PDF Attached

Multi

month highs were seen for many CBOT ag contract months. Soybean oil was limit lower and limits expand 50 percent (along with complex).

https://www.cmegroup.com/trading/price-limits.html

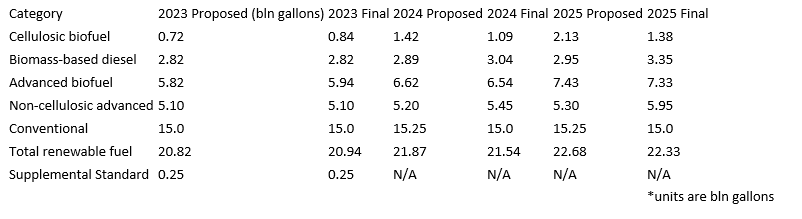

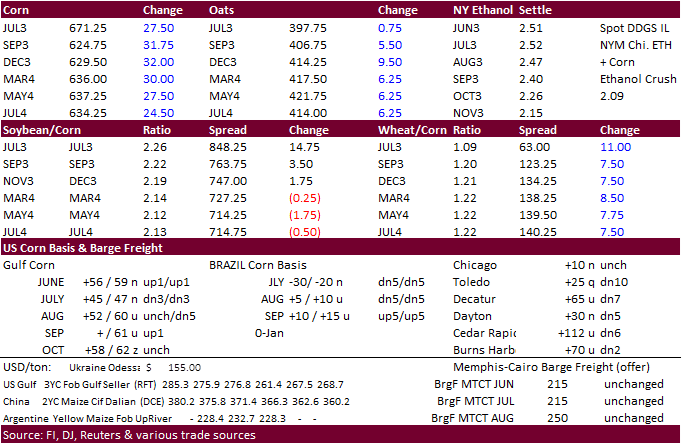

EPA released mandates for 2023-2025 and traders viewed the advanced biofuel as less than expected (modest increase). Some traders were looking for a 5-7% increase for advanced from the December proposal of 5.82 billion gallons. US crush margins were down sharply.

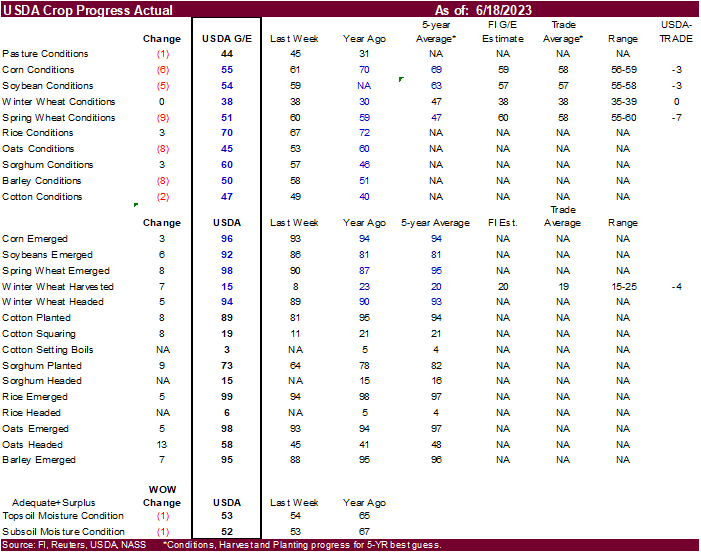

A decline in spring wheat, corn and soybean conditions underpinned those markets. Careful of the sharp increase in some of these markets. Prices tend to fall faster when fundamentals change.

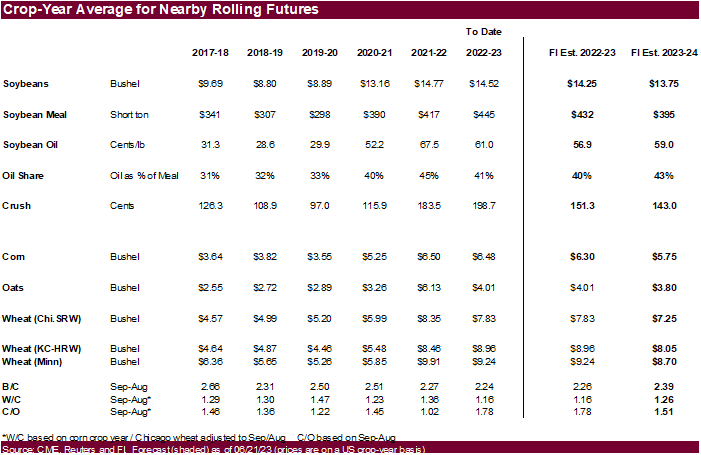

FI

crop year average update.

We took SBO for 2022-23 down about 300 points, raised meal by $5, and soybeans adjusted higher by about 25 cents. 2023-24 raised corn and soybean averages by about 25 and 15 cents, respectively, and left wheat unchanged. Adjusted new crop SBO lower and meal

about unchanged from previous. This can and will easily change as we move deeper into the summer growing season. See below.

Today

is the official start of NA summer. US weather looks good for US wheat (PNW still dry) bias Great Plains and parts of the WCB for summer crops. It will be wet for the far ECB while the heart of the US will see net drying. The southeastern US will see rain

through Friday and northeast areas this weekend. The central and northwestern areas have a chance for rain late this week.

US

EPA mandates:

Fund

estimates as of June 21 (net in 000)

![]()

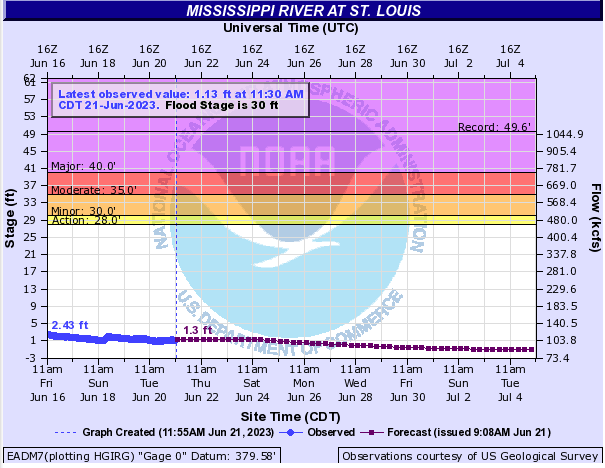

The

lack of rain for the Midwest is not only impacting early US crop conditions, but other industries as well. Miss. River water levels are low for this time of year. Other parts of the world are feeling the strain. The Panama Canal area is seeing its driest season

in more than a century. https://maritime-executive.com/article/panama-canal-further-restricts-drafts-due-to-falling-water-levels

University

of Illinois: Dry Weather and Drought in the Midwest, Middle-June 2023

Schnitkey,

G., N. Paulson, C. Zulauf and J. Baltz. “Dry Weather and Drought in the Midwest, Middle-June 2023.”

farmdoc

daily

(13):112, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 20, 2023.

7-day

WEATHER

TO WATCH

- U.S.

Midwest drier areas have a good chance for scattered showers and thunderstorms during the late weekend and again in the second half of next week - Resulting

rainfall will be quite varied from one location to the next, but some of the driest areas in Illinois, Iowa, Missouri, Indiana, Wisconsin and Michigan will have an opportunity for some badly needed moisture - No

drought busting rain is expected, but enough moisture will fall in “portions” of the dry region to allow “partial” relief to the poor pollination conditions

- Follow

up rain will be imperative both in higher volume and higher frequency - U.S.

southeastern states will continue to deal with excessive moisture, although a brief break from the pattern is expected this weekend into early next week - Rain

will fall into Friday and again late next week - Southern

Georgia, northern Florida and areas west into southern Mississippi have been most impacted by heavy rain recently

- Crops

in Georgia and the Carolinas will be wettest through Friday while drying occurs in the Delta and interior southeastern crop areas - These

areas will trend wetter again along with Alabama next in the first week of July after a few days of drying this weekend and early next week - U.S.

temperatures are unlikely to be excessively warm in the Midwest, northern Plains, or southeastern states, but excessive heat will impact Texas periodically - Hot

temperatures in Texas Tuesday sent afternoon readings into the range of 100 to 115 degrees Fahrenheit and similar temperatures are expected for at least the next ten days and probably for two weeks - Crop

and livestock stress is already rising and will continue high through the forecast period - Unirrigated

crops will suffer most from the heat and dryness - West

Texas cotton, corn and sorghum conditions will steadily decline over the next two weeks as soil moisture is depleted - Southwestern

dryland areas will be most impacted initially - It

will take a while for the Texas Panhandle, southwestern Oklahoma and the northeastern Counties of West Texas to experience crop moisture stress - Northern

U.S. Plains and Manitoba Canada along with parts of Minnesota will get dryness easing rainfall in this coming week

- Rainfall

of 1.00 to 2.00 inches and locally more will result which should help bolster soil moisture for improved crop development - Sugarbeets,

dry beans, corn, soybeans, sunseed, wheat, barley and oats will all benefit from the moisture along with canola and many other crops - Soil

moisture in these areas is very short in the top and subsoil - U.S.

hard red winter wheat rainfall should become less frequent and less significant for a while which may help to improve crop maturation and harvest conditions in time - Cool

temperatures occurred again in the Pacific Northwest today with frost noted in several areas from eastern Oregon into the upper Snake River Basin, but little to no damage resulted - Mexico’s

drought will last another week to ten days - There

is evidence of developing monsoonal rainfall in the second week of the forecast - Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual - Drought

continues to impact Gatlin lake and the Panama Canal shipments with little change likely in future weeks/months - Tropical

Storm Bret was 505 miles east of the Windward islands at 1200 GMT today moving westerly at 16 mph and producing maximum sustained wind speeds of 60 mph out 60 miles from the storm center - Bret

will move across the Lesser Antilles late Thursday and will begin to weaken in the Caribbean Sea during the latter part of this week and into the weekend - The

storm may not survive the wind shear expected over the Caribbean Sea with remnants of the storm eventually drifting into northern parts of Central America next week - A

new tropical depression may form well to the southwest of the Cabo Verde Islands later this week, but it will not be any more significant than Tropical Storm Bret and it may curve to the northeast of the northern Leeward Islands and dissipate without threatening

land next week. - Canada’s

Prairies will receive erratic rainfall in the coming week, but it looks as though southeastern Manitoba may get some significant rain to ease recent dryness - Greater

rain is expected in the Prairies during July to further improve the moisture profile - Northern

Europe is expected to trend over the next few days finally easing some persistent dryness that has lasted more than a month in some areas of Germany, Netherlands, Belgium, eastern France and western Poland - The

lack of hot weather helped conserve soil moisture and protect crop development for much of that period of time - Widespread

rain is expected in Russia’s eastern New Lands and neighboring areas of northern Kazakhstan in the second week of the outlook - Temperatures

will be cooler than usual this week. - Russia’s

northeastern New Lands have been were cool enough for frost and a few light freezes recently, but the impact on crops was minimal.

- India’s

monsoon is expected to begin performing better later this week and especially next week with greater rainfall - Monsoonal

precipitation was virtually non-existent during the weekend as it has been during much of the past three weeks - The

improvement will be greatest from the upper east coast through Madhya Pradesh and Uttar Pradesh to northern parts of the nation - Maharashtra

to Tamil Nadu and Andhra Pradesh will do poorly with rain threatening sugarcane and rice - Recent

rain was greatest from Gujarat and southeastern Sindh, Pakistan into Rajasthan where 2.25 to more than 6.00 inches of rain resulted - The

rain was associated with remnants of Tropical Cyclone Biparjoy - Most

of the greatest rain fell in Gujarat and Rajasthan last weekend and only light to moderate rain has occurred since then into Uttar Pradesh and northern Madhya Pradesh - Some

welcome rain fell in eastern Thailand, Laos and central Vietnam last weekend with rainfall of 1.50 to more than 4.00 inches resulting - Tuesday’s

weather was drier with only sporadic showers of limited significance - Western

Thailand continues to miss the greater rain events, although some showers are occurring periodically - Western

Thailand rice, sugarcane and corn (among other crops) are hurting in the absence of significant rainfall this season - Indonesia

and Malaysia rainfall decreased notably Tuesday with net drying likely in many areas - An

erratic rain pattern is expected for a while - Philippines

rainfall recently has been erratic and mostly light, but soil moisture was rated well.

- Vietnam

coffee, sugarcane and rice production areas in the Central Highlands need greater rain in unirrigated areas - Australia

rainfall recently was greatest in the south - Winter

crop establishment is advancing well. - Timely

rainfall is expected over the next ten days in most crop areas maintaining a well-established crop - South

Africa winter crops are still establishing well and timely rainfall is expected through the next ten days - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks - Ontario

and Quebec weather should be favorably mixed over the next ten days - Summer

crop conditions are still rated favorably with little change likely -

No

changes in South America weather are expected over the coming week -

Argentina

rainfall will be limited leaving many areas from Cordoba into La Pampa and western Buenos Aires too dry for wheat emergence and establishment -

Favorable

field conditions will prevail in the eastern Argentina wheat areas due to previous rain and cool temperatures conserving the moisture through low evaporation rates -

Rain

is possible next week -

Southern

Brazil will continue plenty wet from southern Mato Grosso do Sul to northern and eastern Rio Grande do Sul and Parana over the next ten days -

More

limited rain is expected in center south crop areas while the north is left mostly dry

-

There

is a very low risk of crop damaging cold for the next ten days in any grain, cotton, sugarcane, citrus or coffee area -

China’s

northern Yellow River Basin and neighboring areas of Inner Mongolia are trending drier and this pattern will prevail for a while possibly leading to crop moisture stress for wheat, coarse grains and oilseeds later this summer -

Southern

China will remain plenty wet and may become excessively wet soon -

This

will interfere with early rice maturation and harvesting with some crop quality declines possible -

Some

sugarcane areas will eventually be flooded -

Most

of the greatest rain will be south of rapeseed areas; though much of the rapeseed harvest has likely been completed -

Xinjiang,

China will experience seasonable temperatures over the next two weeks -

Crop

conditions are improving because of the recent development of more seasonable temperatures -

Today’s

Southern Oscillation Index was -12.87 and it will move lower over the next several days

Source:

World Weather, INC.

Wednesday,

June 21:

- Grain

and Oilseeds MENA conference in Cairo, day 1 - SIIA

Haze Outlook 2023 in Singapore - USDA

Total Milk Production

Thursday,

June 22:

- Port

of Rouen data on French grain exports - EIA

weekly US ethanol inventories, production, 10:30am - Grain

and Oilseeds MENA conference in Cairo, day 2 - Brazil

Unica cane crush, sugar production (tentative) - USDA

Red Meat Production, 3pm - HOLIDAY:

China,

Hong Kong

Friday,

June 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

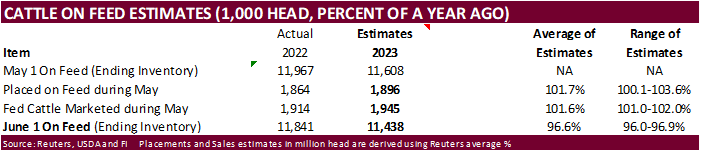

Cattle on Feed, 3pm - US

cold storage data for beef, pork and poultry - HOLIDAY:

China

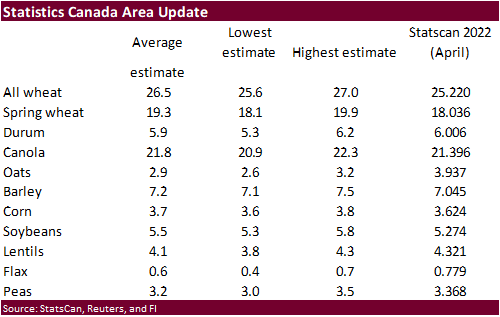

Canada

plantings. June 28 release (7:30 am CDT)

Macros

106

Counterparties Take $2.037 Tln At Fed Reverse Repo Op.

Fed’s

Powell Repeats Officials See Rates Somewhat Higher By Year End

Fed’s

Powell: Process Of Getting Inflation Back Down To 2% Has A Long Way To Go – Prepared Testimony To House Financial Services Committee

Fed’s

Powell: Interest-Rate Pause Is Expected To Be Temporary

Canadian

Retail Sales (M/M) Apr: 1.1% (est 0.4%; prevR -1.5%)

Canadian

Retail Sales Ex Auto (M/M) Apr: 1.3% (est 0.5%; prev -0.4%)

·

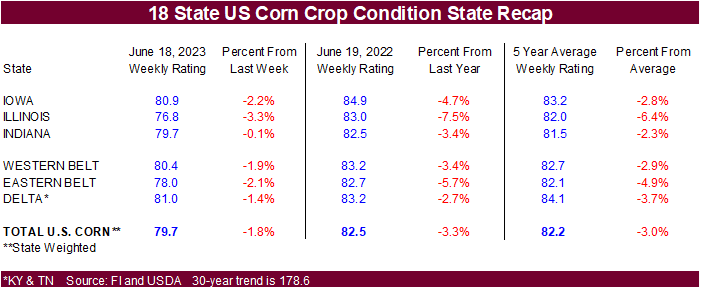

A large 6 point drop in US corn crop conditions for the G/E categories sent nearby and new-crop corn futures higher today.

·

December corn traded as high as $6.2950, not seen for that contract since early November.

·

Attached are updated US soybean and corn balance sheets.

·

The USDA Broiler report showed eggs set in the US up slightly from a year ago and chicks placed down slightly.

·

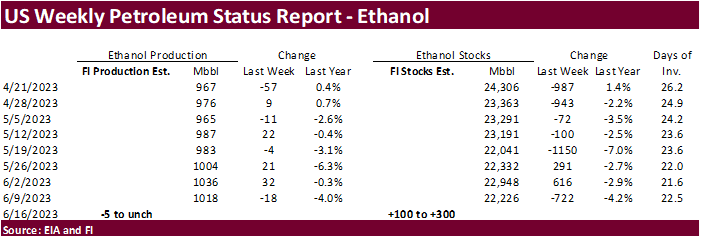

A Bloomberg poll looks for weekly US ethanol production to be up 5,000 thousand barrels to 1028k (1002-1035 range) from the previous week and stocks off 92,000 barrels to 22.134 million.

·

The hardest hit areas for US corn conditions occurred across the ECB followed by the WCB.

Due

out Friday

Export

developments.

-

Algeria

seeks 120,000 tons of corn on June 22 for shipment during July shipment and potentially another for FH August shipment.

-

Taiwan’s

MFIG group bought about 65,000 tons of corn from Brazil at 82.79 cents a bushel over the December contract.

Price

outlook (6/21/23)

July

corn $6.25-$7.25

September

corn $5.75-$7.25

December

corn $5.25-$7.25

·

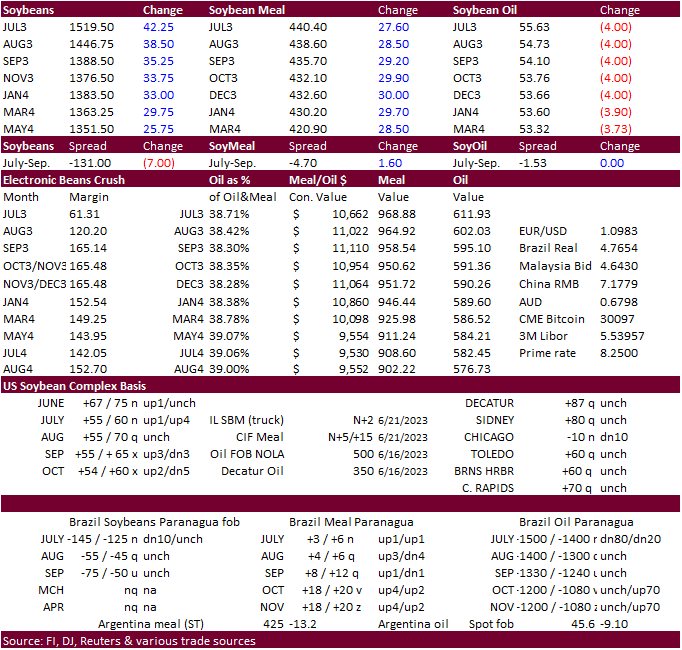

EPA released mandates for 2023-2025 and traders viewed the advanced biofuel as less than expected, sending soybean oil limit lower (renewable).

·

July soybean oil synthetic was around 55.25. Futures closed at 55.63.

·

Soybeans and meal rallied after USDA released a bullish crop progress report, along with strength in corn and wheat. Crush margins were hammered but soon to expiring July did rebound from session lows. Back month crush margins

still look attractive.

·

September soybean oil prices are expected to stabilize quickly, unlike the follow through selling we saw in December post EPA proposal release. This is based on deteriorating US crop conditions and today’s trade nearly taking

out the speculative gains late last week after EPA announced the delaying RFS mandate release. A lower trend for SBO would theoretically work against the longer term outlook for a ramp up in biofuel production (renewable).

·

We lowered our US soybean yield from 51.5 to 50.4 bu/acre, production from 4.465 to 4.370 billion, exports from 1.960 billion to 1.940 billion, crush unchanged, and carryout out stocks from 315 to 240 million.

·

We heard last week that China bought about 34 cargoes of soybeans from Brazil and 4 out of the PNW. Some speculate the PNW cargoes are for new crop for stockpiling.

·

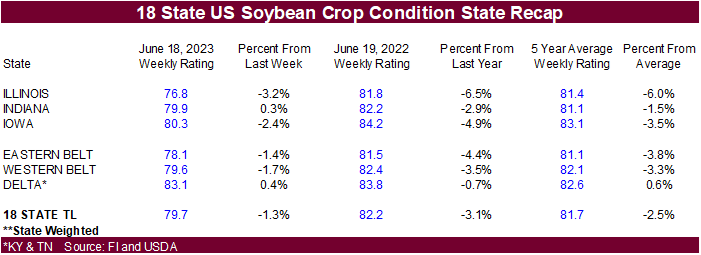

US soybean conditions dropped 5 points from the previous week. Still early but worrisome.

·

(Bloomberg) — India’s oilmeals exports fell to 436,596 tons in May from 493,448 tons in April, according to the Solvent Extractors’ Association of India.

-

Rapeseed

meal exports fell to 233,663 tons from 246,568 tons in April -

Soymeal

exports fell to 114,225 tons from 177,243 tons in April -

Rice-bran

extract exports rose to 42,398 tons from 37,479 tons in April

-

China

will auction off 306,700 tons of imported soybeans from state reserves on June 27.

Price

outlook (6/21/23)

Soybeans

– July $14.50-$15.50, November $12.50-$15.25

Soybean

meal – July $400-$475, December $375-$500

Soybean

oil – July 51.00-58.00, December 50.00-58.00

·

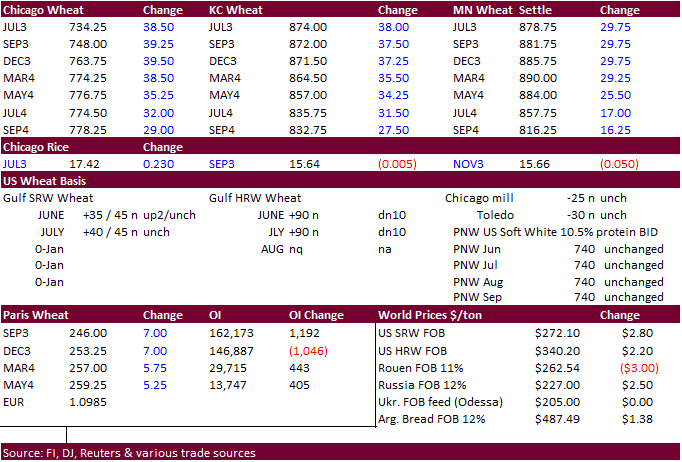

US wheat traded higher from a steep drop in the US spring wheat rating and higher corn. US winter wheat conditions were unchanged, about as expected.

·

September Paris wheat futures were up 7.00 euros at 247 per ton.

·

An India trade group told Reuters that they look for the wheat crop to fall short of government expectations to around 101 and 103 million tons, below the official 112.74 million tons estimated by the government. USDA is at 113.5

million tons.

·

SovEcon estimated Russia wheat production at 86.8 million tons, down from 88 million previous. USDA this month raised their estimate to 85MMT from previous 81.5 and compares to 2022-23 of 92 MMT.

·

Germany’s association of farm cooperatives estimated 2023 wheat crop to decrease 2.9% to 21.87 million tons. Winter rapeseed was seen down 3.1% to 4.14 million tons.

·

China is nearing winter wheat harvest completion. 137MMT was last projected by the country. USDA is at 140MMT.

Export

Developments.

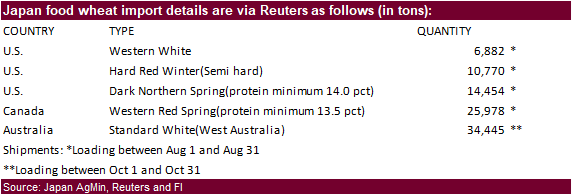

·

Japan seeks 92,529 tons of milling wheat later this week for Aug shipment.

Rice/Other

Price

outlook (6/21/23)

Chicago

Wheat July $7.00-$7.75, September $7.00-$8.25

KC – July $8.25-$9.10, September $8.00-$9.50

MN – July $8.25-$9.25, September $8.00-$9.50

#non-promo