PDF Attached includes updated news/maps from the weekend.

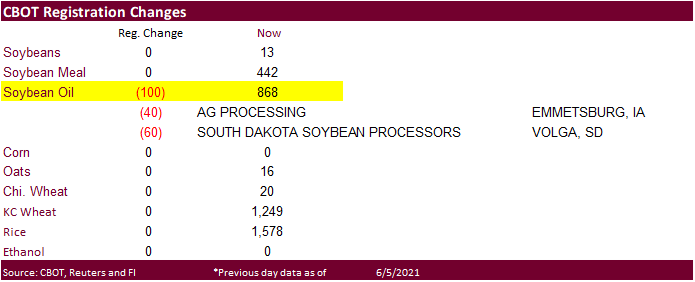

100

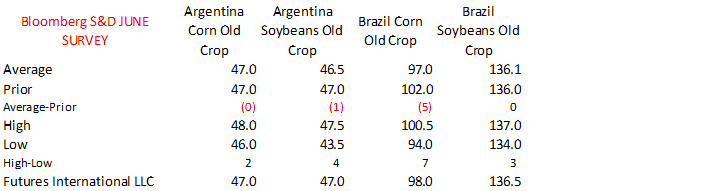

soybean oil registrations were cancelled out of 2 locations (Emmetsburg, IA and Volga, SD, on Friday (SBO registrations stand at 868).

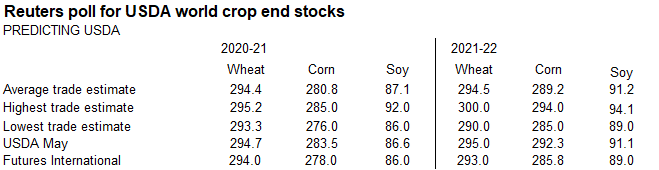

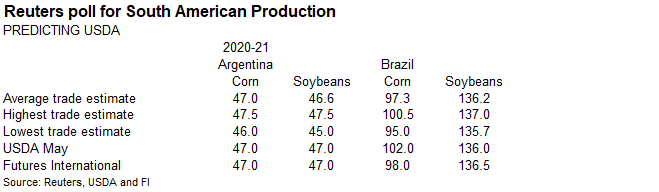

World

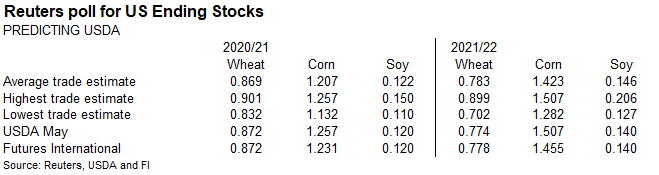

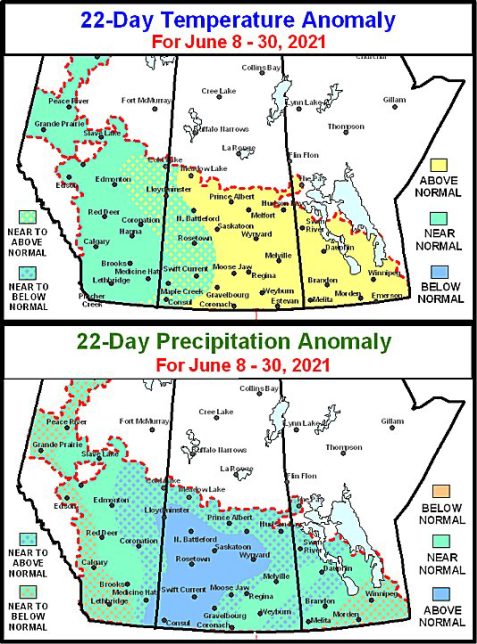

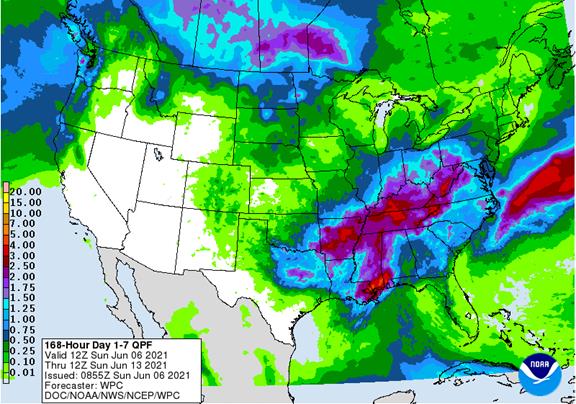

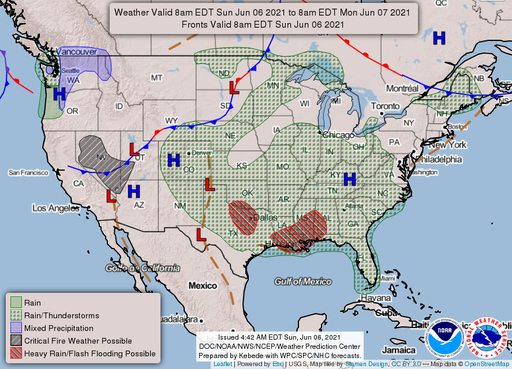

Weather on Sunday emailed a report calling for the Canadian Prairies to improve over the next couple of weeks. Attached is our updated US wheat production by class and balance sheet. Trade estimates for WASDE included below. CBOT agriculture markets rebounded

Friday. The fundamentals were unchanged. The major difference from Thursday was a reversal in the USD. Some weather maps turned a touch drier for the US on Friday. The northern Plains have an opportunity for rain early next week when the ridge shifts back

across the western areas of the US. This would be beneficial after this week’s heat event.

Source:

World Weather Inc.

As

of Sunday am

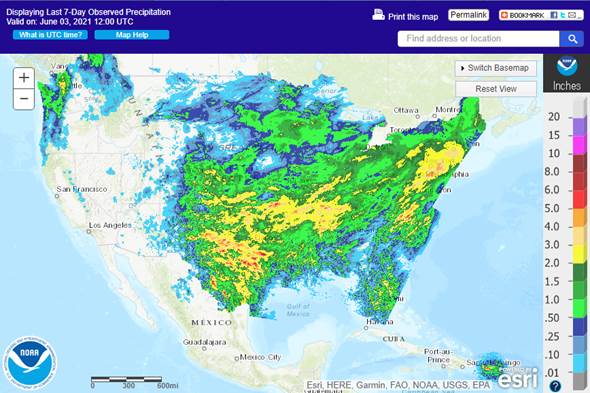

Past

week (through Friday afternoon)

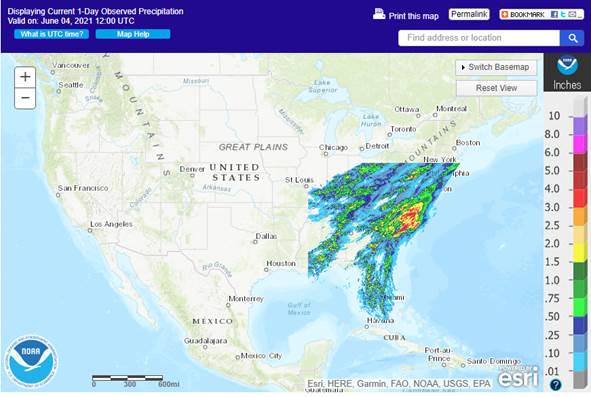

Sunday

WORLD

HIGHLIGHTS

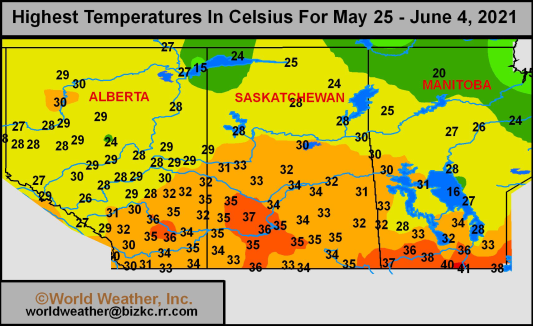

- Too

much heat and dryness has occurred this week across the northern Plains, upper Midwest and southern Canada Prairies resulting in notable crop and livestock stress

o

Some relief is expected this weekend, but many areas will remain too dry for an extended period of time

o

An extreme high of 104 degrees Fahrenheit occurred At Fort Qu’Appelle, SK Thursday afternoon and extremes over 100 were also noted in interior western North Dakota and eastern Montana

- Weather

computer forecast modeling continues to be divergent over how much relief from dryness will occur in the coming ten days in the northern Plains, upper Midwest and southeastern parts of Canada’s Prairies

o

World Weather, Inc. expects some rain, but not enough to make a big difference in long term soil moisture

- The

long term weather outlook will perpetuate a restricted rainfall pattern for many of these areas - Lower

U.S. Midwest, Delta and southeastern states weather will be favorably mixed over the next ten days supporting most crop needs, although it is still questionable how much relief will occur to dryness in some southeastern locations - West

Texas rainfall frequency and intensity will decrease while temperatures trend warmer and this will improve planting, emergence and establishment conditions for corn, sorghum, cotton and other crops in the region

o

Recent rain bolstered soil moisture in many areas, but there is still some dryness in southwestern dryland production areas in the region

- U.S.

Pacific Northwest dryland winter crop areas have been hurt by the lack of rain and recent warm to hot temperatures while wheat and other crops were reproducing and beginning to fill

o

Irrigated crops are still in good shape and the same is true for spring and summer crop areas that are more dependent on irrigation

- Drought

in the western U.S. is still a big concern for water supply and eventual forest fires

o

Relief is unlikely and there will be some excessive heat in the second week of the two week outlook over parts of the region

- Canada’s

Prairies crops are still hurting from limited moisture, although temporary relief in May was a boon to crop emergence and early development

o

Rain is now needed once again

o

Western and northern parts of the Prairies will receive the greatest rainfall in the coming week

o

Second week rainfall will become more limited and temperatures will heat up again after a period of somewhat milder weather in this coming week

o

Crop stress will remain greatest in the southeastern Prairies where dryness relief will be more limited

- Southeast

Canada crop weather will remain mostly good for corn, soybeans and wheat, although some net drying is expected due to lack of rainfall and warm temperatures in the coming week - East-central

China will continue drying out for the next ten days

o

Below average precipitation and warm temperatures will prevail through the weekend in most of east-central China and northward to Inner Mongolia

o

The environment will be good for winter wheat maturation and harvesting as well as late season planting of summer crops

o

Some showers will occur near and north of the Yellow River next week offering some relief

o

Areas from eastern Sichuan to Shandong and northern Jiangsu will not see much rain for the next ten days to two weeks

- Crop

moisture stress will begin this weekend and continue next week as the region starts to notably dry down in unirrigated areas - Northeastern

China will experience a little less rain and some warming during the coming week

o

The environment will improve soybean, corn and many spring crops

- Xinjiang

China will cool down into Saturday and keep its below average degree day accumulations for cotton and other crop areas through mid-month

o

Showers are most likely in the northeast late this weekend and again later next week

- A

few strong thunderstorms will occur today into Saturday

o

A brief period of warming is expected early to mid-week next week and then more cooling will occur in the following weekend

- Rain

is expected late next week and into the following weekend as well - Less

rain in southeastern China into the weekend will help flood water recede; however, there will still be periods of rain along in the southern coastal provinces and rain will return next week suggesting improvement will come slowly for Fujian

o

Fujian, China has been excessively wet recently as have a few areas west from Jiangxi into Huna

- Drying

will be welcome throughout this region, although it may not last long - Russia’s

southern New Lands will be wetter biased and a little cooler into the weekend along with parts of Kazakhstan

o

The moisture and temperature change will provide improvements for crop and field conditions after recent weeks of dry and warm conditions

- Russia’s

New Lands will trend a little drier and warmer later next week and into the following weekend

o

The returning drier and warmer bias may eventually add new stress to crops that have already had a stressful start to the growing season

- Western

Australia will be drier biased for a while, but recent rain was welcome

o

wheat, barley and canola establishment is improving after recent rain

o

Additional planting will take place in this week’s drier weather

- Eastern

Australia received some rain this week and more is needed

o

New South Wales, southern Queensland and South Australia have been dry this autumn and the moisture boost has been improving dryland planting

o

Additional rain early to mid-week next week should prove very important and beneficial for crop planting, emergence and establishment

- India’s

monsoon will produce below average rainfall for many areas in the coming week

o

Monsoon performance will be a little sporadic for a while in early June, but some increase in rainfall is expected in the south and west-central parts of the nation later this month to support early season planting of summer crops

o

Rainfall will increase in eastern and some central crop areas June 10-17 while the west remains drier than usual

- Brazil’s

weather outlook is a little wetter today in Minas Gerais, Sao Paulo and northern Mato Grosso do Sul for next week

o

The precipitation event may be overdone and it comes rather late in the Safrinha crop season to change the bottom line much

- Some

improvement in grain quality and there is a slight chance for enhanced yield - Tropical

Depression Blanca dissipated west of Mexico Thursday and overnight - Tropical

Storm Choi-Wan has moved north of the Philippines and will not have much impact of eastern Asia during the next few days as the system continues to weaken and shift to the northeast

o

The storm brought some beneficial moisture to some of the drier areas in the Philippines

o

Crop damage was minimal

- Eastern

and southern Mexico rainfall will continue for a few more days before trending drier again late this weekend into next week

o

Drought will prevail in western parts of the nation, but dryness in the east is slowly easing

- Argentina’s

weather over the next two weeks will be well mixed in the east with sufficient drying time to support ongoing harvest progress while enough rain falls to ensure good wheat planting and emergence conditions

o

Rain is needed in Cordoba and neighboring areas, but most other wheat production areas have good planting moisture

- South

Africa rain will continue to receive restricted rainfall over the coming week

o

Winter wheat planting and establishment will continue, although there is need for rain in Free State and other areas in the east

- West

Africa rainfall will increase over the next ten days

o

Greater rain is needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

- A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

- East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will continue well below average during much of the next week to ten days

- Mainland

areas of Southeast Asia rainfall continues lighter and more sporadic than usual and this trend will continue through the weekend and into next week with some improvement possible June 11-18 - Indonesia

and Malaysia rainfall was sporadic and light Thursday

o

There is still a need for greater rainfall

o

Rainfall is expected to be erratic and light at times during the next week to ten days, but all areas will get at least some rain at one time or another

- Philippines

rainfall this week was welcome and improved crop and field conditions in many areas

o

There is still need for greater rainfall in Luzon Island

- Europe

weather will improve this week because of greater rainfall in Spain, southern France, some areas in Italy and a part of the Balkan Countries

o

Portions of each region has been a little drier than usual in recent weeks

o

Crop moisture elsewhere should remain favorably rated, although net drying is expected in the Baltic Plain and neighboring areas of northeastern Europe

- Southern

Oscillation Index is mostly neutral at +4.45 and the index is expected to move lower over the few several days - North

Africa weather in the coming week will include a few showers and thunderstorms causing some disruption periodically to harvest progress for wheat and barley

o

No winter crop quality issues are expected

- New

Zealand weather during the coming week to ten days will be drier than usual with temperatures near to above average

o

the exception will be along the west coast of South Island and in the far northwest tip of North Island where rain is expected this weekend into next week

Source:

World Weather, Inc.

Monday,

June 7:

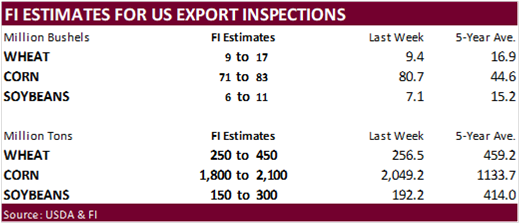

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions, planting — corn, cotton, soybeans, wheat, 4pm - China

customs to publish trade data, including imports of soybeans, edible oils, meat and rubber - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Malaysia, New Zealand

Tuesday,

June 8:

- Australian

crop report - International

Grains Council Conference, day 1 - France

agriculture ministry’s monthly crop estimates

Wednesday,

June 9:

- EIA

weekly U.S. ethanol inventories, production - International

Grains Council Conference, day 2 - FranceAgriMer

releases monthly grains report

Thursday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Malaysian

Palm Oil Board inventory, output and export data for May - Brazil’s

Conab releases output, yield and acreage data for corn and soybeans - Port

of Rouen data on French grain exports - Malaysia

June 1-10 palm oil export data

Friday,

June 11:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

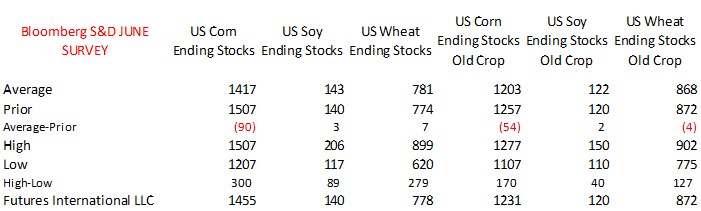

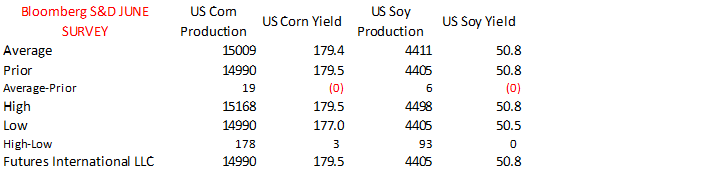

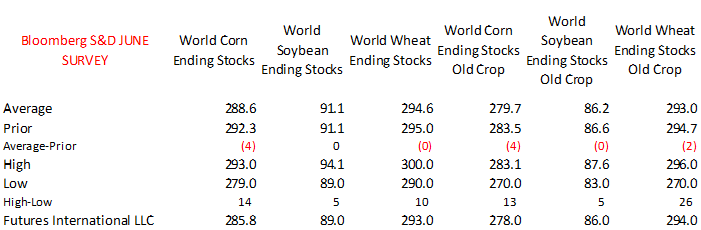

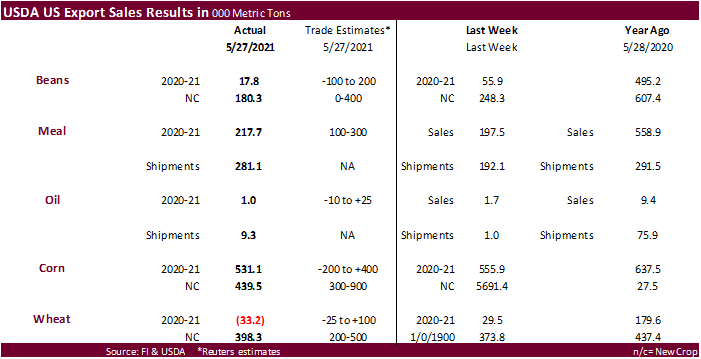

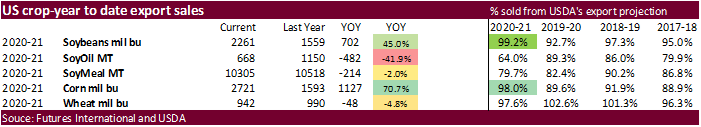

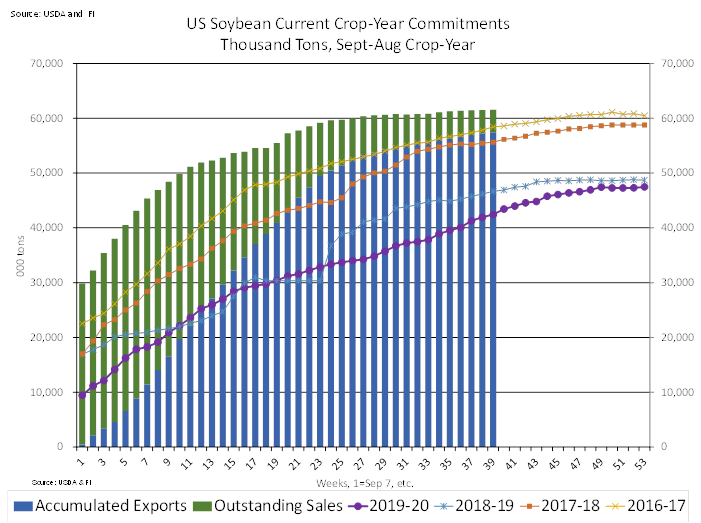

USDA

Export Sales

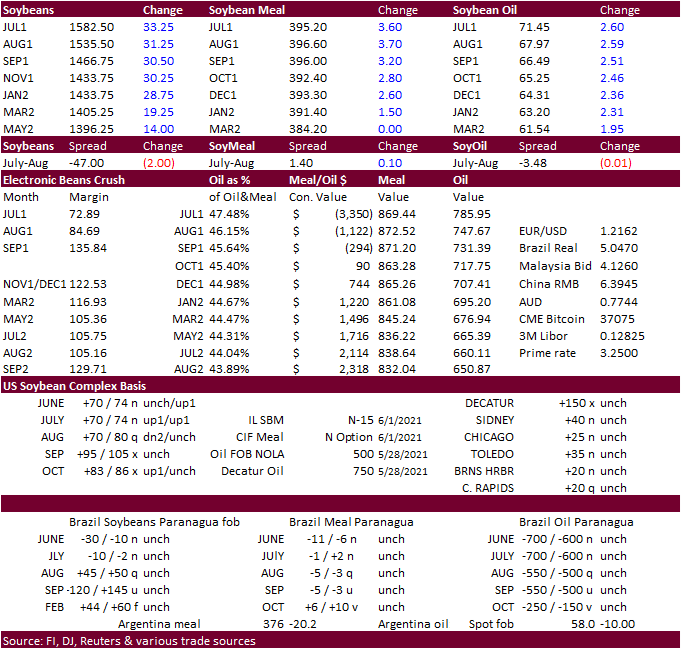

Soybean

sales were light and corn better than expected due to higher than expected old crop sales.

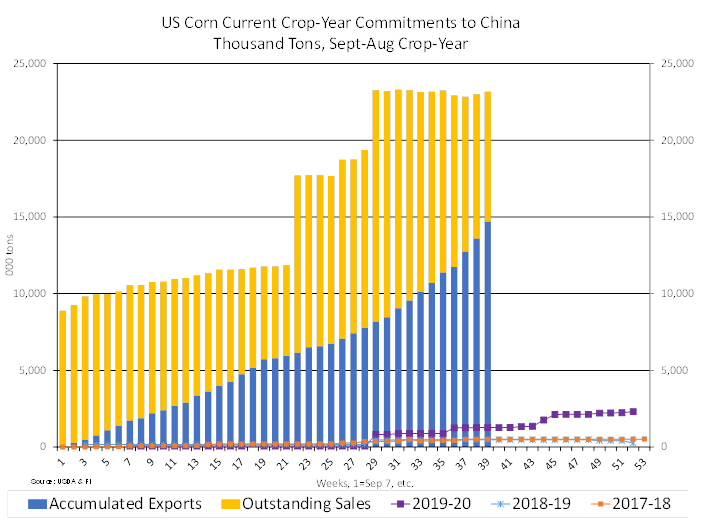

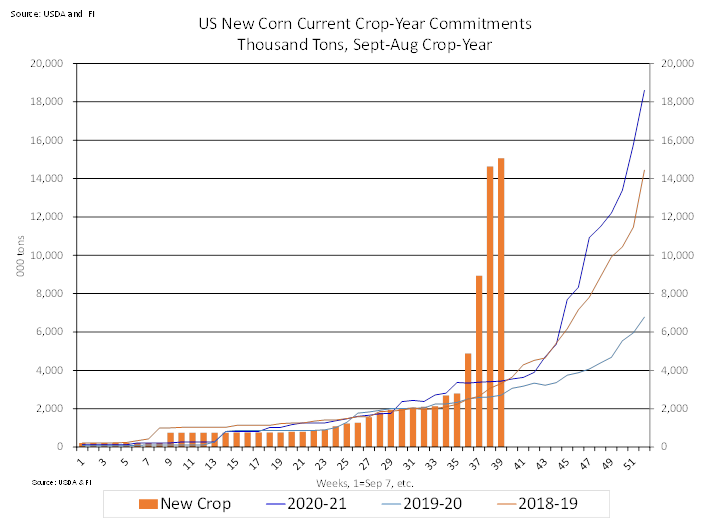

US

soybean export sales were near the low end of a range of expectations for old and new crop combined. Meal sales were 217,000 tons and soybean oil only 1,000 tons. Soybean meal shipments improved to 281,100 tons from 192,100 tons previous week and soybean

oil shipments were 9,300 tons versus 1,000 week earlier. US corn export sales for old crop were better than expected at 531,100 tons and new crop sales were 439,500 tons. China bought 2 cargoes of old crop corn (158,500 MT, including 63,800 MT switched from

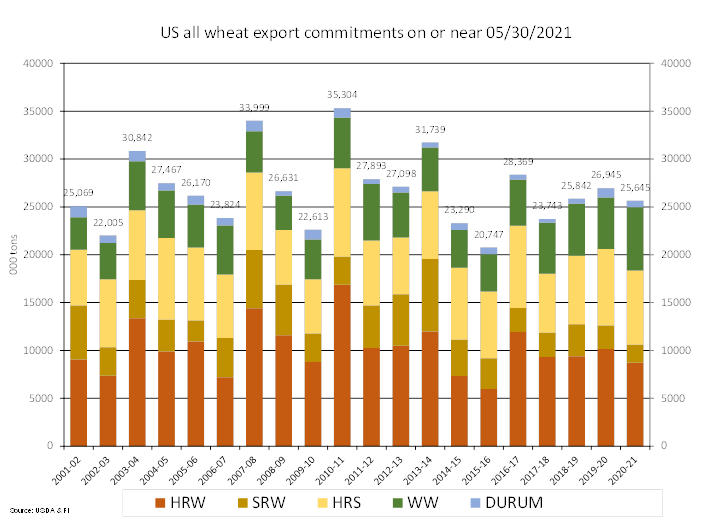

unknown destinations). Sorghum sales were only 2,700 tons. Pork sales were 24,300 tons. All wheat old crop sales were negative 33,200 tons and new-crop 398,300 tons, a decent figure.

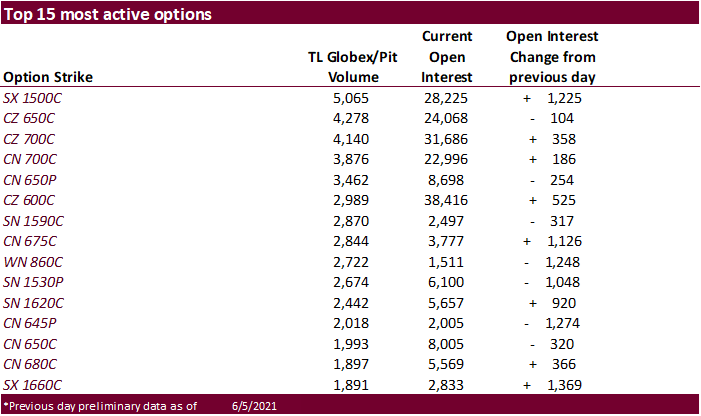

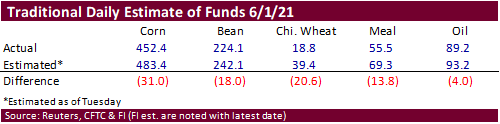

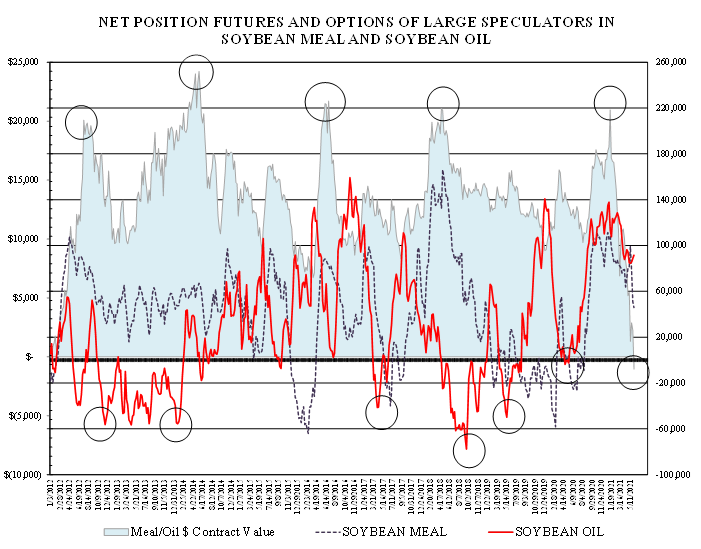

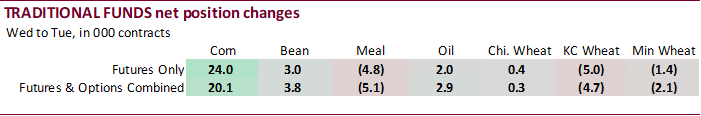

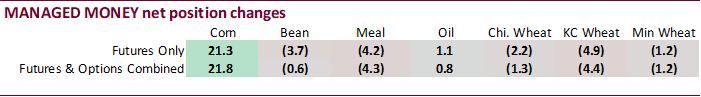

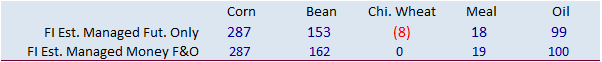

Funds

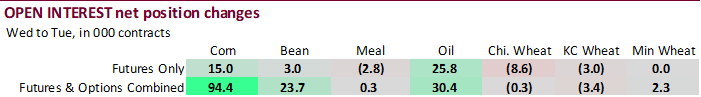

were less long than estimated for the 5 major CBOT commodities we follow on a daily basis, bit don’t see any price reaction from the positions as prices were back and forth Tuesday through Thursday before rallying Friday. Traditional funds and money managers

added to their net long position in corn for the week ending 6/1, while decreased their net long positions for the soybean complex, by a small amount. Note for futures and options combined, open interest in corn was up sharply by 94,400 contracts while futures

only open interest rose 15,000. Last week into Tuesday, corn option volume was heavy for a few of those days.

The

meal/oil contract value had a large change over the short term but we don’t see a recovery until soybean oil prices cool.

US

Change In Nonfarm Payrolls May: 559K (est 674K; prevR 278K; prev 266K)

US

Unemployment Rate May: 5.8% (est 5.9%; prev 6.1%)

US

Average Hourly Earnings (M/M) May: 0.5% (est 0.2%; prevR 0.7%; prev 0.7%)

US

Average Hourly Earnings (Y/Y) May: 2.0% (est 1.6%; prevR 0.4%; prev0.3%)

US

Change In Private Payrolls May: 492K (est 610K; prevR 219K; prev 218K)

US

Change In Manufacturing Payrolls May: 23K (est 25K; prevR -32K; prev -18K)

US

Average Weekly Hours All Employees May: 34.9 (est 34.9; prevR 34.9; prev 35.0)

US

Labour Force Participation Rate May: 61.6% (est 61.8%; prev 61.7%)

US

Underemployment Rate May: 10.2% (prev 10.4%)

Canadian

Net Change In Employment May: -68.0K (est -25.0K; prev -207.1K)

Canadian

Unemployment Rate May: 8.2% (est 8.2%; prev 8.1%)

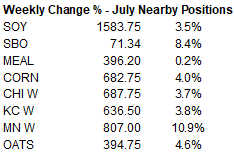

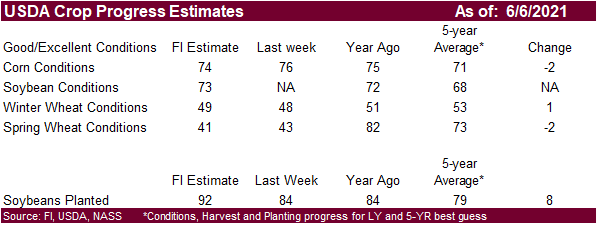

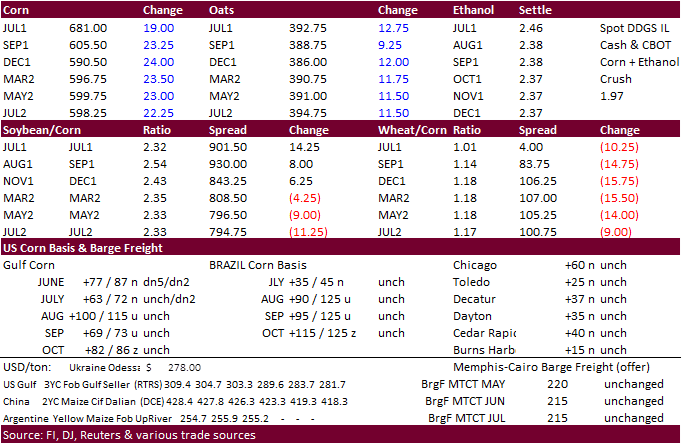

Corn

- US

corn futures surged again on US weather. Corn open interest was down only 1,040 contracts on Friday. USDA old crop export sales exceeded expectations and China booked a couple of old crop corn cargoes, a surprise. Net drying is seen across the US over the

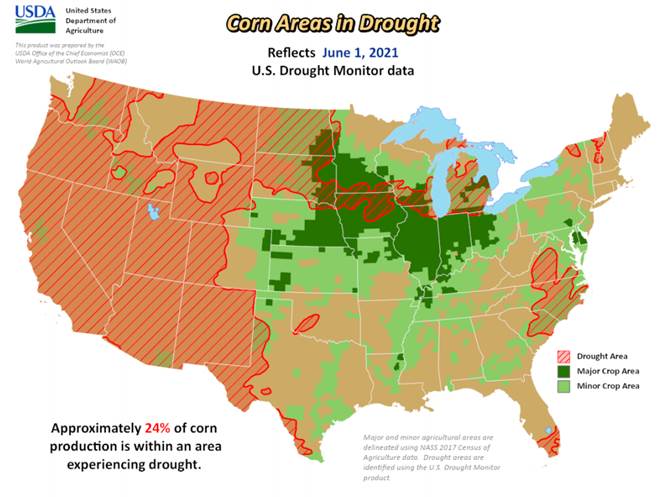

next week, bias IA, MN and parts of the upper Midwest. 24

percent of the US corn area is experiencing drought conditions with 6 percent severe and 1 percent exceptional. For comparison, in mid-August 2020, about 30 percent of the US corn area was experiencing drought.

- For

the week July corn was up 4.0% and July Oats up 4.6%. - Brazil

has a chance for rain. Yesterday’s GFS model runs showed rains developing across the Brazil Safrinha corn areas of Mato Grosso do Sul into southern Minas Gerais Tuesday through Thursday of next week.

- Ukraine

completed their spring plantings. - Cargill’s

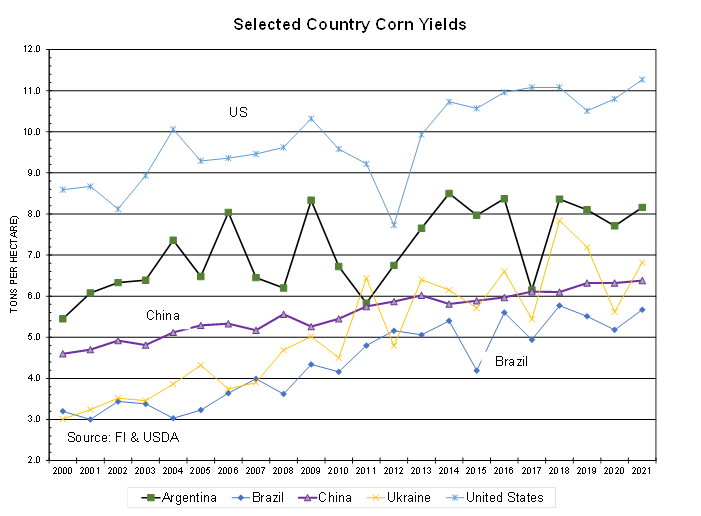

chief executive said China’s feed grain industry is unlikely to become self-sufficient despite efforts to ramp up domestic production. We agree over the medium term, but China has a chance to significantly expand corn yields by adopting GMO. They could potentially

add 20 to 35 percent more corn to their production over the next 5 to 10 years.

Export

developments.

EIA:

U.S. energy consumption in 2020 increased for renewables, fell for all other fuels

https://www.eia.gov/todayinenergy/detail.php?id=48236&src=email

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

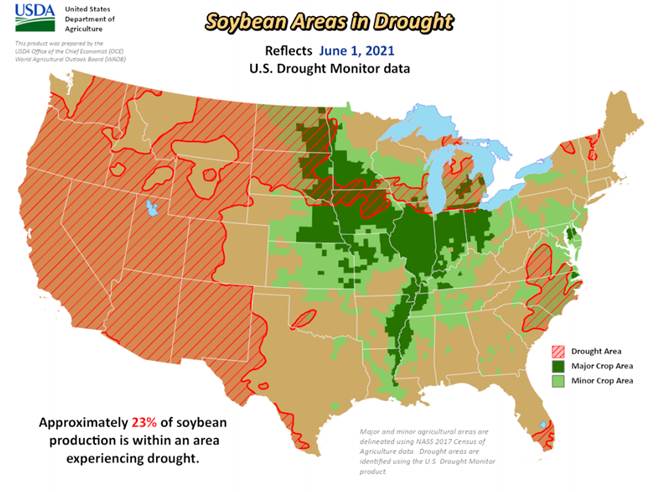

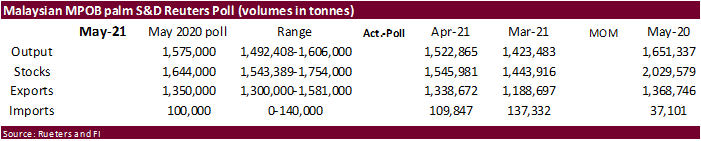

Soybeans

-

The

soybean complex was higher on US weather concerns. Canola also rallied on wheat with the dry bias across the Canadian Prairies. USDA export sales for soybeans were poor. Product sales were near expectations. Traders should focus on US domestic demand &

shipments rather than export commitments for the remainder of the crop year.

-

23

percent of the US soybean crop area is experiencing some type of drought condition. Of that, only 2 percent is extreme and one percent exceptional. 66 percent is severe.

-

Outside

product market values were mixed on Friday, but that didn’t impact today’s rally in soybean meal and soybean oil. Malaysian palm ended 29 MYR lower and cash was unchanged at $1,065/ton. For the week palm was up 3 percent. European rapeseed oil cash prices

surged from yesterday and soybean oil was lower. -

Soybean

oil failed to test yesterday’s contract high basis the July. For the week it was up 8.4 percent. For the week meal was up 0.2% and July soybeans up 3.5%.

- Egypt’s

GASC seeks vegetable oils on June 8 and requested payment with a 180-day letters of credit. Arrival is for August 1-20.

- Iran’s

GTC bought 30,000 tons of each soybean oil and sunflower oil for June/July shipment. The soybean oil could be sourced from South America. Prices were not provided.

Updated

6/2/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 67-72.50; December 55-68 cent range

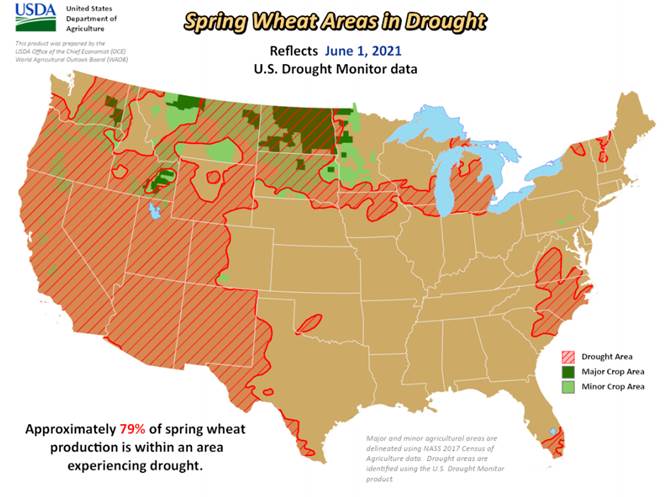

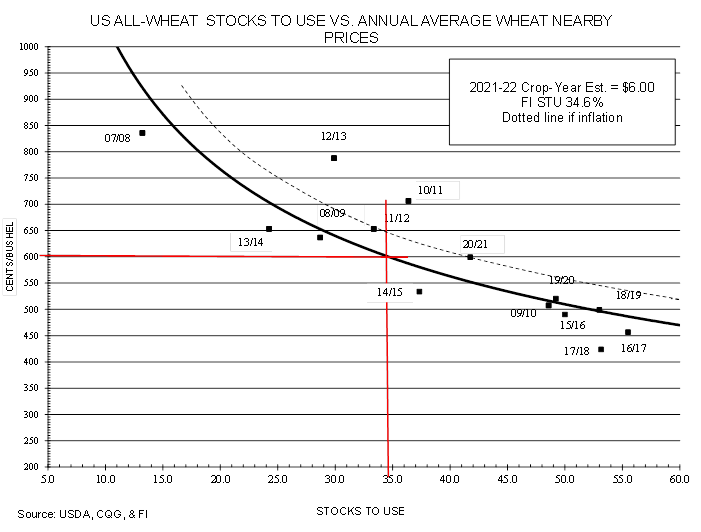

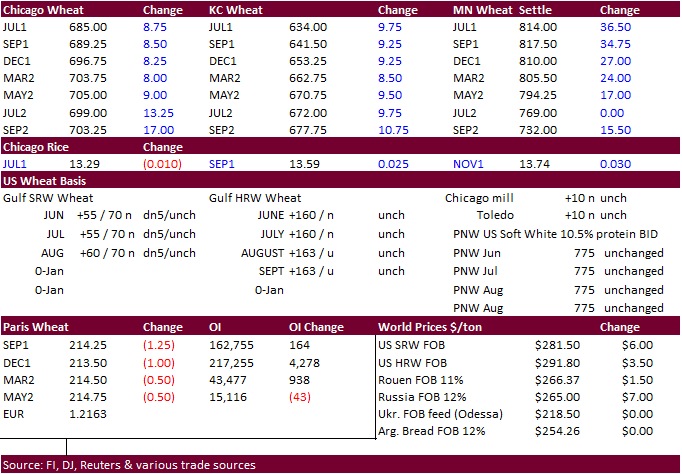

- Fresh

contract highs in Minneapolis wheat led the US and EU markets higher today

on adverse US weather. Note the weather forecast also calls for rain across the northern US Plains from the shift in the ridge Tuesday and Wednesday next week. Rain, even light amounts, would be welcome after the heat event during the second half of this

week. Hottest temperature for the Dakotas could happen on Saturday (see high temperature map in the weather section).

- For

those trading MN wheat, it might be worthy to know the last trade of the day was the session, or new contract high.

- July

Minn wheat was up 32.25 cents today and up 10.9% for the week. July Chicago was up 11.50 on Friday and up 3.7% for the week. July KC was up 12.25 cents and for the week up 3.8%.

- 79

percent of the US spring wheat area is experiencing drought conditions with 39% severe and 11% exceptional.

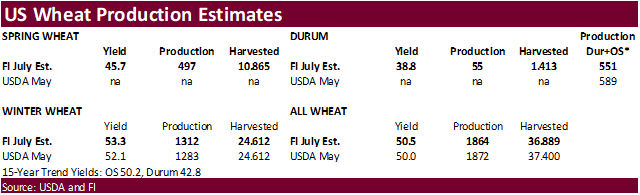

- US

hard red spring abandonment could end up high this crop year. A ten-year trend abandonment would suggest 5.1% harvested/planted. We think it could be as high as 10% this year if conditions fail to improve. That would be the highest abandonment since 2002

when abandonment was 15%. In that year, nationwide, the “U.S. racked up its fifth warmest summer on record, as temperatures in the Great Basin and Rockies averaged around 2 to 4 degrees above normal,” according to the USDA crop production summary.

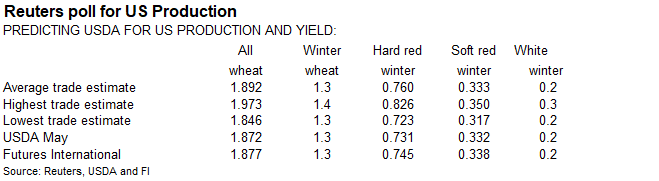

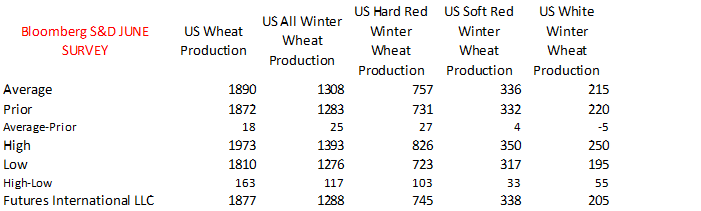

- USDA

estimates the combined durum and spring wheat production at 589 million bushels. Using the last spring wheat crop condition, we think production is 38 million bushels below that level at 551 million. For the purpose of the June S&D, USDA may leave the other

spring and durum production unchanged. The first survey for the spring crop is July. Working July estimates below.

- Attached

we included FI’s US wheat production broken down by class. - IHS

Markit on Friday estimated the US wheat production at 1.924 billion bushels, much higher than our working estimate. They are using 1.3 billion for winter, 505 million for HRW, 55 million for spring white and 64 million for durum.

- The

US Wheat Associates weekly harvest report noted harvest delays continue in Texas with cool and wet weather, and conditions improved from central Oklahoma north with warmer and drier weather. They noted overall the SRW wheat crop looks good.

- French

wheat crop conditions as of May 31 were unchanged from the previous week at 80 percent. Winter and spring barley each declined by 1 point, to 76% and 84%.

- September

Paris wheat market basis September was down 0.75 euros at 214.75. EU wheat was up nearly 2 percent for the week.

- Tunisia

looks for their grain crop to be up 7 percent to 1.65 million tons from 1.5 million last year.

- Russia’s

wheat export duty increased June 9 to $29.40/ton from $28.10. Corn goes to $50/ton, down from $52.20.

- Iran’s

GTC bought 195,000 tons of milling wheat for June/July shipment. Prices were not provided.

- Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment. - Jordan

seeks 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment.

Rice/Other

·

South Korea bought an estimated 94,400 tons of rice out of 134,994 tons sought, on May 13, at $986.00 and $989.00 a ton c&f from China and at $572.00 and $578.50 a ton c&f from Vietnam. Arrival

is for between September 2021 and January 2022.

·

Egypt seeks 100,000 tons of raw cane sugar on June 5.

·

Pakistan received offers for white sugar, with lowest at $533.90/ton c&f.

Updated

6/2/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.50-$8.50

U.S.

EXPORT SALES FOR WEEK ENDING 5/27/2021

|

|

||||||||

|

|

CURRENT |

NEXT |

||||||

|

COMMODITY |

NET |

OUTSTANDING |

WEEKLY |

ACCUMULATED |

NET |

OUTSTANDING |

||

|

CURRENT |

YEAR |

CURRENT |

YEAR |

|||||

|

|

THOUSAND |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

|

-3.9 |

393.7 |

641.3 |

63.8 |

8,331.4 |

9,526.2 |

142.6 |

1,260.1 |

|

|

2.9 |

126.6 |

128.8 |

31.0 |

1,743.7 |

2,317.8 |

35.4 |

861.9 |

|

|

-8.7 |

424.6 |

1,040.1 |

108.3 |

7,337.4 |

6,960.3 |

107.9 |

1,274.6 |

|

|

-23.5 |

324.6 |

614.2 |

40.1 |

6,280.8 |

4,750.9 |

112.4 |

944.3 |

|

|

0.0 |

28.6 |

43.4 |

0.0 |

653.8 |

922.1 |

0.0 |

8.4 |

|

|

-33.3 |

1,298.0 |

2,467.8 |

243.2 |

24,347.1 |

24,477.3 |

398.3 |

4,349.4 |

|

BARLEY |

0.4 |

2.6 |

9.2 |

0.0 |

26.8 |

41.1 |

0.0 |

22.2 |

|

CORN |

531.1 |

17,843.5 |

11,461.2 |

2,127.4 |

51,264.8 |

29,011.1 |

439.5 |

15,067.4 |

|

SORGHUM |

-2.7 |

1,067.7 |

1,320.9 |

236.3 |

6,167.6 |

2,625.9 |

184.9 |

1,594.9 |

|

SOYBEANS |

17.8 |

4,071.0 |

6,731.3 |

221.7 |

57,466.0 |

35,705.2 |

180.3 |

7,450.6 |

|

SOY |

217.7 |

2,034.2 |

2,419.9 |

281.1 |

8,270.4 |

8,098.2 |

0.5 |

637.7 |

|

SOY |

1.0 |

50.5 |

257.7 |

9.3 |

617.3 |

892.4 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

|

6.7 |

220.8 |

251.2 |

11.5 |

1,414.3 |

1,210.2 |

0.0 |

0.0 |

|

|

0.0 |

16.1 |

32.6 |

0.3 |

24.8 |

63.9 |

0.0 |

0.0 |

|

|

11.3 |

13.5 |

12.6 |

0.3 |

37.1 |

55.0 |

0.0 |

0.0 |

|

|

0.1 |

45.1 |

42.6 |

0.4 |

111.2 |

76.1 |

0.0 |

0.0 |

|

|

3.3 |

59.5 |

46.3 |

2.4 |

539.6 |

798.1 |

0.0 |

0.0 |

|

|

3.2 |

185.2 |

169.1 |

19.3 |

497.4 |

545.2 |

0.0 |

0.0 |

|

|

24.5 |

540.1 |

554.4 |

34.1 |

2,624.4 |

2,748.5 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND |

||||||

|

UPLAND |

180.8 |

3,130.8 |

5,010.3 |

366.5 |

12,596.6 |

11,315.4 |

98.8 |

2,020.1 |

|

|

7.3 |

158.1 |

143.5 |

13.6 |

646.7 |

413.7 |

0.0 |

4.0 |

This

summary is based on reports from exporters for the period May 21-27, 2021.

Wheat: Net

sales reductions of 33,300 metric tons (MT) for 2020/2021 were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Brazil (16,500 MT, including 15,000 MT switched from Mexico), Jamaica (8,900 MT, including 8,500

MT switched from unknown destinations), Burma (8,500 MT), Guyana (5,300 MT, including 5,000 MT switched from unknown destinations), and Indonesia (2,000 MT), were offset by reductions primarily for South Korea (44,800 MT), Mexico (13,600 MT), unknown destinations

(12,900 MT), and Malaysia (5,600 MT). For 2021/2022, net sales of 398,300 MT were primarily for the Philippines (105,500 MT), Japan (65,700 MT), Mexico (52,600 MT), South Korea (48,600 MT), and Nigeria (46,000 MT). Exports of 243,200 MT were down 54 percent

from the previous week and 56 percent from the prior 4-week average. The destinations were primarily to Mexico (63,200 MT), South Korea (57,700 MT), Burma (33,800 MT), Malaysia (23,400 MT), and Brazil (16,500 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 63,900 MT is for Spain.

Corn:

Net sales of 531,100 MT for 2020/2021 were down 5 percent from the previous week, but up noticeably from the prior 4-week average. Increases primarily for Japan (179,500 MT, including 126,000 MT switched from unknown destinations and decreases of 2,900 MT),

China (158,500 MT, including 63,800 MT switched from unknown destinations), South Korea (138,000 MT, including decreases of 5,000 MT), Costa Rica (97,400 MT), and Colombia (80,300 MT, including 89,000 MT switched from unknown destinations and decreases of

13,900 MT), were offset by reductions primarily for unknown destinations (227,000 MT). For 2021/2022, net sales of 439,500 MT were primarily for unknown destinations (202,400 MT), Japan (150,800 MT), Mexico (64,300 MT), and Canada (14,200 MT). Exports of

2,127,400 MT were up 15 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to China (1,112,500 MT, including 76,100 MT – late), Mexico (302,300 MT), Japan (280,100 MT, including 97,900 MT – late), South

Korea (140,200 MT, including 9,000 MT – late), and Colombia (109,900 MT).

Optional

Origin Sales:

For 2020/2021, options were exercised to export 129,000 MT to South Korea (79,000 MT) and unknown destinations (50,000 MT) from the United States. The current outstanding balance of 80,500 MT is for unknown destinations. For 2021/2022, the current outstanding

balance of 60,000 MT is for unknown destinations.

Late

Reporting:

For 2020/2021, exports totaling 183,000 MT of corn were reported late to Japan (97,900 MT), China (76,100 MT), and South Korea (9,000 MT).

Barley:

Total net sales of 400 MT for 2020/2021 were for South Korea. No exports were reported for the week.

Sorghum:

Net sales reduction of 2,700 MT for 2020/2021 resulting in increases for China (65,300 MT, including 68,000 MT switched from unknown destinations and decreases of 8,900 MT), were more than offset by reductions for unknown

destinations (68,000 MT). For 2021/2022, net sales of 184,900 MT were for China (129,900 MT) and unknown destinations (55,000 MT). Exports of 236,300 MT were up 45 percent from the previous week and 62 percent from the prior 4-week average. The destination

was to China.

Export

Adjustment: Accumulated

exports of sorghum to unknown destinations were adjusted down 30,086 MT for week ending May 20th. This shipment was reported in error.

Rice:

Net sales of 24,500 MT for 2020/2021 were down 31 percent from the previous week and 50 percent from the prior 4-week average. Increases primarily for the United Kingdom (10,000 MT), Mexico (9,600 MT), Canada (2,900 MT), Japan (1,800 MT), and El Salvador

(1,800 MT, including 2,500 MT switched from Honduras and decreases of 700 MT), were offset by reductions primarily for Honduras (2,500 MT). Exports of 34,100 MT were down 54 percent from the previous week and from the prior 4-week average. The destinations

were primarily to Japan (14,200 MT), El Salvador (5,800 MT), Guatemala (4,400 MT), Mexico (2,200 MT), and Canada (2,100 MT).

Exports

for Own Account:

For 2020/2021, new exports for own account totaling 100 MT were for Canada. Exports for own account totaling 100 MT to Canada were applied to new or outstanding sales. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 17,800 MT for 2020/2021 were down 68 percent from the previous week and 82 percent from the prior 4-week average. Increases primarily for Japan (41,000 MT, including 9,000 MT switched from unknown destinations and decreases of 200 MT), Colombia

(15,500 MT, including 13,000 MT switched from unknown destinations), Canada (10,900 MT), Indonesia (5,900 MT, including decreases of 500 MT), and Taiwan (5,200 MT, including decreases of 500 MT), were offset by reductions primarily for unknown destinations

(72,000 MT). For 2021/2022, net sales of 180,300 MT were for unknown destinations (132,000 MT), Mexico (34,000 MT), China (10,000 MT), Panama (5,600 MT), and Taiwan (4,300 MT), were offset by reductions for Costa Rica (5,600 MT). Exports of 221,700 MT–a

marketing-year low–were down 25 percent from the previous week and from the prior 4-week average. The destinations were primarily to Mexico (103,400 MT), Japan (34,800 MT, including 3,000 MT – late), Taiwan (19,900 MT), Indonesia (17,400 MT), and Colombia

(15,500 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Late

Reporting:

For 2020/2021, exports totaling 3,000 MT of soybeans were reported late to Japan.

Soybean

Cake and Meal:

Net sales of 217,700 MT for 2020/2021 were up 10 percent from the previous week and 31 percent from the prior 4-week average. Increases primarily for the Philippines (59,100 MT, including decreases of 100 MT), Ecuador (48,000 MT), the Dominican Republic (19,100

MT), Colombia (17,500 MT, including 11,000 MT switched from Ecuador and decreases of 12,200 MT), and Mexico (13,700 MT, including decreases of 4,200 MT), were offset by reductions for El Salvador (700 MT). For 2021/2022, net sales of 500 MT were primarily

for Japan. Exports of 281,100 MT were up 46 percent from the previous week and 64 percent from the prior 4-week average. The destinations were primarily to Colombia (74,700 MT, including 2,300 MT – late), the Philippines (50,500 MT), Ecuador (37,000 MT),

Mexico (29,200 MT), and Israel (18,400 MT).

Late

Reporting:

For 2020/2021, exports totaling 2,300 MT of soybean cake and meal were reported late to Colombia.

Soybean

Oil:

Net sales of 1,000 MT for 2020/2021 were down 41 percent from the previous week, but unchanged from the prior 4-week average. Increases primarily for Jamaica (4,000 MT) and Mexico (600 MT), were offset by reductions primarily for Colombia (3,000 MT). Exports

of 9,300 MT were up noticeably from the previous week, but down 3 percent from the prior 4-week average. The destinations were primarily to the Dominican Republic (7,700 MT), Mexico (1,000 MT), and Canada (600 MT).

Cotton:

Net sales of 180,800 RB for 2020/2021 were up 6 percent from the previous week and 82 percent from the prior 4-week average. Increases were primarily for Pakistan (74,900 RB), China (43,200 RB, including 3,200 RB switched from Vietnam and decreases of 23,100

RB), Vietnam (22,900 RB, including 3,900 RB switched from China, 200 RB switched from Thailand, 100 RB switched from Japan, and decreases of 16,200 RB), Nicaragua (8,800 RB, switched from Vietnam), and Turkey (8,000 RB). For 2021/2022, net sales of 98,800

RB were primarily for South Korea (36,100 RB), Pakistan (24,200 RB), Turkey (13,600 RB), Vietnam (10,300 RB), and Colombia (4,800 RB). Exports of 366,500 RB were up 13 percent from the previous week and 5 percent from the prior 4-week average. Exports were

primarily to China (96,400 RB), Vietnam (96,100 RB), Turkey (33,500 RB), Pakistan (33,400 RB), and Mexico (15,300 RB). Net sales of Pima totaling 7,300 RB were down 42 percent from the previous week and 18 percent from the prior 4-week average. Increases

were primarily for Peru (3,200 RB), India (2,700 RB), China (600 RB), Bangladesh (500 RB), and Pakistan (200 RB). Exports of 13,600 RB were down 22 percent from the previous week and 21 percent from the prior 4-week average. The destinations were primarily

to India (8,900 RB), Vietnam (2,600 RB), Austria (600 RB), Egypt (400 RB), and Italy (300 RB).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance of 13,600 RB is for China (7,600 RB), Vietnam (5,600 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 226,600 pieces for 2021 were down 64 percent from the previous week and 41 percent from the prior 4-week average. Increases primarily for China (135,500 whole cattle hides, including decreases of 15,100 pieces), South Korea (44,700 whole cattle

hides, including decreases of 3,300 pieces), Brazil (20,600 whole cattle hies, including decreases of 100 pieces), Ethiopia (13,100 whole cattle hides), and Mexico (7,500 whole cattle hides, including decreases of 7,100 pieces), were offset by reductions for

Thailand (1,300 pieces). In addition, total net sales reductions of 800 kip skins were for Belgium.

Exports of 418,900 pieces were up 13 percent from the previous week and from the prior 4-week average. Whole cattle hides exports were primarily to China (262,600 pieces), South Korea (50,400 pieces), Mexico (31,500 pieces),

Thailand (25,100 pieces), and Taiwan (11,500 pieces). Exports of 5,200 calf skins were to Italy. In addition, exports of 7,700 kip skins were to Belgium.

Net

sales of 272,000 wet blues for 2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Vietnam (124,500 unsplit), Italy (90,500 unsplit, including decreases of 400 pieces), China (40,900 unsplit), and Thailand

(16,000 unsplit), were offset by reductions for Mexico (100 grain splits). Exports of 208,900 wet blues were up noticeably from the previous week and up 74 percent from the prior 4-week average. The destinations were primarily to Italy (81,300 unsplit and

3,900 grain splits), Vietnam (55,500 unsplit), China (27,400 unsplit and 2,200 grain splits), Thailand (17,000 unsplit), and Mexico (7,000 grain splits and 6,800 unsplit). Net sales of 495,000 splits reported for China (375,300 pounds, including decreases

of 2,700 pounds) and Taiwan (125,700 pounds, including decreases of 3,300 pounds), were offset by reductions of Vietnam (6,000 pounds). Exports of 446,300 pounds were to Vietnam (235,100 pounds), Taiwan (126,000 pounds), and China (85,300 pounds).

Beef:

Net

sales of 12,600 MT reported for 2021 were down 55 percent from the previous week and 38 percent from the prior 4-week average. Increases were primarily for Japan (4,000 MT, including decreases of 600 MT), South Korea (2,500 MT, including decreases of 400

MT), Taiwan (1,900 MT, including decreases of 100 MT), Mexico (1,400 MT, including decrease of 100 MT), and Chile (900 MT). Exports of 12,400 MT–a marketing-year low–were down 36 percent from the previous week and 34 percent from the prior 4-week average.

The destinations were primarily to Japan (4,800 MT), South Korea (3,500 MT), Taiwan (900 MT), China (800 MT), and Mexico (700 MT).

Pork:

Net

sales of 24,300 MT reported for 2021 were down 47 percent from the previous week and 24 percent from the prior 4-week average. Increases primarily for Mexico (13,900 MT, including decreases of 1,600 MT), China (4,800 MT, including decreases of 900 MT), Japan

(1,800 MT, including decreases of 800 MT), Colombia (1,600 MT, including decreases of 100 MT), and Canada (1,200 MT, including decreases of 500 MT), were offset by reductions for South Korea (1,000 MT), Nicaragua (100 MT), and Peru (100 MT). Exports of 36,400

MT were down 24 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), China (9,700 MT), Japan (3,400 MT), South Korea (2,100 MT), and Canada (1,800 MT).

Terry

Reilly

Senior

Commodity Analyst – Grain and Oilseeds

Futures

International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook

Terrace, Il. 60181

W:

312.604.1366

ICE

IM: treilly1

Skype:

fi.treilly

Trading

of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation

to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information

or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.