PDF Attached

Grains

traded lower while the soybean complex settled higher. US soybean spreading against corn and positioning was noted. US weather over the near term will be good for corn development. Russia wheat prospects continue to improve, and USDA could be estimating that

crop at least 6 million tons below what will be realized.

Global export developments are picking. After the close Egypt announced they seek wheat. US crop conditions were lower

than expected for corn and soybeans.

Calls:

Soybeans

8-12 cents higher

SBO

40-70 points higher

Soybean

meal $3-$5 higher

Corn

4-7 higher

Wheat

5-9 higher

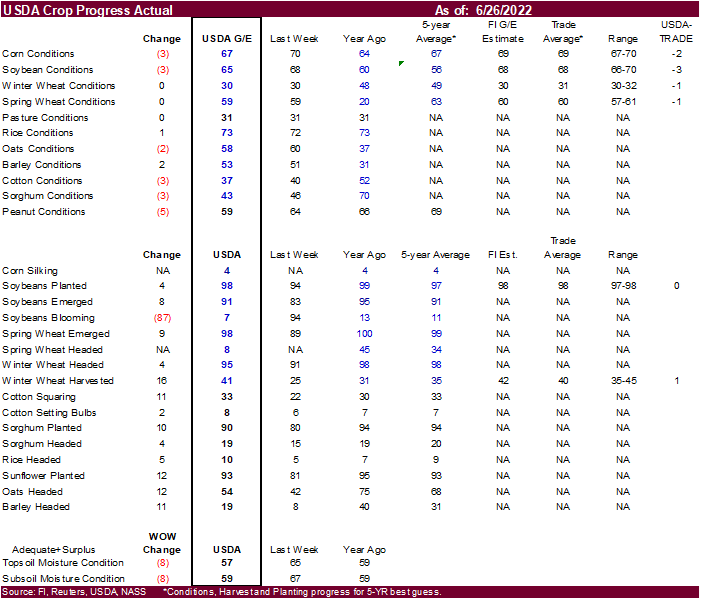

US

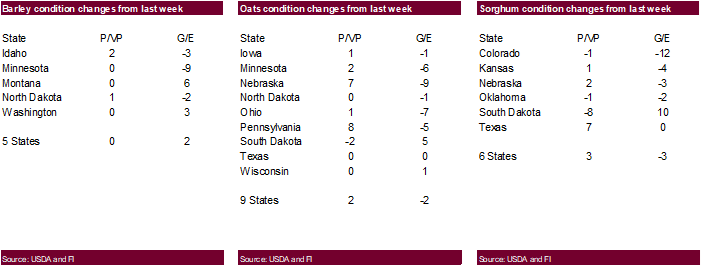

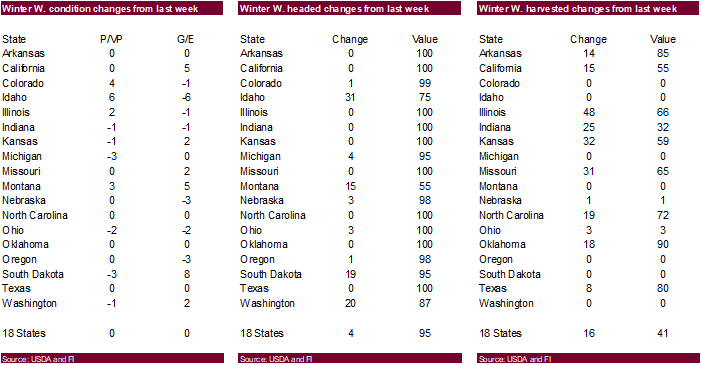

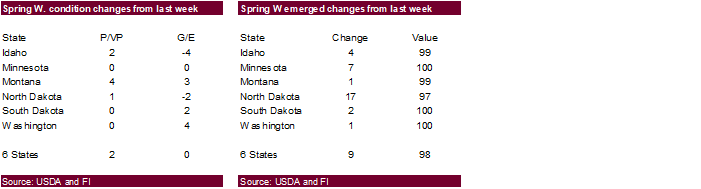

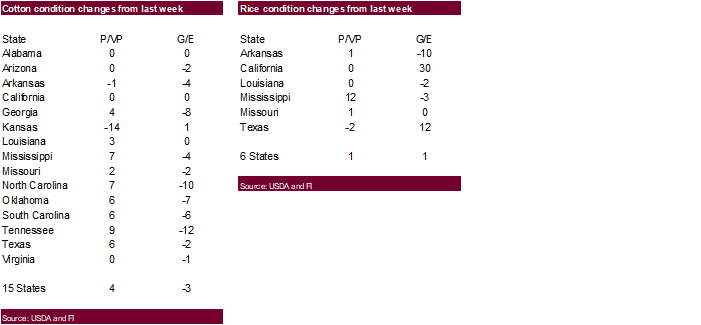

corn crop conditions fell to 67 percent from 70 percent previous week. The trade was looking for a one point decrease. US soybean crop conditions of 65 percent were also below expectations, down from 68 previous week. The trade was looking for unchanged. US

spring wheat and winter wheat conditions were unchanged from the previous week. The trade was looking up one for winter wheat and up one point for spring. Winter wheat harvest progress was 41 percent versus 40 percent trade average.

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

weekend rainfall was greater than expected in parts of Illinois and northeastern Iowa - Northwestern

Iowa was much wetter than the European model suggested and a little wetter than the GFS predicted

- Southern

Minnesota was drier than expected - U.S.

Midwest dry pockets need to be closely monitored over the next two weeks - Limited

rainfall and seasonable temperatures will induce drying and if rainfall is missed additional drying is likely - Soil

moisture is already low in many areas - U.S.

Delta and southeastern states will get some needed rain in the next week to ten days offering some relief from recent hot and dry biased conditions - Texas

Coastal Bend is expecting some significant rain later this week - Northwestern

France is advertised drier in the next ten days than suggested Friday - Less

rain is advertised in portions of Russia’s Southern Region and eastern Ukraine relative to the outlook from Friday - A

tropical cyclone will evolve west of Luzon, Philippines and produce some very heavy rain from Wednesday through Saturday. The storm may reach the previously flooded areas of Guangdong, China late this weekend into early next week which may cause new damage

from returning floods - A

second tropical cyclone “may” evolve later this week and could impact western Japan and/or the Korean Peninsula this weekend into early next week – confidence is low - A

tropical disturbance 900 miles east southeast of the Windward Islands will likely become a tropical cyclone later this week - The

windward Islands and Central America will be most impacted - Torrential

rain and serious flooding will be possible in Nicaragua, Honduras and Guatemala late this week and into the weekend - Eastern

Australia may get rain Thursday into the weekend with Queensland and northeastern New South Wales wettest

- Argentina

is still expecting rain today into Tuesday offering a short term bout of relief from dryness from parts of Cordoba to Entre Rios and northern Buenos Aires

WEATHER

DETAILS

- Best

U.S. weekend rainfall occurred in eastern North Dakota, northern Minnesota, northeastern Iowa and Illinois during the Friday through Sunday morning period - Rain

totals varied from 1.00 to 2.00 inches occurred in each of these areas with local totals to 3.00 inches in interior eastern Iowa and to 2.88 inches in northwestern Illinois - Rain

also fell in a “locally” heavy manner in central and northwestern Georgia, in parts of the Florida Panhandle and in central and southwestern Florida’s peninsula where rainfall reached 2.00 to nearly 4.00 inches

- Locally

heavy rain also impacted a part of the central Delta Sunday night - Rain

fell significantly from the Texas Panhandle to south-central and southeastern Kansas where 0.35 to 1.25 inches and local totals to 3.46 inches - Net

drying occurred elsewhere - U.S.

week one weather will limit rainfall from southern Minnesota, southeastern South Dakota and northeastern Nebraska through much of Iowa to southern Michigan and northwestern Ohio

- Rainfall

in these areas will vary from 0.10 to 0.65 inch which may not be enough to counter evaporation, although temperatures should be close to normal with a slight warmer bias - Indiana,

parts of Ohio, southern Minnesota and northeastern Nebraska are already quite dry - Showers

will occur a little more often and a little more significantly to the north and south of the above region with 0.50 to 1.50 inches resulting with a few greater amounts by this time next week

- Week

two U.S. Midwest weather is expected to be favorably mixed, although some of the model data may be a little too wet; regardless there will not be any excessive heat or prolonged periods of dry weather in a large portion of the region leaving most crops developing

well - This

is consistent with our previous statements about early season crops performing possibly better than late season crops – if we assume drier and warmer conditions in the western Midwest and central and southern Plains in the second half of summer will evolve

as expected by GFS. - Do

not be surprised to see a little more net drying in the second week forecast in parts of the Midwest than what is advertised by the models today - Temperatures

will be a little warmer than usual - U.S

southern Plains and Delta may experience the most frequent below average precipitation, although the absolute driest conditions are expected in parts of Texas and Oklahoma - The

Delta should get some scattered showers and thunderstorms that will help crops develop even though some of the rainfall will be lighter than usual - U.S.

southeastern states will experience periodic showers and thunderstorms during the next ten days, but resulting rainfall may be lighter than usual, but still sufficient to support crop development

- A

close watch on evaporation rates will be warranted - If

it gets too warm the lighter than usual rainfall will not be enough to counter moisture losses through evaporation - The

bottom line for U.S. crops is mostly favorable with relatively normal crop development but be aware that some pockets of dryness are quite likely to continue and could fester. Most likely the dry pockets will not be widespread enough to seriously pull down

production potentials, but that is what needs to be closely monitored. The second week could trend a little drier than advertised in the southwestern Corn Belt and Delta, but the outlook should be closely monitored over the next few weeks as corn moves into

the moisture sensitive reproductive phase of development. Topsoil moisture has been reduced in many eastern Midwest, Delta and Tennessee River Basin locations and those are the areas that need to be most closely monitored until significant rain falls. West

Texas cotton, corn and sorghum areas will remain too dry, despite some sporadic showers of limited significance.

- Canada’s

Prairies will experience a mix of rain and sunshine so that most crops develop well - There

will be some pockets of drying that will need to be monitored, but there will eventually be sufficient rain to prevent a serious dry bias from evolving over a broad region - The

bottom line remains a good one for the region, despite some pockets of dryness and a few areas of excessive moisture. - Europe

weather is expected to be active from central and eastern France to Germany and western Poland over the coming week to ten days - Net

drying is expected in the northwest half of France, despite some showers - Spain,

Portugal, Peninsular Italy and portions of the Balkan Countries will also experience net drying, despite a few showers - Eastern

Europe temperatures will be well above normal in this first week of the outlook which may exacerbate net drying in the areas that do not get much rain - Far

western Europe may be just slightly cooler biased - Second

week temperatures will be near normal in the north and warmer than usual in the south - Western

Europe received some welcome rain during the weekend with most of France and parts of Germany getting some needed rain

- That

moisture and the rain that occurred late last week should have started a notable improving trend in topsoil moisture especially in France and parts of Germany - Parts

of eastern Europe experienced net drying - Temperatures

in southern and eastern Europe were quite warm during the weekend with many highs in the 80s and lower 90s Fahrenheit - The

heat helped to accelerate drying in parts of the region which raises the need for rain

- Europe’s

bottom line is mixed with some areas of dryness in eastern Europe that will need to be closely monitored. Recent rain in the west has brought some improvement, although pockets of dryness are lingering - Hotter

weather occurred in parts of Kazakhstan during the weekend with highs in the 90s and over 100 Fahrenheit - The

heat was greatest outside of key sunseed and spring wheat areas, but a few southeastern crop areas reported extreme highs to 106 - Cool

temperatures occurred during the weekend in Russia’s eastern New Lands with highs in the upper 40s and 50s in the northeast and in the 60s and lower 70s in the south - Some

frosty temperatures “may” evolve this week in eastern Russia’s New Lands, but too much wind and cloudiness is expected to bring on a serious risk of crop damage - Western

CIS weather will be favorably mixed with sunshine and rain during the next two weeks - Temperatures

will be warmer than usual in this first week of the outlook - The

warmer weather will shift into the eastern New Lands during the second week of the forecast as rain increases and cooling begins in the west - Russia’s

Southern Region away from the Black Sea coast and the Georgia border will continue to dry out along with eastern Ukraine - These

areas will need greater rain and sooner rather than later because the ground is already dry - The

bottom line for the CIS is mostly good, but dryness will remain in parts of Russia’s Southern Region (away from the Georgia Border and away from the Black Sea coast) as well as eastern Ukraine. These areas will need greater rain - China’s

North China Plain received some needed rain overnight and it will get some additional needed rain this week to offer some relief to recent dryness that was not relieved by rain last week - Shandong

got good rain last week and again Sunday, but Henan, Shanxi, Hebei, northern Anhui and parts of Jiangsu still need rain even though some fell overnight - Some

immediate relief has already occurred from rain overnight and follow up showers of lighter intensity are expected during the second half of this week into the weekend that should perpetuate the improving trend - Southern

China’s weather has been improving since torrential rain ended last week, but a tropical cyclone evolving west of Luzon Island, Philippines may bring excessive rain to Guangdong, Fujian and neighboring areas during the weekend and early next week

- Southern

China weather will resume a more normal distribution of rain and sunshine next week after the tropical cyclone passes

- Northeastern

China will continue to see frequent rainfall during the next ten days maintaining wet field conditions in some areas - The

bottom line for China remains favorable in many areas with relief likely from dryness in the North China Plain. Concern will be rising over eastern Guangdong and Fujian if the tropical cyclone evolves and comes ashore as advertised. The northeast will remain

wet, but crop development should advance relatively well. Drying is needed in the northeast and parts of the far south. - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week - Some

cooler biased conditions may briefly evolve, but temperatures will not fall below normal - Queensland

and parts of New South Wales, Australia will get some rain late this week and into the weekend causing a delay to winter planting of wheat, barley and some canola, but the moisture should be good for crops that have already been planted - Southern

Australia weather will remain favorable for wheat, barley and canola planting and emergence during the next couple of weeks - India’s

monsoonal rainfall is expected to continue improving over the next couple of weeks

- Sufficient

rain is expected over the next two weeks to bolster soil moisture in many important summer grain, oilseed and cotton areas throughout the central, north and eastern parts of the nation - Rain

in the northwest will be slowest in coming, but rain is possible during the weekend and especially next week

- Ontario

and Quebec, Canada weather should be favorably mixed over the next two weeks

- A

little drier and warmer bias would be most welcome and that is exactly what is expected - South

Korea rice areas will get a few periods of rain during the next ten days bringing needed relief after weeks of dryness - Some

relief has already begun, but much more rain is needed - A

tropical cyclone may evolve to the west of the Philippines during mid-week this week before shifting north northeast into southeastern China - The

storm will produce excessive rain over much of western and northern Luzon Island and a few neighboring areas - The

storm could also produce exorbitant amounts of rain in Taiwan as well - A

second tropical cyclone will form east of Taiwan during mid- to late week that could bring heavy rain to the Korean Peninsula and a part of western Japan during the weekend and early next week

- Western

Argentina has a better chance for rain early this week - Areas

from central Cordoba to northern Buenos Aires and Entre Rios will be most impacted - Follow

up moisture will be extremely important - Western

crop areas are still much too dry, but all wheat areas in the nation would benefit from rain - La

Pampa, San Luis and central and southwestern parts of Buenos Aires will not be impacted by this event - Drier

biased conditions are expected to resume again after the early week rain event passes - Far

southern Brazil will receive additional waves of light rain over the next couple of weeks - Drying

farther to the north will support Safrinha crop maturation and harvest progress and is considered to be normal - There

is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks - Mexico’s

monsoonal rainfall will be good the west and north-central parts of the nation during the coming two weeks - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for far southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding is possible - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days - South

Africa’s rain last week was great for wheat, barley and canola emergence and establishment - Some

disruption to fieldwork resulted, but this week’s weather will be much improved with better drying conditions for harvest progress - Winter

crops will continue to establish well. - Central

America rainfall will be abundant during the next ten days - Torrential

rain will bring flooding to Nicaragua, Honduras and Guatemala this weekend into early next week due to an approaching tropical cyclone - Tropical

Storm Celia will move northwest away from western North America and poses no threat to land - Today’s

Southern Oscillation Index was +15.73 and it will move erratically during the coming week - New

Zealand rainfall will be lighter than usual in North Island and eastern portions of South Island while near to above average in western parts of South Island over the coming week

Source:

World Weather INC

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton; harvest progress for winter wheat, 4pm - HOLIDAY:

Chile

Tuesday,

June 28:

- EU

weekly grain, oilseed import and export data - Malaysian

Palm Oil Board’s Transfer of Technology seminar

Wednesday,

June 29:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - OECD-FAO

agriculture outlook report - Vietnam’s

general statistics dept releases June coffee, rice, rubber export data - USDA

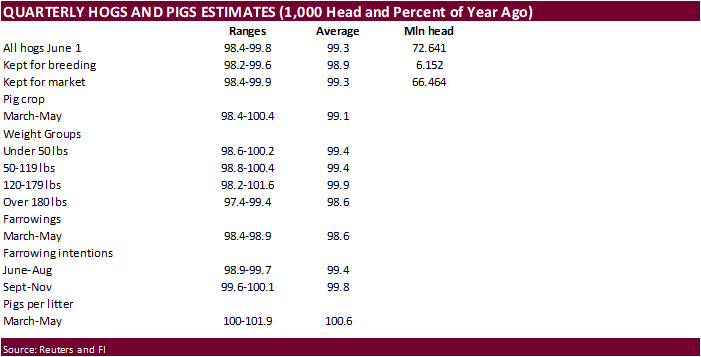

hogs & pigs inventory, 3pm

Thursday,

June 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon - US

acreage for corn, soybeans and wheat - US

agricultural prices paid, received, 3pm - Malaysia’s

June palm oil export data

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Source:

Bloomberg and FI

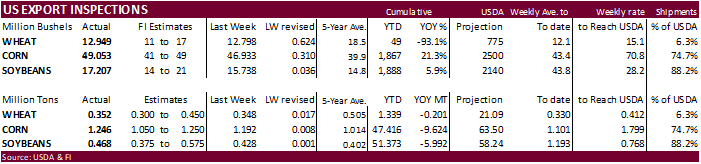

USDA

inspections versus Reuters trade range

Wheat

352,404 versus 300000-600000 range

Corn

1,246,014 versus 900000-1250000 range

Soybeans

468,309 versus 300000-575000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 23, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/23/2022 06/16/2022 06/24/2021 TO DATE TO DATE

BARLEY

49 0 392 49 1,175

CORN

1,246,014 1,192,151 1,045,179 47,416,406 57,040,207

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 0 0 0 0

RYE

0 0 0 0 0

SORGHUM

148,647 71,415 37,212 6,689,082 6,478,504

SOYBEANS

468,309 428,322 111,250 51,372,809 57,365,307

SUNFLOWER

0 0 0 2,260 240

WHEAT

352,404 348,309 291,043 1,339,338 1,540,185

Total

2,215,423 2,040,197 1,485,076 106,819,944 122,425,618

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

Durable Goods Orders May P: 0.7% (est 0.2%; prev 0.5%)

US

Durables Ex Transportation May P: 0.7% (est 0.3%; prev 0.4%)

US

Cap Goods Orders Nondef Ex Air May P: 0.5% (est 0.1%; prev 0.4%)

US

Cap Goods Ship Nondef Ex Air May P: 0.8% (est 0.2%; prev 0.8%)

US

Pending Home Sales (M/M) May: 0.7% (est -3.9%; prev R -4.0%)

EIA

Says Timeline Of Weekly Report Release Still Unclear

96

Counterparties Take $2.156 Tln At Fed Reverse Repo Op (prev $2.181 Tln, 97 Bids)

·

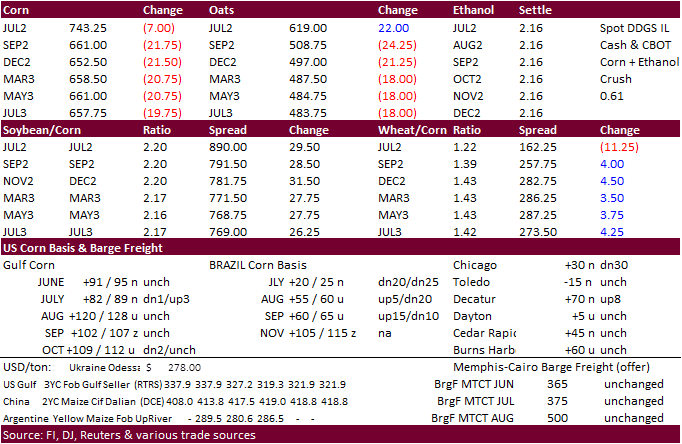

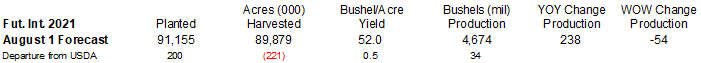

After trading higher on Friday, traders sold corn

futures

Monday on improving US weather. September corn hit a 4-month low. Weekend rains were better than expected across parts of the Midwest. Technical selling and positioning ahead of the US June acreage and stocks report was likely. Some traders are looking for

US corn plantings to increase. A Reuters traded guess looks for corn plantings to increase 400,000 acres to 89.9 million. Expect a volatile week. July corn ended 6 cents lower and December down 21 cents.

·

Funds sold an estimated net 17,000 corn contracts after buying 10,000 on Friday.

·

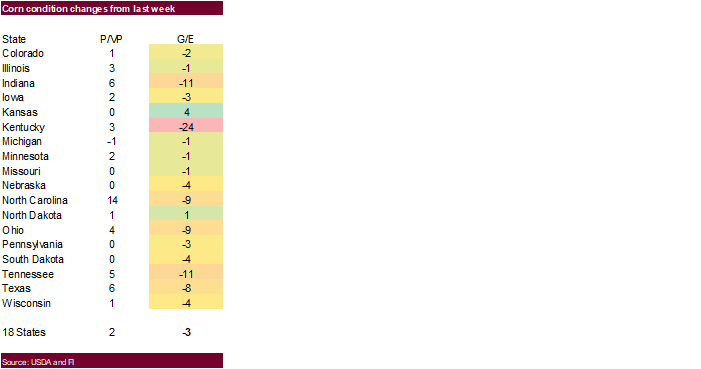

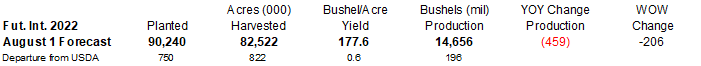

US corn crop conditions fell to 67 percent from 70 percent previous week. The trade was looking for a one point decrease. We revised down our US corn yield from 180.1 to 177.6 bu/ac.

·

WTI crude oil was $2.21 higher.

·

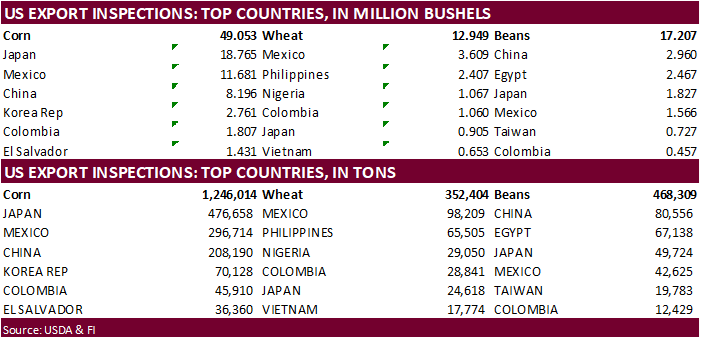

USDA US corn export inspections as of June 23, 2022 were 1,246,014 tons, within a range of trade expectations, above 1,192,151 tons previous week and compares to 1,045,179 tons year ago. Major countries included Japan for 476,658

tons, Mexico for 296,714 tons, and China for 208,190 tons.

·

AgRural: Brazil 2021-22 total corn crop estimated at 113.8 MMT, up from 112.3 million previously. Second crop was projected at 80.3 million tons versus 80.9 million previous. Center-South was 20 percent harvested for the second

corn crop.

·

China hog futures hit a one year high. Germany’s hog herd fell to more than a decade low.

·

First Notice Day for deliveries are a week away. We see no corn deliveries at the moment. There could be Chicago and KC wheat deliveries, and some rice. Soybean oil could be 0-100. No meal and no soybeans.

Export

developments.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US or SA on June 29 for Aug 25-Sep 13 shipment.

Due

out Wednesday

Updated

6/27/22

September

corn is seen in a $5.75 and $7.75 range

December

corn is seen in a wide $5.75-$8.25 range

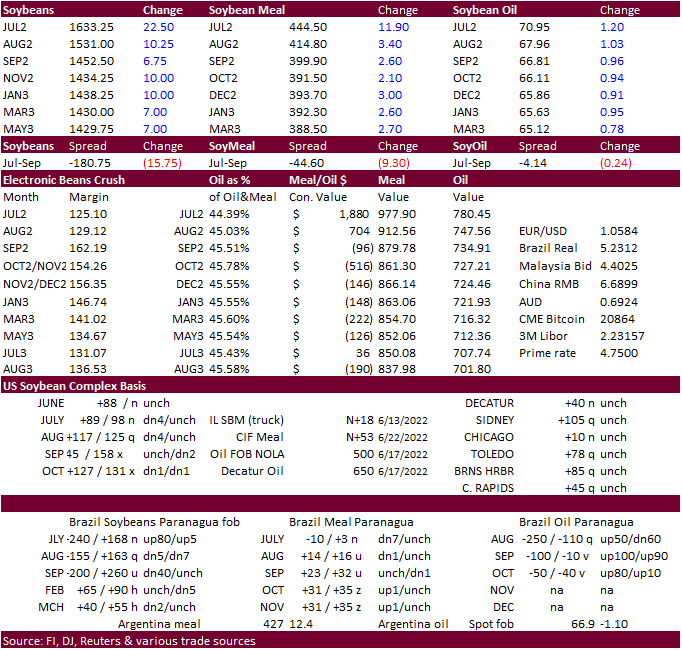

·

CBOT soybean complex traded higher in part to supportive outside related markets, spreading against corn and wheat. There is some uncertainty over the US August weather outlook. Weather over the short term looks good, one reason

corn futures traded lower. One trader noted there could have been some corn/soybean acreage plays that underpinned soybean prices.

·

Fund buying extended for the second consecutive session with an estimated net 9,000 soybeans bought 5,000 meal and 3,000 soybean oil.

·

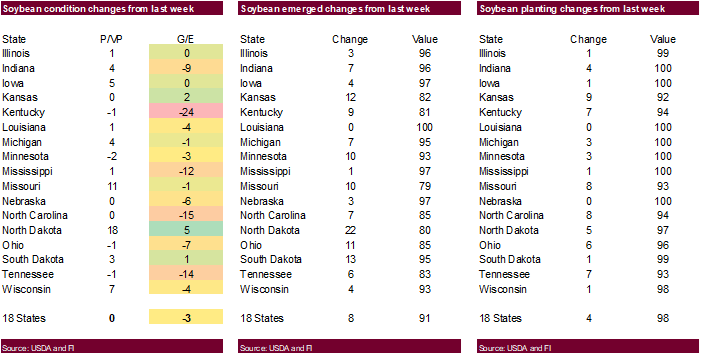

US soybean crop conditions of 65 percent were also below expectations, down from 68 previous week. The trade was looking for unchanged.

·

USDA US soybean export inspections as of June 23, 2022 were 468,309 tons, within a range of trade expectations, above 428,322 tons previous week and compares to 111,250 tons year ago. Major countries included China for 80,556

tons, Egypt for 67,138 tons, and Japan for 49,724 tons.

·

Palm oil rallied 5.5%. Talk of mill closures in Peninsular Malaysia was seen as bullish. Millers are slowing production due to the recent decline in CPO prices.

·

Demand destruction is spilling over into several commodity markets.

·

AgriCensus reported Ceres Global Ag Corp has postponed building out their large canola plant in Saskatchewan, Canada. The $350 million crushing facility is projected to run over budget, in part to inflation for building materials.

·

CBOT corn and soybean open interest was down a good amount on Friday.

·

We don’t look for major changes in US crop conditions when updated later today. The US drought monitor did show expanding dryness bias WCB, which might shift conditions for G/E lower for soybeans and corn.

·

Strategie Grains raised its forecast for this year’s EU rapeseed crop to 18.3 million tons from 18.2 million a month ago, about 8% above last year. They see rapeseed and sunseed prices falling as supplies improve.

Export

Developments

·

China will be back late this week selling a half a million tons of soybeans out of reserves

Updated

6/27/22

Soybeans

– August $14.00-$16.50

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – August $380-$440

Soybean

oil – August 66.00-70.00

·

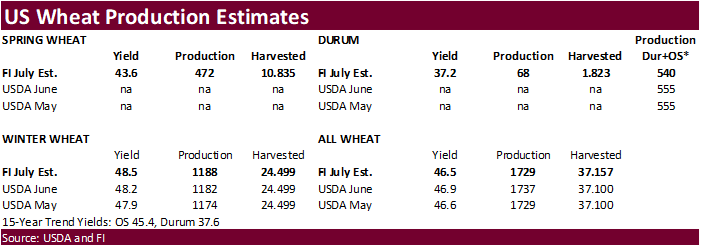

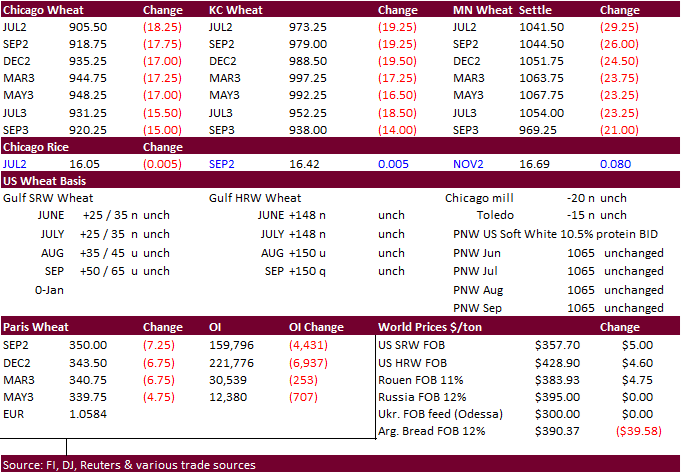

In a two-sided traded, US wheat futures settled lower. September Chicago hit its lowest level since early March overnight. Russian wheat crop prospects continue to grow. MARS pegged the Russian wheat crop at 88.8 million tons

(16% increase from last year). USDA is at 81 million tons.

·

After the close Egypt floated a wheat import tender for September and/or October shipment.

·

The USD was 34 points weaker.

·

Funds sold an estimated net 7,000 Chicago wheat contracts on Friday.

·

US spring wheat and winter wheat conditions were unchanged from the previous week. The trade was looking up one for winter wheat and up one point for spring. Winter wheat harvest progress was 41 percent versus 40 percent trade

average.

·

USDA US all-wheat export inspections as of June 23, 2022 were 352,404 tons, within a range of trade expectations, above 348,309 tons previous week and compares to 291,043 tons year ago. Major countries included Mexico for 98,209

tons, Philippines for 65,505 tons, and Nigeria for 29,050 tons.

·

Paris September wheat was down 7.25 euros at 350 euros per ton.

·

Egypt secured Indian wheat over the weekend. Egypt has enough wheat supplies to last for 5.7 months. They said they plan to cut wheat imports by 500,000 tons per year, or about 10%, by boosting domestic production.

·

India exported 1.8 million tons of wheat since slapping on their export ban.

·

Russian wheat export prices have been under pressure from a rally in the currency and high export taxes. IKAR reported 12% protein for spot shipment at $400 fob, down about $20/ton from the previous week.

·

Ukraine June to date grain exports are down 44 percent from same period year ago to 1.11 million tons.

·

Moldova lifted its export ban for wheat and flour that has been in place since March 1.

·

Egypt seeks wheat for Sep and/or Oct shipment.

·

Egypt bought 180,000 tons of wheat from India. They have been in talks since the beginning of the month.

·

Saudi Arabia bought 495,000 tons of wheat for Nov-Jan shipment at an average price of $441.93 per ton.

·

Taiwan Flour Millers seeks 40,000 tons of US milling wheat on June 29 for Aug shipment.

·

Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

·

Bangladesh seeks 50,000 tons of wheat on July 5 and again July 14 for shipment within 40 days (updated 6/27).

·

Jordan seeks 120,000 tons of milling wheat on June 28 for Sep-Nov shipment.

·

Jordan seeks 120,000 tons of feed barley on June 29 for Oct and/or Nov shipment.

Rice/Other

·

None reported

Updated

6/27/22

Chicago

– September $8.75 to $10.00 range, December $8.50-$12.50

KC

– September $9.00 to $11.00 range, December $8.75-$13.50

MN

– September $9.75‐$11.25, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.