PDF Attached

CBOT grain and oilseed markets saw most of the move on the Sunday evening open period following some relief rains over the weekend. Also weighing on ags were the talk out of the Biden Administration of relaxing the biofuel blending mandates which pressured RIN prices and bio-feedstocks.

Crop Conditions

Weather – QPC 1-5 day precipitation forecast

U.S. weather during the weekend provided no big surprises. Scattered showers and thunderstorms produced rain in nearly half of the Corn Belt, but only 15-20% of the region received enough rain to change soil moisture and most of the changes were expected to be brief.

Rainfall was greatest in eastern Nebraska into northeastern Kansas and northwestern Missouri where 0.70 to 1.99 inches resulted. Net drying occurred from eastern Minnesota and western Wisconsin through much of Iowa and western Illinois to eastern Missouri. Other areas of drying occurred in portions of Indiana, Michigan, and Ohio. Northern Plains rain ended Friday with additional 0.20 to 0.80 inch of moisture in northwestern and north-central North Dakota and in a few areas in western Minnesota.

Rain fell most abundantly in the southeastern states from Alabama and northwestern Florida to Virginia and North Carolina. The precipitation varied from 0.50 to 2.00 inches with a few greater amounts in random locations. The moisture was very good for improving topsoil moisture and crop conditions. Welcome drying occurred in the Delta after flooding last week. Texas rainfall was mostly confined to the Panhandle and a few areas near the Oklahoma border. Rainfall in the northern Panhandle ranged up to 1.63 inches. West Texas, the Blacklands, South Texas and Coastal Bend were dry. Oklahoma and eastern grain areas of Kansas received rain with highly varying amounts resulting in varying impacts on crops.

No adversity impacted winter wheat and summer crops benefited from the rain. Temperatures were very warm in the heart of the Midwest with highs in the upper 80s through the lower to a few middle 90s Fahrenheit. The heat accelerated drying. Northern Plains temperatures were in the 80s to near 90, but were confined to the 70s and lower 80s Friday after rain left the region. West Texas heat was oppressive Friday with extremes of 95 to 111 Fahrenheit and one location to the southwestern crop areas reaching 113.

U.S. weather this week will be warmest in the Plains and western Corn Belt Tuesday through Thursday when highs in the 80s and 90s and a few extremes over 100 are expected. Cooling is expected late this week and into the coming weekend which may slow drying rates. Rain is expected sporadically this week and next week keeping a level of concern over long term soil moisture across the upper Midwest and northern Plains. No serious crisis in crop development is expected right away, but concern remains in the long-term outlook. Drying will occur in the far northern Plains, North Dakota, eastern Montana, northern South Dakota and northwestern Minnesota. These areas experienced a boost in topsoil moisture last week and this drying will return moisture shortages in the topsoil over time. Erratic rain in the Midwest will leave some pockets of drying while other areas experience enough rain to experience status quo conditions. Subsoil moisture will remain supportive of summer crop development.

U.S. weather June 21-27 will include some periodic showers and thunderstorms in the Midwest with cooler biased temperatures that will help to slow drying rates but will maintain concern over the long term outlook for key crop areas in the upper Midwest which are already too dry. Subsoil moisture will stay favorably rated and crops are not expected to experience serious crop stress. Temperatures will be a little milder than usual, but still warm enough to induce drying during periods of rain free weather. No widespread area of dryness is expected, but pockets of mild crop stress will occur with a few areas of greater crop stress. Rain from the tropical cyclone that impacts the Gulf of Mexico Coast States this weekend will linger in the eastern states early next week. An erratic shower pattern will occur in the Plains during the June 21-27 period with most of the moisture too light and brief to have much impact on soil moisture or winter crop harvesting. The showers will be welcome for summer crops

Canada’s Prairies will experience net drying except in western and northern Alberta and some far northern crop areas in Saskatchewan and Manitoba during the next ten days. Temperatures will be very warm to hot during the early to middle part of this week and then milder. The cooler conditions will help slow drying rates and help stave off a serious bout of moisture stress.

South America weather during the weekend was mostly dry in both Brazil and Argentina; temperatures were mild to warm. Harvest progress advanced well in both countries. Rain is still needed in southwestern Argentina’s wheat production areas. Safrinha corn and cotton remain stressed in northern production areas, although much of the corn crop is in the late filling, maturation, and early harvest stages.

Argentina weather will continue mostly dry over the next two weeks with rain only expected in eastern most parts of the nation next week. Brazil rain will continue mostly in southern grain areas from Mato Grosso do Sul and parts of Sao Paulo into RGDS during the next two weeks. The precipitation will not harm Safrinha corn, although drying will soon be needed to support maturation and harvest progress. The rain will be very good for wheat production and potential yields are high. Temperatures will cool down in Argentina this coming weekend into next week and in Brazil next week, but there is very little risk of frost or freezes in corn, sugarcane, citrus or coffee areas of Brazil for now.

France, Germany, Poland, and areas south into northern Italy and Slovenia and north to Scandinavia will be warmer than usual in this coming week. Rain is expected periodically across the continent, but there will be some net drying for a while. The situation will need to be closely monitored for signs of expanding dryness. For now, the situation looks good for most crop areas.

Net drying is expected from the lower Volga River Basin east into Kazakhstan and southern portions of Russia’s New Lands this week. Some warm weather is expected in this region. A full blown Sukhovei is not expected, but east to northeasterly wind speeds and warm temperatures will occur over the next ten days leading to faster rates of drying. Wednesday and Thursday of this week and again this weekend into early next week will be warmest and driest with highs in the 90s to near 100 degrees Fahrenheit which will accelerate drying. A close watch on the region is warranted just in case temperatures become more extreme and the heat becomes more impressive. Cooling is expected this weekend into next week and some rain is expected which may offer relief to northern Kazakhstan and southeastern Russia’s New Lands.

Mexico rainfall will continue confined to southern parts of the nation this week leaving drought in dominance of western, central, and northern Mexico. Rain should increase and advance to the north during the June 20-26 period.

Source: World Weather, Inc.

Tuesday, June 15:

- FT Commodities Global Summit, day 1

- Malaysia June 1-15 palm oil export data

- Malaysia CPO export tax for July (tentative)

- New Zealand Food Prices and global dairy trade auction

Wednesday, June 16:

- EIA weekly U.S. ethanol inventories, production

- FT Commodities Global Summit, day 2

- Australia’s Abares to release agricultural commodities report

- Brazil’s Unica may release cane crush, sugar production data (tentative)

- CNGOIC oilseed conference, Chengdu, China, Day 1

Thursday, June 17:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- Itau webinar on agribusiness outlook, Sao Paulo, Brazil

- CNGOIC oilseed conference, Chengdu, China, Day 2

Friday, June 18:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China customs to publish trade data, including imports of corn, wheat, sugar and pork

- World coffee market report by USDA’s Foreign Agricultural Service, 3pm

- FranceAgriMer weekly update on crop conditions

- USDA Total Milk Production

Source: Bloomberg and FI

Macros

• S&P and Nasdaq closed at record highs.

• UK’s Johnson delays end of England lockdown to July 19 as COVID cases rise.

• G-7 confirms 1 billion dose vaccine pledge in communique.

• 49 counterparties take $583.9 billion at Fed’s fixed-rate reverse repo today.

Corn

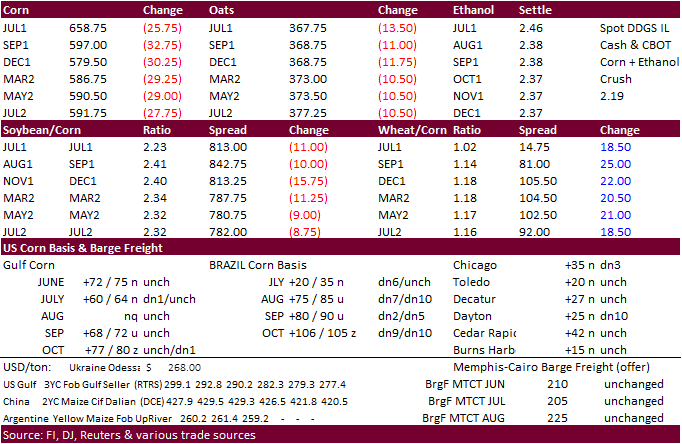

- Corn futures were lower from the get-go as weekend rains and chatter out of Washington D.C. about easing biofuel blending mandates. While the biofuel talk was unconfirmed, the mention of it sent RIN prices lower.

- The inflation hedge trade has shown to run its course for the ag markets. The Fed has been telling the market there is no inflation fear by using reverse-repos at a record pace daily. Unlike commodities, the equity markets have taken notice and have closed at record highs today. The reckoning for the massive liquidity injection will come someday, but not today, so trade accordingly.

- The two-week outlook was trending cooler and wetter on the midday models.

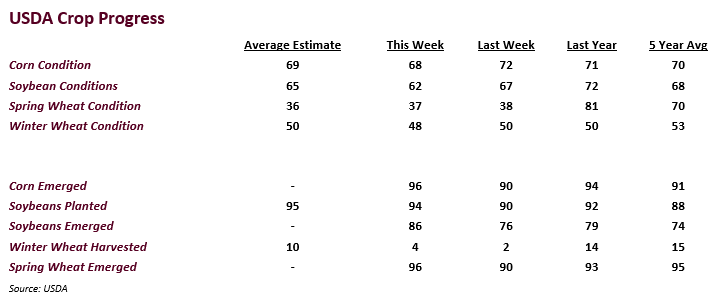

- Corn conditions came in today at 68% G/E, 1 point less than expected.

- USDA’s export inspections for corn came in at the low-end of the estimate range.

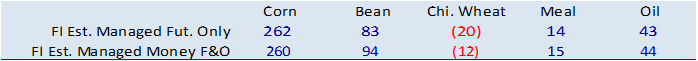

- Funds in corn were net sellers of 21,000 corn contracts on the session.

Export developments.

Updated 6/10/21

July corn seen in a $6.50 and $7.50 range

December corn is seen in a $4.75-$7.00 range.

Soybeans

- The soybean complex traded lower all session on improved weather and weaker global vegoils. Palm oil slid near 8% overnight.

- The food vs. fuel battle was brought to center stage again after the unconfirmed policy talk on biofuel blending. Speculation is that demand for soy-based biodiesel may decrease, but the way policymakers look at these mandates retroactively, it’s anyone’s guess here. More details are needed here.

- Funds on Monday sold an estimated net 14,000 soybean contracts, sold 7,000 soybean meal and sold 6,000 soybean oil contracts.

- USDA’s export inspections of soybeans came in below trade expectations.

- ICE Canola fell 2% today, notching the fourth straight down day.

- US soy crop is at 62% G/E, lower than the 65% G/E expected.

- USDA seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

Updated 6/10/21

July soybeans are seen in a $15.00-$16.25; November $12.75-$15.00

Soybean meal – July $360-$410; December $380-$460

Soybean oil – July 68-74; December 57-70 cent range

- Wheat finished lower on spillover pressure from soy and corn markets. Spring wheat was the biggest loser after weekend rains fell on the Northern Plains.

- USDA’s export inspections came in as expected.

- US winter wheat conditions were at 48% G/E, lower that the 50% G/E that was expected. The winter wheat harvest is getting off to a slow start as only 4% of the crop is harvested, less than the 10% harvested which was expected.

- US spring wheat conditions fell by 1 point to 37% G/E, which was better than the 36% G/E that was expected.

- Funds on Monday sold an estimated net 6,000 SRW wheat contracts.

- September Paris wheat market basis September settled down 1.75 euros, at 209.50 euro/ton.

- Egypt seeks the usual tender for wheat for August 21-31 shipment and with payment at sight.

- Jordan seeks 20,000 tons of wheat bran on June 15 for July/August shipment.

- Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on June 16 under its SBS import system, for arrival in Japan by November 25.

- Jordan seeks 120,000 tons of wheat on June 22 for December shipment.

- Jordan is back in for feed barley on June 23 for Nov/Dec shipment.

Updated 6/10/21

July Chicago wheat is seen in a $6.30-$7.15 range

July KC wheat is seen in a $5.95-$6.70

July MN wheat is seen in a $7.50-$8.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.