US

wheat and corn settled lower, soybeans & meal mixed (bull spreading noted for soybeans and corn from strong spot cash prices), and soybean oil lower. Weather models somewhat improved for the US Midwest (morning and afternoon updates). Not all areas will benefit

from rain over the next 10 days. The

Goldman Roll started today. The Great Plains will see rain over the next week. The heart of the US will see rain Friday through Sunday. The northwestern Midwest will turn drier next week while the southeast turns wetter. Black Sea grain export deal talks resume

Friday in Geneva. Earlier this week Russia said it saw no prospects to extend the deal. China May soybean imports jumped to a record 12.02 million tons despite tighter inspection protocols.

Fund

estimates as of June 7 (net in 000)

![]()

Weather

WEATHER

TO WATCH

-

Low

soil moisture in the U.S. crop areas and recent warm weather has expanded crop stress and raised more market worry over the fate of crops -

Cooling

in the next week will reduce that stress and even though rain is advertised it is likely to be sporadic and light enough to maintain some concern over crop conditions and production potential especially in the longer-range outlook since this is only June and

there is a lot of summer weather still yet to come -

GFS

model is predicting too much rain for the U.S. Midwest, Delta and southeastern states during the second week of the outlook today -

Less

rain and more sunshine in U.S. hard red winter wheat areas in the next two weeks should bode well for improved crop and field conditions -

West

Texas cotton, corn and sorghum areas will experience a good mix of light showers and sunshine, though there is need for greater warmth -

Some

southwestern counties in West Texas did not get adequate relief from dryness and still need greater rain -

Temperatures

will continue cooler than usual into the weekend, but next week’s temperatures will be a little closer to normal -

The

longer range outlook will promote less rain and greater warmth over time a favorable outlook for late summer rainfall -

Soil

and crop conditions in the heart of central, eastern and southern Texas are mostly good for developing cotton, corn and sorghum -

GFS

model is predicting too much rain for Alberta and southwestern Saskatchewan during the second week of the forecast today; some showers are expected, but a general soaking seems to be a little out of line with reality -

Ontario

and Quebec, Canada will get some welcome rain next week while dry and mild to cool weather occurs over the balance of this week and during the weekend -

Mexico’s

drought remains serious with western and central parts of the nation quite warm to hot and dry over the next week to ten days -

Tropical

Cyclone Biparjoy in the Arabian Sea will spend several days over open water and it will disrupt normal monsoon rainfall in southern and eastern parts of the nation -

There

are no tropical cyclones in the Atlantic Ocean Basin today and none are expected -

Tropical

Cyclone Guchol in the Philippine Sea poses no threat to land -

Southeast

Asia rainfall continues to occur routinely enough to support most crops favorably -

Northern

Europe temperatures will be warmer than usual this week and that will create a more stressful environment for crops as they deal with another week of dry conditions

-

Southern

Europe has been receiving frequent rainfall in recent weeks and the trend will continue for another week

-

Eastern

CIS New Lands will begin to receive some timely rainfall the remainder of this week bringing some relief to the drier biased areas of Kazakhstan and Russia’s eastern New Lands -

The

precipitation will be sporadic helping some areas more than others -

Kazakhstan

is not likely to get nearly as much rain and unirrigated crop stress will continue -

Russia’s

Volga River Basin and Ukraine will be dry for the next week to ten days raising crop moisture stress for some crops since the ground is already drying out -

There

is some potential for relief after June 14 -

Summer

crops in China are expected to see a mostly good mix of rain and sunshine during the next ten days -

Some

far southern China crop areas may become a little too wet during the next ten days.

-

Northeast

China will see sufficient rain to maintain a good outlook for corn, soybeans, sugarbeets and spring wheat -

There

is a dryness concern from northern Jilin into Inner Mongolia and “some” relief is possible in the next couple of weeks, although more rain will be needed -

Xinjiang,

China will experience more seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Monsoonal

rainfall is expected to occur in the mainland areas of Southeast Asia during the next two weeks resulting in improved sugarcane, rice and coffee conditions among other crops like corn -

Some

caution is needed since some of the computer forecast model data is exaggerating the anticipated rainfall

-

Philippines,

Indonesia and Malaysia will see a favorable mix of weather during the next two weeks supporting most crop needs -

Australia

weather over the next ten days will include rain in Victoria, New South Wales, southeastern South Australia and southwestern Western Australia -

The

moisture will be ideal for wheat, barley and canola establishment -

A

boost in rainfall will be needed in Queensland and in interior South Australia and in some northern and eastern Western Australia crop areas -

South

Africa rainfall will be restricted over the next ten days, though some rain will benefit southwestern winter wheat, barley and canola production areas -

West-Central

Africa rainfall will be favorably distributed for coffee, cocoa, sugarcane and cotton as well as rice during the next ten days -

East-central

Africa has been and will continue to be favorably distributed from Uganda and southwestern Kenya to Ethiopia through the next ten days with western Ethiopia wettest relative to normal -

Argentina

weather over the next ten days will not provide much rainfall which will favor fieldwork in many areas, but no relief from dryness is likely in the southwest -

Brazil

weather during the coming will be dry for most of the nation’s key crop areas this week, although some rain will fall in coastal Bahia and areas northward -

Rain

is expected in far southern Brazil Sunday into Wednesday of next week, June 11-14 -

Today’s

Southern Oscillation Index was -19.42 and it will move erratically higher over the next week

Source:

World Weather, INC.

Thursday,

June 8:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Russia

grain union conference in Gelendzhik, day 3 - HOLIDAY:

Brazil

Friday,

June 9:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - Sustainable

World Resources conference in Singapore - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Russia

grain union conference in Gelendzhik, day 4

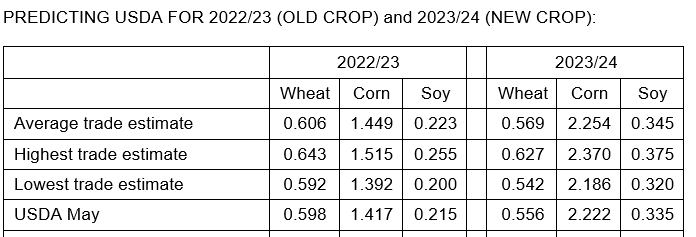

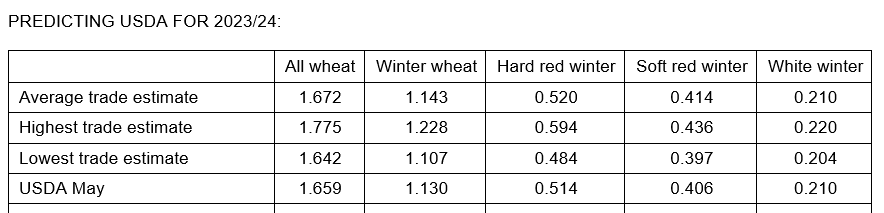

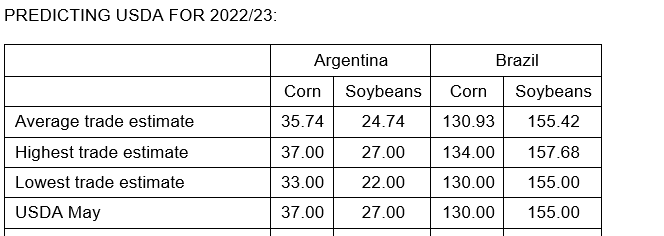

Reuters

estimates for USDA S&D

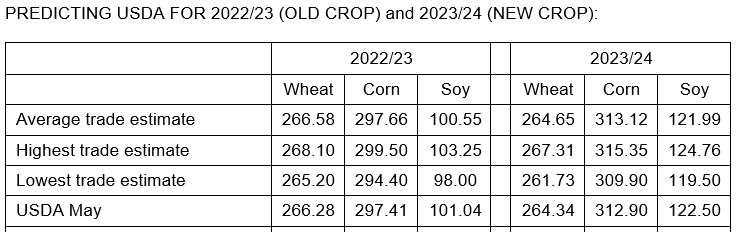

Bloomberg

estimates for Conab – June 13 release

Macros

POLL:

78 Of 86 Economists See Fed Holding Fed Funds Rate At 5.00%-5.25% In June; 8 See 25Bp Hike – RTRS

–

32 Of 86 Economists See Fed Raising Fed Funds Rate At Least Once More In 2023; 8 Say June, 24 Say July

US

Trade Balance Apr: -$74.6B (est -$75.8B; prevR -$60.6B)

Bank

Of Canada Hikes Policy Rate By 25Bps To 4.75%, Analysts Saw BoC On Hold

Canadian

Int’l Merchandise Trade Apr: C$1.94B (est C$0.55B; prevR C$0.23B)

Canadian

Labour Productivity (Q/Q) Q1: -0.6% (prev -0.5%)

U.S.-China

April Trade Deficit $20.28 Bln VS March Deficit $16.61 Bln

U.S.

Crude Oil Exports Fell To 4.00 Million Barrels Per Day In April (VS 4.83 million BPD In March) – U.S. Census

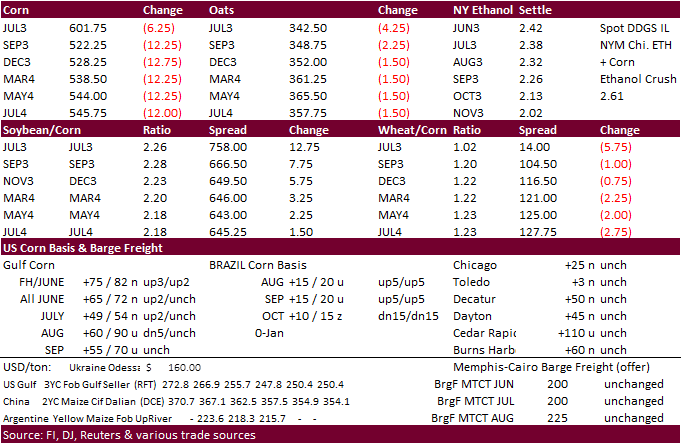

Corn

·

Fundamental news was light.

·

Traders are losing confidence that the national US corn yield will end up above trend this year, but on our corn crop condition weighted basis, the national yield as of August 1 is currently projected above a 15 and 30-year trend.

Our bias is for US corn conditions to decline over the next few weeks given the dryness across the majority of the belt. It’s early though.

·

The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed down 2 percent. Cumulative placements were down slightly from the same period a year earlier.

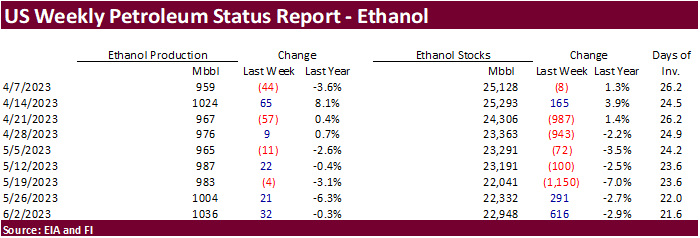

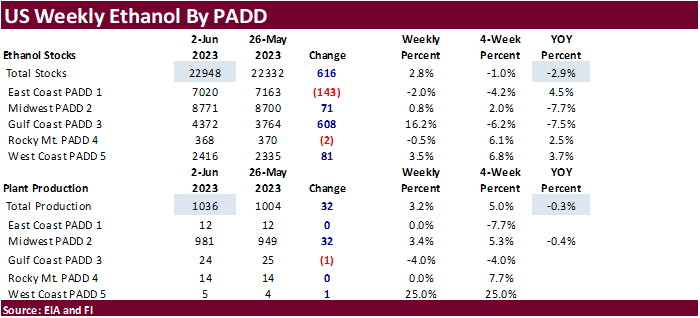

US

weekly ethanol update

·

The US weekly EIA ethanol data was viewed positive for US corn futures.

·

US weekly ethanol production increased 32,000 barrels per day to 1.036 million barrels per day, largest volume since December 9, 2022. US ethanol stocks increased a large 616,000 barrels to 22.948 million barrels.

·

For comparison, a Bloomberg poll looked for weekly US ethanol production to be up 13,000 thousand barrels from the previous week and stocks up 72,000 barrels.

·

US ethanol production of 1.036 million barrels per day is about 0.3% below from about the same time a year ago.

·

Over the past 4 weeks, production changes averaged up 18,000 and stocks down 86,000 barrels.

·

Early September 2022 to date (40 weeks) US ethanol production is running 3.1% below the same period a year ago.

·

There were no ethanol imports reported this week. Exports were 97,000 barrels, up from 54,000 barrels from the previous.

·

Ethanol stocks of 22.948 million barrels are down about 2.9% from a year ago and 1.0% below a previous 4-week average. The record for ethanol stocks was 27.689 million barrels set on 4/17/20, but today’s inventories are still

considered at a good level.

·

Days of inventory of 21.6 compares to 24.2 a month ago and 22.1 during comparable period a year ago.

·

Weekly ending stocks of total gasoline were up 2.745 million barrels to 218.815 million barrels (was down 5 consecutive weeks). Implied gasoline demand was up 120,000 barrels to 9.218 million barrels.

·

The net blender input of fuel ethanol was down 39,000 from the previous week to 887,000 bpd, below its previous 4-week average of 915,000 bpd.

·

Net production of combined finished reformulated and conventional motor gasoline with ethanol was 8.720 million barrels, down 405,000 barrels from the previous week and represents 91.0 percent of total finished motor gasoline,

below 91.1% previous week.

·

For 2022-23, we are using 5.215 billion bushels, unchanged from previous, and compares to 5.250 billion by USDA and 5.326 billion for 2021-22.

University

of Illinois: Perspectives on Non-decreasing National Yield Trends

Schnitkey,

G., C. Zulauf, N. Paulson and J. Baltz. “Perspectives on Non-decreasing National Yield Trends.”

farmdoc daily (13):103, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2023.

https://farmdocdaily.illinois.edu/wp-content/uploads/2023/06/fdd060623.pdf

Export

developments.

-

Algeria

seeks up to 140,000 tons of corn on June 8 for July-Aug 15 shipment.

Updated

06/6/23

July

corn $5.75-$6.35

September

corn $4.50-$5.75

December

corn $4.25-$5.75

·

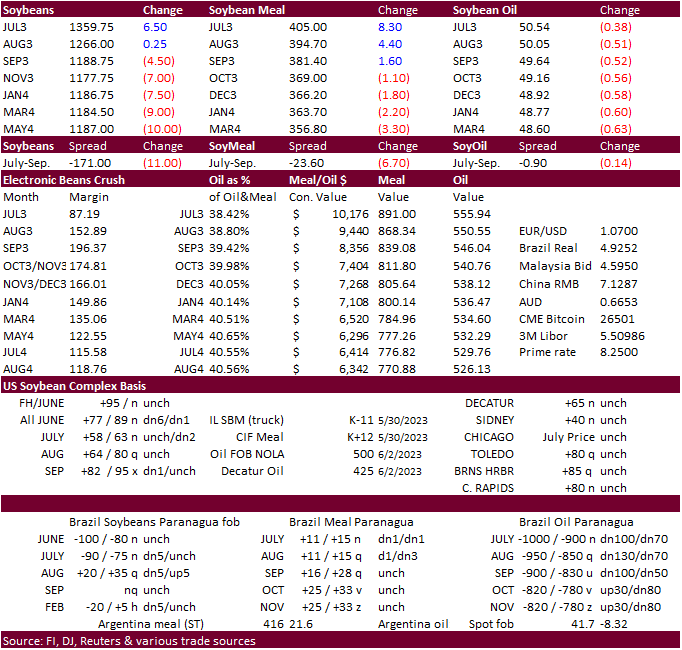

Soybeans and meal were mostly higher in the nearby contracts with bull spreading in focus while back months fell from a wetter morning and midday weather outlooks. Not all areas for the 6-10 turned wetter. Missouri into southern

IL was drier. Soybean oil traded lower following weakness in offshore values and a reversal in product spreading after rallying yesterday. Yesterday there was a rumor a large commercial is looking to buy back soybean oil receipts. There was no SBO registration

cancelations Tuesday evening, but more soybean meal came out.

·

Nearby soybeans are seeing follow through bull spreading in part of the USDA old crop sales announcement to Spain. Additional US soybean purchases by EU crushers should not be ruled out despite the large Brazil crop.

·

SN/SX was last 180.00/183.25, up 13.25 cents on the day.

·

China May soybean imports jumped to a record 12.02 million tons despite tighter inspection protocols and were up 24 percent from year ago and compares to 7.26 million tons during April. Higher soybean product prices in China drew

stocks lower by the end of April, prompting a boost in May arrivals. One trader expects June China soybean arrivals to reach 13 million tons. January-May China soybean imports were 42.31 million tons, up 11.2 percent from the same period year ago.

·

China edible vegetable oil imports in May were 646,000 tons, bringing Jan-May totals to 3.736 million, a 129.5% increase from the previous period.

·

Germany formally asked the EU Commission to launch an investigation over concerns that companies in Asia, including China, are mixing biofuels with cheaper oils before exporting to the EU. They want to find out if the “whether

the sustainability and greenhouse gas emission savings criteria are met” (Reuters). Recently, other trade groups also asked the Commission to investigate the sharp rise in EU biofuel imports.

Export

Developments

·

Iran seeks 120,000 tons of soybean meal from Brazil for July and/or August shipment.

·

Algeria seeks 35,000 tons of soybean meal on June 8 for July 1-15 shipment.

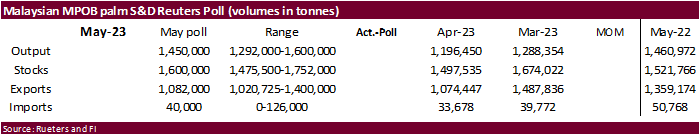

Reuters

MPOB estimates

Soybeans

– July $13.00-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$420, December $290-$450

Soybean

oil – July 48-52, December 43-53, with bias to upside

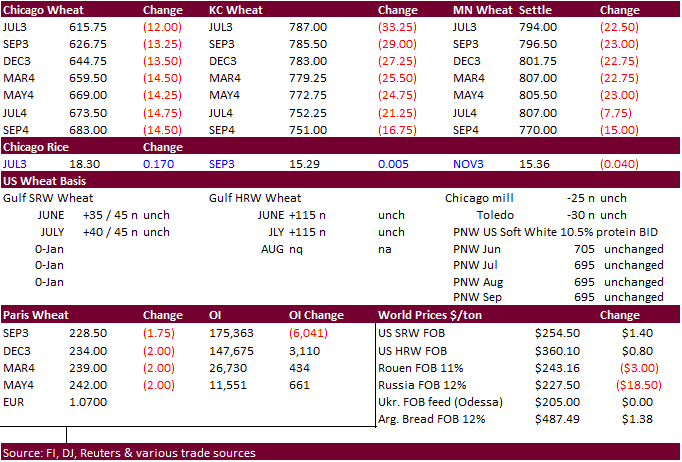

Wheat

·

US wheat futures traded two-sided in Chicago before fund selling pulled contracts more than 10 cents lower. High protein wheat futures were sharply lower led by KC (down 16.75-33.25 cents). MN was over 20 cents lower. US export

demand is poor and the US Great Plains will see rain one time or another over the next seven days.

·

Traders will be monitoring wheat production areas for southeast Ukraine after the dam breach.

·

China’s largest wheat producing province of Henan saw heavy rains over the past 14 days, potentially lowering quality. About 30 million tons is grown in that province.

·

It remains dry across the Canadian Prairies.

·

Argentina’s wheat area was revised down 300,000 hectares by the Rosario Board of Trade due to unfavorable dry conditions. The planting progress pace is expected to improve after recent rains but note the window normally closes

by early July.

·

Black Sea grain export deal talks resume Friday in Geneva. Earlier this week Russia said it saw no prospects to extend the deal.

·

September Paris milling wheat officially closed 1.75 euros lower, or 0.8%, at 228.00 euros a ton (about $244.00 ton).

·

EU soft wheat exports so far this season reached 28.88 million tons by June 4, up from 25.93 million during the same period year earlier.

Export

Developments.

·

Egypt was thought to have bought about 55,000 tons of wheat at maybe $229/ton fob (lowest offer earlier) from Russia for July 21-31 shipment. Freight was $15.50/ton.

·

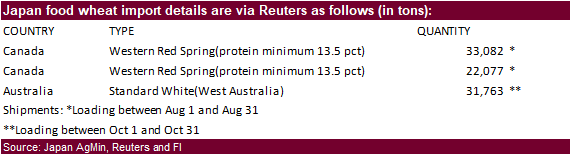

Taiwan seeks about 56,000 tons of US wheat from the US on June 14 for July 31-August 14 shipment off the PNW.

·

Japan seeks 86,922 tons of food wheat later this week for August shipment.

·

Morocco seeks 500,000 tons of feed barley on June 14.

Rice/Other

·

South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

Chicago

Wheat – July $5.75-$6.50, September $5.50-$6.75

KC

– July $7.75-$8.75, September $7.50-$9.00

MN

– July $7.75-$8.75,

September $7.25-$9.00

#non-promo