PDF Attached

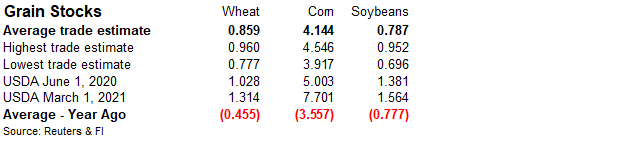

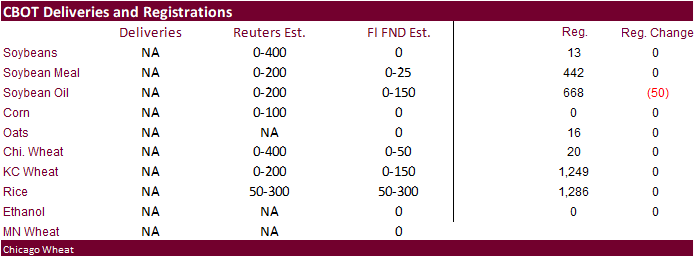

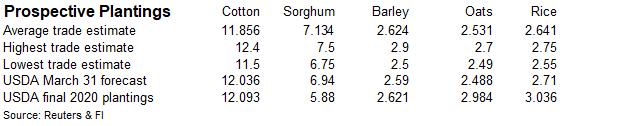

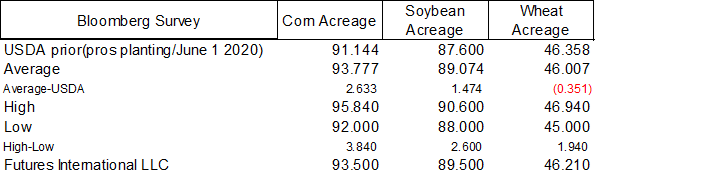

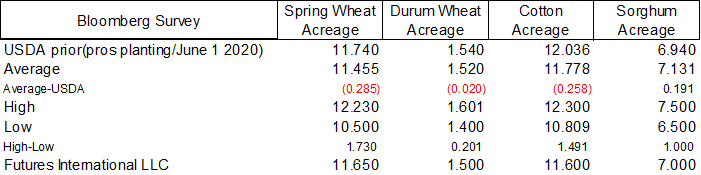

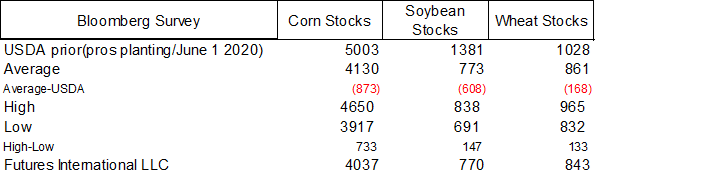

Wednesday we get USDA US June 1 stocks and updated planting area. Some of the trade is looking for heavier CBOT deliveries than we predicted.

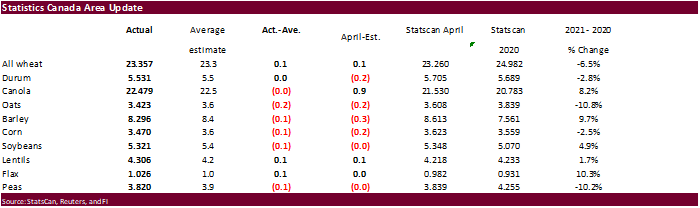

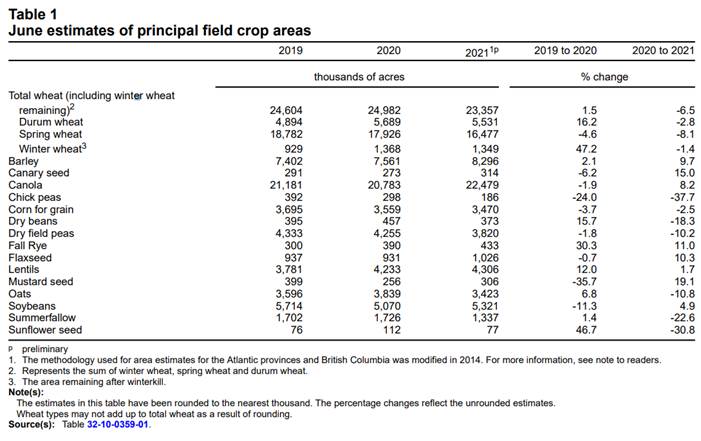

StatsCan vs. trade, prior and last year

Weather

World Weather Inc.

MOST IMPORTANT WEATHER OF THE DAY

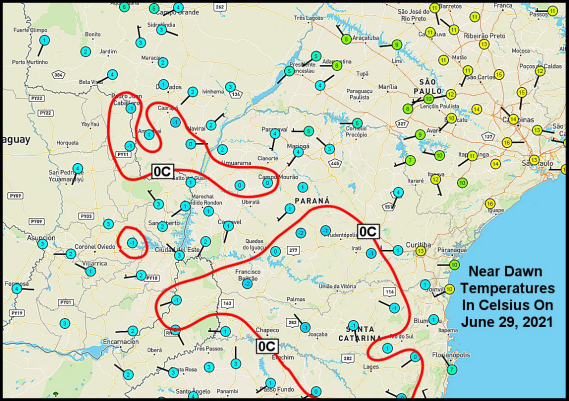

- Frost and freezes occurred this morning in interior southern Brazil raising concern over immature Safrinha corn conditions

o Some of the immature crop may have been negatively impacted, but most of the crop should not have been seriously affected

o Wheat was likely burned back by the frost and freezes, but no permanent harm was suspected to the crop

- Cold will continue in southern Brazil through Thursday with slightly cooler readings possible Wednesday morning in key grain production areas

o Some frost is expected in southern coffee, citrus and sugarcane areas as well both Wednesday and Thursday mornings

- Damage to these soft commodity crops is not expected to be very great, but concern over crop conditions may support a greater market interest today

- Not much rain will fall in South America over the next ten days – at least not in key grain, coffee, citrus or sugarcane areas

o Some moisture is still needed in wheat areas, although Argentina’s crop is still rated much better than that of the past couple of years

- China’s weather remains well mixed, despite some flooding rain during the past weekend

o Dryness is not likely to be a problem in the nation during the next two weeks

o Additional bouts of flooding are most likely in the south

o Northeastern grain and oilseed areas will be favorably moist

- Xinjiang, China cotton, corn and other crop areas continue to experience unusually cool conditions in the northeast while more seasonable conditions have been occurring in the central and west

o This weekend into next week will bring better weather to the northeast

- Russia’s Southern Region and other areas in western Russia and Ukraine will receive welcome rain later this week and into next week to help restore favorable soil moisture after the past week of very warm and dry conditions

- Kazakhstan crop weather has been quite dry and hot recently along with some neighboring southern Russia New Lands locations

o The situation is not likely to change much, the excessive heat will break down during the weekend and some showers may evolve next week

- A general soaking of rain is needed, but not very likely

- Most other areas in Russia are expecting a good mix of weather preserving and protecting good production potentials

- Europe weather will be well remain well mixed over the next ten days except in the Mediterranean countries where dryness is expected

o A part of the western Balkan Countries and areas northeast into Hungary and western Slovakia are trending too dry and rain is needed

- Not much rain is expected in these areas for a while and stress will continue for unirrigated crops

- North Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- India’s monsoon will continue to underperform in the interior west and north, but a change in weather is expected next week and especially in the second week of July that should bring on greater rainfall and improved crop development and planting conditions

- Australia weather will continue well mixed over the next two weeks supporting improved winter crop establishment

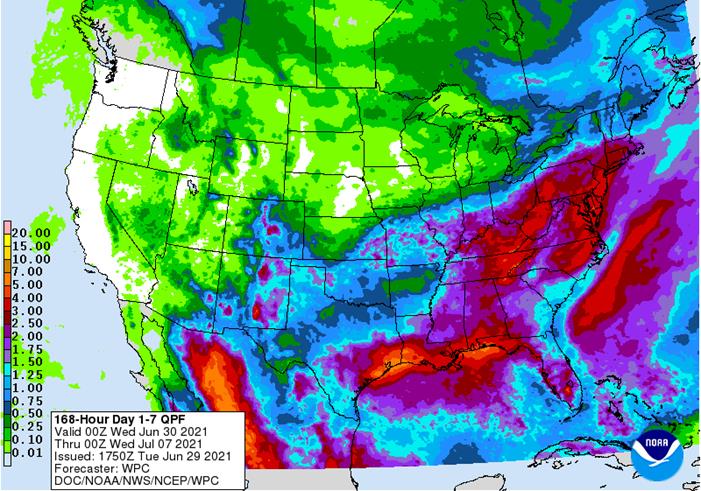

- U.S. weather is not likely to change much in the coming week

o Restricted rain will occur in the northern Plains, upper Midwest and a part of the northwestern Corn Belt

o Frequent rain will fall in the Ohio River Basin

- Some soft wheat areas may not welcome the abundant moisture much longer

o A good mix of rain and sunshine will occur in the Delta and southeastern states

o More rain is expected in West Texas after a serious improvement in crop and field conditions occurred during the weekend

o Interior far western U.S. may experience a few showers and thunderstorms during the next ten days

- No general soaking of rain is expected, but lightning could spark the start of the fire season

o Excessive heat in the northwestern U.S. will be slow to abate, but as it does some of the heat will reach into the northwestern U.S. Plains

- Canada’s western Prairies were hot Monday with extreme highs reaching 104 degrees Fahrenheit in western Alberta

o Most of the Prairies were dry and the heat will expand to the east over the balance of this week

- Canada’s Prairies and the northwestern U.S. Plains will experience excessive heat and dryness through the next several days with high sin the 90s to 108 degrees Fahrenheit

o Some showers and thunderstorms will attempt to bring a little relief late this week and again next week

- Next week’s rainfall coverage and amounts may be greater than this week

o Canada’s Prairies weather outlook for next week does turn wetter for a little while, although a general soaking may not occur

- U.S. week two weather is expected to continue bringing alternating periods of rain and sunshine to the Midwest, although below average precipitation is expected in the northern Plains, upper Midwest and immediate neighboring areas in the northwestern Corn Belt

o Some model data brings rain to the drier areas July 7-9, but World Weather, Inc. believes the rain is overdone

o A tropical cyclone may impact the central Gulf of Mexico Coast during the middle part of next week, although confidence is low

- Tropical Storm Enrique continues to help bring moisture northward into western and some north-central Mexico crop areas this week

o Landfall is expected in southern Baja California Wednesday as a tropical storm

o The storm will become a depression Wednesday afternoon and then may dissipate later this week

o Drought relief is expected in some areas, but much more rain will be needed to knock the drought out

- Tropical Storm Danny dissipated over Georgia today

o The system failed to produce much adverse weather

- Two tropical waves in the tropical Atlantic will be closely monitored over the next ten days with one expected to reach the Antilles during mid- to late-week this week producing some heavy rainfall

o The system is not likely to evolve into a significant tropical cyclone in the next few days, but it will be closely monitored

o The second wave is over the tropical Atlantic Ocean and it has a better potential to become a tropical cyclone later this week and it will enter the eastern Caribbean Sea Friday before moving toward The Gulf of Mexico this weekend

- Thailand, Cambodia and Vietnam will continue drier biased this week with Vietnam getting greater rain July 2-8

o A general boost in precipitation is possible in many mainland areas of Southeast Asia next week

- Thailand, corn, rice, sugarcane and other crops are all becoming stressed because of dryness. The same may be occurring in some Cambodia and Vietnam locations

- Thailand rainfall will improve in the second week of the forecast

- Indonesia and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops

- Philippines rainfall will be near to below average for at a while, but a boost in rainfall is expected this weekend and next week

o Some areas may experience net drying for a while this week

- Southeastern Canada corn, soybean and wheat conditions are rated mostly good, although a greater boost in rainfall might be welcome near the U.S. border at some point into time over the next few weeks.

o Some of that precipitation need is expected over the coming week as rain from the U.S. Midwest streams into the region

o Recent rain bolstered soil moisture in many areas across Ontario and Quebec away from the U.S. border

- West Africa rainfall in Ivory Coast and Ghana will be near average during the coming ten days

o Nigeria and Cameroon will see a mix of precipitation during the next ten days with most crops benefiting well from the pattern

- A part of Nigeria will receive less than usual rainfall during this period, but timely rain is still expected

- Erratic rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o A boost in precipitation is needed and expected

- Ethiopia rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas

- South Africa will experience additional showers in the far west periodically this week

o The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Mexico rainfall will continue in southern parts and western of the nation over the coming week

o The precipitation will bring some drought relief to Sonora, Baja California, western Chihuahua, Sinaloa, western Durango and parts of Zacatecas

o Northeastern and north-central Mexico will have need for more rain

- Nicaragua and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o Additional improvement is needed and may come slowly

- Southern Oscillation Index is mostly neutral at -0.67 and the index is expected to move erratically this week

- New Zealand rainfall during the coming week to ten days will be less than usual and temperatures will be a little cooler biased

Source: World Weather Inc.

1-7 DAY

Tuesday, June 29:

- Canada Statcan data on seeded area for wheat, durum, canola, barley and soybeans

- South Africa updates corn production

Wednesday, June 30:

- EIA weekly U.S. ethanol inventories, production

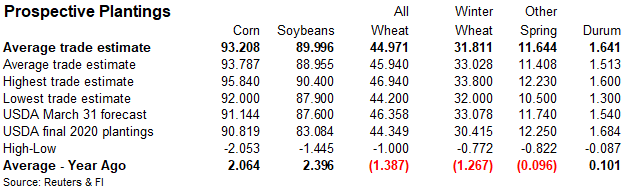

- U.S. acreage data for corn, wheat, soybeans and cotton; quarterly grain stockpiles

- Bloomberg New Economy Catalyst; climate and agriculture

- Malaysia June 1-30 palm oil export data

- U.S. agricultural prices paid, received

Thursday, July 1:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- World cotton outlook update from International Cotton Advisory Committee

- Costa Rica, Honduras monthly coffee exports

- U.S. corn for ethanol, DDGS production, 3pm

- USDA soybean crush, 3pm

- Port of Rouen data on French grain exports

- Australia Commodity Index

- AB Sugar trading update

- HOLIDAY: Canada, Hong Kong

Friday, July 2:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Source: Bloomberg and FI

Source: Bloomberg and FI

Macros

US CB Consumer Confidence Jun: 127.3 (est 119.0; prev R 120.0)

– Expectations: 157.7 (prev R 148.7)

– Present Situations: 107.0 (prev R 100.9)

OPEC+ JTC 2021 Leaves Global Oil Demand Growth Unchanged At 6M Bpd – RTRS Citing Two Sources

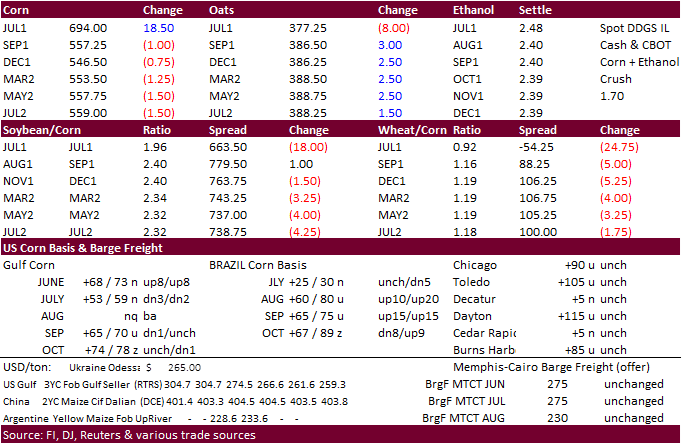

- US corn traded two-sided with soon to be expiring July closing 19 cents higher, September up 1 cent, and December 1.25 cents higher. US weather does not look good for the far western Corn Belt, specifically for ND and SD. IA has an opportunity to see rain over the next week, but amounts are projected at about 75 percent of normal. Eastern Corn Belt is in good shape. Brazil weather concerns were noted after freezes occurred, but some noted the crop had been already made, or damaged, in the most northern areas where temperatures fell below 32 degrees. Map of cold weather provided by World Weather Inc. earlier this morning. Tonight, temperatures could be worse.

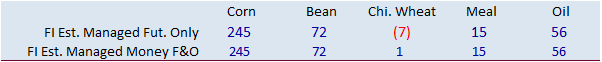

- Funds bought an estimated net 2,000 corn.

- Look for light CBOT corn deliveries, if any.

- South Africa’s CEC: corn production for 2021 at 16.233, up from 16.180 in May and up from 15.300 year ago. 8.937 million tons of white and 7.296 million tons of yellow.

- China plans to auction off 155,000 tons of imported corn on July 2.

- 123,977 tons of US

- 31,539 tons of Ukraine origin

- Live hog prices in China have rebounded significantly, up 31 percent from Friday, in part to China buying domestic product for reserves. Poor crush margins may have also led to a slowdown in heard expansion.

- U of I: Lower Pig Crop and Farrowing Intentions Support Higher Prices

- https://farmdocdaily.illinois.edu/2021/06/lower-pig-crop-and-farrowing-intentions-support-higher-prices.html?utm_source=rss&utm_medium=rss&utm_campaign=lower-pig-crop-and-farrowing-intentions-support-higher-prices

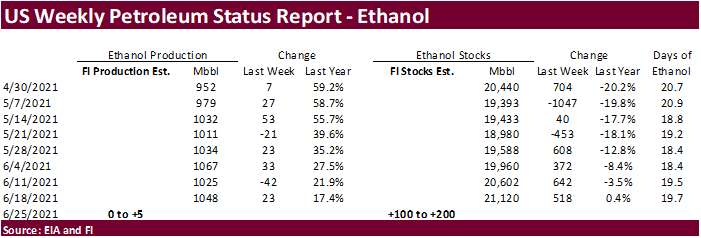

- A Bloomberg poll looks for weekly US ethanol production to be down 4,000 barrels (1025-1060 range) from the previous week and stocks up 86,000 barrels to 21.206 million.

Export developments.

- Iran seeks 60,000 tons of corn on Wednesday for Aug/Sep shipment.

Updated 6/25/21

December corn is seen in a $4.25-$6.00 range.

Soybeans

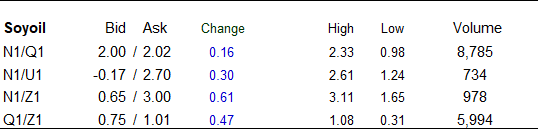

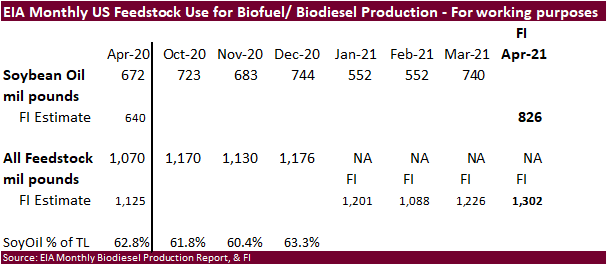

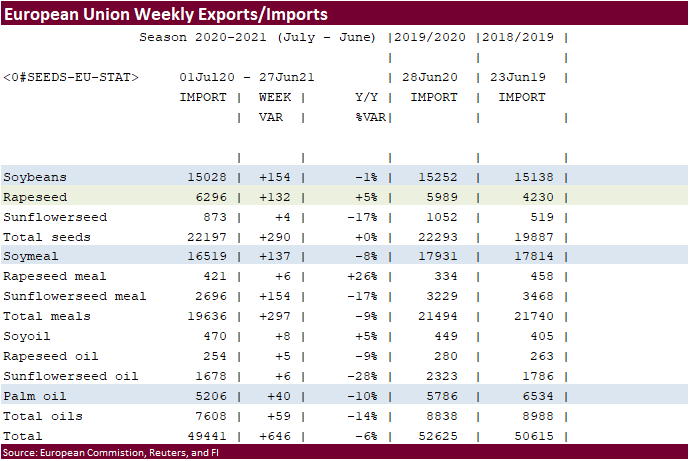

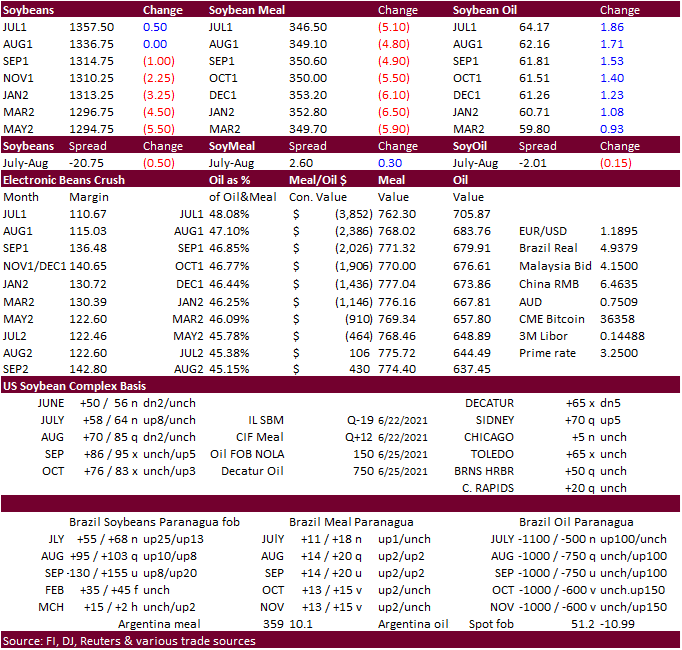

- Soybeans ended higher in the front months, unchanged for November and lower in the 2022 January & March positions. Spreading was active. Soybean oil was up sharply on expectations for the EPA to grant less small refinery waivers but that is speculation at this point, in our opinion. We need to find out first what will be proposed for mandates before making assumptions on feedstock demand, but much of the trade does think the Biden green fuel stance will support biofuel policy. Yesterday 50 soybean oil registrations were cancelled out of Volga, SD, lowering the total for all SBO registrations to only 668. Soybean oil spreads were very choppy. August SBO finished 171 points higher and September 153 higher. Soybean meal was on the defensive despite a higher close in corn. Weather forecast was mostly unchanged.

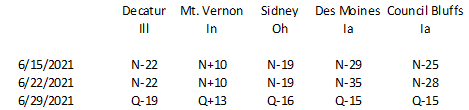

- Latest soybean meal basis selected location for the US we track on a weekly basis shows a big jump for WCB August positions.

- We are starting to wonder if the delay in US soft wheat harvesting due to heavy rain across the ECB will push back second soybean crop plantings. Feedback welcome.

- Reuters: U.S. biofuel groups urge EPA to curb oil refinery waivers despite ruling https://www.reuters.com/article/idUSKCN2E42CK

- India cut their import tax on crude palm oil to 10% from 15% for three months, effective June 30.

- Palm could open higher tonight.

- Funds in Chicago bought an estimated net 3,000 soybean contracts, sold 1,000 soybean meal and bought 4,000 soybean oil contracts.

- A Reuters polls calls for the May US soybean crush to end up near 173.4 million (172.5-174.0 range) from 169.8 million in April and below May 2020 of 179.5 million. Stocks were estimated at 2.144 billion (2.125-2.160 range) compared with 2.178 billion at the end of April and 2.447 billion at the end of May 2020.

- Canola traded sharply higher by $25.10 in the November position. Limit reverts back to $30/ton. Note the contract gapped higher today.

- StatsCan reported Canadian canola plantings at 22.5 million acres, up 1 million acres from April estimate of seeding intentions and up 8% from last year.

- We look for little or zero initial First Notice Day deliveries for the soybean complex (SBO zero to 150, meal 0-25, soybeans zero). We are hearing soybean meal could zero for FND, but some circulate during the period. Soybean meal basis is weak despite the recent increase in export interest. Corn no deliveries expected and Chicago wheat 0-50. MN wheat zero and KC 0-150.

- Iran seeks 60,000 tons of soybean meal on Wednesday for Aug/Sep shipment.

Updated 6/25/21

August soybeans are seen in a $12.15-$14.50 range; November $11.50-$14.75

August soybean meal – $320-$390; December $320-$400

August soybean oil – 48.50-65; December 46-65 cent range

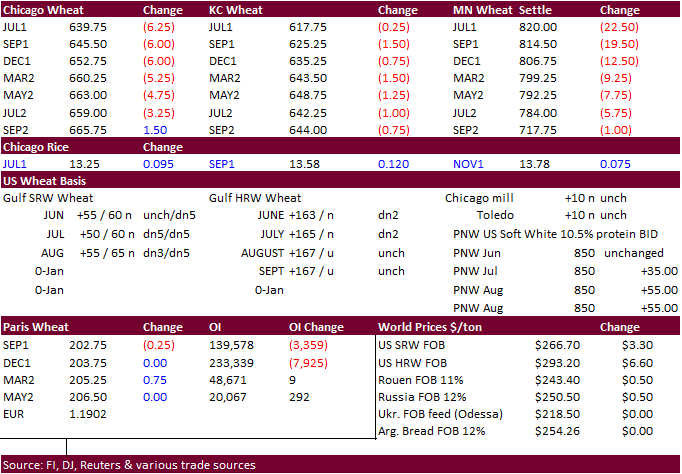

- Multiyear highs (2013 on month rolling basis) in Minneapolis wheat sent the spring wheat higher this morning but profit taking pulled most contracts lower led by the expiring July. Chicago ended lower and KC mixed (bull spreading). USD was higher.

- MN September traded at an intraday high of $8.57/bu, $1.20 above its session low made on June 14. These types of moves over a short period of time will create volatility.

- Nearby rolling Minneapolis wheat – monthly

- US spring wheat ratings were down a more than expected 7 points from the previous week to 20% G/E, prompting us to further lower July initial spring and durum production prospects. PNW 10.5% protein wheat cash values are up 35-55 cents this week.

- Heat and dryness across the northern Great Plains has not been as bad since 1988.

- Record breaking heat will start to ease across the PNW by midweek.

- Funds sold an estimated net 3,000 Chicago wheat contracts.

- StatsCan estimated Canadian all-wheat plantings at 23.4 million acres, slightly higher than the 23.3 million in the April report and down 6.5% from a year ago.

- For the second week in a row the local Manitoba government in Canada mentioned crops are stressed by high temperatures and strong winds along with lack of rain.

- A shortfall in North American wheat supplies could be easily offset by a large Black Sea crop.

- IKAR increased their Russian wheat forecast from 82 to 83.6 million tons, down from 85.9MMT in 2020.

- Agritel sees Ukraine wheat production at record 30.5 million tons, up from 25.3 million last year.

- September Paris wheat was unchanged at 200.75/ton.

- Iran seeks 60,000 tons of milling wheat on Wednesday for Aug/Sep shipment.

- Tunisia seeks 100,000 tons of soft wheat and 100,000 tons of barley on Wednesday, optional origin.

- Thailand seeks up to 197,700 tons of feed wheat on Wednesday, in five consignments, for shipment between Aug and Dec.

- Jordan retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

- Jordan retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh seeks 50,000 tons of rice from India.

Updated 6/25/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.00-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.