PDF Attached

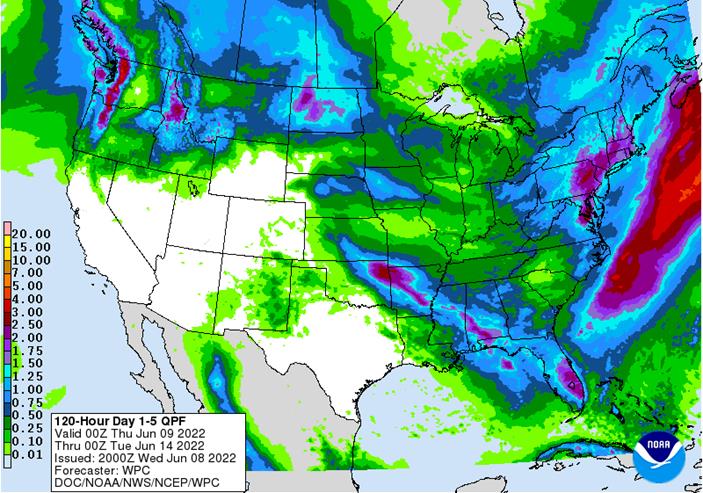

QPF 5-day Precipitation

WEATHER EVENTS AND FEATURES TO WATCH

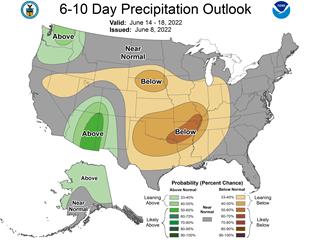

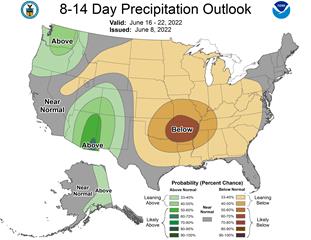

- Ridge building expected in the central U.S. during the second week of the forecast should verify well, but what is not fully understood yet is the exact positioning of the ridge and its expected amplitude along with its persistence potential.

- This weather feature will likely be around during a fair amount of the summer thanks to the negative phase of Pacific Decadal Oscillation (PDO), but for the next few weeks it will be pushed around by a very strong jet stream which should prevent any stagnation in the ridge that would raise a serious crop issue

- Initially the ridge will be a welcome change bringing with it warmer temperatures

- Less rainfall will not be a problem initially and most of the net drying will be in the southern Plains, lower Midwest and Delta initially as well

- Routinely occurring rainfall will occur in the northern U.S. as disturbances move across the top of the high pressure ridge

- Recent rain in interior southern Alberta and far southwestern Saskatchewan, Canada has improved topsoil moisture and relieved some drought

- Much more rain is needed especially in east-central Alberta and west-central and interior southwestern Saskatchewan where there has not been any serious relief from dryness recently

- These drought stricken areas may have a better opportunity for rain next week and into the balance of this month, but until then dryness is expected to prevail

- The potential for rain next week will be somewhat determined by the high pressure ridge development that is expected and positioning of the ridge will have much to say about where in the Prairies significant rain may fall

- Drying in previously water-logged areas of the eastern Canada Prairies continues, but time is running out with a more active weather pattern to return soon

- Fieldwork is advancing and progress is expected to continue until the wetter weather returns next week

- Some rain will occur Friday into Saturday, but early to mid-week next week will be wettest

- U.S. weather is predicted to be well mixed for the coming week with alternating periods of rain and sunshine expected to promote aggressive crop development while allowing some fieldwork to advance

- Central and southern Texas, California and most of the southwestern states will continue drier biased for the next ten days to two weeks

- Dryland crop stress will likely resume in time as temperatures heat up getting into the 90s and over 100 Fahrenheit frequently

- U.S. Delta and southeastern states will experience a good mix of weather during the coming week with drying expected in the second week of the outlook

- Most grain, oilseed, cotton, rice crops will remain in good shape, despite the drying trend

- Net drying is expected in central and eastern Ukraine, Russia’s Southern Region and western Kazakhstan over the next ten days

- The environment will be good for fieldwork, but may result in developing crop stress as the region dries out over time

- Recent storms in France improved topsoil moisture, but brought some crop damage from hail and damaging wind

- The impact was low on the nation as a whole, but there was crop damage and assessing the extent of that damage will be ongoing

- France is likely to experience some additional drying periodically over the next week to ten days which may return some dryness worry over time

- Much of Europe will experience alternating periods of rain and sunshine during the next ten days favoring crop development and fieldwork; however, rain totals will continue lighter than usual in portions of the continent keeping the need for routinely occurring precipitation relatively high

- Harvest weather in North Africa has been and will continue mostly good

- Rain will fall sporadically in parts of Morocco late this week into next week, but warm to hot temperatures will evaporate the moisture shortly after it occurs preventing the precipitation from having much impact

- East-central China is drying out and the trend will continue for a little while, but scattered showers and a few thunderstorms are expected periodically that will slow this trend and for some areas it may reverse it for a while

- The second week of the outlook is looking wetter today relative to that predicted Tuesday

- Southern China’s excessive rain recently has induced a second round of serious flooding south of the Yangtze River Valley causing damage to rice and minor corn, soybean and ground nut production areas

- Some sugarcane areas have also been too wet

- The wettest weather is becoming confined to the southern coastal provinces now and it will persist there for much of the coming week to ten days

- China’s greatest problem with excess moisture is expected to occur in the southern coastal provinces over the next couple of weeks with another 6.00 to 15.00 inches of rain expected and locally more resulting in additional flooding

- Xinjiang, China weather has been relatively good and crops should perform well as long as temperatures are close to normal and water supply for irrigation is plentiful

- India’s monsoon has not performed very well in this first week of the official rainy season, but it is still very early in the season and there is plenty of time for change

- Next week’s rainfall should increase in central parts of the nation where rainfall will be closer to normal while rainfall continue lighter than usual in the south

- Southeast Asia rainfall will continue abundant in many areas through the next two weeks

- Local flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar

- Southern Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development

- Western Australia will receive waves of rain over the next several days bolstering topsoil moisture for much improved wheat, barley and canola germination and emergence conditions

- Additional planting will occur aggressively following this week’s rain

- East-central Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia

- West-central Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally

- South Africa’s restricted rainfall over the next ten days will be good for summer crop harvest progress and some late winter crop planting

- Rain in western parts of the nation will be good for wheat, barley and canola emergence and establishment

- Argentina rainfall will continue restricted in western crop areas and a boost is needed to support winter crop planting, emergence and establishment

- Some rain “may” fall in a part of wheat country during the latter part of next week and into the following weekend

- Rain is expected in western and southern Mato Grosso the remainder of this week resulting in some improvement in field moisture and cotton crop conditions

- The moisture will come too late for corn production

- Southern Brazil will also be plenty wet over the next several days maintaining a wet environment for wheat and Safrinha corn produced from Mato Grosso do Sul to Sao Paulo, Parana, Santa Catarina and northern Rio Grande do Sul

- Central America rainfall will be abundant during the next ten days with excessive rainfall possible along the Pacific Coast

- Mexico rainfall this week will be a little greater than usual in the interior west-central and northwest parts of the nation and close to normal in the far south while below average elsewhere

- Next week’s weather will trend wetter in the east and south while continuing periodically in the interior west-central and northwest

- Today’s Southern Oscillation Index was +18.17 and it will slowly decline over the next few weeks

- New Zealand rainfall will be greater than usual this week and then lighter next week

Source: World Weather Inc.

Bloomberg Ag Calendar

Thursday, June 9:

- China’s first batch of May trade data, including soybeans, edible oils, rubber and meat imports

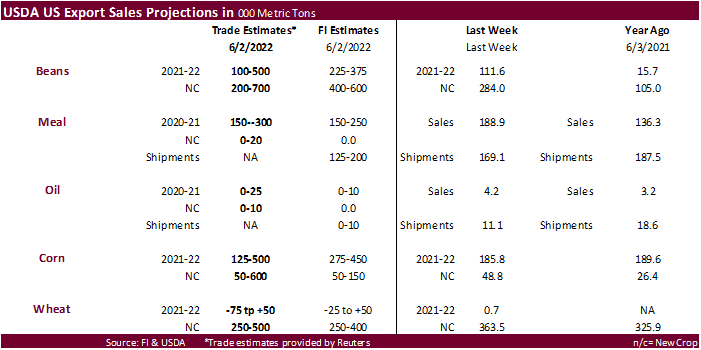

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Ecosperity sustainability conference, Singapore

- Russian Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 3

Friday, June 10:

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, 12pm

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- ICE Futures Europe weekly commitments of traders report

- Malaysian Palm Oil Board’s data for May output, exports and stockpiles

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Malaysia’s June 1-10 palm oil export data

- Brazil’s Unica may release cane crush and sugar output data (tentative)

Source: Bloomberg and FI

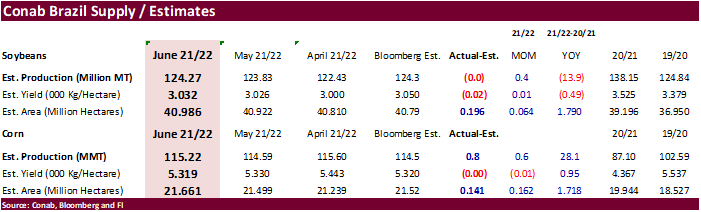

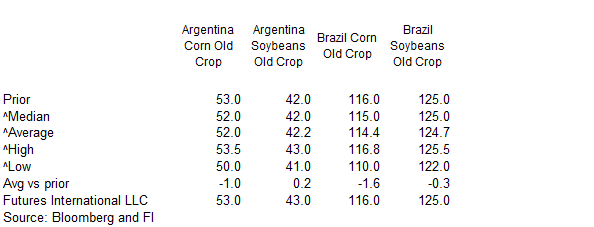

Conab:

Soybean production near expectations and 400,000 tons above previous month.

Corn production 800,000 tons above expectations and 600,000 tons above May estimate.

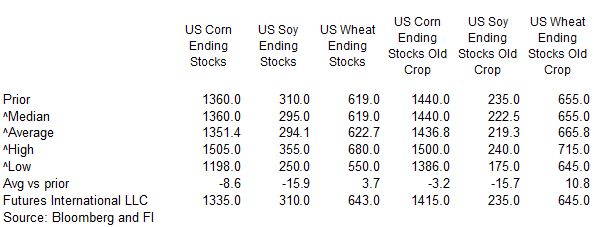

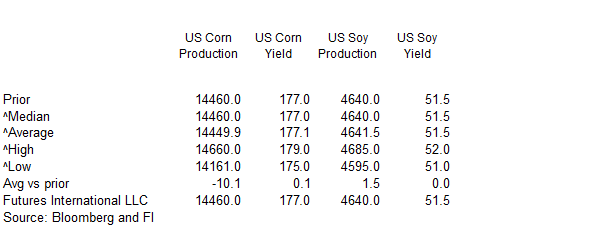

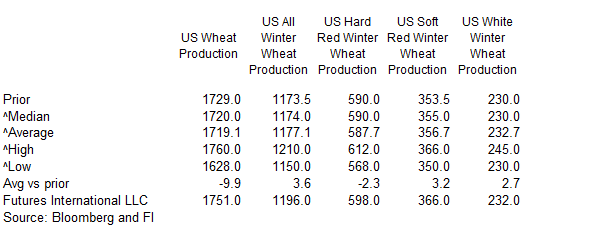

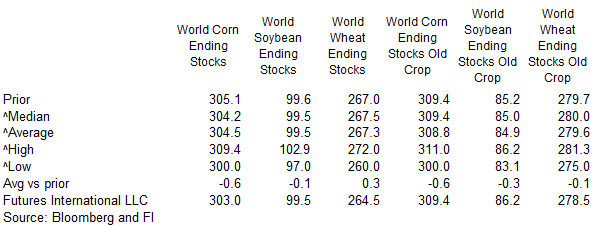

USDA S&D estimates

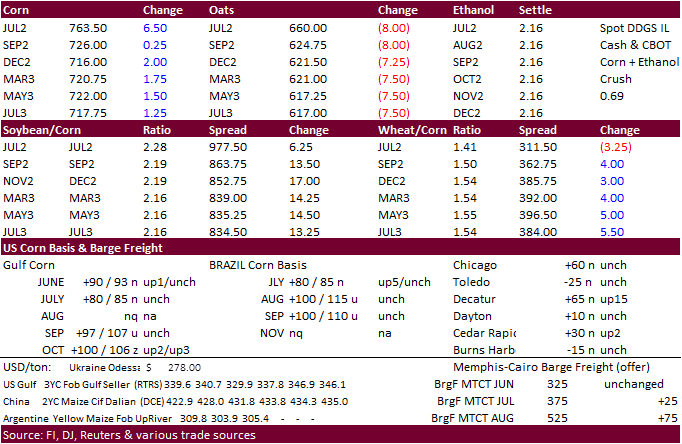

· US corn futures rose for a third straight session on demand and hot and dry weather seen in next week’s forecast.

· With Covid restrictions easing in China, traders are banking on them tendering for corn and soybeans over the next several weeks.

· China looks to buy 40,000 tons of frozen pork on June 10.

Export developments.

· The Philippines bought 53,000 tons of corn from South America at around $405-$410/ton, c&f for July shipment.

Updated 6/1/22

July corn is seen in a $6.75 and $8.00 range

December corn is seen in a wide $5.50-$8.00 range

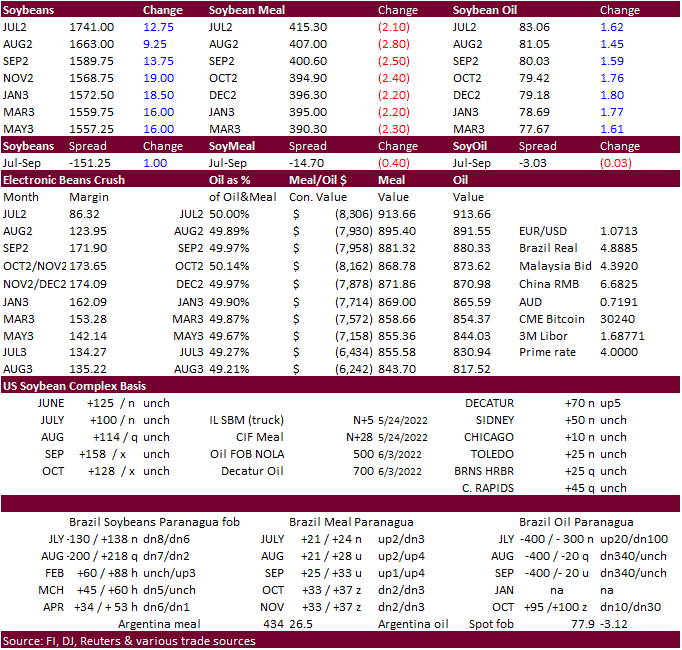

· CBOT soybean futures rose on demand and hot and dry weather appearing in the 6-10 day forecast. Both SN2 and SX2 hit contract highs during the session.

· CBOT soybean oil traded higher today following crude oil, while soymeal declined marginally.

· There is talk out of Brazil may increase its biodiesel (soybean oil) blend to 15% vs 10% later in the year to combat high oil prices. We think they need to take care of the food sector before that could happen.

· Brazil Conab came out right around the market averages.

· France’s farm ministry, for its first estimate of the year, pegged the French winter rapeseed, the crop at 3.87 million tons, up 17.8% year-on-year.

· Egypt’s GASC import tender for soybean oil & sunflower oil was cancelled and bought cheaper local oils.

· China will offer another 500,000 tons of soybeans out of reserves on June 10.

Updated 6/1/22

Updated 6/1/22

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – July $375-$465

Soybean oil – July 76-81

Wheat

· Wheat futures traded higher today on thoughts that even though Russia has said they would lift a blockade for exports, nothing of consequence will ship.

· The head of Ukraine’s grain association said the Turkey talks with Russia will not work to guarantee security of shipments in the Black Sea and without port access, about half of Ukraine’s corn crop could potentially not get harvested.

· Meanwhile Russia said sanctions must be lifted for Russian grain to reach markets.

· India could soon allow to export 1.2 million tons of wheat, according to trade sources, but many exporters have yet to secure export permits.

· France’s farm ministry, for its first estimate of the year, pegged the French winter barley crop at 8.25 million tons, up 0.4% compared with last year.

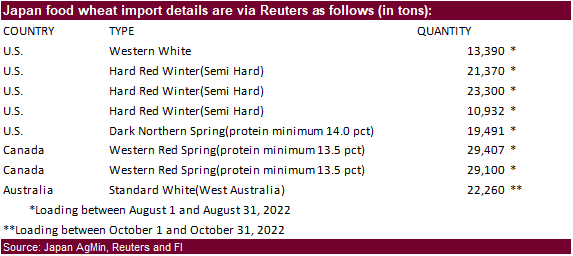

· Jordan bought 60,000 tons of barley, optional origin at $444.90/ton c&f for LH September shipment. Japan seeks 169,250 tons of wheat from the US, Canada and Australia later this week.

· Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on June 15 for arrival by Nov 24.

· Jordan seeks 120,000 tons of wheat on June 14 for September/October shipment.

Rice/Other

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.