PDF Attached

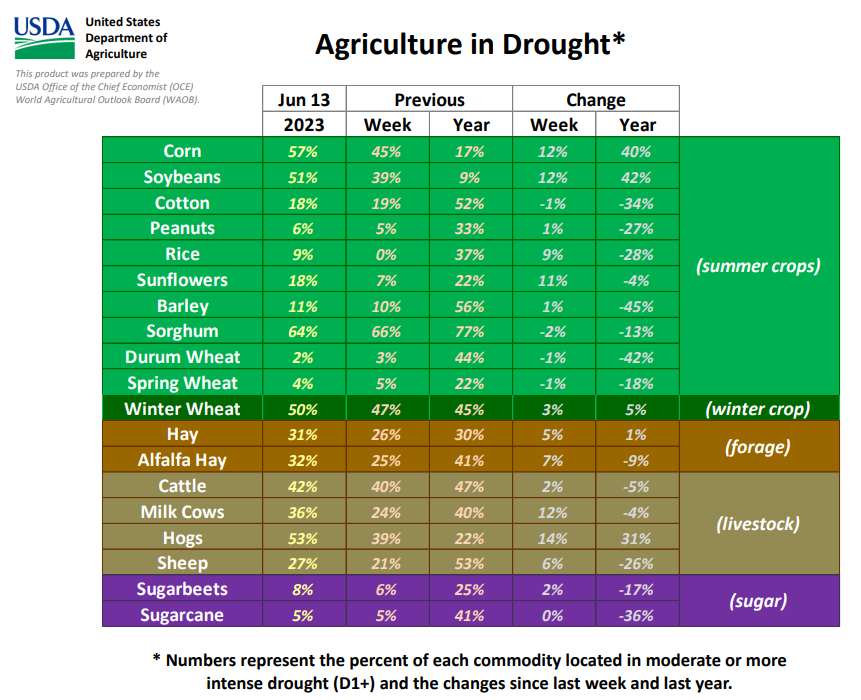

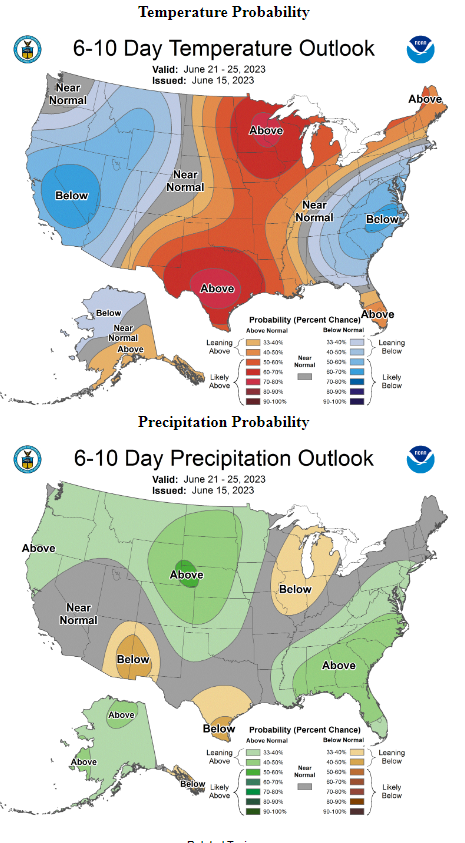

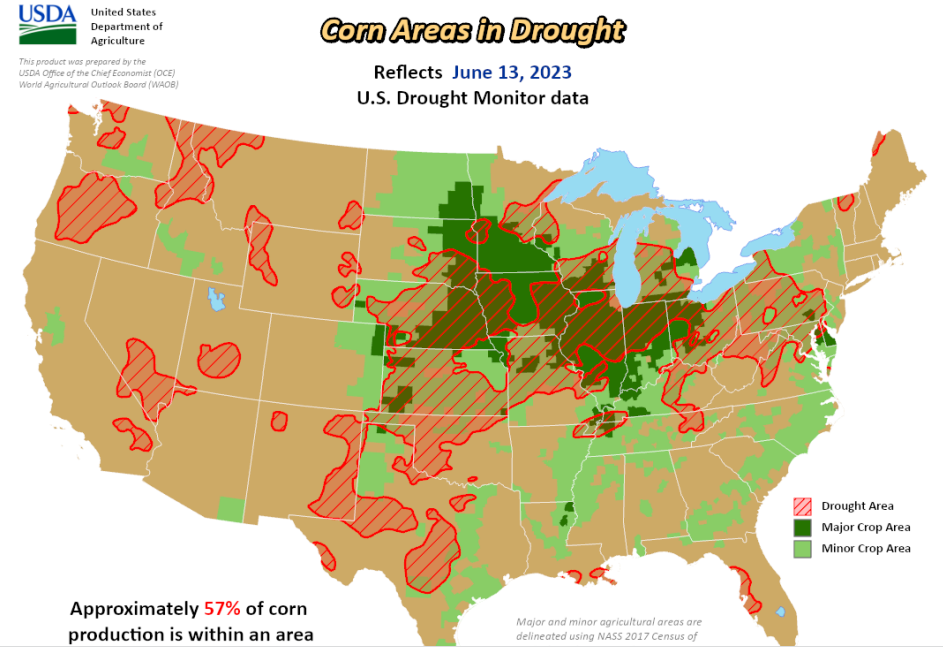

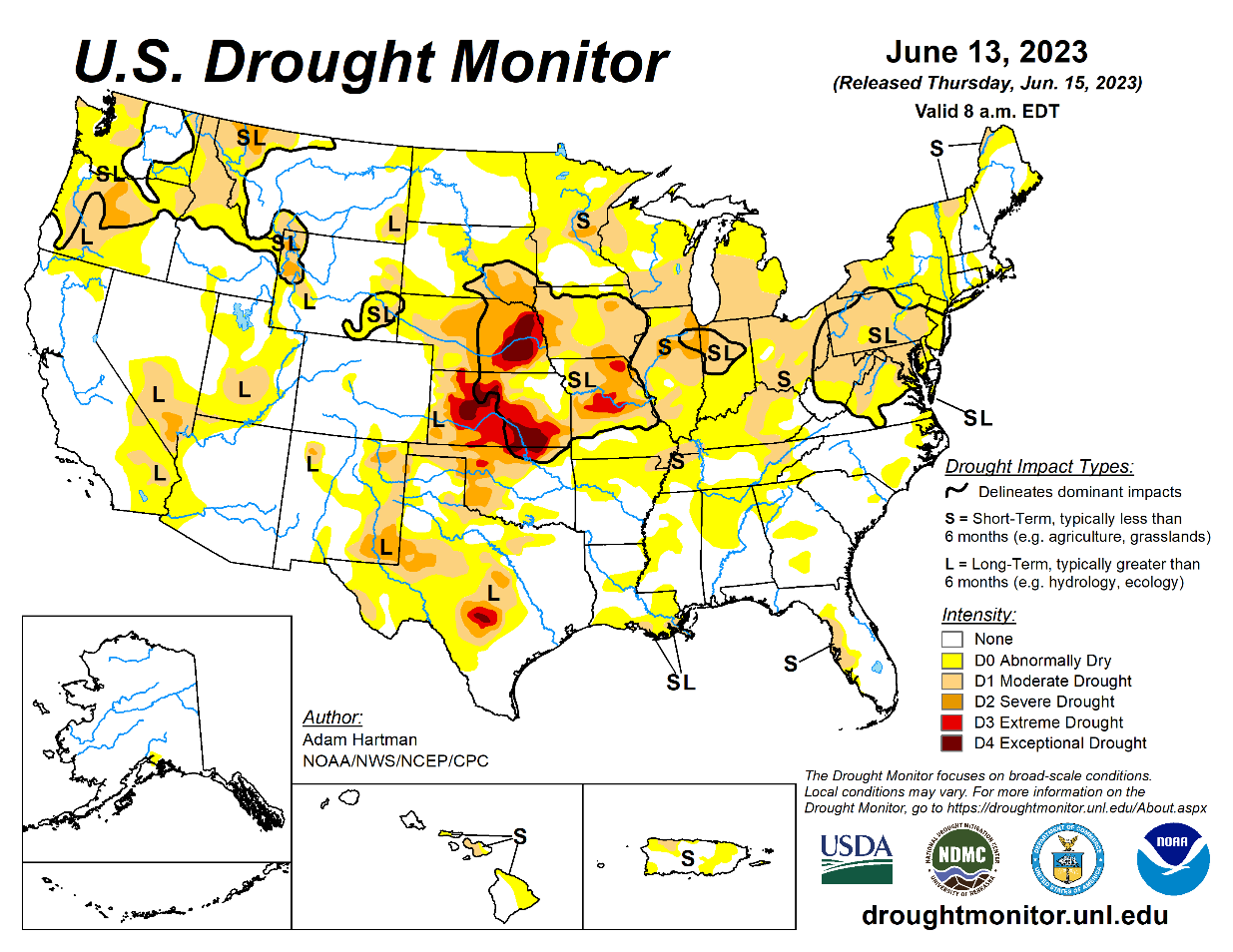

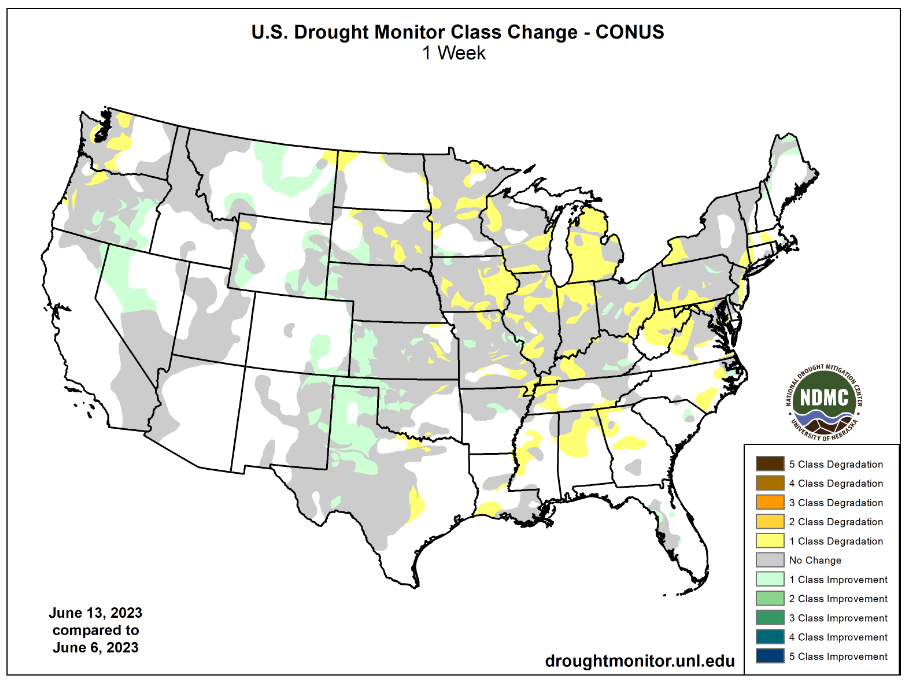

USD was down 79.6 points and WTI higher by $2.35/bbl. NOPA’s May crush for 95 percent of US processors was larger than expected, but they added a new member for the IA region. US soybean oil stocks came in well below expectations and that supported SBO futures. Soybeans, meal and grains also rallied on NA supply concerns. A drier US forecast supported prices today. The US CPC has a grim outlook for summer North American weather (see weather headlines). After the release of the US weekly drought monitor, several comments/tweets are flying around, including one that stated Illinois alone during the April 1-June 10th period is driest on record since 1988, second driest since data going back to 1951. Class one degradation was most notable for MI, IL, IA, and parts of WI & MN.

Fund estimates as of June 14 (net in 000)

![]()

Reuters headlines on CPC El Niño update:

U.S. weather forecaster CPC: El Niño conditions are present and equatorial sea surface temperatures are above average across central and eastern equatorial pacific ocean

U.S. CPC: El Niño is expected to strengthen and persist through the winter 2023-24

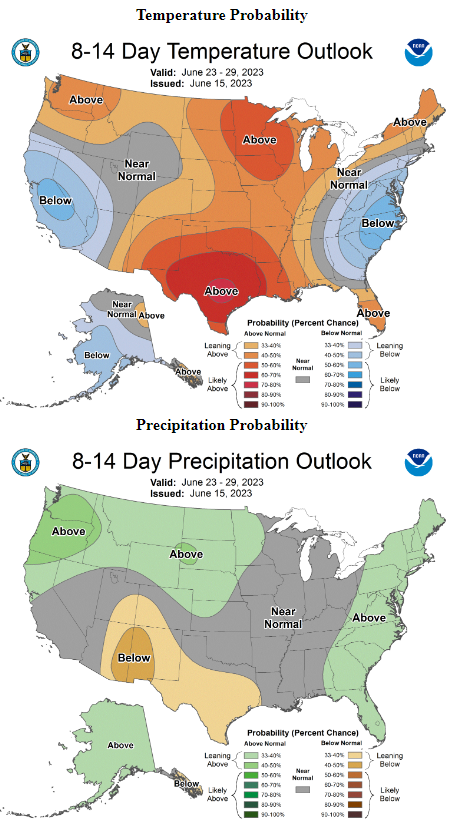

U.S. CPC: July-August-September 2023 temperature outlook favors above-normal seasonal mean temperatures across a majority of the U.S.

U.S. CPC: July-August-September precipitation outlook depicts elevated probabilities of below-normal precipitation for parts of southwest, pacific northwest, great lakes

U.S. CPC: July-August-September above-normal precipitation is favored across much of great plains, parts of middle to lower Mississippi valley, Northern Rockies, Florida peninsula

U.S. CPC: highest probabilities (more than 50 %) of above-normal temperatures are forecast across parts of California, pacific northwest, great basin, southwest, gulf coast, and east

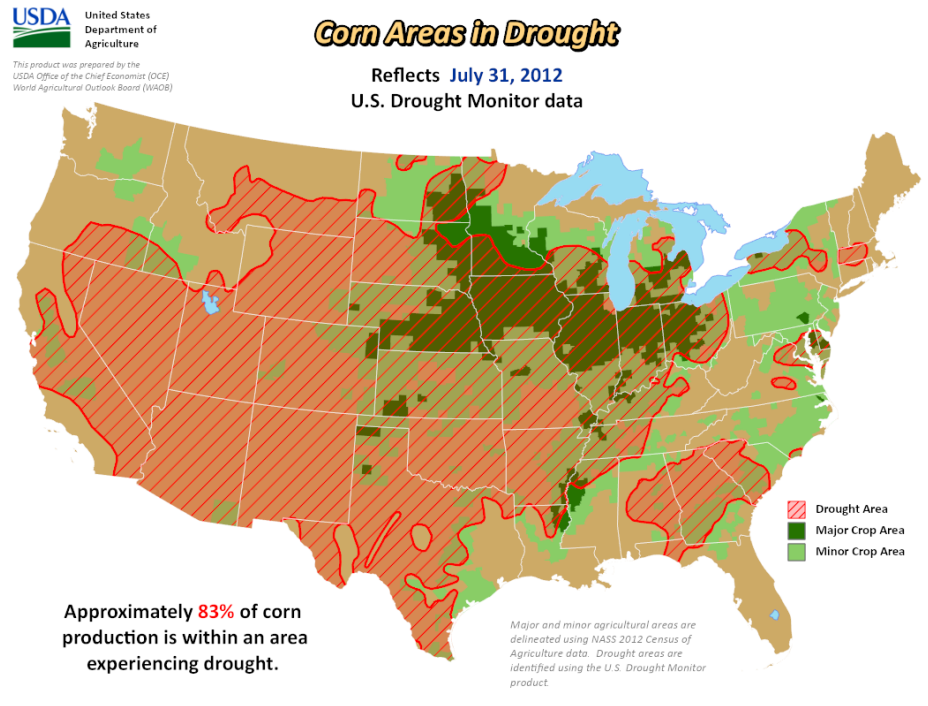

Initial (very first USDA Ag IN Drought publication) report by USDA for drought (July 31, 2012) – Below

For June 2012 comparison, visit this link https://downloads.usda.library.cornell.edu/usda-esmis/files/cj82k728n/rj4304774/4x51hj308/weather_weekly-06-20-2012.pdf

WORLD WEATHER HIGHLIGHTS FOR JUNE 15, 2023

- No major changes overnight

- Tropical Cyclone Biparjoy will reach the northwest coast of Gujarat, India this evening and will bring with it some torrential rain, a storm surge and some windy conditions

- Remnants of the storm will move through Rajasthan Friday into the weekend with some rain reaching as far east as Uttar Pradesh; most of the moisture from the storm will be welcome, despite some flooding

- U.S. Midwest dryness will continue from eastern Minnesota, eastern Iowa and northeastern Missouri to western Wisconsin and parts of Illinois over the coming week to nearly 10 days

- Canada’s Prairies are still expecting some increase in shower and thunderstorm activity over the next ten days, but some of the rain will continue erratic and light leaving a greater need for more rain

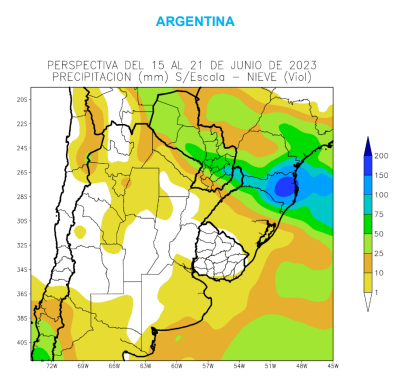

- Argentina rainfall will continue well below normal leaving western wheat areas too dry

- Northern Europe rainfall will continue restricted in this first week of the outlook especially from northeastern France through Germany, but the following week should trend wetter

- Russia’s eastern New Lands are only expecting partial relief to dryness over the next two weeks, although there will be no excessive heat for a while

- There is some potential for frost and light freezes in Russia’s northeastern New Lands this weekend and next week

- India’s monsoonal rainfall will continue minimal in this first week of the outlook, but conditions may begin to improve after June 22; rain will be most significant in association with Tropical Cyclone Biparjoy in the north through the weekend

- Australia’s rainfall will be greatest near the southern coast over the next ten days

- Northern China (north of the Yellow River) will be driest over the next ten days leaving very good crop weather for the remainder of nation

- Thailand and Vietnam rainfall will continue lighter than usual, but timely; water supply remains well below normal with little change likely

Source: World Weather, INC.

Thursday, June 15:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, June 16:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

Sunday, June 18

- China’s 2nd batch of May trade data, including agricultural imports

Monday, June 19:

- MARS monthly report on EU crop conditions

- HOLIDAY: US, Argentina

Tuesday, June 20:

- USDA export inspections – corn, soybeans, wheat, 11am

- US corn, cotton, soybean, spring wheat and winter wheat condition, 4pm

- China’s 3rd batch of May trade data, including country breakdowns for commodities

- US planting data for cotton, spring wheat and soybeans, 4pm

- New Zealand global dairy trade auction

- EU weekly grain, oilseed import and export data

- HOLIDAY: Argentina

Wednesday, June 21:

- Grain and Oilseeds MENA conference in Cairo, day 1

- SIIA Haze Outlook 2023 in Singapore

- USDA Total Milk Production

Thursday, June 22:

- Port of Rouen data on French grain exports

- EIA weekly US ethanol inventories, production, 10:30am

- Grain and Oilseeds MENA conference in Cairo, day 2

- Brazil Unica cane crush, sugar production (tentative)

- USDA Red Meat Production, 3pm

- HOLIDAY: China, Hong Kong

Friday, June 23:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

- US Cattle on Feed, 3pm

- US cold storage data for beef, pork and poultry

- HOLIDAY: China

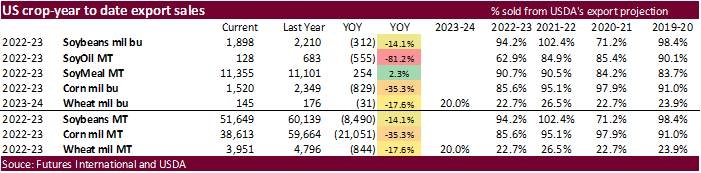

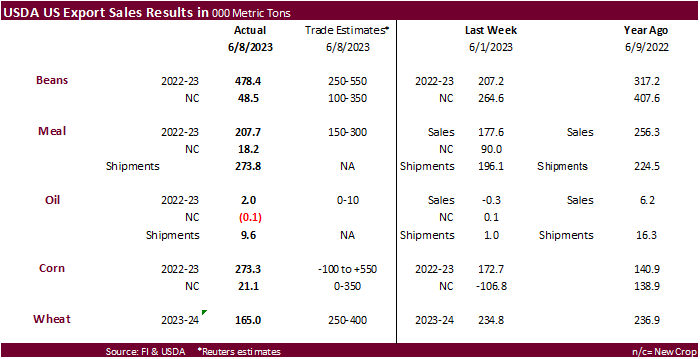

USDA export sales

USDA export sales were near the upper end of expectations for soybeans for old crop and below expectations for new crop. Old crop soybean sales included 218,700 tons for Spain. Soybean meal and soybean oil sales were withing a range of expectations. Soybean meal and oil shipments were good. Corn export sales were a positive 273,300 tons for old crop, up from 172,700 tons previous week and all-wheat sales were a low 165,000 tons. For corn, Japan and Mexico were the largest takers. Sorghum sales were 114,200 tons, with most for China. Pork sales were 26,700 tons with Mexico taking 10,700 tons.

US Initial Jobless Claims Jun 10: 262K (est 245K; prev 261K)

US Continuing Claims Jun 3: 1775K (est 1768K; prev 1757K)

US Retail Sales Advance (M/M) May: 0.3% (est -0.2%; prev 0.4%)

US Retail Sales Ex Auto (M/M) May: 0.1% (est 0.1%; prev 0.4%)

US Retail Sales Ex Auto And Gas May: 0.4% (est 0.2%; prev 0.6%)

US Import Price Index (M/M) May: -0.6% (est -0.5%; prev 0.4%)

US Import Price Index Ex Petroleum (M/M) May: -0.2% (est -0.1%; prev -0.1%)

US Import Price Index (Y/Y) May: -5.9% (est -5.6%; prev -4.8%)

US Export Price Index (M/M) May: -1.9% (est -0.1%; prev 0.2%)

US Export Price Index (Y/Y) May: -10.1% (est -8.4%; prev -5.9%)

US Empire Manufacturing Jun: 6.6 (est -15.1; prev -31.8)

US Philadelphia Fed Business Outlook Jun: -13.7 (est -14.0; prev -10.4)

Canadian Manufacturing Sales (M/M) Apr: 0.3% (est -0.2%; prev 0.7%)

ECB raised rates by 25 points

US EIA Natural Gas Storage Change (BCF) 9-June: +84 (exp +94; prev +104)

Salt Dome Cavern NatGas Stocks (BCF) 9-June: +5 (prev +15)

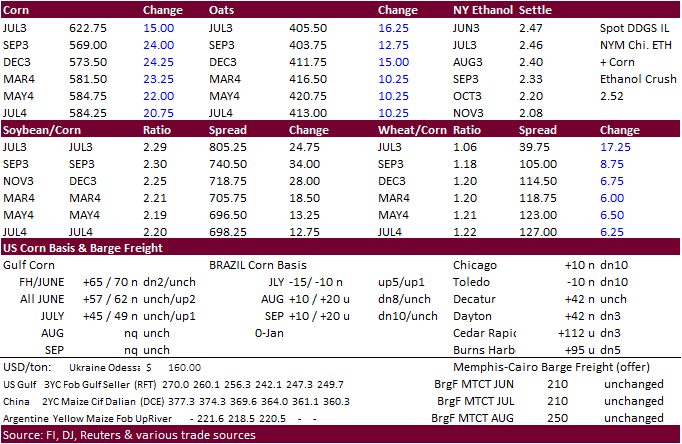

· Corn futures closed higher on bullishness as the US Corn Belt is drying out which raises concerns of yield loss and lower production.

· US drought monitor, morning weather model runs, CPC long term summer outlook for the US, and technical buying, are all attracting funds back to long positions, hence the “risk-on” trade noted today.

· July corn rose 15.5c while new-crop December rose 25.25c.

· EPA reported that the U.S. generated 1.28 billion ethanol (D6) blending credits in May compared to 1.16 billion in April.

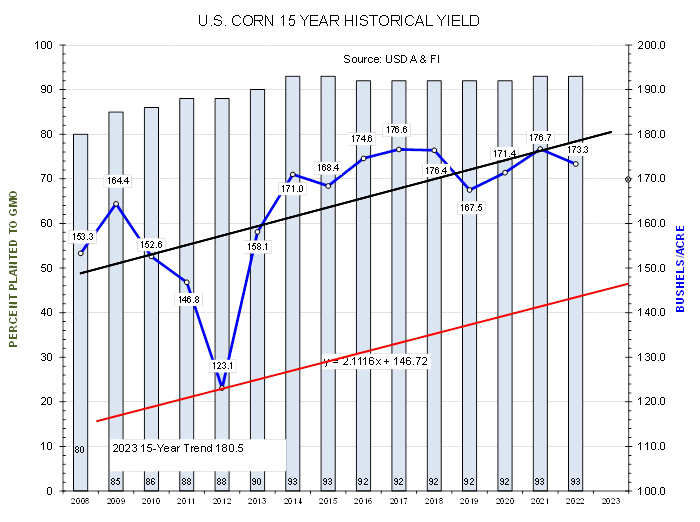

15-year trend yield for those comparing this June weather pattern to 2012:

Export developments.

- Results awaited: Iran seeks 120,000 tons of soybean meal and 120,000 tons of corn.

July corn $5.75-$6.35

September corn $4.50-$5.75

December corn $4.25-$5.75

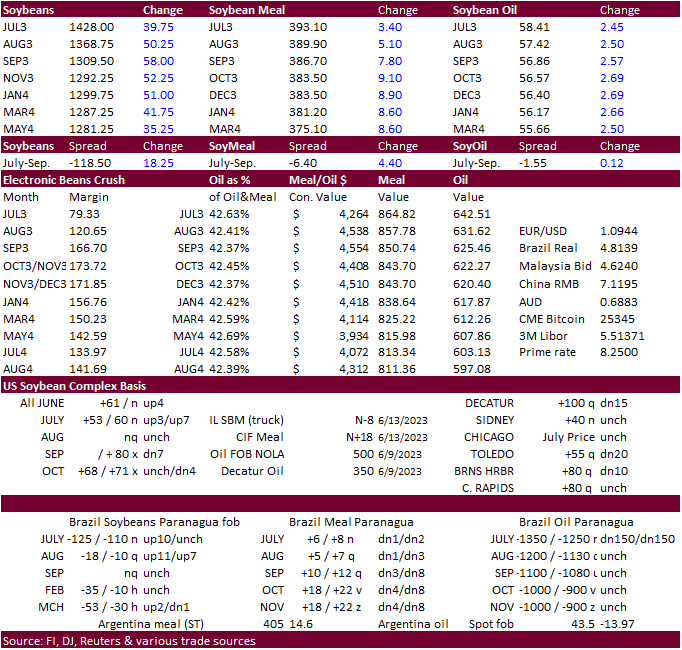

· CBOT soybeans rose for the sixth day in a row on continued buying on dry weather across the US Midwest. Meal and SBO rose sharply, helped by bullish NOPA data.

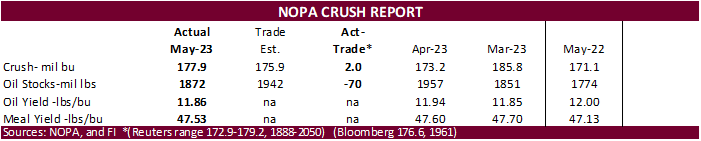

· The NOPA crush report was friendly for the soybean complex. NOPA US crush for May was a record for the month at 177.9 million bushels, 2 million above the average trade guess of 175.88 million, 4 million above April but down 0.6 percent on a daily adjusted basis from the previous month. Soybean oil stocks were 1.872 billion pounds, down 85 million from April (April was a 14-month high) and was 70 million pounds below expectations.

· Note the higher than expected crush includes a new NOPA member for the IA locations. Shell Rock Soy Processors LLC

· China plans to auction off 315,000 tons of (2020) imported soybeans on June 20.

· Argentina Rosario grains exchange: 2022-23 soybean production 20.5 MMT versus 21.5MMT previous.

· India cut their import duty on SBO and sunoil to 12.5% vs 17.5%.

· India May palm oil imports fell to a 27-month low to 439,173 tons versus 510,094 tons in April.

- Soyoil imports at 318,887 T vs 262,455 T in April. Average from November 2022 through May is 818,203 tons.

- Sunflower oil imports at 295,206 T vs 249,122 T in April

- Total vegetable oil imports 1.06 million tons, up 1 percent from April.

· Cargo surveyors released June 1-15 Malaysian palm oil export data. ITS reported 464,380 tons, a decrease of 16.6% from 557,090 previous period month earlier. AmSpec reported a 166.4% decrease to 437,101 tons. For comparison, June 1-10 had declined between 16.7% and 17.6% (Reuters).

· EPA reported that the U.S. generated 750 million biodiesel (D4) blending credits in May compared to 603 million in April.

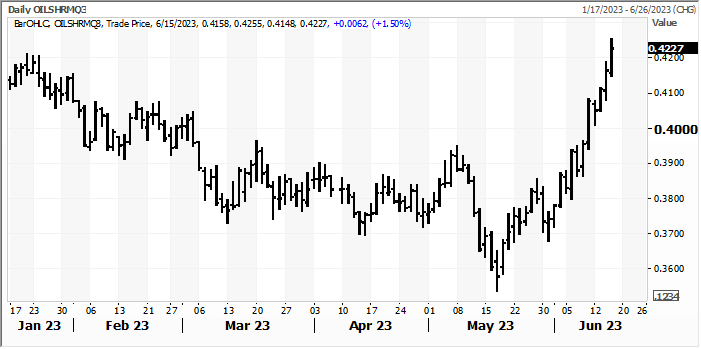

August soybean oil share as of 11:40 am CT

- Iran seeks 120,000 tons of soybean meal and 120,000 tons of corn on June 14.

- USDA seeks 6,410 tons of vegetable oils on June 15 for FH July shipment to the Dominican Republic.

Soybeans – July $13.90-$14.50, November $11.00-$14.50

Soybean meal – July $390-$445, December $290-$450

Soybean oil – July 56.00-60.00, December 52-60

· US wheat futures rose on short-covering and corn and soy bullishness. At a time of year when we would expect to see harvest pressure starting, it may be absent this season in the US with the smaller crop and continued geopolitical concerns.

· The EU will remain hot through the end of the month.

· Strategie Grains lowered its 2023-24 European Union soft wheat production estimate to 128.7 million tons from 130.0 million in May, about 3% above 2022-23. Barley was cut 2 million tons to 47.9 million tons, about 6% below last year. France and Spain have been hardest hit with heat.

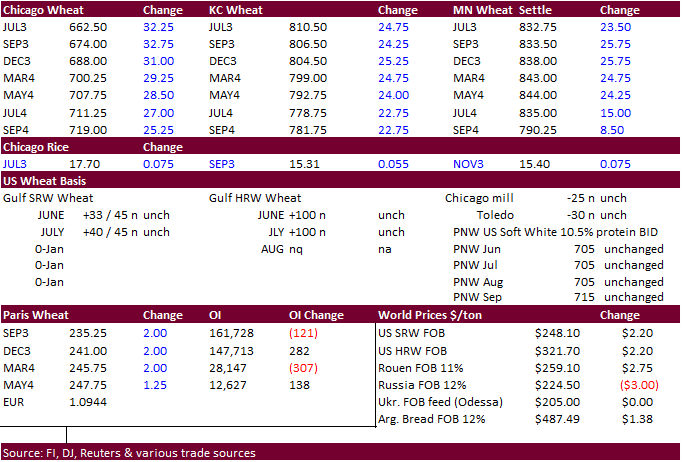

· September Paris wheat futures closed up 1.75 euros at 235.00 per ton.

· Argentina Rosario grains exchange: Planted area of wheat 5.6 million hectares.

· Argentina’s precipitation outlook will be dry for their wheat areas over the next week.

Export Developments.

· Iraq bought 400,000 tons of Australian wheat for arrival through September.

· Japan in a SBS import tender seeks 60,000 tons of feed wheat and 20,000 tons of barley on June 19 for arrival by November 30.

· Results awaited: Morocco seeks 500,000 tons of feed barley.

Rice/Other

Chicago Wheat July $6.30-$6.90, September $6.00-$7.00

KC – July $7.60-$8.50, September $7.50-$9.00

MN – July $7.80-$8.70, September $7.25-$9.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |