PDF Attached

Calls:

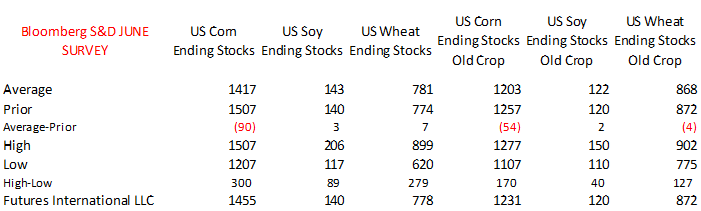

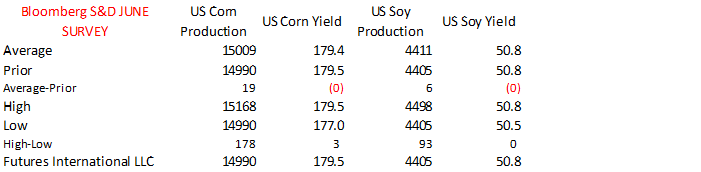

Soybeans 5-8 higher, corn up 3-6, wheat 1-4

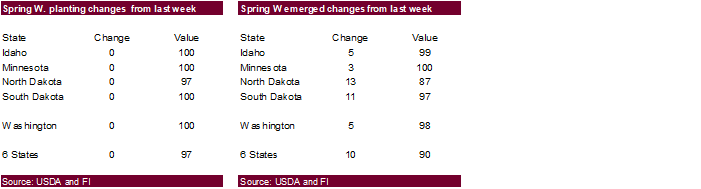

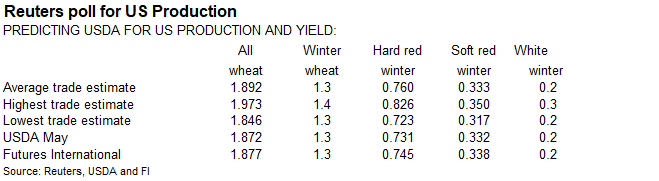

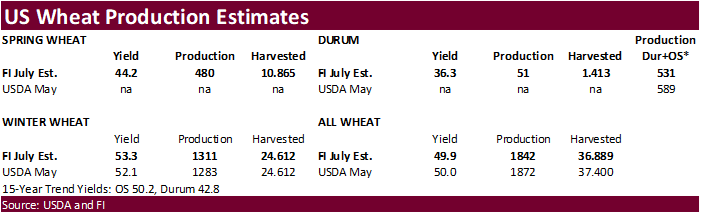

We

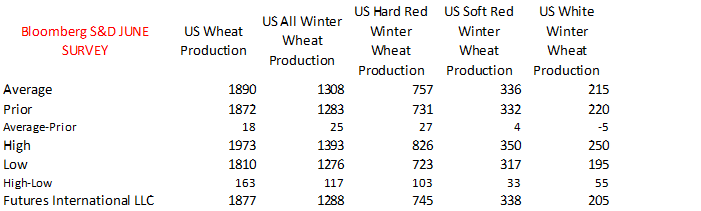

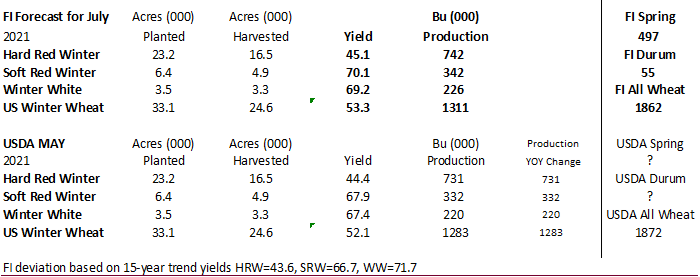

think the decline in spring wheat conditions is supportive for all three US wheat markets. We are using 1.842 billion for US wheat production, below 1.872 billion USDA May. FI’s spring wheat was lowered to 480 million from 497 million and durum to 51 million

to 55 million. Our total other spring and durum combined wheat production estimate is 531 million, down from 552 million previous, and 58 million below USDA. Our winter wheat production estimate for July is higher than USDA May (FI estimates already set

for June S&D).

Midday

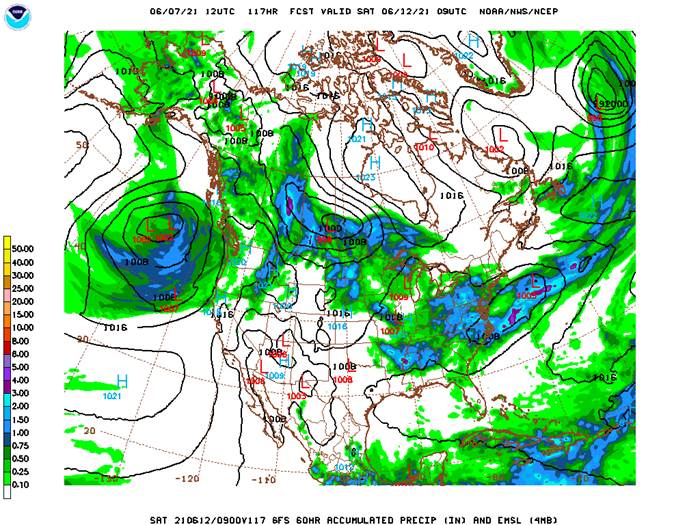

weather models appeared to be a little wetter for the “I” states for week one. Bear spreading dominated price action. North American weather concerns supported back month contracts. The weather models are still hot and dry for the upper US Great Plains and

Midwest. The southwestern US Plains will see excessive heat this week. WCB will dry down. Earlier WTI crude oil topped $70 for first time since 2018. Canada’s Prairies have an opportunity for rain over the next two weeks.

FAO:

May food price index is up 30.8% from year earlier.

Wed

to Fri rain in N and South Dakota & rain is now forecast for IA that didn’t seem to be in this morning – midday

World

Weather, Inc.

WORLD

HIGHLIGHTS

- As

noted Friday in our mid-day high pressure ridge discussion, the North America high pressure ridge will be shifting to the west not the east once we get through this workweek

o

The change limits the amount of heat that reaches the heart of the Midwest and should perpetuate showers and thunderstorms in the lower and eastern Midwest as time moves along; however, resulting rainfall is not likely to counter

evaporation very well especially in the western Corn Belt and the region will be closely monitored for drying down later this month

o

Thunderstorms that occur in the northern Plains and upper Midwest this week will offer a little relief to dryness, but the summer is still very young and there is plenty of time for the region to dry back down again – and it will

- Most

of the rain expected will be sporadic so that several counties will be impacted with each round of precipitation

- A

few storms will occur tonight in eastern North Dakota and Minnesota, but the greater rainfall will occur Tuesday night and Wednesday in northeastern Montana and northwestern through north-central North Dakota and on into southeastern Canada’s Prairies - 0.40

to 1.50 inches of rain will result, but more limited rainfall will occur in neighboring areas - Another

round of storms may occur Thursday night into Friday with Canada’s Prairies getting much of that rain - Several

days of drying will then occur in the northern Plains this weekend into next week with a few thunderstorms possible in Minnesota and areas to the southeast

- U.S.

high pressure ridge is not too threatening and will move around during the next two weeks; The northern Plains will be warmest relative to normal early this week and then the southwestern Plains will be warmest shortly after that

o

Far western U.S. temperatures will be hottest relative to normal next week

- Some

relief to dryness is expected in the northern U.S. Plains and Canada’s Prairies this week - West

Texas will trend drier for a while this week

o

Excessive heat is expected Wednesday through Friday with extreme highs of 103 to 107 Fahrenheit

o

Showers and some cooling are expected this weekend into early next week, but resulting rainfall will be limited

- South

Texas will be dry and warmer during the next week to ten days - U.S.

lower and eastern Midwest will be favorably moist along with the Delta and southeastern states - U.S.

Pacific Northwest and portions of the western Corn Belt will be drier than usual - Far

western U.S. will remain very dry - East-central

China rain prospects are little better for the next two weeks than those of Friday, although Shandong, northern Jiangsu and parts of Hebei will be quite dry for a while. - Xinjiang,

China will be unsettled with mild to cool temperatures for a while

o

Frequent thunderstorms are expected in the northeast with some severe weather possible

- India’s

Monsoon will remain an underperformer this week, but a monsoon depression coming inland from the Bay of Bengal will produce heavy rain from Odisha to northeastern Maharashtra, Madhya Pradesh and southern Rajasthan later this week into next week - Russia’s

New Lands are still likely to be influenced by a high pressure ridge next week generating very warm and dry biased weather

o

A sukhovei may evolve next week bringing excessive heat, wind and low humidity to western Kazakhstan and Russia’s Southern Region.

- No

weekend surprises were noted in South America

DETAILS

AND ISSUES OF THE DAY

- Weakness

in the subtropical jet stream next week may still give way to a potential tropical cyclone or two in the western Atlantic Ocean Basin; including, but not limited to the Gulf of Mexico, Caribbean Sea and western Atlantic Ocean

o

The same weakness predicted by various computer forecast models noted in our special report on June 3 remains today

- A

close watch on the tropics will be warranted because of any storm’s potential influence on North America weather - Canada’s

Prairies are poised to get multiple waves of rain during the next week to ten days offering relief to very dry soil and crop stress

o

One wave of rain is possible in southeastern Saskatchewan and western Manitoba during mid-week this week with a follow up rain event in eastern Alberta and western Saskatchewan late this week and into the weekend

o

Sufficient rain will fall to bolster soil moisture for a significant improvement in crop and field conditions that will hopefully carry crops into the drier days of summer

o

Temperatures this week will be near normal in the west and a little warmer than usual in the southeast

- Rain

in Canada’s Prairies during the weekend was most concentrated on central and eastern Alberta and northwestern Saskatchewan; not including southern Alberta

o

Rainfall varied from 0.20 to 0.60 inch

o

Western and far southern Alberta were dry along with the remainder of Saskatchewan

o

Showers in southern Manitoba produced 0.05 to 0.60 inch

o

Temperatures were hot in the southeast Friday, but cooled down in all areas during the weekend with readings more seasonably warm after the late week heat surge last week

- U.S.

northern Plains were excessively hot Friday with highs in the upper 90s to 106 degrees Fahrenheit in the Dakotas and in the 90s in eastern Montana, Minnesota and Neighboring areas

o

Most of the Midwest temperatures were in the 80s and lower 90s during the weekend

- U.S.

weekend rainfall was greatest from central Texas to the lower Delta and into random locations into the southeastern states

o

1.00 to 3.00 inches fell in eastern Texas, western Louisiana and southwestern Arkansas while crop areas in the lower Delta reported 0.50 to 1.60 inches

o

A few areas in central and southwestern Florida received heavy rain and a few local totals over 1.00 inch occurred along the central Alabama/Georgia border and in coastal areas of the Carolinas and Virginia

o

West Texas rainfall was minimal, along with the Midwest and most of the far western states

o

Temperatures were warm to hot in many areas and net drying resulted

- U.S.

weather in this coming week will be greatest in the lower and eastern Midwest, Delta, Tennessee River Basin and southeastern states

o

Rain amounts by June 13 will vary from 2.50 to more than 4.00 inches in the Delta while varying from 0.70 to 2.50 inches in most other areas with a few pockets of heavier rain

o

Some rain will fall in the northern Plains and upper Midwest with amounts of 0.50 to 1.50 inches and local totals over 2.00 inches

- Northwestern

North Dakota could receive 2.00 to 3.00 inches

o

Driest weather is expected from Kansas to southeastern Minnesota and Wisconsin

o

West Texas rainfall will be limited this week as well

o

South Texas and the Texas Coastal Bend will be dry biased while the Blacklands of Texas and areas north into Oklahoma receive 0.60 to 2.00 inches and locally more

o

Very little rain will impact the unirrigated crop areas in the valleys of Washington, Oregon and Idaho

- U.S.

week two rainfall will be scattered across a large part of the central and eastern U.S. and Canada, but the precipitation will be erratic in many areas

o

The Gulf of Mexico Coast states may be wettest depending on the tropics

o

West Texas will be dry and very warm to hot

o

Far western U.S. will be dry and very warm to hot

o

Midwest weather will experience erratic rainfall and warm temperatures

- The

bottom line to U.S. weather over the next two weeks will be mostly good for lower and eastern Midwest, although the second week will be drying down. The Delta and southeastern states should experience a good mix of weather while West and South Texas dries

out and heats up. The central Plains will dry down favoring winter wheat maturation and harvest conditions. Drying in Texas will be good for summer crop planting, but livestock stress will be rising on warmer temperatures. Dryland winter crop stress will continue

in the Pacific Northwest, although this week’s cooler weather will help to conserve soil moisture. Drought in the far western states will remain a serious concern. “Some” relief from dryness is expected in the northern U.S. Plains and Canada’s Prairies, although

more rain will be needed especially in the northern Plains. - Brazil’s

outlook for the next ten days will be unchanged from that of late last week

o

Mato Grosso, Goias and southwestern Minas Gerais will receive little to no rain of significance maintaining crop stress for Safrinha corn and cotton

- Production

is still expected to be well below average

o

Tuesday through Friday will generate rain in many of the southern crop areas from Rio Grande do Sul to Mato Grosso do Sul, Parana, Sao Paulo and southern Minas Gerais

- Sufficient

rain will fall to bolster soil moisture and maintain a status quo outlook for crop production from the region - Temperatures

will be seasonable with a slight warmer than usual bias - Brazil

weekend rain was limited to eastern coastal areas and from far southwestern Mato Grosso and Paraguay into Rio Grande do Sul where rainfall varied from 0.25 to 1.35 inches

o

Temperatures were near to slightly above average

- Argentina

weather over the next ten days to two weeks will be restricted on rainfall and temperatures will cool from above normal levels this week down to near normal next week - Argentina

rainfall during the weekend was significant in Entre Rios, east-central and northeastern Santa Fe and Corrientes along with eastern Chaco and eastern Formosa

o

Rainfall varied from 1.00 to 2.50 inches in Entre Rios to eastern and southern Corrientes and up to 0.88 inch elsewhere

o

The remainder of the nation was dry and mild to warm

- India

rain was greatest in the west, south and far Eastern States during the weekend

o

Moisture totals ranged from 1.00 to 2.50 inches from southern Andhra Pradesh to southern Karnataka and Kerala

o

Rainfall varied from 1.58 to 3.54 inches from eastern Bangladesh into the far Eastern States of India

o

Rainfall elsewhere was no more than 0.80 inch

o

Most of the nation’s rain was lighter than usual and that trend will continue over this coming week

- A

monsoon depression will evolve this week in the northern Bay of Bengal bringing significant rain through Odisha, Telangana and Chhattisgarh to northeastern Maharashtra, southern Rajasthan and Madhya Pradesh

o

The wet bias will begin during mid-week this week, but will be most significant late this week through the middle of next week

- Rain

totals of 6.00 to 15.00 inches will be possible resulting in some flooding - Northwestern

areas will not be nearly as wet as those from Madhya Pradesh to Odisha - Some

crop and field damage is possible because of flooding, but it is early enough in the planting season to limit the impact - China

weekend rainfall was greatest in the Northeast Provinces with up to 2.75 inches resulting in Jilin while 1.00 to 2.00 inches occurred in surrounding areas

o

Less than 0.30 inch of rain fell in central and southeastern Heilongjiang and western Liaoning

o

Rain also fell in the southern coastal provinces and areas west into Yunnan with rainfall to 2.50 inches in southern Zhejiang and southeastern Guangxi while amounts of 0.25 to 0.88 inch occur elsewhere

o

Net drying dominated the remainder of the nation; including the North China Plain, Yellow River Basin and Yangtze River Basin

- China’s

weather will be favorably mixed over the next ten days

o

Portions of the lower Yellow River Basin, North China Plain and east-central provinces will receive very little rainfall, but some relief to dryness is advertised for the upper and middle Yellow River Basin including Sichuan,

western Hebei, Hubei, Shaanxi and Shanxi

- That

leaves most of China in good shape for normal crop development - A

boost in rainfall will be needed soon from Jiangsu and parts of Anhui to Hebei and Shandong

o

Some welcome drying will occur in northeastern China for a little while

o

Far southern China will continue wettest

o

Temperatures will be warm in the north and near normal in the far south

- Xinjiang,

China reported a few showers and thunderstorms in northeastern crop areas during the weekend while most other areas were dry

o

Temperatures turned cooler in the northeast with low temperatures slipping to the 40s Fahrenheit after being in the 50s late last week

o

Highest afternoon temperatures during the weekend cooled from the 80s and lower 90s in northeastern Xinjiang to the upper 70s and lower 80s

- Cooling

in other areas dropped high temperatures from the lower and middle 90s early in the weekend down to the 80s and lower 90s Sunday - Xinjiang,

China will experience frequent bouts of rain during the coming week and temperatures will be mild to cool in many areas

o

Southwestern areas will not be nearly as wet, but temperatures will trend cooler as well

- Highs

will fall to the 70s and 80s in the northeast and the 80s and lower 90s in the southwest - Australia

rainfall this week will be greatest from southeastern South Australia and Victoria to eastern New South Wales and in a few southeastern Queensland locations

o

The moisture will be supportive of planting, germination and emergence, although more will be needed to more fully restore soil moisture which continues low

o

This weekend and early next week will be relatively dry

- Only

a few showers are expected

o

Western Australia will receive a more significant increase in rainfall late next week

o

Temperatures will be seasonable during the coming ten days

- Australia

weekend precipitation was mostly limited with Victoria with a few sporadic showers in New South Wales resulting in light rainfall

o

Temperatures were mild

- Europe

weather during the weekend brought significant rain to France and eastern Spain with totals of 0.20 to 0.60 inch and several amounts of 1.00 to 2.14 inches in interior southern France and

o

More restricted rainfall occurred elsewhere

o

Temperatures were warm with many highs in the 70s Fahrenheit and lows in the 40s and 50s with a few lower 60s southwest

- Europe’s

greatest rain will impact the central and eastern parts of the continent during the next ten days with sufficient rain to maintain favorably moist soil conditions

o

Some areas in the North Sea region will receive restricted amounts of rain

o

Southwestern Spain and Portugal will also receive limited rainfall

o

Temperatures will be near to above average this week and trend a little warmer in central and eastern Europe next week

- Waves

of rain will continue in the western CIS through the coming ten days

o

Most of the rain will occur near and west of the Ural Mountains this week and then farther to the west next week

o

New Lands’ rainfall this week will be erratic and light with areas near the Ural Mountains wettest

- Next

week’s New Lands rainfall will be more limited especially in the central and south and into northern Kazakhstan where soil moisture is already low

o

Temperatures will be near normal with a slight warmer bias in Kazakhstan and in the far northwest part of Russia

- A

High pressure ridge is still advertised for next week in a part of the Russia New Lands resulting in warmer temperatures and more significant crop stress in some areas - Some

frost and freezes were noted during the weekend in the southeastern Russia’s New Lands and northern Kazakhstan possibly impacting early season crop development - Excessive

heat occurred in parts of Central Asia during the weekend including Uzbekistan, Turkmenistan and a few immediate neighboring areas where extreme highs ranged from 100 to 115 degrees Fahrenheit

o

The heat will bubble up to the north next week, but should be more confined to the same region this week

- Russia’s

Southern Region received some welcome rain during the weekend with 0.10 to 0.80 inch and local totals to 0.92 inch resulted

o

A few of these showers reached into western Kazakhstan and the lower Volga River Valley

- Southeast

Asia rainfall increased in eastern Malaysia, northern Sumatra and parts of Luzon Island, Philippines during the weekend

o

The rain was welcome

o

Other areas experienced net drying excerpt in northwestern Mindanao and southeastern Luzon Island where localized rainfall of significance was noted

- Much

of Southeast Asia is expecting bouts of rain through the next ten days, although amounts will be lighter than usual at times.

- Southern

Mexico rainfall will continue through the next week

o

Drought will prevail in western parts of the nation, but dryness in the east was partially eased by rain last week

- Argentina’s

weather over the next two weeks will be well mixed in the east with sufficient drying time to support ongoing harvest progress while enough rain falls to ensure good wheat planting and emergence conditions

o

Rain is needed in Cordoba and neighboring areas, but most other wheat production areas have good planting moisture

- South

Africa rain is expected from Northern Cape into Free State this workweek

o

The moisture will be light, but still beneficial for some winter crop planting emergence and establishment

- West

Africa rainfall will increase over the next ten days

o

Greater rain is needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

- A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

- East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will increase in Ethiopia this week while little change occurs elsewhere

- Southern

Oscillation Index is mostly neutral at +0.26 and the index is expected to move lower over the few several days - North

Africa weather will trend a little wetter in northern Algeria and Tunisia late this week and into the weekend

o

Some light rain fell in the same region during the weekend

o

No winter crop quality issues are expected

- New

Zealand weather during the coming week to ten days will be drier and warmer than usual

o

the exception will be along the west coast of South Island where rain is expected this weekend into next week

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Monday,

June 7:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions, planting — corn, cotton, soybeans, wheat, 4pm - China

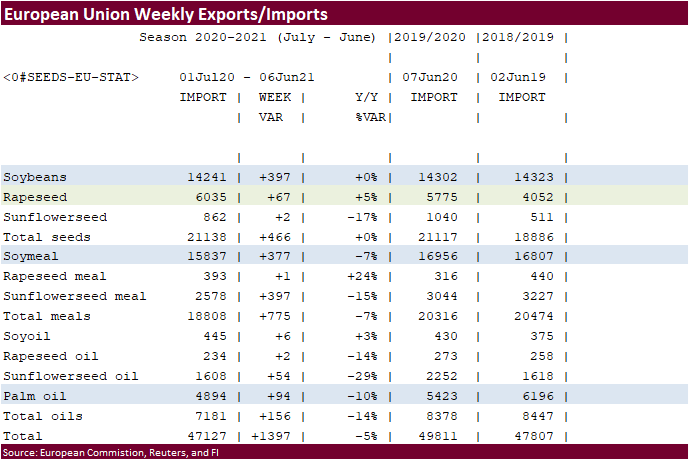

customs to publish trade data, including imports of soybeans, edible oils, meat and rubber - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Malaysia, New Zealand

Tuesday,

June 8:

- Australian

crop report - International

Grains Council Conference, day 1 - France

agriculture ministry’s monthly crop estimates

Wednesday,

June 9:

- EIA

weekly U.S. ethanol inventories, production - International

Grains Council Conference, day 2 - FranceAgriMer

releases monthly grains report

Thursday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

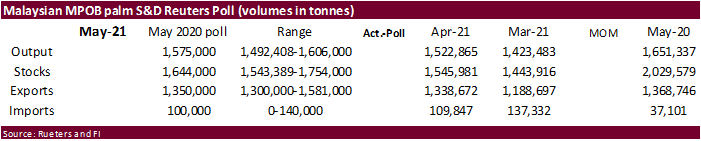

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Malaysian

Palm Oil Board inventory, output and export data for May - Brazil’s

Conab releases output, yield and acreage data for corn and soybeans - Port

of Rouen data on French grain exports - Malaysia

June 1-10 palm oil export data

Friday,

June 11:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

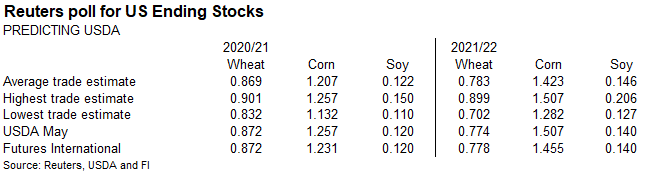

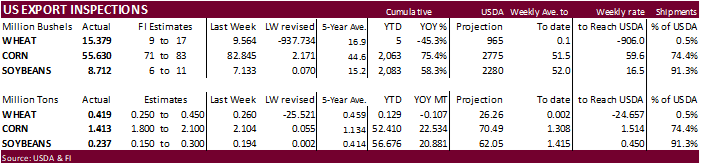

inspections versus Reuters trade range

Wheat

418,547 versus 230000-450000 range

Corn

1,413,073 versus 1400000-2200000 range

Soybeans

237,108 versus 100000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 03, 2021

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/03/2021 05/27/2021 06/04/2020 TO DATE TO DATE

BARLEY

0 0 367 0 367

CORN

1,413,073 2,104,363 1,220,985 52,410,264 29,876,128

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 499 0 0 0

RYE

0 0 0 0 0

SORGHUM

216 236,955 197,986 6,203,846 3,519,171

SOYBEANS

237,108 194,131 274,052 56,676,447 35,795,706

SUNFLOWER

0 0 0 240 0

WHEAT

418,547 260,288 510,262 128,874 235,496

Total

2,068,944 2,796,236 2,203,652 115,419,671 69,426,868

—————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

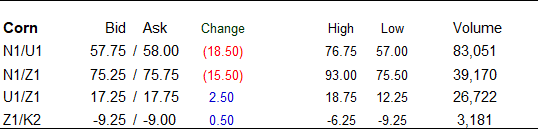

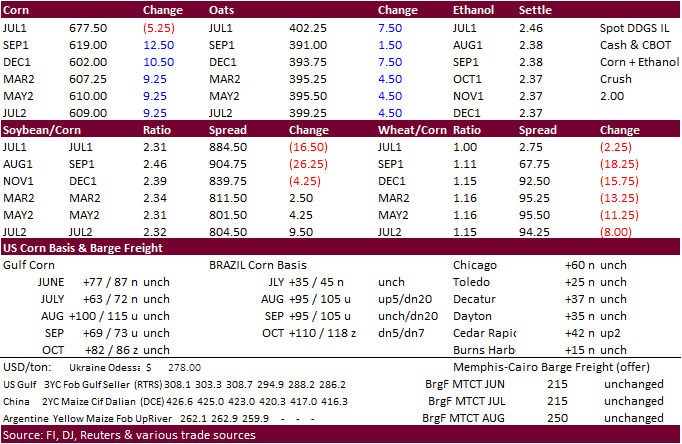

Corn

- US

corn futures started sharply higher

on US weather concerns bias WCB and upper Midwest, but bear spreading pressured the July (down 3.50). December was up 11.25 cents. With July corn sitting at a 3-week high earlier, some profit taking. December gapped sharply higher overnight but much of the

gains were wiped out by noon. December could fill that gap sometime this week.

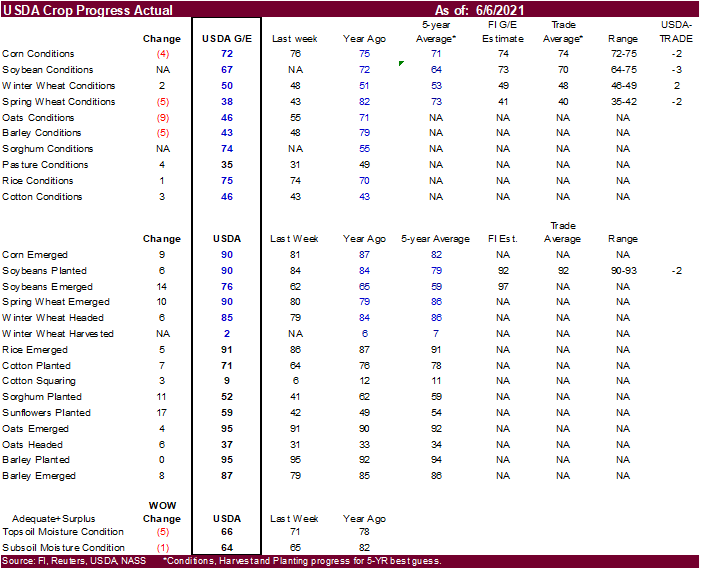

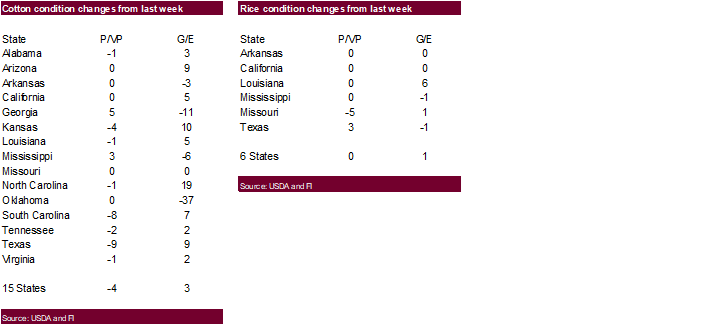

-

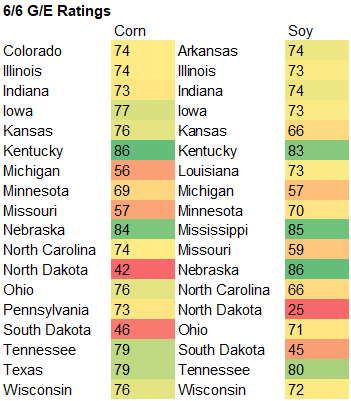

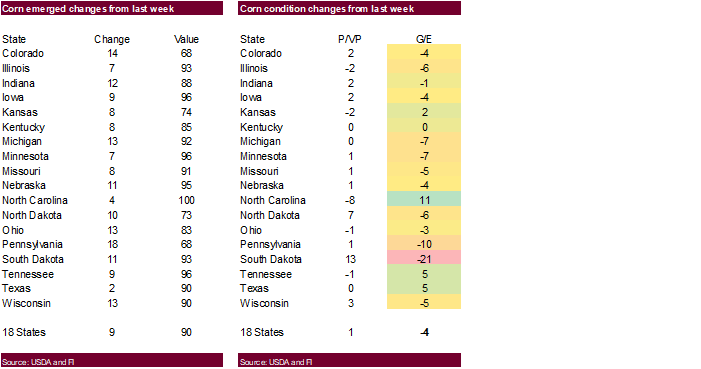

US

corn conditions were reported 2 points below expectations at 72 percent, down 4 points from the previous week, below 75 year ago and above 71 percent average. 90 percent of the corn crop is emerged.

- US

corn inspections were on the lower end of trade expectations. USDA US corn export inspections as of June 03, 2021 were 1,413,073 tons, within a range of trade expectations, below 2,104,363 tons previous week and compares to 1,220,985 tons year ago. Major

countries included China for 542,565 tons, Mexico for 313,845 tons, and Japan for 310,891 tons.

-

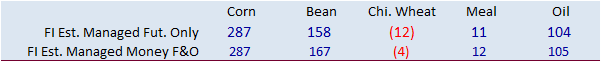

Funds

were even in corn today. -

Argentina

grain custom export workers launched a 7-hour strike over COVID-19 vaccinations. This may impact all export locations and should disrupt grain exports.

- Heat

forecast for the southwestern growing areas are also of concern. ECB conditions look ok with rain occurring over the weekend. Prices gradually trended lower from a lower trade in wheat and slightly wetter US weather models.

- July

corn versus back month spreads collapsed today, ahead of the official start of the Goldman Roll that will last five days. The July has been losing value against the back months for a few reasons, including a weather premium building into new crop, slowing

demand for spot corn, and increase in producer selling.

- Last

week the money managed long positions fell short of expectations, not a price influencer, but a remainder there is room for them to add long positions.

-

Earlier

WTI crude oil topped $70 for first time since 2018.

Export

developments.

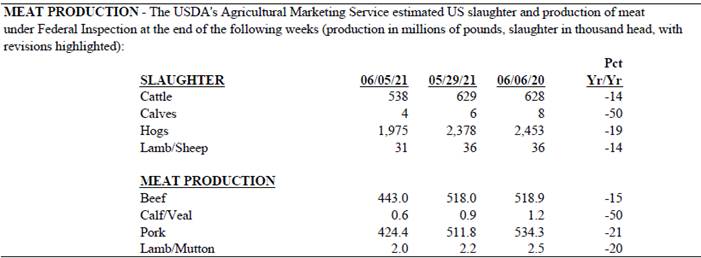

US

meat production took a hit last week in large part from the closures of JBS plants

Source:

Trade News Service.

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

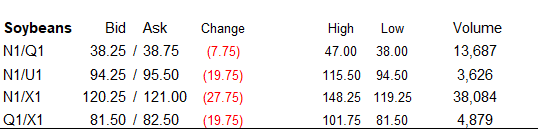

Soybeans

-

Bear

spreading pressured July through September soybean futures contracts while the new-crop back months found support from adverse North American weather and higher outside related commodity markets. This trend in bear spreading has been going on for a few weeks

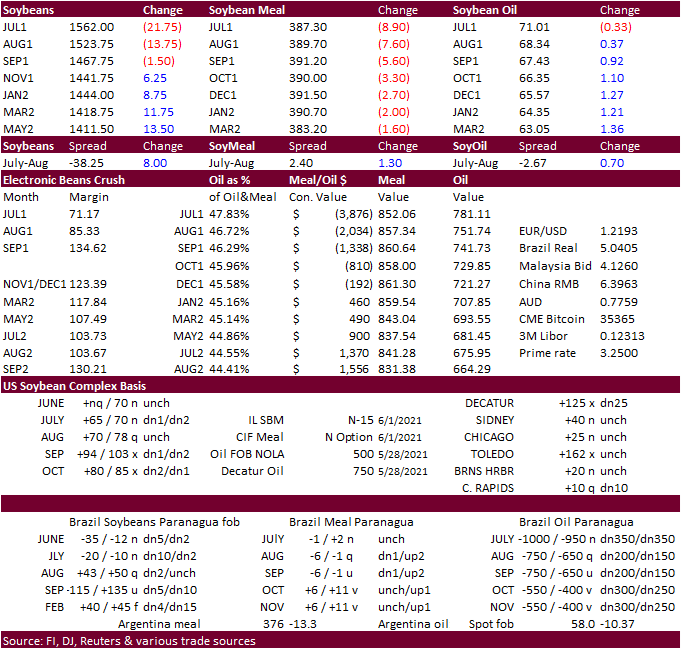

for soybeans and corn but today’s movement was exceptional for soybeans. July soybeans were off 23.50 cents (November up 4.50), July meal down $9.30 (December meal down $2.70) and July soybean oil off 51 points (December soybean oil up 109 points). January

crush hit a new contract high, settling at $1.250. July crush fell 6 cents to $0.7050.

-

Funds

bought an estimated net 5,000 soybeans, sold 7,000 soybean meal and bought 5,000 soybean oil.

-

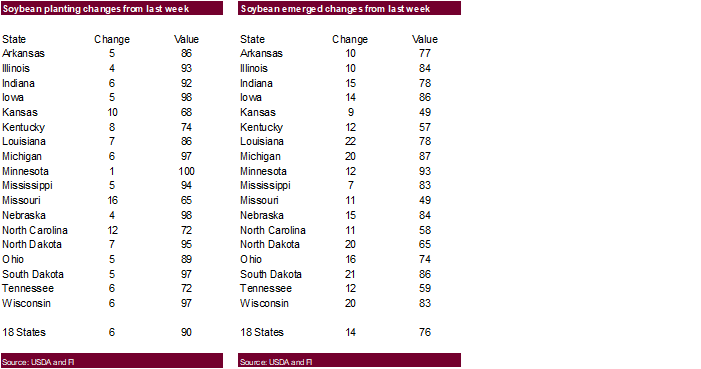

US

initial soybean conditions were reported 3 points below expectations at 67 percent, below 72 year ago and above 64 percent average. 90 percent of the soybean crop had been planted.

-

Canola

futures most active contract hit a record high of C$784.40 per ton before easing from a setback in soybeans.

- Central

IL soybean basis fell 25 cents from Friday through Monday morning and remain concerned on tight soybean oil supplies if crush rates fall below expectations this summer. Soybean oil registrations fell 100 on Friday,

out

of 2 locations (Emmetsburg, IA and Volga, SD, on Friday (SBO registrations stand at 868). Demand for soybean oil exports is slow but interior its firm, as indicated in very high cash basis bias WCB.

- Soybean

basis at other locations were unchanged to lower. Lincoln NE was down 10 and Cedar Rapids fell 10 cents.

-

USDA

US soybean export inspections as of June 03, 2021 were 237,108 tons, within a range of trade expectations, above 194,131 tons previous week and compares to 274,052 tons year ago. Major countries included Indonesia for 71,573 tons, Mexico for 62,716 tons, and

Malaysia for 28,235 tons. -

Trade

News Service: At the end of last week IL crude was a nominal 750 over, Eastern cash nominally 650 over and the West a nominal 2,000 over. Crude degummed oil fob the Gulf was 150 over, down sharply from a few weeks ago. Fully refined oil delivered to the New

York area was steady at a nominal 3,850 over. -

US

soybean meal basis fell at a few locations across the US over the weekend. Chicago was down $3/short ton to 10 under, Decatur, Il down $4 to 10 under, and Morristown, IN off $4 to 10 under.

-

The

weather models are still hot and dry for the upper US Great Plains and Midwest. The southwestern US Plains will see excessive heat this week. WCB will dry down.

-

We

think soybean oil can reach 75 cents. Today the high was 73.74 cents, taking out the absolute closing high of 72.7 cents (nearby rolling high) established during the 2007-08 crop year (omits expiring prices).

-

Rotterdam

rapeseed and soybean oil prices were 25-65 euros higher from last Friday.

-

Malaysian

was on holiday. -

Indonesia

will see heavy rain affecting palm oil production this week. -

China

sees May soybean imports at 9.61 million tons, up from 7.45 million in April and compares to 9.38 million tons a year ago. Reuters noted some cargoes were rolled over due to arrival delays in China in June. China hog prices have been under pressure from a

rebound in production, leading some to think China will slow soybean purchases from SA and US, which we have seen in recent week. China crush margins are improving but remain at low levels. Through the first 5 months of this year, China imported 38.2 MMT

of soybeans, up 12.8% from the same period last year. We don’t see a slowdown for China importing corn from the US and Ukraine over the next few months.

-

Egypt

is in for vegetable oils on Tuesday. -

Cargill

plans to build a $200 million palm refinery in Indonesia’s Lampung province, set to be finished late next year.

China:

Crude

oil: May imports fell 14.6% from a year earlier to 40.97 million tons

Iron

ore: May imports rose 3.2% from a year to 89.79 million tons

Copper:

May imports rose 2.2% from a year earlier to 445,725 tons

Soybeans:

May imports rose 2.5% from a year earlier to 9.61 million tons

Meat:

May imports fell 3.3% from a year earlier to 789,000 tons

- Egypt’s

GASC seeks vegetable oils on Tuesday for August 1-20 arrival. Payment with 180-day letter of credit was requested.

- USDA

last week bought 80 tons of 4 liter vegetable oil. Prices paid ranged from $2116,34 to $2,884.71 per ton.

- USDA

last week bought 1,000 tons of vegetable oil in 4 liter cans at $2,416.31 to $2,946.40 per ton.

- USDA

seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

Updated

6/7/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 69-75 (up 200 & 250 points); December 57-70 cent range (up 200)

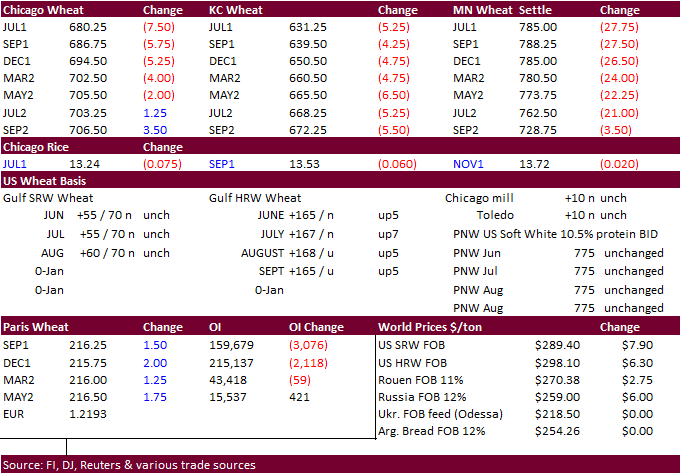

- US

wheat started higher following soybeans and corn but a large price break in Minneapolis wheat futures eventually eroded gains in Chicago and Kansas City. Algeria is in for wheat this week so EU traders will be monitoring those prices and tender amount. The

southwestern US Plains will see excessive heat this week. Dakota’s saw extreme heat over the weekend as predicted.

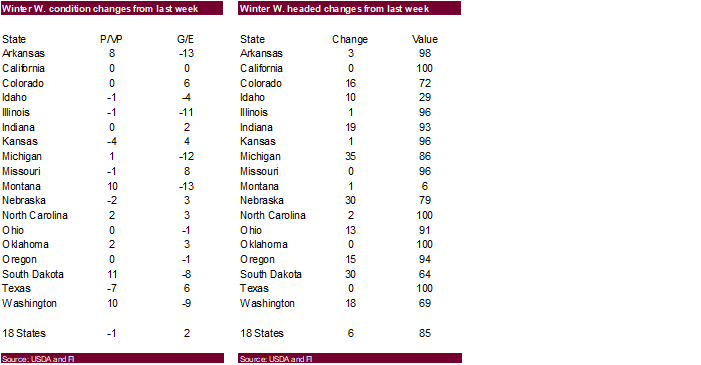

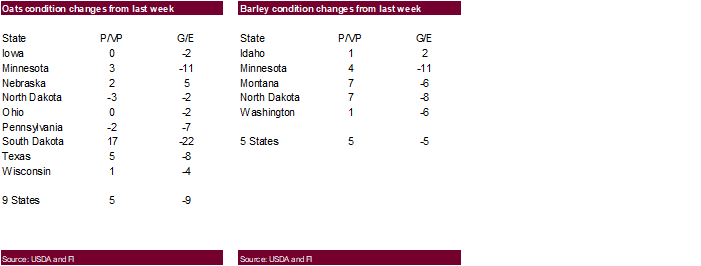

- US

winter wheat conditions were up 2 points to 50 percent and were 2 points above an average trade estimate. US spring wheat conditions declined a large 5 points last week to 38 percent, 2 points below a trade average.

- We

think the decline in spring wheat conditions is supportive for all three US wheat markets. We are using 1.842 billion for US wheat production, below 1.872 billion USDA May. Spring wheat was lowered to 480 million from 497 million and durum to 51 million

to 55 million. Our total other spring and durum combined wheat production estimate is 531 million, down from 552 million previous, and 58 million below USDA. Our winter wheat production estimate for July is higher than USDA May (FI estimates already set

for June S&D).

- Funds

sold an estimated net 4,000 SRW wheat contracts. - USDA

US all-wheat export inspections as of June 03, 2021 were 418,547 tons, within a range of trade expectations, above 260,288 tons previous week and compares to 510,262 tons year ago. Major countries included Philippines for 165,627 tons, Mexico for 74,246 tons,

and China for 64,065 tons. - Canada

has an opportunity for rain over the next two weeks and that might be limiting upside in wheat.

- Minneapolis

July wheat tanked 27.75 cents. KC July was down 6.50 cents and Chicago July off 7.50 cents.

- IKAR

raised its Russia wheat production estimate from 79.5 million tons to 80.0 million.

- September

Paris wheat market basis September was up 1.75 euros at 216.25. - The

Philippines finance minister stated they may seek cheaper feedgrains outside of Southeast Asia, such as India. Reuters: “Half of the roughly 20 tropical cyclones expected to form in the western Pacific Ocean through to September are predicted to hit land

in east Asian nations, including the Philippines.” - Tunisia

looks to harvest 1.07 million tons of durum wheat, up 7 percent from year earlier.

- Algeria

seeks 50,000 tons of milling wheat on June 8 for July and/or August shipment.

- Jordan

seeks 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment. - Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment.

Rice/Other

·

South Korea plans to release 80,000 tons of rice in June to alleviate short supplies.

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen down 115,000 bales to 2.99m bales vs USDA’s previous estimate, according to the avg in a Bloomberg survey of ten analysts.

o

Estimates ranged from 2.3m bales to 4.05m bales

o

Global ending stocks seen 353,000 bales lower at 90.64m bales

Updated

6/2/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.50-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.