PDF Attached

US

inflation was reported slightly above expectations. The consumer price index increased 1.0% last month after gaining 0.3% in April, the Labor Department said on Friday. Economists polled by Reuters had forecast the monthly CPI picking up 0.7%.

USDA

released their June supply and demand estimates

Reaction:

Slightly

bullish soybeans but the trade had that worked in. Bearish corn and neutral wheat. Bottom picking from longs looking to get back into the market lifted grains higher shortly after the report was released. Soybeans were lower on buy the rumor, sell the fact

over exports. Soybean oil is lower on product spreading and weakness in palm oil.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

US

soybean supply was unchanged for new crop. Old crop stocks were trimmed 30 million bushels with an increase in US 2021-22 export by 30 million to 2.170 billion. All other demand categories were unchanged. USDA cited lower Brazil export for the change in US

exports. USDA made no changes in its 2022-23 demand. With a lower carry in, USDA lowered new-crop stocks by 30 million to 280 million. The soybean price is forecast at $14.70 per bushel, up 30 cents from last month. Global oilseed production for 2022-23 was

lowered 0.3 million tons to 646.8 million as lower sunflower seed is partly offset by higher rapeseed and soybean output. Global 2022-23 soybean ending stocks were raised 0.9 million tons to 100.5 million. The took 2021-22 Argentina soybean production up 1.4

million tons to 43.4 million and 2021-22 Brazil soybean production up 1.0 million tons to 126.0 million.

2021-22

US corn ending stocks was perhaps the largest surprise, with a 45 million bushel increase to 1.485 billion. USDA lowered current crop year exports by 50 million bushels based on current inspections and Census data. USDA export sales commitments are also lagging.

USDA increased food, seed, and industrial use (FSI) by 5 million bushels, citing higher use for glucose and dextrose and starch, partially offset by a decline in high fructose corn syrup. USDA also increased its projection for 2022-23 FSI by 5 million. There

was no other changes in new-crop US corn demand. Supply was unchanged. USDA will release its Acreage report on June 30. New crop ending stocks were raised 40 million bushels. World corn production was increased 5.1 million tons. Corn production was up for

Ukraine, reflecting higher area. Global corn ending stocks were estimated at 310.5 million tons, up 5.3 million from May.

2022-23

US wheat production was upward revised 8 million bushels to 1.737 billion with an increase in winter wheat by that amount. USDA reduced Hard Red Winter and raised Winter White and Soft Red Winter. Combined other spring and durum was unchanged. Some of the

trade was looking for a downward revision in other spring. US domestic use and exports were unchanged resulting in higher stocks by 8 million to 627 million. The all-wheat yield was upward revised 0.3 bushel to 46.9 bushels per acre. USDA lowered global wheat

production due to a 2.5 million ton decrease for India, partially offset by an upward revision to Russia by 1 million tons to 81 million tons. World consumption was reduced by 1.5 million tons in large part to less feed use. USDA lowered India’s exports and

raised Russia. Projected 2022-23 world ending stocks were lowered 0.2 million tons to 266.9 million, a six-year low.

US

temperatures will be above normal starting next week.

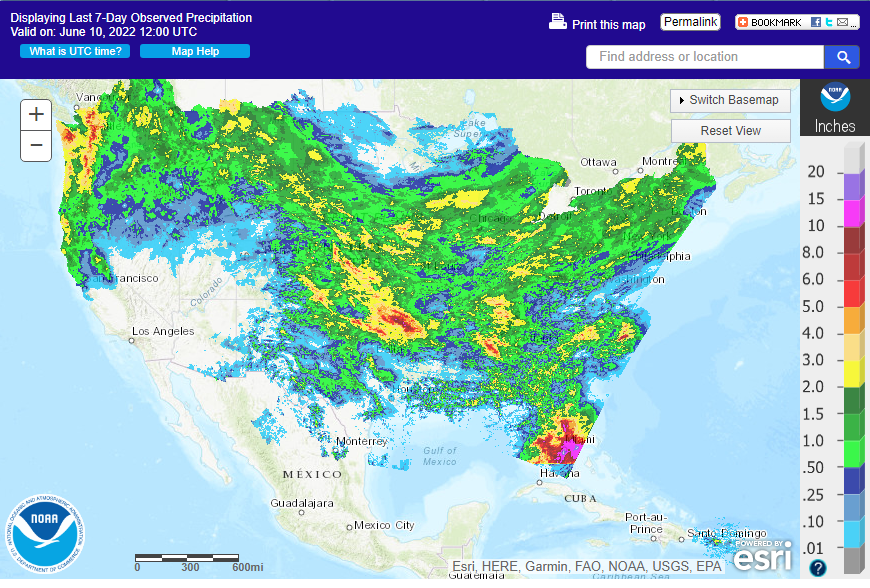

Past

7 days

WORLD

WEATHER HIGHLIGHTS FOR JUNE 10, 2022

- Canada’s

Prairies will receive much needed rain in the drought stricken areas early next week and again about a week later - Relief

is expected and improvement in crop conditions will result - Eastern

Canada’s Prairies will experience rain today into Tuesday that will bring fieldwork to a halt - Some

progress may resume later next week, but more rain is expected a few days later which may limit additional progress for late season crops - West

Texas cotton areas will be hot and dry through much of the next ten days with some strong wind speeds at times - This

pattern will reverse the improving trend from earlier this month and in late May - U.S.

Midwest weather will remain favorable for crop development and fieldwork for a while, but the lower half of the region as well as the southern Plains and Delta will experience net drying that will become important in weeks 2 , 3 and 4 - Timely

rain will become very important those later weeks to prevent a more significant bout of drying from occurring - The

tropical cyclone the GFS continues to carry in its second week outlook may not verify, but remember that is presence influences that model in the second week of the forecast and can skew the forecast

- Argentina’s

western wheat areas will continue dry over the next ten days; rain is going to be needed in some eastern areas too soon - Southern

Brazil will remain wet biased for a little while longer and drying will be needed to promote Safrinha crop maturation and harvesting - Europe

will trend drier over the next ten days especially in the west; France, the U.K. and Germany in particular - Portions

of southern Europe are still dry and unlikely to get much relief. - The

lower Danube River Basin will get some rain and that is one of the driest areas - Irrigated

fields will develop normally, but some dryland areas in southern Europe, including southern France, will need significant rain soon to support summer crops - Russia’s

Southern Region, eastern Ukraine and western Kazakhstan are predicted to get a little rain after day 10, but until then net drying will continue raising concern about crop conditions as the soil dries out - Confidence

in the second week rainfall is low, but not out of the realm of possibilities - China’s

North China Plain is still expected to get a little rainfall during the next couple of weeks, but it may prove to be infrequent and light enough to leave some long term worry over unirrigated crops in the region - Northeast

China is quite wet and would benefit from some net drying - Southern

China’s heavy rain will stay near the south coast for a while, but concern over early rice production will continue and sugarcane needs drier weather along with some minor corn, soybeans and groundnuts in the region - Western

Australia will still get some needed rain over the next few days improving topsoil moisture for wheat, barley and canola

Source:

World Weather Inc.

Bloomberg

Ag Calendar

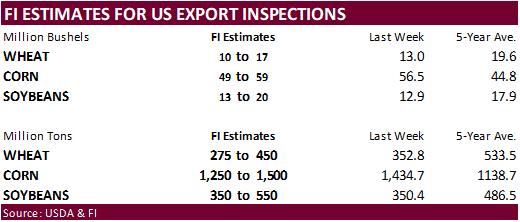

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop planting data for soybeans and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - HOLIDAY:

Australia, Russia

Tuesday,

June 14:

- EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

June 15:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

June 1-15 palm oil export data - St

Petersburg International Economic Forum, June 15-18

Thursday,

June 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Brazil, South Africa

Friday,

June 17:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

June 18:

- China’s

second batch of May trade data, including corn, pork and wheat imports

Source:

Bloomberg and FI

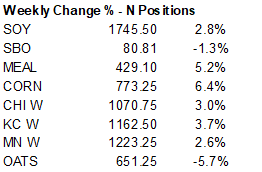

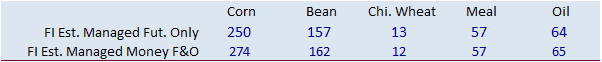

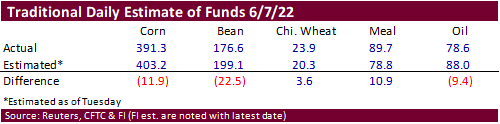

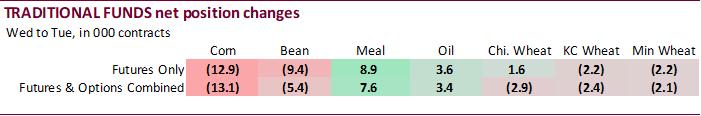

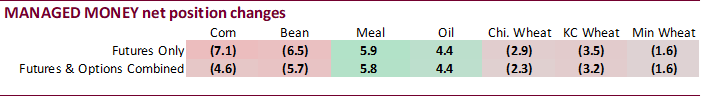

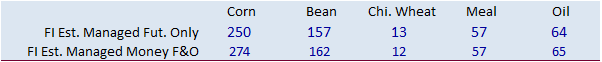

The

Commitment of Traders report showed funds reduced their net long position for soybeans instead of extending it, as expected. Funds were less long than expected for corn and soybean oil and added more contracts than expected for soybean meal.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

184,445 -8,074 457,765 -9,333 -597,179 19,636

Soybeans

83,586 -6,728 189,903 -858 -244,204 7,556

Soyoil

47,258 3,111 103,970 -4,672 -167,965 2,430

CBOT

wheat -40,555 -6,484 148,365 -1,632 -104,037 8,437

KCBT

wheat 6,750 -2,815 63,770 878 -69,082 3,644

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

264,327 -4,638 275,392 -4,264 -594,145 19,555

Soybeans

158,928 -5,702 107,998 -4,247 -242,071 9,600

Soymeal

53,169 5,808 88,293 -2,701 -192,877 -2,074

Soyoil

68,823 4,363 82,228 -3,985 -176,363 1,430

CBOT

wheat 12,675 -2,349 54,902 -4,676 -76,934 7,877

KCBT

wheat 37,498 -3,152 28,272 893 -61,519 3,245

MGEX

wheat 13,922 -1,601 174 -721 -25,238 1,255

———- ———- ———- ———- ———- ———-

Total

wheat 64,095 -7,102 83,348 -4,504 -163,691 12,377

Live

cattle 21,350 9,265 70,339 -671 -107,902 -9,259

Feeder

cattle -4,906 4,108 4,553 -281 4,454 -1,611

Lean

hogs 22,473 3,982 54,281 2,403 -66,278 -3,523

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

99,459 -8,427 -45,032 -2,228 2,217,675 4,735

Soybeans

4,427 319 -29,283 29 979,103 15,985

Soymeal

22,686 1,801 28,728 -2,834 429,842 10,926

Soyoil

8,574 -939 16,737 -869 471,053 24,532

CBOT

wheat 13,130 -531 -3,773 -320 462,463 8,078

KCBT

wheat -2,812 721 -1,438 -1,707 205,338 130

MGEX

wheat 4,068 -507 7,074 1,574 73,168 -4,170

———- ———- ———- ———- ———- ———-

Total

wheat 14,386 -317 1,863 -453 740,969 4,038

Live

cattle 21,437 898 -5,224 -231 349,418 -21,325

Feeder

cattle 1,022 655 -5,122 -2,871 57,468 -1,154

Lean

hogs -2,145 -2,214 -8,331 -648 264,832 2,851

Macros

US

CPI (Y/Y) SA May: 8.6% (est 8.3%, prev 8.3%)

US

CPI (M/M) SA May: 1% (est 0.7%, prev 0.3%)

CPI

Ex Food And Energy (Y/Y) May: 6% (est 5.9%, prev 6.2%)

CPI

Ex Food And Energy (M/M) May: 0.6% (est 0.5%, prev 0.6%)

Canada

Employment Change May: 39.8K (est 30K, prev 15.3K)

Unemployment

Rate May: 5.1% (est 5.2%, prev 5.2%)

Participation

Rate May: 65.3% (est 65.3%, prev 65.3%)

US

EIA Expects Refinery Utilization To Average 96% In June, 94% In July, And 96% In August

US

Univ. Of Michigan Sentiment Jun P: 50.2 (est 58.1; prev 58.4)

–

Current Conditions: 55.4 (est 62.9; prev 63.3)

–

Expectations: 46.8 (est 55.3; prev 55.2)

–

1-Year Inflation: 5.4% (est 5.3%; prev 5.3%)

–

5-10 Year Inflation: 3.3% (prev 3.0%)

·

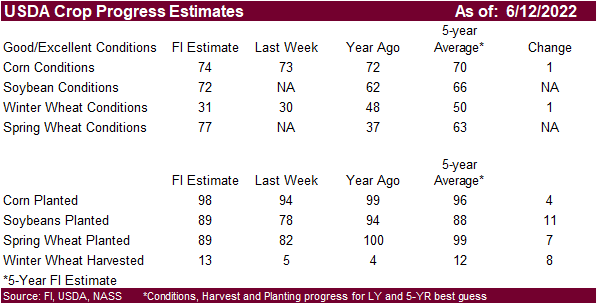

US corn futures initially traded lower after hitting a two-week high on Thursday. Post USDA report prices traded two-sided. The dip in corn prices attracted longs to the market. USDA made no changes to their area or yield numbers

in its monthly update for corn and soybeans. 2021-22 US corn ending stocks were upward revised 45 million bushels due in part to a 50 million bushel cut in corn exports. USDA export sales for corn were poor yesterday and US weather looks good, with exception

to hot temperatures expected next week across the heart of the US. Some crop stress is expected.

·

Funds bought an estimated net 1,000 corn contracts.

·

For those following options, there were rumors that the heavy corn call spreads done today was some large weather group hedging.

·

US equity markets were down sharply mainly on a bearish US inflation report. Up 8.6%, US inflation is at another 40-year high.

·

The Baltic Dry Index fell for the third consecutive week on weakness in smaller vessels. The index was down 12% for the week.

·

In China’s month S&D update, there were no changes to supply or demand for corn and soybeans. China mentioned corn for feed demand was increasing while wheat feed was decreasing.

·

Indian state oil retailers have agreed to provide some monetary relief to sugar mills and other producers of ethanol to compensate for high energy costs in support to use more biofuels.

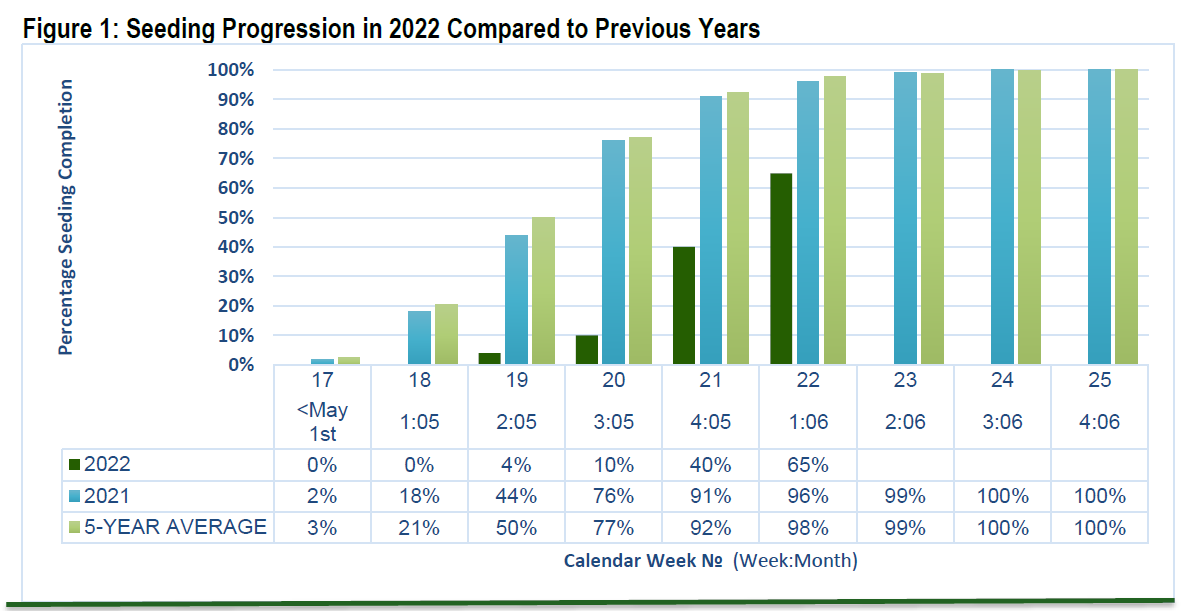

·

Manitoba, Canada, crop report: Provincial seeding progress sits at 65% completion, behind the 5-year average of 96% for Week 22 remains highly variable within each region, and many wet spots and low-lying areas are left unseeded

in an effort to maximize equipment planting time.

Export

developments.

·

China looks to buy 40,000 tons of frozen pork on June 10.

Updated

6/9/22

July

corn is seen in a $7.25 and $8.25 range

December

corn is seen in a wide $5.75-$8.50 range