PDF Attached

The

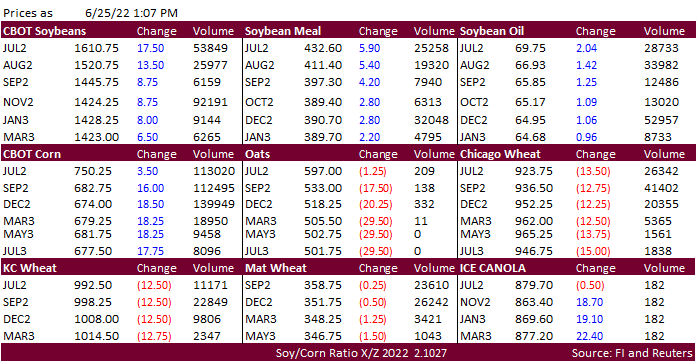

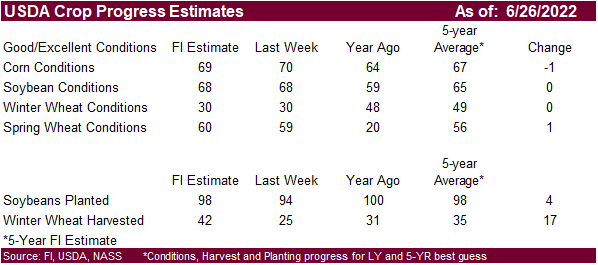

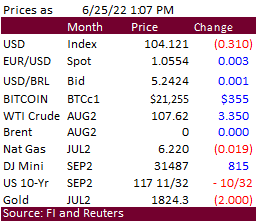

soybean complex rallied in part to bargain buying, broad based commodity buying, higher WTI crude oil, sharp increase in US equities, and 31 point decline in the USD. Corn followed while wheat extended losses on favorable global weather. It will busy next

week with US quarterly reports due out.

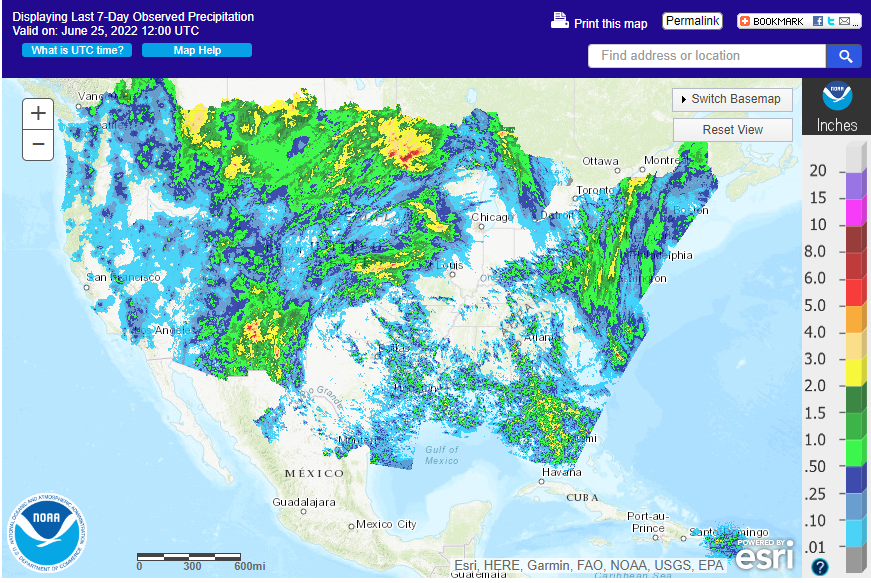

WEATHER

EVENTS AND FEATURES TO WATCH

-

U.S.

weekend rainfall will be greatest in parts of Kansas, Iowa, northern Missouri and northeastern Kansas as well as from the eastern Dakotas into central and northern Minnesota.

-

Rainfall

of 0.50 to 1.50 inches and locally more will impact each of these areas -

Some

relief is also expected from a part of the Delta into areas near and south of the Ohio River where 0.30 to 1.25 inches of rain is expected -

Net

drying is likely elsewhere -

Eastern

U.S. Midwest rainfall will be most restricted through the end of next week resulting in more drying

-

This

includes areas form central and western Ohio and southeastern Michigan through Indiana and southern and east-central Illinois to the northern Delta, parts of central and southern Missouri and areas southwest into Oklahoma

-

U.S.

topsoil moisture by the end of next week should be favorable for crops in Iowa, Wisconsin, Minnesota and the eastern Dakotas as well as the interior southeastern states -

Dryness

will remain a concern, though, in the eastern Midwest, parts of the Delta, Oklahoma, northern Texas and from western Kansas to Montana and western North Dakota -

Canada’s

southwestern Prairies will experience net drying in this first week of the outlook once again, but previous rainfall should have the region favorably moist to support crops -

Central

Saskatchewan is driest and has the greatest need for rain -

Some

rain is expected in the region this weekend, but more will be needed -

Second

week rainfall in the key U.S. crop areas should be better than in this first week of the outlook with many areas getting rain at one time or another -

Portions

of the Eastern Midwest may have some of the driest conditions to deal with, but the situation is not likely to be critical -

U.S.

bottom line still looks favorable for many areas, despite dryness in the eastern Midwest, Delta and a part of the northwestern Plains. The drier areas are not likely to see extreme weather that would seriously cut into production potentials, but the second

week rainfall will prove to be very important as will that of weeks 3 and 4 since this is the time period that corn will pollinate. Sufficient rain is advertised in the coming ten days from Iowa to Minnesota and Wisconsin to get those crops in very good shape

for pollination. Crop conditions will also be improving in the eastern Dakotas and western Minnesota and in parts of the southeastern states leaving pockets in the eastern Midwest with an ongoing low soil moisture issue. A close watch on the distribution of

rain beyond day ten is warranted for the eastern Midwest until greater rain falls. Recent crop moisture stress has had no serious impact on production potentials in the Midwest, but some of the stress in the Tennessee River Basin and neighboring areas has

been a little tough on crops in those areas and potential yields could soon be negatively impacted if rain fails to develop -

Strong

cool front dropping through Canada’s Prairies and the northern U.S. Plains Friday and Saturday will eventually overspread the Midwest this weekend and early next week -

High

temperatures will cool to the 70s and lower 80s in the Midwest and to the 60s and 70s for a single day in Canada and the northern Plains Saturday -

Some

rain will accompany the frontal system, but resulting rainfall will mostly be light and there will be a need for greater rain -

The

Gulf of Mexico will not be open as a moisture source during this first week of the outlook because of the high pressure system aloft will have its base in the region preventing much moisture from flowing northward and enhancing rainfall -

However,

a disturbance over Florida and southern Georgia Saturday will move west along the coast reaching Louisiana Sunday into Monday and a fair amount of the Texas upper Coast and Blacklands during the early part of next week -

This

moisture will join a cool front moving south from the Midwest and northern Plains next week to possibly enhance a small part of the rain event -

U.S.

ridge of high pressure will relocate to the west next week and will be over the Rocky Mountain region and high Plains briefly -

This

position may allow another cool front to drop through Canada and the north-central and eastern United States during the first days in July

-

The

Gulf of Mexico “may” open up as a moisture source when this new bout of cooling occurs -

The

greatest rain potential in the northern Delta and Tennessee River Basin as well as areas north into the Midwest does not evolve until the first days of July

-

By

then some crops away from the coast may be more seriously stressed making the need for rain greater -

North

America Ridge of high pressure is expected to meander between the Rocky Mountains and the western Corn Belt during weeks 3 and 4 of the forecast -

This

position will keep weather conditions in the eastern and northern Midwest favorable with brief bouts of milder air and some rainfall -

The

southwestern Corn and Soybean Production region, Delta and southern Plains will likely have the toughest time getting rain -

Texas

cotton, corn, soybean and sorghum areas may get some rain as the two cool fronts from the northern Plains and Midwest drop into the region -

The

first chance for rain will be during the first half of next week -

No

soaking is expected away from the upper Texas coast, but a little relief from the hot, dry, bias will occur in a few areas in the Blacklands and both West and South Texas -

The

upper Texas Coast may get 1.00 to 3.00 inches of rain -

Cotton,

rice and a few corn, sorghum and soybean areas will benefit, but most of the rain will be kept near the coast.

-

Some

interior southern Texas locations may also get a little rainfall, but much more will be needed -

The

second chance for rain in the southern Plains is expected in the first week of July and rainfall will again be a little erratic leaving some areas much too dry and offering temporary relief for other areas -

West

Texas rainfall will be greatest Sunday through Tuesday with a few amounts over 1.00 inch, but no more than 25% of the production region will get 0.75 inch or more -

Most

of the dryland production areas will not get enough rain for a sustainable improvement in soil moisture -

Follow

up precipitation will be too light and sporadic to have much impact. -

U.S.

far west is not likely to get much rain through the next two weeks -

U.S.

southwest monsoonal rainfall will continue to feed into New Mexico and eastern Arizona through the weekend and then it may extend a little farther to the north during the following week -

Some

of this moisture will reach Kansas, the Texas Panhandle and eastern Colorado and Nebraska during the weekend and especially next week inducing some greater central Plains rainfall

-

This

moisture might also benefit Iowa and northern Missouri rainfall -

Western

Europe will experience cooling with periods of rainfall during the next ten days -

France,

Germany and the U.K. will be most impacted -

Eastern

Europe from the Baltic States and parts of Poland southward through Hungary and parts of Romania will experience net drying in the coming week to possibly ten days -

Net

drying for some of this region will induce a little crop stress because dryness is already present, but most areas will handle the drier weather in stride -

The

lower Danube River Basin and western Ukraine is driest. -

CIS

precipitation has been most restricted in recent weeks in Ukraine, Russia’s Southern Region and western parts of Kazakhstan where soil conditions are drying out -

Rain

is predicted today into Monday for central and eastern Ukraine and western portions of Russia’s Southern Region resulting in improved crop and field conditions

-

The

lower Volga River Basin and western Kazakhstan will likely remain drier than usual, but at least “some” relief will occur to the west

-

Flooding

in southern China is prevailing after horrendous amounts of rain fell in the past few weeks, but the weather has improved and will continue improved -

Flooding

continues a serious problem in parts of the far south, and it will continue for a while, albeit gradually improving -

No

more excessive rain is expected into early July -

Northeastern

China will continue to receive frequent bouts of rain resulting in some very wet conditions and some local flooding especially this weekend into next week

-

Parts

of this region are too wet and need to dry down for a while -

Some

of the dry areas in the North China Plain received rain Wednesday and more is expected this weekend into early next week -

Much

improved crop conditions are anticipated -

Some

immediate improvement already occurred from Wednesday’s rain, but much more will be needed to put a greater dent in the moisture deficits that have recently accumulated.

-

China’s

Xinjiang province continues to experience relatively good weather -

A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week -

Some

cooler biased conditions may briefly evolve, but temperatures will not fall below normal -

India’s

monsoonal rainfall is expected to continue improving over the next couple of weeks, but this first week’s totals were still a little light in some areas

-

Maharashtra

and Madhya Pradesh will be wettest in this coming week with near to above normal amounts are likely -

Australia

weather will be good for fieldwork; including the planting of winter wheat, barley and canola during the next week -

Queensland

may get some beneficial rain next week, but mostly to the north of key crop areas

-

Ontario

and Quebec, Canada weather should be favorably mixed over the next two weeks

-

A

little drier and warmer bias would be most welcome and that is exactly what is expected -

South

Korea rice areas were critically dry, but will get a few periods of rain during the next ten days bringing needed relief

-

A

tropical cyclone may evolve in the western Pacific Ocean near the northern Philippines next week that could threaten Taiwan and/or China after impacting the northern Philippines -

Western

Argentina has a better chance for rain early next week -

Areas

from central Cordoba to northern Buenos Aires and Entre Rios will be most impacted -

Follow

up moisture will be extremely important -

Western

crop areas are still much too dry -

Far

southern Brazil will receive additional waves of rain over the next couple of weeks -

Drying

farther to the north will support Safrinha crop maturation and harvest progress -

Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast -

Mexico’s

monsoonal rainfall will improve in the west and north-central parts of the nation during the coming two weeks -

Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone -

The

same may be true for southern Texas -

Southeast

Asia rainfall will continue abundant in many areas through the next two weeks -

Local

flooding is possible -

Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development -

East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia -

West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally -

Some

needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days -

South

Africa’s rain this week was great for wheat, barley and canola emergence and establishment -

Some

disruption to fieldwork resulted, but next week will be dry biased once again -

Central

America rainfall will be abundant during the next ten days -

Tropical

Storm Celia will move northwest while intensifying well off the west coast of Mexico, but the system will be too far from land to have much impact other than light rainfall along the central coast today

-

Today’s

Southern Oscillation Index was +14.25 and it will move erratically lower over the coming week -

New

Zealand rainfall will be increasing during the coming week after recent drying

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

June 27:

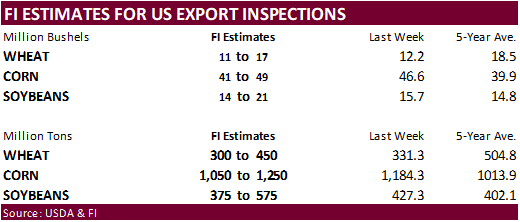

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton; harvest progress for winter wheat, 4pm - HOLIDAY:

Chile

Tuesday,

June 28:

- EU

weekly grain, oilseed import and export data - Malaysian

Palm Oil Board’s Transfer of Technology seminar

Wednesday,

June 29:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - OECD-FAO

agriculture outlook report - Vietnam’s

general statistics dept releases June coffee, rice, rubber export data - USDA

hogs & pigs inventory, 3pm

Thursday,

June 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon - US

acreage for corn, soybeans and wheat - US

agricultural prices paid, received, 3pm - Malaysia’s

June palm oil export data

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Source:

Bloomberg and FI

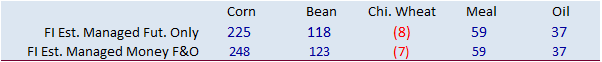

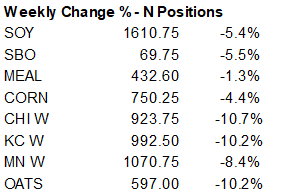

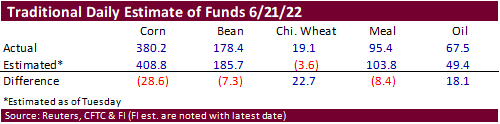

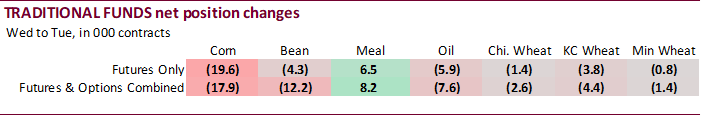

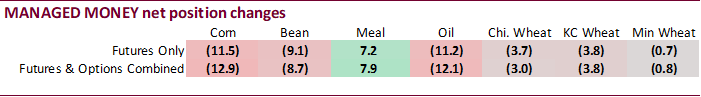

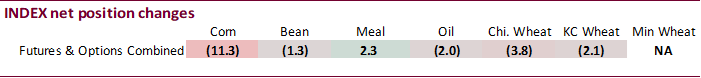

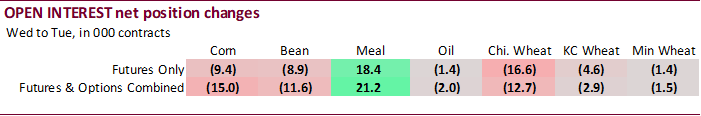

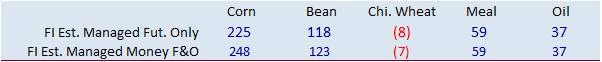

The

trade was off on estimating the traditional net long position for corn but keep in mind we saw some volatile days. Open interest didn’t change all that much, suggesting traders were busy positioning for the week ending June 21. Index funds appeared to have

liquidated net long positions, what we speculated earlier this week.

Macros

·

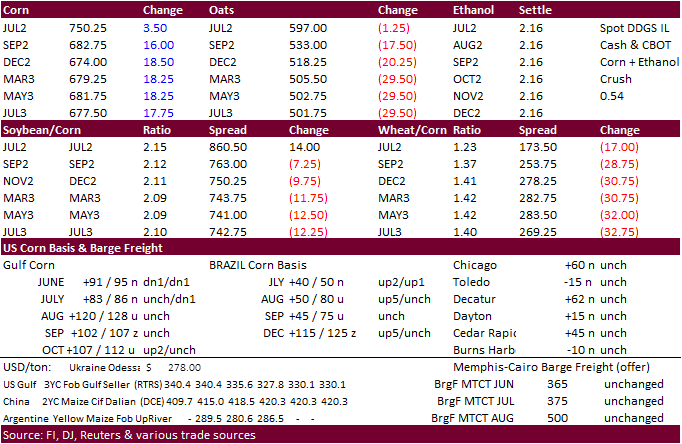

Corn futures

increased on Friday in large part to broad based commodity buying and a very good rebound in US export sales. The WTI crude market rallied, equities were higher, and the USD was lower. News was light, as it had been over the short trading week, for corn.

·

US Gulf corn increased about 1-2 cents from Thursday to around 94 over the July for spot.

·

Funds bought an estimated net 10,000 corn contracts.

·

42 percent of the Argentina corn crop had been collected, a slow 5 point increase from the previous week.

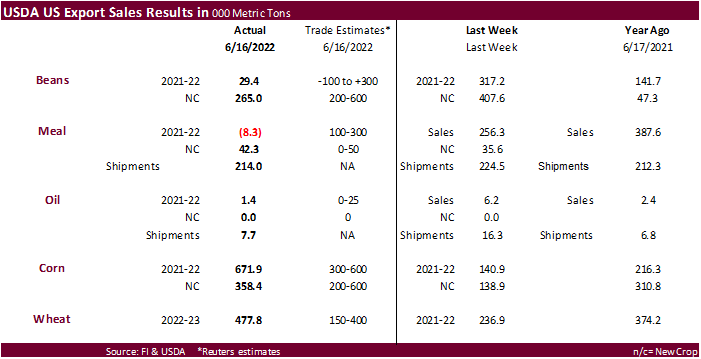

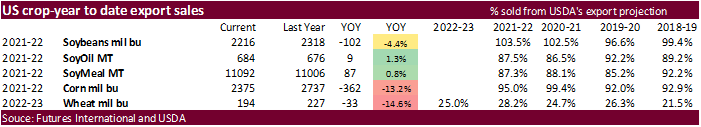

Export

developments.

·

South Korea’s KFA bought a cargo of corn at $356.99 percent ton for September arrival.

·

NOFI was also in for corn.

·

EU Black Sea barley trade picked up late this week.

Due

out Wednesday

Updated

6/22/22

July

corn is seen in a $7.25 and $8.00 range

December

corn is seen in a wide $5.75-$8.25 range