PDF Attached

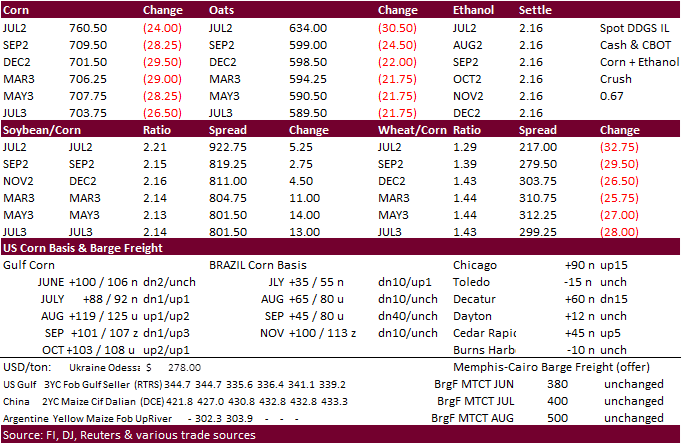

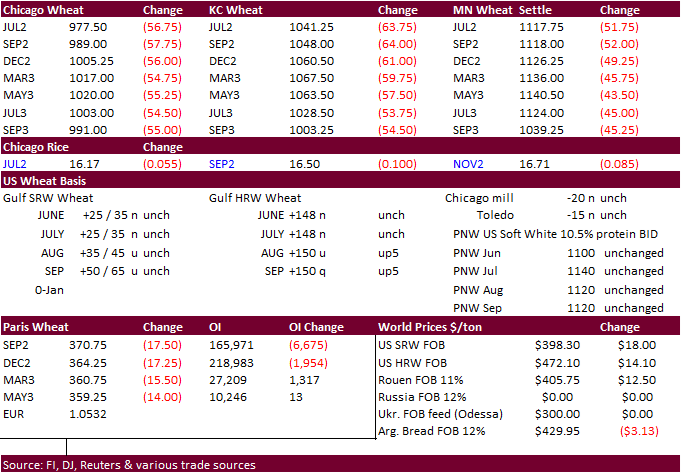

CBOT

agriculture markets traded sharply lower on expectations for improving US weather, easing inflation concerns food), and demand destruction. The US high pressure ridge will shift west over the next couple of weeks, improving rainfall changes. There are several

import tenders on deck for wheat. And more are expected if futures prices continue to selloff.

Source:

Reuters and FI

Source:

Reuters and FI

7-day

past precip

WEATHER

EVENTS AND FEATURES TO WATCH

- Improvements

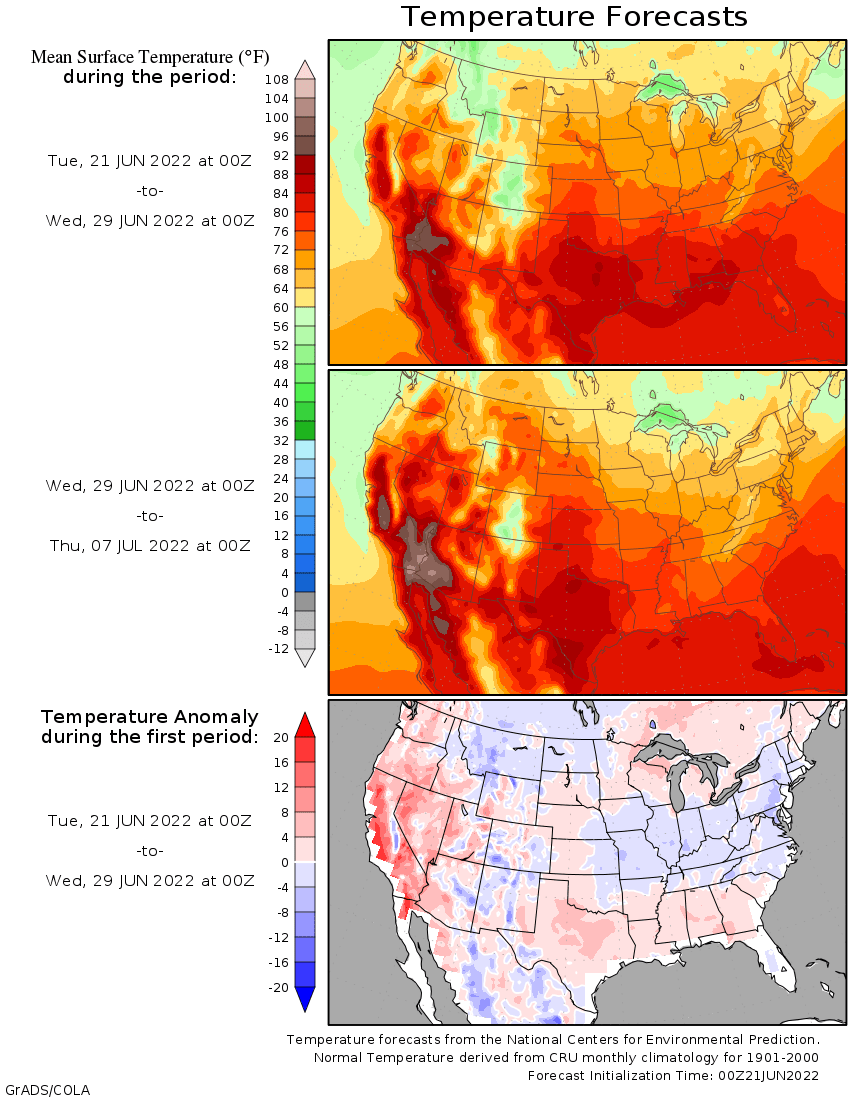

in many world weather trouble spots in today’s forecast model runs will likely leave some bearishness in market mentality, although U.S. concerns will continue with restricted rainfall in this first week of the outlook - North

America’s high pressure ridge that brought excessive heat to the U.S. Plains, southeastern Canada’s Prairies, the U.S. Midwest, Delta and southeastern states will be breaking down this week, although the base of the ridge will remain over the southern Plains,

Delta, Tennessee River Basin area and parts of the southeastern states limiting rainfall for another week and keeping those areas very warm to hot - Limited

eastern U.S. Midwest rainfall is also expected in this week - The

North America high pressure ridge will relocate to the west in the Rocky Mountain and high Plains region next week and several models suggest it may remain over that region into weeks 3 and 4 - This

implies less heat for the Midwest and an opportunity for showers and thunderstorms as time moves along, but this first week’s rainfall may be limited to the northern Plains, Upper Midwest and a few areas in the central Plains - Europe

is expecting rain and cooler weather after excessive heat and dryness during the weekend - Ukraine

and western parts of Russia’s Southern Region will have a better chance for rain later this week and especially next week - Rain

is due for the North China Plain this weekend and especially next week easing long term dryness - India’s

monsoon is expected to perform more favorably next week with restricted rain continuing for a while this week

- Weekend

high pressure ridge over U.S. Midwest and Great Plains kept temperatures hot and restricted rain - Highest

afternoon temperatures in the Plains and western Corn Belt were in the 90s to 105 degrees Fahrenheit; hottest in the Plains - Eastern

U.S. Midwest temperatures during the weekend were mostly in the 70s and 80s, but warming occurred Monday pushing afternoon temperatures into the 80s and some 90s - Nighttime

lowest temperatures during the weekend were in the upper 40s and 50s in the Midwest, but in the 60s and lower 70s in the Plains and far western Corn Belt

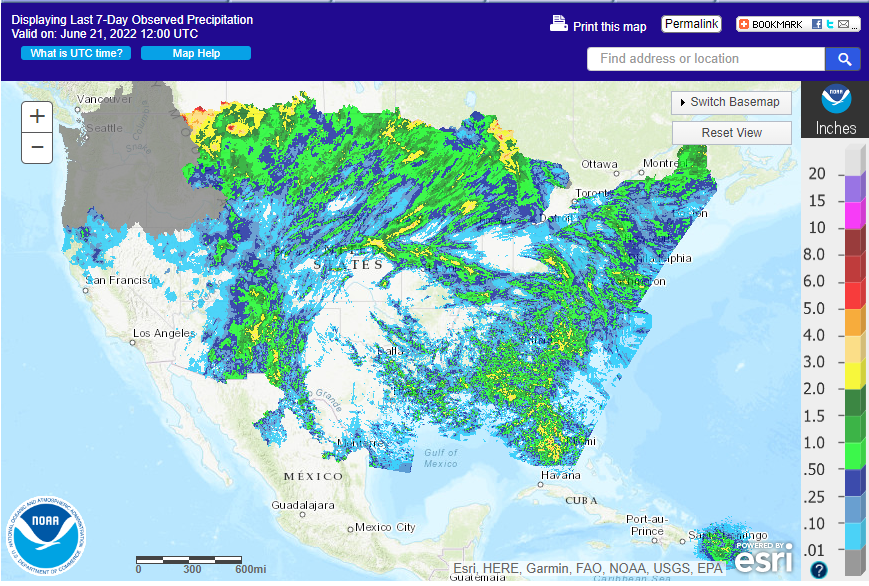

- Key

U.S. crop areas get minimal amounts of rain and continued to dry out during weekend - North

America high pressure ridge responsible for weekend heat and dryness will break down over the coming week, but cooling will be gradual, and temperatures are unlikely to drop below average - Hottest

in the central and southern Plains and Midwest today and possibly again in the Plains only Thursday and Friday 90-degree highs are expected once again - A

couple of extreme highs near 100 are also possible - The

Midwest will be hottest today and again Saturday - Lower

U.S. Midwest, Southern Plains, Delta and southeastern states will be the most consistently warm region with daily highs throughout the week in the 90s to near 100.

- This

region will steadily dry down over this coming week and the need for rain will steadily rise along with crop moisture stress - Driest

first week of the forecast will be in the southern U.S. Plains, Delta, Tennessee River Basin and eastern Midwest - Steadily

declining soil moisture is expected through the weekend in these areas, despite a few showers of limited significance - Northern

U.S. Plains and upper Midwest will receive timely this week to support crop development

- This

includes the Dakotas and Minnesota - Iowa

rain expected Thursday night Into early Saturday morning, but until then net drying is expected - Wisconsin

may also get some timely rainfall late this week - Kansas

rainfall is possible periodically this week and some of it will be locally heavy with some potential for hail and damaging wind - West

Texas rainfall is expected to remain very limited during the next two weeks

- Some

rain will fall in the Texas Panhandle, but that which falls farther to the south will not likely be enough to counter evaporation - West

Texas, the Texas Blacklands and Coastal Bend areas will be mostly dry this week, but could receive showers of limited significance next week - Week

two, three and four North America outlooks by the GFS, European, CFS, European Ensemble and GFS Ensemble models all place the ridge of high pressure out to the west in North America

- Most

models keep the ridge either over the Rocky Mountains or in the western high Plains region - This

creates a northwesterly flow of air aloft for the U.S. Midwest Corn and Soybean Belt and periods of showers and thunderstorms - Rainfall

might not be greater than usual, but at least there would be precipitation occasionally if the models are correct - Some

locally heavy rain would likely result especially once the ridge has been to the west for a little while - This

outlook should reduce market concern over poor crop and field conditions, but keep in mind that Gulf of Mexico is not open as a good moisture source for a while and that could still leave rainfall below average – certainly for the this first week of the outlook

- World

Weather, Inc. is not convinced the ridge will remain as far to the west as advertised through the next few weeks, but it will be out there for a while - Pacific

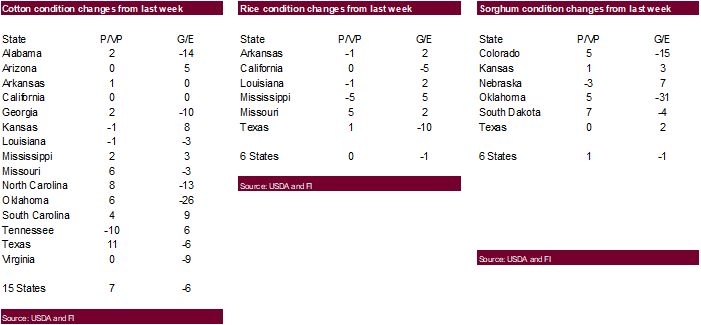

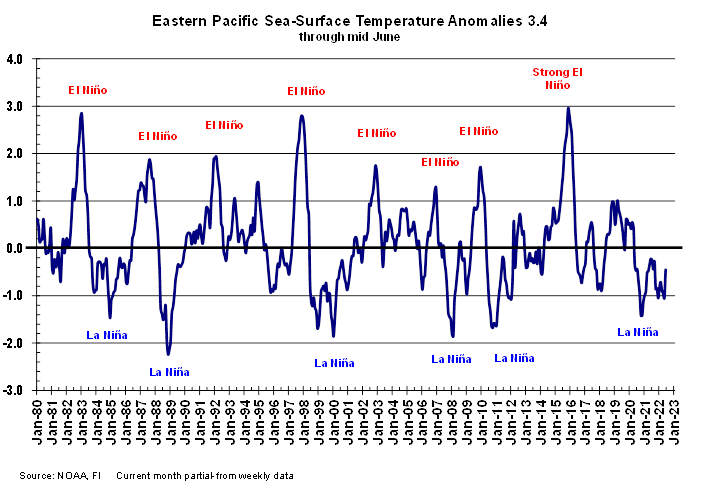

Decadal Oscillation is still significantly negative and predicted to move more negative in the next ten days - La

Nina is expected to continue to remain just strong enough to counter some of the PDO influence, but as soon as La Nina weakens more significantly the ridge may be allowed to move to the east - Europe

weekend precipitation was minimal, and temperatures were warm to hot in the west

- Highest

temperatures were in the 90s to 106 degrees Fahrenheit from Spain through France to Germany and parts of Spain - Crop

moisture and heat stress evolved - Livestock

stress also reached a peak briefly during the weekend - Relief

came Monday with some cooling and scattered showers and thunderstorms in central and northwestern France, southern parts of the U.K. and a few areas in Germany - Europe

will experience cooling with periods of rainfall during the next ten days - The

precipitation will not be evenly distributed, and more rain may be needed in several areas - The

North Sea region may be one of the drier areas along with some areas in the Mediterranean region - CIS

precipitation has been most restricted in Ukraine, Russia’s Southern Region and western parts of Kazakhstan where soil conditions are drying out - Rain

is predicted later in this coming week for central and eastern Ukraine and western portions of Russia’s Southern Region resulting in improved crop and field conditions

- The

lower Volga River Basin and western Kazakhstan will likely remain drier than usual, but at least “some” relief will occur to the west

- Excessive

rain continued to impact southern China during the weekend with amounts varying from 7.00 to more than 25.00 inches resulting in parts of eastern Jiangxi , northeastern Fujian and southern and western Zhejiang - One

location in the northern Guangdong reported more than 46.00 inches since dawn Friday - Flooding

continues a serious problem in parts of the far south

- Locally

heavy rain also occurred near the Inner Mongolia/Liaoning border and in northwestern Jilin, China where upwards to nearly 10.00 inches resulted in a couple of locations - Rainfall

elsewhere in China was more limited with the North China Plain and central Yellow River Basin staying dry with crop stress prevailing - Some

of the dry areas in the North China Plain will get rain in the next two weeks with the greatest amounts expected in Shandong during the workweek and in other areas late this weekend into early next week - Much

improved crop conditions are anticipated - Southern

China flooding rain should subside greatly during the coming week, although some rain is expected to linger for a little while - The

drier weather will be extremely welcome, although it will take a while for all of the flooding to subside and for the damage to be assessed - India’s

monsoon continued to perform poorly during the weekend, but greater rain started to occur in central parts of the nation Monday.

- Some

locally heavier rain was noted in Madhya Pradesh where local totals varied from 4.00 to more than 6.00 inches.

- Northern

parts of the nation received some welcome rain along with northern Pakistan - Bangladesh

and the far Eastern States of India were wettest with local totals over 9.00 inches

- India’s

monsoonal rainfall is expected to continue improving this week and next week, but this week’s totals will still be below average except in Maharashtra and Madhya Pradesh where near to above normal amounts are likely - Australia

weather will be good for fieldwork; including the planting of winter wheat, barley and canola during the next week - There

is potential for generalized rain in Queensland next week, but there is no good agreement in the models - The

moisture may delay farming activity - Canada’s

Prairies will receive a favorable mix of rain and sunshine during the next two weeks

- Crop

development will continue to advance relatively well - Central

and south-central Saskatchewan has the greatest need for rain - Ontario

and Quebec weather should be favorably mixed over the next two weeks - A

little drier and warmer bias would be most welcome and that is exactly what is expected - South

Korea rice areas continue critically dry and are in need of rain - Waves

of rain are expected June 23-30 that should seriously improve soil moisture

- Some

flooding might evolve - A

tropical cyclone may evolve in the western Pacific Ocean east of the Philippines next week that could threaten Taiwan, China, the Korean Peninsula or Japan late next week - A

second storm will evolve north of Guam next week as well - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week - Western

Argentina will remain mostly dry through much of the coming ten days - At

least some rain is needed in all wheat areas in the nation, although subsoil moisture is still rated well in the east

- Southern

Brazil began receiving additional rain Sunday and it was expected to continue through the middle part of this week

- Drying

is needed to support Safrinha crop maturation and harvest progress - Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast - Mexico’s

monsoonal rainfall will be erratic, but it will improve somewhat this week

- Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar - Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - South

Africa’s rain this week will be good for wheat, barley and canola emergence and establishment - Some

disruption to fieldwork is expected, but next week will be dry biased once again - Central

America rainfall will be abundant during the next ten days - Tropical

Storm Blas dissipated off the central western Mexico coast Monday - Tropical

Depression Celia will move northwest while intensifying off the west coast of Mexico, but the system will be too far from land to have much impact - Today’s

Southern Oscillation Index was +16.39 and it will move erratically over the coming week - New

Zealand rainfall will be lighter than usual over the next week, but recent past precipitation has the ground saturated.

Bloomberg

Ag Calendar

Tuesday,

June 21:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

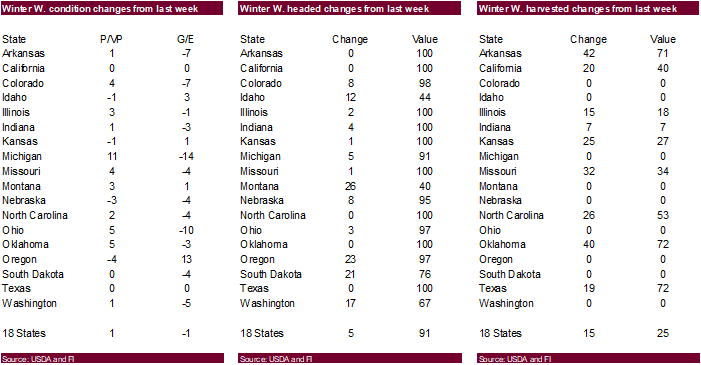

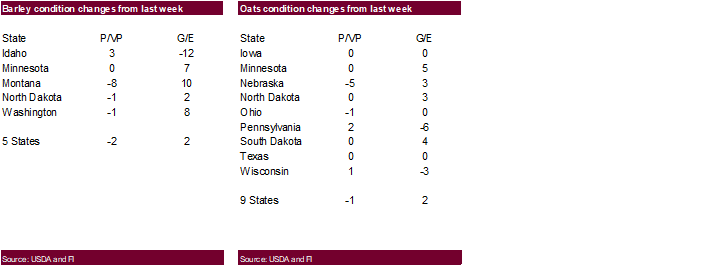

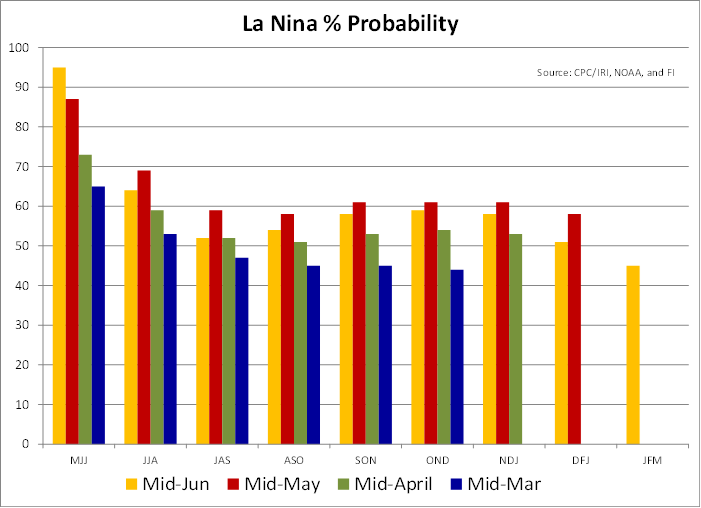

crop planting data for soybeans and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - European

Food Safety Authority’s One Conference on food safety, Brussels and online, June 21-24 - New

Zealand global dairy trade auction - USDA

total milk production, 3pm - EU

weekly grain, oilseed import and export data

Wednesday,

June 22:

- Specialty

& Fine Food Asia trade show June 22-24 in Singapore

Thursday,

June 23:

- EIA

weekly U.S. ethanol inventories, production, 11am - US

cold storage data for beef, pork and poultry, 3pm - USDA

world coffee report - International

Grains Council’s monthly report - USDA

red meat production, 3pm

Friday,

June 24:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions - Brazil’s

Unica to release cane crush and sugar output data (tentative) - US

cattle on feed, poultry slaughter - HOLIDAY:

New Zealand

Source:

Bloomberg and FI

USDA

inspections estimates via Reuters

Wheat

300000-500000

Corn

600000-1300000

Soybeans

300000-625000

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 16, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/16/2022 06/09/2022 06/17/2021 TO DATE TO DATE

BARLEY

0 0 73 0 783

CORN

1,184,268 1,221,332 1,775,716 46,162,509 55,995,028

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 0 0 0 0

RYE

0 0 0 0 0

SORGHUM

71,415 140,248 18,378 6,540,435 6,441,292

SOYBEANS

427,344 608,116 205,645 50,903,522 57,254,057

SUNFLOWER

0 0 0 2,260 240

WHEAT

331,328 411,916 554,712 969,953 1,249,142

Total

2,014,355 2,381,612 2,554,524 104,578,679 120,940,542

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

Existing Home Sales Change May: 5.41M (est 5.40M; prev R 5.60M)

–

Existing Home Sales (M/M): -3.4% (est -3.7%; prev R -2.6%)

–

Median Home Price (USD): 407.6K Or +14.8% (prev 391.2K Or +14.8%)

Canada

Retail Sales (M/M) Apr: 0.9% (est 0.8%; prev 0.0%)

–

Retail Sales Ex Auto (M/M) Apr: 1.3% (est 0.6%; prev 2.4%)

livesquawk

Philadelphia Fed Non-Manufacturing Regional Business Activity Index 4.6 In June VS 23.4 In May

–

Non-Manufacturing Firm-Level Business Activity Index 24.7 In June VS 22.8 In May

–

Non-Manufacturing New Orders Index 15.5 In June VS 3.9 In May

–

Non-Manufacturing Full-Time Employment Index 27.7 In June VS 15.3 In May

–

Wage And Benefit Cost Index 60.5 In June VS 56.8 In May

EIA:

US Crude Oil Refining Capacity Fell By 126K Bpd In 2021

97

Counterparties Take $2.189 Tln At Fed Reverse Repo Op (prev $2.229 Tln, 103 Bids)

·

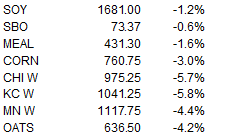

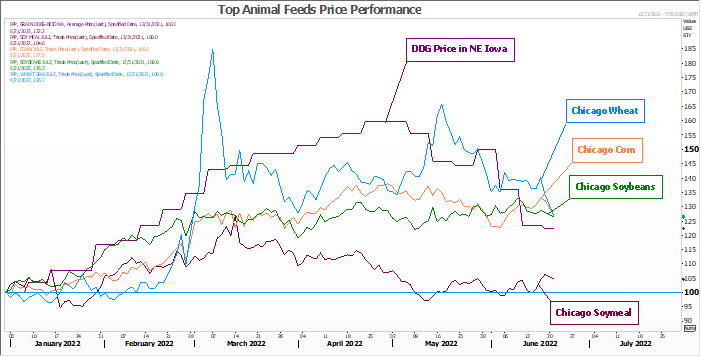

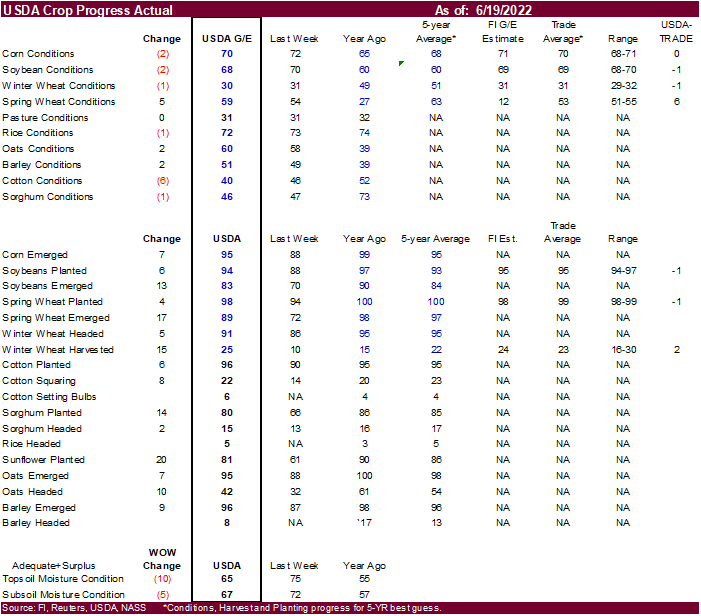

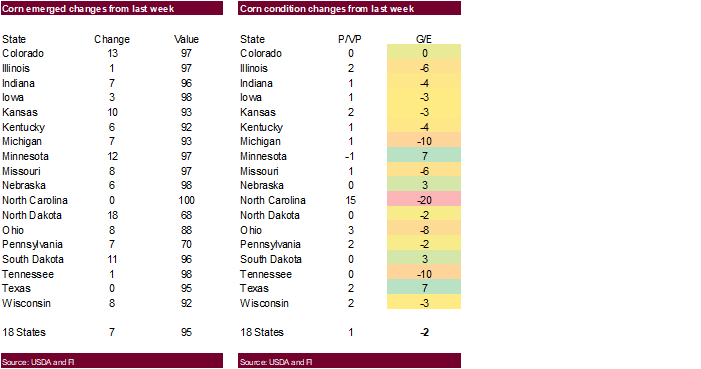

US corn futures were sharply lower after hitting a one-month high last week as concerns over extreme heat abating with a weather forecast calling for the US ridge to shift west over the next two weeks.

Cooler temperatures and increasing changes for rain should be good for the US corn crop. But for the near term, expect the US warm temperatures to stress some of the corn crop.

·

July corn hit it lowest level since June 7.

·

Funds sold an estimated net 21,000 corn contracts, largest single day sale since June 1.

·

WTI crude oil was +$1.00 higher after 2 pm CT.

·

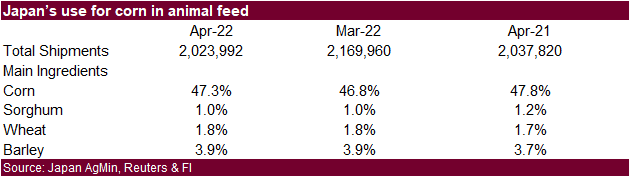

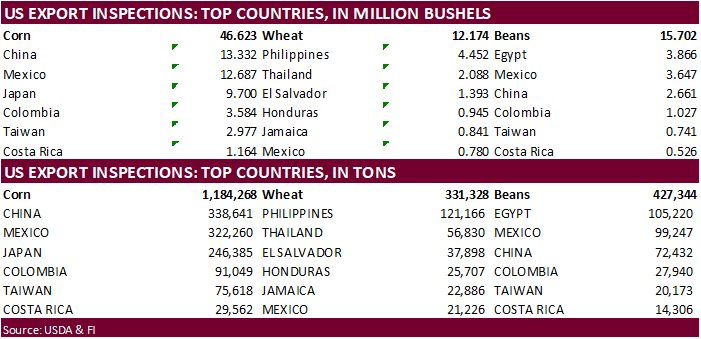

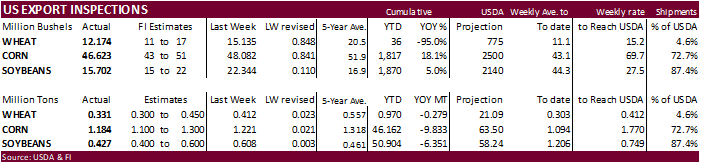

USDA US corn export inspections as of June 16, 2022 were 1,184,268 tons, within a range of trade expectations, below 1,221,332 tons previous week and compares to 1,775,716 tons year ago. Major countries

included China for 338,641 tons, Mexico for 322,260 tons, and Japan for 246,385 tons.

·

Bloomberg – June 1 herd seen rising y/y to 11.89m head, according to a Bloomberg survey of nine analysts. That would be the sixth consecutive month of y/y increases</li><li>May placements seen unchanged

from a year ago

·

China’s corn imports from Ukraine in May fell to only 126,727 tons, down from 1.26 million tons a year ago. China imported 695,585 tons of corn from Ukraine in April. China imported 1.9 million tons of

corn from the US in May, up slightly from 1.89 million tons a year ago.

·

China January – May US corn imports: 6.37 (6.67 year ago) and Ukraine: 4.82 (4.99 year ago).

·

Brazil corn exports are up during the January through May period. The southern port of Paranagua rose 161% in the first five months of the year to 1.546 million tons, up from 591,538 tons previous year.

·

Agroconsult held a crop Brazilian crop tour and found its corn production estimates higher than originally thought. 89.3 million tons of second corn was seen this season, more than the 87.6 million tons

forecast in May. The total crop was estimated at 114.8 million tons.

·

Anec looks for Brazil corn exports to reach 1.758 million tons, slightly down from 1.793 million in previous week.

·

The White House may roll out a US gas tax holiday, another move to ease high gas prices. Gasoline stocks have been down the last 11 consecutive weeks.

Wolf

Administration suspends Pennsylvania’s biodiesel fuel requirement

Export

developments.

·

None reported

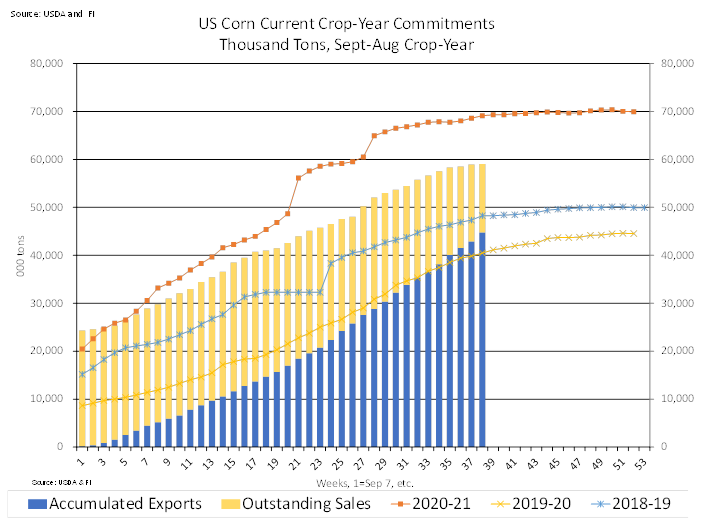

US

corn commitments

are running below year ago level.

Updated

6/14/22

July

corn is seen in a $7.00 and $8.25 range

December

corn is seen in a wide $5.75-$8.25 range

·

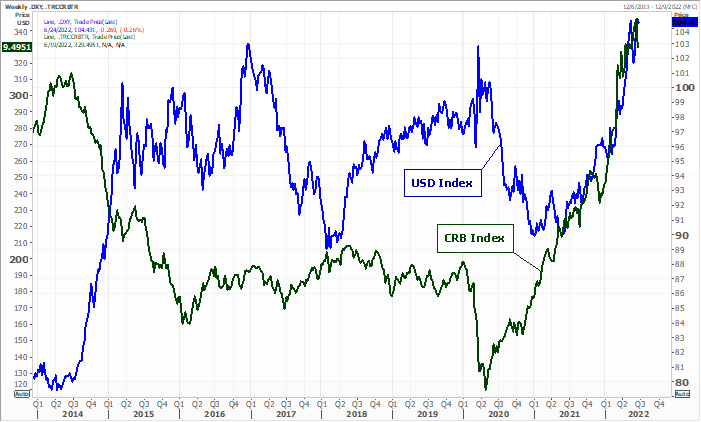

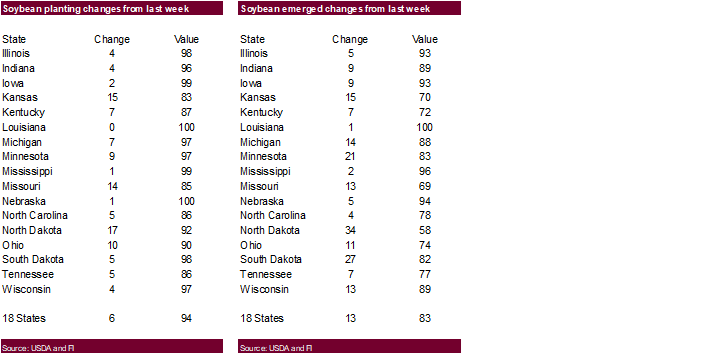

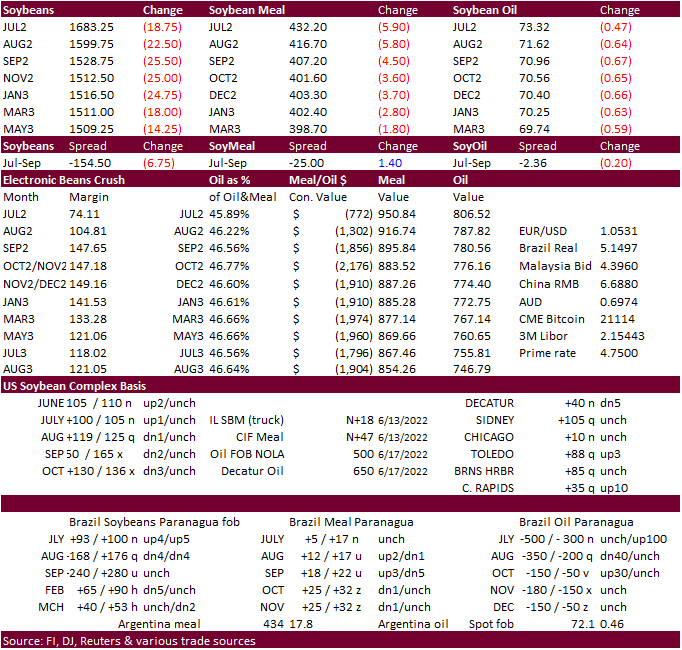

CBOT soybeans, meal and oil ended lower from demand destruction, inflation concerns, improving US weather and technical selling. Palm oil was sharply lower at the start of the week from improving production

and Indonesia increasing CPO exports. The July soybean oil contract traded below its 100-day MA for the first time since December, ending below that level. Losses in soybean meal increased after the open on product spreading despite firm US meal basis. July

soybeans traded below its 50-day MA but ended at near that level.

·

Funds sold an estimated net 12,000 soybeans, 4,000 meal and 2,000 soybean oil.

·

Euronext rapeseed for the August position was down 21.25 euros to 719.75, or 2.9%.

·

USDA US soybean export inspections as of June 16, 2022, were 427,344 tons, within a range of trade expectations, below 608,116 tons previous week and compares to 205,645 tons year ago. Major countries

included Egypt for 105,220 tons, Mexico for 99,247 tons, and China for 72,432 tons.

·

Oil World looks for Malaysian palm futures to rebound in anticipation the decline in palm oil prices was overdone.

·

Malaysia will suspend subsidies for selected cooking oil products from July 1 to boost domestic supply and stabilize prices.

·

AmSpec reported Malaysian June 1-20 palm oil exports down 17 percent to 659,768 tons from 794,527 tons previous month. SGS reported a 12.5 percent decrease to 734,231 tons. ITS 738,368 tons, down 10.5

percent from 824,589.

·

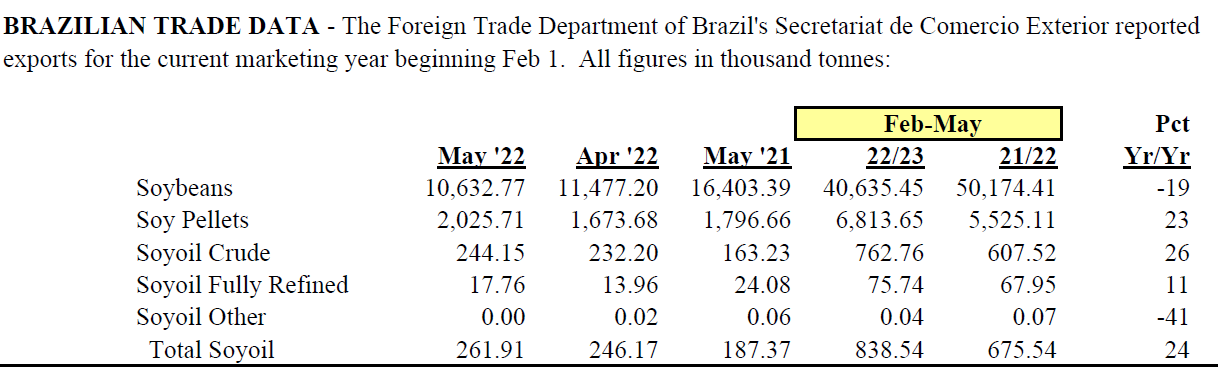

Anec looks for Brazil soybean exports to reach 10.795 million tons, slightly down from 10.840 million in previous week, for the month of June.

·

Agroconsult raised its estimate for Brazil’s soybean crop to 126.9 million tons, higher than previous 124.6 million tons.

·

Brazil soybean exports for the week ending June 19 were 2.56 million tons. June 1-19 soybean exports reached 5.62 million tons, down from 7.57 exported June 1-20, 2021.

·

Below table suggests Brazil is crushing a lot of soybeans.

Trade

News Service:

Export

Developments

·

Last Thursday USDA reported 5,860 tons of vegetable oil was sold for exports at mostly $2577.10 to $3393.80 per ton.

·

China will be back late this week selling a half a million tons of soybeans out of reserves but note over the past few weeks a small amount had been sold from what was offered.

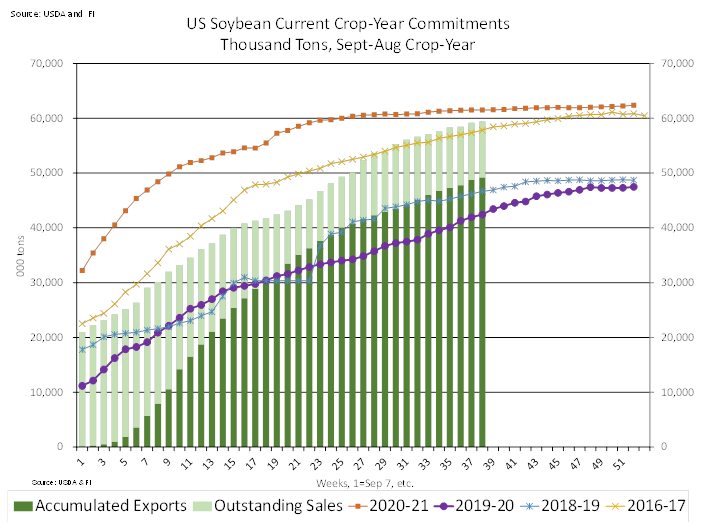

US

soybean commitments

are near USDA’s export projection of 59.87 million tons. To reach this amount, the US will need to increase shipments and hope outstanding sales don’t roll into new crop. About 27.5 million bushels of soybean exports per week are needed to reach USDA’s export

projection from now until the end of the crop year.

August

Paris rapeseed

Updated

6/17/22

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $400-$450

Soybean

oil – July 71.00-76.00

·

US wheat futures were lower on ongoing Black Sea corridor shipping talks, improving Western European weather, prospects for a large Russian grain crop and US harvesting pressure. Chicago wheat is near

its lowest level since early April.

·

KC type wheat led to the downside.

·

The USD was down 23 points at around 3:00 pm CT.

·

Funds sold an estimated net 16,000 SRW wheat contracts.

·

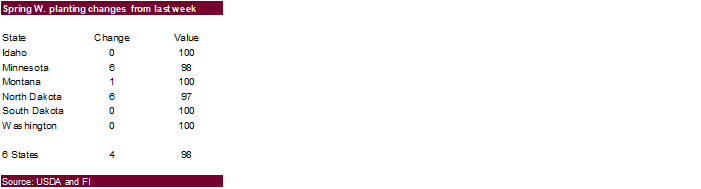

Parts of US spring wheat growing areas will see limited precipitation this week, western bias.

·

SovEcon estimated Russia’s 2022 wheat crop could reach 89.2 million tons, up 0.6 million tons and a new record high. The spring wheat area and yield were increased, and they lowered the winter wheat yield.

·

Turkey will continue talks this week with Russia over Black Sea exports. They hope to create safe passage export corridors from Ukraine.

·

The Russian Grain Union said Russia may export 45 million tons of grain this season, a decline of 8.3% year-on-year, including 36.2 million tons of wheat (a decrease of 4.8% year-on-year) and 4 million

tons of corn (4.2 million tons last season). Russian grain exports totaled 42.73 million tons from the beginning of the agricultural season from July 1, 2021, to June 19, 2022.

·

USDA US all-wheat export inspections as of June 16, 2022, were 331,328 tons, within a range of trade expectations, below 411,916 tons previous week and compares to 554,712 tons year ago. Major countries

included Philippines for 121,166 tons, Thailand for 56,830 tons, and El Salvador for 37,898 tons.

·

Paris September wheat was down 17.50 euros, or 4.5%, at 372.50 euros per ton.

·

MARS estimated the European Union 2022 soft wheat yield at 5.76 tons per hectare, down from 5.89 forecast last month, 4.7% below 2021 and 1.3% below the five-year average.

·

Egypt said they need to import 5 million tons of wheat for the 2022-23 year. Imports from Russia over the past three months are up more than 80 percent.

·

Algeria seeks 50,000 tons of wheat on June 21, valid until next day, for August shipment. They have thought to have picked up 660,000 tons of wheat at an average $445/ton.

·

Jordan passed on 120,000 tons of wheat for LH Sep through FH November shipment.

·

Jordan seeks 120,000 tons of feed barley on June 22 for Oct/Nov shipment.

·

Tunisia seeks 75,000 tons of soft wheat and 50,000 tons of barley on June 22, optional origin, for shipments July 20-August 15.

·

Bangladesh seeks 50,000 tons of wheat on July 5 for shipment within 40 days.

·

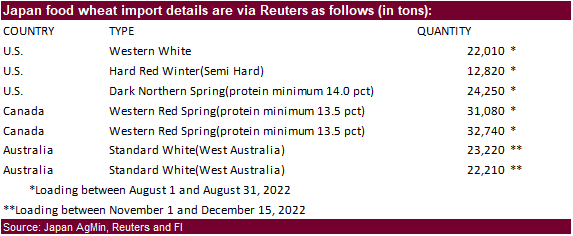

Japan seeks 168,330 tons of food wheat later this week.

·

Kazakhstan will sell 1 million tons of grain from the upcoming harvest to Iran, the Kazakh government said on Monday (Reuters).

Rice/Other

·

None reported

Updated

6/17/22

Chicago

– July $9.25 to $11.00 range,

December $8.50-$12.50

KC

– July $10.00 to $12.00 range,

December $8.75-$13.50

MN

– July $10.50‐$12.25,

December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.