We

raised our corn for ethanol use for the current year by 20 million bushels. Attached is our updated US corn balance sheet.

Old

crop soybeans reversed to close lower. Back months were lower on an unchanged US weather outlook calling for rains across the growing regions. Meal remained the defensive from product spreading. Corn ended lower but losses were limited from a higher trade

in wheat. We expect wheat prices to soon stabilize, at least for KC and Chicago type wheat from ongoing and upcoming US and Black Sea harvest pressure.

![]()

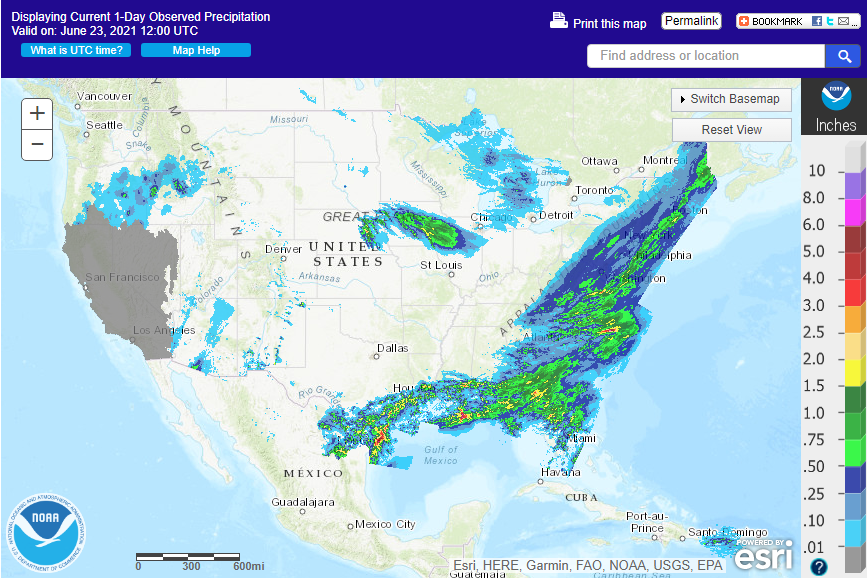

WORLD

WEATHER HIGHLIGHTS FOR JUNE 23, 2021

- Strong

to severe thunderstorms producing heavy rain, strong wind speeds and hail will evolve Thursday into Saturday in the heart of the Midwest.

- Some

excessive rain is expected and flooding will result. - Crop

damage will be possible because of the hail and flooding, but losses should be low.

- The

moisture will saturate the soil in a part of the central Midwest and that should help carry crops into first half of July in many areas.

- In

the meantime excessive heat and dryness in the far western parts of North America in this coming week will creep to the east into a part of western Canada and the northern U.S. Plains as June comes to an end and July begins.

- This

eastward advancement of the heat and continued dryness will further stress spring and summer crops in Canada’s Prairies and the northern U.S. Plains.

- Western

Russia’s heat and dryness will peak in the next few days with cooling and some showers expected next week. - Temperatures

in the 80s and 90s will continue throughout western Russia with little to no rain for the next few days

- Relief

is expected to occur from northwest to southeast across the drier and warmer biased region this weekend through next week - Recent

rain has begun easing dryness in southeastern Russia’s New Lands and northern Kazakhstan and some of the region’s spring wheat and sunseed crop has benefited - Dryness

remains a concern in the southeast Ural Mountains region including some western New Lands’ spring wheat and sunseed areas - Very

warm and dry weather has been occurring over the past week in western Russia with highest temperatures in the 80s and lower 90s with little to no rain except in western areas of Russia’s Southern Region and southern Ukraine - China’s

weather will remain favorably mixed except from Jiangsu to Shaanxi and parts of Shanxi where net drying is expected for a while - Northeastern

China weather is favorably mixed - Southern

China will remain quite wet for the next ten days - India’s

weather will continue dry in the north and in some interior western and far southern parts of the nation while crops to the east are good shape - Not

much change in the pattern is likely for at least two weeks with the biggest concern over dryness rising in the northwest part of the nation - It

is still early enough that this dryness should not be a huge problem, but July rainfall is a must - Western

Thailand rainfall will remain restricted for a while - Other

Southeast Asia countries will experience good weather for a while - Australia

and Europe weather will be favorably mixed over the next two weeks - Argentina

rainfall will continue restricted in the west and south where a boost in rainfall would be welcome for winter crops - Wheat

and barley are in better condition than either of the past two planting seasons, but a little more moisture would be welcome - Brazil

harvest weather will remain good for Safrinha corn, sugarcane, citrus, coffee and northeastern cotton - There

is no risk of frost or freezes in immature crop areas - Canada’s

Prairies will experience a mix of rain and sunshine in the coming week, but many areas will continue too dry or will dry down - West

Texas rain is expected this weekend into early next week offering some relief to persistent dryness

- Excessive

heat and dryness is predicted for the U.S. Pacific Northwest and British Columbia this weekend and early next week with some of the heat and dryness expanding to the Canada Prairies and northern U.S. Plains by the end of next week

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Thursday,

June 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, poultry slaughter, red meat production, 3pm

Friday,

June 25:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia

June 1-25 palm oil export data - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

Macros

Canada

Retail Sales Fall 3.2% In May – StatsCan Flash Estimate

US

DoE Crude Oil Inventories (W/W) 18-Jun: -7614K (est -3500K; prev -7355K)

–

Distillate Inventories: 1754K (est 1000K; prev -1023K)

–

Cushing Crude Inventories: -1833K (prev -2150K)

–

Gasoline Inventories: -2930K (est 1050K; prev 1954K)

–

Refinery Utilization: -0.4% (est 0.5%; prev 1.3%)

US

Crude Stocks Fell To Lowest Since March 2020 Last Week – EIA

73

Counterparties Take $813.6B At Fixed-Rate Reverse Repo (prev $791.605 Bln, 74 Bidders)

- US

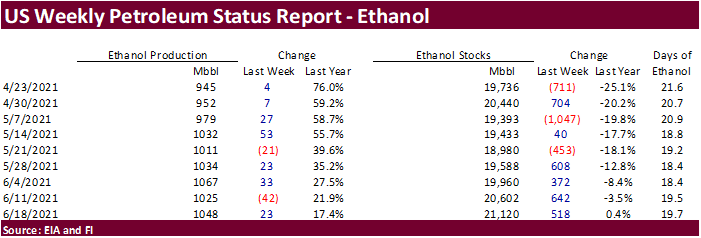

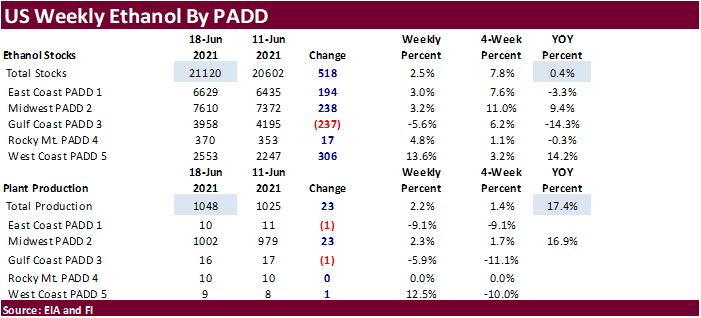

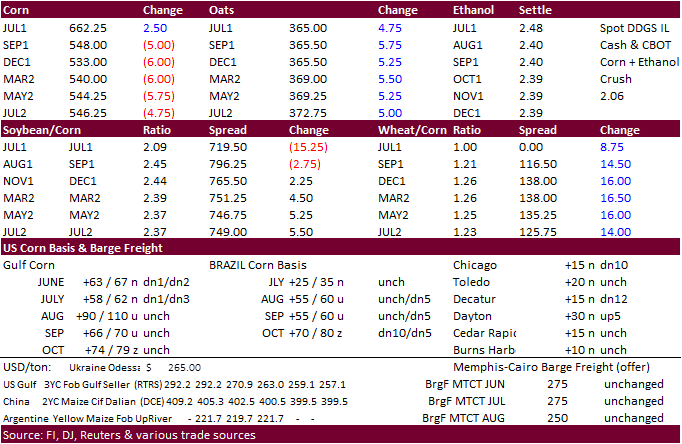

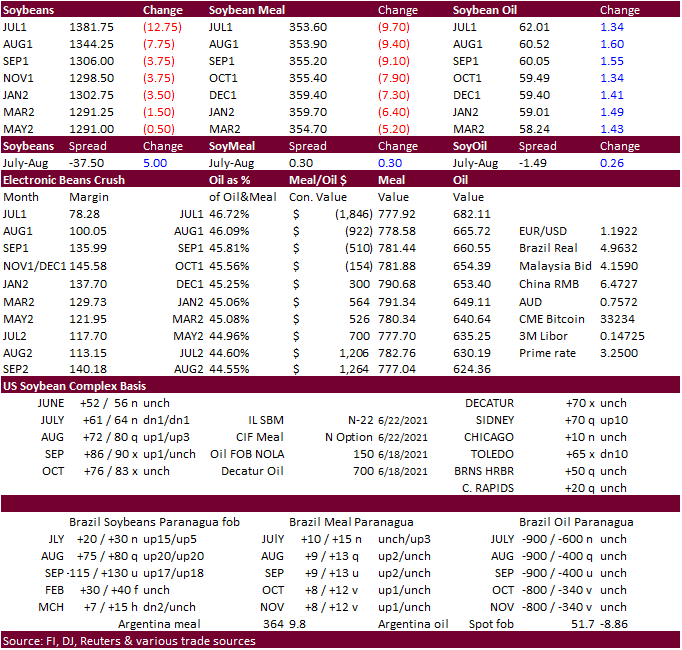

corn futures traded lower in the back months on a favorable US weather outlook. It rained in Iowa. July ended 4.50 cents higher on expectations for USDA to report tighter June 1 inventories next week. Expect a wide range of expectations for the US corn stocks

when released by the wires. Spot US demand is good. Weekly US ethanol production came in better than expected. We raised our corn for ethanol estimate. (see below). USD was slightly higher.

- Funds

sold an estimated net 5,000 corn. - Farmers

Business Network surveyed 2000 producers for US area and they have 92.9 million acres for corn and 86.5 million for soybeans. USDA is at 91.144 & 87.600 million, respectively. ProFarmer estimates also were released and they are using 93.6 for corn and 88.7

for soybeans. - Early

harvest across the lower and central Delta and Southeast should limit upside in the September/December corn spreads, currently around 15.25 cents, but if July rallies into First Notice Day deliveries, it could prop up the September position over the short

term. - China

corn prices are running near December levels. Prices hit a record in January. Poor quality of wheat (more used for feed now), high corn imports and government’s initiative to cool rising commodity prices are some of the reasons for the weakness in China

corn prices. - Meanwhile

China’s National Development and Reform Commission (NDRC) and market regulators launched investigations across multiple provinces to access commodity prices and supplies. China commodity prices during May rose at their fastest annual pace in more than 12

years. - July

options expire Friday. - USDA’s

weekly Broiler Report showed eggs set in the US up 1 percent from a year ago and chicks placed down 1 percent. Cumulative placements from the week ending January 9, 2021 through June 19, 2021 for the United States were 4.49 billion. Cumulative placements

were up 1 percent from the same period a year earlier.

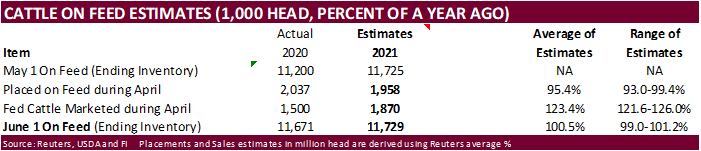

We

are using 5.060 billion for 2020-21 US corn for ethanol use, up about 20 million bushels previous and 10 million above USDA. 2019-20 corn use was 4.852 billion.

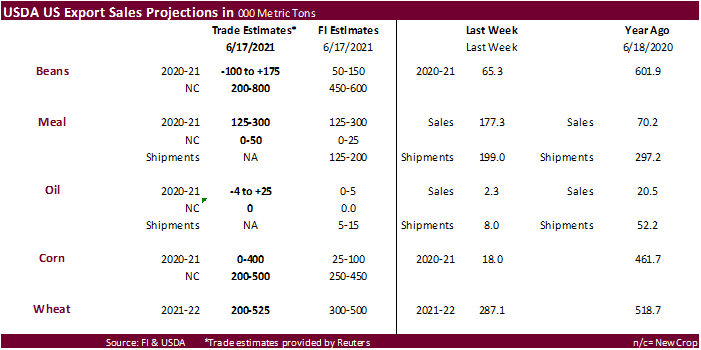

Export

developments.

Updated

6/22/21

July

corn seen in a $6.00 (up 50) and $7.00 range

September

$5.00 and $6.75

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

Nearby

soybeans started higher but by settlement was the leader to the downside in the most actively traded positions. March 2021 ended slightly higher. July was off 9.50 cents and November off 2.00. November canola traded limit higher during the session. Weather

is driving canola higher. Word Weather Inc noted “The situation is expected to worsen next week as a heat wave from the northwestern U.S. and British Columbia advances into the western Prairies and northwestern U.S. Plains.” The US weather outlook calling

for rains across the growing regions. -

Soybean

oil futures rose today by a large amount from positioning ahead of the US Supreme Court ruling over biofuel waiver mandates. Speculation of them striking down the waivers granted during the Trump Administration was noted, but no one knows what the ruling

will be. There was no Supreme Court Decision today but expect traders to check Thursday and or Friday for updates. Here is one link to follow up to date rulings.

https://www.supremecourt.gov/opinions/slipopinion/20

-

Rising

RIN prices this week have supported soybean oil prices. -

Meal

was on the defensive today from product spreading. -

400

July crush traded in the last few minutes at 78. -

Funds

sold an estimated net 3,000 soybean contracts, sold 6,000 soybean meal and bought 6,000 soybean oil contracts.

-

Palm

futures were up 55MYR and cash was $30/ton higher on talk of improving demand but gains were likely trimmed after the Malaysian Palm Oil Association (MPOA) estimated June 1-20 production increased 15% from the month before.

-

Argentine

producers sold 22.5 million tons of soybeans this crop year (21.7MMT week earlier), below 25.2 million tons year ago. The 22.5MMT represents just over 50% of the BA Grain Exchange 43.5-million-ton production estimate. Argentina is expected to crush about

40.5 million tons in 2021. -

The

Argentina soybean crush during the month of May was 4.298 million tons, a 6% increase from a year earlier, and highest for that month since 2017. Cumulative Jan-May soybean crush was 18.0 million tons, 2.6 million tons above the same period a year ago. Cumulative

Jan-May all oilseed crush was 19.6 million tons, 2.7 million tons above the same period a year ago.

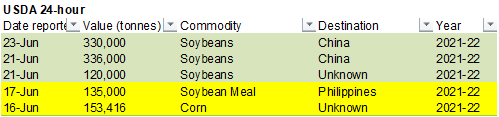

- Under

the 24-hour announcement system, USDA reported 330,000 tons of soybeans to China for 2021-22 delivery.

- Yesterday

Egypt bought 63,000 tons of soybean oil and 10,500 tons of sunflower oil for September 5-30 arrival.

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

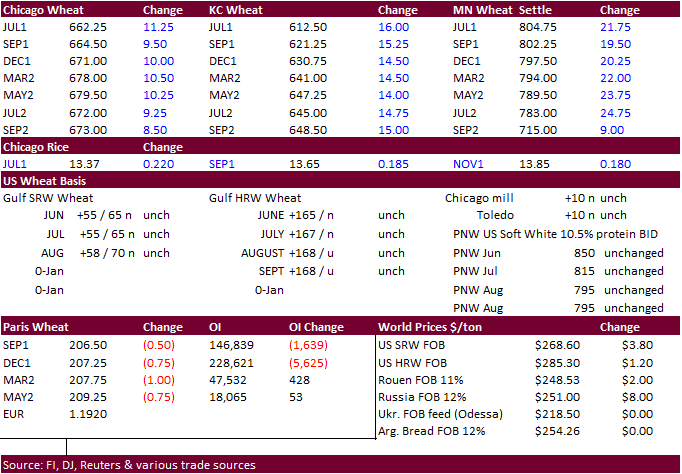

- Chicago

wheat ended higher on technical buying and follow through strength in Minneapolis futures. Ongoing and upcoming US and Black Sea harvest pressure had little impact on US futures but may have provided a role in a weaker EU wheat futures trade. South Dakota

could see rain by end of Saturday

but North Dakota and the Canadian Prairies have returned to a drier bias.

- Funds

bought an estimated net 7,000 Chicago wheat contracts. - Russia’s

AgMin sees the 2021 grain harvest at 127.4 million tons, unchanged from previous.

- Sovecon

raised its forecast for Russia’s 2021 wheat crop by 2.2 million tons to 84.6 million tons due to good weather. They also increased the planted area. They have the grain crop at 131 million tons, up 1.2 million from previous.

- Ukraine

grain stocks as of June 1 were 6.9 million tons, up 830,000 tons from the previous year. The stocks do not include small farms. 2020 production was 65 million tons versus 75 million in 2019.

- September

Paris wheat was down 0.25 euro at 206.75. European weather looks good for the remainder of the week.

- Nigeria

restricted the use of the US Dollar for wheat imports, forcing importers to circumvent that rule in order to help keep up with demand. Nigeria consumes about 4.7 million tons of wheat and producer only about 1 percent of that amount.

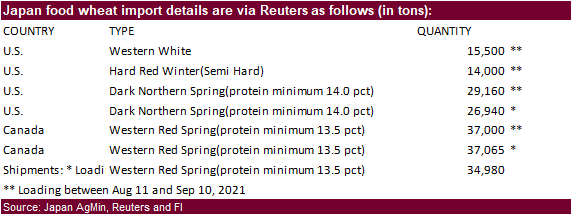

- Taiwan

seeks 55,000 tons of US million wheat on June 24 for Aug 12-26 shipment from the PNW.

- Ethiopia

seeks 400,000 tons of wheat on July 19. - Iran

seeks optional origin wheat on Wednesday. - Japan

seeks 159,665 tons of food wheat this week.

- Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Cancelled:

Jordan is back in for feed barley (in today) for Nov/Dec shipment.

Rice/Other

- CROP

TENDER: BANGLADESH TO BUY 50,000 TONS RICE FROM BAGADIYA

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.