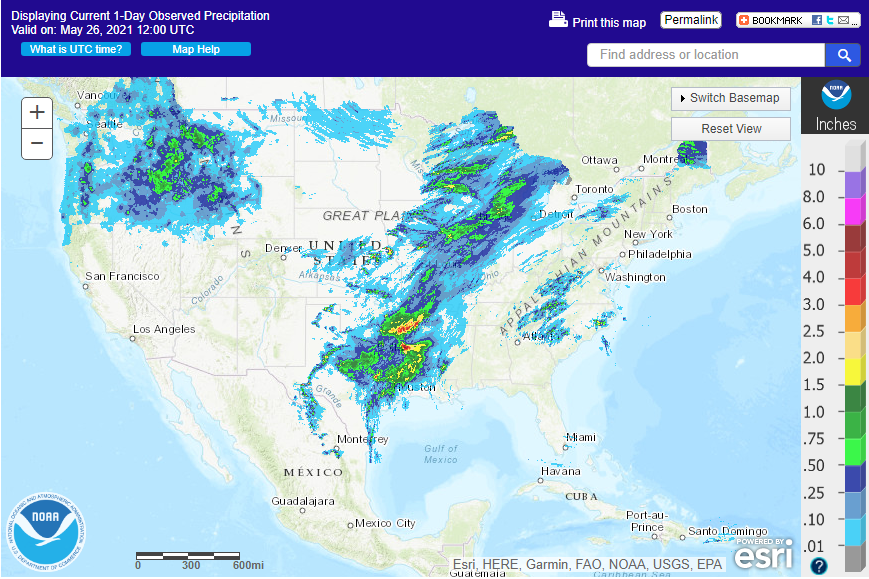

- U.S.

crop weather is expected to be nearly ideal over the next ten days with all areas getting rain at one time or another except parts of the southeastern states

o

Net drying in the southeastern states is already firming the soil and additional heat and dryness in this coming week is expected to stress early planted crops and slow emergence and establishment for the more recently planted

fields that are not irrigated

- A

close watch on this part of the nation is warranted for a while; second week rainfall is still being advertised, but confidence in its distribution and significance remains a little low - West

Texas cotton, corn, sorghum and peanut production areas will experience a good mix of rain and sunshine during the next two weeks

o

Southwestern parts of the dryland production area needs rain and “some” is expected

o

Other crop areas in the Low Plains, northern High Plains and Rolling Plains will receive significant rain often bolstering soil moisture for many areas especially in this coming week to ten days

o

Some drying will occur in the second week of June

- U.S.

hard red winter wheat production areas may get rain a little more often than desired and there is some concern over grain quality in the more advanced crops in the south where some of the greatest rain frequency and intensity is expected

o

Most of the crop will benefit from the rain and warm weather

- U.S.

Northern Plains will get some rain in the coming week, but greater precipitation is going to be needed later this spring and summer as temperatures trend warmer - U.S.

Pacific Northwest crop areas are back to a dry bias after some beneficial moisture fell in Oregon during the past week

o

Unirrigated winter crops in the region need more moisture for the best yields

- Most

of the far western U.S. will experience net drying conditions over the next week to ten days leaving drought conditions firmly in place

- Brazil

will be drier biased into the end of this week with only a few showers of limited significance expected

o

A new weather disturbance will produce rain in the south in the second half of this week and during the weekend

- The

additional moisture will maintain favorably moist conditions in many winter wheat production areas and will maintain a better environment for some of the late season Safrinha corn production areas

o

Not much rain is expected in Mato Grosso, northern Mato Grosso do Sul, Goias, southwestern Minas Gerais or crop areas farther to the north over the next ten days

- Safrinha

corn and cotton in these areas will be stressed

o

Temperatures will be cooler biased in the wettest areas

o

Next week’s weather will be much drier

o

Safrinha crop areas will not be as dry as they have been again through the next couple of weeks, despite drying next week

- Argentina

will receive very little rain for the next ten days

o

Crop moisture for wheat planting is mostly very good

o

Improved summer crop harvest progress is expected as this week moves forward

o

Temperatures will be a little cooler biased for a while this week and into next week especially in the east

- Russia’s

southern New Lands and Kazakhstan will temperatures ease a little bit over the coming week after very warm conditions in recent weeks

o

Precipitation will be restricted for a while, but a few showers are possible

o

Greater rain will be needed to restore favorable soil moisture; until that time crop development will be sluggish

- Western

Russia, Belarus, Ukraine and Baltic States will continue to receive periodic rainfall through the next ten days maintaining moisture abundance in the soil

o

some welcome rain will fall in the lower Volga River Basin during the next few days further improving that region’s soil moisture and also neighboring areas of Russia’s Southern Region

- Southern

China will continue to see frequent waves of rain over the next ten days, flooding will occur periodically with the greatest rain expected south of the Yangtze River

o

Flooding is expected in parts of this region periodically throughout the forecast period

- North

China Plain and Yellow River Basin will experience net drying conditions over the coming week

o

Subsoil moisture is still favorable west of Hebei and northeastern Shandong, but rain is going to be needed soon in Liaoning, Hebei and northeastern Shandong

- Some

of the rain needed in Liaoning, Hebei and Shandong will occur later this week and into next week offering some welcome relief to dryness - Other

areas in the Yellow River Basin will be drying out as time moves along through the first week in June - Northeastern

China will continue to see frequent bouts of rain intermixing with periods of sunshine during the next two weeks

o

Soil conditions will be wetter biased and some drier weather might be welcome

o

Temperatures in these wetter biased areas may be a little cooler than usual

- Xinjiang

China weather was dry biased Tuesday with seasonable temperatures and this trend will continue for a while

o

Daily high temperatures will be in the 70s and 80s northeast followed by lows in the 40s and 50s while highs in the southwest are in the 80s and lower 90s followed by lows in the 50s and lower 60s

- Mexico

drought remains serious, although enough rain fell last week to bring some relief in east-central parts of the nation.

o

This week’s weather will be less beneficially wet with isolated to scattered showers continuing in the east with mostly light rain resulting

o

A boost in rainfall may occur again in southern and eastern areas next week

o

The recent moisture has helped improve planting, emergence and establishment conditions for many early season crops in the wetter areas, but the west-central and northwest parts of the nation are still quite dry.

- Australia

received rain in Victoria Tuesday and some beneficial moisture is expected to evolve in Western Australia late this week and through the weekend

o

The precipitation will prove to be quite supportive of autumn planting, germination and emergence

- India

rainfall will be greatest over the next few days from Tropical Cyclone Yaas

o

Amounts of 3.00 to 8.00 inches will occur from northeastern Odisha to southeastern Uttar Pradesh and western Bihar

o

Other areas in India are not likely to receive much rain for a while, although sporadic pre-monsoonal showers are expected periodically

o

Net drying is expected in many areas

o

Temperatures were seasonably warm to hot

- South

Africa will be dry and warm this week before some rain evolves next week and temperatures turn briefly cooler - West

Africa rainfall is expected to be erratic and lighter than usual during the coming week with a boost in precipitation expected in the first week of June

o

Coffee, cocoa, sugarcane, rice and cotton areas are mostly well rated, but greater rain will be needed soon as additional drying evolves

- East-central

Africa has been and will continue to be lighter than usual – at least through the coming ten days - Southern

Oscillation Index is mostly neutral at +6.01 and the index is expected to move lower this week

- North

Africa weather this week will produce a few showers, but resulting rainfall is expected to be infrequent and light

o

Winter small grains will continue to mature and be harvested around the precipitation

- Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks

o

Greater rain is needed in the northern and western Philippines

- Luzon

Island, Philippines will be last to get significant rain - New

Zealand precipitation for the next week to ten days will be greatest in eastern parts of the nation and temperatures will be cooler biased - Europe

weather is expected to sufficiently balanced with rain and sunshine in most of the continent during the next two weeks

o

Southwestern Spain and Portugal will be driest along with southern Italy and southern Greece

o

Temperatures will be cooler than usual in central and eastern parts of the continent and warm biased in the southwest

Source:

World Weather, Inc.

Wednesday,

May 26:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica releases cane crush, sugar output data - HOLIDAY:

Malaysia, Indonesia, Singapore, Thailand

Thursday,

May 27:

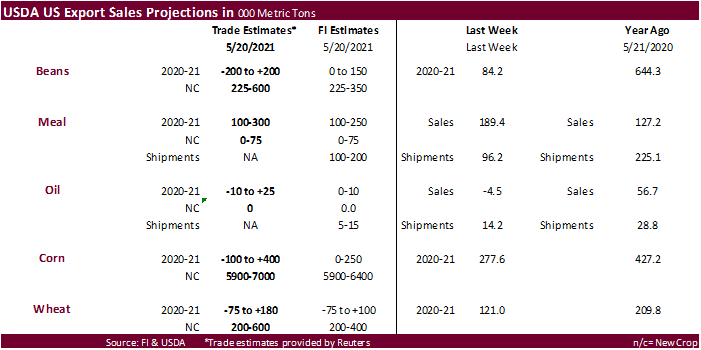

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - Brazil

orange crop forecast for 2021-22

Friday,

May 28:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

US

DoE Crude Oil Inventories (W/W) 21-May: -1662K (est -1000K; prev 1320K)

–

Distillate Inventories: -3013K (est -2000K; prev -2324K)

–

Cushing Inventories: -1008K (prev -142K)

–

Gasoline Inventories: -1745K (est -1100K; prev -1963K)

–

Refinery Utilization: 0.70% (est 0.25%; prev 0.20%)

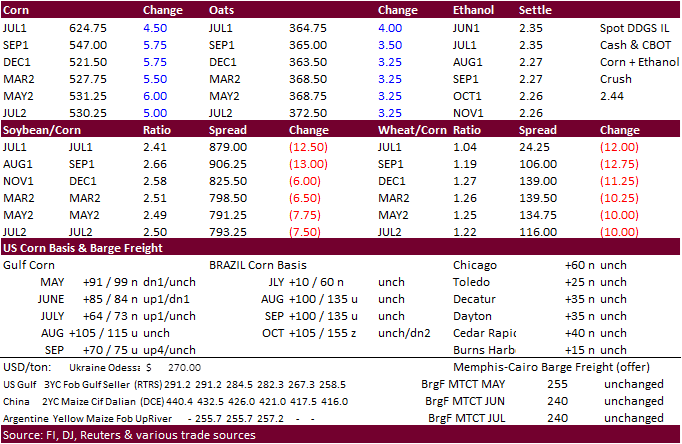

- July

CBOT corn traded at its lowest level since April 21 but rebounded hard by 21.75 cents to close 4.25 cents higher on the day at $624.50/bu. Today’s low was $6.0275, below our target support level of $6.05. We think the July contract could drop below $6.00

by FND if additional bearish items develop. Today traders reacted to a story that China cancelled 1 million tons of old crop corn sales. The rebound in corn, in our opinion, was due to bottom picking and technical buying. A Bloomberg story noted China was

clamping down on corn imports on concerns buying was out of control. We think China will need the corn regardless over the next two years to help ease inflation.

- July

corn is about $1.05 off its absolute high made a couple weeks ago. - UkrAgroConsult

projects Ukraine could ship a record 11 million tons of corn to China during the 2021-22 crop year, up from 8.5 to 9.0 million tons forecast for the current marketing year.

- US

Senate Committee on Finance will be reviewing US clean energy tax credits this afternoon. Starts around 1:30 CT…..https://www.finance.senate.gov/hearings/open-executive-session-to-consider-an-original-bill-entitled-the-clean-energy-for-america-act

- South

Africa’s Crop Estimates Committee (CEC) will update their 2020-21 SAf corn production estimate on May 27 and a Reuters poll looks for production to expand to 16.413 million tons (9.131MMT yellow/7.287 white) from 16.095 million last month, and up from 15.300

million previous season.

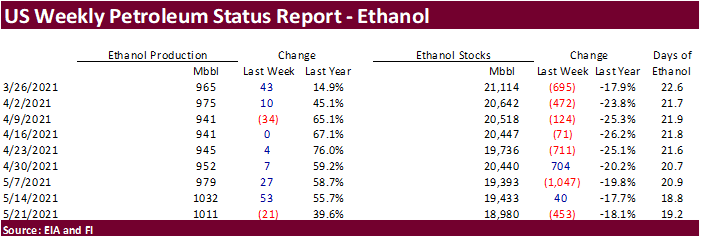

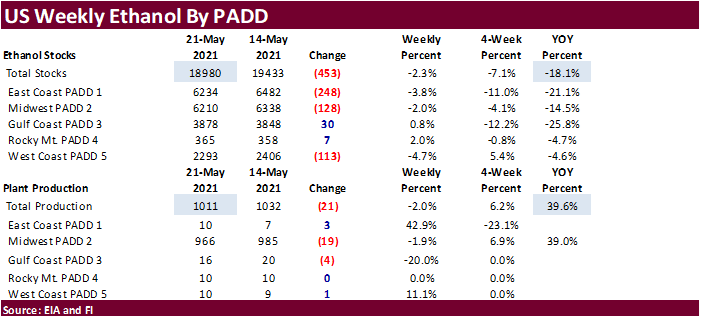

Weekly

US ethanol production

dropped a more than expected 21,000 barrels to 1.011 million and stocks decreased 453,000 barrels to 18.980 million, lowest level since December 30, 2016. We raised our 2020-21 US corn for ethanol use based on weekly production exceeding 1 million barrels

per day, favorable margins, and recovery in the summer driving season.

Export

developments.

- South

Korea’s MFG bought 68,000 tons of optional origin corn at about $306/ton for arrival by September 28.

- South

Korea’s NOFI group bought about 137,000 tons of corn, according to AgriCensus for arrival by end of September, at about $307/ton.

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

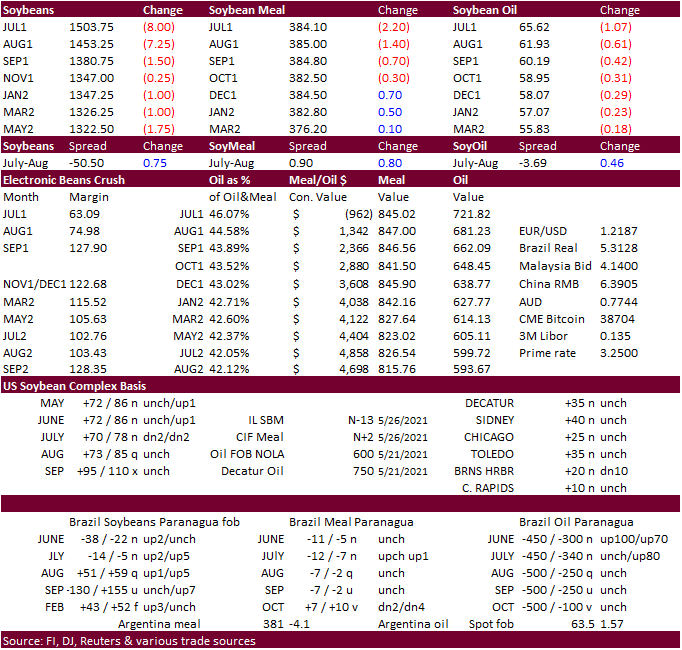

- CBOT

soybeans ended lower led by old crop contracts. July was off 8.25 cents while November fell 0.25 cent. July soybean meal dropped $2.50 and December was up $0.50/short ton. Soybean oil was on the defensive despite a higher trade in energy markets. Some

noted overbought conditions. Note Malaysia was on holiday. AgriCensus noted Malaysia limited the palm oil workforce to 60% to slow or prevent the spread of covid.

- Argentina

has seen disruptions in shipping this week. Port workers launched a 48-hour strike today over Covid-19 vaccines. Apparently, they do not qualify as essential workers. Meanwhile, Argentina barges stuck in the Parana river due to low water levels carrying

soybeans might be able to be dislodged soon as Argentina and Paraguay agreed to release water from an upriver dam. (AgriCensus)

- The

Brazilian government will start vaccinating Santos port workers this week.

- Anec

sees Brazil soybean exports during May at 14.9 million tons while other groups are putting that number closer to 15 to 16 million tons, which would be a record and up from 14.1 million year ago.

- November

soybeans could test $13.00 sometime in first half June if we see US rains pickup across the ECB.

- None

reported

Updated

5/25/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

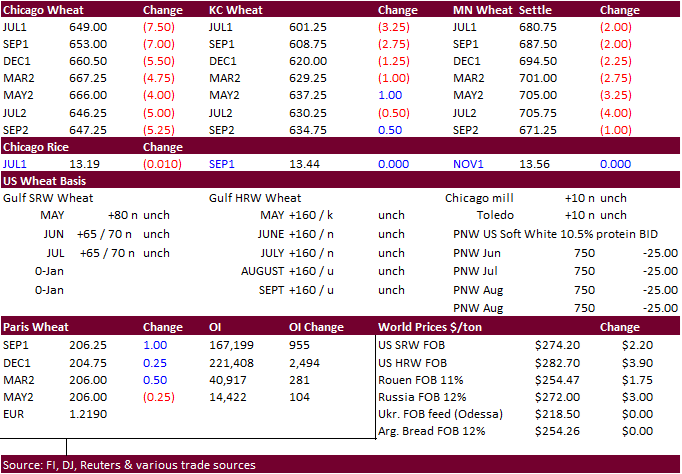

- Wheat

traded lower on lack of US export developments, recent rain that fell across the Great Plains benefiting crop development, and competitive EU & Black Sea supplies. Results are awaited on Algeria’s import tender for wheat. Spot fob prices suggest French wheat

is about $3-$5 cheaper than Black Sea origin. Corn/wheat spreading was likely today.

- The

recent dip in US and EU wheat futures are attracting routine buyers. Tunisia and Japan announced import tenders.

- We

see support at $6.35 for July Chicago wheat. - September

Paris wheat market basis September was up 0.75 euro at 206.00. - MARS

in their monthly EU update increased their EU wheat yield to 5.91 tons/hectare from 5.86 projected in April, above a 5-year average.

- Tunisia

seeks 92,000 tons of wheat, optional origin, on Thursday for June 15 through July 25 shipment.

- In

its weekly SBS import tender, Japan on June 2 seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by November 25.

- Jordan

cancelled their 120,000-ton barley import tender for Oct-Nov shipment.

- Results

awaited: Algeria seeks 50,000 tons of durum wheat on Wednesday, valid until Thursday, for shipment between July 1-31.

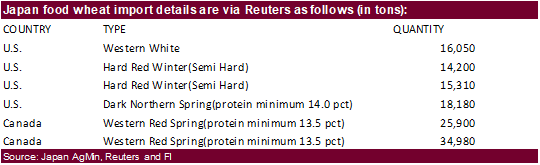

- Japan

seeks 124,620 tons of food wheat from the US and Canada later this week.

- Bangladesh

seeks 50,000 tons of milling wheat on May 30. - USDA

seeks 83,000 tons of hard red winter wheat for Africa on May 25 for July 6-16 shipment.

Rice/Other

·

None reported

Updated

5/24/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $6.55-$7.40

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.