PDF Attached

Very

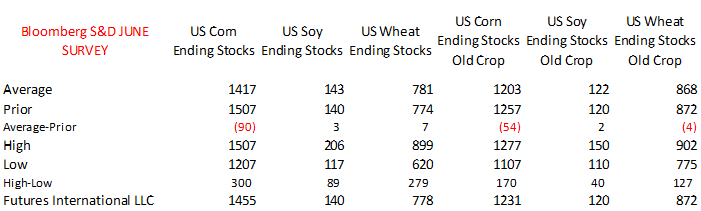

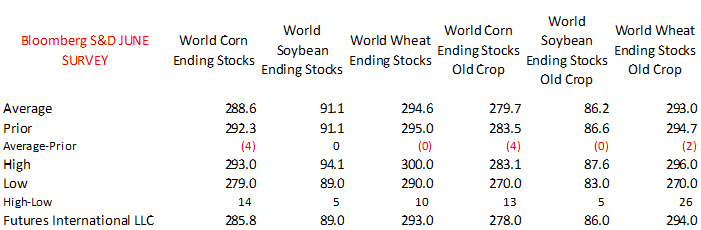

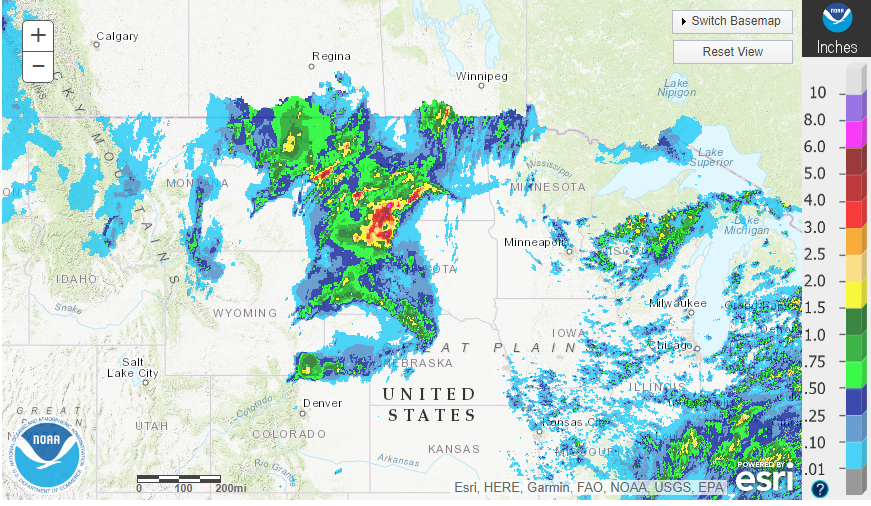

choppy trading range today on positioning ahead of the USDA report due out on Thursday. Corn reversed to traded higher bias the nearby contract. MN wheat was down again after rain fell across parts of the Northern Plains and Canadian Prairies, pressuring

Chicago and KC type wheat. The soybean complex was lower in part to technical selling and rain falling across the ECB.

Mid-day

for the short and medium range forecast for most models (not GFS) reduced rain for the northern U.S. Plains and increased it in Canada’s eastern Prairies for Thursday night into Saturday.

![]()

World

Weather, Inc.

WORLD

HIGHLIGHTS

- Portions

of the Western U.S. Corn Belt will be drying out over the next ten days

o

No excessive heat is expected

o

Some cooling will occur for a little while next week

o

The drying is not likely to cause critical crop stress; however, concern will rise over crop conditions the next time temperatures turn hot after the period of net drying

- U.S.

high pressure ridge aloft is still expected to shift westward into the Rocky Mountains and high Plains region this weekend and especially next week creating a northwesterly wind flow aloft over the Midwest

o

In this pattern there may be some shower and thunderstorms and less heat

o

Crop conditions will only improve if generalized rain evolves

o

Moisture in the northwestern Corn Belt will be restricted especially if a tropical cyclone comes into the Gulf of Mexico as suggested by some forecast models today

- As

noted a week ago, the potential for tropical cyclone development in a part of the western Atlantic Ocean Basin will be highest from June 13-17

o

Recent forecast models have suggested tropical systems may evolve in the southwestern Gulf of Mexico a week from now with another tropical wave of small tropical system in the Caribbean Sea a little later in the forecast period

- Monsoon

depression evolving in the northern Bay of Bengal will bring significant rain to India from Odisha to Madhya Pradesh this weekend and early next week

o

Flooding is expected, although rain amounts have been reduced today over those advertised earlier this week

- Amounts

of 4.00 to 10.00 inches and locally more will be possible resulting in some flooding

o

Not much planting has occurred thus far this summer and the storm will cause delays in fieldwork, but only a small area of replanting may be necessary

o

A follow up monsoon depression is possible in the second week of the outlook a little farther to the east from West Bengal and Bangladesh to Uttar Pradesh

- Interior

western India will be drier than usual over the next ten days

o

The area includes Gujarat, interior Maharashtra, Karnataka, Tamil Nadu and much of Andhra Pradesh

- East-central

China, including the Yellow River Basin and North China, will receive rain this weekend through all of next week to ease the region from recent dryness

o

Crop stress relief is expected

- Northeast

China crop weather will be mostly good over the next two weeks - Southern

China will remain plenty wet for the next two weeks - Xinjiang,

China will trend a little cooler than usual in the northeast during the coming week with periods of rain possible

o

Southwestern areas will see a little cooler bias in temperatures and limited rain potential

- Lower

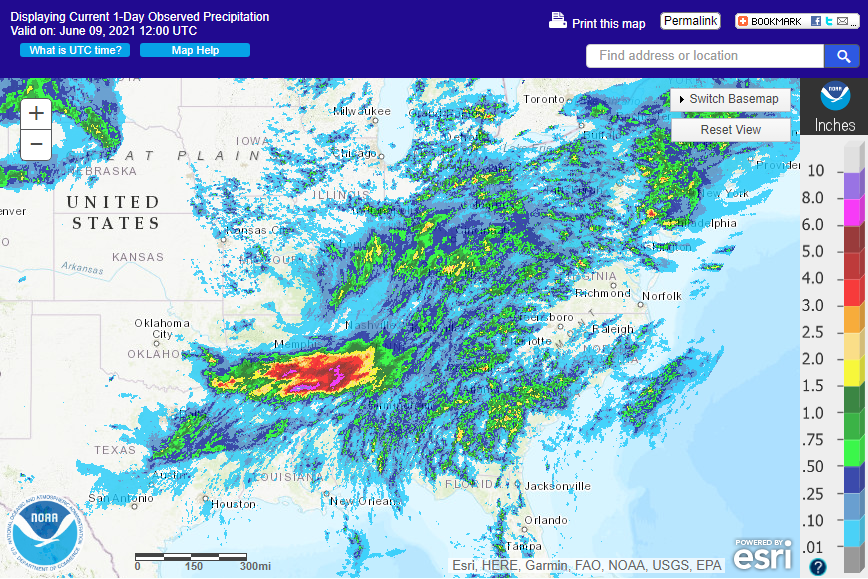

U.S. Midwest, Delta and southeastern states will continue to see a good mix of weather for a while, although the Delta and Tennessee River Basin will need to dry down after recent heavy rain

o

Delta rainfall overnight was greater than expected with 1.00 to 3.00 inches and local totals of 3.00 to 8.00 inches noted

- Some

flooding resulted - West

Texas will be exceptionally hot over the next few days with highs of 100 to 108 Fahrenheit

o

Scattered showers will pop up during the weekend and next week as the region cools back down for a little while

- Far

western U.S. crop areas will continue quite dry during the next ten days with temperatures turning warmer than usual next week and continuing into the following weekend - Canada’s

Prairies will receive relief from dryness through the weekend, but follow up moisture will still be needed

o

Short term relief is imperative after recent drying has soil moisture rated short to very short

o

Crop stress has been increasing and there have been reports of blowing dust in a few areas

o

Rain will occur in the southeast corner of the Prairies tonight and Wednesday and across eastern Alberta, western and central Saskatchewan Thursday night into Saturday

o

Week two weather (June 16-22) will be a little drier and warmer biased once again

- Mexico

rainfall will continue confined to southern parts of the nation during the next two weeks leaving drought in dominance of western, central and northern Mexico

o

Recent rain in eastern Mexico eased long term dryness

- Nicaragua

and Honduras have been drier biased for the past month and need rain

o

Some improvement is expected over the next week to ten days as rain develops in some of the driest areas

- Safrinha

corn areas of Brazil will experience no serious weather changes over the next ten days

o

Dryness will remain in Mato Grosso, Goias, southwestern Minas Gerais and northern Sao Paulo

o

Showers and thunderstorms farther to the south in Brazil periodically will be good for wheat and late Safrinha crops

o

Safrinha corn and cotton production will be down this year, despite periodic rainfall in the south

- Argentina’s

summer crop harvest has advanced well in recent weeks

o

Winter wheat areas are drying down and there are some areas in Cordoba that need significant moisture

- The

dry bias will prevail over the next week to ten days - Australia

will see some periodic showers and some sunshine during the next two weeks

o

Greater volumes of rain are needed especially in South Australia, Queensland and, northwestern Victoria and western New South Wales

- Russia’s

New Lands are still likely to be influenced by a high pressure ridge next week generating very warm and dry biased weather

o

A sukhovei may evolve early next week bringing excessive heat, wind and low humidity to western Kazakhstan and eastern portions of Russia’s Southern Region.

- Western

Europe will be trending drier over the coming week

o

Temperatures will be warm, but not excessively hot

o

Drying will raise the need for rain in time

- Southeast

Asia rainfall increased in the mainland areas Tuesday while staying light in Philippines, Indonesia and Malaysia

o

The rain was welcome

- Much

of Southeast Asia is expecting bouts of rain through the next ten days, although amounts will be lighter than usual at times.

- South

Africa rain will be minimal for a while supporting summer crop harvesting and winter crop planting

o

A boost in rain is always needed in winter crop areas

- West

Africa rainfall will increase over the next ten days

o

Greater rain is needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

- A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

- East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will increase in Ethiopia this week while little change occurs elsewhere

- Southern

Oscillation Index is mostly neutral at -0.53 and the index is expected to begin leveling off during the balance of this week after a steady decline - North

Africa weather will trend a little wetter in northern Algeria and Tunisia late this week and into the weekend

o

No winter crop quality issues are expected

- New

Zealand weather during the coming week to ten days will be drier and warmer than usual

o

the exception will be along the west coast of South Island where rain is expected this weekend into next week

Source:

World Weather, Inc.

Wednesday,

June 9:

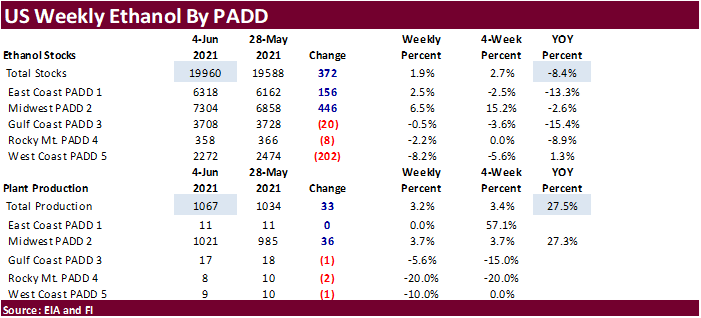

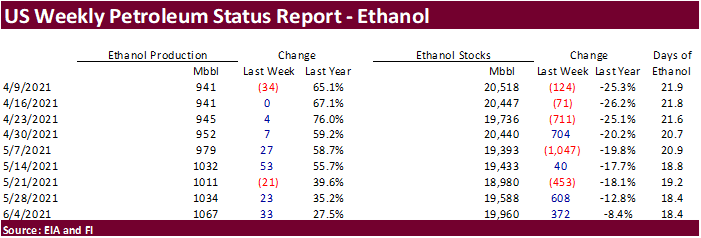

- EIA

weekly U.S. ethanol inventories, production - International

Grains Council Conference, day 2 - FranceAgriMer

releases monthly grains report

Thursday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

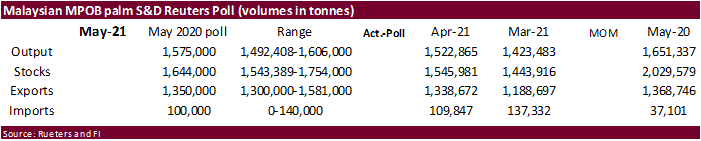

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Malaysian

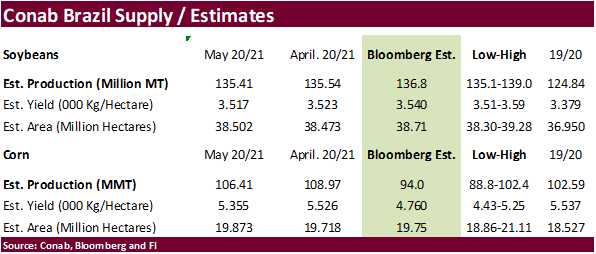

Palm Oil Board inventory, output and export data for May - Brazil’s

Conab releases output, yield and acreage data for corn and soybeans - Port

of Rouen data on French grain exports - Malaysia

June 1-10 palm oil export data

Friday,

June 11:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macros

FED

REVERSE REPO FACILITY USAGE CLIMBS TO RECORD $502.9 BILLION

US

MBA Mortgage Applications Jun 4: -3.1% (prev -4.0%

Mexican

CPI Core (M/M) May: 0.53% (est 0.48%; prev 0.37%)

Mexican

CPI (M/M) May: 0.20% (est 0.18%; prev 0.33%)

Mexican

CPI (Y/Y) May: 5.89% (est 5.86%; prev 6.08%)

China

May 2021 Inflation data:

CPI

1.3% y/y expected 1.6% y/y, prior 0.9%

food

prices expected to fall, pork prices continue to plunge, for the month/month -0.2%

PPI

9.0% y/y, higher than the median estimate and fastest since 2008, expected 8.5%, prior 6.8%

impacted

by rising commodity prices, for the m/m, +1.6%

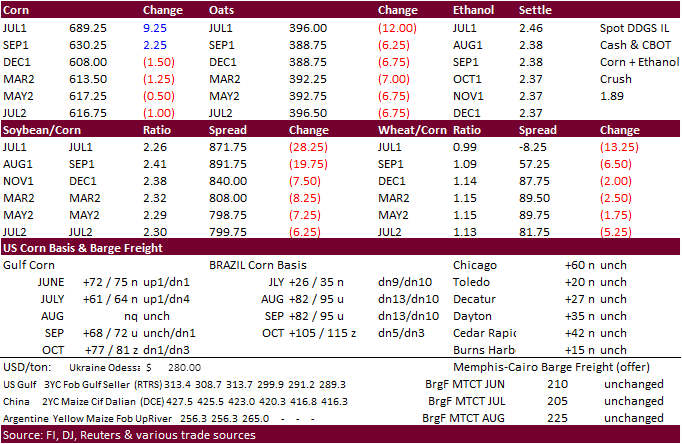

Corn

- US

corn traded in a wide two-sided range, rallying late in part to a robust weekly ethanol production reported by EIA. The Midwest region was a record. Ethanol margins were good.

- December

corn failed fill its recent gap of $5.9275. The low was $5.9300. -

Funds

bought an estimated net 10,000 corn contracts. - First

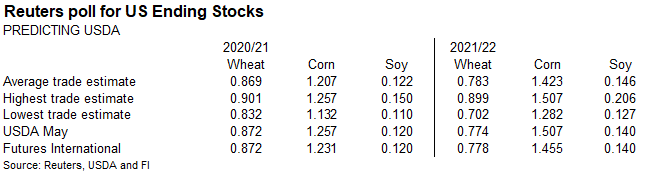

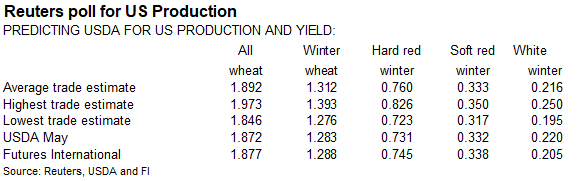

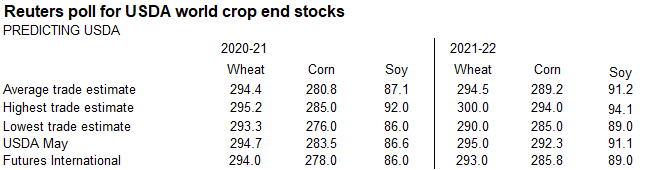

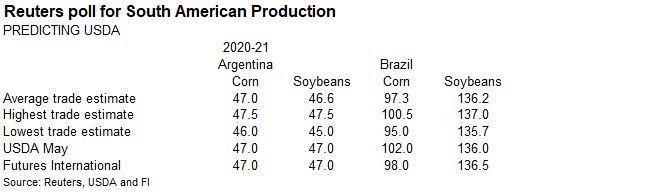

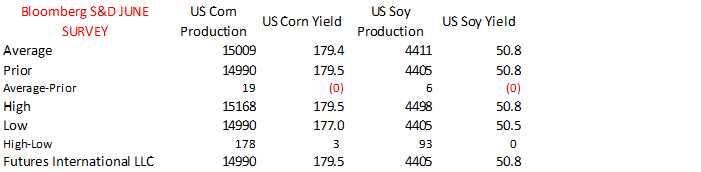

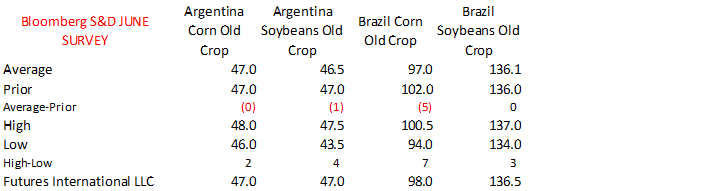

thing Thursday morning will be Brazil’s Conab update on corn production and this maybe very important to watch, as it could give us an idea and comparison with USDA’s update later in the morning. Trade estimates are above for both reports.

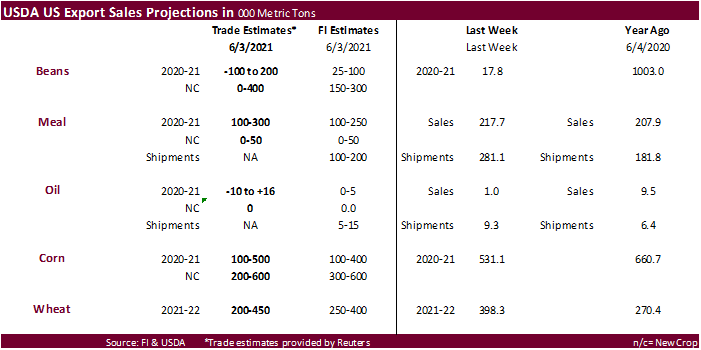

- Trade

estimate for USDA export sales for combined old and new crop range from 300,000 to 1.1 million tons.

- Upper

MN and southern WI saw rain over the past day. A good portion of the ECB was wet.

- Brazil’s

MGDS, southern Minas, southern Goias, Sao Paulo, through RGDS will see rain through the end of the workweek. - Brazil

started importing Argentina corn. During the Jan-Apr period Brazil imported 758,000 tons of corn from neighboring countries, up 70 percent from a year earlier.

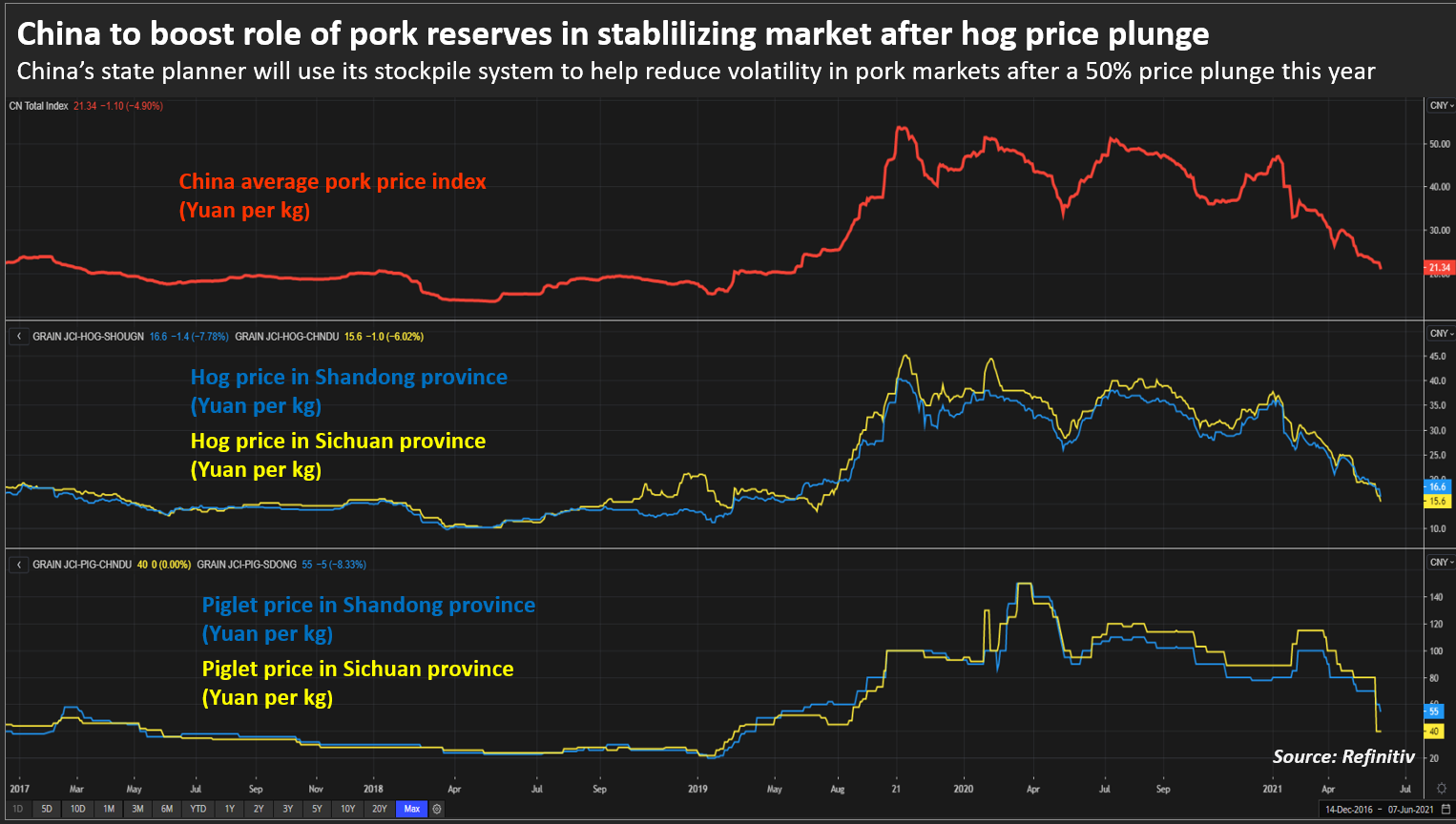

- China

announced they will use their state reserves of pork to help stabilize prices, without getting into details. We think they will be buying and storing pork to help prop up prices. Pork prices are down about 50 percent since the begging of the year and margins

are now unprofitable in many areas. China’s state reserve program for pork is not thought to be large relative to average monthly consumption. China grain and oilseed prices, with exception of meal, were lower.

- After

releasing CPI and PPI May economic data, China announced measure to control feed commodity prices but it’s unclear what they will exactly do.

- China’s

Sinograin will offer 11,058 tons of Ukrainian imported corn at auction from reserves on June 11.

- Today

was the third day of the Goldman Roll. - USD

was 5 points lower as of 1:40 pm CT. - IKAR

increased its Russian corn production estimate to 15.1 million tons from 14.5 million previously, which would be the second highest in history. Record was 2016 at 15.3 million tons. In 2020 Russia harvested 13.9 million tons of corn.

- USDA’s

weekly Broiler Report showed eggs set in the US up 2 percent and chicks placed up 1 percent. Cumulative placements from the week ending January 9, 2021 through June 5, 2021 for the United States were 4.11 billion. Cumulative placements were up 1 percent from

the same period a year earlier.

China

hog chart created by Reuters

Source:

Reuters

Export

developments.

U

of I – Direct Costs and Prices on Grain Farms

Schnitkey,

G., N. Paulson, C. Zulauf and K. Swanson. “Direct Costs and Prices on Grain Farms.”

farmdoc daily (11):90, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 8, 2021.

https://farmdocdaily.illinois.edu/2021/06/direct-costs-and-prices-on-grain-farms.html

Updated

5/24/21

July

is seen in a $6.00 and $7.25 range

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

The

soybean complex was lower mainly on positioning and lower outside product values. The ECB saw good rains over the past day.

-

News

was very light. -

We

are not looking for any major changes to the US and world balance sheets on Thursday by USDA, and think the focus will be on corn with an expected downward revision in Brazil’s corn production that could prompt USDA to raise their US corn export projection,

possibly for old and new-crop. -

USDA

export sales estimates for soybeans range from zero to 600,000 tons for combined crop years.

-

Funds

sold an estimated net 11,000 soybeans, sold 3,000 soybean meal and sold 4,000 soybean oil.

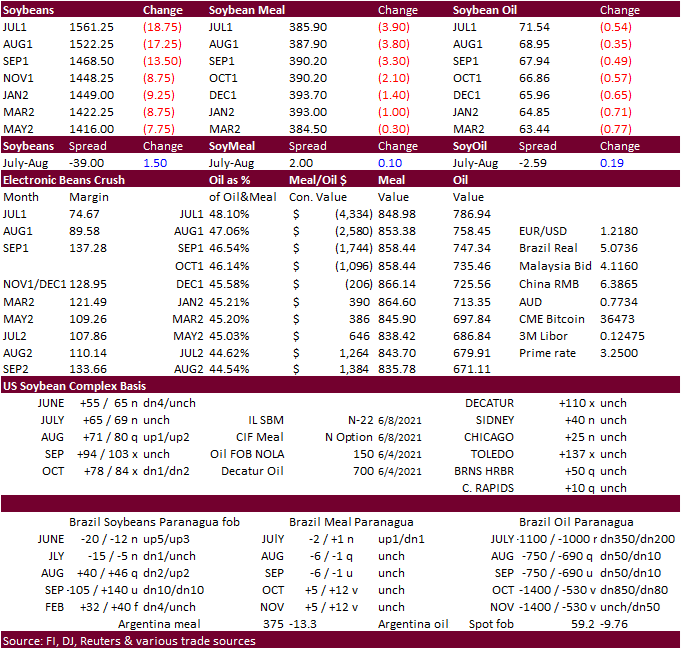

-

Malaysian

palm oil traded sharply lower by 178 points (5-week low) and cash was off $35/ton to $1,015. Rotterdam feed and vegetable oil prices were mixed to mostly lower. Offshore values are leading soybean oil 196 points lower and meal $2.10 lower.

-

Argentina

product basis levels have been under pressure.

- USDA

seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

Updated

6/7/21

July

soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean

meal – July $360-$420; December $380-$460

Soybean

oil – July 69-75; December 57-70 cent range

- US

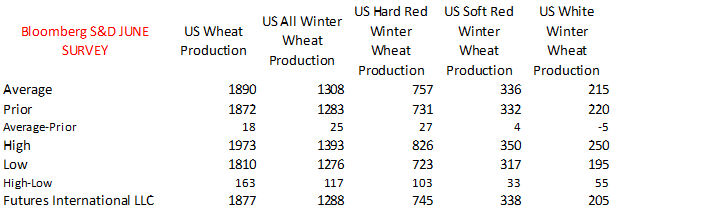

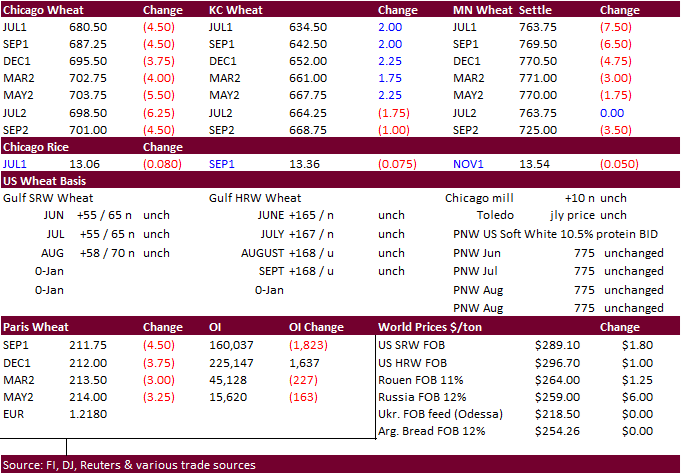

wheat started the day session lower again led by the Minneapolis contract after rain fell across parts of the Dakotas. In a late session rally, KC finished higher and Chicago and MN paired losses.

- The

recent dip in prices attracted more buyers to the market. Japan, Tunisia and Ethiopia all announced import tender over the past day.

- Funds

sold an estimated net 3,000 SRW wheat contracts. - Canadian

Prairies weather improves through Friday with an increase in rainfall. The Northern Great Plains will see more local rains through Friday as indicated in the evening GFS model. Rain for the Northern Plains over the past day was near expectations.

- Trade

estimate for all wheat export sales range from 200,000 to 450,000 tons. - September

Paris wheat settled down 3.75 euros, or 1.7%, at 212.50 euros ($258.74) a ton. - (Reuters)

– Algeria’s state grain office has barred a 33,000-tonne durum wheat shipment from Canada from entering the eastern port of Annaba port, for non-compliance with agreed specifications, Ennahar TV reported on Wednesday on Twitter.

- Algeria

may have bought 480,000 tons of wheat, up from 400,000 tons previously reported. There were in for July and/or August shipment and prices were reported at $297.50 and $298/ton c&f.

- Tunisia

seeks 50,000 tons of soft wheat on June 10, optional origin. - Ethiopia

seeks 400,000 tons of milling wheat on June 14, two lots of 200,000 tons each with delivery within 70 to 90 days of contract date.

- Jordan

passed 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment. - Japan

seeks 80,000 tons of feed wheat and 100,000 tons of barley on June 16 under its SBS import system, for arrival in Japan by November 25.

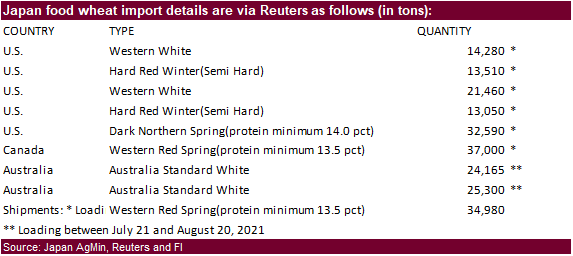

- Japan

seeks 181,355 tons of food wheat later this week from United States, Canada and Australia.

- Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment. - Jordan

seeks 120,000 tons of wheat on June 22 for December shipment.

Rice/Other

·

Indonesia aims to produce 55.2 million tons of rice in 2022 and 20.1 million tons of corn.

Updated

6/2/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.50-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.