PDF Attached includes revised daily estimate of funds

Sunday weather maps and crop progress estimates below.

On

Friday, private exporters reported sales of 101,600 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year.

EPA

is finalized a 20.63 billion gallon RFS into gasoline and diesel for 2022, a 9.5% increase over last year’s target. It sounds like a large increase but consider we were still in a pandemic a year ago. This should be final but there is a two month review on

the numbers.

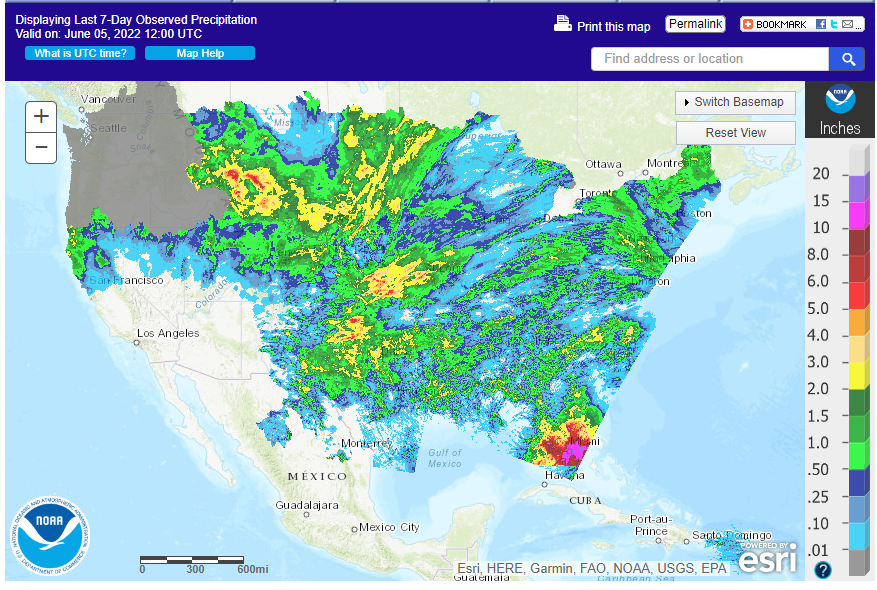

Weather

As

of Sunday morning – past seven days

WEATHER

EVENTS AND FEATURES TO WATCH

- West

Texas dryland crop areas received 0.60 to 1.78 inches of rain overnight - The

moisture was ideal in improving topsoil moisture and some crops will respond well to the moisture with quicker seed germination and plant emergence - Follow

up rain is critically important for those crop areas because of poor subsoil moisture - Irrigated

crops in West Texas will benefit most from the recent rain and future crop development should advance well in those areas - West

Texas will see additional rain tonight into Saturday before dry and warmer weather evolves for a several day period next week - Ridge

building has been hinted at for the central and eastern U.S. during the second week of the outlook by the GFS model run - This

feature is suspected of being too strong and too far to the east - Some

higher heights are expected, but no well-defined ridge of high pressure system is expected so soon, but a weaker ridge is possible, and it may be more centrally located in the Great Plains - Changes

are expected over the weekend and that may warrant a close watch on weather model changes during the weekend - Western

and southern Alberta, Canada will get rain late this weekend and into early next week offering some relief to persistent dryness

- Some

of this rain will also reach into far southwestern Saskatchewan, Montana, southwestern North Dakota and much of South Dakota - Rain

totals of 0.50 to 1.50 inches is expected an locally more - Drought

will remain in east-central Alberta and west-central into south-central Saskatchewan during the coming week with little to no rain expected and warmer temperatures - Some

of this region will have the potential for rain in the second week of the outlook, but no general soaking of moisture is expected - Any

relief that occurs in the drought stricken areas will only be temporary with a huge need for follow up rain - Eastern

Saskatchewan and Manitoba will be in a net drying mode during the coming week with some rain returning in the second week of the outlook, June 10-16 - Frost

and a few very light freezes occurred this morning in parts of Saskatchewan and Manitoba, but the impact on emerged crops will be very low since most temperatures were no colder than 30 Fahrenheit (-1C).

- U.S.

crop weather in the Plains and Midwest will be well balanced with periods of rain and sunshine over the next ten days

- Crop

development and fieldwork will advance favorably - Some

decrease in rainfall and rise in temperatures may evolve after June 13 - Tropical

Storm Alex was forming in the southeastern Gulf of Mexico this morning and it will move across southern Florida this weekend resulting in some heavy rain and breezy conditions - The

storm will induce some local flooding, but no damage to citrus or sugarcane is expected - U.S.

Pacific Northwest will see a mix of rain and sunshine to support developing crops - California

and the southwestern desert region will continue quite dry during the coming two weeks except in far northern California where some rain is possible near the coast\ - Ontario

and Quebec weather will continue to be well balanced with periods of rain and sunshine - Relief

from dryness is expected in Europe over the next week to ten days with all areas impacted except Spain and Portugal - The

greatest relief is expected in France, Germany and the United Kingdom where moisture stress has evolved recently - Sufficient

moisture will fall to raise topsoil moisture and support ongoing crop development - Western

Argentina wheat areas still need a boost in precipitation to induce the best planting, germination and emergence conditions - Not

much precipitation of significance is expected for a while raising worry over the fate of wheat planting and establishment this month - Only

western areas are too dry; favorable soil moisture is present in other areas - Southern

Brazil has been and will continue to be a little too wet for a while - Drying

is needed to protect immature late season summer crops and to reduce flood potentials in wheat areas - Rain

is expected in western and southern Mato Grosso and Mato Grosso do Sul, Brazil Tuesday through Thursday of next week - The

moisture will be good for winter wheat and for cotton, but it will come too late for much change in Safrinha corn

- Southeastern

Europe is getting enough rain to ease its recent dryness, but more is needed - Southwestern

Europe will have some ongoing needs for rain – especially in Spain and Portugal - Russia’s

Southern Region, southeastern Ukraine and western Kazakhstan will dry down through the weekend and into next week raising the need for timely rain later this month - Western

and northern Russia will continue in an active weather pattern bringing waves of rain and milder than usual weather periodically - Some

of the wetter and milder biased weather will also occur in Belarus, the Baltic States and northwestern Ukraine - Xinjiang,

China will experience some periodic rainfall in the northeast while most other areas away from the mountains are left mostly dry - Corn

an cotton planting are advancing well - North

China Plain dryness is not likely to go away anytime soon, despite the potential for a few showers in the coming week to ten days - Unirrigated

crop moisture stress has begun, although wheat has not been seriously impacted since it is largely irrigated and much closer to full maturation - Three

waves of light rain will fall in the next ten days that may whittle back some of the dryness, but more rain will be necessary - Southern

China is bracing for additional waves of heavy rainfall late this week and next week - Flooding

has already been a problem south of the Yangtze River recently and even though the rain is taking a short term break there is much more coming - Damage

to sugarcane and rice is possible - Some

areas in the interior south reported up to 54 inches of rain during the month of May. - Southern

India monsoonal rainfall is expected to be lighter than usual over the next ten days - The

impact will be low for now, but greater rain will be needed in time - Australia

soil moisture is rated mostly well, but there will be need for rain in Western and South Australia this month especially in northern crop areas to restore favorable soil moisture

- New

South Wales and many areas in southeastern Queensland have favorable soil moisture for autumn planting and establishment of wheat, barley and canola - Rain

is expected in the dry areas of Western Australia by mid-month - South

Africa weather is expected to be mostly dry for a while - Both

the harvest of summer crops and the planting of winter grains will advance well in the drier weather this week - Temperatures

will be near to above normal this week - All

of Southeast Asia will get rain at one time or another over the next couple of weeks. - The

precipitation will be good for most crop needs; however, it will be heavy along the Myanmar lower coast and in parts of both Laos and Vietnam into Cambodia - Northwestern

Luzon Island, Philippines and Taiwan will also be wet - Thailand

may not be included in the heavier rainfall that other Southeast Asia nations will experience for a while, but scattered showers and thunderstorms are still expected - West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall will be most significant in Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania’s Pare region dries down seasonably - North

Africa rainfall will be limited in the next two weeks, although some rain is expected very lightly - Most

wheat and barley in the region is maturing and being harvested keeping the need for rain very low - Most

of the rain expected will be limited and should not adversely impact crop conditions or field progress - Turkey

crop areas will be the only ones in the Middle East to get significant rainfall during the next week to ten days - A

boost in rain is needed in many areas, but this is the beginning of the dry season

- These

areas may have experience a decline in wheat, rice and cotton production this year – at least in unirrigated areas - Mexico

rainfall is expected to slowly increase in central and southern parts of the nation during the next ten days to two weeks with next week wettest - The

moisture will be welcome and should be a part of the developing monsoon season - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Today’s

Southern Oscillation Index was +17.61 and it will steadily decline over the next few weeks - New

Zealand rainfall will be trending wetter over the next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

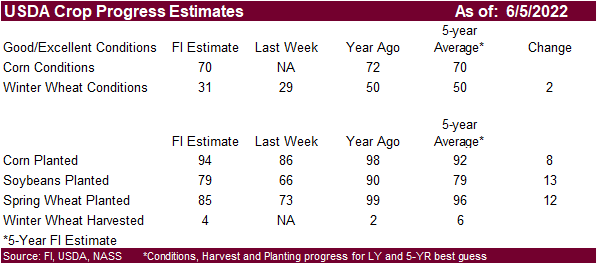

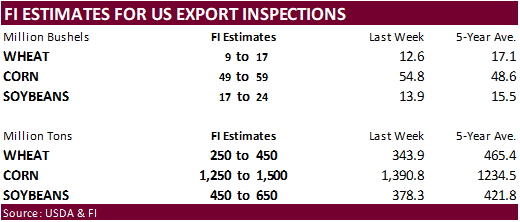

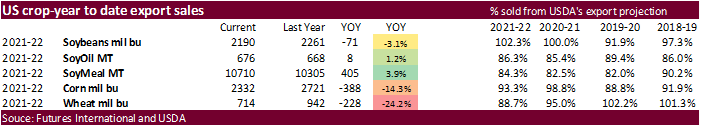

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop planting data for corn, soybeans, wheat and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - HOLIDAY:

Germany, South Korea, Malaysia, New Zealand - Malaysia’s

June 1-5 palm oil export data

Tuesday,

June 7:

- EU

weekly grain, oilseed import and export data - Vietnam’s

customs department releases May export data for coffee, rice and rubber - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 1 - International

Grains Council conference, day 1 - Global

Food Summit in Munich, day 1 - Purdue

Agriculture Sentiment - Abares

agricultural commodities outlook - New

Zealand Commodity Price - New

Zealand global dairy trade auction - France

agriculture ministry releases crop estimates

Wednesday,

June 8:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 2 - International

Grains Council conference, day 2 - Global

Food Summit in Munich, day 2 - France

AgriMer monthly grain outlook

Thursday,

June 9:

- China’s

first batch of May trade data, including soybeans, edible oils, rubber and meat imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Ecosperity

sustainability conference, Singapore - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 3

Friday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

June 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Source:

Bloomberg and FI

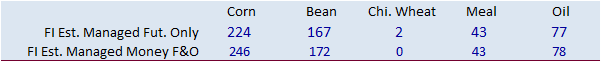

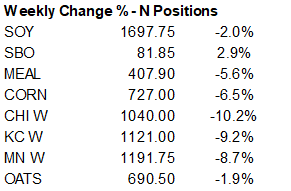

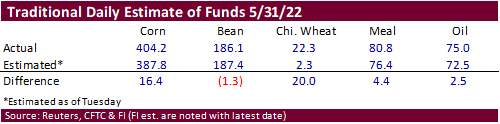

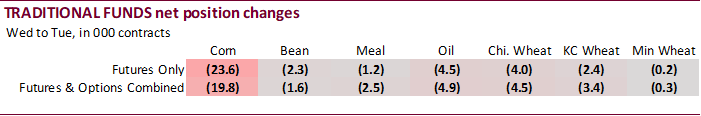

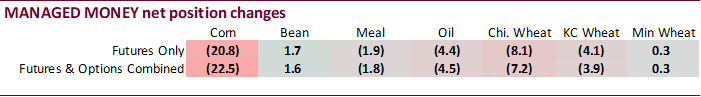

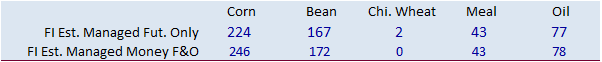

Funds

are still negative for wheat but not as less long than expected.

Macros

101

Counterparties Take $2.031 Tln At Fed Reverse Repo Op (prev $1.985 Tln, 97 Bids)

US

Nonfarm Payrolls May: 390K (est 320K; prev 428K; prevR 436K)

US

Unemployment Rate May: 3.6% (est 3.5%; prev 3.6%)

–

US Average Hourly Earnings (M/M) May: 0.3% (est 0.4%; prev 0.3%)

–

US Average Hourly Earnings (Y/Y) May: 5.2% (est 5.2%; prev 5.5%)

US

Private Payrolls May: 333K (est 302K; prev 406K; prevR 405K)

–

US Manufacturing Payrolls May: 18K (est 39K; prev 55K; prevR 61K)

–

US Average Weekly Hours May: 34.6 (est 34.6; prev 34.6)

–

US Participation Rate May: 62.3% (est 62.3%; prev 62.2%)

US

ISM Services Index May: 55.9 (est 56.5; prev 57.1)

·

US corn futures fell from technical selling and a higher USD, but losses were limited after USDA reported 101,600 tons of corn were sold to unknown. Funds sold an estimated net 1,000 corn contracts.

·

News was fairly light.

·

EPA will require 20.63 billion gallons of renewable fuels for 2022, a 9.5% increase from last year. This is achievable, IMO, as the US produces more ethanol than required. There is a 60-day comment period on the final RFS levels

but expect this number to be inked.

·

Russia again mentioned they will not block gain exports from Ukraine.

·

The USD was 35 points higher.

·

Iraq reported a bird flu outbreak. 24,060 birds were culled.

·

Private exporters reported sales of 101,600 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

6/1/22

July

corn is seen in a $6.75 and $8.00 range

December

corn is seen in a wide $5.50-$8.00 range