PDF Attached

Attached

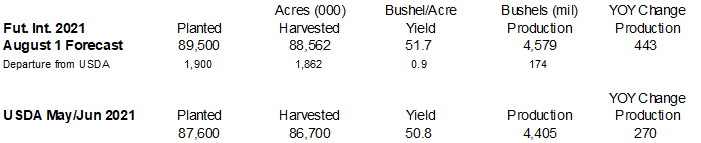

is our US soybean balance with updated 2021 yield. Today is/was a US Federal Holiday and CFTC’s Commitment of Traders will be delayed until Monday.

![]()

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Western

Russia, western Kazakhstan and far eastern Ukraine will dry down over the next ten days to possibly two weeks and temperatures will become warmer than usual

o

Soil moisture in this region is mostly rated good today except in western Kazakhstan and eastern most parts of Russia’s Southern Region where dryness is already a problem

- This

region, however, is not large enough in size (yet) to have much influence on the market place - Eastern

Russia’s New Lands and northeastern Kazakhstan spring wheat and sunseed areas will continue to get some relief from recent dry and warm weather

o

Scattered showers and cooler weather is expected and crops should respond well

o

Western parts of northern Kazakhstan and southwestern parts of the eastern New Lands of Russia will continue to experience limited rainfall and the pressure will remain on for some of the yields in this region

- Gujarat,

India received some needed rain Thursday and additional rain is coming that will improve the outlook for soybeans, groundnuts and cotton - Other

areas in western India will continue to experience limited rainfall and net drying

o

Watch grain, cotton and oilseeds in central Maharashtra as well as sugarcane from that region into Tamil Nadu and Andhra Pradesh due to expected below average rainfall and warm temperatures for a while

o

Eastern India soil and crop conditions are still rated favorably with little change likely

- East-central

China is back to a drying bias that will last at least ten days

o

Recent rain has soil moisture ideally rated which should reduce concern over the drying bias for a while

- Other

areas in China will experience a good mix of rain and sunshine through the next ten days - Australia

weather is also expected to be well mixed with periods of rain and sunshine supporting improved wheat, barley and canola planting and establishment

o

South Australia, Queensland, northwestern Victoria and parts of western New South Wales have been driest and still have the greatest need for more moisture.

- No

changes in South America were noted overnight

o

Argentina still has need for a little more rain in wheat areas, but recent dry weather has planting and early crop development advancing relatively well

- Brazil’s

Safrinha cotton continues to suffer from minimal moisture - Brazil’s

Safrinha corn is maturing and being harvested in a mostly good environment

- There

is no risk of frost or freezes in Brazil’s coffee, grain, sugarcane or citrus production areas for at least the next ten days - Portions

of Canada’s Southern Prairies are still lacking soil moisture and will experience restricted rain in this coming week, despite cooler temperatures

o

Some forecast models are advertising greater rain in the last days of June, but confidence is low

o

Additional warm and dry weather is expected later in July and August keeping the pressure on crops in the region

- Cooling

in eastern Canada’s Prairies this weekend into early next week could bring some patches of soft frost, but crop damage is not likely unless temperatures get colder than advertised

- Southeastern

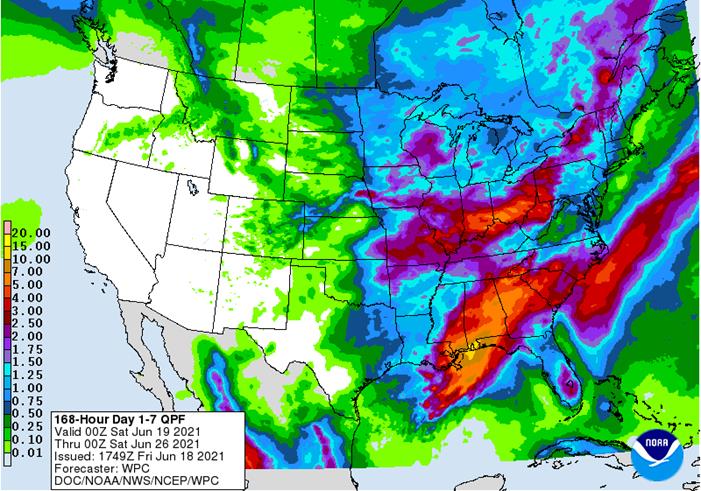

Canada’s corn, soybean and wheat conditions remain favorably rated, although a little more rain might be welcome - U.S.

Midwest rainfall and cooler biased conditions in the next two weeks will be of great interest

o

World Weather, Inc. believes some of the rainfall advertised is a little overdone, but many areas will get precipitation often enough to prevent any declines in crop conditions outside of the far west

o

Far western fringes of the Corn Belt may not receive much high volume rainfall, but some showers and cooling is expected

o

Relief from recent heat and moisture stress is expected in some western Corn Belt locations, but big soakings of rain are not likely

- Longer

range outlook keeps the northern Plains and upper Midwest along with portions of southern Canada’s Prairies with limited rainfall and warm biased temperatures

o

The lower eastern Midwest will likely be far enough removed from dryness in the Plains to experience ongoing favorable crop development potential

- U.S.

central Plains and southwestern states experienced hot temperatures Thursday and the heat will slowly recede to the southwest over the next few days

o

Extreme highs reached 108 Fahrenheit at Hill City, Kansas while reaching the 115 to 123-degree range in the southwestern desert areas

o

The hottest conditions will be mostly from the southern Plains into the southwestern desert region through the weekend

- Cooling

in the central and eastern United States will be most significant this weekend and next week at which time temperatures will be well below average

o

The cool off will come with some needed rain will be good for summer crops by reducing evaporation, lifting topsoil moisture conserving soil moisture through slower drying rates

o

Northwestern and west-central parts of the Corn Belt will not get as much rain as other areas in the Midwest and that will leave them vulnerable to returning crop stress in July when temperatures are warmer once again and rainfall

is further diminished

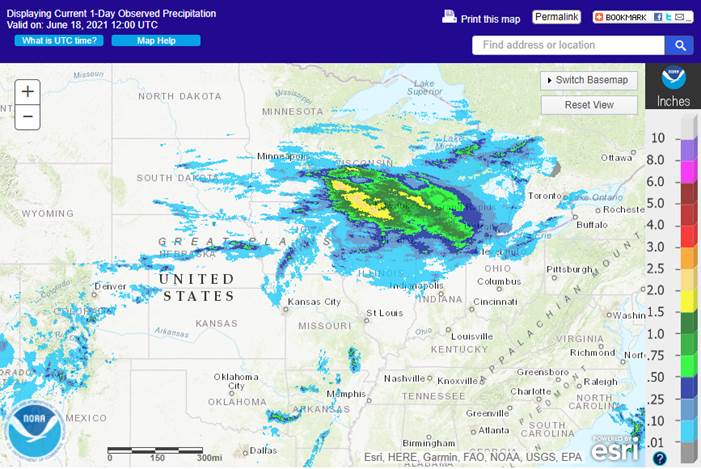

- U.S.

Delta weather will continue improve as the developing tropical cyclone in the Gulf of Mexico takes a path more to the east of that predicted Wednesday

o

Flood damage to crops in southern Arkansas and parts of central and interior northern Mississippi was notable in a few areas last weekend and drier weather is expected to be welcome in the coming week

o

A few showers will set back the drying trend as frontal system moves into the Delta early next week

- U.S.

southeastern states will mostly benefit from the moisture coming from the tropical cyclone and two frontal systems that follow it during the next ten days

o

Too much rain is expected from southeastern Mississippi, southwestern Alabama and far western parts of the Florida Panhandle into northern Georgia

- Crop

damage is not likely to be very great unless the storm becomes more intense than expected

- Tropical

Storm Claudette will evolve in the central Gulf of Mexico later today, but the system will race inland Saturday from southeastern Louisiana into southern Alabama producing 3.00 to more than 8.00 inches of rainfall and inducing some flooding

o

Damage from the system is not expected to be very great

o

Not much damaging wind expected

o

Flooding will be the greatest concern

o

Rain will also occur northeast into northern Georgia

- West

Texas will not see much precipitation for a while, but there are chances for rain evolving periodically in the next ten days that may bring some temporary relief from recent warm to hot temperatures and dry conditions.

o

Most of the resulting rain will not counter evaporation and net drying will continue

- U.S.

hard red winter wheat areas will not be seriously impacted by showers and thunderstorms that pop up next week when cooling is greatest in the region.

o

Harvest progress will advance around the precipitation.

- Drought

in the far western U.S. is not expected to change through the end of June

o

Monsoonal precipitation from Mexico should begin to stream into the southwestern desert region and southern Rocky Mountains during the second and third weeks in July

- Rain

is still needed for unirrigated winter crops in the U.S. Pacific Northwest, although it is quickly getting too late for much benefit

o

Most spring and summer crops are irrigated and water supply is sufficient for that purpose

- Eastern

France, Germany, Poland and areas south into northern Italy and Slovenia and north to Scandinavia will be warmer than usual for another day and then cooling is expected from west to east across the continent

o

Rain is expected periodically across the continent favoring the west in this first seven days of the outlook and then favoring the east June 23-30

- The

situation looks good for most crop areas - Rain

will occur erratically across Southeast Asia during the coming week.

o

Most areas will get rain at one time or another by June 26.

- Rainfall

will be lighter than usual in the mainland areas of Southeast Asia and in parts of Philippines - West-central

Africa rainfall will remain supportive of coffee, cocoa, sugarcane, rice and cotton development

o

Some increase in rainfall frequency and intensity is expected especially near the coast

- East-central

Africa rainfall continues lighter than usual in Uganda, and parts of Kenya and changes are not likely to come anytime soon

o

Any precipitation will be welcome, but greater amounts are desired

o

Ethiopia is experiencing slowly improving rainfall in the west

- Mexico

rainfall will continue in southern parts of the nation over the coming week while some rain expands into the interior far west

o

Rain should increase and advance to the north during the June 24-30 period, but it will be erratic

- Nicaragua

and Honduras have been drier biased for the past month still have need greater rain

o

Some improvement is occurring and will continue over the next week

- North

Africa rainfall will be sporadic and light for another few days and then drier conditions are expected

o

The precipitation is not likely to have a big impact on unharvested winter crops

- Southern

Oscillation Index is mostly neutral at -1.55 and the index is expected to vary in a narrow range this weekend and early next week - South

Africa weather was mostly dry Thursday and little change was expected over the next ten days

o

Winter crop establishment has been favorable in the southwest, but unirrigated areas in Free State has been a little dry and rain is needed

- New

Zealand rainfall during the coming week to ten days will be a little lighter than usual in South Island and near to above normal in the north

o

Temperatures will be near to above average

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Friday,

June 18:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - China

customs to publish trade data, including imports of corn, wheat, sugar and pork - World

coffee market report by USDA’s Foreign Agricultural Service, 3pm - FranceAgriMer

weekly update on crop conditions - USDA

Total Milk Production

Sunday,

June 20:

- China

customs publishes country-wise import data for farm goods such as soybeans and corn

Monday,

June 21:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions — corn, cotton, soybeans, wheat, 4pm - Monthly

MARS report on EU crop conditions - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

June 22:

- Copersucar,

one of Brazil’s top sugar and ethanol exporters, holds presser on the market’s outlook - Future

Food-Tech’s Alternative Proteins Summit, day 1 - OECD

to release agricultural policy evaluation report - U.S.

cold storage data – pork, beef, poultry, 3pm

Wednesday,

June 23:

- EIA

weekly U.S. ethanol inventories, production - Future

Food- Tech’s Alternative Proteins Summit, day 2

Thursday,

June 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, poultry slaughter, red meat production, 3pm

Friday,

June 25:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia

June 1-25 palm oil export data - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

Macros

Canadian

New Housing Price Index May: 1.4% (prev 1.9%)

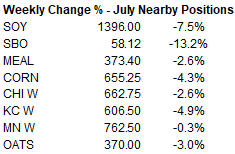

- US

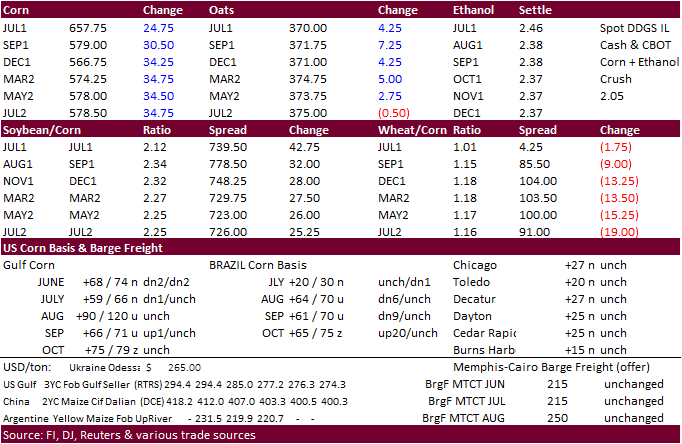

corn futures recovered 22.25-34 cents today on technical buying. July was up 22.25 cents and December up 33.75 cents. Many traders are standing aside, waiting for the markets to find some footing. December overnight traded below yesterday’s low but failed

to generate additional selling. The contract hit its lowest level since May 27 yesterday and overnight. Bottom picking lifted the contract higher and that lasted throughout the day session. Stronger USD by 34 points by 2:45 pm limited gains.

- Funds

bought an estimated net 18,000 corn contracts on Friday. - Sunday’s

open will depend on changes in the weather. - China

May corn imports reached 3.16 million tons, bringing Jan-May imports to 11.7MMT (+323% Y/Y). This puts them on track to import 26-28 million tons of corn throughout 2021.

- China’s

central government urged its main growing regions to boost fertilizer supplies during the summer. The government has been concerned over food security and high prices. Reuters noted the prices of urea jumped 9% in the first 10 days of June to a record 2,674

yuan ($414.87) per ton. - (Reuters)

– China will grant 20 billion yuan ($3.1 billion) in subsidies to farmers to help them cope with rising fertilizer and diesel prices, state media quoted the cabinet as saying on Friday. China will reduce financing burdens on small firms that have been hurt

by rising commodity prices, the cabinet was quoted as saying after a regular meeting. - Reuters

noted US merchant refiners racked up a shortfall of 1.6 billion dollars in biofuel credits. This comes after Delta airlines was said to have refused to buy biofuel credits, reported last month. We think end users expect the new administration to provide

relief for refiners.

Export

developments.

- South

Korea’s FLC bought 65,000 tons of corn, optional origin, at $295.21 per ton c&f for arrival around October 10.

- South

Korea’s MFG bought 136,000 tons of corn, through to be South American origin, at $295.21 per ton c&f for arrival around October 5.

- China’s

Sinograin on Thursday sold 37,126 tons of imported Ukrainian corn to replenish tightening supplies and alleviate high prices. No details were provided.

Updated

6/17/21

July

corn seen in a $5.50 and $7.00 range

September

$5.00 and $6.75

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

Not

much to report from this morning other than a Reuters headline suggesting China bought at least 8 US soybean cargoes for October shipment out of the PNW. No prices were provided. That’s just under 500,000 tons.

-

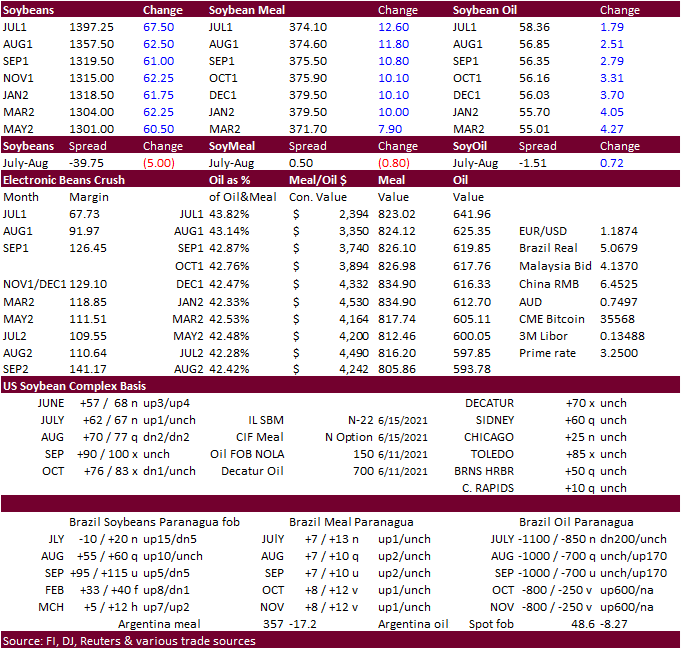

The

US soybean complex ended sharply higher led by a big rebound in soybean oil after that contract closed the expanded limit lower on Thursday. Soybeans and meal saw bull spreading. Soybean oil was up 155 to 368 (Dec) on bear spreading.

-

Funds

on Friday bought an estimated net 18,000 soybean contracts, bought 6,000 soybean meal and bought 7,000 soybean oil contracts.

-

Ironically,

canola futures have been the hardest major oilseed market to be hit month to date, down about 14.3%. Attached is our price performance.

-

Some

of the outside soybean oil related markets didn’t follow CBOT sharply lower yesterday. China ag futures traded about 0.5%-2.7% lower. Palm futures were up 47MYR and cash up $10/ton to $865. Offshore values this morning were leading SBO 378 points higher

(702 points higher for the week to date!) and meal $4.80/short ton higher ($1.10 higher for the week to date). Note China’s Dalian Exchange started trading palm oil options.

-

Oil

World prices indicated US SBO Gulf as of this morning was down nearly 20% from the comparable timeframe week earlier.

-

With

the large break in soybean oil, some EU biodiesel end users added hedges. We heard “A lot of blenders that were anticipating cutting blend rates in Q3 because of no discretionary blend value were able to lock in values to keep blending at B20.” We have been

under the impression that global vegetable oil demand will remain strong through 2021 and 2022, despite the negative US related headlines earlier this week.

-

China

cash crush margins eroded this week with the increase in volatility with global futures, coupled with a sharply lower imported cash price of soybeans into China. Yet they started their new-crop US soybean buying campaign. They tend to start buying new-crop

around this time of year. -

APK-Inform:

Ukraine 2021-22 rapeseed harvest 2.46MMT for 2021, down from 2.51 previous and 2.62 million tons in 2020.

-

APK-Inform:

Ukraine 2021-22 rapeseed export prices declined 10 percent from week ago to $555 to $570/ton (down about $70).

-

Several

Argentine maritime workers unions and the grain receivers union Urgara announced a strike action for June 18 (AgriCensus). It will last for 24-hours, related to COVID-19 vaccines. This might be the 4th one in three weeks, but unsure as we have

officially lost count. We don’t see a price implication from this strike, unlike previous strikes.

-

(Reuters)

– “China will issue new rules on the management of price indexes for commodities and services, it said on Thursday as the government steps up scrutiny of the country’s commodity markets and battles to contain inflation. The measures, effective from Aug. 1,

will standardize how price indexes are compiled and improve transparency on the release of information, the National Development and Reform Commission (NDRC) said on its official WeChat account.” -

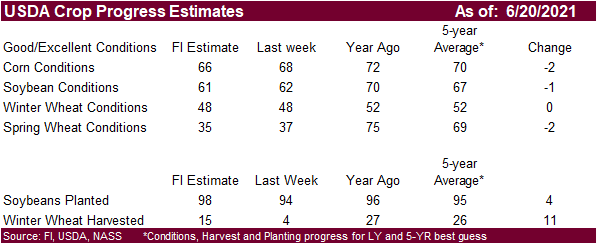

We

revised our US soybean yield to 51.7 from 52.7 (10-year trend) based on the latest crop rating.

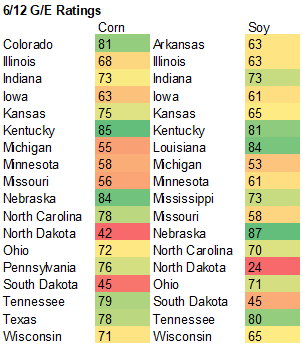

Ratings

may trend lower, so we look for a lower yield in coming weeks unless these upcoming rains end up widespread and ample enough to ease WCB and upper Midwest drought conditions. Below are corn and soybean ratings G/E last week. ND, SD, MI, MO lowest rated for

soybeans.

Export

Developments

- None

reported

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

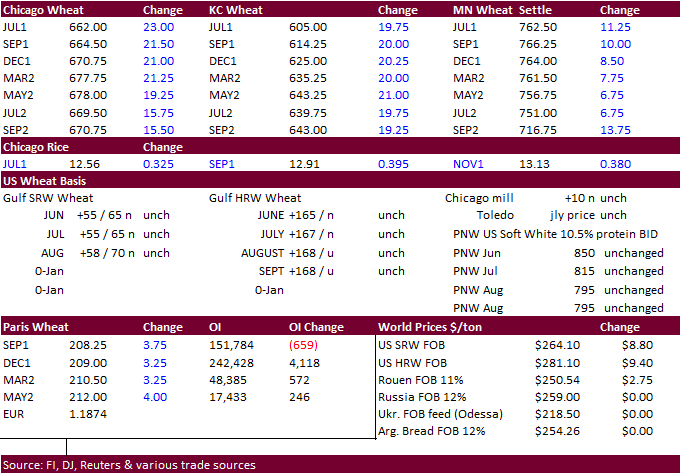

- US

wheat futures ended higher from technical buying, higher corn and soybeans, and firm global import demand. The USD was up about 34 points this afternoon. It was a quiet session in terms of fresh developments after the day session open.

- Funds

on Friday

bought an estimated net 12,000 SRW wheat contracts. - France’s

wheat crop condition as of June 14 were steady from the previous week at 81%, highest for this time in six years, according to Bloomberg. French winter barley was unchanged at 76%. Spring barley and corn French crop conditions were also unchanged .

- September

Paris wheat settled up 3.75 euros, or 1.8%, at 208.25 euros ($247.19) a ton. Week to date it was down 3 euros.

- US

Wheat Associates: “Record breaking high temperatures are being set across the Great Plains, accelerating harvest and crop maturity. The first HRW samples from Oklahoma and Texas have been delivered to the lab with data expected next week. With SRW harvest

well underway, the first samples were analyzed this week. Despite sporadic rainfall, drought conditions persist in the northern and PNW states, hindering development and expected yield of SW, HRS and HRW crops.”

- *Iran’s

GTC bought at least 195,000 tons of milling wheat (60k sought) for July and August shipment at 280 euros per ton ($333.37) c&f.

- *The

Philippines bought 150,000 tons of milling wheat. One consignment could be Australian-origin for shipment between July 21 and Aug 10 was bought at an estimated $324.25 a ton c&f. Another consignment could also be Australian origin for Aug. 5-25 shipment at

an estimated $321.50 a ton. Details of the third cargo is not known. - Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

- None

reported

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.