PDF Attached

FOMC

Raises Benchmark Interest Rate By 75Bps; Target Range Stands At 1.50% – 1.75%

–

Interest Rate On Reserves Balances Raised To 1.65% From 0.90%

That

is the largest rate hike since 1994.

US

Rate Futures Price In 93.4% Chance Of 75 Bps Hike In July; 55% Probability Of 50 Bps Rise In September After Fed

The

USD was sharply lower in late afternoon trading, WTI lower and US equities higher. Most agriculture markets saw selling. Nearby corn and meal were higher. Some light showers are expected for the (Midwest) southeastern areas and southern regions, lasting through

Friday. Most of the rest of the Midwest will be dry through the end of the week. The two-week outlook calls for around 65 percent of normal precipitation for the US Midwest.

Private

exporters reported the cancellation of sales of 100,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

![]()

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

weather will continue to be closely monitored, but no serious crop moisture stress is expected in this first week of the outlook, despite excessive heat at times and declining topsoil moisture - Heat

stress will occur, but soil moisture is sufficient to limit the impact on crops - Replenishing

rain must occur later this month and in July to prevent greater stress from evolving and that may not occur uniformly - A

close watch on the rain distribution and temperatures later this month and into July will be warranted following this period of net drying and excessive heat - Some

showers in Iowa and southeastern Nebraska overnight were welcome and helped briefly improve topsoil moisture in a few areas, but much of the precipitation was light - With

more heat and dryness coming up later this week and into early next week the moisture will help add a little cushion of time before more serious moisture stress evolves

- Some

forecast model runs have suggested erratic rainfall may return to these areas and the upper Midwest next week as the high pressure ridge breaks down - No

general soaking of rain is expected, though, and that will leave need for a very close watch on future precipitation and temperatures since pockets of low soil moisture are sure to evolve – not only in the western Corn Belt, but in some eastern areas as well - Moisture

shortages will be in the topsoil only. Subsoil moisture is expected to remain favorable – at least for now - Texas

cotton, corn and sorghum areas will not get enough rain to counter evaporation and net drying is expected over much of the next two weeks - This

includes West Texas where dryland crops are not likely to survive very long without a generalized rain of significance - Scattered

showers in the U.S. southeastern states will help slow the region’s drying trend over the coming week, but a net decline in soil moisture is expected in many areas

- Some

increase in rainfall “may” evolve in the June 23-29 period - U.S.

Delta will experience net drying during the coming week to ten days, despite some isolated to showers and thunderstorms - Temperatures

will be warm enough to keep evaporation rates high - U.S.

northern Plains weather is expected to be favorably mixed for fieldwork and crop development during the next two weeks

- Temperatures

will become hot briefly this weekend with extreme highs in the 90s to over 100 degrees Fahrenheit - That

will contrast with highs in the 60s and 70s in parts of North Dakota today and Thursday

- U.S.

far western states will experience net drying during much of the next ten days, although some rain will fall in the Cascade Mountains and along the Washington and Oregon coast as well as the far northern Rocky Mountains - Early

season monsoonal precipitation is expected to begin this weekend and continue next week from the southwestern desert region into the central Rocky Mountains - Livestock

and crop stress is expected through early next week as waves of excessive heat continue to impact the U.S. Plains, Midwest, Delta and southeastern states - Some

cooling will occur briefly in the central and southern Plains today and early Thursday before temperatures heat back up again Friday through early next week

- Central

Plains high temperatures will sip to the upper 80s and 90s during the “coolest” days and then rise to the range of 100 to 110 this weekend and early next week - U.S.

Midwest, Delta and southeastern states will see highs in the 90s to near 100 degrees Fahrenheit today and then cooling is expected from northwest to southeast Thursday and Friday

- Some

of the cooling will begin in the upper Midwest today - More

heat is possible this weekend into next week, but the hottest conditions should stay in the western Corn and Soybean crop areas - Net

drying is expected in the central and southern parts of the Great Plains, the lower Midwest and Delta during the next ten days - Showers

and thunderstorms will occur periodically in the northern Plains and northern Midwest (especially next week) helping to keep crops in relatively good condition

- A

short term bout of excessive heat is expected in the northern U.S. Plains and southeastern Canada’s Prairies along with the upper U.S. Midwest this weekend into early next week with highs in the 90s to 105 degrees Fahrenheit - Most

of the heat in southeastern Canada’s Prairies will be limited to 90-degree highs and it will only last a day or two - The

heat will be welcome after abundant rainfall - U.S.

weather in weeks 3, 4 and 5 according the GFS, ECMWF and CFS models should result in a mean ridge position in the Plains with a bias in the high Plains most favored resulting in a weak west to northwesterly flow pattern aloft across the Midwest - This

pattern would keep the Plains and a part of the western Corn Belt warmest relative to normal and generate waves of showers and thunderstorms from the northern Plains into the northern and eastern Midwest

- Temperatures

would be closest to normal in the eastern Midwest - Areas

from Nebraska to Texas and the southwestern Corn Belt would get the least amount of rain, although not necessarily totally dry - Be

careful using these longer range forecast tools…..they use persistence and climatology and are no usually very good dealing with anomalous trends - The

bottom line for the U.S. is still a little tenuous with net drying this first week to ten days of the outlook in the lower Midwest, central and southern Plains and Delta and a favorable mix of weather in the northern Plains and southeastern states.

- The

month of June may finish out with brief periods of rain in the Midwest and northern Plains and warmer than usual temperatures while temperatures are warmest relative to normal in the Inter-Mountain West, the central and southern Plains and a part of the Delta.

Timely rain may prevent key Corn and Soybean production areas from becoming too dry, but areas of short to very short topsoil moisture will show up toward the end of next week. Crop stress should be expected, although favorable subsoil moisture and some timely,

but erratic, rain events should keep the crops performing favorably. Any persistence of hot, dry weather beyond next week would present a greater threat to crops.

- Rain

potentials in weeks 3, 4 and 5 along with more seasonable temperatures may limit crop stress in parts of the northern Plains and northern and eastern Midwest. West Texas cotton areas will be driest and warmest throughout the forecast period.

- Confidence

in these weeks 3, 4 and 5 outlooks is not high - Rain

fell beneficially in northern and eastern Saskatchewan, Manitoba and parts of Alberta again Monday - The

heart of Saskatchewan was not impacted nor was far western Alberta - Relief

has occurred in some of the drought stricken areas of the Prairies this week and more rain will fall today and early Thursday in a part of the region - Ontario

and Quebec, Canada will experience a favorable mix of weather during the coming ten days to two weeks.

- Crop

development should advance favorably - Fieldwork

will only be briefly disrupted by rain - Western

and central Europe will experience net drying conditions through the weekend - Showers

and thunderstorms will slowly increase next week - The

resulting moisture will be extremely important for winter, spring and summer crops after previous days of drying

- Some

of the advertised rainfall may be overdone and it should be closely monitored especially in France, the U.K. and Germany - Temperatures

will be warm during both weeks of the two-week outlook - Net

drying is expected in many interior parts of Russia’s Southern region, parts of south-central and southeastern Ukraine and western Kazakhstan during the next ten days, although totally dry weather is unlikely - Greater

rain will be needed later in the month of June and July to improve soil and crop conditions - Far

southern Russia and Georgia will experience frequent rain later this week into early next week resulting in a notable boost in soil moisture favoring long term crop development - Western

and northern parts of the Commonwealth of Independent States will experience frequent rainfall over the next ten days maintaining moisture abundance in the soil and good crop development potential - Rain

northern Kazakhstan will be great for spring wheat and some sunseed crops - South

Korea rice areas continue critically dry and are in need of rain - Far

southern China will continue to receive too much rain for another week resulting in more flooding and more concern over rice, sugarcane and some minor corn, soybean and groundnut production areas

- The

heaviest rain should be about over; however - Drying

is badly needed and some may occur next week - Northeast

China will continue to see rain routinely which may challenge summer crop planting since much of the region is already wet - Drying

will be most needed in Liaoning and Jilin where the ground is already a little too wet - China’s

Xinjiang province continues to experience relatively good weather, although warm conditions are expected early to mid-week this week before some welcome cooling occurs in the second half of this week and into the weekend - China’s

North China Plain will see limited rainfall for the coming week and then may get some scattered showers offering limited relief in the June 23-29 period - India’s

monsoonal rainfall will continue to perform poorly through Friday before some increase in rainfall is expected this weekend into next week

- The

greater rainfall next week and in the following week should slowly bring on improved planting and establishment conditions for many summer crops - Greater

rainfall may still be needed - Southern

Australia will receive waves of rain over the next ten days maintaining a very good outlook for wheat, barley and canola - Western

Argentina will remain mostly dry through next week raising concern over winter crop planting and establishment - A

few showers may occur briefly in the second half of the week, but much more will be needed - Most

of next week’s rain will be greatest in Buenos Aires where improved topsoil moisture is expected - At

least some rain is needed in all wheat areas in the nation, although subsoil moisture is still rated well in the east and more rain is expected there in the second half of next week - Southern

Brazil will see more rain this weekend into next week - Improved

Safrinha corn maturation conditions will result and winter wheat improvements are likely while dry weather is present over the next few days - Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast - Mexico’s

monsoonal rainfall is expected to start a little sporadically leaving parts of the nation quite dry, but a slow increase in precipitation will eventually take place - Interior

western areas will be wettest over the coming week along with southwestern coastal areas and a few lower eastern coastal areas - A

tropical disturbance may bring heavy rain to the Yucatan Peninsula this weekend before reaching the lower east coast of Mexico early next week - Remnants

of the storm could bring some welcome rain to coffee, citrus and sugarcane areas of southern Mexico next week - Another

tropical cyclone may evolve off the lower western Mexico coast during mid-week this week producing heavy rain in southwestern Mexico - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar - Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - South

Africa’s restricted rainfall in the east over the coming week will be good for summer crop harvest progress and some late winter crop planting - Rain

in western parts of the nation will be good for wheat, barley and canola emergence and establishment - Central

America rainfall will be abundant during the next ten days with excessive rainfall possible along the Pacific Coast

- A

tropical cyclone may form near the Nicaragua and Costa Rica coast during mid-week this week bringing significant rain to northeastern Nicaragua and eventually to eastern Honduras, Belize and then Yucatan Peninsula later this week - Some

very heavy rain will fall in coastal areas. - Today’s

Southern Oscillation Index was +14.87 and it will move erratically over the coming week - New

Zealand rainfall will diminish to infrequent showers over the coming week; recent rain was welcome and beneficial.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

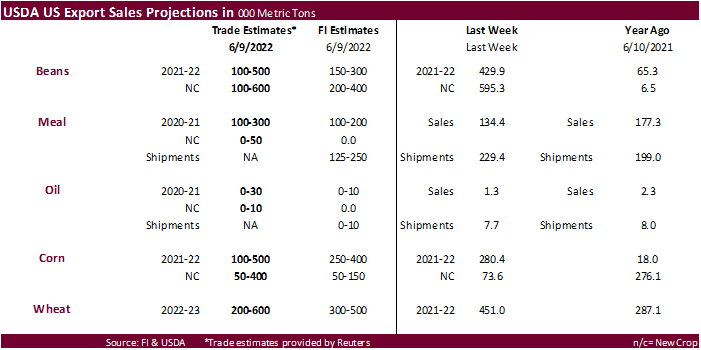

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Brazil, South Africa

Friday,

June 17:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

June 18:

- China’s

second batch of May trade data, including corn, pork and wheat imports

Source:

Bloomberg and FI

IHS

Markit US 2022 planting update via

Reuters

-

Corn

plantings 90.965 million acres, up 455,000 acres from its previous forecast and up from 89.490 million March USDA -

Soybean

plantings 88.735 million acres, down 280,000 acres from its previous forecast and below 90.955 million March USDA -

Spring

wheat plantings 10.490 million acres, up 340,000 from its previous forecast and below 11.200 million acres March USDA -

Durum

wheat 1.715 million acres, below 1.915 million March USDA -

All-cotton

plantings 12.126 million acres, below 12.234 million March USDA

Macros

FOMC

Raises Benchmark Interest Rate By 75Bps; Target Range Stands At 1.50% – 1.75%

–

Interest Rate On Reserves Balances Raised To 1.65% From 0.90%

Fed’s

Median View Of Fed Funds Rate At End-2022 3.4% Vs 1.9% In March Projection

–

Interest Rate On Reserves Balances Raised To 1.65% From 0.90%

–

Fed’s Median View Of Fed Funds Rate At End-2023 3.8% (Prev 2.8%)

–

Fed’s Median View Of Fed Funds Rate At End-2024 3.4% (Prev 2.8%)

–

Fed’s Median View Of Fed Funds Rate In Longer Run 2.5% (Prev 2.4%)

–

Fed Sees Year-End U.S. Jobless Rate At 3.7% In 2022 (Prev 3.5%), 3.9% In 2023, 4.1% In 2024; Median Long-Run Forecast At 4.0% (Prev 4.0%)

–

Fed Sees PCE Inflation At 5.2% In 2022 (Prev 4.3%), 2.6% In 2023, 2.2% In 2024; Median Long-Run Forecast At 2.0% (Prev 2.0%)

–

Fed Sees GDP Growth At 1.7% In 2022 (Prev 2.8%), 1.7% In 2023, 1.9% In 2024; Median Long-Run Forecast At 1.8% (Prev 1.8%)

–

Fed Policymakers’ Projections Show They Expect To Start Cutting Rates In 2024

–

Kansas City Fed’s George Dissents In Favour Of 50 Bps Rate Hike

US

Rate Futures Price In 93.4% Chance Of 75 Bps Hike In July; 55% Probability Of 50 Bps Rise In September After Fed

96

Counterparties Take $2.163 Tln At Fed Reverse Repo Op (prev $2.224 Tln, 97 Bids)

US

MBA Mortgage Applications Jun 10: 6.6% (prev -6.5%)

US

MBA 30-Year Mortgage Rate Jun 10: 5.56% (prev 5.40%)

Bloomberg)

— Russia’s currency trades near highest level against the dollar since March 2018.

US

Retail Sales Advance (M/M) May: -0.3% (est 0.1%; prev 0.9%)

US

Retail Sales Ex Auto (M/M) May: 0.5% (est 0.7%; prev 0.6%)

US

Retail Sales Ex Auto And Gas May: 0.1% (est 0.4%; prev 1.0%)

US

Retail Sales Control Group May: 0.0% (est 0.3%; prev 1.0%)

US

Import Price Index (M/M) May: 0.6% (est 1.1%; prev 0.0%)

US

Import Price Index Ex Petroleum (M/M) May: -0.1% (est 0.6%; prev 0.4%)

US

Import Price Index (Y/Y) May: 11.7% (est 11.9%; prev 12.0%)

US

Export Price Index (M/M) May: 2.8% (est 1.3%; prev 0.6%)

US

Export Price Index (Y/Y) May: 18.9% (prev 18.0%)

US

Empire Manufacturing Jun: -1.2 (est 2.3; prev -11.6)

June

Housing Market Index At Lowest Since June 2020 – NAHB

–

Index Of Prospective Buyers Below Break-Even 50 Level For First Time Since June 2020

·

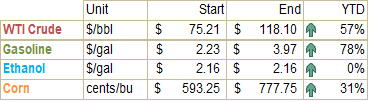

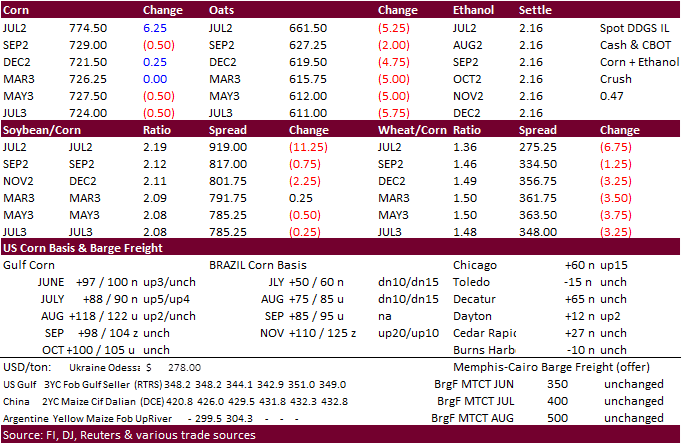

US corn futures ended mixed with July gaining 5.75 cents, September lower by 0.5 cent, and December off 0.25 cent. The USD was sharply lower and WTI crude oil sold off. Funds were net even in corn.

·

The weekly ethanol report was seen as slightly supportive for US corn futures.

·

The US heat is good for established corn but at the same time stressing recently emerged plants.

·

US producer selling has slowed, and this has firmed basis for corn and soybean meal basis over the last week.

·

Traders are watching to see if Ukraine corn shipments will soon increase out of the Baltic Sea, a new route previously announced earlier this week.

·

Ukraine grain exports so far for the month of June reached 613,000 tons.

·

China’s Ministry of Agriculture and Rural Affairs reported the May sow herd fell 0.2% from the previous month to 41.77 million heads, 4.3% lower than a year ago. China slaughtered 97.45 million pigs at large slaughterhouses in

the first four months of the year, up 45.7% from the previous year.

·

The weekly USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed up one percent. Cumulative placements from the week ending January 8, 2022 through June 11, 2022 for the United States were 4.30 billion.

Cumulative placements were down slightly from the same period a year earlier.

·

The monthly Turkey Hatchery report showed eggs in incubators on June 1 up slightly from last year, poults hatched during May up 8 percent and net poults placed up 9 percent.

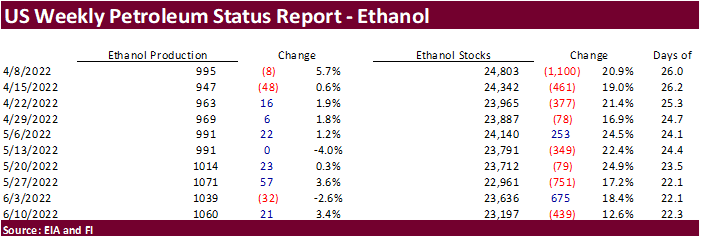

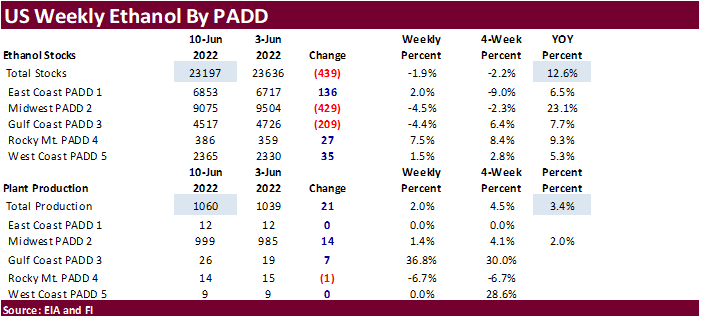

Weekly

US ethanol increased 21,000 barrels to 1.060 million barrels and stocks fell 439,000 barrels to 23.197 million barrels.

A

Bloomberg poll called for weekly US ethanol production to be up 4,000 barrels from the previous week and stocks up 142,000 barrels. September 2021 to date ethanol production rebounded 7.9 percent from the same period year earlier.

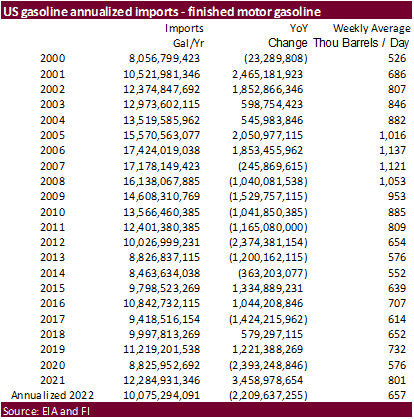

Days

of inventory were 22.3 days, up from 22.1 previous week and compares to 24.4 days month ago and 19.5 year ago. Gasoline stocks declined for the eleventh consecutive week to 217.47 million barrels, down 710,000 from the week ending June 3, and lowest since

late November 2021. Gasoline supplied to market dropped 106,000 barrels to 9.093 million barrels and compares to around 9.3 million around this time year ago. US gasoline demand, on a 4-week rolling basis, steadily declined over the last ten weeks. Ethanol

blended to gasoline ran at 89.7% for the week ending June 10, down from 91.2% previous week.

US

DoE Crude Oil Inventories (W/W) 10-Jun: +1956K (est -2200K; prev -2025K)

–

Distillate: +725K (est -500K; prev +2592K)

–

Cushing: -826K (prev -1593K)

–

Gasoline: -710K (est +500K; prev -812K)

–

Refinery Utilization: -0.5% (est 0.3%; prev 1.6%)

Export

developments.

·

China seeks to buy 40,000 tons of frozen pork for reserves on June 17.

June

corn acreage

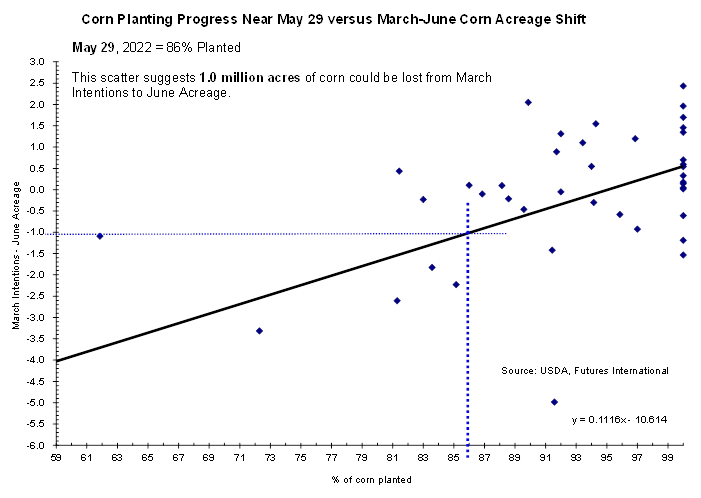

US

corn plantings lagged during the month of May and 86 percent of the crop was planted as of May 29, suggesting the US corn crop planted area could fall 1 million acres from March to June. But as of June 12th, US corn plantings caught up to 97 percent,

at its respective 5-year average. We think US corn acres could expand 750,000 acres when updated at the end of the month. Below is a graph of what could have happened if US corn plantings failed to get into the ground during first half June.

Updated

6/14/22

July

corn is seen in a $7.00 and $8.25 range

December

corn is seen in a wide $5.75-$8.25 range