PDF attached

We

look for a higher trade in spring wheat tonight after conditions dropped a large ten points.

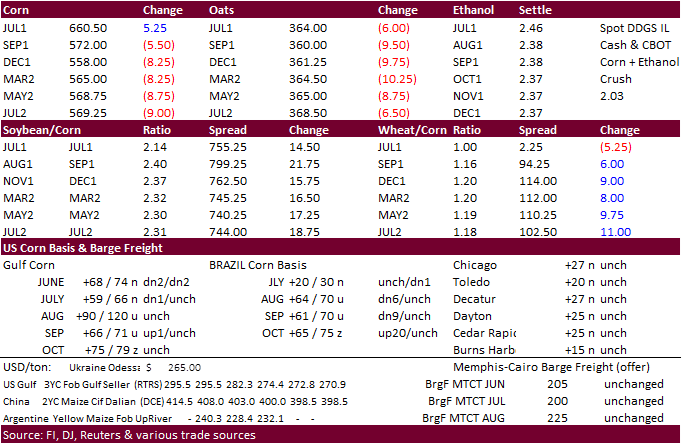

CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 3.2% TO $2,400 PER CONTRACT FROM $2,325 FOR JULY 2021 – Reuters News

Calls:

Soybeans

8-14 higher

Corn

4-8 higher

Chicago

wheat 5-10 higher

KC

Wheat 6-11 higher

Minneapolis

wheat 8-15 higher

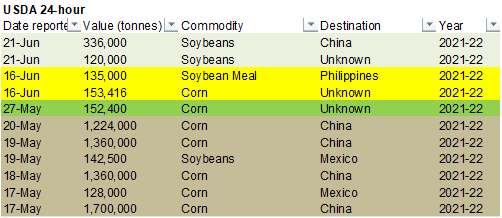

WASHINGTON,

June 21, 2021–Private exporters reported to the U.S. Department of Agriculture the follow activity:

–Export

sales of 336,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

–Export

sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

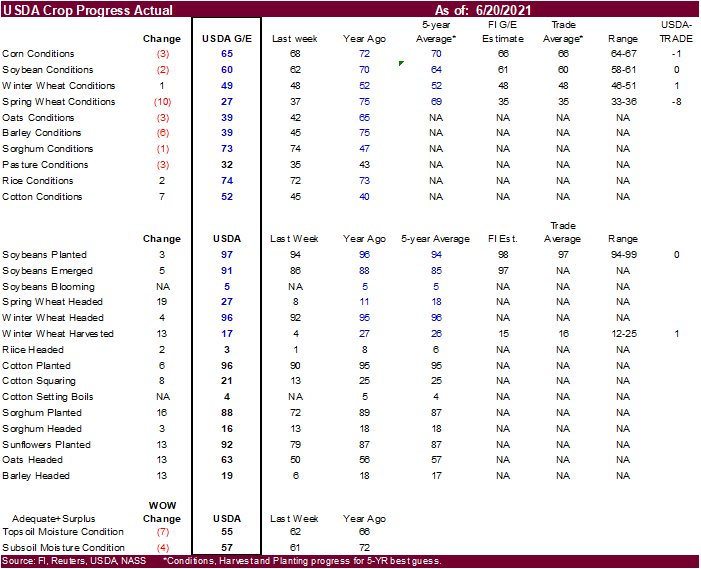

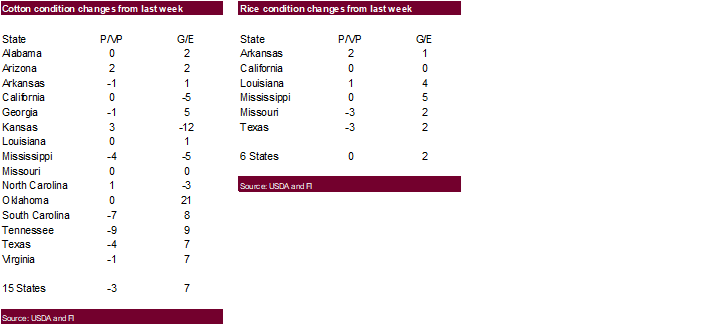

US

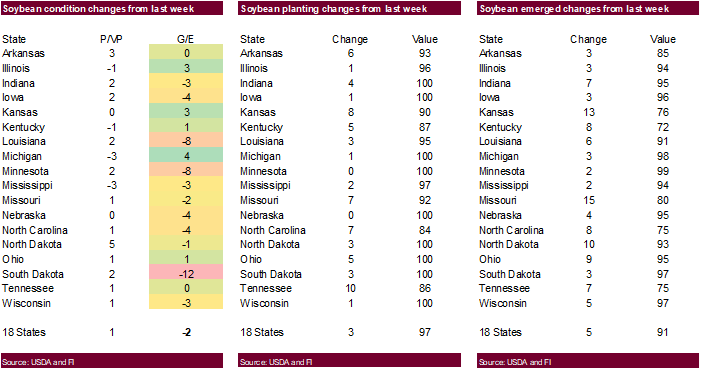

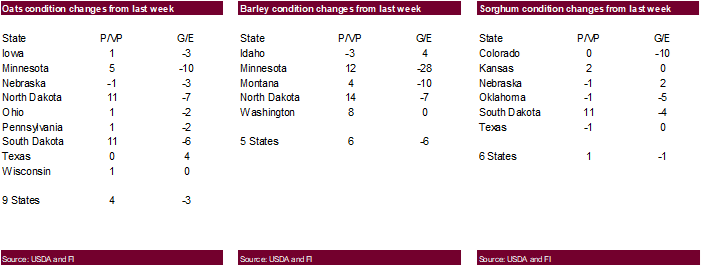

Crop Progress

US

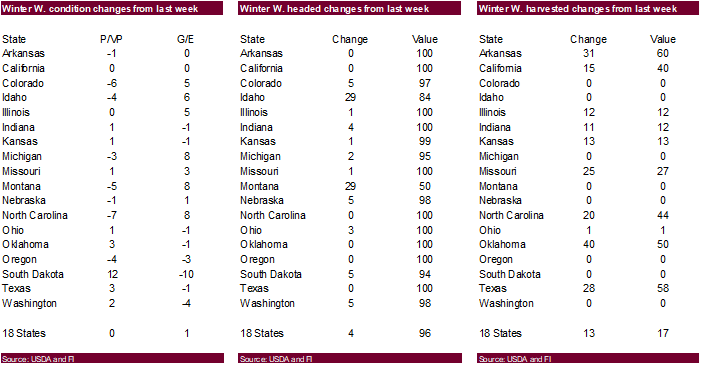

WINTER WHEAT – 49 PCT CONDITION GOOD/EXCELLENT VS 48 PCT WK AGO (52 PCT YR AGO) -USDA

US

RICE – 74 PCT CONDITION GOOD/EXCELLENT VS 72 PCT WK AGO (73 PCT YR AGO) -USDA

US

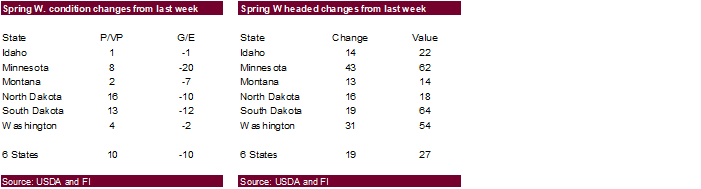

SPRING WHEAT – 27 PCT CONDITION GOOD/EXCELLENT VS 37 PCT WK AGO (75 PCT YR AGO) -USDA

US

CORN – 65 PCT CONDITION GOOD/EXCELLENT VS 68 PCT WK AGO (72 PCT YR AGO) -USDA

US

COTTON – 52 PCT CONDITION GOOD/EXCELLENT VS 45 PCT WK AGO (40 PCT YR AGO) -USDA

US

SOYBEAN – 60 PCT CONDITION GOOD/EXCELLENT VS 62 PCT WK AGO (70 PCT YR AGO) -USDA

US

COTTON – 96 PCT PLANTED VS 90 PCT WK AGO (95 PCT 5-YR AVG) -USDA

US

SOYBEANS – 97 PCT PLANTED VS 94 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US

SOYBEANS – 91 PCT EMERGED VS 86 PCT WK AGO (85 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 96 PCT HEADED VS 92 PCT WK AGO (96 PCT 5-YR AVG) -USDA

US

RICE – 3 PCT HEADED VS 1 PCT WK AGO (6 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 27 PCT HEADED VS 8 PCT WK AGO (18 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 17 PCT HARVESTED VS 4 PCT WK AGO (26 PCT 5-YR AVG) -USDA

US

SOYBEANS – 5 PCT BLOOMING (5 PCT YR) (5 PCT 5-YR AVG) -USDA

US

COTTON – 21 PCT SQUARING VS 13 PCT WK AGO (25 PCT 5-YR AVG) -USDA

US

COTTON – 4 PCT SETTING BOLLS (5 PCT YR) (4 PCT 5-YR AVG) -USDA

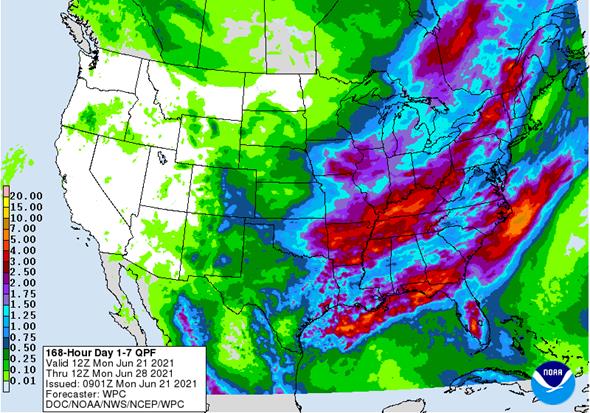

1-7

DAY

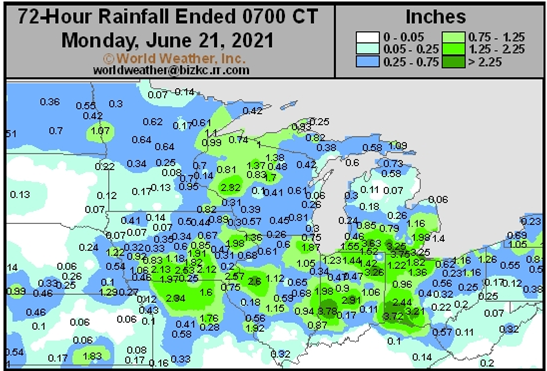

Source:

World Weather Inc.

WORLD

WEATHER INC.

MID-DAY

US WEATHER UPDATE — “SUMMARY AND COMMENT”

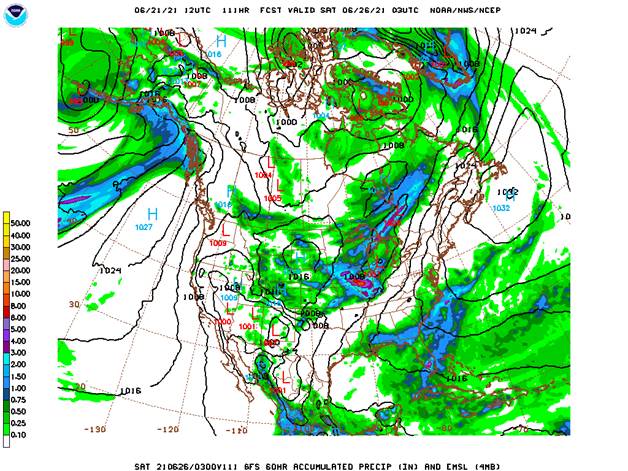

Today’s

mid-day GFS model run suggested the first week would not be quite as wet in northeastern Missouri, but increased rain in central Illinois. The latest data still targets much of Iowa, northeastern and east-central Missouri and much of central and southern Illinois

along with western and southern Indiana for heavy rain most of which occurs Thursday night into Saturday.

Rain

was also increased from northern Illinois through Ohio and western Pennsylvania for Saturday through Wednesday, June 30. Rain was also increased from the lower Delta into Georgia for early to mid-week next week. The second week outlook finished out with a

reduction in Texas and northwestern Delta rainfall and a boost in southeastern U.S. rain due to the displacement of a tropical cyclone once advertised for eastern Texas now advertised to move through western parts of Florida’s Panhandle and then into Alabama

late next week and into Saturday. The model also increased rain from eastern Colorado into Iowa, and southern Wisconsin July 1-3 and from southeastern North Dakota into eastern Nebraska, Iowa and Minnesota July 4-5.

Earlier….

MOST

IMPORTANT WEATHER OF THE DAY

- U.S.

crop outlook did not change greatly overnight; most of the Midwest either has received or will receive rain maintaining a period of improved weather

o

Not all areas will be treated the same

- Northwestern

Corn Belt and northern Plains crop areas will only experience partial relief and moisture deficits will remain that will come back to have a greater influence on production potential and market prospects in July - These

areas include the Dakotas Minnesota, parts of Nebraska and parts of Iowa - A

predicted tropical cyclone in the Gulf of Mexico during the middle part of next week is having some influence on week two forecasts in the U.S. and some caution is advised; confidence in the second week forecast is low today because of this and because of

a trough of low pressure advertised to dig into eastern Canada’s Prairies and the upper U.S. Midwest – this latter feature may not verify very well - Not

many changes were noted in the remainder of the world overnight

DETAILS

FOR THE WORLD

- U.S.

weekend weather offers few surprises

o

Rain was heavier than expected in southern Michigan and northern Indiana

o

Rain fell from portions of western and southern Iowa into the Ohio as well as from eastern Wisconsin into Michigan and northern Indiana

- Rain

amounts varied from 0.25 to 0.75 inch often with some 1.00 to 2.00 inch totals in western and southern Iowa, central and northern Missouri, west-central Illinois and from east-central Illinois to southwestern Ohio Rain totals varied from 2.00 to 3.72 inches

in interior southern Indiana and near the Cincinnati area of southwestern Ohio - Rainfall

of 1.00 to 3.57 inches also occurred from southern Michigan into northernmost Indiana and Ohio

o

Rain reported in western and northern Iowa, southwestern into central Minnesota, South Dakota, interior eastern Nebraska, eastern Kansas and areas near the Ohio River were dry or experienced net drying

o

Rain also developed in North Dakota and from there into northern Minnesota where rainfall also ranged from 0.20 to 0.75 inch with a few totals as great as 1.50 inches

- Tropical

Storm Claudette reached southern Mississippi Friday night and Saturday morning and produced heavy rain from extreme southeastern Louisiana into Alabama and western parts of the Florida Panhandle

o

Rain totals of 3.00 to 8.00 inches resulted through dawn today near the Gulf of Mexico coast while 2.00 to 5.41 inches occurred in other areas from eastern Mississippi through northern and central Georgia

- Amounts

of 0.75 to 2.00 inches occurred in South Carolina, southern Georgia and parts of both Florida’s Peninsula and North Carolina

o

Peak wind speeds at the time of landfall were no more than 45 mph.

- All

of U.S. grain and oilseed areas in the Midwest, Delta and southeastern states will receive additional rain over the coming week to ten days.

o

Northwestern Corn Belt crop areas will be driest

o

Illinois, eastern Missouri and southeastern Iowa may be wettest along with parts of the southeastern states

o

Advertised rain in the eastern Dakotas and upper Midwest for early next week may be overdone in the model data

o

Greater warming and less rain is possible in the first week of July, although that does not show up well in the model data today

- U.S.

temperatures will plummet early this week - High

temperatures today will be in the 60s and lower 70s in the upper Midwest while in the 70s in the northern and central Plains and lower western Midwest while the coolest air farther east and south will occur Tuesday with highs in the 60s and 70s in the eastern

Midwest and in the 70s to lower 80s in the Delta and southeastern states - Lowest

morning temperatures will drop to the 40s tonight with a few upper 30s possible near the Canada border Lows in the 40s and 50s are expected Tuesday morning over most of the Midwest with 50s and 60s likely in the Delta and southeastern states Tuesday and Wednesday

- A

few patches of soft frost cannot be ruled out for tonight in a few northern North Dakota and northwestern Minnesota locations - Warming

in the U.S. Plains Tuesday into Thursday will restore highs in the 90s to 103 degrees Wednesday afternoon and to the range of 90s to 105 degrees Thursday excepting the far northern Plains where some cooling is expected again

o

Western Corn Belt temperatures will rebound back into the 80s and 90s Wednesday and Thursday

o

Eastern Midwest temperatures will rebound back to the 80s Thursday into Friday

- Another

wave of cooling is expected late Thursday through Saturday in the Plains and Midwest, but temperatures will not be as cool as those of early this week

o

Highs will fall to the 70s and 80s with lowest morning temperatures in the 40s and 50s north and the 50s and lower 60s south

- Week

two U.S. temperatures will be closer to normal in the Midwest, becoming warmer than usual in the Plains and staying well above average in the far western U.S.

o

U.S. Delta and southeastern states will experience temperatures a little cooler than usual

- U.S.

far western states will be warm to hot throughout the next ten days with very little rainfall - U.S.

Great Plains will see sporadic showers and thunderstorms during the next ten days with temperatures falling below average briefly early this week and then above normal during mid-week

o

Temperatures will be near to above normal during the weekend and most of next week

- The

bottom line for the U.S. Midwest, Delta and southeastern states will be good for developing corn, soybeans, cotton and sorghum east of the Great Plains. Sufficient rainfall is expected to bolster soil moisture, reduce crop stress and help bring about some

further improvement in crop conditions Cooler temperatures will also help to conserve soil moisture through slower evaporation and give crops adequate rest from recent heat and dryness. Crop development potential will be good during the next two to three weeks

except in the northwestern Corn Belt where moisture deficits will remain and relief will be more temporary. Winter wheat harvest conditions in the Great Plains will advance around showers and thunderstorms while unirrigated summer crops experience net drying

and some heat stress periodically. - Tropical

Depression Claudette will move across the coast of North Carola today and out to sea where it will likely regain tropical storm intensity and move northeast toward Nova Scotia and Newfoundland, Canada Tuesday and Wednesday respectively - Canada’s

Prairies rainfall during the next ten days will be greatest in Alberta while net drying occurs in the central Prairies

o

Showers will be possible in the central and east, but not enough rain will fall to counter evaporation

o

Crop moisture stress will continue in the driest areas, but this week’s milder weather will be of some benefit in eastern crop areas

- Frost

occurred this morning in parts of Saskatchewan with lows in the 30s and lower 40s Fahrenheit

o

Extreme lows slipped to 31 and 32 respectively at Rosetown and Val Marie, Saskatchewan with soft frost in other areas

- Most

of the coldest temperatures were of short duration - Western

Russia is still expecting a full week of dry and warm weather

o

Soil moisture will be in a steady decline and daily high temperatures will rise through the 80s and into the 90s Fahrenheit with some extremes over 100 from western Kazakhstan into eastern portions of Russia’s Southern region

o

There is potential for scattered showers next week and temperatures may slip a little lower on the wetter days, but no general soaking of rain is expected

o

Crop stress will slowly rise especially in eastern parts of Russia’s Southern Region, western Kazakhstan and the lower most Volga River Valley

- Crop

stress will expand to the north if the predicted showers and thunderstorms fail to evolve next week; until then subsoil moisture should carry most crops through the warm and dry period - Eastern

Russia’s New Lands will experience additional showers and thunderstorms along with cooler temperatures this week to offer additional relief to crop moisture stress that has been occurring in recent weeks

o

Some rain already fell in this region during the weekend with 0.20 to 0.80 inch and a few amounts over 1.00 inch, but mostly in the southeastern New Lands and northeastern spring wheat areas of Kazakhstan

o

Another 0.30 to 1.00 inch of moisture is expected in these same areas this week with a few greater amounts

o

Western portions of northern Kazakhstan and southwestern spring wheat areas of Russia’s New Lands (east of the Ural Mountains region) will continue dry biased and crop stress will prevail

- The

bottom line for western Russia is one of developing concern over the net drying trend that is expected this week. Next week’s rain will be extremely important, but early indications suggest the rain may be a little disappointing and the need for moisture will

continue to rise as does crop moisture stress. - China

soil moisture is still rated favorably today, but a new drying trend is under way that will firm the soil from southern Shandong and northern Jiangsu to Henan and neighboring areas in southern Shaanxi and southern Shanxi.

o

Crop conditions will remain good this week, but some moisture stress is expected next week that may slow crop development

o

Rain will fall in a timely manner north of the Yellow River to maintain good crop conditions

o

Rain will fall frequently near and south of the Yangtze River through the next two weeks

- Excessive

moisture is expected in the southern coastal provinces where some flooding may occur next week when rainfall is greatest

o

A good mix of rain and sunshine is expected in the Northeast Provinces during the next ten days, although some net drying is expected for a while this week

o

Temperatures will be near to above average in the north and near to below average in the south

- China’s

weekend precipitation was scattered throughout the northeastern provinces and from southeastern China into eastern Sichuan and southern Shaanxi

o

Rain amounts varied from 0.40 to 1.35 inches with a few greater amounts to more than 2.00 inches

o

Rain from northeastern Fujian and Zhejiang to eastern Sichuan and neighboring areas varied from 0.88 inch to 2.75 inches

- Local

totals reached over 9.00 inches in southern Anhui and over 4.00 inches in eastern Sichuan

o

Net drying occurred in the Yellow River Basin and far southern provinces

o

Temperatures were warmest in the dry areas with high sin the 90s to near 100 degrees Fahrenheit.

- Xinjiang,

China crop areas turned warmer during the weekend with little to no rain

o

High temperatures were in the 80s southwest and the lower 90s northeast

- Xinjiang,

China will turn wetter and cooler once again this week in the northeast with periods of thunderstorms and below average temperatures all week

o

Southwestern crop areas will be dry with temperatures closer to normal.

- China’s

bottom line is one of developing concern over drying in east-central parts of the nation over the next couple of weeks. To a lesser degree there is a little concern over net drying in the northeastern provinces. Most of nation’s crops will remain in good shape

this week, but moisture stress will be evolving next week making the need for rain steadily higher during that week. In Xinjiang there is ongoing concern over degree day accumulations. - Europe’s

hotter weather in the west late last week shifted to the east during the weekend and rain fell from the U.K. into northern and western France and a part of the Iberian Peninsula

o

Rainfall varied from 0.20 to 0.60 with some amounts to 1.69 inches from southern parts of the U.K. into northern France

- Europe

weather will be trending wetter this week as the weekend disturbance in northwestern parts of the continent shifts to the east

o

Temperatures will be warmer than usual in eastern Europe and the western Commonwealth of Independent States this week while cooling occurs in the far west

o

Well timed precipitation is expected in most of the continent with the exception of some Mediterranean Sea countries where rainfall will be minimal

o

The bottom line in Europe will remain mostly very good as long as timely rain occurs as advertised. There may be some areas in the western Balkan Countries that will trend a little too dry raising some crop stress

- Australia

weather has been and will continue to be favorably mixed through the first week of July resulting in well-established wheat, barley and canola in most of the nation. There will be need for greater rain in parts of South Australia, northwestern Victoria and

Queensland as time moves along. - India’s

monsoon will continue behave with less vigor than usual in interior western parts of the nation

o

A boost in precipitation will be needed soon to ensure the best summer crop development

o

Soil moisture today is most favorably rated in central and eastern parts of the nation

o

Some areas in Gujarat received rain during the weekend and last Thursday, but more will be needed soon

o

Most of India’s rainfall this week will be lighter than usual except in the far east

o

Some increase in rain is expected in the interior south next week, but central and northwest will continue drier than usual

- Southeast

Asia rainfall continues lighter and more sporadic than usual in the mainland crop areas and this week’s weather will not likely change much

o

Indonesia and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops

o

Philippines rainfall will be below average for at least the next ten days

- Some

areas may experience net drying - West

Africa rainfall in Ivory Coast and Ghana will be above average during the coming ten days

o

Nigeria and Cameroon will see a mix of precipitation during the next ten days with most crops benefiting well from the pattern

- Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas - South

Africa was dry during the weekend and will continue that way into Wednesday

o

Showers will begin in the far southwest late this week and during the weekend

- The

moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- North

Africa received a few showers during the weekend, but not enough rain fell to disrupt any late season harvesting of winter crops

o

A few other showers of limited significance will occur during the next ten days

- Argentina

weather during the weekend was dry and mild to cool in most of the nation

o

Late season summer crop harvesting advance well as did wheat planting

o

As of last Thursday, cotton harvesting was 68% done compared to 92% last year; corn was 58% complete compared to 78% the previous year, peanuts were 74% harvested compared to 96% in 2020, dry bean harvesting was complete on 65%

of the acreage which compared to 63% last year and sorghum harvesting was 81% done compared to 89% in 2020

- Barley

and wheat planting was 47% complete - Argentina

rainfall during the next ten days will be mostly confined to the northeast where 0.50 to 1.50 inches and locally more may fall from brief periods of rain late this week and again late next week

o

Most other winter crop areas will be dry allowing fieldwork to advance without weather related delay

- There

is need for rain in western and some southern winter crop areas, but the situation is not critical

o

Temperatures will be seasonable

- Brazil

rain during the weekend was greatest from southeastern Paraguay through far southern Mato Grosso do Sul, Parana, Santa Catarina and northern Rio Grande do Sul to southern Sao Paulo

o

Amounts ranged from 0.50 to 2.35 inches except at Florianopolis where nearly 5.00 inches resulted

o

Temperatures were cool in the south and mild to warm in the north

- Brazil

will experience alternating periods of rain and sunshine in southern parts of the nation through the next ten days while most areas to the north remain seasonably dry

o

The moisture will be good for wheat and other winter crops

o

Safrinha crops will gradually mature and be harvested during this period of time, although Cotton will continue to fill bolls in some areas

o

Harvesting of sugarcane, coffee and citrus will advance well

- Southeast

Canada corn, soybean and wheat areas will receive some periods of rain this week and temperatures will be seasonable

- Rain

fell in many southeastern Canada crop areas Friday into Sunday with amounts varying from 0.20 to 0.65 inch and a few amounts to 1.07 inches

o

Highest temperatures were in the 70s and lower to a few middle 80s Fahrenheit

- Mexico

rainfall will continue in southern parts of the nation over the coming week while some rain expands into the interior far west

o

Rain should increase and advance to the north during the June 26-July 2 period, but it will be erratic

- Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at -3.17 and the index is expected to trend a little lower this week - New

Zealand rainfall during the coming week to ten days will be a little lighter than usual in eastern South Island and near to above normal in the west while a good mix of rain and sunshine occur in North Island

o

Temperatures will be near to above average

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Monday,

June 21:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions — corn, cotton, soybeans, wheat, 4pm - Monthly

MARS report on EU crop conditions - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

June 22:

- Copersucar,

one of Brazil’s top sugar and ethanol exporters, holds presser on the market’s outlook - Future

Food-Tech’s Alternative Proteins Summit, day 1 - OECD

to release agricultural policy evaluation report - U.S.

cold storage data – pork, beef, poultry, 3pm

Wednesday,

June 23:

- EIA

weekly U.S. ethanol inventories, production - Future

Food- Tech’s Alternative Proteins Summit, day 2

Thursday,

June 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, poultry slaughter, red meat production, 3pm

Friday,

June 25:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia

June 1-25 palm oil export data - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

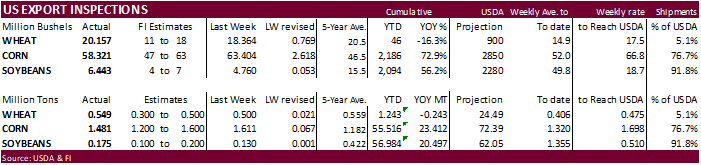

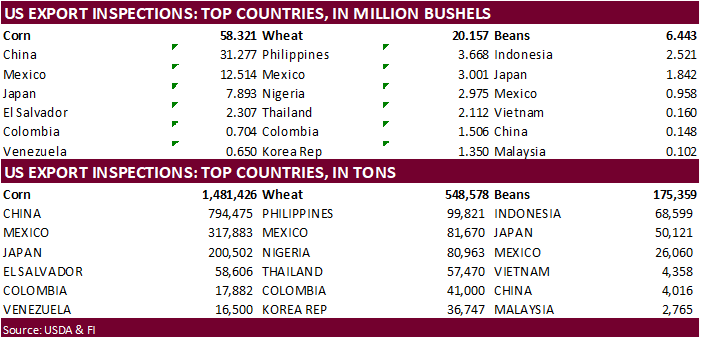

USDA

inspections versus Reuters trade range

Wheat

548,578 versus 300000-525000 range

Corn

1,481,426 versus 1200000-1625000 range

Soybeans

175,359 versus 100000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 17, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/17/2021 06/10/2021 06/18/2020 TO DATE TO DATE

BARLEY

73 710 0 783 367

CORN

1,481,426 1,610,533 1,305,824 55,515,995 32,103,601

FLAXSEED

0 0 24 0 24

MIXED

0 0 0 0 0

OATS

0 0 100 0 300

RYE

0 0 0 0 0

SORGHUM

18,330 151,740 110,459 6,436,284 3,852,299

SOYBEANS

175,359 129,536 255,810 56,983,618 36,486,985

SUNFLOWER

0 0 0 240 0

WHEAT

548,578 499,774 686,036 1,242,837 1,485,594

Total

2,223,766 2,392,293 2,358,253 120,179,757 73,929,170

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

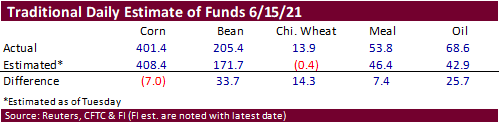

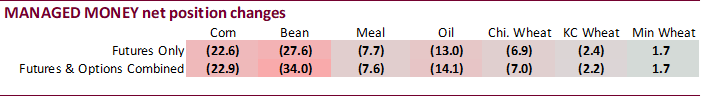

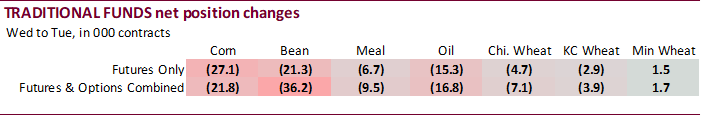

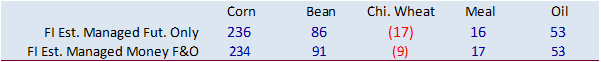

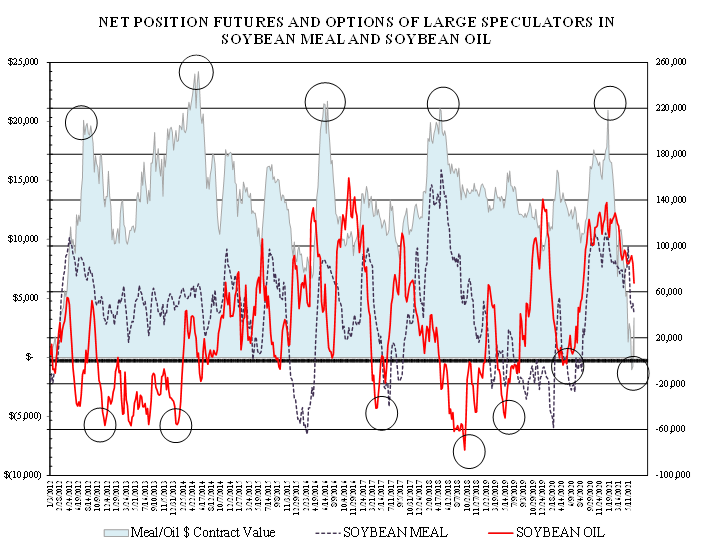

Money

managers were not as long in corn but were much more long than expected for soybeans, soybean oil, meal and Chicago wheat. This comes after they reduced long positions for the major agricultural commodities for the week ending 6/15. We see this as slightly

supportive, but with the one business day in reporting, some traders may look past the positions as we are four trading days beyond actual data.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

213,016 -23,542 432,760 5,983 -606,016 35,404

Soybeans

61,643 -33,417 184,081 32 -236,409 45,354

Soyoil

40,429 -14,309 122,040 -1,373 -177,669 17,979

CBOT

wheat -44,886 -8,252 160,564 2,423 -107,435 7,539

KCBT

wheat 1,944 -3,096 62,228 -299 -59,161 6,635

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

252,730 -22,868 239,446 3,649 -567,686 35,964

Soybeans

107,492 -33,991 86,751 1,318 -208,124 46,900

Soymeal

19,092 -7,628 87,809 3,648 -154,785 7,402

Soyoil

67,226 -14,093 118,141 3,737 -201,079 15,364

CBOT

wheat -8,396 -7,022 76,762 128 -77,838 8,699

KCBT

wheat 17,487 -2,226 43,084 1,902 -52,907 5,206

MGEX

wheat 15,298 1,708 3,301 -635 -27,909 141

———- ———- ———- ———- ———- ———-

Total

wheat 24,389 -7,540 123,147 1,395 -158,654 14,046

Live

cattle 63,573 10,633 86,205 -184 -161,038 -7,769

Feeder

cattle 4,378 1,105 6,756 97 -1,249 -89

Lean

hogs 86,503 1,882 63,768 337 -155,685 -1,880

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

115,268 1,100 -39,760 -17,846 2,538,875 -20,169

Soybeans

23,196 -2,257 -9,315 -11,969 1,165,967 -29,894

Soymeal

21,322 -1,903 26,562 -1,519 468,746 5,463

Soyoil

511 -2,709 15,201 -2,298 662,386 -5,074

CBOT

wheat 17,714 -95 -8,243 -1,710 532,513 7,918

KCBT

wheat -2,654 -1,642 -5,010 -3,239 222,545 -5,092

MGEX

wheat 1,129 -49 8,181 -1,164 88,059 -451

———- ———- ———- ———- ———- ———-

Total

wheat 16,189 -1,786 -5,072 -6,113 843,117 2,375

Live

cattle 24,402 751 -13,142 -3,430 341,491 2,474

Feeder

cattle 2,024 460 -11,909 -1,572 49,444 57

Lean

hogs 15,202 1,005 -9,788 -1,344 389,751 8,034

=================================================================================

Source:

Reuters, CFTC, & FI

Macro

68

Counterparties Take $765.141 Bln At Fixed-Rate Reverse Repo (prev $747.121 Bln, 61 Bidders)

- US

corn futures opened lower, but the July spot contract paired losses and trade higher by mid-morning on technical buying and a rebound in outside markets. July gave up gains by early afternoon but rallied late session to close 4 cents higher (modifies up 5.25

cents). - US

equities rallied and WTI crude oil rebounded to traded sharply higher. The USD was weaker, down 36 points by 1:39 pm CT. Improving US weather pressured the back months. December ended 9.25 cents lower. Fundamental news was light. Argentina was on holiday.

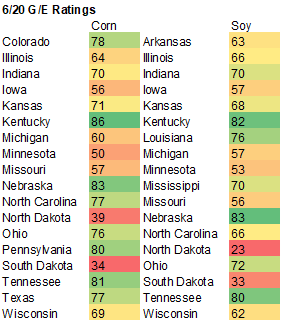

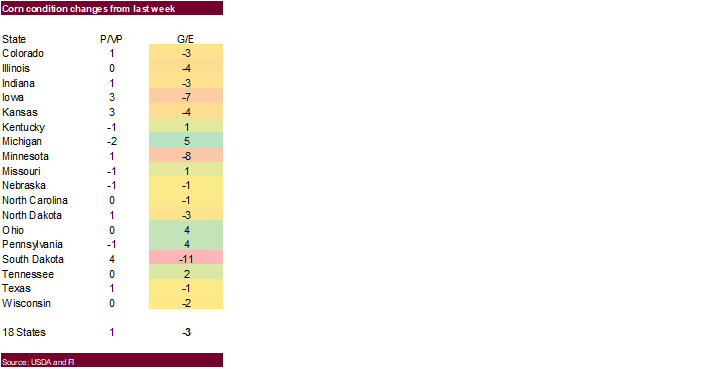

- US

corn conditions were down 3 points, one point lower than expected. - We

dropped our corn yield to 177.8 bu/ac from 179.5 week ago and lowered corn production by 145 million to 15.162 billion. USDA is at 14.990 billion.

- Midday

outlook for today through Saturday confirmed expected good rain for the heart of the US, but also a drier pattern than that over the past weekend, allowing for conditions to improve.

- Cooler

US temperature this week should slow evaporation rates for parts of the US WCB. Note 41 percent of IA growing regions was experiencing some type of drought as of last week. Most of IA saw rain over the weekend but more is needed to stabilize and/or improve

crop conditions. - Funds

sold an estimated net 4,000 corn contracts on Monday.

- Volatility

remains very high (near ten year high). - USDA

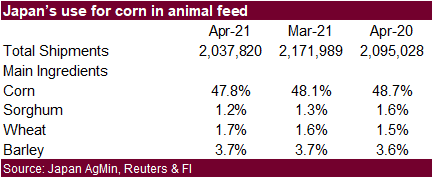

US corn export inspections as of June 17, 2021 were 1,481,426 tons, within a range of trade expectations, below 1,610,533 tons previous week and compares to 1,305,824 tons year ago. Major countries included China for 794,475 tons, Mexico for 317,883 tons,

and Japan for 200,502 tons. - Bloomberg

noted earlier that “lean hog futures for August delivery fell by the exchange limit. Prices over the last six sessions are down 11%, the biggest such drop since June 2020.” They paired some losses by noon CT.

- Crop

tours should kick off next month for the NA summer crops. Note ProFramer corn and soybean tour is August 16-19. The spring wheat crop tour starts July 26.

Export

developments.

Updated

6/17/21

July

corn seen in a $5.50 and $7.00 range

September

$5.00 and $6.75

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

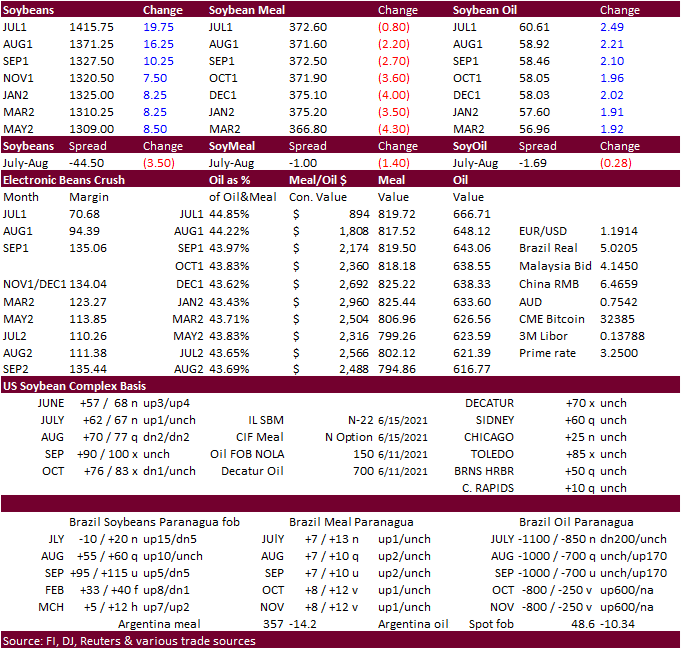

The

US soybean complex opened lower on favorable weekend US weather and expectations for US soybean conditions to start to stabilize. The front month soybean contracts rallied after it was confirmed China bought US soybeans last week, and a rebound in soybean

oil (saw help from higher energy prices). Back months ended higher as well despite improving US weather. Soybean meal was on the defensive from product spreading. The US ECB is in good shape and WCB improved from widespread rains over the weekend. Many

growing areas across the upper Midwest also saw beneficial rains. We expect the US drought monitor to show less extreme dry conditions when released Thursday morning. Some traders noted the long-term US weather forecast calls for net drying, something to

monitor in coming days. -

US

soybean conditions were down 2 points, in line with expectations. -

We

are using a 51.4 yield (51.7 previous) and 4.552 billion production (down 27 million from previous).

-

USDA

reported 336,000 tons of soybeans for China (2021-22) and 120,000 tons of soybeans for unknown (2021-22).

-

Commercial

hedging was light today. Argentina was on holiday. -

Funds

on Monday bought an estimated net 7,000 soybean contracts, sold 1,000 soybean meal and bought 9,000 soybean oil contracts.

-

We

see strong support for July soybeans at $12.94 and November at $11.60 (well below current value). After today we are pretty far from those levels.

-

USDA

US soybean export inspections as of June 17, 2021 were 175,359 tons, within a range of trade expectations, above 129,536 tons previous week and compares to 255,810 tons year ago. Major countries included Indonesia for 68,599 tons, Japan for 50,121 tons, and

Mexico for 26,060 tons. -

Brazil

is expected to plant a record 40 million hectors of soybeans for the 2021-22 crop, up from 37.8 million hectares this year, according to farmer group Aprosoja. That’s a potential +140MMT crop using a 3.530 yield. Conab pegged this year’s crop at 135.86 million

tons. -

Additional

China trade data statistics were released. China imported 9.23 million tons of Brazil soybeans in May, up from 5.08 million tons in April (15.66 tons Jan-May from Brazil). China also imported 244,431 tons from the US.

-

China

cash crush margins are nearly unchanged from the previous week and unfavorable when using the imported price of US spot soybeans.

-

Agriculture

and Agri-Food Canada last week estimated Canadian canola production for 2021-22 unchanged at 20.050 million tons, up from current crop-year 18.720 million tons. They have the 2021-22 carryout at 750,000 tons, up from 700,000 for 2020-21. We also look for Canadian

canola stocks to end up below 1 million tons for 2020-21, tightest carryout in years. For 2019-20 the carryout was 3.131 million tons. Soybean production for 2021-22 was pegged at 6.225 million tons, down from 6.359 million for 2020-21.

-

Cargo

surveyor SGS reported month to date June 20 Malaysian palm exports at 962,184 tons, 96,948 tons above the same period a month ago or up 11.2%, and 255,172 tons below the same period a year ago or down 21.0%. This reported monthly change is very different

from the other 2 major trade reporting groups. ITS reported Malaysian palm oil exports for the June 1-20 period at 945,745 tons, down 0.8% from the same period a month ago. AmSpec reported a 1.8% decrease for June 1-20 palm oil exports to 937,135 tons.

-

(Reuters)

– “Indonesia will change its palm oil export levy scheme to reduce the highest rate to $175 per ton soon, Finance Minister Sri Mulyani Indrawati said on Monday, compared with $255 per ton under the current rules. A new regulation will soon be issued for authorities

to collect a $50 per ton export levy when crude palm oil prices reach a minimum of $750 per ton, she said. For every $50 increase in prices, the levy will rise by $20 for crude palm oil and $16 for derivative products, but there will be a ceiling rate of $175

when CPO prices go above $1,000.“

- WASHINGTON,

June 21, 2021–Private exporters reported to the U.S. Department of Agriculture the follow activity:

–Export

sales of 336,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

–Export

sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

-

Egypt

seeks soybean oil and sunflower oil on June 22 for September 5-30 arrival.

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

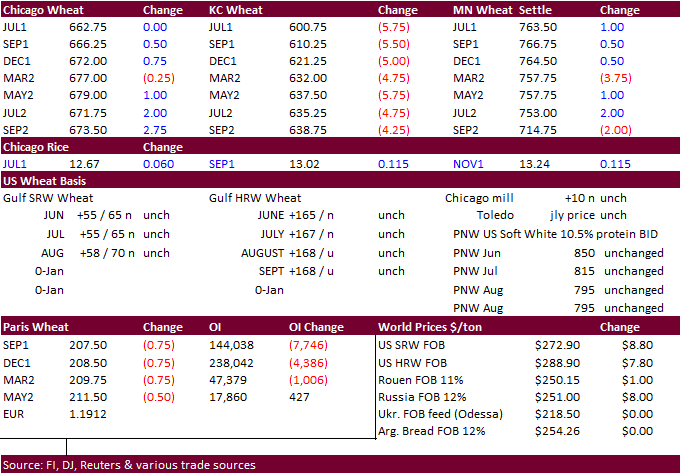

- US

wheat futures started lower following weakness in corn and soybeans. Losses were paired led by Chicago on a sharply lower USD and support in outside commodity markets. But lower KC wheat pulled Chicago mostly lower. MN ended higher on spring wheat production

concerns. News and export developments were light over the weekend. Harvesting pressure was a main feature for lower KC prices.

-

US

spring wheat conditions were down 10 points, 8 points lower than what was expected.

- US

winter wheat conditions were up 1 point, one point above an average trade guess.

- US

winter wheat harvest was reported at 17 percent, one point above expectations.

- Expect

US winter wheat harvesting progress to peak in about 2 weeks, weather permitting.

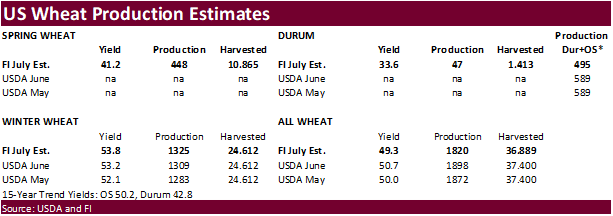

- We

left our US winter wheat production estimate unchanged at 1.325 billion, above 1.309 USDA June.

- Our

US spring wheat production was lowered to 448 million (478 previous) and durum to 47 million (51 previous. Combined OS and durum is 495 million, below 529 previous and well below USDA’s working estimate of 589 million.

- Funds

on Monday

bought

an estimated net 1,000 SRW wheat contracts. - USDA

US all-wheat export inspections as of June 17, 2021 were 548,578 tons, above a range of trade expectations, above 499,774 tons previous week and compares to 686,036 tons year ago. Major countries included Philippines for 99,821 tons, Mexico for 81,670 tons,

and Nigeria for 80,963 tons. - September

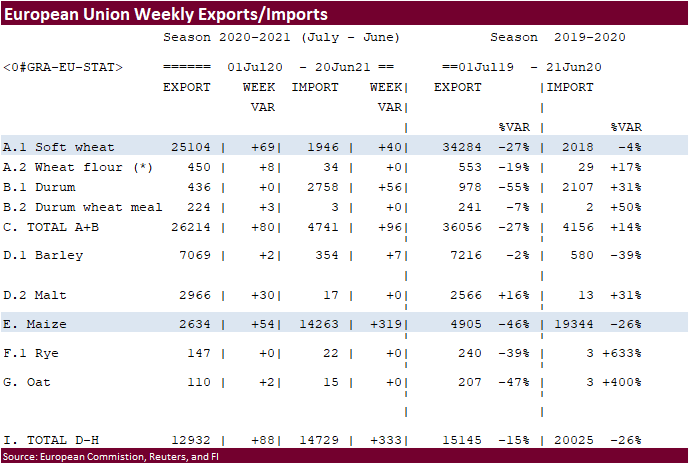

Paris wheat tested a 3-week low earlier today, but the contract paired some losses to close down 1.00 euro, or 0.5%, at 207.25 euros a ton. The lower USD, higher Euro weighed on prices.

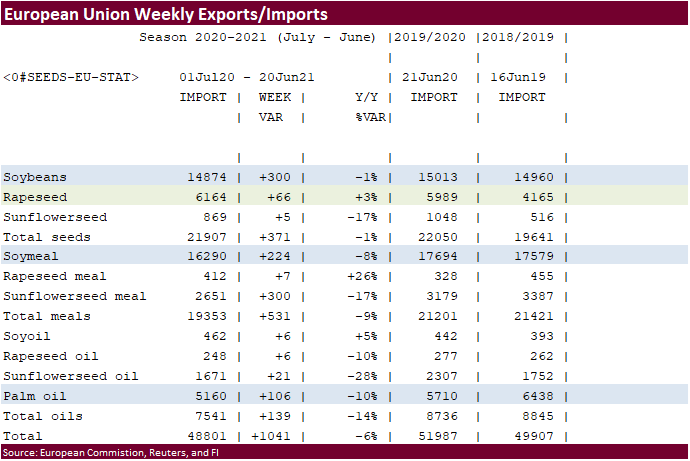

- EU’s

crop monitoring service estimate the soft wheat yield at 6.01 tons per hectare, up from 5.91 previous and 5.6% above average. Barley was pegged at 4.97 vs, 4.89/tons per hectare. Corn was raised to 7.84 from 7.81 by MARS. Rapeseed was 3.23 from 3.21 in

May. - Russian

wheat exports so far this crop-year are running about 10 percent above year ago. Grain exports could reach above 48.5 million tons. 38 million of wheat had been shipped as of mid-June.

- Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

- None

reported

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.