PDF Attached

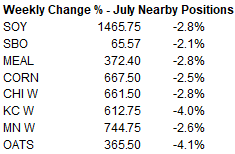

Lower

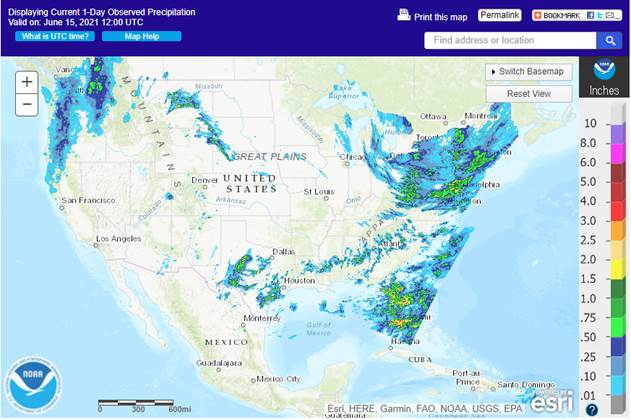

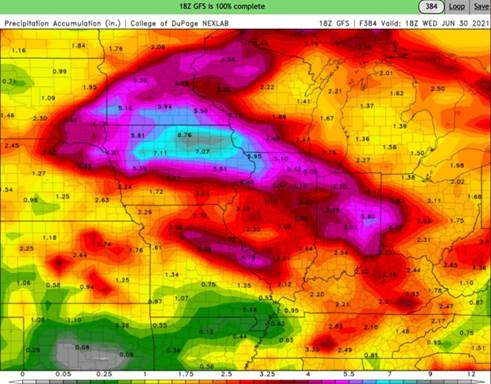

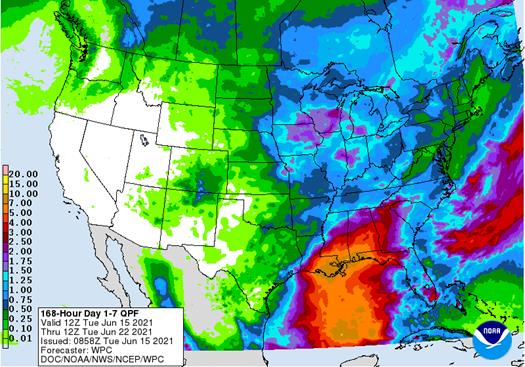

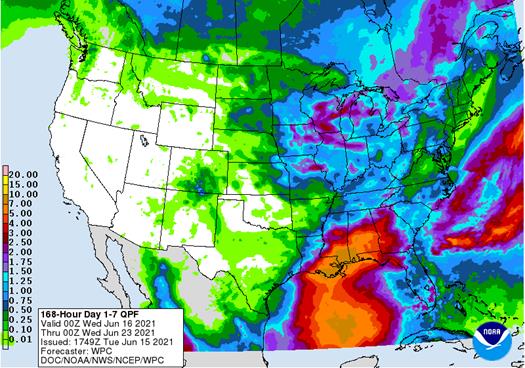

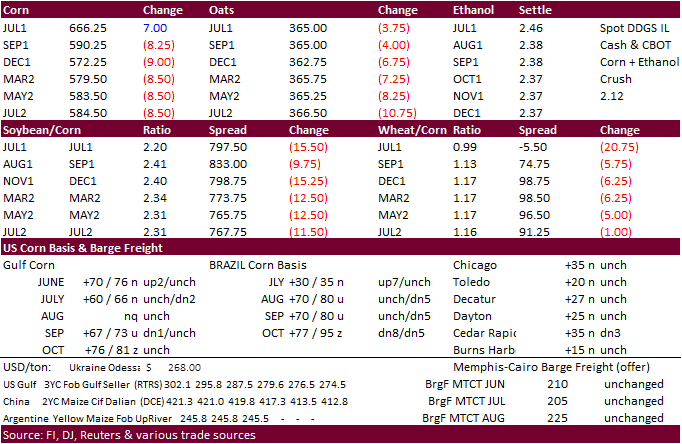

trade with exception to July corn and back month MN wheat contracts. The 1-7 day looks as if rain forecast for IA, WI, lower MN, IL & IA is wetter than that of yesterday (both maps below). Temperatures are also a little cooler. 15 days out shows good rain

across northern IA. Soybean oil failed a reversal

despite a friendly US NOPA crush bean oil inventory figure. We revised some price ranges.

Week

to date changes (2 days)

15

days out shows good rain across northern IA.

VALID

TUESDAY…

…VALID

WEDNESDAY (previous day)

WORLD

WEATHER HIGHLIGHTS FOR JUNE 15, 2021

-

Tropical

Storm Bill will impact Newfoundland as a mid-latitude storm after losing its tropical characteristics today.

-

A

new tropical depression or tropical storm is expected in the Gulf of Mexico later this week that will bring heavy rain to eastern Louisiana, southern Mississippi and Alabama.

-

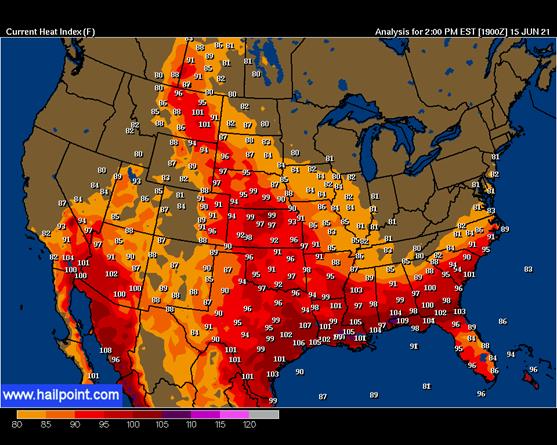

In

the meantime, three days of excessive heat in the central U.S. will be followed by milder weather for most of the U.S. Plains and Midwest during the weekend and all of next week. -

Extreme

highs to 106 will occur in Montana today and 100-104 in Nebraska and South Dakota Wednesday and in the 90s to 102 in the central Plains and southwestern corn Belt Thursday

-

Periods

of rain next week will help maintain a good environment for summer crops in the Midwest.

-

North

Dakota, northeastern South Dakota and Minnesota may not receive much rain and will continue to deal with some dryness

-

Russia’s

southeastern New Lands and neighboring Kazakhstan will get relief from dryness also in the coming ten days.

-

Warm

and relatively dry weather is expected from western Kazakhstan into the lower Volga River Valley of Russia for the next ten days -

Good

weather will continue in western parts of the CIS -

Excessive

rain fell in Shandong, China overnight resulting in some flooding -

Eastern

China’s dry region has shrunk tremendously in the past week, but pockets of dryness are lingering -

The

outlook for Europe, Australia and South America is largely unchanged from Monday.

-

Europe

will experience a good mix of weather for the next ten days -

Australia

will get some periodic showers that will support winter crop emergence and establishment, although greater rain would be welcome -

Argentina

will continue to receive restricted rainfall over the next ten days -

Wheat

areas in the south and west would benefit from greater rainfall -

Brazil

rainfall will continue in the interior south with no risk of crop damaging cold in key grain, sugarcane or coffee areas during the next ten days -

India’s

monsoon will remain weak leaving the interior west and far south with limited rainfall for the balance of this month. -

East-central

Africa coffee, cocoa, rice and sugarcane areas need greater rainfall -

This

includes parts of Ethiopia, Kenya and Uganda

Source:

World Weather, Inc.

Tuesday,

June 15:

- FT

Commodities Global Summit, day 1 - Malaysia

June 1-15 palm oil export data - Malaysia

CPO export tax for July (tentative) - New

Zealand Food Prices - New

Zealand global dairy trade auction

Wednesday,

June 16:

- EIA

weekly U.S. ethanol inventories, production - FT

Commodities Global Summit, day 2 - Australia’s

Abares to release agricultural commodities report - Brazil’s

Unica may release cane crush, sugar production data (tentative) - CNGOIC

oilseed conference, Chengdu, China, Day 1

Thursday,

June 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Itau

webinar on agribusiness outlook, Sao Paulo, Brazil - CNGOIC

oilseed conference, Chengdu, China, Day 2

Friday,

June 18:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs to publish trade data, including imports of corn, wheat, sugar and pork - World

coffee market report by USDA’s Foreign Agricultural Service, 3pm - FranceAgriMer

weekly update on crop conditions - USDA

Total Milk Production

Source:

Bloomberg and FI

Macros

CBOE

To Extend Global Trading Hours For VIX, SPX Options To Nearly 24 Hours, Beginning Nov 21, 2021

US

Empire Manufacturing Jun: 17.4 (est 22.7; prev 24.3)

US

Retail Sales Advance (M/M) May: -1.3% (est -0.7%; prevR 0.9%; prev 0.0%)

US

Retail Sales Ex-Auto (M/M) May: -0.7% (est 0.4%; prevR 0.0%; prev -0.8%)

US

Retail Sales Ex-Auto, Gas May: -0.8% (est 0.0%; prevR 0.1%; prev -0.8%)

US

Retail Sales Control Group May: -0.7% (est -0.5%; prevR -0.4%; prev -1.5%)

US

PPI Final Demand (M/M) May: 0.8% (est 0.5%; prev 0.6%)

US

PPI Ex-Food, Energy (M/M) May: 0.7% (est 0.5%; prev 0.7%)

US

PPI Ex-Food, Energy, Trade (M/M) May: 0.7% (est 0.5%; prev 0.7%)

US

PPI Final Demand (Y/Y) May: 6.6% (est 6.2%; prev 6.2%)

US

PPI Ex-Food, Energy (Y/Y) May: 4.8% (est 4.8%; prev 4.1%)

US

PPI Ex-Food, Energy, Trade (Y/Y) May: 5.3% (est 5.1%; prev 4.6%)

Canadian

Existing Home Sales (M/M) May: -7.4% (prev -12.5%)

- Weather

was driving factor for the lower trade for back month corn positions. The weather models still call for milder temperatures mid this week and next week. 1-7 day for the US looked wetter for the WCB that that of yesterday. 15 days out shows good rain across

northern IA. - Today

we also think US corn futures are lower on follow through selling and lower wheat. Front month July ended higher on good demand for spot US domestic corn.

- Brazil’s

AgMin said they will open their doors to US GMO corn for feed purposes if the second crop is not large enough to meet consumption needs. (AgriCensus) How much and when TBD. Timing of this might be key. US corn exports this summer need to increase. Yesterday’s

inspections report came in at the low end of expectations and 67 million bushels are needed to be shipped in order to reach USDA’s 2.850 billion bushel crop year export projection.

- US

corn exports this summer need to increase. Yesterday’s inspections report came in at the low end of expectations and 67 million bushels are needed to be shipped in order to reach USDA’s 2.850 billion bushel crop year export projection.

- Yesterday

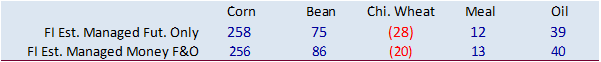

funds sold an estimated net 4,000 corn contracts. - US

crop conditions were widely ignored today. Corn conditions came in at 68% G/E, down 4 points, 1 point less than expected.

- Argentina

is close in talks with producers on re-opening beef exports. - USDA

announced they plan to allocate $700 million in aid to biofuel producers to assist industries recovering from pandemic repercussions in the next 60 days. Reuters: “USDA is honoring its commitment to get financial assistance to producers and critical agricultural

businesses, especially those left out or underserved by previous COVID aid.”

- Macro

inflation concerns could slow downward momentum in corn futures sometime this week. - A

Bloomberg poll looks for weekly US ethanol production to be down 4,000 barrels (1050-1077 range) from the previous week and stocks up 189,000 barrels to 20.149 million.

Export

developments.

- China’s

Sinograin plans to sell or auction off 37,126 tons of imported Ukrainian corn on June 18 to replenish tightening supplies and alleviate high prices.

Updated

6/15/21

July

corn seen in a $6.50 and $7.50 range

September

$5.50 and $6.75

December

corn is seen in a $4.75-$7.00 range.

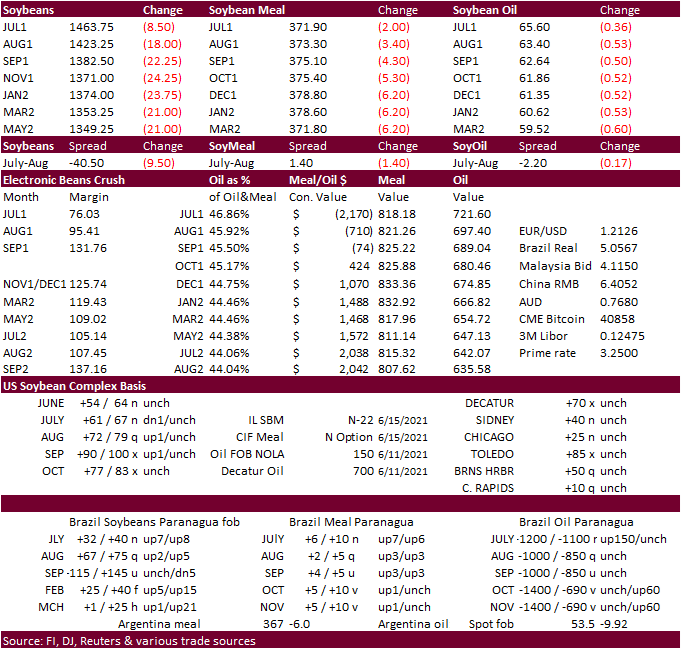

Soybeans

-

A

rebound in front month soybean oil contract was short lived but the reversal in bear spreading in soybeans remained in place throughout the session. All three markets closed lower. NOPA’s US May crush came in below expectations and soybean oil stocks tightened

from the previous month and are 210 million pounds below end of May 2020. July soybeans for the second day held above its 100-day MA of $14.4725. July meal reached another multi-month low earlier. July soybean oil ended 39 points lower. Spreads were in

play again today (sheet attached). Note we revised our price ranges below. ICE canola hit a 2-week low.

-

We

think the biofuel relief talk is overdone with no update or confirmation that it will happen. There might some type of relief but not without some type of bipartisan deal with food producers. Temporarily reducing biofuel mandates is an unusual practice in

the US, but other countries, like Brazil, have used measures to curb either inflation or rising costs for specific sectors. Some speculate RIN prices have peaked around these levels.

-

We

are hearing Gulf soybean meal is attracting business. European countries bought some US soybean meal this week and Asian buyers could soon return to the market. This comes after USDA’s CCC announced they are in for meal for donation on June 17, 25,000 tons

for Bangladesh and 8,000 tons for Cambodia. We have not seen those sizes for CCC soybean meal tenders in a while. Gulf soybean meal basis is around option (0), same as week ago.

-

Argentina

soybean oil was quoted by Oil World earlier this morning at $1,179/ton, down $168/ton from a May price average of $1,348. They also noted Black Sea sunflower oil prices could be offered at a discount versus soybean oil and other vegetable oils, shifting demand

which would be bearish SBO and palm oil. -

Oil

World noted first half June Brazil soybean exports were 5.1 million tons, down from 6.3 million a year earlier.

-

Funds

on Tuesday sold an estimated net 4,000 soybean contracts, sold 2,000 soybean meal and sold 4,000 soybean oil contracts.

-

China

is back from holiday and futures fell hard led by palm oil and meal. China

hog futures hit a new low. China

crush margins declined from last week and are negative for the spot position. It’s been a while since we heard of China buying a good amount of soybeans from SA or the US.

-

Germany’s

association of farm cooperatives estimated the 2021 winter rapeseed crop up 4.6% from last summer’s crop to 3.67 million tons and compares to their previous estimate of 3.62 million tons. - AmSpec:

Malaysian palm June 1-15 shipments down 6.2% to 652,700 tons. ITS 3.8 decline to 658,900.

-

Yesterday’s

USDA soybean export inspections of 128,092 tons were below expectations and a marketing year low.

-

US

soy crop is at 62% G/E, down 5 points, 3 lower than expected. 94% of the crop is planted, one point below expectations.

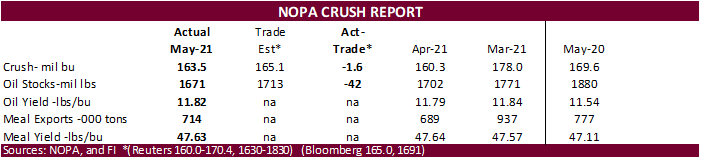

The

lower than expected US May soybean crush and end of May soybean oil stocks is viewed supportive for SBO, in our opinion. Crush margins were mostly higher at the time this was written.

US

soybean meal exports at 714,000 short tons was neutral and slightly supportive for that contract. Generally, you see a lower May soybean oil yield. For May it was reported at 11.82 pounds per bushel, up from 11.79 previous month, a small offset from the

higher than expected implied soybean oil demand. Note the SBO yield for the month of May was second largest since at least 2006, below the record of 11.92 of May 2013. The meal yield was 47.63 versus 47.64 last month.

US

crushers used 5.27 million bushels per day of soybeans, below 5.34 million during the month of April, and lowest monthly rate so far this season. The 163.5 million bushels crush was 1.6 million bushels below a Reuters trade guess, and well below 169.6 million

a year ago. Soybean oil stocks of 1.671 billion are 42 million below the 1.713 billion pound Reuters trade average (Bloomberg was @ 1.691 billion), and below 1.880 billion at the end of May 2020 (210 million less), and lowest stock figure since November 2020.

Look

for USDA to leave its US crush estimate unchanged next month and possible take SBO down 25-50 million pounds if they decide to again upward revise domestic demand.

Renewable

Fuel Annual Standards – EPA Annual Volume Standards

We

are under the opinion proposed and final (set later this year) will be mostly unchanged for diesel and conventual.

https://www.epa.gov/renewable-fuel-standard-program/renewable-fuel-annual-standards

- There

is talk of US soybean meal business being done today. - USDA’s

CCC program seeks 25,000 tons of soybean meal for Bangladesh and 8,000 tons for Cambodia on June 17 for July 15-25 shipment.

- Today

USDA was in for 1,180 tons of packaged vegetable oil for export donation for July 16-Aug 15 shipment.

Updated

6/15/21

July

soybeans are seen in a $14.10-$15.50;

November $12.75-$15.00

Soybean

meal – July $360-$400; December $380-$460

Soybean

oil – July 62.50-68.00;

December 57-70 cent range

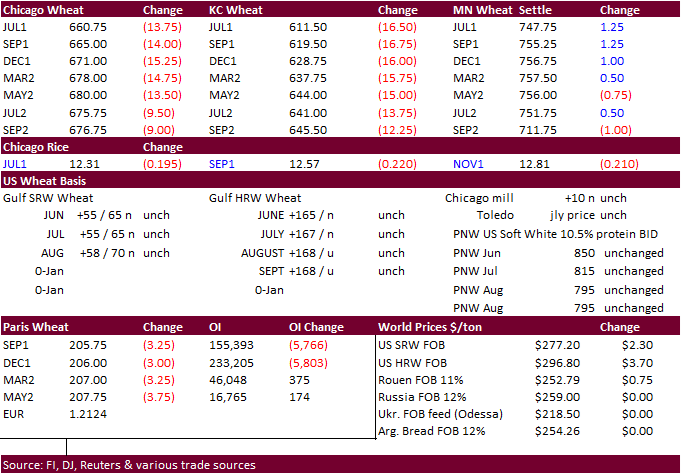

- US

KC and Chicago wheat futures ended lower on forecasts for improving US and Canadian weather. MN wheat ended mostly higher on spreading. Egypt was in for wheat and lowest offer was $250.88 a ton for 60,000 tons of Russian wheat, but they cancelled their import

tender. Reuters noted high freight rates may have been the reason for the cancellation. Baltic Dry index is at its highest in a month.

- Some

noted the negative undertone for KC wheat today was related to concerns over a low-quality crop leading to soft export demand, but we have seen in years past that hot temperatures can boost protein levels for wheat. - Funds

on Tuesday sold an estimated net 8,000 SRW wheat contracts. - September

Paris wheat closed 1.5% lower or 3.25 euros at 205.75 euros a ton on favorable EU weather. -

Germany’s

association of farm cooperatives said the 2021 wheat crop is expected to increase by 3.8% on the year to 22.98 million tons. 22.66 million tons was their previous estimate.

- US

winter wheat conditions were at 48% G/E, 2 points below the previous week and 2 lower than expected. The winter wheat harvest is getting off to a slow start as only 4% of the crop is harvested, less than the 10% harvested which was expected. This was 6 points

below a average trade guess. US spring wheat conditions fell by 1 point to 37% G/E, 1 point better than expected.

- *Egypt

cancelled their import tender for wheat on high freight costs, according to Reuters citing traders. Lowest offer was $250.88 a ton for 60,000 tons of Russian wheat. There were at least 19 offers.

- *Jordan

passed on 20,000 tons of wheat bran on June 15 for July/August shipment.

- *South

Korea’s MFG bought 65,000 tons of feed wheat and $304.25/ton c&f for October and November arrival.

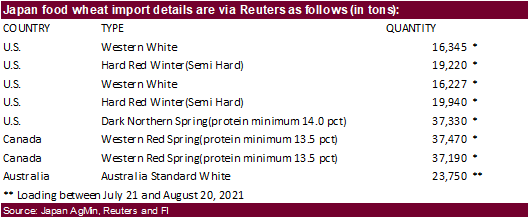

- *Japan

seeks 207,472 tons of food wheat.

- *The

Philippines seeks 205,000 tons of milling wheat for Aug/Sep shipment. - Japan

seeks 80,000 tons of feed wheat and 100,000 tons of barley on June 16 under its SBS import system, for arrival in Japan by November 25.

- Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

·

None reported

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.