PDF Attached

CBOT

markets will reopen Monday evening. https://www.cmegroup.com/tools-information/holiday-calendar.html

US

debt ceiling optimism sent US equities and many commodity markets higher. The USD was down 6 points as of 1:40 pm CT and WTI crude up $0.83.

CBOT

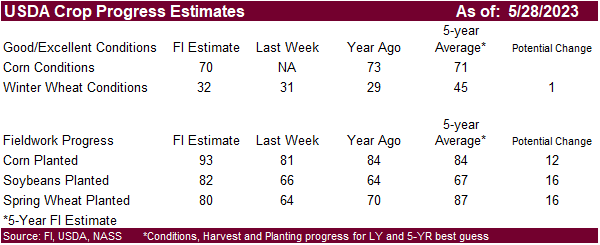

soybean complex and grains were strong today. US weather concerns and Black Sea shipping uncertainty along with positioning ahead of the long holiday weekend underpinned prices. USDA will update crop progress on Monday. We look for a good jump in planting

progress, a slight increase in US winter wheat conditions, and near average for initial US corn conditions, although drought conditions across the WCB could drag the US aggregate below the 71 percent 5-year average. We are currently looking for 70.

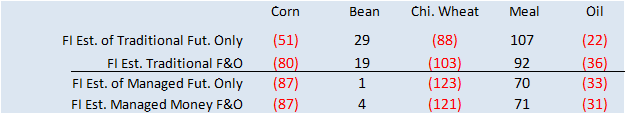

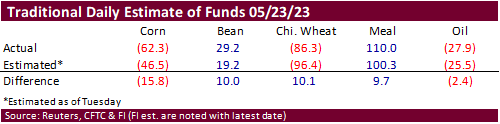

Fund

estimates as of May 26

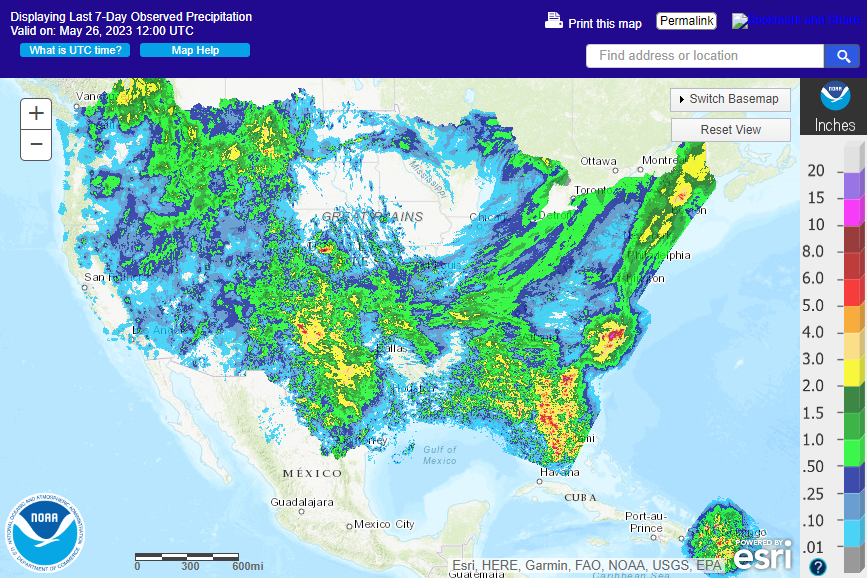

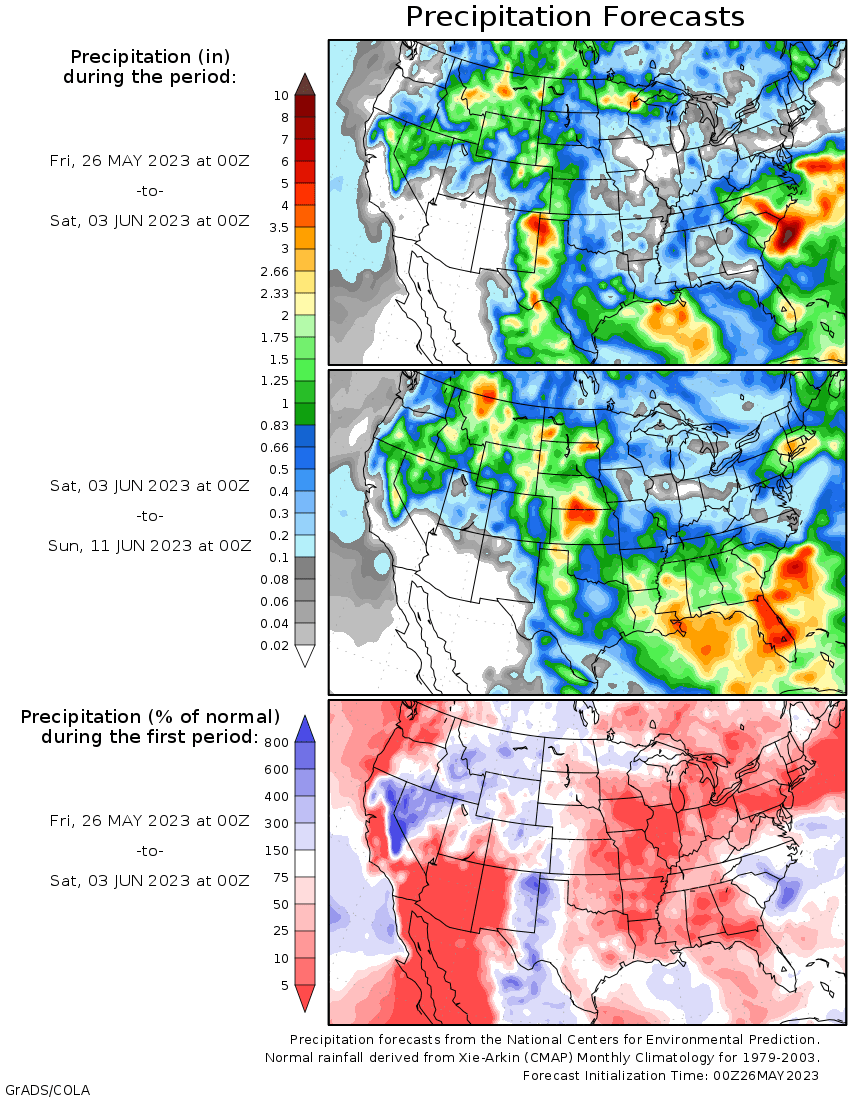

Weather

Last

seven days

WEATHER

TO WATCH

-

Gulf

of Mexico moisture will not be available for enhanced rainfall in the U.S. Midwest through the next full week and probably not for ten days -

U.S.

Midwest rainfall will therefore be lighter than usual through at least June 5 -

The

earliest that the Gulf of Mexico will reopen as a moisture source for the Midwest would be after June 5 and more likely after June 7 -

Wet

bias in the U.S. high Plains region will help to keep high pressure weak in those areas in early June when the ridge relocates back to the western parts of North America -

U.S.

Midwest rainfall will be most restricted and temperatures warmest during the coming week with temperatures in the 80s and lower 90s expected over multiple days -

Returning

high pressure ridge to the western parts of North America during the second weekend of the two week outlook will help release cooler from northern Canada and force it southward into the Midwest

-

Showers

will accompany these cool fronts in the second and third weeks of June inducing some periodic rain, although the rain amounts may be lighter than usual for that time of year -

Canada’s

most drought stricken region in the Prairies includes east-central and interior southern Alberta and much of western Saskatchewan crop areas -

These

areas will have an improving opportunity for rain during the second half of next week and especially in the following weekend as the high pressure ridge consolidates as it moves westward from the Midwest toward the Plains and Prairies.

-

Rain

chances in the drought areas should be very good for a few days and that should lead to short term improvements in crop and field conditions, although a permanent end to drought is certainly not expected -

Rain

that fell earlier this week in western Alberta and that which occurred so far in Saskatchewan has been welcome and very helpful in easing dryness and improving seed germination, plant emergence and establishment -

The

same can be said of northern and west-central Manitoba. -

The

unsettled weather in Saskatchewan and Manitoba will shift to the southeast this weekend and early next week just long enough to bring some needed moisture in central and southeastern Manitoba and then a return of drier and warmer weather is expected next week -

Ontario

and Quebec, Canada need more consistent warm temperatures to stimulate better wheat, corn and soybean development -

Some

improving trends are expected over the next week -

Portions

of West Texas and the southwestern U.S. Plains are becoming a little too wet and frequent rainfall may continue through the middle part of next week -

The

wetter bias will delay fieldwork; including the planting of corn, sorghum and cotton while also slowing the maturation of winter wheat -

Some

wheat quality concerns are expected with head sprouting possible in the southwestern U.S. Plains -

A

good mix of weather is expected in the northern U.S. Plains and upper Midwest to support both fieldwork and crop development over the next ten days to two weeks.

-

U.S.

Pacific Northwest weather will remain drier biased in the Yakima Valley while rain falls frequently in Idaho, Wyoming and neighboring areas where sugarbeets and dry beans are produced -

Mexico

drought will continue in western parts of the nation through the next two weeks -

Rain

in eastern Mexico will be sufficient to support most crops with some of that moisture also reaching into southern Texas -

Central

America rainfall is expected to increase sufficiently for improved moisture conditions in many areas from Guatemala to Panama during the next ten days, but amounts may not be great enough to fix the water levels on Lake Gatun that influences shipping through

the Panama Canal -

Draught

restrictions will continue -

Argentina

received heavy rain overnight in east-central and southeastern parts of the nation benefiting many wheat production areas -

Additional

rain is expected in the coming week, but it will not favor La Pampa, western Buenos Aires or southwestern Cordoba where soil moisture is still restricted -

Good

wheat planting prospects will continue in all other areas -

Center

south Brazil weather will be dry biased the remainder of this week and this weekend while temperatures are warmer than usual -

Net

drying is expected and unirrigated Safrinha crops will become more stressed -

Early

maturing corn will be maturing and should not be seriously stressed by the environment -

Well-timed

rain will fall in Safrinha crop areas of Mato Grosso do Sul, Sao Paul and Parana late this weekend and early next week resulting in a perfectly timed improvement in topsoil moisture to carry late planted corn through reproduction in a favorable manner -

Mato

Grosso and Goias may not be included in the rain event next week and crop moisture stress may continue to rise, although there is only a small amount of very late crop development in these areas relative to the remainder of the Safrinha crop region which should

limit the downside for production -

Cooling

after early next week’s southern Brazil rain event may bring down temperatures into the 40s Fahrenheit, but no frost event is presently anticipated

-

Northern

Europe will dry out over the next ten days -

The

region will experience seasonable temperatures which may help to keep the drying rates at a reasonable level, but the region will need to be closely monitored for possible dryness issues later in June -

Southern

Europe continues to deal with frequent showers and thunderstorms -

Flooding

occurred recently in northern Italy -

Some

grain quality concerns may be developing in early maturing winter small grains -

The

pattern is not likely to change much for at least the next week and possibly ten days -

Russia’s

eastern New Lands are drying down and will need to be closely monitored over the next few weeks for moisture shortages and crop stress -

Today’s

forecast models suggest rain will fall in the June 3-9 period, but it is unclear how significant that may or may not be -

Western

Russia, Belarus and western Ukraine may dry down for the next ten days while the Volga River Basin and Ural Mountains region get periodic rain along with eastern Ukraine and Russia’s Southern Region -

Australia’s

winter crops are establishing favorably in portions of the south, especially in Victoria, southeastern South Australia and southern New South Wales locations -

Greater

rain is needed in interior parts of Western and South Australia, Queensland and some north-central production areas of New South Wales -

Northern

India will get unusually great amounts of rain for this time of year slowing fieldwork and raising some unharvested winter crop quality concerns -

Much

of the winter crop should be harvested, though -

Rain

will be good for early season cotton in Punjab, Haryana and parts of Rajasthan as well as in parts of Pakistan

-

China

weather will continue favorably mixed except in a small part of eastern Inner Mongolia where drought is prevailing -

Alternating

periods of rain and sunshine elsewhere in China will be great for long term crop development -

Xinjiang,

China temperatures will continue cooler than usual over the next ten days -

Northeastern

Xinjiang will experience highs in the 70s Fahrenheit while other areas in the province experience 80s -

All

of these temperatures are still not optimum for cotton or corn -

Warming

is needed to induce the best crop development -

Some

showers will occur in the northeast. -

An

improved environment of warmer weather is needed -

The

persistent cool conditions this spring may lead to a higher potential for crop damage in the autumn if frost and freezes occur prior to crop maturity.

-

Mainland

Southeast Asia rainfall will steadily increase l into next week bringing relief from early season dryness -

Improved

rice and corn planting conditions are expected -

Improved

sugarcane, coffee and other crop development is also likely as well -

Water

supply in the region is below average and concern is rising over water supply when El Nino kicks in and starts reducing summer rainfall which makes the greater rain forthcoming all the more important -

Indonesia

and Malaysia rain frequency and intensity is expected to diminish over the next two to three weeks

-

Some

net drying is expected, but crop conditions will remain favorably rated. -

Philippines

rainfall will remain well mixed with sunshine over the next ten days -

Typhoon

Mawar was producing sustained wind speeds of 167 mph at 1500 GMT today -

The

storm will move west northwesterly toward Taiwan and the northeastern part of Luzon, Philippines, but landfall is not likely through Tuesday -

Taiwan

may be more vulnerable to the storm than the Philippines and notable weakening is expected prior to the storm getting near those areas -

The

odds are high that the storm will turn back to the northeast with possible influence on Japan -

South

Africa will see some showers begin to evolve today and they will last into next week benefiting winter wheat development , but disrupting some farming activity -

North

Africa rainfall will be periodic over the next ten days, but it comes a little too late to change production for Morocco and northwestern Algeria -

Recent

rain in northeastern Algeria and northern Tunisia has been timely and sufficient to improve late season production potential, though it is unclear how much benefit has resulted -

Drier

weather will soon be needed in Morocco and northwestern Algeria to protect crop quality and support harvesting -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Today’s

Southern Oscillation Index was -13.29 and it should move lower over the next several days

Source:

World Weather, INC.

Monday,

May 29:

- Vietnam’s

coffee, rice and rubber exports in May - HOLIDAY:

US, UK, France, Germany

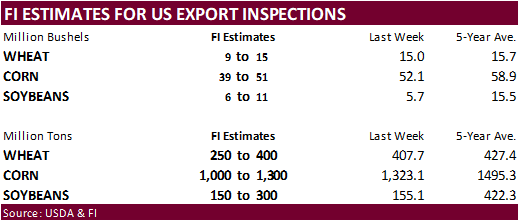

Tuesday,

May 30:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - US

cotton and winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - EARNINGS:

FGV

Wednesday,

May 31:

- US

agricultural prices paid, received - Malaysia’s

May palm oil exports

Thursday,

June 1:

- EIA

weekly US ethanol inventories, production, 11am - USDA

soybean crush, corn for ethanol, DDGS production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Indonesia

Friday,

June 2:

- FAO

food price index, monthly grains report - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Italy, Indonesia

Source:

Bloomberg and FI

CFTC

Commitment of Traders

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-149,636 -22,722 281,469 3,938 -77,850 14,443

Soybeans

-4,688 -7,783 109,560 -9,666 -74,344 16,821

Soyoil

-54,010 -234 94,507 19 -40,853 605

CBOT

wheat -103,157 -4,775 68,229 -3,209 27,746 7,709

KCBT

wheat -3,374 1,991 41,830 -347 -32,987 87

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-98,027 -6,040 247,243 -3,229 -102,147 15,578

Soybeans

4,147 -19,795 90,927 -5,523 -79,273 18,482

Soymeal

73,789 -6,498 93,930 1,564 -200,887 8,209

Soyoil

-36,877 -494 111,956 1,745 -70,461 -762

CBOT

wheat -118,788 -6,019 67,963 -249 25,476 7,650

KCBT

wheat 16,621 28 30,828 108 -35,245 -390

MGEX

wheat -6,402 -1,564 1,241 -191 2,299 4,027

———- ———- ———- ———- ———- ———-

Total

wheat -108,569 -7,555 100,032 -332 -7,470 11,287

Live

cattle 101,990 1,718 50,103 -697 -163,044 1,474

Feeder

cattle 16,771 2,153 948 34 -3,943 -1,496

Lean

hogs -24,129 -4,731 50,637 -14 -30,245 3,978

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

6,913 -10,650 -53,982 4,341 1,774,459 19,667

Soybeans

14,727 6,209 -30,527 628 842,442 27,165

Soymeal

20,994 1,434 12,173 -4,710 539,152 19,450

Soyoil

-4,976 -99 357 -389 610,653 34,218

CBOT

wheat 18,166 -1,657 7,183 275 477,760 6,533

KCBT

wheat -6,736 1,985 -5,469 -1,730 210,376 -83

MGEX

wheat 2,871 -849 -9 -1,424 64,651 441

———- ———- ———- ———- ———- ———-

Total

wheat 14,301 -521 1,705 -2,879 752,787 6,891

Live

cattle 29,346 226 -18,396 -2,721 406,177 9,104

Feeder

cattle -261 618 -13,515 -1,310 83,284 4,228

Lean

hogs -1,012 -397 4,749 1,165 330,477 11,008

Macros

107

Counterparties Take $2.190 Tln At Fed Reverse Repo Op.

US

Personal Income Apr: 0.4% (est 0.4%; prev 0.3%)

US

Personal Spending Apr: 0.8% (est 0.5%; prev 0.0%)

US

PCE Core Deflator (M/M) Apr: 0.4% (est 0.3%; prev 0.3%)

US

PCE Core Deflator (Y/Y) Apr: 4.7% (est 4.6%; prev 4.6%)

US

Wholesale Inventories (M/M) Apr P: -0.2% (est 0.0%; prevR -0.3%)

US

Advance Goods Trade Balance Apr: -$96.8B (est -$85.9B; prevR -$82.7B)

US

Retail Inventories (M/M) Apr: 0.2% (est 0.2%; prevR 0.5%)

US

Durable Goods Orders Apr P: 1.1% (est -1.0%; prevR 3.3%)

US

Durables Ex Transportation Apr P: -0.2% (est -0.1%; prevR 0.3%)

US

Cap Goods Orders Nondef Ex Air Apr P: 1.4% (est -0.1%; prevR -0.6%)

US

Cap Goods Ship Nondef Ex Air Apr P: 0.5% (est 0.1%; prevR -0.2%)

US

Univ. Of Michigan Sentiment May F: 59.2 (est 58.0; prev 57.7)

–

Current Conditions: 64.9 (prev 64.5)

–

Expectations: 55.4 (prev 53.4)

–

1-Year Inflation: 4.2% (est 4.5%; prev 4.5%)

–

5-10 Year Inflation: 3.1% (est 3.1%; prev 3.2%)

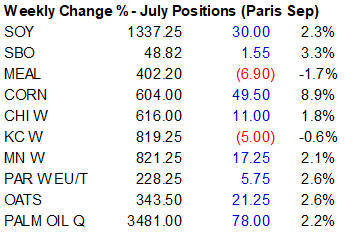

Corn

·

Corn futures were up sharply led by new crop over net drying across the heart of the Midwest through at least June 3. Temperatures across the Midwest began to rise back to normal to above normal levels Thursday and that will last

until at least early next week. July/September corn spread was weaker today on profit taking. Week to date, July corn appreciated an impressive 8.9%. With US corn supplies getting tighter, July corn may have upside of another 20 cents by First Notice Day.

However, additional cancellations by China could keep nearby prices in check.

·

USDA initial corn conditions will be released Thursday afternoon and we look for a tentative 70 percent for the combined good and excellent categories, below a 5-year average of 71 percent.

·

Grain railcar origination for US class 1 railroads were down sharply over the past two weeks (to May 20) and well below a three-year rolling average. Unknown if this reflects lack of producer selling, shortages, or ample supplies

for destinations. We note barge movements did spike for the week ending May 20.

·

France is close to rolling out a bird flu vaccine. Southwestern France has seen an increase in cases over the past month. Other countries are testing vaccines.

·

CME pork futures hit a record low Friday on poor US demand. Retail prices remain too high to increase demand, according to a Reuters article. We agree based on regular Chicago grocery market prices, but some deals have been rolled

out prior to the long holiday weekend.

Export

developments.

-

None

reported

July

corn $5.25-$6.25

September

$4.25-$5.50

December

corn $4.25-$5.75

·

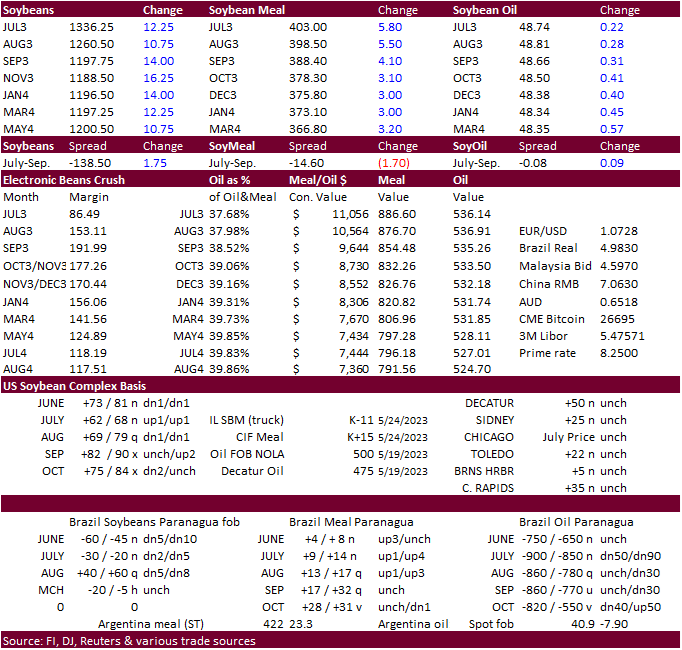

Soybeans were sharply higher from a rebound in soybean meal prices, higher soybean oil, and strength in grains. A week to date decline in soybean meal prices have been limiting gains earlier this week for soybeans. Soybean oil

was higher following overseas markets and higher WTI crude oil.

·

Malaysian palm ended the week 2.1% higher on long term weather concerns (El Nino) and talk of increasing demand by China and India.

·

Third month (Aug) Malaysia palm futures increased 66 ringgit to 3559 and Aug. cash increased $7.50 to $827.50/ton.

·

Earlier offshore values were leading SBO higher by about 27 points this morning (145 points lower for the week to date) and meal $2.50 short ton lower ($8.10 lower for the week).

US

domestic soybean meal demand

Chatter

this week included concerns over US soybean meal consumption after the US Supreme Court upheld California’s Prop 12 Law, forcing US industry-wide changes to the pork industry. Pork margins have eroded as costs have increased. As far for US soybean meal ending

stocks for 2022-23 and 2023-24, we see no impact as exports could easily absorb a decline in domestic consumption in part to the slowdown in Argentina soybean meal exports. We think USDA is already too low on their 2022-23 US soybean meal export projection

given the recent increase in commitments over the past six weeks. The weekly pace to reach USDA’s export projection is less than half of what USDA has reported for commitments on average over the past four weeks.

Getting

back to the California law, building out new pig pens to accommodate breeding hogs will be a challenge for most US producers, affecting about three-fourths of the industry, and hardest hit will be the large producers that cannot accommodate space and/or have

the capital to change or expand infrastructure.

CME

hog futures hit a contract low yesterday as US pork demand has slowed, but over the long term this law that will impact the entire US industry could eventually drive-up retail pork prices. Rason is it’s nearly impossible to trace where pork products originated,

as many processing and food plants take in the raw material from multiple origins, and this may force some producers to scale back on raising hogs.

California

consumes about 12 to 14 percent of all US pork consumption. The state raises a small number of hogs. In our opinion, USDA needs to think about rolling out grants or relief to all pig producers that will face financial hardship to ensure food security or expect

the US pig population to possibly drop over the next two years.

Export

Developments

·

None reported

Soybeans

– July $12.75-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$450, December $290-$450

Soybean

oil – July 44-50, December 43-53, with bias to upside

Wheat

·

US wheat was higher on Black Sea shipping concerns as the Ukraine/Russia conflict intensified. Blasts damaged buildings in Russia’s southern city of Krasnodar. US weather concerns are noted. Profit taking in KC/Chicago wheat spreads

limited gains for the HRW type wheat futures.

·

US Wheat Associates noted HRW wheat harvest is off to a slow start for Texas and southern OK harvest will start at the southern boarder this weekend. For SRW, many states are headed and harvesting progress has already started

in the Delta. Northern durum planting in North Dakota is behind average.

·

French wheat crop conditions for the week ending May 22 were steady at 93 percent and compares to 69 percent year earlier. 93 percent is highest for this time of year since 2011. Winter and spring barley were unchanged from the

prior week, at 90% and 95% respectively.

·

September Paris wheat were up 5.00 euros to 228.25 per ton.

·

Germany’s association of farm cooperatives estimated the Germany 2023 wheat crop at 22.31 million tons, a 0.9% decline from 2022. The 2023 winter rapeseed crop was pegged at 4.28 million tons, about unchanged from year ago.

·

India’s weather department expects normal monsoon rains this season. If realized this would be the fifth straight year. They did warn El Nino could hinder output.

·

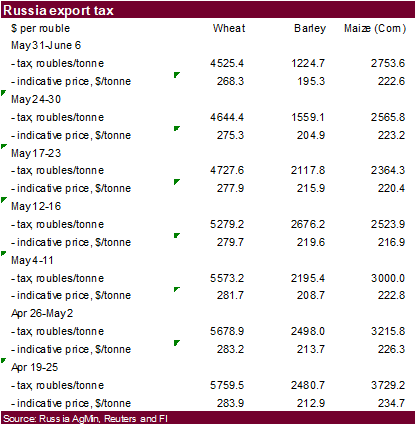

Russia’s wheat export tax for the week ending June 6 will decline 2.6% from the current week.

Export

Developments.

·

Taiwan Flour Millers Association bought an estimated 56,000 tons of various types of milling wheat from the US for July 12 and July 26 shipment from the PNW.

It included 37,610 tons of U.S. dark northern spring wheat minimum 14.5% protein at an estimated $339.14 a ton FOB, 11,720 tons of hard red winter wheat minimum 12.5%

protein at $334.00 a ton FOB and 6,670 tons of soft white wheat minimum 8.5% and maximum 10% protein bought at $265.65 a ton FOB.

Rice/Other

·

Cotton snapped a 4-day losing streak on US debt deal optimism.

Chicago

Wheat – July $5.50-$6.50

KC

– July $7.50-$8.75

MN

– July $7.25-$8.75

September

– same ranges as July

#non-promo