CBOT

agriculture markets were mostly higher from a more than expected drop in US corn, soybean and spring wheat crop ratings. MN wheat dropped on technical selling. Egypt bought 60k soybean oil and 40k sunflower oil. The volume hints countries are securing food

supplies amid tightening world inventories. Egypt has enough vegetable oil to meet demand through November.

WORLD

HIGHLIGHTS

-

Canada’s

Prairies will receive relief from dryness through the weekend, but follow up moisture will still be needed

o

Short term relief is imperative after recent drying has soil moisture rated short to very short

o

Crop stress has been increasing and there have been reports of blowing dust in a few areas

o

Rain will occur in the southeast corner of the Prairies tonight and Wednesday and across eastern Alberta, western and central Saskatchewan Thursday night into Saturday

o

Week two weather (June 16-22) will be a little drier and warmer biased once again

-

Northern

U.S. Plains relief from dryness will be a little erratic over the next several days, but rain will fall

o

Many areas will get 0.20 to 0.75 inch and the heavier amounts will be more localized to north-central North Dakota tonight and to interior western and central North Dakota Thursday night into Friday

o

Additional showers will occur periodically in the following week, but it will require much more rain than being offered to restore soil moisture to normal

-

North

America ridge of high pressure will shift to the west this weekend and into next week producing a northwesterly flow pattern in the Midwest for a week

o

Some showers and thunderstorms will occur in the pattern, but rain intensity and coverage will be limited enough in the north and western parts of the Corn Belt that the situation will need to be watched for when warmer temperatures

return later this month

-

Crop

stress may evolve in the drier areas a little faster with the next round of heat – not this week, but later in June -

U.S.

lower Midwest, Delta and southeastern states will experience favorable crop weather for the next ten days -

West

Texas mini heatwave rest of this week will generate extreme highs of 100 to 108 and very little to no rain

o

Livestock stress is expected

o

Quick drying in the topsoil is also expected which may lead to some crusting soil in recently planted cotton, corn and sorghum fields

-

West

Texas temperatures will cool down notably this weekend into next week and a few showers and thunderstorms will begin to pop up periodically as well -

U.S.

Pacific Northwest and portions of the western Corn Belt will be drier than usual -

Far

western U.S. will remain very dry -

Areas

of disturbed tropical activity are anticipated in parts of the Caribbean Sea, Gulf of Mexico and western Atlantic Ocean during the next two weeks as the subtropical high pressure system breaks down and the subtropical jet stream temporarily dissipates -

Mexico

rainfall will continue confined to southern parts of the nation during the next two weeks leaving drought in dominance of western, central and northern Mexico

o

Recent rain in eastern Mexico eased long term dryness

-

Nicaragua

and Honduras have been drier biased for the past month and need rain

o

Some improvement is expected over the next week to ten days as rain develops in some of the driest areas

-

Safrinha

corn areas of Brazil will experience no serious weather changes over the next ten days

o

Dryness will remain in Mato Grosso, Goias, southwestern Minas Gerais and northern Sao Paulo

o

Showers and thunderstorms farther to the south in Brazil periodically will be good for wheat and late Safrinha crops

o

Safrinha corn and cotton production will be down this year, despite periodic rainfall in the south

-

Argentina’s

summer crop harvest has advanced well in recent weeks

o

Winter wheat areas are drying down and there are some areas in Cordoba that need significant moisture

-

The

dry bias will prevail over the next week to ten days -

Australia

will see some periodic showers and some sunshine during the next two weeks

o

Greater volumes of rain are needed especially in South Australia, Queensland and, northwestern Victoria and western New South Wales

-

India’s

monsoon depression evolving over the northern Bay of Bengal will bring torrential rainfall and flooding to crop areas from Odisha into Madhya Pradesh this weekend into next week

o

Rainfall of 6.00 to 15.00 inches and possibly more will occur near the center of the depression

-

Delays

in summer crop planting will result and some flooding could induce property damage

o

Heavy rain will also occur along the west coast of India during the coming week inducing more flooding and possible property damage

-

China’s

Yellow River Basin, North China Plain and east-central provinces will receive some much needed late this week and especially next week bringing sufficient rain to many areas that has been drying down

o

The bottom line for China should be good for most crops in the nation

-

The

northeastern provinces would benefit from less rain and warmer temperatures and the far south needs a longer period of dry weather to restore the best possible crop conditions after frequent rain and flooding this spring -

Xinjiang,

China crop areas in the northeast will continue to deal with cooler than usual weather through the next week and possibly a little longer.

o

Periodic rain and thunderstorms are expected as well resulting in some threat to a few crops

-

Degree

day accumulations are notably behind normal in parts of northeastern Xinjiang

o

Southwestern crop areas in Xinjiang will remain in the best condition with more limited potential for rain and temperatures staying closer to normal

-

Europe

weather will trend a little drier during the coming ten days especially in western and northern parts of the continent.

-

Russia’s

New Lands are still likely to be influenced by a high pressure ridge next week generating very warm and dry biased weather

o

A sukhovei may evolve next week bringing excessive heat, wind and low humidity to western Kazakhstan and Russia’s Southern Region.

-

Excessive

heat occurred in parts of Central Asia during the weekend and Monday including Uzbekistan, Turkmenistan and a few immediate neighboring areas where extreme highs ranged from 100 to 115 degrees Fahrenheit

o

The heat will bubble up to the north next week, but should be more confined to the same region this week

-

Russia’s

Southern Region received some welcome rain during the weekend with 0.10 to 0.80 inch and local totals to 0.92 inch resulted

o

A few of these showers reached into western Kazakhstan and the lower Volga River Valley

-

Southeast

Asia rainfall increased in eastern Malaysia, northern Sumatra and parts of Luzon Island, Philippines during the weekend

o

The rain was welcome

o

Other areas experienced net drying excerpt in northwestern Mindanao and southeastern Luzon Island where localized rainfall of significance was noted

-

Much

of Southeast Asia is expecting bouts of rain through the next ten days, although amounts will be lighter than usual at times.

-

South

Africa rain is expected from Northern Cape into Free State this workweek

o

The moisture will be light, but still beneficial for some winter crop planting emergence and establishment

-

West

Africa rainfall will increase over the next ten days

o

Greater rain is needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

-

A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

-

East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will increase in Ethiopia this week while little change occurs elsewhere

-

Southern

Oscillation Index is mostly neutral at -0.26 and the index is expected to begin leveling off during the balance of this week after a steady decline -

North

Africa weather will trend a little wetter in northern Algeria and Tunisia late this week and into the weekend

o

Some light rain fell in the same region during the weekend

o

No winter crop quality issues are expected

-

New

Zealand weather during the coming week to ten days will be drier and warmer than usual

o

the exception will be along the west coast of South Island where rain is expected this weekend into next week

Source:

World Weather, Inc.

Tuesday,

June 8:

- Australian

crop report - International

Grains Council Conference, day 1 - France

agriculture ministry’s monthly crop estimates

Wednesday,

June 9:

- EIA

weekly U.S. ethanol inventories, production - International

Grains Council Conference, day 2 - FranceAgriMer

releases monthly grains report

Thursday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

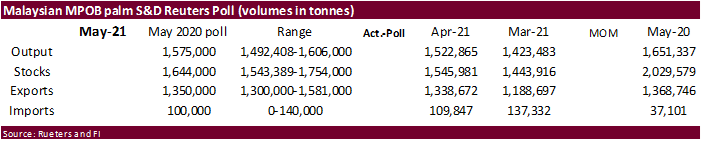

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Malaysian

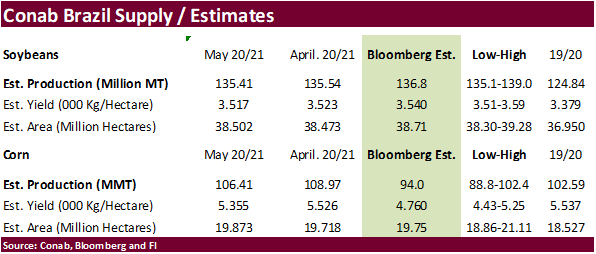

Palm Oil Board inventory, output and export data for May - Brazil’s

Conab releases output, yield and acreage data for corn and soybeans - Port

of Rouen data on French grain exports - Malaysia

June 1-10 palm oil export data

Friday,

June 11:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macros

US

Trade Balance (USD) Apr: -68.9B (est -68.7B; prev -74.4B)

US

Crude Oil Exports Reached 3.24 Million B/D In April (Vs 2.61 Million B/D In March)

US

China April Trade Deficit USD25.83 Bln Vs March Deficit USD27.69 Bln

USDA

To Invest More Than USD4Bln To Boost Food Supply Chains

US

JOLTS Job Openings Apr: 9286K (est 8200K; prev R 8288K)

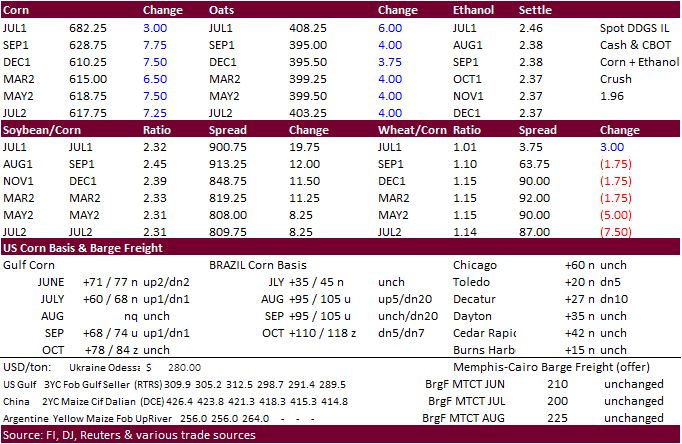

Corn

- US

corn futures traded higher, led by the back months, on US weather concerns bias WCB and more than expected 4 point drop in US corn crop condition ratings. Several upper US states are in need of rain and we expect crop stress to increase next week if areas

miss out on rain over the next 5 to 7 days. Corn import tenders remain quiet and we think many importing countries are focused on new-crop supplies at the moment, and maybe waiting for a pullback before committing. The weather outlook appeared to be mostly

unchanged this morning with emphasis on net drying across the WCB this workweek.

-

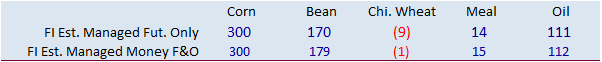

Funds

bought an estimated net 13,000 corn contracts. - Spreads

were under pressure again. After the text we included a page on selected spreads. Today was the second day of the Goldman Roll.

- USD

was 17 higher as of 3 pm CT. - The

USDA plans to invest more than 4 billion USD to strengthen the food system through the Build Back Better initiative.

-

US

corn conditions were reported 2 points below expectations at 72 percent, down 4 points from the previous week, below 75 year ago and above 71 percent average. 90 percent of the corn crop is emerged.

-

A

Bloomberg poll looks for weekly US ethanol production to be up 2,000 barrels (1020-1047 range) from the previous week and stocks up 110,000 barrels to 19.698 million.

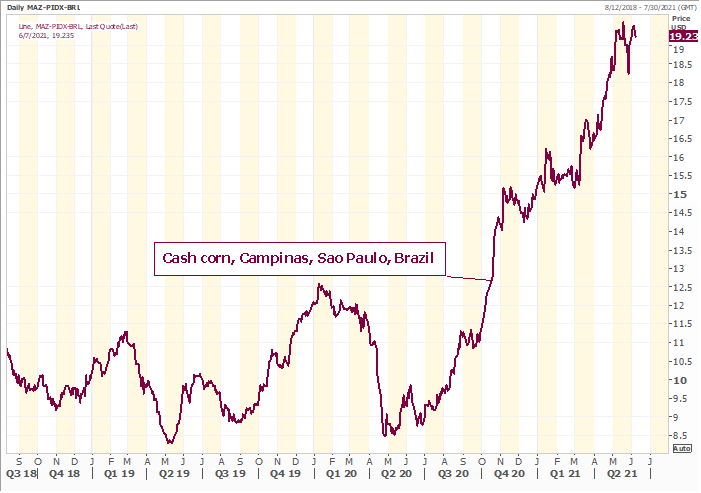

Brazil

interior corn prices are expected to stay high for months

Source:

Reuters and USDA

U

of I: International Benchmarks for Corn Production

Langemeier,

M. “International Benchmarks for Corn Production.” farmdoc daily (11):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 4, 2021.

https://farmdocdaily.illinois.edu/2021/06/international-benchmarks-for-corn-production-5.html

Export

developments.

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

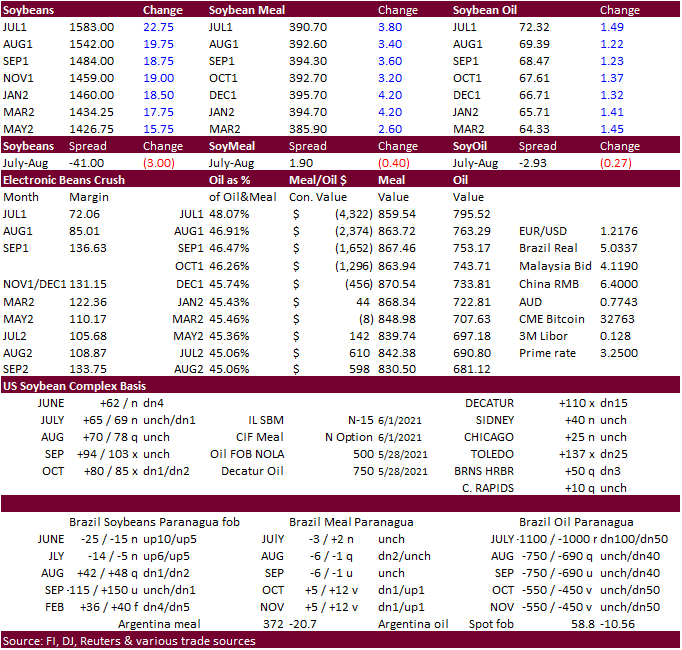

Soybeans

-

The

soybean complex ended sharply higher on lower than expected US initial soybean crop ratings and a mostly unchanged US weather forecast. The ECB appears to be in good shape but the WCB and upper Midwest is in need of rain.

-

Funds

bought an estimated net 12,000 soybeans, sold 3,000 soybean meal and bought 7,000 soybean oil.

-

Egypt

bought 60k soybean oil and 40k sunflower oil. The SBO price was higher than their previous tender and sunflower oil sharply lower (see export section). The volume hints countries are securing food supplies amid tightening world inventories. Egypt has enough

vegetable oil to meet demand through November. -

After

spreads collapsed yesterday, they rebounded today. Some think the move Monday was overdone. N/X fell to a December low earlier in the day but looks like it caught a bid by mid-morning. This spread was around 120 this morning then rallied to 130 by around

10 am before going out around 123.75-124.25. Second week of May it was hovering around 200 cents. -

Argentine

producers sold 20.9 million tons of soybeans as of June 2 for the 2020-21 season, up 863,600 tons from the previous week, and down from 24.4 million tons at this time year ago.

-

Argentina

soybean crushing hit a six-year high in April at 4.2 million tons. That brings Q1 crush to 13.7 million tons. -

Argentina

crushers called off a strike after the government agreed to step up vaccinations for grain related workers. Meanwhile the 7-hour strike by custom workers delayed shipments today.

-

AgriCensus

noted Brazil exported 2.5 million tons of soybeans during the first week of June.

-

Brazil

soybean exports for the month of June are seen reaching 11 million tons, according to Anec.

-

US

weather will be mixed over the next week. The Corn Belt could see roughly 0.75-2.00 inches of rain this week bias the southeastern areas while the northwest will remain mostly dry. -

France

sees the winter rapeseed production down 9.2% to 2.95 million tons, below 3 million for the first time in 20 years, and 32% below the five-year average. The average yield was expected to rise to 3.00 t/ha from 2.93 t/ha last year, but the crop area was estimated

to have decreased to 984,000 hectares from 1.11 million. (Reuters) -

US

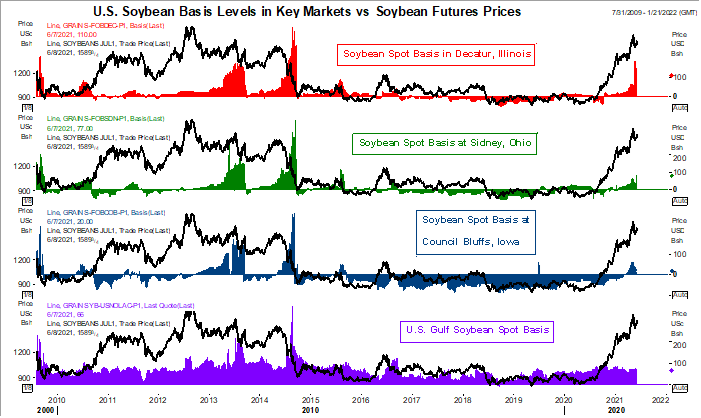

soybean meal basis was mostly unchanged from Monday. ECB was 11-18 over for many IN locations, Decatur, IL 10 under, and IA 10-20 under.

-

November

Decatur, Il, soybean basis fell 15 cents to 110 over and Lafayette, IN, down 10 to 95 over the August. Toledo, OH, soybean basis was down 25 to 137 cents over the November.

-

US

initial soybean conditions were reported 3 points below expectations at 67 percent, below 72 year ago and above 64 percent average. 90 percent of the soybean crop had been planted.

-

Cargill

: and HELM partner to build $300M commercial-scale, renewable BDO facility, first in the US, to meet growing customer demand (marketscreener.com)

- Egypt’s

GASC bought 60,000 tons of soyoil and 40,000 tons of sunflower oil for arrival in Egypt between Aug 1-20 with payment in 180 days. The soybean oil, 2 cargoes, was all bought at $1,299 a ton c&f ($36/ton higher than their previous purchase last month, according

to AgriCensus data) and the sunflower oil all at $1,368 a ton c&f ($222/ton lower than previous purchase last month). - USDA

seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

Soybean

basis at selected US locations have eased this week but in retrospect remains low compared to other years were summer stocks were tight. ECB remains a premium over WCB

Source:

Reuters and FI

Updated

6/7/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 69-75; December 57-70 cent range

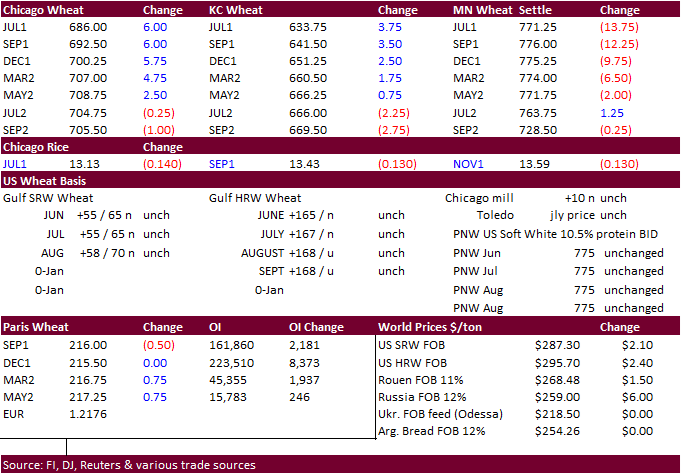

- US

wheat ended higher in Chicago, mostly higher for KC and MN lower. - We

were a little surprised the MN contract broke despite the declines in US spring wheat rating. Japan and Jordan joined Algeria this week in announcing new import tenders. Algeria bought at least 400,000 tons of wheat.

- So

far for the week MN July wheat is down 5.1% and, KC July down 0.6% and Chicago wheat down 0.4%.

- Funds

bought an estimated net 3,000 SRW wheat contracts. - The

Northern Great Plains will see rain relief today through Friday. World Weather is only looking for 0.20 to 0.75 inch, heavier amounts localized, to north-central North Dakota tonight and interior western and central North Dakota Thursday night into Friday.

One major analytical firm noted it may take up to 12 inches of rains to pull the Dakota’s out of drought condition over the next month. That’s eye opening. Note some weather models include up to only 65% of the Northern Plains receiving rain. This should

be monitored. - Canadian

Prairies may see roughly three quarters of an inch of rain over the next week, encompassing 60-80 percent of the growing areas. More rain is needed, especially southeastern Saskatchewan and Southern Manitoba. We are hearing current Canadian Prairie conditions

are mixed. - September

Paris wheat market basis September was down 0.25 euros at 216.25 at the time this was written. - France’s

AgMin: Projected winter barley 7.74 million tons, up 19.3% from last year but 6.4% below 5-year average.

- US

winter wheat conditions were up 2 points to 50 percent and were 2 points above an average trade estimate. US spring wheat conditions declined a large 5 points last week to 38 percent, 2 points below a trade average.

- Algeria

bought around 400,000 tons of milling wheat for July and/or August shipment at $297.50 and $298/ton c&f.

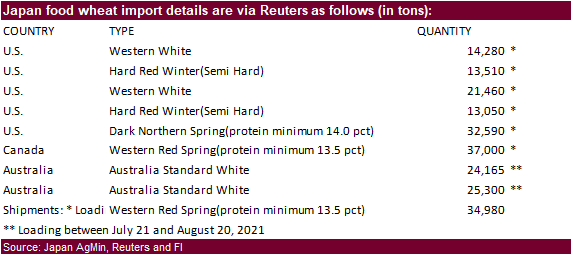

- Japan

seeks 181,355 tons of food wheat later this week from United States, Canada and Australia.

- Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

seeks 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment. - Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment.

Rice/Other

·

None reported

Updated

6/2/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.50-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.