PDF Attached

Month

end. Follow through selling in ags in part to lower outside markets that was kicked off by poor manufacturing China economic data eventually dried, and short covering pared many losses. The USD was up 19 points earlier and WTI crude oil $1.40 lower. Most of

the early action was driven by funds. Mixed close for CBOT contracts. We left our US corn production estimate unchanged. EIA reported a strong March US soybean oil use for biofuel.

![]()

Weather

WEATHER

TO WATCH

-

China’s

wheat harvest area is drying out again after heavy weekend rainfall -

The

production area was impacted by significant rain during the weekend of May 22 and this past weekend resulting in concern over wheat quality declines -

The

weather is expected to be much improved over the next ten days which should help to dry out the crop and limit grain quality losses -

Northern

Europe’s soil moisture continues in decline, but temperatures have not been excessively warm which has kept most crops in favorable condition -

Rain

will continue to elude the region for ten more days and temperatures may rise slightly, but crops will likely stay in favorable condition for a while longer -

Southern

Europe continues to experience frequent rain and thunderstorm activity maintaining wetter biased soil conditions -

There

is a risk of local flooding in many areas and some flooding has already occurred periodically in a few areas -

The

next ten days do not offer a serious change in the moisture situation -

Eastern

CIS New Lands soil conditions have dried out more notably in the past week with topsoil moisture now rated short to very short east of the Ural Mountains and into northern Kazakhstan

-

The

heat and dryness will last another five days and then the opportunity for scattered showers and thunderstorms and gradual cooling is expected -

Relief

will evolve, but it is still questionable how significant that will be -

Canada’s

drought region of eastern Alberta and western Saskatchewan will have a couple of “opportunities” for rain during the next week -

The

first round of rain is expected Friday into Saturday favoring central and western Saskatchewan -

The

second round of rain may favor both eastern Alberta and western Saskatchewan

-

Relief

from drought is expected, albeit temporarily and more rain will be needed.

-

Other

areas in the Prairies will experience some timely rainfall during the next ten days and the resulting precipitation will be welcome, although briefly disrupting to farming activity.

-

Portions

of southern Manitoba have been trending a little dry recently and greater rain is needed, despite the fact that some rain occurred earlier this week -

Ontario

and Quebec weather has improved with warmer temperatures and limited rainfall in recent days -

A

trend change back to cooler conditions and some periodic rain is expected this weekend and especially next week that will maintain favorable crop and field conditions -

U.S.

rain will fall frequently from western Texas to Montana for another ten days

-

Some

of the crop areas in this region are becoming too wet and flooding has already occurred in several localized areas -

The

worst flooding known is near Herford, Texas where 11 inches of rain fell earlier this week resulting in serious flooding in a couple of feedlots resulting in animal deaths

-

Some

wheat quality declines are under way in the central and southwestern Plains where drier weather is needed to protect the quality and overall production of this year’s crop which has already been reduced by drought -

West

Texas cotton, corn and sorghum production areas (including those in the Texas Panhandle) are experiencing delays to planting because of frequent rain and wet field conditions -

These

delays could continue for another week to ten days as daily showers and thunderstorms impact portions of the region -

The

earliest that a drier weather pattern can evolve on June 10 -

U.S.

Delta drying is expected through the next ten days and that will raise the need for rain by the end of this forecast period, but crops are mostly in good shape today -

U.S.

southeastern states are expecting a mix of rain and sunshine during the next ten days with more sun than rain -

The

environment will be most welcome in the Carolinas and Virginia where rainy weather occurred this past weekend

-

U.S.

Midwest drying has left topsoil moisture rated short to very short and subsoil moisture marginally adequate to short -

Rain

is needed, but unlikely to occur for another ten days – at least significant rain -

Gulf

of Mexico moisture is still unavailable for to crops in the Midwest because of weather systems near the Gulf of Mexico coast that are preventing moisture inflows from the water to the land -

This

pattern will prevail for another ten days which is why the Midwest fails to get a good drink of water -

U.S.

Pacific Northwest will continue to dry out with the Yakima Valley of Washington and neighboring areas of north-central Oregon in need of rain -

Irrigation

is used extensively in the region and will support many crops -

Temperatures

will rise above normal next week and that will accelerate the need for irrigation and raise crop stress for unirrigated areas -

Mexico’s

drought is not likely to improve for the next two weeks -

Rain

will occur periodically in eastern and far southern portions of the nation, but seasonal rains are expected to be delayed starting by at least two more weeks -

Seasonal

rains in India will also be delayed during the first half of June -

The

lack of rain will raise much worry over the general performance of the summer monsoon on India -

Northern

India will continue to receive showers and thunderstorms for a little while longer -

The

precipitation reported in the past week was greater than usual and an anomaly resulting from a more southward extent of the mid-latitude westerly winds aloft -

This

pattern will continue for another ten days -

North

Africa will continue to receive frequent rain through the next week to ten days -

The

rain comes late in the growing season and may be threatening durum wheat quality in Morocco and northwestern Algeria while crop areas to the east may have benefited from recent rain.

-

China’s

excessive rain between the Yellow and Yangtze Rivers during the weekend ended earlier this week -

Drier

weather is expected for a while -

Fieldwork

was delayed, but the moisture should prove to be good for summer crop development in areas that were not flooded -

Wheat

areas need to dry down to protect grain quality -

Some

of the flooded areas likely had recently planted crops damaged and replanting is necessary -

Xinjiang,

China will continue cooler than usual -

Degree

day accumulations are well below normal and cotton, corn and other crops are not developing normally -

Warming

is needed -

The

next ten days will continue cooler than usual -

Thailand,

Cambodia and Laos rainfall in this coming week will be lighter than usual -

Some

beneficial rain fell during the weekend -

Typhoon

Mawar will be downgraded to tropical storm status southeast of Taiwan today and the storm will continue to move east northeast away from major agricultural areas -

Taiwan

and Luzon Island, Philippines are not likely to be impacted by the storm -

The

Ryukyu Islands will experience heavy rain and some windy conditions as the storm passes by -

Australia

weather during the next ten days should be unsettled enough to produce rain in some of the more important winter crop areas to help get winter crops better established -

Resulting

rainfall will be light, though, leaving need for much more away from the coast

-

South

Africa rainfall in this coming week will be sufficient to support good wheat, barley and canola emergence and establishment -

Some

summer crop harvest delays are likely and some interruption to late season winter crop planting is also expected -

The

moisture will help winter crops become better established -

Argentina

rainfall will be restricted in this next ten days, but last week’s rain has soil moisture looking very good for planting from Santa Fe and Entre Rios into central and eastern Buenos Aires -

Western

Buenos Aires and Cordoba still have a big need for rain and they may have to wait for a while -

Brazil

recent rain in Mato Grosso do Sul, Parana and immediate neighboring areas was good for Safrinha crops – especially those planted so very late -

The

moisture was also good for wheat establishment -

Drier

weather is now expected for a while -

Brazil

sugarcane, citrus and coffee harvest delays occurred briefly Tuesday and will continue today, but drier weather will be quick enough to resume to prevent any negative impact -

Central

America rainfall is expected frequently over the next ten days supporting improved soil moisture and some better runoff after a slow start to the rainy season -

Indonesia

and Malaysia rain frequency and intensity has been and is expected to continue better than advertised last week -

The

pattern will perpetuate favorable crop conditions from rice and sugarcane to oil palm, coconut and rubber development -

Philippines

rainfall will remain well mixed with sunshine over the next ten days -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Latest

Pacific Ocean surface water temperature data shows more weakening in the negative PDO -

Notable

warming has been occurring in the past couple of weeks off the west coast of North America while cooling is occurring south of the Aleutian Islands -

Both

suggest a steady reduction in the intensity of negative PDO, although the event is still significant enough to impact North America weather for several more weeks -

Today’s

Southern Oscillation Index was -14.79 and it should move erratically this week -

El

Nino continues to evolve -

Latest

ocean temperature data shows a slower progress of warming, but the trend is still in place and an El Nino event is likely to be declared in place next month -

Please

be sure to recall that El Nino’s influence will first be on the tropics, and it will take a few weeks or months for a mid-latitude influence to begin

Source:

World Weather, INC.

Wednesday,

May 31:

- US

agricultural prices paid, received - Malaysia’s

May palm oil exports

Thursday,

June 1:

- EIA

weekly US ethanol inventories, production, 11am - USDA

soybean crush, corn for ethanol, DDGS production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Indonesia

Friday,

June 2:

- FAO

food price index, monthly grains report - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Italy, Indonesia

Source:

Bloomberg and FI

Macros

107

Counterparties Take $2.255 Tln At Fed Reverse Repo Op.

US

JOLTS Job Openings Apr: 10.103M (est 9.375M; prev R 9.745M)

US

Rate Futures Price In 71% Chance Of June Hike After Jolts Data Vs Roughly More Than 60% Late Tues

EIA:

US Crude Oil Exports Rose To 4.807M Bpd In March (Vs 3.998M Bpd In Feb)

US

MNI Chicago PMI May: 40.4 (est 47.2; prev 48.6)

Canada

Quarterly GDP Annualized Q1: 3.1% (est 2.5%, prev 0.0%; prevR -0.1%)

Canada

GDP M/M Mar: 0.0% (est -0.1%, prev 0.1%)

–

GDP Y/Y Mar: 1.7% (est 1.8%, prev 2.5%)

German

CPI Y/Y MayP: 6.1% (est 6.5%, prev 7.2%)

German

CPI M/M MayP: -0.1% (est 0.2%, prev 0.4%)

German

CPI EU Harmonized Y/Y MayP: 6.3% (est 6.7%, prev 7.6%)

German

CPI EU Harmonized M/M MayP: -0.2% (est 0.2%, prev 0.6%)

Corn

·

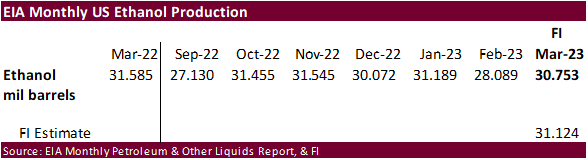

Corn futures opened the day session sharply lower but closed unchanged for the July position and down 3.25-3.75 for the back months.

WTI crude oil was down hard early this morning did recover early after EIA reported a monthly record March US crude oil exports of 4.807 million barrels per day.

·

Baltic Dry Index fell 13 percent to 977 points.

·

Brazil started second corn crop harvest progress, with less than 1 percent complete.

·

Brazil bird flu cases reached 31, in wild birds. The country does not see repercussions by importers.

·

China will soon officially approve Argentina corn imports. Short term we see no impact but next crop year (2024 Argentina local), we look for both countries to benefit from this approval.

·

The USDA Broiler Report showed eggs set in the US down 1 percent and chicks placed down 1 percent.

·

Cumulative placements from the week ending January 7, 2023 through May 27, 2023 for the United States were 3.92 billion. Cumulative placements were down slightly from the same period a year earlier.

·

A Bloomberg poll looks for weekly US ethanol production to be up 15,000 thousand barrels to 998k (990-1010 range) from the previous week and stocks down 63,000 barrels to 21.979 million.

·

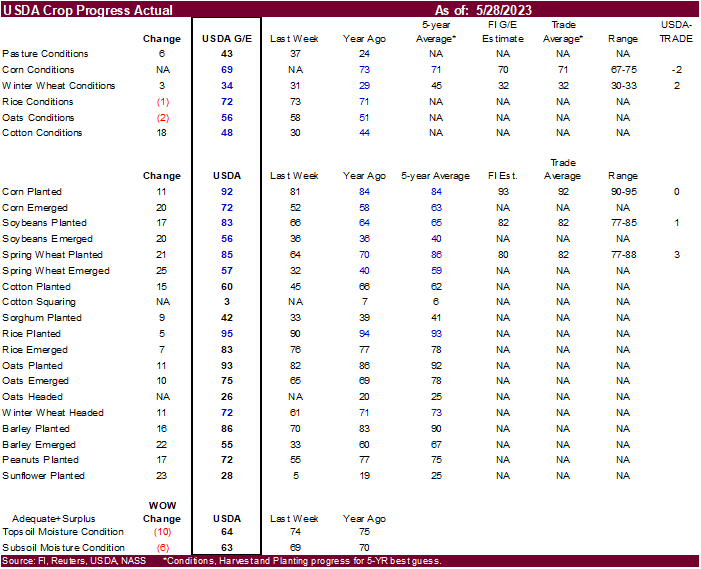

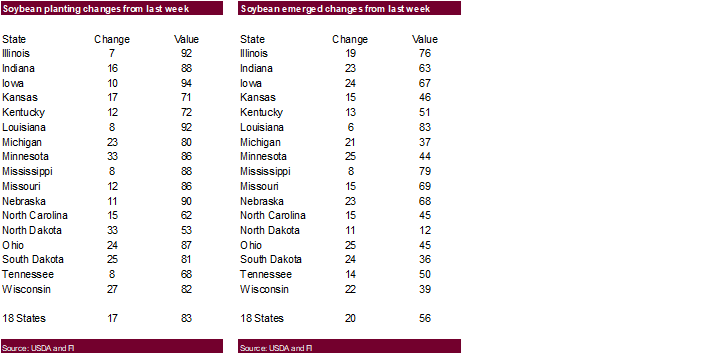

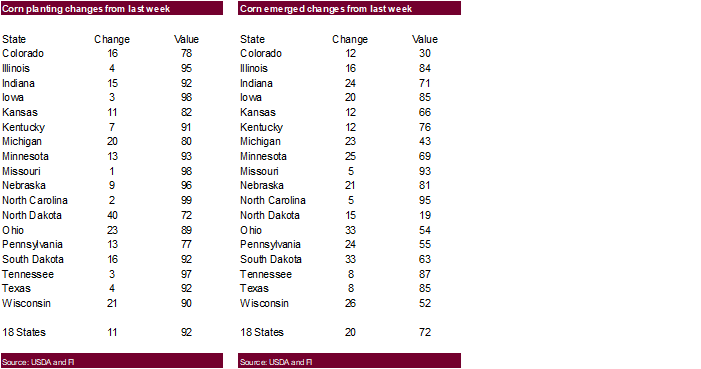

USDA initial corn conditions came in at 69% G/E which was below the 71% expected, but still good considering the ongoing drought across the WCB. Most of the miss can be attributed to the low initial rating in PA, MO, and NE.

Last year we were at 73% G/E and the 5-year average of 71 percent.

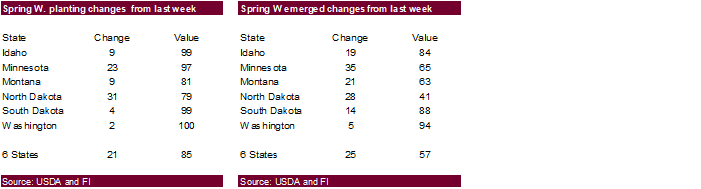

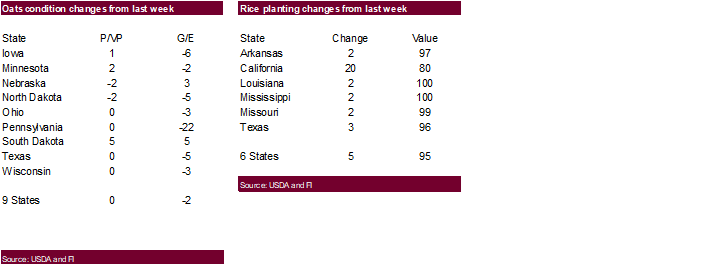

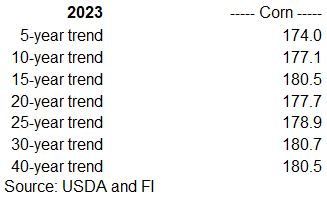

We

left out US corn production estimate unchanged

at 15.317 billion bushels, 180.5 yield (USDA May 181.5), despite a good start to US corn conditions. Reason is that it is early and WCB ratings could decline over the next few weeks when corn hits 100 percent emergence (72 percent as of Sunday). Note the

FI weighted rating suggests an August 1 yield range of 184.7 to 185.5 bu/acre. See attached US balance, 15- and 30-year trend yield charts and crop rating scatter.

2023

US corn trend yields

Export

developments.

-

None

reported

July

corn $5.25-$6.25

September

corn $4.25-$5.50

December

corn $4.25-$5.75

·

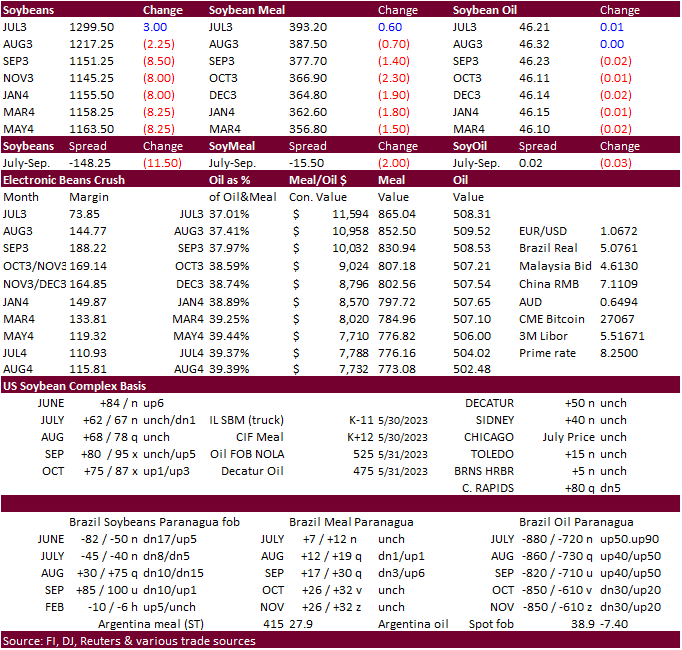

Another lower trade for the soybean complex before short covering set in. Front month soybeans and soybean meal ended higher and back month slower. Soybean oil was mixed, even after Malaysian palm oil traded sharply lower overnight

on slow palm oil exports. Some palm contracts hit lows.

·

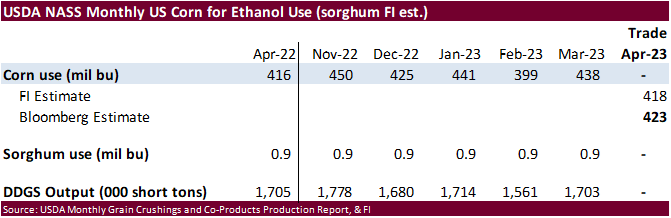

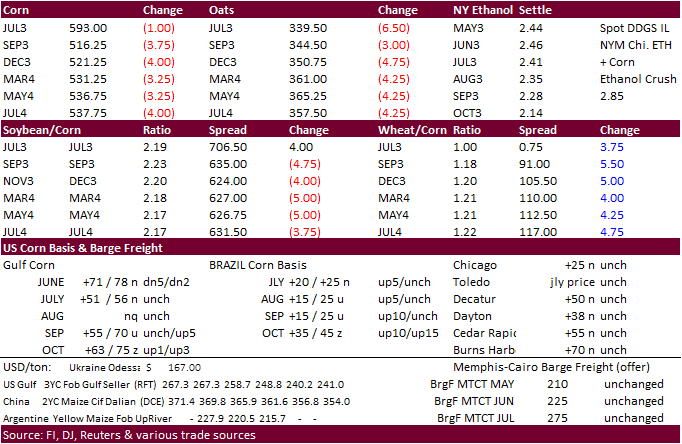

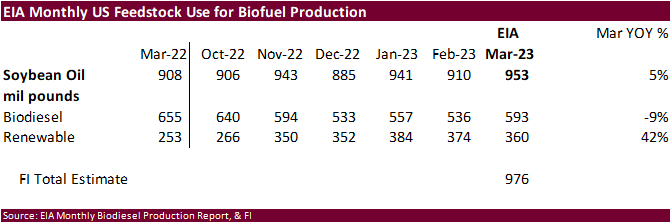

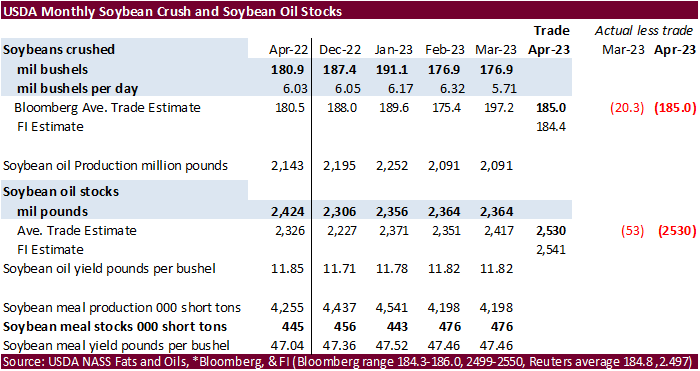

EIA reported US soybean oil for biofuel use for the month of March of 953 million pounds, above 908 million March 2022. Although the figure was below our estimate, it reinforces our idea USDA is too low for 2022-23 crop year soybean

oil for biofuel use. We are using 11.875 billion pounds versus 11.600 billion by USDA. That compares to 10.348 billion for 2021-22.

·

The latest Argentina soybean dollar has thought to have generated 6.5-7.0 million tons of producer sales over the past month and half.

·

AmSpec reported May Malaysian palm oil exports at 1.085 million tons, down 1.8 percent from April. ITS reported a 0.8% decline to 1.167 million tons.

·

Indonesia set its CPO reference price at $811.68 per ton for the June 1-15 period, below $893.23 per ton for the May 16-31 period. The new export tax reference price was $33 per ton and levy at $85.

Export

Developments

·

Egypt seeks vegetable oils June 1 (30k soybean oil & 10k sunflower) for July 11-25 arrival. They are also in for local oils.

·

USDA seeks 1,140 tons of packaged vegetable oil on June 6 for July shipment.

Soybeans

– July $12.75-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$450, December $290-$450

Soybean

oil – July 44-50, December 43-53, with bias to upside

Wheat

·

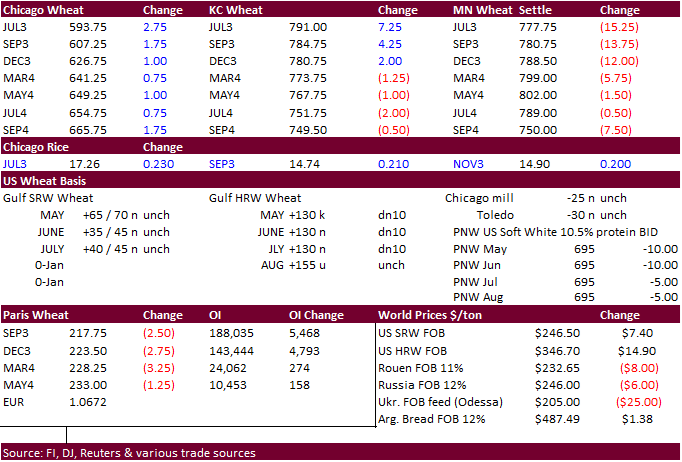

US wheat traded two-sided for Chicago and KC, ending higher for the nearby contracts. MN ended lower on cheaper Black Sea supplies and advancement of US spring wheat plantings.

·

Chicago earlier hit its lowest level since 2020 on a rolling monthly basis.

·

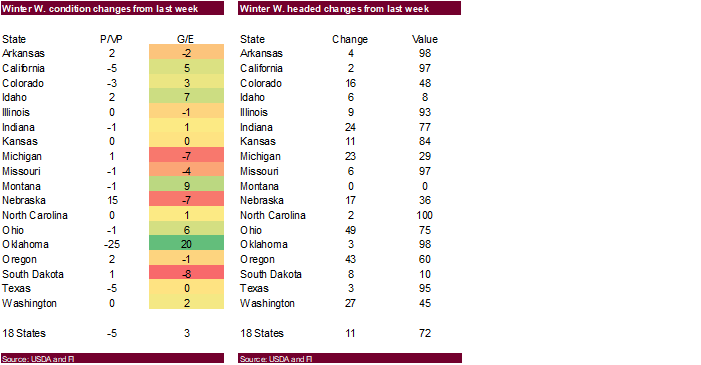

Despite the 3 point increase in the USDA US winter wheat national rating, all three classes dropped on our weighted basis from the previous week. OK fell 8.1%, TX down 0.8%, and CO was off 2.0% (weighted adjusted).

·

December Paris wheat futures were down 2.50 euros to 218.25 per ton, a new multi-month low.

·

US end users were thought to have bought 60,000 tons European Union (Poland and Germany) for July shipment. Total purchases range from 270,000 to 300,000 tons. Polish wheat is about $100 percent ton cheaper than Gulf HRW wheat.

·

China’s AgMin is asking local authorities to increase the pace of wheat harvesting of damaged grain, after heavy rain flooded fields, mainly across Henan, which produces about 25 percent of China’s crop. .Heavy rain across the

southern half of central Henan province last week.

·

Russian 12.5% wheat was about $225 ton earlier this week (July position), well below the AgMin target of $260/ton.

·

Hungary asked the EU to extend export curbs until the end of 2023.

·

Ukraine grain exports to date (June-May) were 45.3 million tons, down from 47 million previous season. That included 15.4 million tons of wheat, 26.9 million tons of corn and 2.6 million tons of barley.

Export

Developments.

·

South Korea’s FLC bought 55,000 tons of feed wheat at $261.25/ton c&f, optional origin.

-

South

Korea’s MFG bought 55,000 tons of feed wheat, optional origin, at an estimated $263.90 a ton c&f.

Rice/Other

·

None reported. See above weather section for crop progress.

Chicago Wheat

– July $5.50-$6.50

KC – July

$7.50-$8.75

MN – July

$7.25-$8.75

September – same ranges as July

#non-promo