PDF Attached

US

agriculture markets rallied on Tuesday on short covering, improving grain global import tender developments, decline in weekly US corn & soybean conditions and higher energy markets. USD was up 53 points post CBOT close. US equities were lower.

WEATHER

EVENTS AND FEATURES TO WATCH

- Not

much precipitation occurred in the U.S. Midwest Monday and temperatures were more seasonable than they were during the early weekend - U.S.

Northern Plains, Midwest, Delta and southeastern states should see alternating periods of rain and sunshine during the next ten days to two weeks - The

volume of rain may be locally great, but much of it will be near normal or a little lighter than usual - The

moisture will still prove to be timely and supportive of crop development - Low

soil moisture in parts of the Midwest will be closely monitored during this two week forecast because of concern of returning dryness later in the summer - This

is an excellent opportunity period for relief to those areas that have dried out most significantly in the past few weeks - U.S.

Midwest temperatures will be seasonable during the coming week with highs mostly in the 80s Fahrenheit and a few upper 70s in the north and a few lower 90s in the south - Hotter

temperatures will occur briefly in the Plains Wednesday with widespread 90s likely and some of the heat may get into the far western Corn Belt briefly Wednesday and Thursday before abating later in the week - Additional

bouts of heat will occur in the Great Plains next week, but most of that should stay to the west of the Mississippi River keeping eastern Midwest crop areas free of strong drying rates - U.S.

Delta and southeastern states will experience periodic showers and thunderstorms in the next two weeks - Some

improved topsoil moisture is expected and a reduction in crop stress will be possible for some areas - Tropical

low pressure center off the Texas coast during mid-week this week will eventually bring heavy rainfall to a part of the Texas Coast - ECMWF

takes the disturbance and moves it to the Delta during the weekend and early part of next week resulting in enhanced rainfall – confidence is low - GFS

model takes this disturbance to Edwards Plateau and southern parts of West Texas this weekend – this is not likely to verify - Regardless

of which solution verifies there will be some significant rain along the middle and upper Texas coast over the second half of this week offering some relief to parts of the region - Northern

U.S. Plains and Canada’s Prairies will experience a good mix of rain and sunshine and seasonable temperatures during the next two weeks - Crop

development should advance relatively well - Potential

Tropical Depression Two is expected to become a tropical storm today and then move along the Venezuela coast Wednesday and Thursday before reaching Nicaragua late this week and during the weekend - The

storm was located 330 miles east of Trinidad at 0800 EDT today moving westerly at 23 mph and producing wind speeds to 40 mph - The

storm has potential to produce heavy rain in Central America and it will be closely monitored - Europe

weather is expected to be active from eastern France to Germany and Poland over the coming week to ten days - Net

drying is expected in the west half of France, despite some showers - Spain,

Portugal, Peninsular Italy and portions of the Balkan Countries will also experience net drying, despite a few showers - Temperatures

in eastern Europe remained quite warm Monday with many highs in the 80s and lower 90s Fahrenheit - The

heat helped to accelerate drying in parts of the region which raises the need for rain in some areas

- Eastern

Europe temperatures will be well above normal in this first week of the outlook which may exacerbate net drying in the areas that do not get much rain - Far

western Europe may be just slightly cooler biased - Second

week temperatures will be near normal in the north and warmer than usual in the south - Europe

rainfall Monday was restricted to Germany, eastern France and western parts of both Czech Republic and Poland - That

moisture and the rain that occurred late last week should have started a notable improving trend in topsoil moisture especially in France and parts of Germany - Parts

of eastern Europe experienced net drying - Cool

temperatures continued Monday in Russia’s eastern New Lands with highs in the 50s and lows today in the upper 30s and 40s Fahrenheit

- Some

cooling reached into northern Kazakhstan Monday after hot conditions occurred briefly during the weekend - The

relief was welcome - Some

frosty temperatures “may” evolve this week in eastern Russia’s New Lands, but too much wind and cloudiness is expected to bring on a serious risk of crop damage - Western

CIS weather will be favorably mixed with sunshine and rain during the next two weeks - Temperatures

will be warmer than usual in this first week of the outlook - The

warmer weather will shift into the eastern New Lands during the second week of the forecast as rain increases and cooling begins in the west - Russia’s

Southern Region away from the Black Sea coast and the Georgia border will continue to dry out along with eastern Ukraine - These

areas will need greater rain and sooner rather than later because the ground is already dry - Temperatures

will be mild to cool for a little while which will help to conserve soil moisture

- Warmer

temperatures will occur this weekend into next week that may exacerbate the dryness and raise the need for significant moisture - The

bottom line for the CIS is mostly good, but dryness will remain in parts of Russia’s Southern Region (away from the Georgia Border and away from the Black Sea coast) as well as eastern Ukraine. These areas will need greater rain - China’s

North China Plain received some needed rain in recent days and it will get some additional needed rain later this week and next week offering additional relief from previous dryness.

- Southern

China’s weather has been improving since torrential rain ended last week, but a tropical cyclone evolving west of Luzon Island, Philippines may bring excessive rain to Guangdong, Fujian and neighboring areas during the weekend and early next week

- Confidence

in the tropical cyclone’s movement is very low and a close watch on the system is warranted - Southern

China weather will resume a more normal distribution of rain and sunshine next week after the tropical cyclone passes

- Northeastern

China will continue to see frequent rainfall during the next ten days maintaining wet field conditions in some areas - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week - Some

cooler biased conditions may briefly evolve later this week and into the weekend - Queensland

and parts of New South Wales, Australia will get some rain late this week and into the weekend causing a delay to winter planting of wheat, barley and some canola, but the moisture should be good for crops that have already been planted - Southern

Australia weather will remain favorable for wheat, barley and canola planting and emergence during the next couple of weeks - India’s

monsoonal rainfall is expected to continue improving over the next couple of weeks

- Sufficient

rain is expected over the next two weeks to bolster soil moisture in many important summer grain, oilseed and cotton areas throughout the central, north and eastern parts of the nation - Rain

in the northwest will be slowest in coming, but rain is possible during the weekend and especially next week

- Ontario

and Quebec, Canada weather should be favorably mixed over the next two weeks

- A

little drier and warmer bias would be most welcome and that is exactly what is expected - South

Korea rice areas will get a few periods of rain during the next ten days bringing needed relief after weeks of dryness - Some

relief has already begun, but much more rain is needed - A

tropical cyclone may evolve to the west of the Philippines during mid-week this week before shifting north into southern China - The

storm will produce excessive rain over much of western and northern Luzon Island and a few neighboring areas - The

storm could also produce exorbitant amounts of rain in Taiwan as well - Confidence

in the storm’s movement is low and it should be closely monitored - A

second tropical cyclone will form east of Taiwan during mid- to late week that could bring heavy rain to South Korea and western Japan during the weekend and early next week

- Central

Argentina will receive some rain today, but only a small part of the nation’s winter crops will benefit - Areas

from central Cordoba to northern Buenos Aires and Entre Rios will be most impacted - Follow

up moisture will be extremely important - Western

crop areas are still much too dry - All

wheat areas in the nation would benefit from rain - La

Pampa, San Luis and central and southwestern parts of Buenos Aires will not be impacted by this event - Drier

biased conditions are expected to resume again after the early week rain event passes - Far

southern Brazil will receive additional waves of light rain over the next couple of weeks - Drying

farther to the north will support Safrinha crop maturation and harvest progress and is considered to be normal - There

is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks - Mexico’s

monsoonal rainfall will be good the west and north-central parts of the nation during the coming two weeks - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for far southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding is possible - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days - South

Africa’s rain last week was great for wheat, barley and canola emergence and establishment - Some

disruption to fieldwork resulted, but this week’s weather will be much improved with better drying conditions for harvest progress - Winter

crops will continue to establish well. - Central

America rainfall will be abundant during the next ten days - Torrential

rain will bring flooding to Nicaragua and Honduras this weekend into early next week due to an approaching tropical cyclone - El

Salvador and Guatemala might also be impacted - Today’s

Southern Oscillation Index was +15.57 and it will move erratically during the coming week - New

Zealand rainfall will be lighter than usual during the balance of this week and then wetter next week

Source:

World Weather INC

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - OECD-FAO

agriculture outlook report - Vietnam’s

general statistics dept releases June coffee, rice, rubber export data - USDA

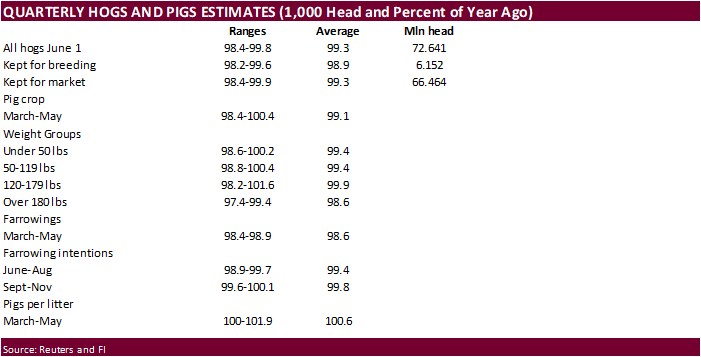

hogs & pigs inventory, 3pm

Thursday,

June 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon - US

acreage for corn, soybeans and wheat - US

agricultural prices paid, received, 3pm - Malaysia’s

June palm oil export data

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Source:

Bloomberg and FI

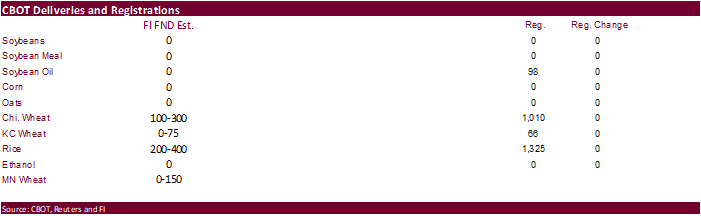

FI

First Notice Day Delivery estimates

Macros

US

FHFA House Price Index (M/M) Apr: 1.6% (est 1.5%; prevR 1.6%)

US

S&P CoreLogic CS 20-City (M/M) SA Apr: 1.77% (est 1.95%; prevR 2.41%)

US

S&P CoreLogic CS 20-City (Y/Y) NSA Apr: 21.23% (est 21.15%; prevR 21.15%)

US

Wholesale Inventories (M/M) May P: 2.0% (est 2.1%; prev 2.2%)

US

Advance Goods Trade Balance May: $-104.3Bln (est-$105.0Bln; prevR -$106.7Bln)

US

Retail Inventories (M/M) May: 1.1% (est 1.6%; prev 0.7%)

US

CB Consumer Confidence Jun: 98.7 (est 100.0; prev R 103.2)

–

Present Situation: 147.1 (prev R 147.4)

–

Expectations: 66.4 (prev R 73.7)

US

May Industrial Output Revised To +0.1% (prev +0.2%)

–

Capacity Utilization Rate Revised To +80.8% (prev +79.0%)

–

Manufacturing Output Revised To -0.2% (prev -0.1%)

(Bloomberg)

— Saudi Aramco may increase the official selling price of its flagship Arab Light crude by $2.50/bbl m/m to Asia for Aug. sales, according to the median estimate in a Bloomberg survey of five refiners, traders.

97

Counterparties Take $2.214 Tln At Fed Reverse Repo Op (prev $2.156 Tln, 96 Bids)

·

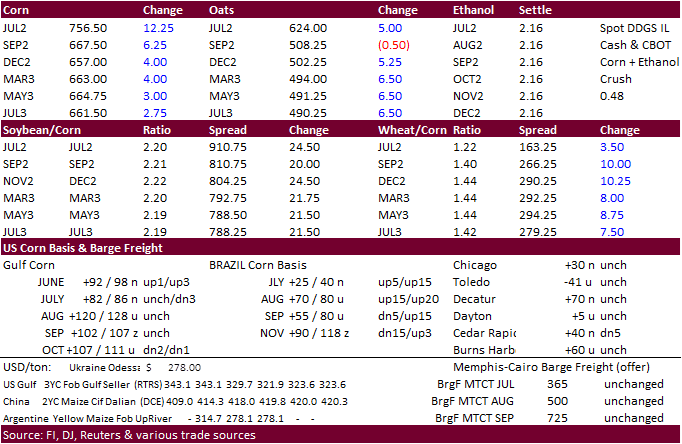

Corn futures

rebounded after crop conditions dipped last week. Parts of the ECB states saw a good decline in ratings, including Indiana, Kentucky, Tennessee, and North Carolina. Higher energy markets lent support.

·

Soon to be expiring July corn was up 15.25 cents and December settled 6.25 cents higher.

·

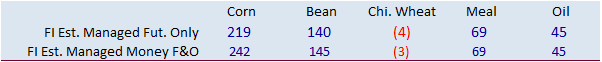

Funds bought an estimated net 11,000 corn contracts.

·

WTI crude oil was $2.30 higher at 1:39 pm CT.

·

Brazil was projected to see less than expected exports by Anec at 1.683 million tons versus 1.758 million previous.

·

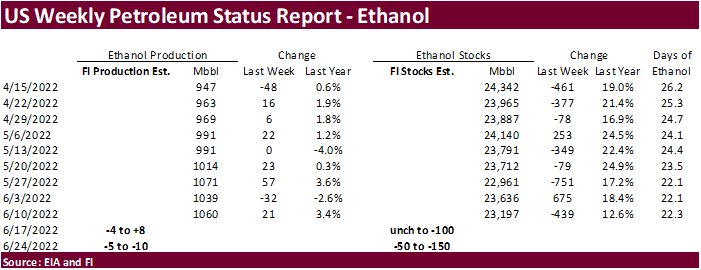

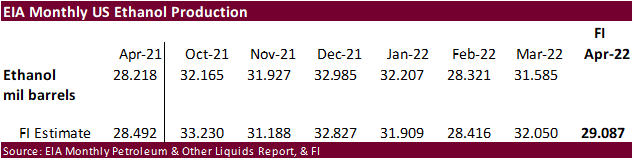

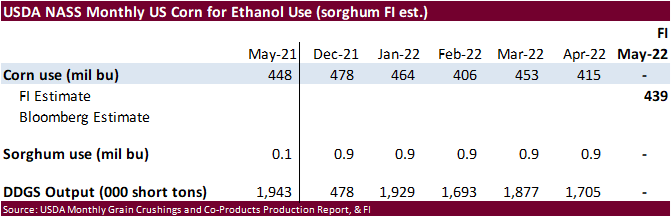

EIA will be out Wednesday with two weeks of ethanol data.

What

Do We Know About Revisions to USDA Planted Acreage Estimates?

Irwin,

S. “What Do We Know About Revisions to USDA Planted Acreage Estimates?” farmdoc daily (12):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 27, 2022.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US or SA on June 29 for Aug 25-Sep 13 shipment.

Due

out Wednesday

Updated

6/27/22

September

corn is seen in a $5.75 and $7.75 range

December

corn is seen in a wide $5.75-$8.25 range