US

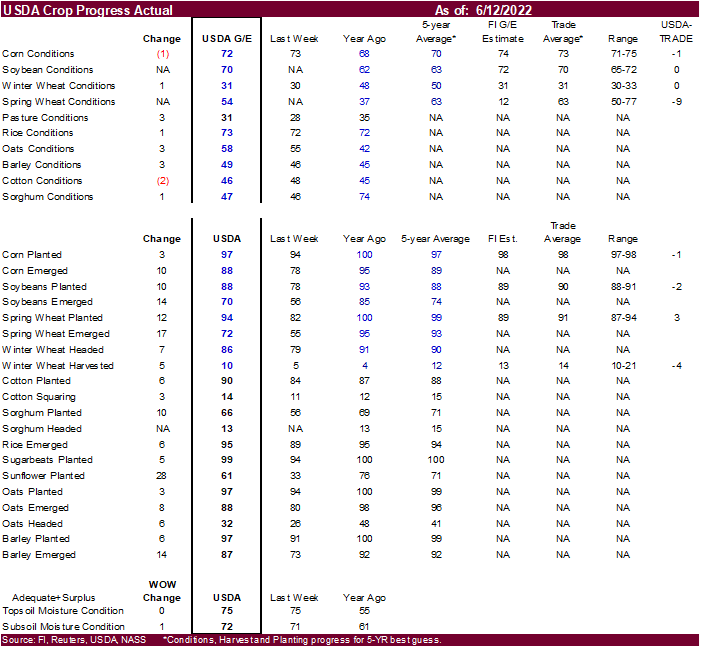

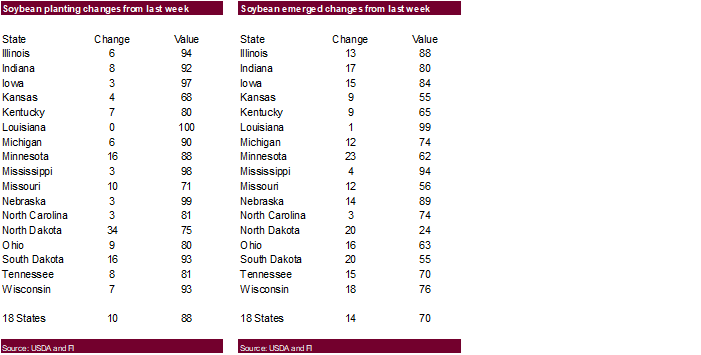

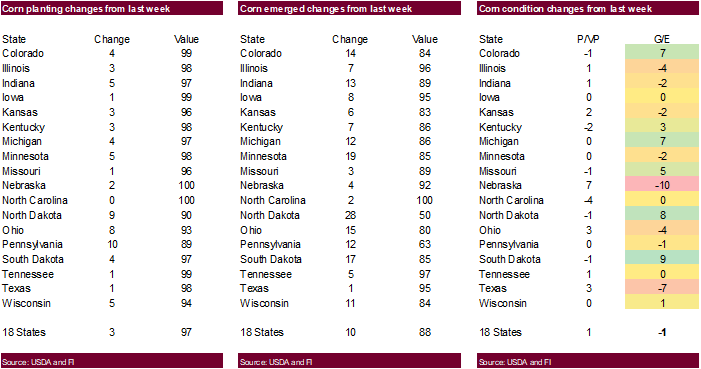

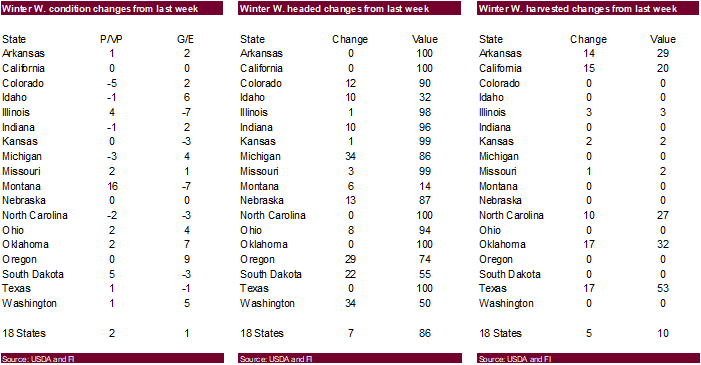

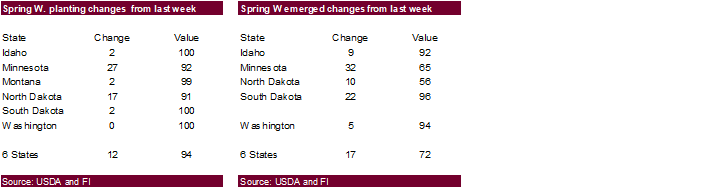

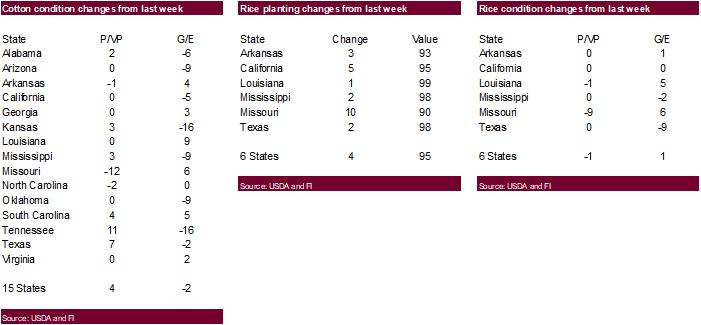

corn and soybean yield estimates will be out later this week. Below is basis crop progress. Spring wheat conditions should lift MN type wheat higher. All other crop progress numbers were near expectations. USD was up more than 110 points! And equities rolled

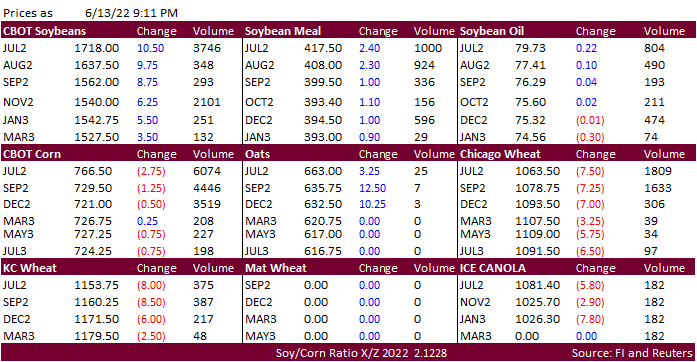

over. Expect volatility to be a theme for the rest of the week. Prices below are of Monday late evening.

Late

Monday…

WEATHER

EVENTS AND FEATURES TO WATCH

-

Not

much changed overnight – U.S. weather will dominate market mentality due to ongoing worry over drying trend and excessive heat -

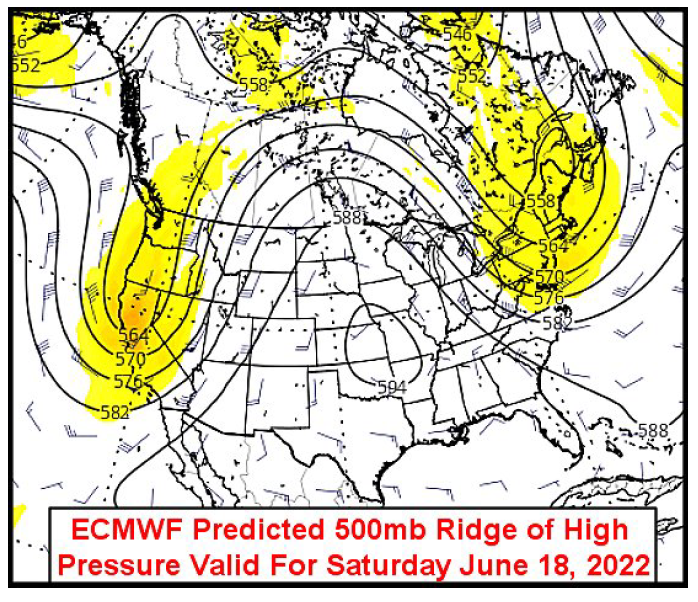

A

ridge of high pressure is predicted in the U.S. Midwest today and Tuesday -

Some

showers and thunderstorms will occur today from southern Minnesota through the southern Great Lakes region to Ohio and some locally strong thunderstorms will be possible -

A

follow up rain event will impact areas from Iowa to Wisconsin and southeastern Minnesota as the ridge in the Midwest breaks down Wednesday into Thursday -

Strongest

ridge of the season will evolve in the Plains and western Corn Belt late this week through early next week inducing excessive heat and dryness -

Temperatures

in the 90s to near and above 100 will occur for the second time this week, but this time it will be hotter and the heat will last longer in the Plains and western Midwest -

Extreme

highs of 95 to 104 are expected in the western Corn Belt while 96 to 108 occurs in the central and southern Plains -

Several

extremes over 110 will occur this weekend into early next week in the central and southern Plains -

High

pressure ridge will begin to weaken in the middle to latter part of next week with thunderstorms possible in the northern Plains and upper Midwest as a first disturbance moves into the ridge -

Resulting

rainfall will only be significant in the northern Plains and eastern Canada’s Prairies -

Serious

livestock stress is expected in the Midwest and Great Plains both early and late this week due to high humidity and extreme temperatures in the Midwest

-

Lower

humidity will occur in the central and southern Plains, but the temperatures will be hotter -

Strong

wind speeds are likely in the Plains and western Corn Belt at times in the coming week

-

Newly

emerged crops in the southwestern Plains; including cotton, corn and sorghum, will be threatened by the extreme temperatures and lack of rain -

Unirrigated

cotton, sorghum and corn production losses are expected -

Northern

U.S. Plains and upper Midwest weather will be most favorable during the next two weeks -

U.S.

weather in weeks 3, 4 and 5 according the GFS, ECMWF and CFS models should result in a mean ridge position in the Plains with a bias in the high Plains most favored resulting in a northwesterly flow pattern aloft across the Midwest -

This

pattern would keep the Plains warmest relative to normal and generate waves of showers and thunderstorms from the northern Plains into the Midwest

-

Temperatures

would be closest to normal in the eastern Midwest -

Areas

from Nebraska to Texas and the southwestern Corn Belt would get the least amount of rain, although not necessarily totally dry -

Be

careful using these longer range forecast tools…..they use persistence and climatology and are no usually very good dealing with anomalous trends -

U.S.

weekend rainfall was scattered in the Midwest and northern Plains, although rarely great enough to counter evaporation -

A

few pockets of rainfall more than 1.00 inch were noted in eastern Iowa, southeastern Nebraska and in eastern Indiana with net drying in many other areas -

U.S.

Delta rainfall was greatest from southeastern Louisiana and southern Mississippi to the heart of western Arkansas with 1.00 to 2.00 inches common and more than 5.00 inches near New Orleans.

-

Southern

and central Florida received widespread rain -

Texas

and much of the central and southern Plains were dry -

Rain

in the Pacific Northwest was greatest from northwestern Montana to western Oregon and southwestern Washington where 0.48 to 1.79 inches resulted -

Weekend

U.S. temperatures were hot in the west-central and southwestern Plains with highs of 95 to 111 degrees Fahrenheit

-

Hottest

in west Texas and the Texas Panhandle as well as far southwestern Oklahoma -

The

bottom line for the U.S. is still a little tenuous with net drying this first week to ten days of the outlook in the lower Midwest, central and southern Plains and Delta and a favorable mix of weather in the northern Plains and southeastern states.

-

The

month of June may finish out with brief periods of rain in the Midwest and northern Plains and warmer than usual temperatures while temperatures are warmest relative to normal in the Inter-Mountain West, the central and southern Plains and a part of the Delta.

Timely rain may prevent key Corn and Soybean production areas from becoming too dry, but areas of short to very short topsoil moisture will show up toward the end of this month. Crop stress should be expected, although favorable subsoil moisture and some timely

rain events should keep the crops performing favorably. -

Rain

potentials in weeks 3, 4 and 5 along with more seasonable temperatures may limit crop stress in parts of the northern Plains and Midwest. West Texas cotton areas will be driest and warmest throughout the forecast period.

-

Confidence

in these weeks 3, 4 and 5 outlooks is not high -

Rain

will impact all of the Canadian Prairies periodically during the next two weeks resulting in sufficient relief for the drought stricken areas in the west. -

Rain

may lead to late season planting delays in the east and some abandonment -

A

large part of the Prairies will see crop improvements and -

There

is some potential for excessive rain to fall along the front range of mountains in southwestern Alberta and in a few other areas northwest from there into northwestern Saskatchewan and northeastern Alberta, although it may take a while for some of the region

to become wet enough to present a problem. -

Areas

near the mountains will be wettest initially -

The

middle two-thirds of Saskatchewan will not likely get a substantial amount of relief from dryness this week, although some rain is certainly expected -

Follow

up moisture will be imperative -

Ontario

and Quebec, Canada will experience a favorable mix of weather during the coming ten days to two weeks.

-

Crop

development should advance favorably -

Fieldwork

will only be briefly disrupted by rain -

Needed

rain fell in parts of the Danube River Basin in Europe during the weekend with moisture totals of 0.35 to 0.80 inch with several amounts of 1.00 to nearly 4.00 inches in Bulgaria and a few random locations in southern Romania and Serbia -

Most

other areas in Europe experienced net drying conditions during the weekend and temperatures were warm -

Western

and central Europe will experience net drying conditions through the first half of the coming weekend -

Showers

and thunderstorms will slowly increase late in this coming weekend into next week

-

The

resulting moisture will be extremely important for winter, spring and summer crops after previous days of drying

-

Some

of the advertised rainfall may be overdone and it should be closely monitored especially in France, the U.K. and Germany -

Temperatures

will be warm during both weeks of the two-week outlook -

Temperatures

in Ukraine and Russia’s Southern Region will be a little warmer than usual over the next ten days similar to that of the weekend -

Highest

temperatures Friday through Sunday6 were in the 80s Fahrenheit with a few extremes in the lower 90s -

Net

drying is expected in many interior parts of Russia’s Southern region, parts of south-central and southeastern Ukraine and western Kazakhstan during the next ten days, although totally dry weather is unlikely -

Greater

rain will be needed later in the month of June and July to improve soil and crop conditions -

Far

southern Russia and Georgia will experience frequent rain later this week into early next week resulting in a notable boost in soil moisture favoring long term crop development -

Western

and northern parts of the Commonwealth of Independent States will experience frequent rainfall over the next ten days maintaining moisture abundance in the soil and good crop development potential -

Rain

northern Kazakhstan will be great for spring wheat and some sunseed crops -

Some

rain fell in the drier areas north of the Yellow River in China from Shaanxi through central and northern Hebei to eastern Inner Mongolia during the weekend with rainfall of 0.35 to 1.50 inches common and several amounts of 1.50 to more than 6.00 inches

-

Wettest

in east-central Hebei and southwestern Liaoning where local flooding was suspected -

East-central

China drying was significant from southern Shandong, southern Shanxi and Henan to Jiangsu during the weekend with crop stress continuing to intensify after weeks of drying in the region -

Net

drying is expected to continue in east-central China for another week to ten days; including Henan, western Shandong, northern Anhui and interior parts of Jiangsu -

South

Korea rice areas also continue critically dry and are in need of rain -

China’s

greatest weekend rain occurred in the southern coastal provinces from Guangxi to southern Zhejiang and Fujian where 2.00 to more than 6.00 inches resulted with some flooding continuing -

Net

drying in the Yangtze River Basin was good for late season rapeseed harvesting and good for summer crop development after too much rain fell in May and earlier this month -

Far

southern China will continue to receive too much rain for another week resulting in more flooding and more concern over rice, sugarcane and some minor corn, soybean and groundnut production areas

-

Drying

is badly needed and some may occur next week -

Northeast

China will continue to see rain routinely which may challenge summer crop planting since much of the region is already wet -

Drying

will be most needed in Liaoning and Jilin where the ground is already a little too wet -

China’s

Xinjiang province continues to experience relatively good weather, although warm conditions are expected early to mid-week this week before some welcome cooling occurs in the second half of this week and into the weekend -

India’s

monsoonal rainfall will continue to perform poorly through Friday before some increase in rainfall is expected this weekend into next week

-

The

greater rainfall next week may still be lighter than usual, but it will expand across a larger part of the nation supporting some fieldwork -

Greater

rainfall may still be needed, though -

Additional

rain in Western Australia during the weekend helped to perpetuate a better planting, emergence and establishment environment for wheat, barley and canola -

More

rain will fall late this week and into the weekend -

Most

of Australia is experiencing a good mix of weather to support autumn wheat, barley and canola planting and production prospects should be good if the timely rainfall pattern continues through spring as expected

-

Little

change in the favorable environment is expected -

Western

Argentina remains dry through next Monday raising concern over winter crop planting and establishment -

At

least some rain is needed in all wheat areas in the nation, although subsoil moisture is still rated well in the east and more rain is expected there in the second half of next week -

Argentina

harvest progress as of last Thursday includes; Cotton 56% complete versus 62% in 2021, corn harvest 56% done compared to 53% last year, peanut harvesting was 63% done which is the same as last year and soybean harvesting was 98% complete while sorghum harvesting

was 64% done compared to 76% last year -

Barley

planting was done on 21% of the acreage which is the same as last year and wheat was 31% done compared to 30% a year ago -

Southern

Brazil dried down for a while during the weekend and the trend for net drying should last through the end of this workweek. -

Improved

Safrinha corn maturation conditions will result and winter wheat improvements are likely -

A

new wave of rain is expected this coming weekend that will last into early next week resulting in the return to wet conditions and possibly poor crop maturation and harvest conditions -

Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast -

Mexico’s

monsoonal rainfall is expected to start a little sporadically leaving parts of the nation quite dry, but a slow increase in precipitation will eventually take place -

Interior

western areas will be wettest over the coming week along with southwestern coastal areas and a few lower eastern coastal areas -

A

tropical disturbance may bring heavy rain to the Yucatan Peninsula this weekend before reaching the lower east coast of Mexico early next week -

Remnants

of the storm could bring some welcome rain to coffee, citrus and sugarcane areas of southern Mexico next week -

Another

tropical cyclone may evolve off the lower western Mexico coast during mid-week this week producing heavy rain in southwestern Mexico -

Soft

frost was suspected in southwestern Parana Sunday and this (Monday) mornings

-

Lowest

temperatures slipped to the 30s Fahrenheit, although most of the frost was suspected in wheat areas and not corn areas -

Additional

frost is expected in Parana Tuesday, but the impact should be minimal on Safrinha corn which continues to fill, mature and be harvested

-

Most

of the coldest temperatures are expected in wheat production areas where some freezes are expected, but the impact should be low -

The

impact on Safrinha crops should be minimal since the coldest conditions will be east of the key production area and crops are advancing enough to become less impacted by frost -

No

freeze is expected in key Safrinha corn areas -

A

hard freeze would be more impactful, but that is not likely -

Southeast

Asia rainfall will continue abundant in many areas through the next two weeks -

Local

flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar -

Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development -

East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia -

West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally -

South

Africa’s restricted rainfall in the east over the next ten days will be good for summer crop harvest progress and some late winter crop planting -

Rain

in western parts of the nation will be good for wheat, barley and canola emergence and establishment -

Central

America rainfall will be abundant during the next ten days with excessive rainfall possible along the Pacific Coast

-

A

tropical cyclone may form near the Nicaragua and Costa Rica coast during mid-week this week bringing significant rain to northeastern Nicaragua and eventually to eastern Honduras, Belize and then Yucatan Peninsula later this week -

Some

very heavy rain will fall in coastal areas. -

Today’s

Southern Oscillation Index was +14.44 and it will steadily decline over the next few weeks -

New

Zealand rainfall will occur routinely over the next couple of weeks maintaining moisture abundance in many areas, but the lower west coast of South Island will likely receive less than usual rain

Source:

World Weather Inc.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop planting data for soybeans and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - HOLIDAY:

Australia, Russia

Tuesday,

June 14:

- EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

June 15:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

June 1-15 palm oil export data - St

Petersburg International Economic Forum, June 15-18

Thursday,

June 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Brazil, South Africa

Friday,

June 17:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

June 18:

- China’s

second batch of May trade data, including corn, pork and wheat imports

Source:

Bloomberg and FI

Tables

for inspections will be out in the morning

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 09, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/09/2022 06/02/2022 06/10/2021 TO DATE TO DATE

BARLEY

0 0 710 0 710

CORN

1,199,976 1,458,519 1,610,988 44,956,885 54,219,312

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 0 0 0 0

RYE

0 0 0 0 0

SORGHUM

140,003 207,953 151,285 6,468,775 6,422,914

SOYBEANS

605,129 365,455 141,320 50,473,191 57,048,412

SUNFLOWER

0 0 0 2,260 240

WHEAT

388,847 355,340 499,945 615,556 694,430

Total

2,333,955 2,387,267 2,404,248 102,516,667 118,386,018

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Brazil

selected export data for the month of May.

Commodity

May 2022 May 2021

CRUDE

OIL (TNS) 4,580,975 5,072,838

IRON

ORE (TNS) 25,523,612 26,538,322

SOYBEANS

(TNS) 10,632,770 14,966,212

CORN

(TNS) 1,165,804 13,919

GREEN

COFFEE(TNS) 142,467 190,118

SUGAR

(TNS) 1,580,438 2,482,695

BEEF

(TNS) 153,161 126,763

POULTRY

(TNS) 400,758 382,762

PULP

(TNS) 1,791,611 1,439,954

US

Soybean and Corn Advisory

2022

U.S. Corn – 89.0 mac Planted, 177.0 bu/ac, 14.35 Billion Bu.

2020

U.S. Soybeans – 91.0 mac Planted, 51.5 bu/ac, 4.64 Billion Bu.

2021/22

Brazil Corn Estimate Increased 3.0 mt to 110.0 Million

2021/22

Brazil Soybean Estimate Increased 1.0 mt to 123.0 Million

2021/22

Argentina Soybeans Increased 1.0 mt to 42.0 Million

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

Macros

Late

Monday

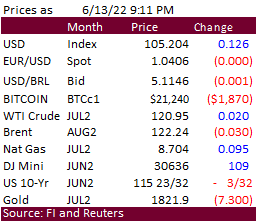

US

FOMC meeting will conclude their two-day session this Wednesday. Outside market volatility is expected to spill over into the ag markets this week.

·

Outside market volatility is expected to spill over into the ag markets this week. USD was up a staggering 123 points at the tine this was written, 9:14 pm CT.

·

US corn futures were higher for the nearby tracking strength in wheat. US temperatures will be very hot this week, causing some crop stress to recently planted corn. Several records for the high in temperatures across the Midwest

are expected to be broken.

·

Ukraine’s First Deputy Agriculture Minister looks for 2022 Ukraine grain production to end up near 48.5 million tons. Ukraine corn producers completed spring plantings on 4.6 million hectares (corn only), down from 5.5 million

in 2021.

Export

developments.

·

None reported

·

Updated

6/9/22

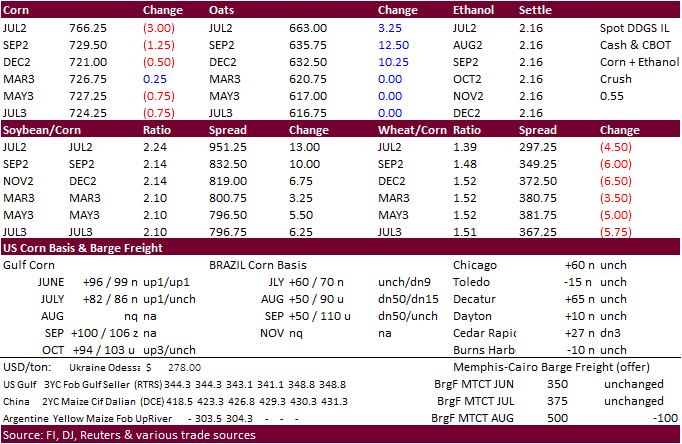

July

corn is seen in a $7.25 and $8.25 range

December

corn is seen in a wide $5.75-$8.50 range