PDF Attached

Most

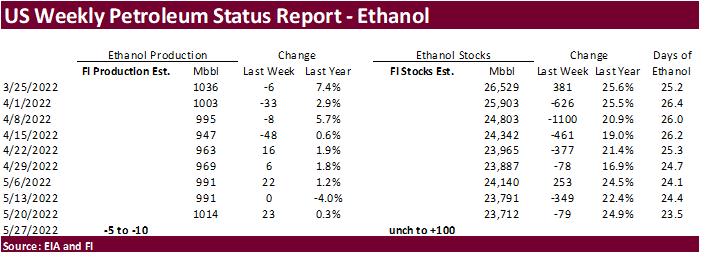

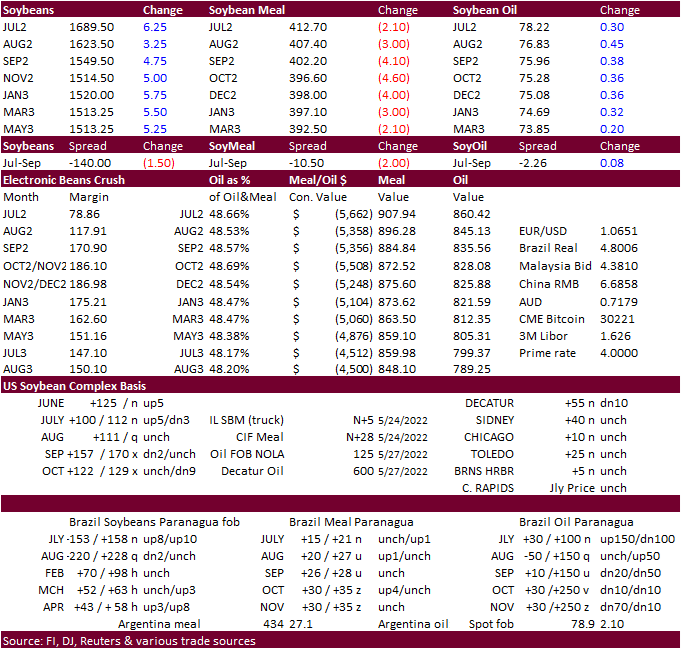

inflation related commodity markets were lower today, with exception of energy. The USD rallied 81 points. USDA NASS reported a slightly higher April US soybean crush and soybean oil stocks were above trade expectations. US corn for ethanol use during April

was below expectations. The US weather forecast was mostly unchanged. Argentina turns drier through Sunday. Brazil will see favorable corn harvest progress this week before slowing next week from rain. A source told Reuters that the Biden administration is

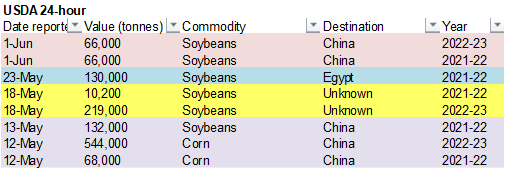

likely to raise ethanol blending mandates for 2021 to 13.94 billion gallons from the EPA proposed refiner blend of 13.32 billion gallons proposed back in December. Note the 13.94 billion is what was blended in 2021. Private exporters reported sales of 132,000

metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year.

![]()

WEATHER

EVENTS AND FEATURES TO WATCH

- Drying

is expected in Canada’s eastern Prairies and a part of North Dakota into the weekend, but temperatures will be cool slowing the drying rates - A

dry and warm weather pattern would be best in expediting a drying trend and helping to get unplanted crops in the ground - Rain

is expected in southern Alberta this weekend and early next week that should offer a little short term relief from dryness

- Rain

from this event is not expected in east-central Alberta of west-central Saskatchewan

- West

Texas cotton, corn and sorghum areas are expecting more rain during the balance of this week with 0.50 to 1.50 inches and local totals of 2.00 to 3.00 inches

- All

crop areas will be impacted and the resulting moisture will be good for future crop development - Today’s

forecast is wetter in a few of the dryland counties of southwestern West Texas - U.S.

hard red winter wheat areas, the Midwest, Delta and southeastern states will experience a favorable mix of weather during the next ten days to two weeks supporting spring fieldwork and crop development - U.S.

Pacific Northwest crop areas still need greater rainfall in unirrigated areas - Ontario

and Quebec are plenty wet and would benefit from a little more sunshine and additional warm weather - Southern

Florida citrus and sugarcane areas may be impacted by a tropical storm this weekend

- Heavy

rain and windy condition are expected, but very little, if any, damage is expected in agricultural areas - Local

flooding and a few strong wind gusts are expected, but the rain will be more welcome than detrimental - Recent

heavy rain from the remnants of Hurricane Agatha have produced some flooding in southern Mexico and northern parts of Central America

- Some

drying would now be welcome - Western

Argentina wheat areas still need a boost in precipitation to induce the best planting, germination and emergence conditions - Argentina’s

main wheat production areas and areas all of the late season sorghum, soybeans, corn and peanuts produced in the nation are cool and moist enough to support crop needs through the harvest - Southern

Brazil has been and will continue to be a little too wet for a while - Drying

is needed to protect immature late season summer crops and to reduce flood potentials in wheat areas - France,

Germany and immediate neighboring areas will receive some welcome rainfall during the coming week

- Dryness

will be eased and some benefit is expected to come to winter, spring and summer crops - Follow

up moisture is needed to ensure dryness does not return to threaten production

- With

that said, a drier and warmer bias is expected to return a little later this month making this rain all the more important - Southeastern

Europe is getting enough rain to ease its recent dryness, but more is needed - Southwestern

Europe will have some ongoing needs for rain - Russia’s

Southern Region, southeastern Ukraine and western Kazakhstan will dry down for a while in the next couple of weeks raising the need for timely rain later this month - Western

and northern Russia will continue in an active weather pattern bringing waves of rain and milder than usual weather periodically - Some

of the wetter and milder biased weather will also occur in Belarus, the Baltic States and northwestern Ukraine - Xinjiang,

China will experience some periodic rainfall in the northeast while most other areas away from the mountains are left mostly dry - Corn

and cotton planting are advancing well - North

China Plain dryness is not likely to go away anytime soon, despite the potential for a few showers in the coming week to ten days - Unirrigated

crop moisture stress has begun, although wheat has not been seriously impacted since it is largely irrigated - Southern

China is bracing for additional excessive rainfall later this week and next week - Flooding

has already been a problem south of the Yangtze River recently and even though the rain is taking a short term break there is much more coming - Damage

to sugarcane and rice is possible - Southern

India monsoonal rainfall is expected to be lighter than usual over the next ten days - The

impact will be low for now, but greater rain will be needed in time - Australia

soil moisture is rated mostly well, but there will be need for rain in Western and South Australia this month especially in northern crop areas to restore favorable soil moisture

- New

South Wales and many areas in southeastern Queensland have favorable soil moisture for autumn planting and establishment of wheat, barley and canola - South

Africa weather is expected to be mostly dry for a while - Both

the harvest of summer crops and the planting of winter grains will advance well in the drier weather this week - Temperatures

will be near to above normal this week - All

of Southeast Asia will get rain at one time or another over the next couple of weeks. - The

precipitation will be good for most crop needs; however, it will be heavy along the Myanmar lower coast and in parts of both Laos and Vietnam into Cambodia - Northwestern

Luzon Island, Philippines and Taiwan will also be wet - Thailand

may not be included in the heavier rainfall that other Southeast Asia nations will experience for a while, but scattered showers and thunderstorms are still expected - West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall will be most significant in Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania’s Pare region dries down seasonably - North

Africa rainfall will be limited in the next two weeks, although some rain is expected very lightly - Most

wheat and barley in the region is maturing and being harvested keeping the need for rain very low - Most

of the rain expected will be limited and should not adversely impact crop conditions or field progress - Turkey

crop areas will be the only ones in the Middle East to get significant rainfall during the next week to ten days - A

boost in rain is needed in many areas, but this is the beginning of the dry season

- These

areas may have experienced a decline in wheat, rice and cotton production this year – at least in unirrigated areas - Mexico

rainfall is expected to slowly increase in central and southern parts of the nation during the next ten days - The

moisture will be welcome and should be a part of the developing monsoon season - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Today’s

Southern Oscillation Index was +18.50 and it will steadily decline over the next few weeks - New

Zealand rainfall will be trending wetter over the next week

Source:

World Weather Inc.

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production, 10:30am - HOLIDAY:

Italy, UK

Friday,

June 3:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong, Thailand, UK

Source:

Bloomberg and FI

Macros

US

MBA Mortgage Applications May 27: -2.3% (prev -1.2%)

–

US 30-Year Mortgage Rate: 5.33% (prev 5.46%)

US

Construction Spending (M/M) Apr: 0.2% (est 0.5%; prev R 0.3%)

US

ISM Manufacturing May: 56.1 (est 54.5; prev 55.4)

–

Prices Paid: 82.2 (est 81.0; prev 84.6)

–

New Orders: 55.1 (est 52.9; prev 53.5)

–

Employment: 49.6 (est 52.0; prev 50.9)

US

JOLTs Job Openings Apr: 11.400M (est 11.350M; prev R 11.855M)

93

Counterparties Take $1.965 Tln At Fed Reverse Repo Op (prev $1.979 Tln, 101 Bids)

·

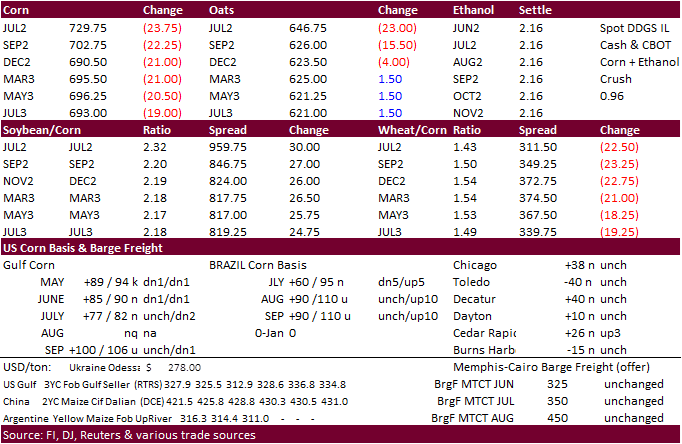

US corn futures

traded sharply lower from a very strong USD and widespread commodity selling (exception energy markets). US weather looks very good for the next two weeks, promoting good yields. Funds sold an estimated net 22,000 corn contracts. July fell 22.25 cents to

$7.3125.

·

December corn broke below $7.00, first time since April 6, settling at $6.9150, down 20 cents.

·

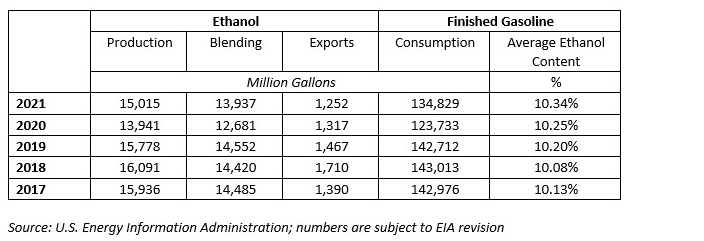

A source told Reuters that the Biden administration is likely to raise ethanol blending mandates for 2021 to 13.94 billion gallons from the EPA proposed refiner blend of 13.32 billion gallons proposed back in December. Soybean

oil jumped on this news, but corn futures eventually faded. However, D6 RINs rallied to $1.42-$1.44 from $1.35 shortly after the Reuters headline. Later D6 traded to at least $1.50. Note the 13.94 billion is what was blended in 2021. 2021 EIA data showed US

ethanol plants produced 15.02 billion gallons, an 8 percent increase over 2020, and blended 13.937 billion gallons (10.3% of finished motor gasoline. Domestic ethanol consumption grew even faster, a 10 percent increase as exports fell slightly from 2020.

·

An official announcement is expected Friday for 2020-2022. RFA table below.

·

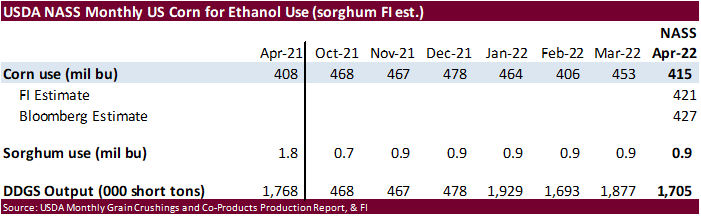

USDA reported April corn for ethanol use at 415 million bushels, below an average trade guess of 427 million, below 453 million during March but up from 408 million April 2021.

·

A Bloomberg poll looks for weekly US ethanol production to be up 3,000 barrels to 1017 thousand (1000-1028 range) from the previous week and stocks up 39,000 barrels to 23.754 million.

·

Although US planting progress increased last week, keep an eye on North Dakota and Minnesota where corn and soybean plantings are lagging well behind normal. The next 5 days looks drier for this area so this week will be a critical

time for producers to get spring grains into the ground for the northern states. We are already hearing up to 1 million corn acres could be lost to prevented plantings. USDA NASS reported US corn planting progress at 86 percent, 1 point above trade expectations,

above 72 week earlier and compares to 94 percent year ago and 87 for the five-year average.

·

The Biden Administration announced more than $2.1 billion of funding will be provided for the US food supply system, focusing on food processing and distribution.

·

StoneX estimated the Brazil 2021-22 total corn crop at 116.8 million tons, up from previous 116.45 million.

·

Ukrainian grain traders union estimated the 2022 Ukraine corn crop at 26.1 million tons, down from 37.6 million last year. Traders estimate the crop between a wide 22 and 28 million tons.

·

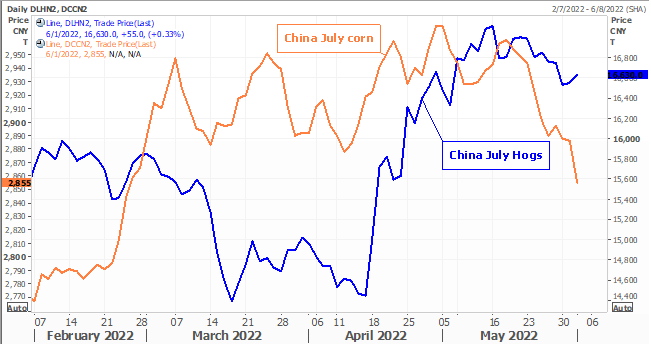

China will buy 40,000 tons of frozen pork for reserves on June 2, tenth round of procurement.

·

China corn prices closed 1.3 percent lower. September corn is trading at its lowest level since February 2022. China hog prices are hanging around multi month highs, leading us to believe inventories will build second half 2022.

·

Mexico plans to buy 521,000 tons of corn to help ease rising inflation.

U

of I – Are Long-Run Prices Still $4 for Corn, $10 for Soybeans, and $5.50 for Wheat?

Schnitkey,

G., C. Zulauf, N. Paulson, K. Swanson and J. Baltz. “Are Long-Run Prices Still $4 for Corn, $10 for Soybeans, and $5.50 for Wheat?” farmdoc daily (12):79, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31,

2022.

Updated

6/1/22

July

corn is seen in a $6.75 and $8.00 range (down 50 and 25 back end)

December

corn is seen in a wide $5.50-$8.00 range

·

Choppy, volatile session. CBOT soybeans,

meal and oil traded in a wide two-sided range. July soybeans ended 7 cents higher, July meal $2.10 lower and July soybean oil 19 points higher. China bought US soybeans overnight and this was seen as supportive. Funds bought an estimated net 4,000 soybeans,

sold 2,000 meal and bought 2,000 soybean oil. USDA’s NASS crush report was viewed neutral for soybeans and slightly bearish for soybean oil.

·

After the open, soybean oil rallied after a source told Reuters that the Biden administration is likely to raise ethanol blending mandates for 2021. This could have been technical as July bounced off a long-term trend line. Soybean

oil sold off around 10:00 am CT only to rebound later in the session.

·

India lowered their base import price of crude and refined palm oil and raised the price of crude soyoil. Duty free imports 2 million tons of soybean oil still stand.

Commodity

New price in $ Old price in $

Crude palm oil 1,625 1,703

RBD palm oil 1,733 1,765

RBD palmolein 1,744 1,771

Crude soya oil 1,866 1,827

Gold 597 592

Silver 721 687

·

StoneX estimated the Brazil 2021-22 soybean crop at 124.4 million tons, up from previous 123.4 million.

·

Covid restrictions continue to ease in China.

·

USDA NASS reported US soybean planting progress at 66 percent, 1 point below trade expectations, above 50 week earlier and compares to 83 percent year ago and 67 for the five-year average.

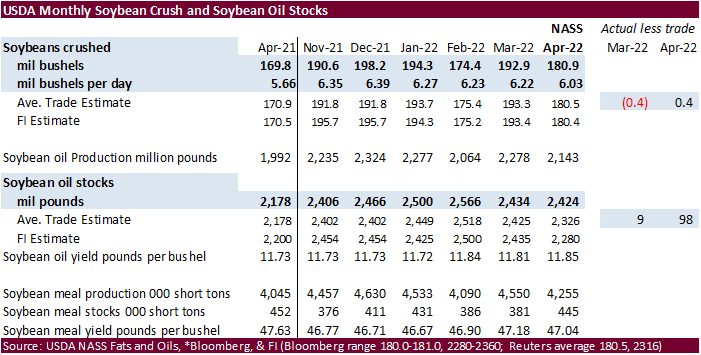

·

The US April soybean crush was reported at 180.9 million bushels, 0.4 million above trade expectations, below 192.9 million crushed during March and well up from 169.8 million during April 2021. On a daily adjusted basis, the

April crush was lowest since September 2021. End of April soybean oil stocks fell 10 million pounds from end of March and was 98 million pounds above an average trade guess. Soybean oil production of 2.143 billion fell 135 million pounds from March. Note the

yield was 11.85, up from 11.81 pounds per bushel previous month. Soybean meal stocks increased to 445,000 short tons at the end of April from 381,000 short tons at end of March.

·

Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the

2022/2023 marketing year.

·

Today China planned to sell about 505,000 tons of imported soybeans from reserves. We heard only 36,300 tons of soybeans were sold.

·

Today the USDA was in for 5,710 tons of packaged veg oil for use in export programs for shipping July 1-25, with notice following day.

Updated

6/1/22

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $375-$465

Soybean

oil – July 76-81 (down 100, down 300)

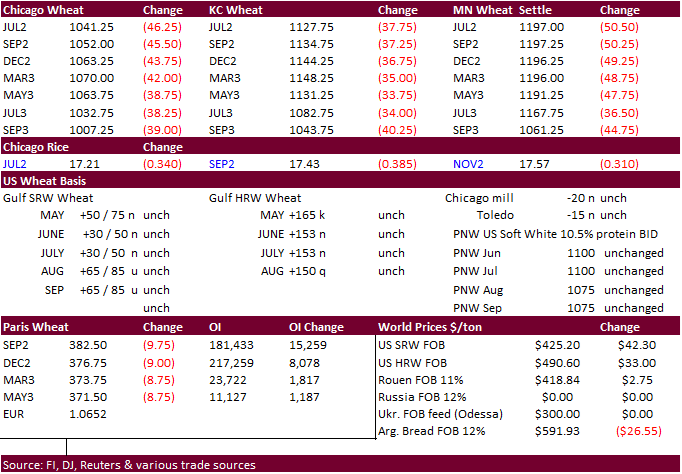

·

Wheat futures started the day mostly higher led by KC type wheat before heavy selling set in. July Chicago wheat hit its lowest level since April 8 before settling 46.25 cents lower at $10.4125. KC July wheat fell 37.25 cent and

July MN was down a large 50.50 cents. Funds sold an estimated net 16,000 Chicago wheat contracts.

·

Egypt bought 465,000 tons of wheat.

·

September EU wheat futures were down 9.75 euros per ton at 380.50 euros, near a one month low.

·

While US weather conditions are improving for the central and upper Great Plains, last week’s rains were too late to boost crop ratings for the southwestern states.

US

winter wheat crop conditions increased one point to 29 percent G/E, at trade expectations. This was the lowest rating for this week since 2006.

USDA

NASS reported US spring planting progress at 73 percent, 6 points above trade expectations, above 49 week earlier and compares to 97 percent year ago and 92 for the five-year average.

·

Ukrainian grain traders union estimated the 2022 Ukraine wheat crop at 19.2 million tons, down 42 percent from last year. Traders estimate the crop between 17 and 21 million tons.

·

Egypt bought 465,000 tons of wheat consisting of 175,000 tons of Russian, 240,000 tons Romanian, and 50,000 tons of Bulgarian origin. The tender called for shipping for fob offers from July 20-31 and/or August 1-10, while shipping

for c&f will be from August 1-20.

·

Algeria started buying optional origin wheat for July/August shipment. AgriCensus noted at least 100,000 tons have been bought at around $480/ton C&F, above $466 they paid mid-May.

·

Results awaited: The Philippines are in for 55,000 tons of feed wheat on June 1 for July 15 through September 27 shipment.

·

Jordan bought 60,000 tons of feed barley at $445/ton c&f for shipment first half of September.

Rice/Other

·

None reported

Updated

6/1/22 (July lowered $1.00)

Chicago

– July $9.50 to $12.00 range,

December $8.50-$12.50

KC

– July $10.50 to $12.75 range,

December $8.75-$13.50

MN

– July $10.75‐$13.00,

December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.