PDF Attached

Attached

are our updated US corn and wheat balances.

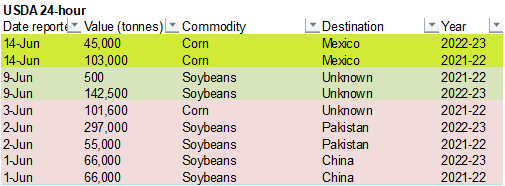

Private

exporters reported sales of 148,000 metric tons of corn for delivery to Mexico. Of the total, 103,000 metric tons is for delivery during the 2021/2022 marketing year and 45,000 metric tons is for delivery during the 2022/2023 marketing year.

Another

wild trading session in US commodity and agriculture markets. WTI saw a large two-sided trade. The soybean complex, corn and wheat ended lower on technical selling. US rainfall will be limited for the Midwest through Friday. Some light showers are expected

in the southeastern areas and southern region Thursday and Friday. The Midwest will see some rain in the west central and eastern areas today. Temperatures will be very hot over the next two days, stressing crops. Western Europe will be hot this week.

US

FOMC meeting will conclude their two-day session this Wednesday. A 75 point hike is not out of the question. If realized, that would be the largest rate hike since 1994. US wholesale prices were up 10.8 percent in May from last year, in line with estimates

but at a very high annual rate.

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- Excessive

heat occurred Monday in the central and southern U.S. Plains with highs of 100 to 108 degrees Fahrenheit - Excessive

heat also impacted the central and lower Midwest, Delta and southeastern states with highs in the 90s to near 100 Fahrenheit - Livestock

and crop stress is expected through early next week as waves of excessive heat continue to impact the Plains, Midwest, Delta and southeastern states - Some

cooling will occur briefly in the central and southern Plains Wednesday and Thursday before temperatures heat back up again Friday through early next week

- Central

Plains high temperatures will sip to the upper 80s and 90s during the “coolest” days and then rise to the range of 100 to 110 this weekend and early next week - U.S.

Midwest, Delta and southeastern states will see highs in the 90s to near 100 degrees Fahrenheit through Wednesday and then cooling from northwest to southeast Thursday and Friday

- More

heat is possible next week, but the hottest conditions should stay in the western Corn and Soybean crop areas - Net

drying is expected in the central and southern parts of the Great Plains, the lower Midwest and Delta during the next ten days - Showers

and thunderstorms will occur periodically in the northern Plains and northern Midwest helping to keep crops in good condition

- A

short term bout of excessive heat is expected in the northern U.S. Plains and southeastern Canada’s Prairies along with the upper U.S. Midwest this weekend into early next week with highs in the 90s to 105 degrees Fahrenheit - U.S.

weather in weeks 3, 4 and 5 according the GFS, ECMWF and CFS models should result in a mean ridge position in the Plains with a bias in the high Plains most favored resulting in a northwesterly flow pattern aloft across the Midwest - This

pattern would keep the Plains warmest relative to normal and generate waves of showers and thunderstorms from the northern Plains into the Midwest

- Temperatures

would be closest to normal in the eastern Midwest - Areas

from Nebraska to Texas and the southwestern Corn Belt would get the least amount of rain, although not necessarily totally dry - Be

careful using these longer range forecast tools…..they use persistence and climatology and are no usually very good dealing with anomalous trends - The

bottom line for the U.S. is still a little tenuous with net drying this first week to ten days of the outlook in the lower Midwest, central and southern Plains and Delta and a favorable mix of weather in the northern Plains and southeastern states.

- The

month of June may finish out with brief periods of rain in the Midwest and northern Plains and warmer than usual temperatures while temperatures are warmest relative to normal in the Inter-Mountain West, the central and southern Plains and a part of the Delta.

Timely rain may prevent key Corn and Soybean production areas from becoming too dry, but areas of short to very short topsoil moisture will show up toward the end of this month. Crop stress should be expected, although favorable subsoil moisture and some timely,

but erratic, rain events should keep the crops performing favorably. Any persistence of hot, dry weather beyond next week would present a greater threat to crops.

- Rain

potentials in weeks 3, 4 and 5 along with more seasonable temperatures may limit crop stress in parts of the northern Plains and Midwest. West Texas cotton areas will be driest and warmest throughout the forecast period.

- Confidence

in these weeks 3, 4 and 5 outlooks is not high - Rain

fell beneficially in Alberta and western Saskatchewan Monday and overnight with moisture totals of 0.30 to 0.68 inch common - However,

northwestern Saskatchewan reported 0.84 to nearly 4.00 inches of rain with the North Battleford area wettest - Rain

also fell significantly in southwestern Alberta where 0.80 to 2.00 inches resulted - At

least some precipitation fell beneficially in most of the drought stricken region in the southwestern Prairies overnight and more will fall through Wednesday to bolster soil moisture and improve crop development

- A

few other showers occurred in southwestern Manitoba overnight with rainfall to 1.25 inches

- West

Texas cotton, corn and sorghum areas will not likely get much “meaningful” moisture over the next ten days - A

few showers and thunderstorms are possible during the middle to latter part of next week, but resulting rainfall is not likely to be enough to counter evaporation - Northern

U.S. Plains and upper Midwest weather will be most favorable during the next two weeks due to timely rainfall and a mix of temperatures - Ontario

and Quebec, Canada will experience a favorable mix of weather during the coming ten days to two weeks.

- Crop

development should advance favorably - Fieldwork

will only be briefly disrupted by rain - Western

and central Europe will experience net drying conditions through the weekend - Showers

and thunderstorms will slowly increase late in this coming weekend into next week

- The

resulting moisture will be extremely important for winter, spring and summer crops after previous days of drying

- Some

of the advertised rainfall may be overdone and it should be closely monitored especially in France, the U.K. and Germany - Temperatures

will be warm during both weeks of the two-week outlook - Net

drying is expected in many interior parts of Russia’s Southern region, parts of south-central and southeastern Ukraine and western Kazakhstan during the next ten days, although totally dry weather is unlikely - Greater

rain will be needed later in the month of June and July to improve soil and crop conditions - Far

southern Russia and Georgia will experience frequent rain later this week into early next week resulting in a notable boost in soil moisture favoring long term crop development - Western

and northern parts of the Commonwealth of Independent States will experience frequent rainfall over the next ten days maintaining moisture abundance in the soil and good crop development potential - Rain

northern Kazakhstan will be great for spring wheat and some sunseed crops - South

Korea rice areas continue critically dry and are in need of rain - Far

southern China will continue to receive too much rain for another week resulting in more flooding and more concern over rice, sugarcane and some minor corn, soybean and groundnut production areas

- Drying

is badly needed and some may occur next week - Northeast

China will continue to see rain routinely which may challenge summer crop planting since much of the region is already wet - Drying

will be most needed in Liaoning and Jilin where the ground is already a little too wet - China’s

Xinjiang province continues to experience relatively good weather, although warm conditions are expected early to mid-week this week before some welcome cooling occurs in the second half of this week and into the weekend - China’s

North China Plain will see limited rainfall for the coming week and then may get some scattered showers offering limited relief in the June 22-28 period - India’s

monsoonal rainfall will continue to perform poorly through Friday before some increase in rainfall is expected this weekend into next week

- The

greater rainfall next week and in the following week should slowly bring on improved planting and establishment conditions for many summer crops - Greater

rainfall may still be needed - Southern

Argentina will receive waves of rain over the next ten days maintaining a very good outlook for wheat, barley and canola - Western

Argentina will remain dry through next week raising concern over winter crop planting and establishment - At

least some rain is needed in all wheat areas in the nation, although subsoil moisture is still rated well in the east and more rain is expected there in the second half of next week - Southern

Brazil will see more rain this weekend into next week - Improved

Safrinha corn maturation conditions will result and winter wheat improvements are likely while dry weather is present over the next few days - Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast - Mexico’s

monsoonal rainfall is expected to start a little sporadically leaving parts of the nation quite dry, but a slow increase in precipitation will eventually take place - Interior

western areas will be wettest over the coming week along with southwestern coastal areas and a few lower eastern coastal areas - A

tropical disturbance may bring heavy rain to the Yucatan Peninsula this weekend before reaching the lower east coast of Mexico early next week - Remnants

of the storm could bring some welcome rain to coffee, citrus and sugarcane areas of southern Mexico next week - Another

tropical cyclone may evolve off the lower western Mexico coast during mid-week this week producing heavy rain in southwestern Mexico - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar - Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - South

Africa’s restricted rainfall in the east over the coming week will be good for summer crop harvest progress and some late winter crop planting - Rain

in western parts of the nation will be good for wheat, barley and canola emergence and establishment - Central

America rainfall will be abundant during the next ten days with excessive rainfall possible along the Pacific Coast

- A

tropical cyclone may form near the Nicaragua and Costa Rica coast during mid-week this week bringing significant rain to northeastern Nicaragua and eventually to eastern Honduras, Belize and then Yucatan Peninsula later this week - Some

very heavy rain will fall in coastal areas. - Today’s

Southern Oscillation Index was +15.00 and it will move erratically over the coming week - New

Zealand rainfall will diminish to infrequent showers over the coming week; recent rain was welcome and beneficial.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

June 15:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

June 1-15 palm oil export data - St

Petersburg International Economic Forum, June 15-18

Thursday,

June 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Brazil, South Africa

Friday,

June 17:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

June 18:

- China’s

second batch of May trade data, including corn, pork and wheat imports

Source:

Bloomberg and FI

Macros

97

Counterparties Take $2.224 Tln At Fed Reverse Repo Op (prev $2.213 Tln, 97 Bids)

US

PPI Final Demand (M/M) May: 0.8% (est 0.8%; prev 0.5%)

US

PPI Ex Food And Energy (M/M) May: 0.5% (est 0.6%; prev 0.4%)

US

PPI Final Demand (Y/Y) May: 10.8% (est 10.9%; prev 11.0%)

US

PPI Ex Food And Energy (Y/Y) May: 8.3% (est 8.6%; prev 8.8%)

Canada

Manufacturing Sales (M/M) Apr: 1.7 (est 1.7%; prev 3.5%)

2023

US High-Yield Default Forecast Raised To 1.25%-1.75% – Fitch

OPEC

Leaves Full-Year 2022 World Oil Demand Growth Forecast Unchanged At 3.36 Million BPD

US

President Joe Biden To Visit Saudi Arabia On July 15-16 – State Television

·

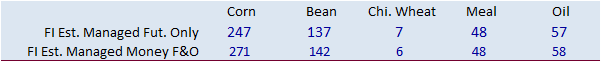

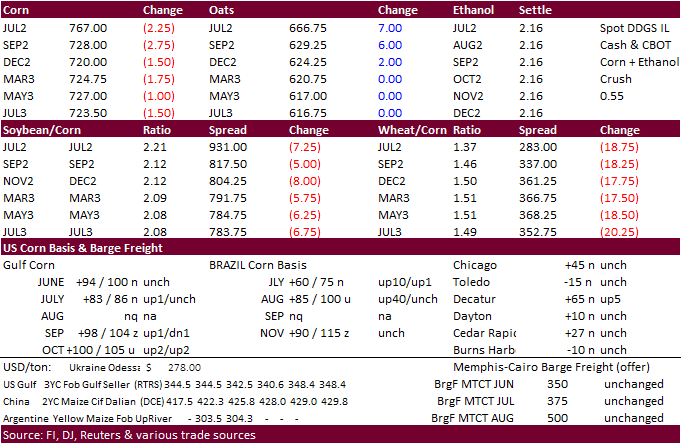

US corn futures traded unchanged to 1.25 cent lower despite a one point decline in US corn crop conditions. Sharply lower wheat spilled over into the corn market. We lowered the yield by 0.50 bushel per acre to 180.1 bushels per

acre. USDA is at 177.0 bushels. For production we are currently 402 million bushels above USDA. We updated our US corn balance sheet attached). USDA reported 148,000 tons of corn sold to Mexico this morning.

·

Funds sold an estimated net 2,000 corn contracts.

·

The USD was up 41 points in late afternoon trading.

·

A senior Ukraine government official said Ukraine’s grain harvest could fall to around 48.5 million tons for 2022 from 86 million tons year ago. Ukraine summer grain plantings are nearly complete, and the area is down more than

25 percent from a year ago.

·

Ukraine’s UAC sees the 2022 corn harvest at 25.7 million tons, up from 21.5 million projected in May.

·

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels to 1043 thousand (1028-1066 range) from the previous week and stocks up 142,000 barrels to 23.778 million.

Export

developments.

·

Private exporters reported sales of 148,000 metric tons of corn for delivery to Mexico. Of the total, 103,000 metric tons is for delivery during the 2021/2022 marketing year and 45,000 metric tons is for delivery during the 2022/2023

marketing year.

Updated

6/14/22

July

corn is seen in a $7.00 and $8.25 range

December

corn is seen in a wide $5.75-$8.25 range