Improving

US weather continues to pressure back month corn and soybeans. Chicago and KC wheat were lower on US harvest pressure and China buying Australian wheat. MN wheat rallied as expected from poor US spring wheat crop conditions.

1-7

DAY

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 22, 2021

- Frost

and freezes occurred north of grain and oilseed areas in Michigan this morning possibly impacting some fruits and vegetable crops.

- Torrential

rain event still advertised for Missouri, Illinois and neighboring areas in both southeastern Iowa and Indiana for Thursday and Friday.

- This

event should not be ignored. - There

is potential for serious flooding with rainfall of 4.00 to 10.00 inches occurring in some very important crop areas over a relatively short period of time.

- There

is also a rumor in marketplace about a ridge of high pressure coming into the central U.S. during the July 4 U.S. holiday weekend, but the ridge is more likely to be farther to the west keeping most of the Midwest away from the heat.

- Make

sure to see our special situation story on the coming summer dryness written last night. We have attached that article to this email - In

Russia, the heat and dryness event under way now will begin to break down during the weekend and especially next week offering cooler temperatures and some rain for areas north of Russia’s Southern Region. - Until

then highs in the 80s and 90s Fahrenheit and now rain will maintain aggressive drying - Extreme

highs near and above 100 will occur in Russia’s Southern Region and western Kazakhstan - No

change in South America - Argentina’s

summer harvest is going well along with winter wheat planting - A

little moisture would be good for drier areas in the west - Brazil

rain will be mostly in the far south - Good

harvest weather for Safrinha corn - Safrinha

cotton is still struggling with dryness resulting in smaller bolls - Australia

will see a good mix of weather during the next ten days favoring winter crop establishment - China

weather will remain good, although a little wet in the south and net drying from Jiangsu to Shaanxi and Shanxi for the next ten days - India’s

interior west and northwest will see well below average rainfall into early July - Concern

will be slowly rising over future crop development in those areas - Thailand

will be drying down for a while especially in the west and south (north of the Malay Peninsula)

- Europe

weather will remain well mixed - Russia’s

Spring wheat and sunseed in the southeastern New Lands and northern Kazakhstan will get some needed rain

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Tuesday,

June 22:

- Copersucar,

one of Brazil’s top sugar and ethanol exporters, holds presser on the market’s outlook - Future

Food-Tech’s Alternative Proteins Summit, day 1 - OECD

to release agricultural policy evaluation report - U.S.

cold storage data – pork, beef, poultry, 3pm

Wednesday,

June 23:

- EIA

weekly U.S. ethanol inventories, production - Future

Food- Tech’s Alternative Proteins Summit, day 2

Thursday,

June 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, poultry slaughter, red meat production, 3pm

Friday,

June 25:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia

June 1-25 palm oil export data - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

Macros

US

Existing Home Sales May: 5.80M (est 5.72M; prev 5.85M)

–

Existing Home Sales (M/M) May: -0.9% (prev -2.70%)

US

Philly Fed Non-Manufacturing Regional Business Activity Index Jun: 59.6 (prev 36.9)

US

Philly Fed Non-Manufacturing Firm Level Business Activity Index Jun: 56.7 (prev 22.1)

US

Philly Fed Non-Manufacturing New Orders Index Jun: 27.4 (prev 16.5)

US

Philly Fed Non-Manufacturing Full Time Employment Index Jun: 4.3 (prev 24.0)

US

Philly Fed Non-Manufacturing Wage & Benefit Cost Index Jun: 42.6 (prev 30.8)

74

Counterparties Take $791.605 Bln At Fixed-Rate Reverse Repo (prev $765.141 Bln, 68 Bidders)

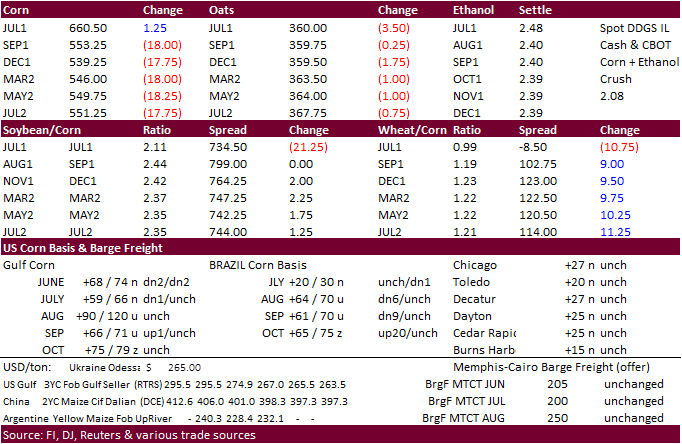

- July

corn rallied against the September and new-crop contracts on same fundamentals – lack of US producer selling, improvement in corn for ethanol use, and tight spot US supplies (will be verified at the end of this month with

Grain Stocks report). July settled 0.50 cent higher and December down 18 cents. New-crop corn futures were mainly lower on a favorable US weather outlook. Selected corn basis weakened from Monday. Lincoln, NE, was down 10 cents to 10 under the July.

- July

options expire Friday. - US

corn conditions were down 3 points, one point lower than expected, but the trade widely ignored this by focusing on precipitation forecast. Cooler US temperature this week should slow evaporation rates for parts of the US WCB.

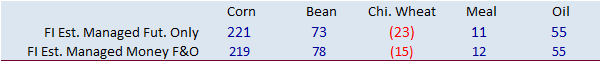

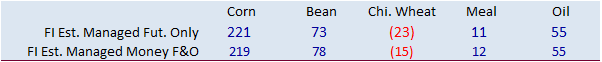

- Funds

sold an estimated net 15,000 corn contracts on Tuesday. - A

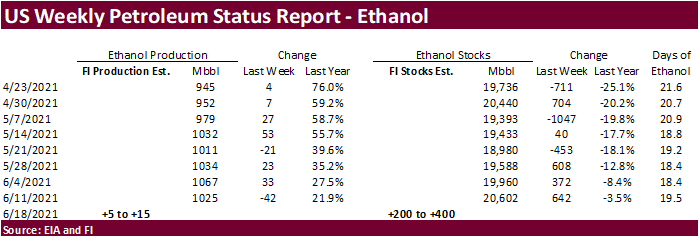

Bloomberg poll looks for weekly US ethanol production to be up 6,000 barrels (1010-1045 range) from the previous week and stocks up 59,000 barrels to 20.661 million.

- US

ethanol RINs were up 13 cents earlier to around $1.58. Biodiesel was up 8 cents to $1.67.

-

Reuters

in a story covering US and Brazil ethanol markets noted Brazil ethanol prices at mills “are near their highest ever at over 3.40 reais per liter ($2.55 per gallon), according to the University of Sao Paulo (USP). Since fuel distributors need to add 27% of

ethanol to gasoline, that has driven up prices.” - In

a Reuters poll, Brazil’s corn production was estimated at 93.93 million tons, 8.5% below year ago. Lowest estimate was 88 million tons (IHS Markit) and highest 104.1 million tons (Safras & Mercado). USDA is 98.5 million tons. Conab at 96.4 million.

- (Bloomberg)

— China’s hog population rose 24% in the year through May. - A

Bloomberg poll calls for June 1 hog inventory at 75.551 million head vs 77.364 million last June, 2.3% decline. The breeding inventory seen down 1.2% y/y, and market hogs seen falling 2.5% y/y.

- A

Bloomberg poll calls for June 1 cattle inventory at 1.96 million, down 4.6%.

- Reuters:

- U.S.

FROZEN BEEF STOCKS 414.047 MLN LBS MAY 31 -USDA - U.S.

FROZEN PORK BELLY STOCKS 36.208 MLN LBS MAY 31 -USDA - U.S.

FROZEN ORANGE JUICE STOCKS 0.736 BLN LBS MAY 31 -USDA

Export

developments.

Updated

6/22/21

July

corn seen in a $6.00 (up 50) and $7.00 range

September

$5.00 and $6.75

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

The

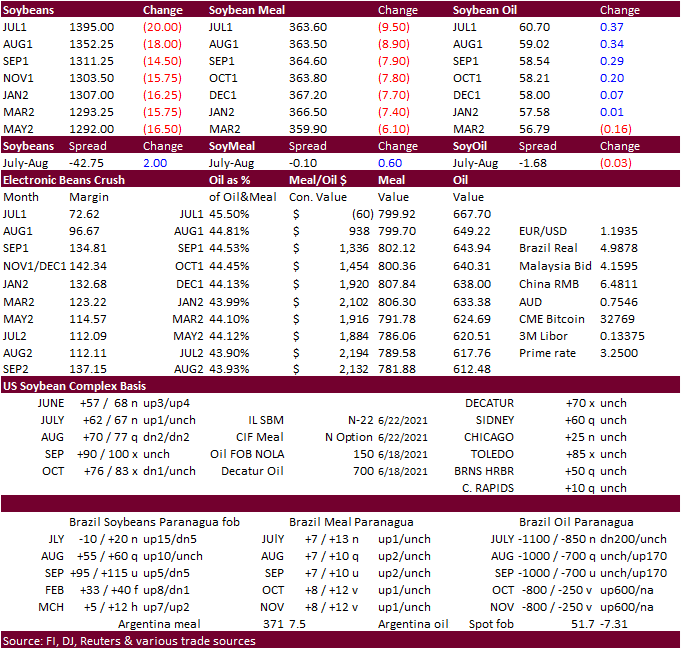

US soybean complex started lower but soybean oil rallied and closed higher for the 2021 positions. Soybeans were under a considerable amount of pressure on improving US weather despite a 2-point decline in US soybean conditions (in line with expectations).

July dropped 20.50 cents and November off 17 cents. Nearby demand is slowing. We lowered our US soybean crop year crush by 11 million bushels to 2.168 billion (USDA @ 2.280 billion). Only problem with this revision is we will now see a tighter US soybean

oil carryout due to lower crush. There was talk China was back in looking for US soybeans off the PNW, but that rumor died off early. There were no 24-hour sales announcements. Argentina was back from holiday.

-

Soybean

oil stayed strong during the day session in part to Egypt buying a combined 73,500 tons of imported vegetable oils. Egypt’s strategic reserves are now at 6-1/2 months.

-

December

meal ended $8.20 short ton lower. It tested the 200-day MA today. The trade may see sell stops if its trades and closes below the $3.6475 level. Next level of support is seen around 362, a 50 percent retracement going back to mid-Aug 2020, then 347, a 61.8

retracement for the same timeframe. The managed money position for soybean meal could turn negative if another $20 is taken out of the current $366.70 per short ton December price.

-

US

soybean meal basis was largely unchanged. -

Funds

on Tuesday sold an estimated net 13,000 soybean contracts, sold 5,000 soybean meal and sold 2,000 soybean oil contracts.

- Malaysia

overtook Indonesia to become the largest supplier for India so far in 2020-21. Crop year started November 1. Malaysian palm exports hit 2.42 million tons to India, up 238% from the same period a year ago. Indonesia exports were 2 million tons, down 32%.

Note Indonesia raised export taxes in December. - (Bloomberg)

— China’s customs confiscated about 215 kilograms of cocaine buried in a vessel, which was carrying soybeans from South America, the department said in a report Tuesday. We are unsure what will happen to the boat and/or crew.

- Egypt

bought 63,000 tons of soybean oil and 10,500 tons of sunflower oil for September 5-30 arrival. Reuters provided a breakdown of the 73,500 tons:

- 30,000

tons of soyoil at $1,184.00 for payment at sight - 30,000

tons of soyoil at $1,184.00 for payment at sight - 10,000

tons of sunflower oil at $1,133.00 for payment at sight

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

- US

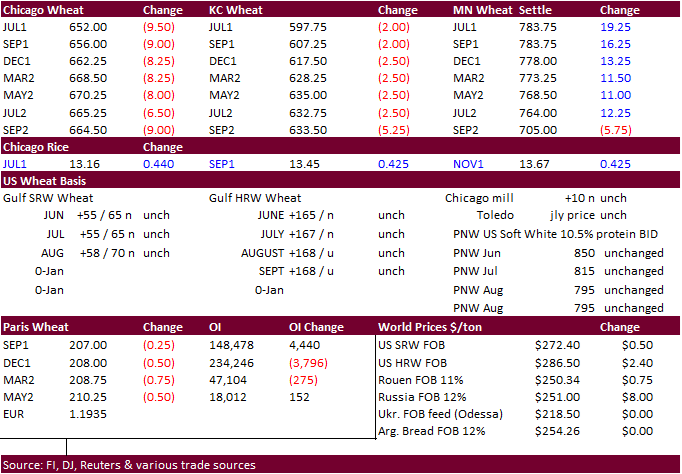

MN wheat futures ended sharply higher following a 10-point drop in spring wheat ratings. KC and Chicago failed to follow MN higher and fund selling coupled with US harvesting pressure pulled these contracts lower. Chinese demand for US wheat could be absent

for a while as they are sourcing from other countries, including Australia.

- China

bought 250,000 tons of Australian wheat for Aug and Sep shipment between $285 and $300 per ton. Unlike barley, China never really cut off Australia with taking in wheat to begin with. Australia shipped about 1.3 million tons to China during the Dec-Apr period.

- Money

managers are thought to hold an estimated net short position for Chicago wheat. Funds on Tuesday sold an estimated net 6,000 SRW wheat contracts.

- *84%

of SD’s subsoil moisture was less than adequate according to the latest USDA crop progress report.

- September

Paris wheat was up down 0.25 euro at 207. Yesterday it tested a 3-week low.

- Russia

stated they plan to supply Algeria with up to 1 million tons of new-crop wheat (July-June 2021 season). Russia has not supplied much wheat to Algeria over the past four years, in fact a small cargo was recently sold and this could be first shipment in four

years. - Pakistan

plans to import up to 4 million tons of wheat, up 1 million from previously planned.

- *China

bought 250,000 tons of Australian wheat for Aug and Sep shipment between $285 and $300 per ton, according to AgriCensus. Unlike barley, China never really cut off Australia with taking in wheat to begin with. Australia shipped about 1.3 million tons to China

during the Dec-Apr period. - *Thailand’s

TFMA booked 60,000-65,000 tons of feed wheat for August shipment at paid $289.50/mt CFR LO, according to AgriCensus. Black Sea was thought to be the origin.

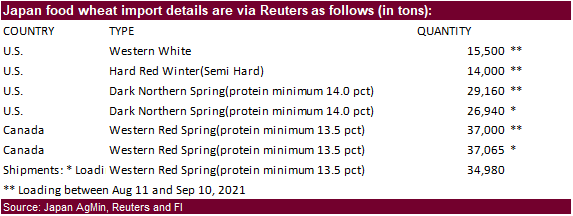

- *Japan

seeks 159,665 tons of food wheat later this week.

- *Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- *Cancelled:

Jordan seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

- None

reported

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.