PDF Attached

Calls:

Higher based on crop progress

Soybeans

20-30 higher

Meal

$4-$7 higher

SBO

50-100 higher

Corn

7-13 higher

Wheat

7-15 higher

We

need a day or two to look at ratings and project accurate (Aug 1) US yields. Bias is for a large SW, corn, and soybean cut. WW stable. US corn yields, what we heard earlier, are around 177 to 179 and 50.5-51.5 for soybeans. Odd trade today as profit taking

offset bull traders looking at US weather forecasts, which called for mix events for the US Midwest over the next week.

Reuters

covering US EPA mandates:

-

US

EPA PLANS TO FINALIZE 2023 BIOFUEL BLENDING VOLUMES AT 20.94 BLN GALLONS, VERSUS 20.82 BLN GALLONS IN PROPOSED RULE – SOURCES -

US

EPA PLANS TO FINALIZE 2024 BIOFUEL BLENDING VOLUMES AT 21.54 BLN GALLONS, VERSUS 21.87 BLN GALLONS IN PROPOSED RULE – SOURCES -

US

EPA PLANS TO FINALIZE 2025 BIOFUEL BLENDING VOLUMES AT 22.33 BLN GALLONS, VERSUS 22.68 BLN GALLONS IN PROPOSED RULE – SOURCES -

U.S.

EPA PLANS TO FINALIZE ETHANOL BLENDING MANDATE AT 15.25 BILLION GALLONS FOR 2023 AND 15 BILLION GALLONS FOR 2024 AND 2025 – SOURCES -

US

EPA TO SET ADVANCED BIOFUEL BLENDING MANDATE AT 5.94 BILLION GALLONS IN 2023, UP FROM A PROPOSED 5.82 BILLION – SOURCES -

US

EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 2.82 BILLION GALLONS IN 2023, UNCHANGED FROM PROPOSAL – SOURCES -

US

EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 3.04 BILLION GALLONS IN 2024, UP FROM PROPOSED 2.89 BILLION GALLONS – SOURCES -

US

EPA TO SET CELLULOSIC BIOFUEL MANDATE AT 840 MILLION GALLONS IN 2023, UP FROM A PROPOSED 720 MILLION GALLONS – SOURCES -

US

EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 3.35 BLN GALLONS IN 2025, UP FROM PROPOSED 2.95 BLN GALLONS – SOURCES

Slight

increase in overall mandates can be read both ways. We will make no changes to our US balance sheets for corn and soybean oil. Perhaps some that bought into soybean oil last week looking for a higher advanced mandate may claw back on positions.

(Reuters)

– The Biden administration plans to increase the amount of biofuels that oil refiners must blend into the nation’s fuel mix in 2023, 2024 and 2025, but the plan includes reducing mandates for corn-based ethanol from proposed levels, two sources familiar with

the matter told Reuters. The Environmental Protection Agency plans to finalize biofuel blending volumes at 20.94 billion gallons in 2023, 21.54 billion gallons in 2024 and 22.33 billion gallons in 2025, the sources said. The EPA is expected to announce the

final rule on Wednesday. The finalized volumes include 15 billion gallons of conventional biofuels like corn-based ethanol in 2023, 2024 and 2025, which represents a decline from a December proposal and is likely to cause consternation among biofuels groups

and farmers. In 2023, however, the EPA plans to include 250 million gallons of “supplemental standard.” The EPA did not immediately respond to a request for comment.

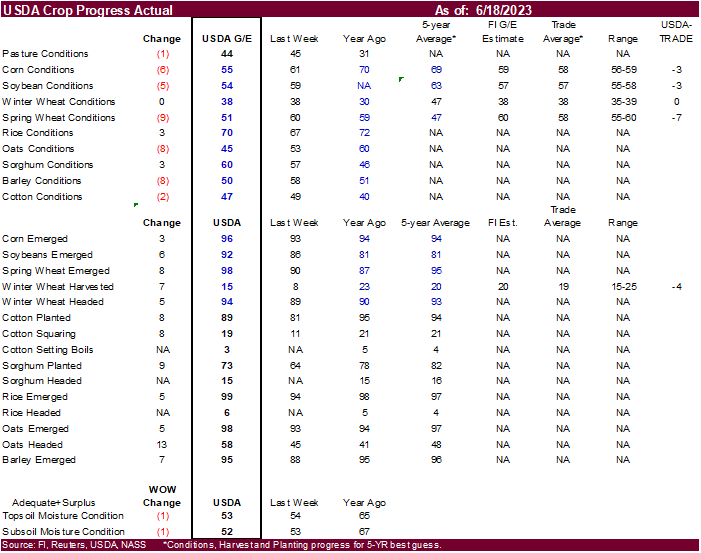

US

WINTER WHEAT – 38 PCT CONDITION GOOD/EXCELLENT VS 38 PCT WK AGO (30 PCT YR AGO) -USDA

US

SPRING WHEAT – 51 PCT CONDITION GOOD/EXCELLENT VS 60 PCT WK AGO (59 PCT YR AGO) -USDA

US

RICE – 70 PCT CONDITION GOOD/EXCELLENT VS 67 PCT WK AGO (72 PCT YR AGO) -USDA

US

CORN – 55 PCT CONDITION GOOD/EXCELLENT VS 61 PCT WK AGO (70 PCT YR AGO) -USDA

US

COTTON – 47 PCT CONDITION GOOD/EXCELLENT VS 49 PCT WK AGO (40 PCT YR AGO) -USDA

US

SOYBEAN – 54 PCT CONDITION GOOD/EXCELLENT VS 59 PCT WK AGO (68 PCT YR AGO) -USDA

US

COTTON – 89 PCT PLANTED VS 81 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US

RICE – 99 PCT EMERGED VS 94 PCT WK AGO (97 PCT 5-YR AVG) -USDA

US

SOYBEANS – 92 PCT EMERGED VS 86 PCT WK AGO (81 PCT 5-YR AVG) -USDA

US

CORN – 96 PCT EMERGED VS 93 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 98 PCT EMERGED VS 90 PCT WK AGO (95 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 94 PCT HEADED VS 89 PCT WK AGO (93 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 10 PCT HEADED (2 PCT YR) (10 PCT 5-YR AVG) -USDA

US

RICE – 6 PCT HEADED (5 PCT YR) (4 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 15 PCT HARVESTED VS 8 PCT WK AGO (20 PCT 5-YR AVG) -USDA

US

COTTON – 19 PCT SQUARING VS 11 PCT WK AGO (21 PCT 5-YR AVG) -USDA

US

COTTON – 3 PCT SETTING BOLLS (5 PCT YR) (4 PCT 5-YR AVG) -USDA

US

corn yields, what we heard, are around 177 to 179 and 50.5-51.5 for soybeans.

Odd

trade today as profit taking offset bull traders looking at US weather forecasts, which called for mix events for the US Midwest over the next week.

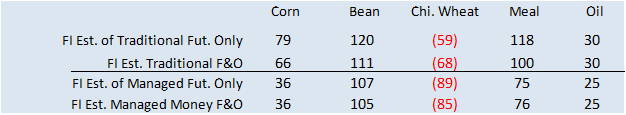

Fund

estimates as of June 20 (net in 000)

7-day

WEATHER

TO WATCH

- No

unusual warmth is expected in key U.S. Midwest crop areas during the next two weeks which should help to conserve soil moisture through less aggressive drying

- U.S.

Midwest precipitation will be restricted for another week to ten days, although totally dry weather is not expected for all crop areas - Showers

that occur will be brief and light from eastern Nebraska and eastern Kansas through portions of Missouri and Iowa to Illinois, northern Indiana and parts of Michigan - Rainfall

in the week will be 0.05 to 0.50 inch with a few totals of 0.75 inch or greater - Net

drying is expected, despite the showers, but without hot temperatures the drying rates will be relatively slow, but still threatening for the areas with little to no soil moisture - Crop

stress will continue in the driest areas of the Midwest and the urgency for rain will remain high in some areas to prevent or stop the potential for declining yields - Some

increase in U.S. Midwest shower and thunderstorm activity is possible next week offering a little more potential relief from recent drying - World

Weather, Inc. still does not see U.S. Midwest drought like that of 2012 - Areas

of dryness will pull back nationwide yields but the situation will not be nearly as bad as that of 2012 - Temperatures

should not be excessively warm and showers will occur periodically to prevent a worst case scenario from emerging - Dryness

remains serious in a number of Midwestern locations, despite weekend rainfall - U.S.

weather occurred mostly as expected during the weekend, although parts of central Iowa were a little wetter than expected - U.S.

eastern Midwest was dry during the weekend – areas from central Illinois and eastern Wisconsin to Michigan and northern Ohio

- Eastern

portions of the Dakotas and some western Minnesota locations experienced net drying as well along with parts of eastern Nebraska, western Iowa and interior eastern Kansas - Rainfall

during the Friday through Monday period was greatest from “portions” of Missouri, eastern Kansas and eastern Nebraska through Iowa to portions of Minnesota , western Wisconsin and far western Illinois - Amounts

were quite varied with some central Iowa locations getting 1.00 to 2.30 inches while most amounts varied from 0.35 to 1.26 inches

- Light

rainfall of 0.15 to 0.60 inch was common with numerous pockets over 1.00 inch

- The

moisture was welcome, but many areas still need more moisture - West

Texas, the Texas Blacklands, Coastal Bend and South Texas were dry and very warm to hot - Central

Texas thunderstorms produced 0.20 to 1.39 inches of rain - Temperatures

in central and southern Texas were 100 to 116 degrees with Cotulla and Laredo, Texas hottest - Crop

and animal stress occurred from southern parts of West Texas to the Texas Coastal Bend and all of South Texas - Scattered

showers and thunderstorms occurred in U.S. hard red winter wheat areas Friday through Sunday with 0.30 to 1.00 inch with many amounts of 1.00 to 2.00 inches - Seibert,

Colorado (east-central) reported 3.27 inches of rain - Many

1.00- to 2.64-inch amounts of rain were noted east-central Colorado - Northern

U.S. Plains rainfall was scattered and mostly light - Manitoba,

Canada was mostly dry during the weekend while 45% of Saskatchewan received up to 0.72 inch with one location getting 1.00 inch - Cool

temperatures occurred in the Pacific Northwest during the weekend with frost noted in several areas, but little to no damage resulted - The

Yakima Valley and northeastern Oregon were coldest - The

U.S. southeastern states have been extremely wet during the past week and must experience some drying conditions soon to protect summer crops - Rainfall

during the holiday weekend was excessively great from east-central and southeastern Mississippi to southern Alabama where 3.00 to 7.00 inches resulted with one location near the Gulf of Mexico Coast along the Mississippi/Alabama border reporting 8.32 inches - Flooding

occurred in some of these areas - Heavy

rain occurred late last week in southern Georgia, northern Florida and southern Alabama with similar amounts resulting - Flooding

rain has impacted western Alberta, Canada and some temporary reprieve occurred to “some” of the drought areas of southern and eastern Alberta shrinking the area of extreme dryness, but leaving some crop areas in desperate need for rain - Rainfall

in west-central Alberta ranged from 1.50 to more than 4.00 inches during the weekend and additional rain of significance was falling today - Rain

fell briefly and lightly in the drought stricken areas of Alberta where northern parts of the dry region getting 0.40 inch to more than 1.00 inch of moisture while the south received a trace to 0.40 inch - Tropical

Storm Bret formed in the central Atlantic Ocean Monday and may become a hurricane briefly Wednesday before weakening back to tropical storm status Thursday night or early Friday as it crosses the Lesser Antilles

- Additional

weakening is expected and the system may dissipate over open water in the Caribbean Sea late this week or during the weekend - Canada’s

Prairies will receive erratic rainfall in the coming week, but it looks as though southeastern Manitoba may get some significant rain to ease recent dryness - Some

rain will also impact the eastern Dakotas and western Minnesota at the same time - Greater

rain is expected in the Prairies during July to further improve the moisture profile - Northern

Europe is expected to trend wetter this week finally easing some persistent dryness that has lasted more than a month in some areas - The

lack of hot weather helped conserve soil moisture and protect crop development for much of that period of time - Widespread

rain is expected in Russia’s eastern New Lands and neighboring areas of northern Kazakhstan in the second week of the outlook - Temperatures

will be cooler than usual this week. - Russia’s

northeastern New Lands were cool enough for frost and a few light freezes during the weekend, but the impact on crops was minimal.

- India’s

monsoon is expected to begin performing better later this week and especially next week with greater rainfall - Monsoonal

precipitation was virtually non-existent during the weekend as it has been during much of the past three weeks - Weekend

rainfall in India was greatest from Gujarat and southeastern Sindh, Pakistan into Rajasthan where 2.25 to more than 6.00 inches of rain resulted - The

rain was associated with remnants of Tropical Cyclone Biparjoy - The

moisture will prove to be very helpful in spurring on some early season summer crop planting quick emergence and rapid development once the surplus moisture runs off or soaks deep into the ground - Heavy

rain also fell in India’s far Eastern States and in Bangladesh during the weekend resulting in some flooding - Some

welcome rain fell in eastern Thailand, Laos and central Vietnam during the weekend with rainfall of 1.50 to more than 4.00 inches resulting - Western

Thailand continues to miss the greater rain events, although some showers are occurring periodically - Western

Thailand rice, sugarcane and corn (among other crops) are hurting in the absence of significant rainfall this season - Weekend

rain in Indonesia and Malaysia was mostly light and sporadic except for southern Sarawak and northern Kalimantan where 3.50 to nearly 8.00 inches of rain resulted - Philippines

weekend rainfall was erratic and mostly light, but soil moisture was rated well.

- India

coffee, sugarcane and rice production areas in the Central Highlands need greater rain in unirrigated areas - Australia

weekend rainfall was greatest in the south - Winter

crop establishment is advancing well. - Timely

rainfall is expected over the next ten days in most crop areas maintaining a well-established crop - South

Africa winter crops are still establishing well and timely rainfall is expected through the next ten days - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks - Ontario

and Quebec weather should be dry this week and then trend wetter this weekend and next week

- Summer

crop conditions are still rated favorably with little change likely -

Mexico

rainfall will continue minimal for the next week to ten days -

Drought

is delaying the planting of many crops and stressing sugarcane, citrus rice, cotton and coffee and other crops that are already developing -

Better

rainfall is expected in the last days of June and especially in July -

No

changes in South America weather are expected over the coming week -

Argentina

rainfall will be limited leaving many areas from Cordoba into La Pampa and western Buenos Aires too dry for wheat emergence and establishment -

Favorable

field conditions will prevail in the eastern Argentina wheat areas due to previous rain and cool temperatures conserving the moisture through low evaporation rates -

Rain

is possible next week -

Southern

Brazil will continue plenty wet from southern Mato Grosso do Sul to northern and eastern Rio Grande do Sul and Parana over the next ten days -

More

limited rain is expected in center south crop areas while the north is left mostly dry

-

There

is a very low risk of crop damaging cold for the next ten days in any grain, cotton, sugarcane, citrus or coffee area -

China’s

northern Yellow River Basin and neighboring areas of Inner Mongolia are trending drier and this pattern will prevail for a while possibly leading to crop moisture stress for wheat, coarse grains and oilseeds later this summer -

Southern

China will remain plenty wet and may become excessively wet soon -

This

will interfere with early rice maturation and harvesting with some crop quality declines possible -

Some

sugarcane areas will eventually be flooded -

Most

of the greatest rain will be south of rapeseed areas; though much of the rapeseed harvest has likely been completed -

Xinjiang,

China will experience seasonable temperatures over the next two weeks -

The

province struggled with coolness earlier this year and crop development is behind the usual pace -

Production

potentials were decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Crop

conditions are improving because of the recent development of more seasonable temperatures -

Recent

high temperatures have been in the 90s to slightly over 100 Fahrenheit -

Central

America rainfall is expected to be abundant to excessive during the next ten days possibly leading to some areas of flooding -

Today’s

Southern Oscillation Index was -13.41 and it will move lower over the next several days

Source:

World Weather, INC.

Tuesday,

June 20:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

corn, cotton, soybean, spring wheat and winter wheat condition, 4pm - China’s

3rd batch of May trade data, including country breakdowns for commodities - US

planting data for cotton, spring wheat and soybeans, 4pm - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Argentina

Wednesday,

June 21:

- Grain

and Oilseeds MENA conference in Cairo, day 1 - SIIA

Haze Outlook 2023 in Singapore - USDA

Total Milk Production

Thursday,

June 22:

- Port

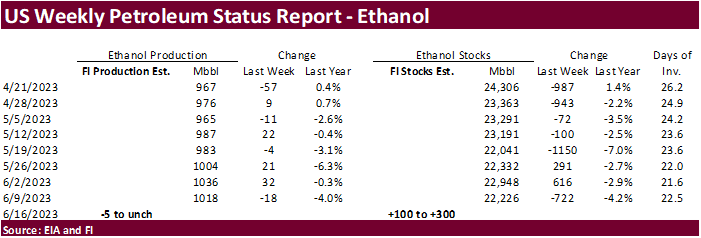

of Rouen data on French grain exports - EIA

weekly US ethanol inventories, production, 10:30am - Grain

and Oilseeds MENA conference in Cairo, day 2 - Brazil

Unica cane crush, sugar production (tentative) - USDA

Red Meat Production, 3pm - HOLIDAY:

China,

Hong Kong

Friday,

June 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

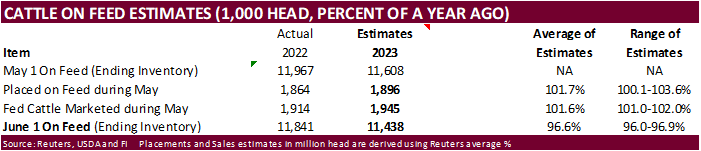

weekly crop condition report - US

Cattle on Feed, 3pm - US

cold storage data for beef, pork and poultry - HOLIDAY:

China

Soybean

and Corn Advisory

2023

U.S. Corn Yield Lowered 1.0 bu. to 177.0 bu/ac

2023

U.S. Soybean Yield Lowered 0.5 bu. to 51.0 bu/ac

2022/23

Brazil Soybean Estimate Unchanged at 155.0 Million Tons

2022/23

Brazil Corn Estimate Increased 1.0 mt to 130.0 Million

2022/23

Argentina Soybean Estimate Lowered 1.0 mt to 21.0 Million

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

102

Counterparties Take $1.989 Tln At Fed Reverse Repo Op.

US

Housing Starts May: 1631K (est 1400K; prev 1401K)

US

Building Permits May: 1491K (est 1425K; prevR 1417K)

US

Housing Starts (M/M) May: 5.2% (est 0.6%; prevR -1.4%)

US

Building Permits (M/M) May: 21.7% (est -0.1%; prevR -2.9%)

US

Philadelphia Fed Non-Manufacturing Activity Jun: -16.6 (prev -16.0)

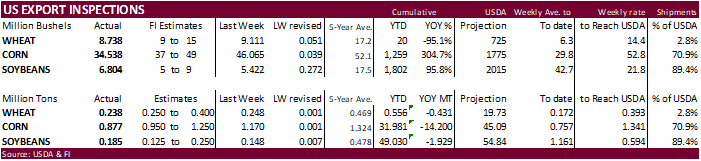

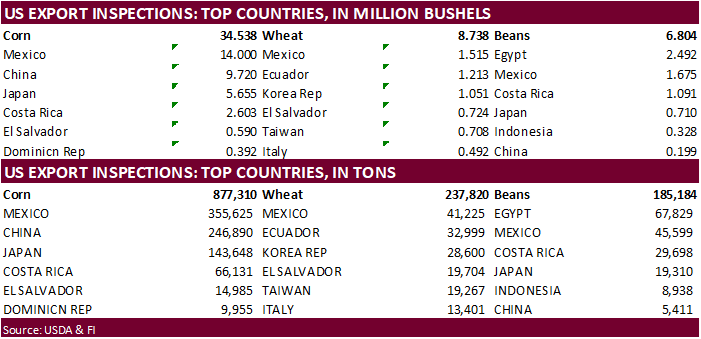

USDA

inspections versus Reuters trade range

Wheat

237,820 versus 150000-400000 range

Corn

877,310 versus 600000-1250000 range

Soybeans

185,184 versus 100000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 15, 2023

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/15/2023 06/08/2023 06/16/2022 TO DATE TO DATE

BARLEY

0 0 0 0 0

CORN

877,310 1,170,114 1,192,567 31,981,064 46,180,990

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 799 0 799 0

RYE

0 0 0 0 0

SORGHUM

1,294 59,161 71,415 1,780,215 6,540,435

SOYBEANS

185,184 147,572 429,644 49,029,863 50,959,154

SUNFLOWER

96 0 0 2,704 2,260

WHEAT

237,820 247,958 348,309 556,270 986,934

Total

1,301,704 1,625,604 2,041,935 83,350,915 104,669,773

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

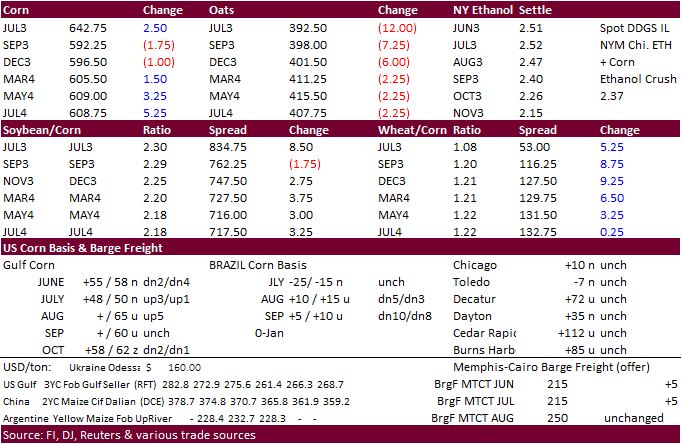

Widespread commodity selling, uncertainty over a mixed US weather forecast, and lower equity markets sent corn futures mostly lower before profit taking shook its tail. Soon to expiring July, and 2023 later months, and July 2024

were mostly higher.

·

December corn traded above $6.00 and that may have triggered new-crop profit taking. Look for a buy if it settles above that level this week

·

USDA US corn export inspections as of June 15, 2023, were 877,310 tons, within a range of trade expectations, below 1,170,114 tons previous week and compares to 1,192,567 tons year ago. Major countries included Mexico for 355,625

tons, China for 246,890 tons, and Japan for 143,648 tons.

·

President Biden and China’s Xi are set to meet today. China lowered rates earlier this week by 10 basis points. Interest rates have been slowly ticking lower in China since at least 2020.

·

Mexico reached a deal with domestic food manufactures to use non-GMO corn.

·

We look for a decline in US soybean and corn ratings

to

decline 2 points.

Due

out Friday

Export

developments.

-

Iran

was thought to have passed on 120,000 tons of corn. -

Taiwan’s

MFIG seeks up to 65,000 tons of corn on June 21.

Price

outlook (6/16/23)

July

corn $5.85-$6.60

September

corn $5.00-$6.75

December

corn $4.50-$7.00

·

CBOT soybeans, soybean meal and soybean oil were mostly lower earlier from profit taking as traders digest upcoming weather forecasts for the US and Europe. Complex closed mixed with producer selling in mind.

·

Concerns over China’s economic health is contributing to a lower trade earlier in the soybean complex. Crop condition changes will change that sentiment.

·

EPA released mandates for 2023-2025. There were small changes from the December proposal. Perhaps some that bought into soybean oil last week looking for a higher advanced mandate may claw back on positions.

·

However, China soybean imports last month were robust. China May soybean imports were 12.02 million tons versus 7.26 for April and 967,000 tons for May 2022. May 2021 was 961,000 tons and May 2020 was 938,000 tons. The record

for the month of May 2023 of 12.02 million tons comes are crushers saw an improvement in inspections (restricted/slowed month earlier) despite a decline in crush margins (also low hog prices). Jan-May China soybean imports were 42.31 million tons, up about

11%. Second batch of trade data showed imports from Brazil at a large 10.94 million tons versus 7.79 million year earlier. US imports were 923,529 tons, off 47 percent from year ago. China US corn imports for reference were 568,434 tons, down from 1.9 million

tons year ago.

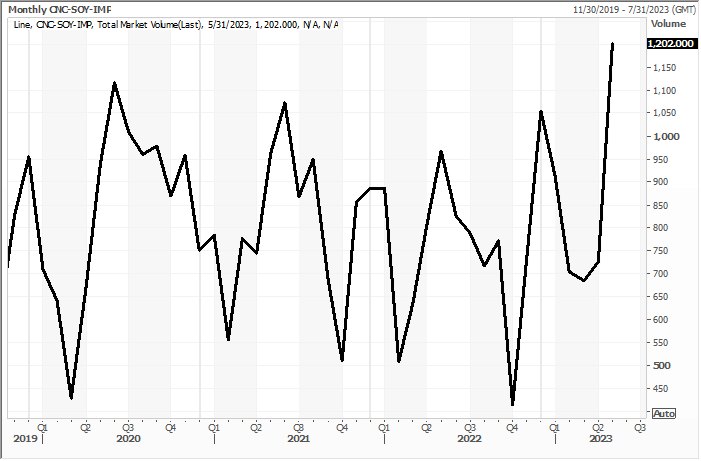

Monthly

China soybean imports

·

Argentina was on holiday today.

·

USDA US soybean export inspections as of June 15, 2023 were 185,184 tons, within a range of trade expectations, above 147,572 tons previous week and compares to 429,644 tons year ago. Major countries included Egypt for 67,829

tons, Mexico for 45,599 tons, and Costa Rica for 29,698 tons.

·

European Union soybean imports in the 2022-23 season (July-June) reached 12.52 million tons by June 11, down 12% from 14.17 million a year earlier. Rapeseed imports reached 7.24 million tons, up 38% compared with 5.26 million

a year earlier. Soybean meal imports were 15.38 million tons, down 4% from 16.06 million the prior season.

·

ITS reported Malaysian June 1-20 palm oil shipments at 632,345 tons, down 17% from the previous period month earlier. AmSpec reported 624,306 tons, down from 716,760 tons previous period during May.

-

China

will auction off 306,700 tons of imported soybeans from state reserves on June 27.

-

Iran

was thought to have passed on 120,000 tons of soybean meal but are back on Wednesday for the same amount.

Price

outlook (6/16/23)

Soybeans

– July $14.20-$15.15, November $11.00-$15.00

Soybean

meal – July $390-$440, December $290-$450

Soybean

oil – July 58.00-62.00, December 54-64

·

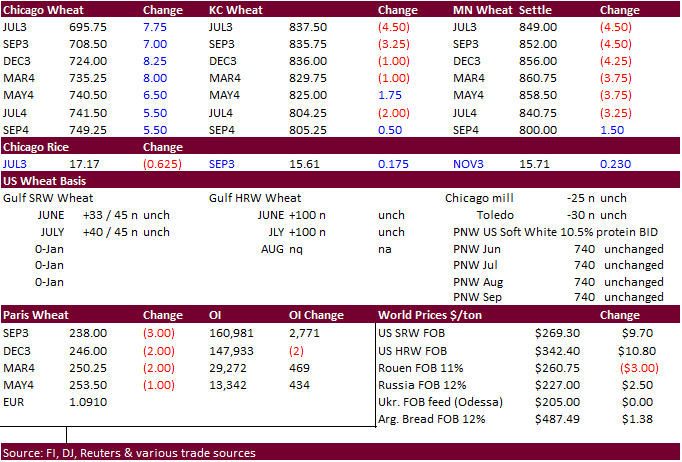

US wheat futures traded without direction, set to go higher after this afternoon US crop progress report. Was initially lower on widespread commodity selling and a US weather forecast calling for additional beneficial rains for

the central and northern Great Plains. Canada saw some relief over the weekend.

·

USDA US all-wheat export inspections as of June 15, 2023 were 237,820 tons, within a range of trade expectations, below 247,958 tons previous week and compares to 348,309 tons year ago. Major countries included Mexico for 41,225

tons, Ecuador for 32,999 tons, and Korea Rep for 28,600 tons.

·

Canada Outlook for Principal Field Crops https://agriculture.canada.ca/en/sector/crops/reports-statistics

·

Russia sees the Black Sea grain deal ending by July 18 but left the door open for additional talks.

·

Look for the UN and Russia to heat up talks over the Black Sea grain deal.

·

September Paris milling wheat officially closed 3 euros lower, or 1.2%, at 239 euros a ton (about $262 ton).

·

India monsoons will improve from now through the end of the month. India’s wheat crop was larger than expected and a good soaking should replenish many of their reservoirs for the upcoming season.

·

EU soft wheat exports so far this season reached 30.37 million tons by June 18, up 11% compared with 27.25 million a year earlier. Barley exports were 6.28 million tons, down 9% from 6.94 million a year ago and corn imports were

25.30 million tons, up 57%.

(Canada)

Manitoba crop report: The biggest concern amongst crop producers remains the lack of significant rainfall. Sporadic showers across Manitoba over the last week made little contribution to crop moisture maintenance. Cereal crops are reported to be in the four

leaf to full flag leaf stage. Crops have shown rapid development and remain in good condition except later planted fields with uneven and thin stands due to dry topsoil. Corn has advanced rapidly with the recent heat and most of the fields are at the V5 to

V8 stage. Canola has advanced rapidly beyond its vulnerable growth stages in most regions except for later planted fields. Soybean development was rapid during the last week with the warm weather. Iron deficiency chlorosis has been observed in most regions.

Hay and pasture growth has slowed and is showing signs of moisture stress. Hay yields will most likely be down from last year.

https://gov.mb.ca/agriculture/crops/seasonal-reports/current-crop-topics.html

Export

Developments.

·

Algeria bought at least 630,000 tons of wheat.

·

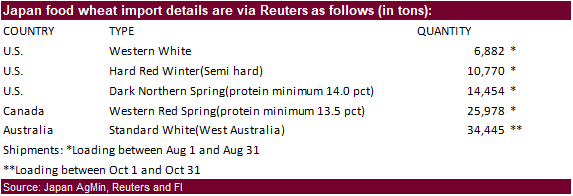

Japan passed on wheat and barley in a SBS import tender.

·

Japan seeks 92,529 tons of milling wheat later this week for Aug shipment.

·

Saudi Arabia snapped up 350,000 tons of wheat from overseas farms.

Rice/Other

·

Mauritius bought 6,000 tons of rice.

Price

outlook (6/16/23)

Chicago Wheat

July $6.50-$7.15, September $6.00-$7.00

KC – July $8.00-$8.80, September $7.50-$9.00

MN – July $8.00-$8.80, September $7.25-$9.00

#non-promo