PDF Attached

Calls:

Corn 2 to 5 lower, soybeans 5 lower and wheat steady to 5 higher bias spring wheat to upside. Don’t discount follow through buying.

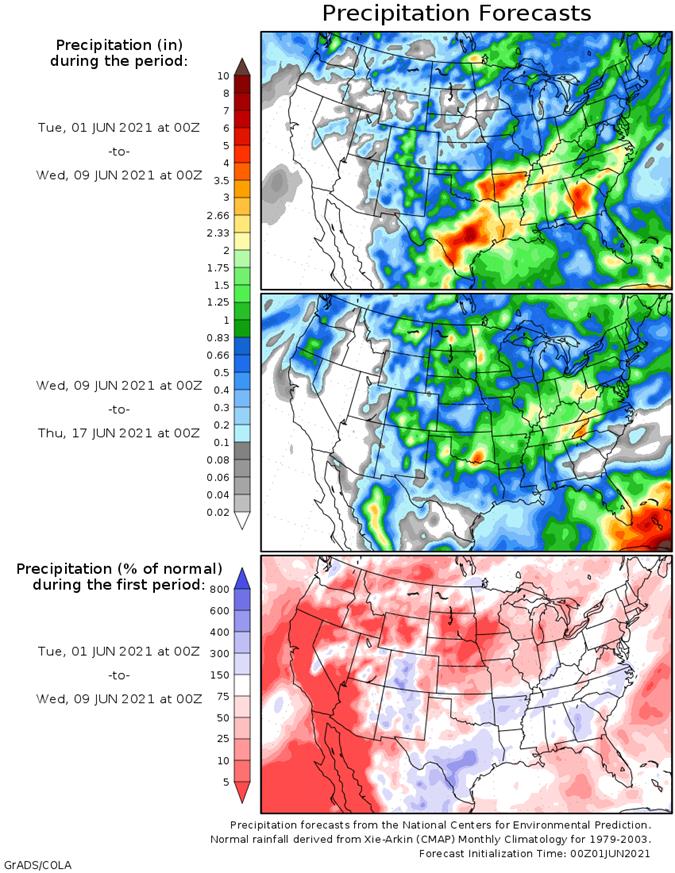

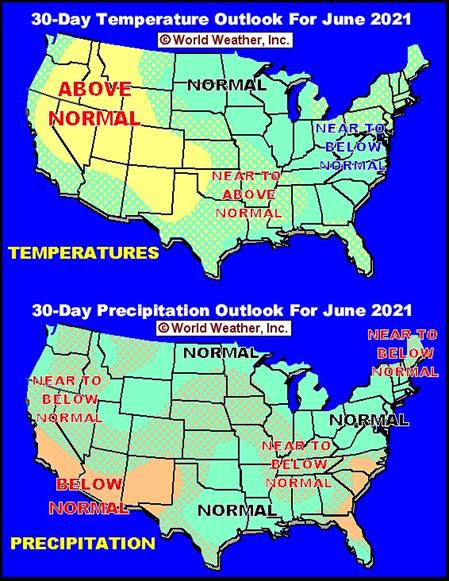

Weather

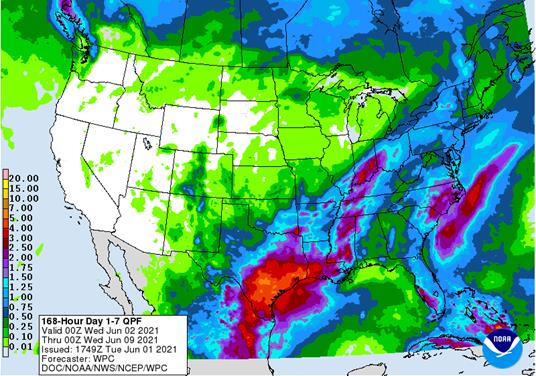

drove futures higher and option volume was one of the heaviest we have seen in a while, notably for corn. Inflation fears are back on the table. Northern spring wheat states and upper Midwest is forecast to dry down over the next several days. SA weather

looks dry for the next two weeks. Wheat export business picked up. US inspections were on the lower end for wheat and soybeans, robust for corn. Note the next U.S. Export Sales Report will be released on Friday June 4, 2021.

MINNEAPOLIS

GRAIN EXCHANGE RAISES HARD RED SPRING WHEAT (HRSW) FUTURES MAINTENANCE MARGIN TO $2,550 PER CONTRACT FROM $2,300 FOR JULY 2021, JULY 2022 – Reuters News

World

Weather, Inc.

WORLD

HIGHLIGHTS

- U.S

northern Plains, Canada’s Prairies will dry down and become quite warm too hot for a while during mid- to late week this week

o

Extreme highs will reach into the 80s and 90s Fahrenheit

o

Very little to no meaningful rain is expected

- Northern

Plains and Canada’s Prairies may experience a few showers Friday into the weekend as temperatures begin to cool, but next week will bring the best chance for rain - High

pressure ridge in central North America during mid-week will relocate to the eastern parts of North America late this week and during the weekend with before breaking down next week

o

The ridge of high pressure should eventually relocate to the Rocky Mountains and/or the western high Plains region during the middle of this month

- West

Texas rainfall during the holiday weekend was welcome and very good for planting and emergence, although dryness remains in unirrigated far southwestern counties

o

Rain totals of 1.00 to 3.00 inches occurred in many areas with some local totals over 4.00 inches

- northern

and far southwestern counties in the region did not receive nearly as much rain as the middle two-thirds of the region

o

Additional rain is expected in this coming week, but the heavier rain events are over

o

Temperatures will be cooler than usual this week and warming will be needed to bring on some greater crop development rates

- U.S.

Delta and southeastern states will experience a good mix of rain and sunshine over the next week with drier weather possible for a while next week

o

The environment will be good for most crops, but especially in the southeastern states

- Drying

in the U.S. Delta during the weekend was good for field access and crop development

o

A good mix of weather is expected in the Delta over the next ten days supporting aggressive crop development

- U.S.

hard red winter wheat areas received additional rain during the weekend maintaining wet field conditions in some areas

o

Drier weather is needed to protect early maturing wheat quality in the south

- Warmer

and drier weather is needed to raise protein levels and to reduce the risk of grain quality issues

o

Weather conditions should improve late this week into next week for a little while with more sunshine and warmer temperatures

- The

bottom line for U.S. crop areas is still a bit mixed. Worry over the northern Plains, Canada’s Prairies and the upper Midwest remains for the heart of summer, although conditions are not seriously adverse today. Some timely rain is expected in the next two

weeks but resulting amounts will not carry crops very long without frequent follow up precipitation. Hard red winter wheat areas will benefit from welcome drying later this week into next week. The region has been too wet recently. Some timely rainfall in

the southeastern states will keep crops viable, but there is still a long term level of concern because of restricted soil moisture and a growing need for greater rainfall. The Delta will experience a good mix of weather while the Pacific Northwest remains

too dry for unirrigated winter crops hurting their production potential. West Texas weather will remain wetter biased for a while this week and then a short term bout of drier weather is expected, and the changes will be good

- East-central

China will continue drying out this week

o

Below average precipitation and warm temperatures will prevail for ten days, although there will be a few showers

o

The environment will be good for winter wheat maturation and harvesting as well as late season planting of summer crops

o

Crop moisture stress will begin this weekend and continue next week as the region starts to notably dry down

- Northeastern

China will continue cooler biased and a little wet

o

The environment will be tough on soybean and late corn planting

o

Warmer and drier weather would be best for spring and summer crop development as well as additional planting

- Xinjiang

China may cool down later this week and keep its below average degree day accumulations for cotton and other crop areas into next week

o

Showers will be restricted to the northeast late this week and into the weekend

- Less

rain is expected in southeastern China this week which will help flood water recede; however, there will still be periods of rain along in the southern coastal provinces suggesting improvement will come slowly for Fujian

o

Fujian, China received excessive rainfall during the weekend and was already too wet prior to that

- Russia’s

southern New Lands will turn wetter and a little cooler this week along with parts of Kazakhstan

o

The moisture and temperature change will provide improvements for crop and field conditions after recent weeks of dry and warm conditions

- Russia’s

southern Region and Ukraine will be plenty moist, if not too wet, over the coming week to nearly ten days

o

Field working delays are likely and slower crop growth is expected

o

Weather was favorable earlier this season allowing field progress to take place and that should reduce some of the concern about rainy weather

o

After two years of drought the region will welcome the rain, but farmers need to finish fieldwork first.

- Western

Australia benefited from rain during the weekend

o

Sufficient amounts occurred to support good wheat, barley and canola establishment

o

Additional planting will take place in this week’s drier weather

- Eastern

Australia will get some welcome rain this week and next week

o

New South Wales, southern Queensland and South Australia have been dry this autumn and need moisture for improved dryland planting

o

Rain during mid-week this week and again early to mid-week next week should prove very important and beneficial for crop planting, emergence and establishment

- India’s

monsoon will produce below average rainfall for many areas in the coming week to ten days

o

Monsoon performance will be a little sporadic for a while in early June, but some increase in rainfall is expected in the south and west-central parts of the nation to support early season planting of summer crops

- India

rainfall during the weekend was sporadic and light, although Nepal and northern Bihar reported some heavy rainfall from the remnant moisture of Tropical Cyclone Yaas

o

Temperatures were seasonably hot from south-central through the northwest

- Brazil

weekend rainfall occurred from southern Mato Grosso do Sul into northern Parana and southern Sao Paulo as well as in some Sul de Minas coffee production areas.

o

Rainfall of 0.30 to 1.58 inches occurred in southern Minas Gerais, although the far southern tip of the state was largely missed by rain

- Similar

rainfall occurred in central and southern Rio de Janeiro

o

Rainfall reached 3.30 inches at Londrina, Parana while varying from 0.35 to 1.51 inches from southern Mato Grosso do Sul into southern and eastern Sao Paulo and northern Parana

o

The moisture was welcome in corn, coffee and some sugarcane production areas, although disruptive to harvesting and a few areas experienced some hail

o

Mato Grosso, Goias and other Safrinha corn production areas were left mostly dry

- Brazil’s

weather outlook has not changed much since Friday with little to no rain in Mato Grosso, Goias, southwestern Minas Gerais or northern and western Sao Paulo keeping Safrinha crops stressed

o

Some showers will occur infrequently in crop areas to the south; including Parana, southern Mato Grosso do Sul and a few areas in southern Sao Paulo

o

Rio Grande do Sul will get routinely occurring rainfall along with Paraguay and Santa Catarina maintaining good winter and late season summer crop conditions

- Tropical

Storm Blanca west of Mexico will stay over open water and pose no threat to land - Tropical

Storm Choi-Wan will move along the eastern Philippine Islands this week producing some moderate to heavy rainfall, but not much crop damage is expected - Canada’s

Prairies will experience very warm temperatures and restricted rain this workweek and then a few showers and some cooling during the weekend

o

Greater rainfall is expected next week, but it may not be well distributed throughout the region

o

The bottom line for Canada’s Prairies is a little tenuous. The region will dry down sharply this week and then there will be an opportunity for rain this weekend into next week. No general soaking of rain is expected, but there

will be some potential for a few strong thunderstorms briefly before a new ridge of high pressure evolves in the second week of June.

- Southeastern

Canada corn, soybean and wheat production areas will experience a good mix of weather during the next two weeks - Eastern

and southern Mexico rainfall will resume this week with sufficient moisture to come along for a further improvement in topsoil moisture

o

Drought will prevail in western parts of the nation, but dryness in the east will slowly be eased

- Argentina

weather was good during the weekend with little to no precipitation supporting summer crop maturation and harvest progress - Argentina’s

weather over the next two weeks will be well mixed with sufficient drying time to support ongoing harvest progress while enough rain falls to ensure good wheat planting and emergence conditions - South

Africa was dry during the weekend except in coastal areas with frost and freezes in many areas

o

The environment was good for summer crop harvest progress and some additional wheat planting

- Rain

is needed in eastern wheat areas to induce the best dryland emergence and establishment - West

Africa rainfall was erratic during the weekend, but all of it was welcome

o

Greater rain is still needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

- A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

- East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will continue well below average during much of the next ten days

- Mainland

areas of Southeast Asia rainfall continues lighter and more sporadic than usual and this trend will continue this week before increasing this weekend and next week

- Indonesia

and Malaysia rainfall was a little more significant late last week and during the weekend and the boost was welcome.

o

There is still a need for greater rainfall

o

Rainfall is expected to be erratic and light at times during the next week to ten days, but all areas will get at least some rain at one time or another

- Philippines

rainfall during the weekend was sporadic and light in many areas except in southern and eastern Mindanao where heavy rain fell from the approaching Tropical Storm Choi-Wan

o

A boost in rainfall is still desired for some of the northern parts of the nation, although the situation is better than it was earlier in May

- Europe

weather will improve this week because of greater rainfall in Spain, southern France, some areas in Italy and a part of the Balkan Countries

o

Portions of each region has been a little drier than usual in recent weeks

o

Crop moisture elsewhere should remain favorably rated.

- Southern

Oscillation Index is mostly neutral at +5.13 and the index is expected to drift lower this week

- North

Africa weather in the coming week will include a few showers and thunderstorms causing some disruption periodically to harvest progress for wheat and barley

o

No winter crop quality issues are expected

- New

Zealand weather during the coming week to ten days will be drier than usual with temperatures near to above average

Source:

World Weather, Inc.

Source:

World Weather, Inc.

Tuesday,

June 1:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop condition and planting — corn, cotton, soybeans, wheat, 4pm - Honduras

and Costa Rica monthly coffee exports - International

Cotton Advisory Committee updates world outlook for fiber market - Australia

Commodity Index - Purdue

Agriculture Sentiment - New

Zealand dairy trade auction - U.S.

corn for ethanol, DDGS production, 3pm - USDA

soybean crush, 3pm - HOLIDAY:

Indonesia

Wednesday,

June 2:

- Nothing

major scheduled

Thursday,

June 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - EIA

weekly U.S. ethanol inventories, production - Port

of Rouen data on French grain exports - New

Zealand Commodity Price - HOLIDAY:

Brazil, Thailand

Friday,

June 4:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Brazil’s

commodities exports for May – Reuters News

Commodity

May 2021 May 2020

CRUDE

OIL (TNS) 5,296,342 8,256,987

IRON

ORE (TNS) 26,662,421 21,459,428

SOYBEANS

(TNS) 16,403,387 14,108,152

CORN

(TNS) 13,919 24,933

GREEN

COFFEE(TNS) 190,118 215,689

SUGAR

(TNS) 2,697,844 2,583,479

BEEF

(TNS) 126,763 154,973

POULTRY

(TNS) 383,191 372,373

PULP

(TNS) 1,446,254 1,530,816

Source:

Reuters and Brazil’s AgMin

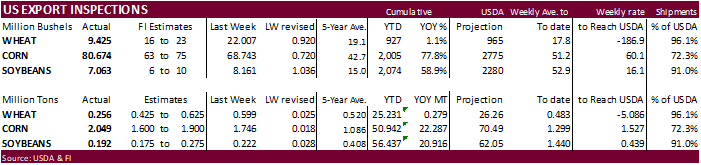

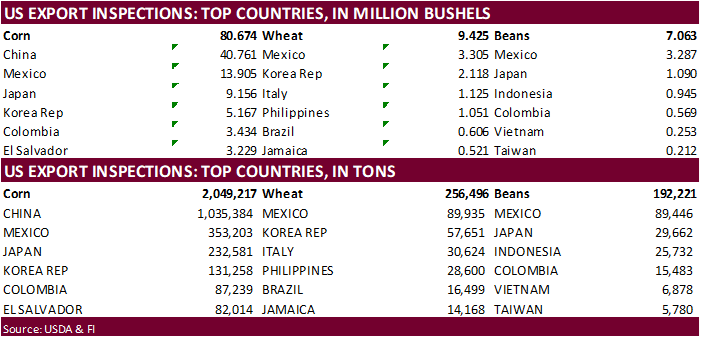

USDA

inspections versus Reuters trade range

Wheat

256,496 versus 250000-625000 range

Corn

2,049,217 versus 1500000-2000000 range

Soybeans

192,221 versus 90000-400000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAY 27, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 05/27/2021 05/20/2021 05/28/2020 TO DATE TO DATE

BARLEY

0 0 0 33,143 30,548

CORN

2,049,217 1,746,162 1,192,384 50,942,045 28,655,143

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

499 0 0 4,789 3,343

RYE

0 0 0 0 0

SORGHUM

162,736 163,697 125,609 6,129,411 3,321,185

SOYBEANS

192,221 222,107 451,878 56,437,429 35,521,654

SUNFLOWER

0 144 0 240 0

WHEAT

256,496 598,941 555,500 25,231,272 24,952,366

Total

2,661,169 2,731,051 2,325,371 138,778,838 92,484,759

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

ISM Manufacturing May: 61.2 (est 61.0; prev 60.7)

–

Prices Paid: 88.0 (est 89.5; prev 89.6)

–

New Orders: 67.0 (est 66.0; prev 64.3)

–

Employment: 50.9 (est 54.6; prev 55.1)

US

Construction Spending (M/M) Apr: 0.2% (est 0.5%; prev 0.2%)

(Bloomberg)

— The OPEC+ alliance agreed to stick with its plan to increase oil production in July, delegates said as their online meeting ended.

Canadian

GDP (M/M) Mar: 1.1% (est 1.0%; prev 0.4%)

Canadian

GDP (Y/Y) Mar: 6.6% (est 6.5%; prev -2.2%)

Canadian

Quarterly GDP Annualized Q1: 5.6% (est 6.8%; prevR 9.3%; prev 9.6%)

Canadian

GDP Contracts 0.8% In April – StatsCan Flash Estimate

Canadian

Markit Manufacturing PMI May: 57.0 (prev 57.2)

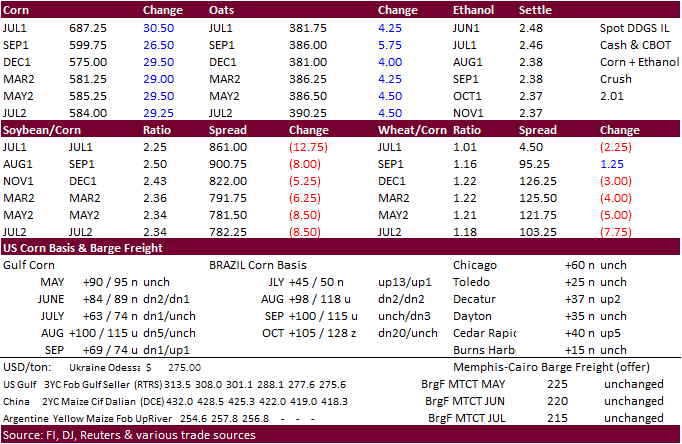

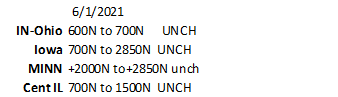

- It

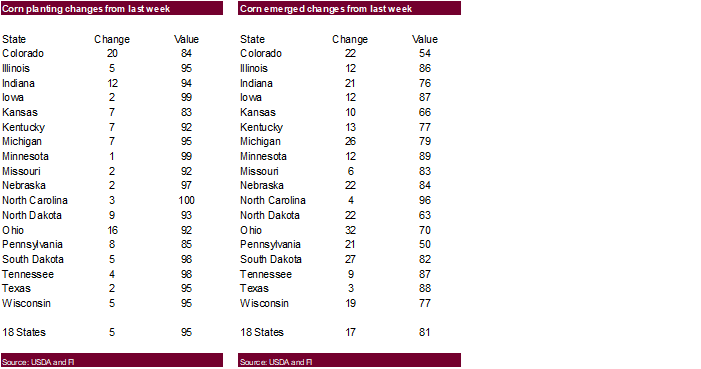

appears the short-term pause and pullback in corn prices might have come to an end after an impressive 32 cent rally basis the July contract today. December was up 31.50 cents. After a long holiday weekend CBOT corn

traded

sharply higher on adverse weather for the US and Brazil. Late on Friday we learned the weekly net fund position reported by the CFTC showed traders overestimating the net long position, a signal money managers remain bullish corn.

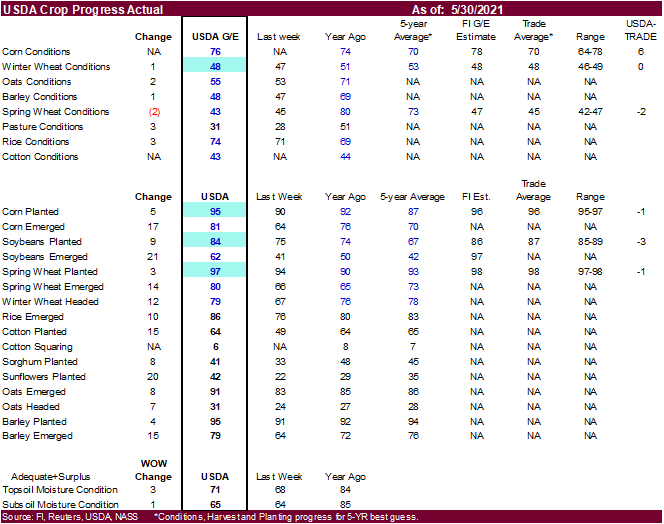

- US

initial G/E corn condition of 76 percent this afternoon was 6 points above a Reuters trade guess, and we could see a lower trade tonight. Don’t discount follow through buying.

- Option

volume was very active today for corn. - Funds

bought an estimated 35,000 corn contracts. - July

corn ended above its 20-day MA. Testing contract highs looked out of reach last week but the long term story with forecasts for dry weather across the upper Midwest and upper Great Plains appear to be generating a second wave of weather premium buying.

- USDA

US corn export inspections as of May 27, 2021 were 2,049,217 tons, above a range of trade expectations, above 1,746,162 tons previous week and compares to 1,192,384 tons year ago. Major countries included China for 1,035,384 tons, Mexico for 353,203 tons,

and Japan for 232,581 tons. - We

see US corn exports at 2.850 billion versus 2.775 USDA for current year and will leave it unchanged for now but will consider increasing the projection based on Brazil exports falling short of 30 million tons (USDA @ 35MMT). Our updated Brazil corn S&D is

attached. - Don’t

discount +$7.00 July corn and +$6.00 December if weather outlooks fail to improve over the next week.

- AgRural

cut Brazil’s second crop corn production by 5MMT to 60. Late last week Safras lowered it to 61.5MMT. Meanwhile StoneX lowered their total Brazil corn output to 89.68 million tons, down from 100.25 previous. USDA is at 102.0MMT, same as last season.

- Keep

an eye on Argentina river levels as they continue to affect barge movement.

- Meat

company JBS had a cyber-attack over the weekend, affecting some plants to temporally to close. Any price reaction should be short term. Cattle futures were under pressure following the announcement.

- Reuters:

(Reuters) – Ukraine’s grain exports have fallen by 23% in the first 11 months of the 2020/21 July-June season to 41.85 million tons, agriculture ministry data showed on Monday. The volume included 15.88 million tons of wheat, 21.14 million tons of corn and

4.17 million tons of barley. Ukraine, which harvested around 65 million tons of grain in 2020, plans to export around 45.8 million tons this season.

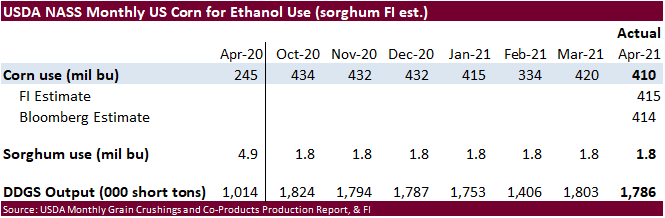

We

left our corn for ethanol use projection unchanged at 5.30 billion, above 4.975 USDA and 4.852 last year.

Export

developments.

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

Soybeans

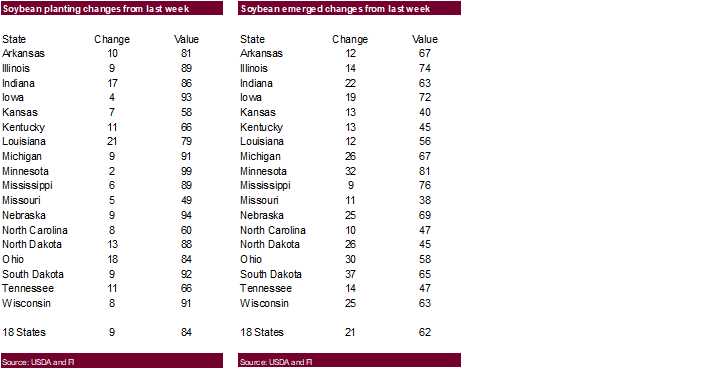

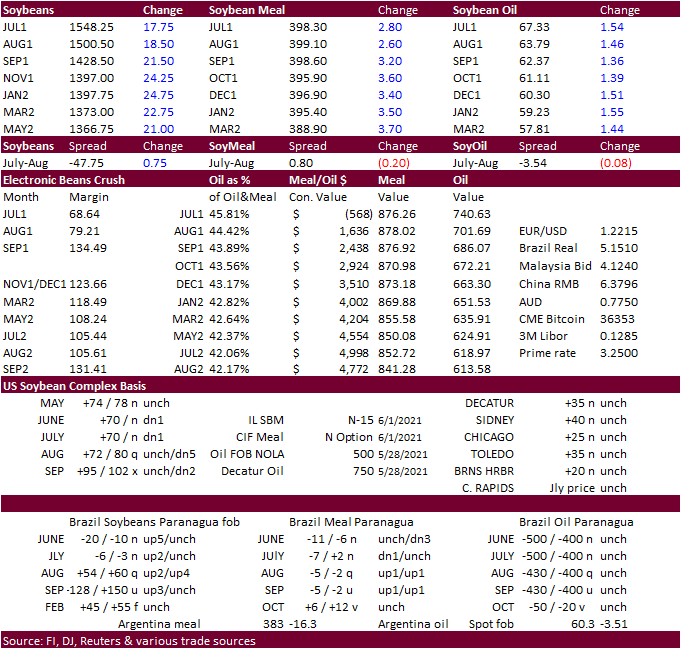

- Soybeans,

meal and soybean oil were all higher (beans and meal well off session lows) on adverse weather forecasts bias the northwestern WCB/Great Plains and upper Midwestern US growing areas. Soybean oil held much of their gains in part to higher energy prices and

tight US stocks. - US

soybean plantings came in 3 points below an average trade guess and we could see a steady open tonight.

- Funds

bought an estimated net 13,000 soybean contracts, 3,000 soybean meal and 7,000 SBO contracts.

- Cold

weather kicked off the long US holiday weekend followed by good rains across the ECB then southern Great Plains. US temperatures will be warmer this week facilitating net drying from below normal precipitation.

- We

are hearing an Indiana crusher had soybeans shipped from the Dakota’s recently, a reminder ECB stocks are tight. August CBOT crush is at 79.25 cents. US soybean meal basis was mostly unchanged to a touch firmer from late Friday.

- Note

USDA AMS soybean oil basis was unchanged at their reported 4 locations they cover each week.

- Late

last week Malaysia announced a full nationwide lockdown from June 1-14. - ITS

reported a 1.5% increase in May Malaysian palm oil shipments to 1.419 million tons were as third week of the month they were running 17.1% ahead for the 1-20 days of April. Past two days aggregate palm futures fell 119 points and cash was down $27.50/ton.

The back months weathered the declines amid optimism that COVID-19 economic recoveries would prevail. Meanwhile Malaysia is looking to petition the WTO over EU curbing palm oil imports. This issue might be long standing. Cargo surveyor SGS reported month

to date May Malaysian palm exports at 1,395,791 tons, 17,303 tons below the same period a month ago or down 1.2%, and 148,803 tons above the same period a year ago or up 11.9%. AmSpec reported a 1.6% increase in palm oil shipments for the month.

- Brazil’s

AgMin reported 16.4 million tons of soybeans were exported during May, up from 14.1 million tons a year ago.

- CBOT

SBO upside this week could be limited if palm futures continue to trend lower, but strong US SBO domestic demand should long-term remain supportive. On Friday EIA reported 740 million pounds of US soybean oil was used for biofuel versus our 715 million pounds

estimate, up from 656 million during March 2020. Remember diesel consumption did not lag during the pandemic like ethanol use due to increase demand for truck transportation.

- USDA

US soybean export inspections as of May 27, 2021 were 192,221 tons, within a range of trade expectations, below 222,107 tons previous week and compares to 451,878 tons year ago. Major countries included Mexico for 89,446 tons, Japan for 29,662 tons, and Indonesia

for 25,732 tons. - Reuters:

Egypt has raised the price of subsidized vegetable oils by 23.5% to 21 Egyptian pounds ($1.34) per one liter bottle effective June 1 following a jump in raw material costs globally, the Supply Ministry said on Sunday.

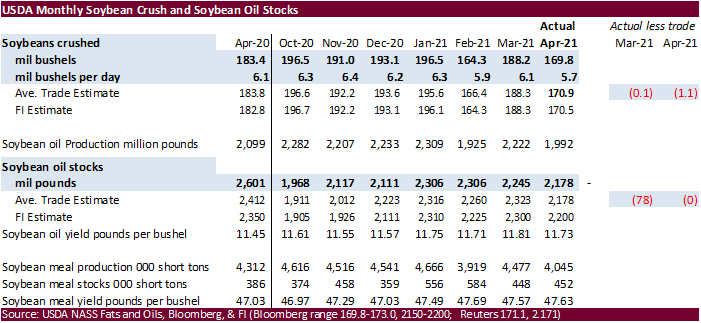

April

US soybean crush fell short of expectations to 169.8 million bushels (170.9 average), down from 188.2 million bushels in March and below 183.4 million in April 2020. US soybean oil stocks as of April 30 were 2.178 billion pounds (at trade expectations), down

from 2.245 billion at the end of March and 2.601 billion at the end of April 2020. We will not make any adjustments to our crush estimates. Look for updated S&D’s later this week.

- Iran

seeks 30,000 tons of each soybean oil and sunflower oil on June 2 for June/July shipment.

Updated

5/25/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

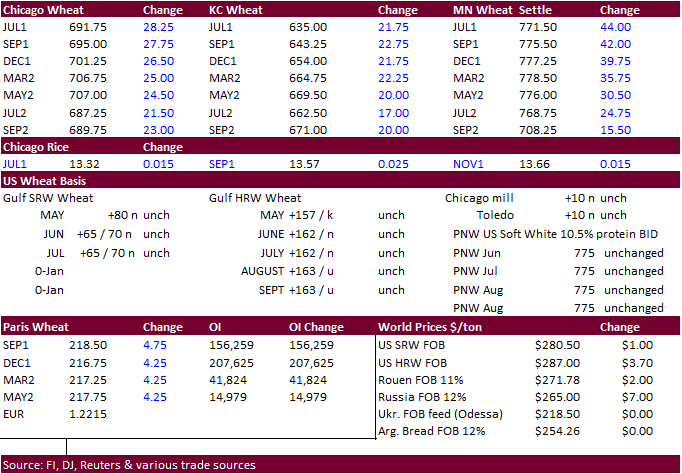

- Spring

wheat MN contracts advanced 44 cents in the nearby contract (+6.0%) and 24.75-42.00 cents in the back months from weather forecast calling for dry and warm weather during FH June for the upper Great Plains and Canadian Prairies. Chicago and KC wheat were

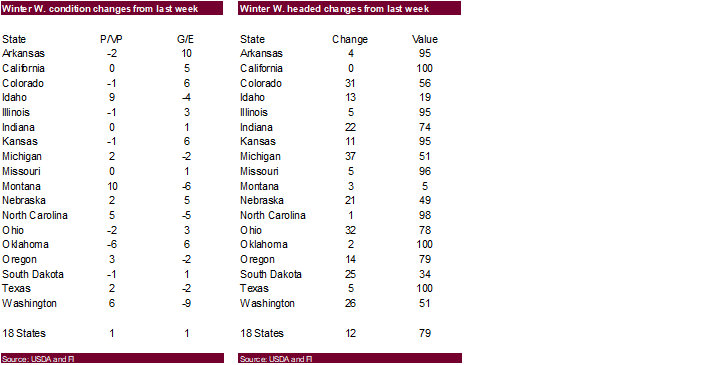

up 20.50-30.00 cents. - US

spring wheat ratings slid 2 points to 43 percent. Winter wheat conditions were up one point.

- Funds

bought an estimated net 15,000 SRW contracts. - USDA

US all-wheat export inspections as of May 27, 2021 were 256,496 tons, within a range of trade expectations, below 598,941 tons previous week and compares to 555,500 tons year ago. Major countries included Mexico for 89,935 tons, Korea Rep for 57,651 tons,

and Italy for 30,624 tons. - September

Paris wheat market basis September was up 5.00 euros at 218.75. - SovEcon

lowered its Russian wheat export forecast to 36.6 million tons for the 2021-22 season from 37.7 million tons current (2020-21) season. SovEcon estimated Russia’s 2021 wheat crop at 80.9 million tons, down from 81.7 million tons due to a slightly smaller winter

wheat area and weather problems. - IKAR:

Russia 2021 wheat production 79.5MMT, up 0.5 previous. 80.7MMT comparison for this year.

- Last

week Russia wheat prices dipped $4/ton to around $256 fob, according to IKAR, based on high pro 12.5%.

- India

looks for a marginally above normal monsoon season. 101% is expected with a range of 96-104% over a 50-year average. This is up from 98% forecast in April.

- Bangladesh

saw offers for 50,000 tons of wheat, lowest $339.33/ton, for shipment within 40 days of contract signing.

- Iran

seeks 60,000 tons of milling wheat on June 2 for June/July shipment. - Jordan

seeks 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment. - Results

are awaited on Indonesia seeking 240,000 tons of feed wheat for Aug/Nov arrival.

- Algeria

bought at least 200,000 tons of durum wheat last week at $380-$385/ton c&f for late July shipment.

- Saudi

Arabia SAGO bought 562,000 tons of wheat, less than expected, at $299.55/ton for Aug/Sep delivery (average price). They were in for 720k 12.5% protein.

Rice/Other

·

Egypt seeks 100,000 tons of raw cane sugar on June 5.

Updated

6/1/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.00-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.