PDF Attached includes FI’s acreage and stocks estimates. Funds are not included.

The Higher They Climb, the Harder They Fall – album by David Cassidy. Soybeans were at their recent highs just ten days ago with July at $17.84. Today it fell below $16.00 and selling expanded at that level. Economic concerns for the US continue as stats call for a recession, and as a result, pressured ag markets again. Ag news was very light. Export sales are delayed until Friday. EIA system problems delayed weekly ethanol data. Many global key cash market location prices were easier from yesterday.

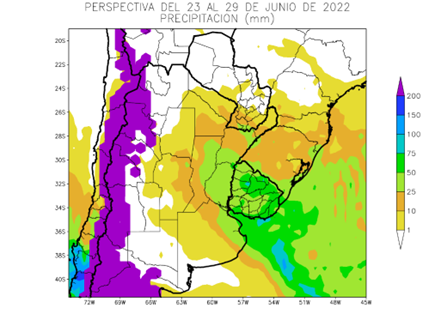

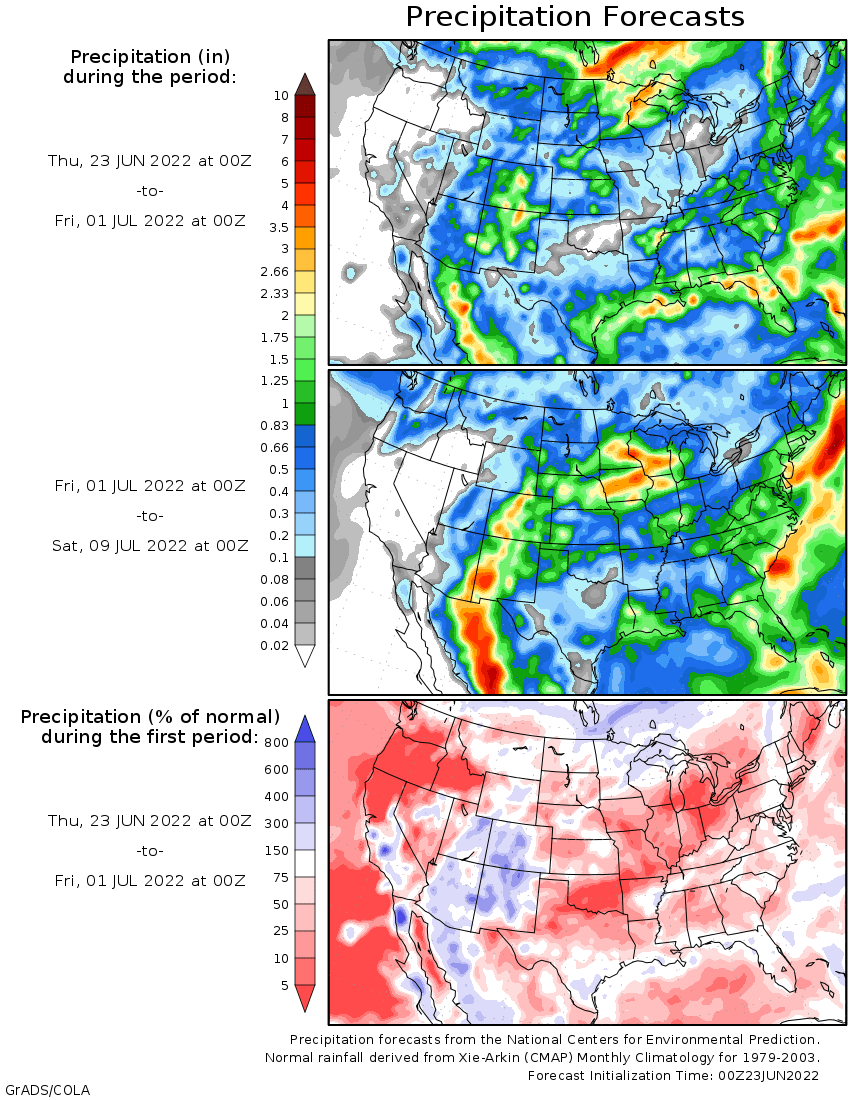

Argentina precip outlook though rest of June

WEATHER EVENTS AND FEATURES TO WATCH

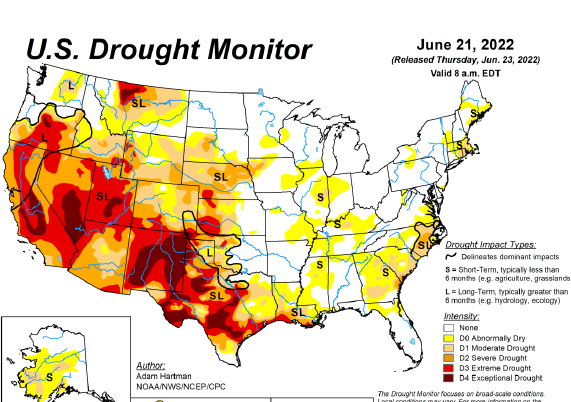

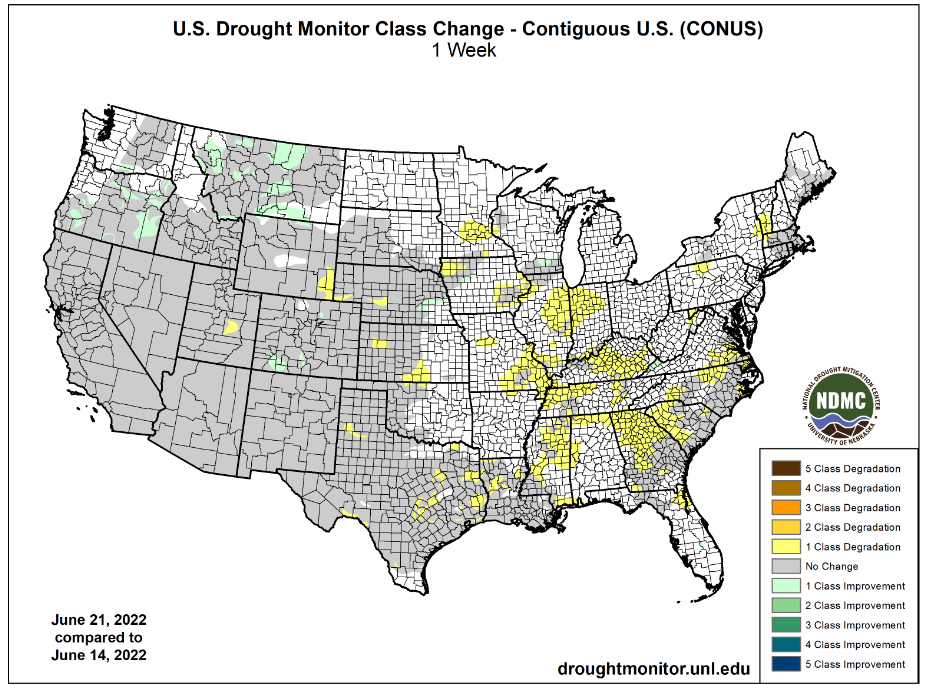

- U.S. topsoil moisture is still rated short to very short across the eastern Midwest, Delta, Tennessee River Basin and southeastern states as well as in much of the central and southern Plains

- Iowa and northern Missouri, southeastern Nebraska, west-central Illinois and areas from North Dakota to northern Minnesota and Wisconsin have the best topsoil conditions

- Most of the Midwest still has adequate subsoil moisture, but it is declining in many areas

- Crop stress has been on the rise in many areas, but mostly due to heat rather than dryness

- That could change soon with additional drying expected in many areas and warm to hot conditions prevailing in the southern states

- U.S. southern Plains, Delta and lowermost Midwest will experience another week of limited rainfall and very warm to hot temperatures

- Totally dry weather is not likely; some showers and brief thunderstorms will accompany a cool front through these areas this weekend but resulting rainfall will be more of a tease than actually providing a relief to dryness.

- This will lead to further crop stress, reduce subsoil moisture and induce some greater concern over crop conditions in each of these areas

- The southeastern states are also too dry, but they may start getting a little rain more frequently to slow the drying trend, although warm temperatures will keep evaporation rates high

- Strong cool front dropping through Canada’s Prairies and the northern U.S. Plains Friday and Saturday will eventually overspread the Midwest this weekend and early next week

- High temperatures will cool to the 70s and lower 80s in the Midwest and to the 60s and 70s for a single day in Canada and the northern Plains Saturday

- Some rain will accompany the frontal system, but resulting rainfall will mostly be light and there will be a need for greater rain

- The Gulf of Mexico will not be open as a moisture source during this first week of the outlook because of the high pressure system aloft will have its base in the region preventing much moisture from flowing northward and enhancing rainfall

- However, a disturbance over Florida and southern Georgia Saturday will move west along the coast reaching Louisiana Sunday into Monday and a fair amount of the Texas upper Coast and Blacklands during the early part of next week

- This moisture will join a cool front moving south from the Midwest and northern Plains next week to possibly enhance a small part of the rain event

- U.S. ridge of high pressure will relocate to the west next week and will be over the Rocky Mountain region and high Plains briefly

- This position may allow another cool front to drop through Canada and the north-central and eastern United States during the first days in July

- The Gulf of Mexico “may” open up as a moisture source when this new bout of cooling occurs

- The greatest rain potential in the northern Delta and Tennessee River Basin as well as areas north into the Midwest does not evolve until the first days of July

- By then some crops away from the coast may be more seriously stressed making the need for rain greater

- North America Ridge of high pressure is expected to meander between the Rocky Mountains and the western Corn Belt during weeks 3 and 4 of the forecast

- This position will keep weather conditions in the eastern and northern Midwest favorable with brief bouts of milder air and some rainfall

- The southwestern Corn and Soybean Production region, Delta and southern Plains will likely have the toughest time getting rain

- Texas cotton, corn, soybean and sorghum areas may get some rain as the two cool fronts from the northern Plains and Midwest drops into the region

- The first chance for rain will be during the first half of next week

- No soaking is expected away from the upper Texas coast, but a little relief from the hot, dry, bias will occur in a few areas in the Blacklands and both West and South Texas

- The upper Texas Coast may get 1.00 to 3.00 inches of rain

- Cotton, rice and a few corn, sorghum and soybean areas will benefit, but most of the rain will be kept near the coast.

- Some interior southern Texas locations may also get a little rainfall, but much more will be needed

- The second chance for rain in the southern Plains is expected in the first week of July and rainfall will again be a little erratic leaving some areas much too dry and offering temporary relief for other areas

- U.S. far west is not likely to get much rain through the next two weeks

- U.S. southwest monsoonal rainfall will continue to feed into New Mexico and eastern Arizona through the weekend and then it may extend a little farther to the north during the following week

- Some of this moisture will reach Kansas, the Texas Panhandle and eastern Colorado and Nebraska during the weekend and especially next week inducing some greater central Plains rainfall

- This moisture might also benefit Iowa and northern Missouri rainfall

- Canada Prairies weather will be favorable for some areas, but a little dry in others

- Too much rain may fall in a part of southwestern through central and northeastern Alberta during the coming week resulting in some areas of standing water especially near the mountains

- Southernmost parts of Alberta and southwestern Saskatchewan will be dry or mostly dry during this first week of the outlook

- Central parts of Saskatchewan have the greatest need for rain and some of this region may get rain over time, although it will come slowly

- Western Europe will experience cooling with periods of rainfall during the next ten days

- France, Germany and the U.K. will be most impacted

- Eastern Europe from the Baltic States and parts of Poland southward through Hungary and parts of Romania will experience net drying in the coming week to possibly ten days

- Net drying for some of this region will induce a little crop stress because dryness is already present, but most areas will handle the drier weather in stride

- The lower Danube River Basin and western Ukraine is driest.

- CIS precipitation has been most restricted in recent weeks in Ukraine, Russia’s Southern Region and western parts of Kazakhstan where soil conditions are drying out

- Rain is predicted Friday into Monday for central and eastern Ukraine and western portions of Russia’s Southern Region resulting in improved crop and field conditions

- The lower Volga River Basin and western Kazakhstan will likely remain drier than usual, but at least “some” relief will occur to the west

- Flooding in southern China is prevailing after horrendous amounts of rain fell in the past few weeks, but the weather has improved

- Flooding continues a serious problem in parts of the far south, and it will continue for a while, albeit gradually improving

- No more excessive rain is expected into early July

- Northeastern China will continue to receive frequent bouts of rain resulting in some very wet conditions and some local flooding especially this weekend into next week

- Some of the dry areas in the North China Plain received rain Wednesday and early today and more is expected early next week

- Much improved crop conditions are anticipated

- Some immediate improvement is expected from Wednesday’s rain, but much more will be needed to put a greater dent in the moisture deficits that have recently accumulated.

- China’s Xinjiang province continues to experience relatively good weather

- A few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week

- Some cooler biased conditions may briefly evolve, but temperatures will not fall below normal

- India’s monsoonal rainfall is expected to continue improving this week and next week, but this first week’s totals will still be below average except in Maharashtra and Madhya Pradesh where near to above normal amounts are likely

- Australia weather will be good for fieldwork; including the planting of winter wheat, barley and canola during the next week

- Queensland’s forecast has turned drier for next week and the following week relative to that of previous days this week

- Ontario and Quebec, Canada weather should be favorably mixed over the next two weeks

- A little drier and warmer bias would be most welcome and that is exactly what is expected

- South Korea rice areas are critically dry, but will get a few periods of rain during the next ten days bringing needed relief

- A tropical cyclone may evolve in the western Pacific Ocean east of the Philippines next week that could threaten Taiwan and/or China and the northern Philippines

- Western Argentina has a better chance for rain early next week, although it will not be well distributed, and more moisture will still be needed

- Western crop areas are still much too dry

- Far southern Brazil will receive additional waves of rain over the next couple of weeks

- Drying farther to the north will support Safrinha crop maturation and harvest progress

- Mato Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast

- Mexico’s monsoonal rainfall will be erratic, but it will improve somewhat this week

- Northeastern Mexico drought relief may not occur without the help of a tropical cyclone

- The same may be true for southern Texas

- Southeast Asia rainfall will continue abundant in many areas through the next two weeks

- Local flooding is possible

- Southern Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development

- East-central Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia

- West-central Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally

- Some needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days

- South Africa’s rain this week has been great for wheat, barley and canola emergence and establishment

- Some disruption to fieldwork resulted, but next week will be dry biased once again

- Central America rainfall will be abundant during the next ten days

- Tropical Storm Celia will move northwest while intensifying well off the west coast of Mexico, but the system will be too far from land to have much impact other than light rainfall along the central coast today and Friday

- Today’s Southern Oscillation Index was +14.94 and it will move erratically lower over the coming week

- New Zealand rainfall will be lighter than usual over the next week, but recent past precipitation has the ground saturated.

Source: World Weather INC

Bloomberg Ag Calendar

Thursday, June 23:

- EIA weekly U.S. ethanol inventories, production, 11am

- US cold storage data for beef, pork and poultry, 3pm

- USDA world coffee report

- International Grains Council’s monthly report

- USDA red meat production, 3pm

Friday, June 24:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- FranceAgriMer weekly update on crop conditions

- Brazil’s Unica to release cane crush and sugar output data (tentative)

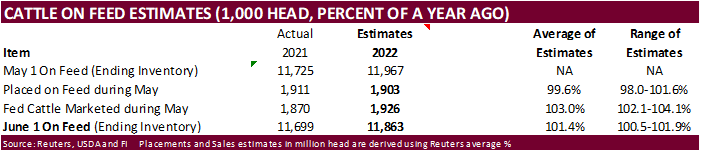

- US cattle on feed, poultry slaughter

- HOLIDAY: New Zealand

Source: Bloomberg and FI

Macros

99 Counterparties Take $2.285 Tln At Fed Reverse Repo Op (prev $2.259 Tln, 95 Bids)

US Initial Jobless Claims Jun 18: 229K (est 226K; prev 229K)

– Continuing Jobless Claims Jun 11: 1315K (est 1320K; prev 1312K)

US Current Account Balance (USD) Q1: -291.4B (est -275.0B; prev -217.9B)

Canada Wholesales Rose 2% M/M In May – Statcan Flash Estimate

– Factory Sales Fall 2.5% In May

Canada’s Factory Sales Drop In May Led By Car Shipments – Statcan

US Unemployment Insurance Weekly Claims Report, June 18 – DOL

US To Provide Another $450 Mln In Military Aid For Ukraine, Including Medium-Range Rocket Systems, Officials Tell AP

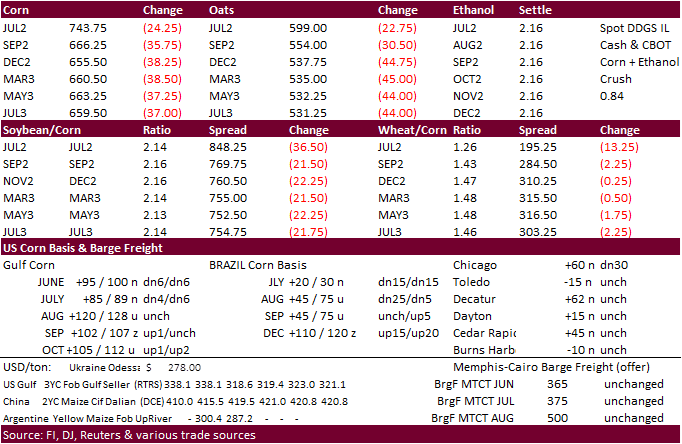

· Corn futures were lower on easing inflation fears and fund selling. US recession concerns are running high. Outside commodity markets had another big day of influencing CBOT ags as weather forecast changes were widely ignored.

· Some areas of the US Corn Belt will miss out on rain over the next week, and the US drought Monitor suggests soil moisture levels have declined from the previous week.

· First Notice Day for deliveries are a week away. We see no corn deliveries at the moment. There could be Chicago and KC wheat deliveries, and some rice. Soybean oil could be 0-100. No meal and no soybeans.

· The International Grains Council (IGC) raised its forecast for 2022-23 global corn by six million tons to 1.190 billion tons. Wheat was unchanged at 769 million tons.

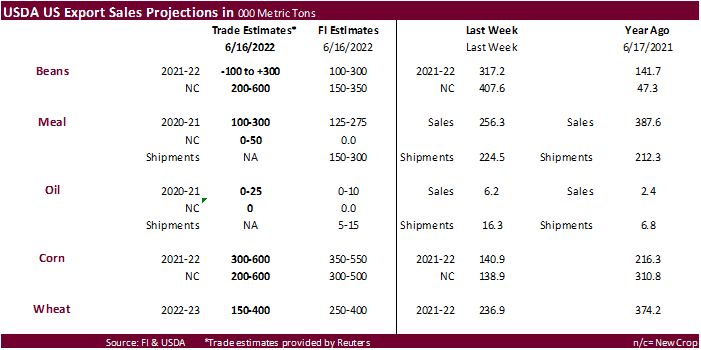

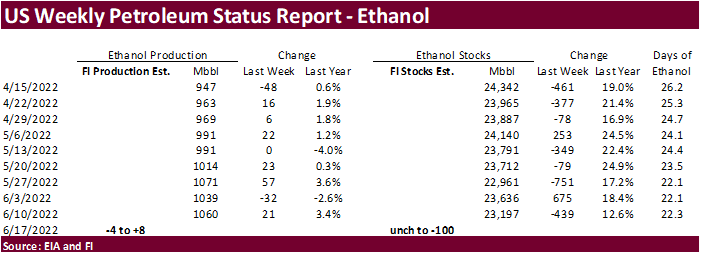

· EIA ethanol data is delayed due to system issues. A Bloomberg poll looked for weekly US ethanol production to be down 5,000 and stocks down 15,000 barrels to 23.182 million.

Export developments.

· None reported

Due out Friday

Updated 6/22/22

July corn is seen in a $7.25 and $8.00 range

December corn is seen in a wide $5.75-$8.25 range

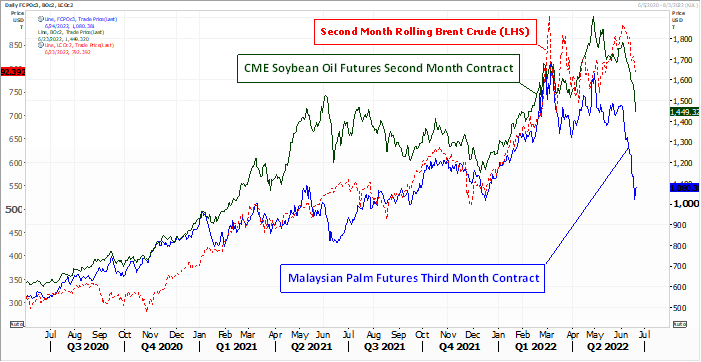

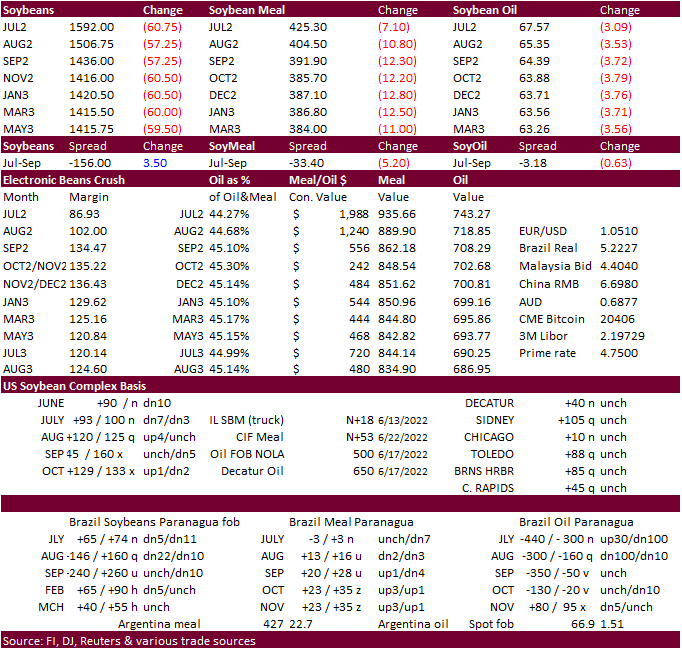

· CBOT soybeans settled sharply lower. Soybean oil sold off hard post day session open despite what had appeared as a reversal in product spreading earlier this morning. Soybean meal ended lower. China meal and vegetable oil futures plunged overnight, sparking widespread global agriculture commodity selling. China soybean meal inventories have tripled, according to Reuters., to over 1 million tons. Improving hag margins are expected to chip away at those stocks.

· Nearby US soybean meal futures fought off losses over the back months from strong spot US interior basis. KC rails was up $5 to 20 over July, truck Council Bluff (IA) up $5, and KC truck up $10, per Reuters.

· Biofuel mandates across the EU are loosening to put downward pressure on rising food prices for vegetable oils and feed grains. Britain is expected to make an announcement this weekend.

· Earlier, Malaysian palm futures rebounded but prices are still way off from week ago levels.

· Two sunflower oil tanks at a terminal in Ukraine’s Black Sea port of Mykolaiv were seriously damaged in a Russian rocket attack (Reuters).

· MPOA Malaysia Palm oil production June 1-20

Pen Msia (+) 19.38%

East Msia (+) 9.64%

Sabah (+) 10.16%

Sarawak (+) 8.21%

Malaysia (+) 15.90%

· September Malaysia palm oil snapped a losing streak by trading 245 points higher and cash palm rose an impressive $45/ton. We thought the market was oversold but expect a good amount in volatility until the export flows stabilize between Malaysia and Indonesia.

Export Developments

· China seeks to sell a half a million tons of soybeans on Friday out of reserves but note over the past few weeks a small amount had been sold from what was offered.

Source: Reuters and FI

Updated 6/23/22

Soybeans – July $15.00-$16.50

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – July $400-$440

Soybean oil – July 66.00-70.00

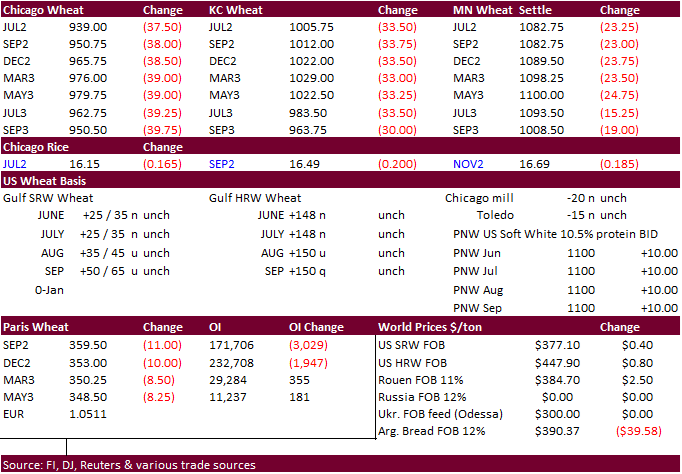

· US wheat futures were sharply lower in a risk off trade amid easing inflation concerns and favorable global weather. News was thin.

· Global export developments are picking up.

· Paris September wheat was down 11 euros at 359.00 euros per ton, lowest level since April 22.

· Turkey is investigating if Ukraine graine was stolen by Russia. Russia denies it.

· (Reuters) – Argentina’s wheat-planting area for the 2022/2023 harvesting season is estimated at 6.3 million hectares (15.6 million acres), down from 6.4 million hectares previously estimated, the Buenos Aires Grains Exchange (BdeC) said on Thursday. The slight cut was due to the lack of rainfall in recent months in key producing areas, BdeC added. The downwardly revised forecast marks the third cut since May, when the exchange estimated a wheat planting area of 6.6 million hectares. Farmers have planted nearly 62% of the area expected for the grain, according to BdeC data.

· APK-Inform estimated Ukraine’s 2022-23 grain crop at 52.4 million tons of grain in 2022, an increase from previous, including almost 18.2 million tons of wheat and 27.7 million tons of corn.

· Saudi Arabia seeks 480,000 tons of wheat for Nov-Jan shipment.

· Algeria bought up to 660,000 tons of wheat, reportedly. Algeria was in for at least 50,000 tons of wheat for August shipment.

· Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

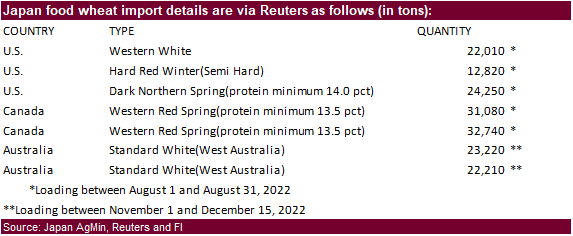

· Japan bought 168,330 tons of food wheat. Original details below

· Bangladesh seeks 50,000 tons of wheat on July 5 for shipment within 40 days.

Rice/Other

· None reported

Updated 6/23/22

Chicago – July $9.00 to $10.00 range, December $8.50-$12.50

KC – July $9.50 to $11.00 range, December $8.75-$13.50

MN – July $10.00‐$11.50, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.