PDF Attached

Fed

leaves rates steady, sees two small hikes by end of 2023 – Reuters News

Fed

leaves policy rate in 5.00%-5.25% range

Another

choppy trade as traders mull over supply concerns and sharply lower USD after US PPI data eased economic concerns. US weather outlook hasn’t changed that much. Midday was a little wetter for the Great Plains and drier for parts of the Midwest for the 11-15

day period. Look for rain to increase across the Midwest over the next week but keep an eye on the dry areas of the northwestern Corn Belt.

Fund

estimates as of June 14 (net in 000)

![]()

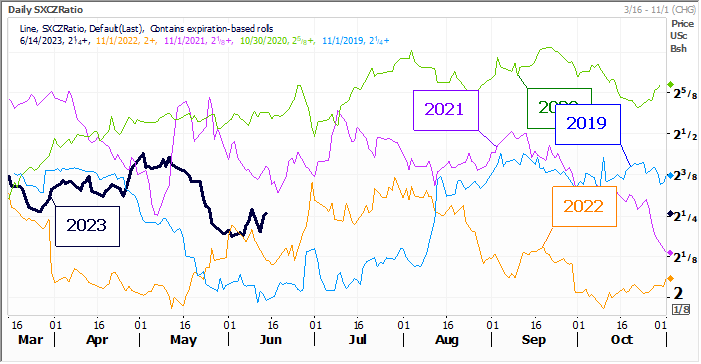

SX/CZ

WEATHER

TO WATCH

-

Alberta

and portions of Saskatchewan, Canada will receive waves of rain during the next ten days improving soil moisture in some of the driest areas and revitalizing some of the withering wheat, barley, canola and other crops produced in the region -

Far

southeastern Alberta and far southwestern and southeastern Saskatchewan may not get much rain, although a few showers are expected -

Not

much rain will fall from eastern Minnesota, eastern Iowa and western Wisconsin through the heart of Illinois to southern Indiana and a part of northern Kentucky in this coming week to ten days -

These

areas are already too dry and crop moisture stress will be intensify -

Yield

loss potentials are rising in this region -

Eastern

U.S. Midwest crop areas will get additional rain today and Thursday with Ohio and Pennsylvania wettest relative to normal

-

Net

drying is expected for a while thereafter until sometime next week when showers may return again -

U.S.

Delta and southeastern states will experience waves of rain with some excessive amounts possibly resulting in some flooding during the next ten days -

Areas

from the heart of the Delta into Georgia are most favored for the greatest rainfall -

U.S.

central Plains summer crop areas will experience a good mix of weather during the next ten days -

Some

winter wheat areas may be a little wetter than desired, but the impact should be relatively low due beneficial breaks in the weather with greater sunshine and drying conditions expected at times

-

Northern

U.S. Plains, the Upper U.S. Midwest and southeastern Canada Prairies will experience restricted rainfall for a while, although totally dry weather is unlikely -

There

will be a growing need for greater volumes of rain in parts of this region which are already quite dry -

Washington’s

Yakima Valley and neighboring areas of north-central Oregon will be dry for much of the next ten days leaving a big need for rain in unirrigated crop areas -

Showers

in the Snake River Valley of Idaho and in much of Montana and Wyoming will be good for sugarbeets, dry beans and other crops produced in the region during the next ten days -

Much

of western and southern Texas will be dry biased for the next ten days and possibly longer with temperatures rising above normal -

Extreme

highs in the 90s to over 100 Fahrenheit are expected frequently -

Crop

and livestock stress is expected -

U.S.

temperatures will be cool in the Midwest for a while into the end of this week and then warmer this weekend into early next week before some additional cooling occurs later next week -

The

mix of temperatures will help keep moisture stress low in the driest areas -

Northern

Europe dryness will continue most serious from northeastern France through Germany to a part of western Poland and northward to Belgium, Netherlands and Denmark through the weekend

-

Relief

from dryness is expected to evolve gradually next week -

Sufficient

rain is expected by July 1 to improve topsoil and crop conditions -

Drying

will also occur in Russia, the Baltic States, eastern Belarus and eastern Ukraine during much of the next ten days firming the soil and raising the need for rain -

A

larger part of Ukraine and Belarus will be impacted by dryness into early next week before rain begins -

Eastern

Russia’s New Lands and northern Kazakhstan will remain drier than usual through the next ten days, although milder than usual temperatures will help limit crop stress for a while -

Southern

Europe will continue wetter than usual for much of the coming ten days limiting fieldwork and slowing some crop development for a while -

North

Africa’s rainy weather pattern of the past few weeks will end after today’s rain ends -

West-central

Africa rainfall has been and will continue to be quite abundant during the next ten days favoring coffee, cocoa, sugarcane and rice development -

A

few areas have been trending a little too wet and less rain might be welcome -

Cotton

areas in Burkina Faso and Mali are trending much wetter -

East-central

Africa rainfall continues to occur routinely and mostly supports normal rice, coffee, cocoa and sugarcane development -

China’s

northern Yellow River Basin and neighboring areas of Inner Mongolia are trending drier and this pattern will prevail for a while possibly leading to crop moisture stress for wheat, coarse grains and oilseeds later this summer -

Southern

China will remain plenty wet and may become excessively wet soon -

This

will interfere with early rice maturation and harvesting with some crop quality declines possible -

Some

sugarcane areas will eventually be flooded -

Most

of the greatest rain will be south of rapeseed areas; though much of the rapeseed harvest has likely been completed -

Xinjiang,

China will experience seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Crop

conditions are improving because of the recent development of more seasonable temperatures -

Recent

high temperatures have been in the 90s to slightly over 100 Fahrenheit -

Tropical

Cyclone Biparjoy was 169 miles southwest of the northwestern most coast of Gujarat, India at 1200 GMT today moving northeast and producing sustained wind speeds of 100 mph -

Landfall

is expected around 1700 GMT Thursday in far northwestern Gujarat with wind speeds of 80 mph, a notable storm surge and torrential rainfall likely

-

Rainfall

should vary from 6.00 to 12.00 inches in general with local totals to more than 15.00 inches

-

Remnants

of the tropical cyclone will move through southern Rajasthan to north-central Madhya Pradesh, India Friday into the Sunday with a swath of heavy rain likely to accompany it -

Portions

of southeastern Sindh, Pakistan will also be adversely impacted by the storm -

India’s

monsoon continues having trouble getting started, but once Tropical Cyclone Biparjoy moves inland and dissipates Thursday through Sunday the potential for greater rain in India will begin rising -

June

20-26 should be much wetter for many areas in India, but not in the west-central parts of the nation where it is likely to remain drier than usual -

Western

Thailand, western Cambodia and Vietnam rainfall continues lighter than usual with little change likely for the next ten days -

Rain

is falling in some of these areas, but not enough has occurred to bolster subsoil moisture and water supply along with rivers and streams are still running low -

Australia

soil moisture is still mostly good for wheat, barley and canola emergence and establishment -

Weather

in the coming ten days will remain plenty wet in crop areas near the southern coast -

A

boost in rainfall will be needed in interior Western Australia (especially in northern crop areas) and in Queensland as well as a few interior South Australia locations -

South

Africa’s southwestern wheat and barley production region continues to get rain with more expected -

Winter

crops in the region are well established -

Some

increase in rain would be welcome for winter crops in Free State -

Argentina

dryness remains a concern for Cordoba, western Buenos Aires and La Pampa while crop areas to the east have seen sufficient rain for aggressive planting and good early season emergence and establishment -

Rain

prospects are poor in Argentina for the next ten days -

Above

normal rain is expected from Mato Grosso to northern Rio Grande do Sul, Santa Catarina, Parana and Sao Paulo, Brazil during the coming week slowing fieldwork and inducing soggy field conditions in wheat and corn areas -

There

is no risk of crop damaging cold in the next ten days -

Drier

weather is needed to protect crop conditions -

Minas

Gerais, Espirito Santo and Rio de Janeiro crop areas of Brazil will be wetter than usual for a brief period of time Friday through Sunday

-

Delays

in sugarcane, coffee and citrus harvesting is expected, but improved weather should evolve next week to limit any concerns.

-

Mexico

drought will continue for at least the next ten days with monsoonal precipitation staying quite limited

-

Delays

in summer crop planting are occurring and concern over sugarcane, coffee, citrus and rice is rising -

Sorghum,

cotton and corn may not perform well for a while with some planting of corn and sorghum to be delayed until seasonal rains arrive -

Central

America rainfall is expected to be abundant to excessive during the next ten days possibly leading to some areas of flooding -

Indonesia,

Malaysia and Philippines rainfall will be mostly well timed for a while, although there will continue to be pockets of drying in Indonesia and Malaysia.

-

Today’s

Southern Oscillation Index was -13.37 and it will move erratically higher over the next several days

Source:

World Weather, INC.

Wednesday,

June 14:

- FranceAgriMer

monthly grains balance sheet - New

Zealand food prices - EIA

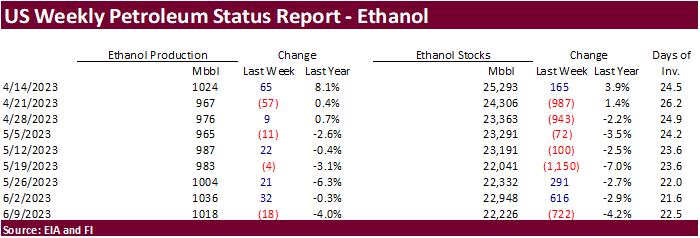

weekly US ethanol inventories, production, 10:30am

Thursday,

June 15:

- USDA

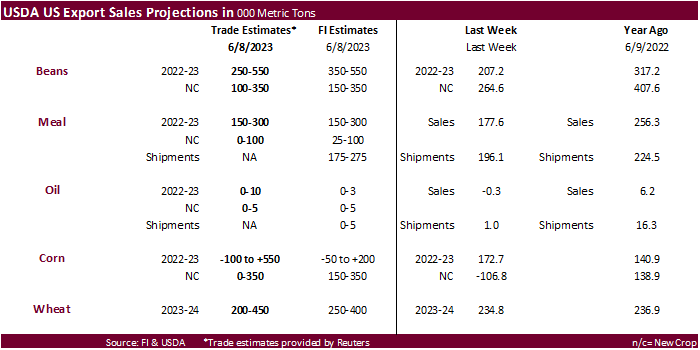

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

June 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Fed

Set To Pause And Keep Option To Raise Rates In July; ECB Expected To Hike Another Quarter Point As Tightening Cycle Nears Terminus

ECB

Expected To Hike Another Quarter Point As Tightening Cycle Nears Terminus

US

PPI Final Demand (M/M) May: -0.3% (est -0.1%; prev 0.2%)

US

PPI Ex Food And Energy (M/M) May: 0.2% (est 0.2%; prev 0.2%)

US

PPI Final Demand (Y/Y) May: 1.1% (est 1.5%; prev 2.3%)

US

PPI Ex Food And Energy (Y/Y) May: 2.8% (est 2.9%; prev 3.2%)

US

DoE Crude Oil Inventories (W/W) 9-June: 7919K (exp -1536K; prev -452K)

Distillate:

2123K (exp 1750K; prev 5074K)

Cushing:

1554K (prev 1721K)

Gasoline:

2108K (exp 1000K; prev 2745K)

Refinery

Utilisation: -2.10% (exp 0.00%; prev 2.70%)

·

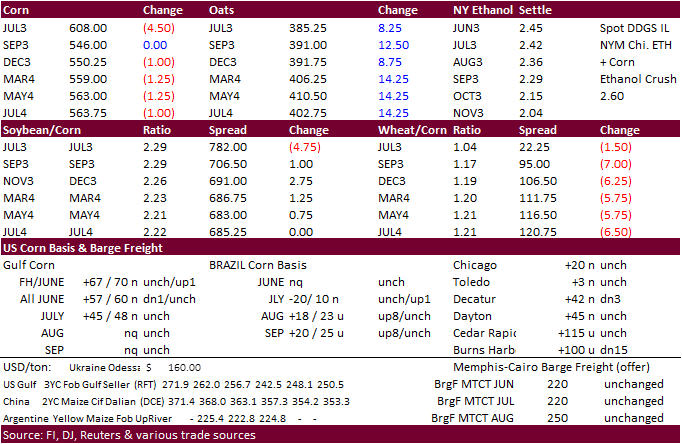

Unusual trading day. Corn futures for the majority of the session traded lower from a slight correction in CBOT agriculture markets and lack of fresh news. September ended up unchanged after a late recovery.

·

US ethanol production fell from the previous reporting week and that renewed ideas of demand destruction as US cash prices remain high and exports have slowed.

·

US weather outlook hasn’t changed that much so losses could be limited for the duration of the week. Note Monday is a US holiday. Look for positioning Thursday and Friday.

·

Russia said they have not decided whether or not to extend or adjust fertilizer export duties. Russia is a crucial global provider of fertilizer.

·

USDA Broiler Report showed broiler eggs set in the US up one percent and chicks placed down 1 percent. Cumulative placements were down slightly from the same period a year earlier.

·

USDA turkey hatchery:

-

Eggs

in Incubators on June 1 Up 7 Percent from Last Year -

Poults

Hatched During May Up 4 Percent from Last Year -

Net

Poults Placed During May Up 4 Percent from Last Year

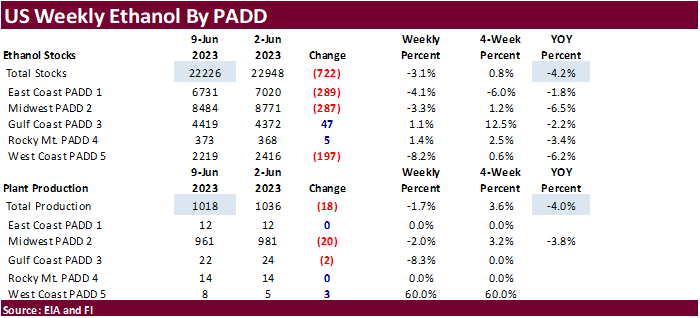

Weekly

US ethanol production

was down 18,000 barrels to 1.018 million and stocks fell a large 722,000 barrels to 22.226 million. For comparison, a Bloomberg poll looked for weekly US ethanol production to be up 7,000 thousand barrels and stocks up 104,000 barrels to 23.052 million. Sep

to date ethanol production is down 3.1% from the same period for 2021-22. US gasoline stocks increased by 2.1 million barrels to 220.9 million and implied demand for gasoline dropped 25,000 barrels to 9.193 million, about up 1.8 percent over a 4-week period

compared to year ago. Ethanol blended into finished motor gasoline ran at about 91.3 percent of the total, a four-week high.

US

DoE Crude Oil Inventories (W/W) 9-June: 7919K (exp -1536K; prev -452K)

Distillate:

2123K (exp 1750K; prev 5074K)

Cushing:

1554K (prev 1721K)

Gasoline:

2108K (exp 1000K; prev 2745K)

Refinery

Utilisation: -2.10% (exp 0.00%; prev 2.70%)

University

of Illinois: Nitrogen Fertilizer Prices Stabilize at High Levels in Spring 2023

Schnitkey,

G., N. Paulson, C. Zulauf and J. Baltz. “Nitrogen Fertilizer Prices Stabilize at High Levels in Spring 2023.”

farmdoc daily (13):108, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 13, 2023.

Export

developments.

-

Results

awaited: Iran seeks 120,000 tons of soybean meal and 120,000 tons of corn.

July

corn $5.75-$6.35

September

corn $4.50-$5.75

December

corn $4.25-$5.75

·

CBOT soybeans were lower to start following light weakness in products and risk off trading after trading in a higher but very choppy session on Tuesday. Then soybeans rebounded, exception July and August, after soybean oil caught

a bid. Yesterday August soybeans nearly tested its 50-day MA of $13.3775. May 2024 fell 0.50 cent. The mixed close indicates lack of direction.

·

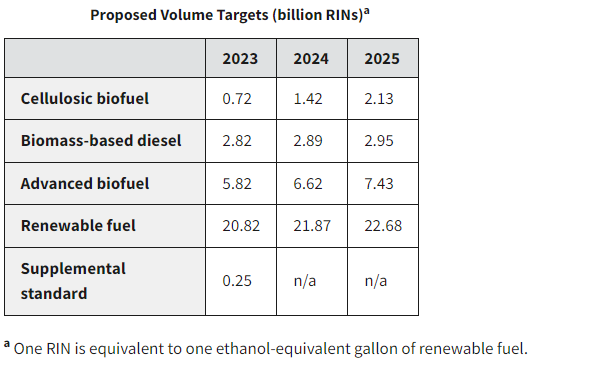

Higher Malaysian and China palm oil and near unchanged EU cash vegetable oil prices did limit downside movement in CBOT soybean oil earlier and the August soybean oil contract hit buy stops after trading through its 100 day moving

average (55.07 that readjusts after today’s close). Dry weather for the EU and US coupled with EPA’s decision to delay RVO mandates also limited earlier losses for SBO.

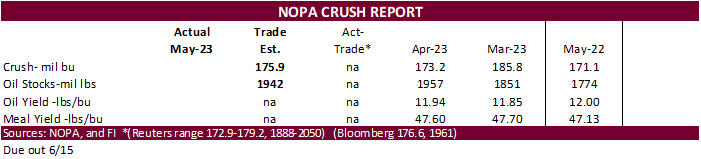

·

NOPA US crush is due out Thursday and traders are looking for 175.88 million bushels for the month of May, down on a daily adjusted basis from April but up nearly 3 percent from year ago. Soybean oil stocks are expected to drop

to 1.942 billion pounds from 1.957 billion pounds at the end of April (a 14 month high).

·

August Malaysia palm futures traded 36 ringgit higher to 3452.

·

Argentina Rosario grains exchange: 2022-23 soybean production 20.5 MMT versus 21.5MMT previous.

Export

Developments

-

Egypt

bought 18,000 tons of vegetable oils consisting of 6,000 sunflower oil at $926 per ton c&f and 12,000 soybean oil at $1,048/ton for arrival between August 20 and September 15.

They

were also in for a small amount of local vegetable oils, but no results were reported.

-

Iran

seeks 120,000 tons of soybean meal and 120,000 tons of corn on June 14. -

Algeria

passed on soybean meal. -

USDA

last week bought 1,220 tons of vegetable oils for export at $1,947-$2,292 per ton.

-

USDA

seeks 6,410 tons of vegetable oils on June 15 for FH July shipment to the Dominican Republic.

-

USDA

seeks 77,000 tons of soybean meal on June 14 for July 10-31 shipment to Indonesia.

EPA

December 2022

Soybeans

– July $13.70-$14.30, November $11.00-$14.50

Soybean

meal – July $370-$415, December $290-$450

Soybean

oil – July 54.00-57.00, December 49-57

·

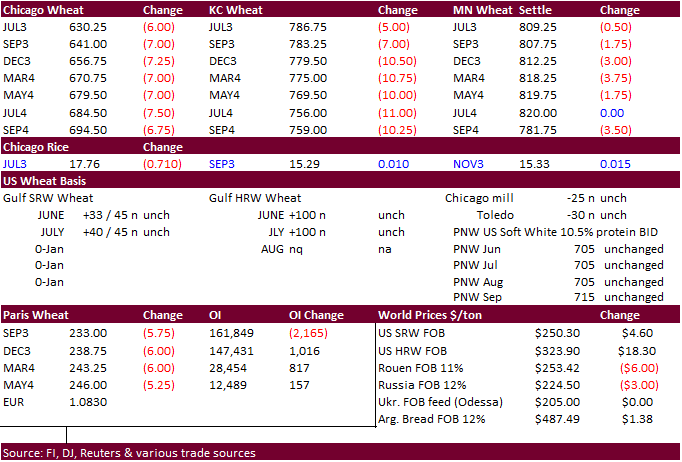

By session end, most US wheat futures traded lower today on light profit taking by funds bias Chicago & KC, and follow through selling for higher protein wheat from rain prospects for the central and northern Great Pains this

week. MN saw limited losses, a surprise with rain in the forecast for parts of Canada’s major producing areas.

·

September Paris milling wheat officially closed 5.75 euros lower, or 2.4%, at 233.25 euros a ton (about $253.25 ton).

·

FranceAgriMer lowered French soft wheat exports outside the European Union for 2022-23 by 100,000 tons to 10.2 million toes, 16% above the previous season.

·

Hot weather is expected to dominate mainland EU this month.

·

Egypt bought 3.5 million tons of local wheat since mid-April, about 350,000 tons greater than what they secured as of around June 10. They will need to import about 5 million tons to reach their 8.25 million ton subsidy program

for the 2023-24 crop year.

·

Look for Egypt to float another import tender soon as the latest purchase of one Russian wheat cargo was thought to be in jeopardy over payment issues.

·

Argentina Rosario grains exchange: Planted area of wheat 5.6 million hectares.

·

Argentina will see net drying over the next week, unwelcome for the recently planted wheat crop.

·

Russia’s Deputy Prime Minister Viktoria Abramchenko noted 2023 Russian wheat exports could grow 10 percent from 2022, which saw a 12 percent growth in terms of revenue (41.5 USD billion).

·

Agritel: Romania wheat production downward revised 15% to 8.76 MMT from 10.35 MMT projected last April, compared to 9.2 MMT year ago.

·

Kyiv School of Economics put out a study suggesting Ukraine’s food production could take 20 years or more to recover.

Export

Developments.

·

Taiwan bought 56,000 tons of US wheat from the US for July 31-August 14 shipment off the PNW. That included U.S. dark northern spring wheat 14.5% protein content at an estimated $341.35 a ton FOB U.S. Pacific Northwest coast or

$368.30 c&f. Another hard red winter wheat 12.5% protein content at $316.32 a ton FOB/$343.27 c&f per ton and soft white wheat 8.5%/max 10% protein at $278.01 a ton FOB/$304.96 a metric ton c&f. (Reuters)

·

Results awaited: Morocco seeks 500,000 tons of feed barley on June 14.

·

Japan in a SBS import tender seeks 60,000 tons of feed wheat and 20,000 tons of barley on June 19 for arrival by November 30.

Rice/Other

Chicago

Wheat July $6.00-$6.50, September $5.50-$6.75

KC – July $7.60-$8.50, September $7.50-$9.00

MN –

July $7.80-$8.50, September $7.25-$9.00

#non-promo