PDF Attached does not include daily estimate of funds

On Thursday USDA quarterly reports are due out.

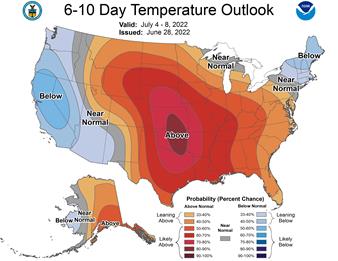

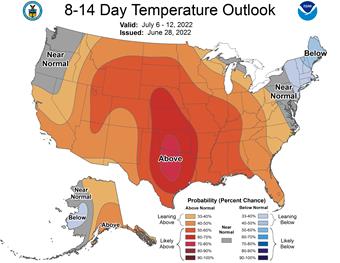

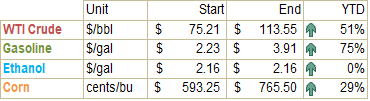

CBOT agriculture commodities were mixed to start, then choppy from positioning ahead of Thursday’s USDA June Acreage and Grain Stocks report. The US weather outlook calls for warm weather over the next two weeks. Then the 6-10 and 11-15 day midday weather outlook appeared to be a little drier and warmer for the US Midwest. The Midwest will see showers in the northern areas through Thursday and west central areas Friday. Eastern NE, eastern ND and MN will see showers today and western GP will see rain this weekend. EIA will update two weeks of ethanol data later this morning.

Hot temperatures can be beneficial for corn development, as long as rain follows.

WEATHER EVENTS AND FEATURES TO WATCH

- U.S. Midwest temperatures will heat up again today and Thursday with cooling likely from north to south Friday into Saturday

- The warmer weather comes without large volumes of rain which is going to lead to more drying

- Recent rain in Iowa and Illinois has provided a cushion against some of the expected moisture losses (drying), but Indiana never got much good rain and neither did Ohio or southern Michigan as well as some areas in Iowa.

- Because of the expected drying into the heart of the weekend and the short term bout of warming over the next few days a net loss in soil moisture is expected once again in many areas

- U.S. Midwest will cool down late this week and into the weekend, but rainfall does not increase until Sunday through Tuesday of next week, according to the European model

- That rain is slated for Iowa, eastern Nebraska and areas southeast into the Ohio River Valley

- The event needs to be closely monitored

- If rain fails to evolve as expected there could be a more significant decline in soil moisture for some areas and a rise in stress due to temporary ridge building that is expected in the western Corn Belt during the middle to latter part of next week bringing some additional warming and less rain once again

- GEFS, EPS and CFS models all push the ridge back out to the west in week 3 creating a greater northwesterly wind flow pattern aloft

- This offers some timely rainfall and cooler temperatures to the Midwest once again, but rain during that period will be critical since many early season crops will be in the midst of reproduction at that time.

- Caution is advised, though, week 3 forecasts can be of low confidence. The fact that all three of these models have a similar solutions adds a little confidence

- A close monitoring of the U.S. outlook is warranted. Nothing is set in stone and with the Gulf of Mexico partially closed during a part of this first week outlook there is concern that rainfall may not be as great as advertised. If the Sunday through Tuesday rain event is missed in the Midwest the potential impact on crops will rise especially for those areas that are already too dry. The week 3 westward shift in the ridge must verify resulting in cooler and wetter biased conditions to provide an opportunity for greater dryness relief.

- West Texas rainfall is unlikely to be significant in the next two weeks

- A tropical low off the upper Texas coast will likely bring rain to the middle and upper Texas coast later this week and into the weekend

- Remnants of this system should move north through far eastern Texas where it should dissipate

- This feature will prevent rain from falling significantly in West Texas, the Blacklands and far South Texas

- It also inhibits northward moisture flux into the Midwest which limits some of the rain potential with this week’s late week and weekend cool front which is why the Sunday through Tuesday event next week is so important

- U.S. southeastern states will see a good mix of rain and sunshine over the next two weeks

- U.S. Delta rainfall may be a little light in the north over the next two weeks, but the middle and lower parts of the region should get periodic showers and thunderstorms supporting crops favorably

- U.S. northeastern Plains and Canada’s Prairies should see a favorable mix of rain and sunshine during the next two weeks supporting good crop development

- U.S. northwestern Plains may not see much rain of significance for a while, although a few showers will occur infrequently

- Some of this dryness could bleed over the border in southwestern parts of Canada’s Prairies

- Tropical Depression Two is expected to become a tropical storm today while continuing to move along the Venezuela coast today and Thursday before reaching Nicaragua late this week and during the weekend

- The storm has potential to produce heavy rain in Central America and it will be closely monitored

- Europe weather is expected to be active from northern Italy to Poland, Belarus and the Baltic States over the coming week

- Net drying is expected in the France and other western European nations, despite some showers

- Recent rain in France has improved topsoil moisture

- Spain, Portugal, Peninsular Italy and portions of the Balkan Countries will also experience net drying, despite a few showers

- Temperatures in eastern Europe remained quite warm Tuesday with many highs in the upper 80s and lower to a few middle 90s Fahrenheit

- The heat helped to accelerate drying in parts of the region which raises the need for rain in some areas

- Eastern Europe temperatures will be well above normal in this first week of the outlook which may exacerbate net drying in the areas that do not get much rain

- Far western Europe may be just slightly cooler biased

- Second week temperatures will be near normal in the north and warmer than usual in the south

- Europe rainfall Tuesday was restricted to the region from northern Italy to Poland and the Baltic States

- Parts of eastern Europe experienced net drying as did the west, although France received good rain last week

- Western CIS weather will be favorably mixed with sunshine and rain during the next two weeks

- Temperatures will be warmer than usual in this first week of the outlook

- The warmer weather will shift into the New Lands during the second week of the forecast as rain increases and cooling begins in the west

- Russia’s Southern Region away from the Black Sea coast and the Georgia border will continue to dry out along with eastern Ukraine

- These areas will need greater rain and sooner rather than later because the ground is already dry

- Temperatures will be mild to cool for a little while which will help to conserve soil moisture

- Warmer temperatures will occur this weekend into next week that may exacerbate the dryness and raise the need for significant moisture

- The bottom line for the CIS is mostly good, but dryness will remain in parts of Russia’s Southern Region (away from the Georgia Border and away from the Black Sea coast) as well as eastern Ukraine. These areas will need greater rain

- China’s North China Plain received some needed rain in recent days and it will get some additional needed rain periodically during the next two weeks offering additional relief from previous dryness.

- Southern China’s weather has been improving since torrential rain ended last week, but a tropical cyclone evolving west of Luzon Island, Philippines may bring excessive rain to western Guangdong and Guangxi during the weekend and early next week

- Confidence in the tropical cyclone’s movement is very low and a close watch on the system is warranted

- Southern China weather will resume a more normal distribution of rain and sunshine next week after the tropical cyclone passes

- Northeastern China will continue to see frequent rainfall during the next ten days maintaining wet field conditions in some areas

- China’s Xinjiang province continues to experience relatively good weather

- A few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week

- Some cooler biased conditions may briefly evolve later this week and into the weekend

- Queensland and parts of New South Wales, Australia will get some rain late this week and into the weekend causing a delay to winter planting of wheat, barley and some canola, but the moisture should be good for crops that have already been planted

- Southern Australia weather will remain favorable for wheat, barley and canola planting and emergence during the next couple of weeks

- India’s monsoonal rainfall is expected to continue improving over the next couple of weeks

- Sufficient rain is expected over the next two weeks to bolster soil moisture in many important summer grain, oilseed and cotton areas throughout the central, north and eastern parts of the nation

- Rain in the northwest will be slowest in coming, but rain is expected during the weekend and especially next week

- Ontario and Quebec, Canada weather should be favorably mixed over the next two weeks

- A little drier and warmer bias would be most welcome and that is exactly what is expected

- South Korea rice areas will get a few periods of rain during the next ten days bringing needed relief after weeks of dryness

- Some relief has already begun, but much more rain is needed

- A tropical cyclone may evolve to the west of the Philippines during the next two days week before shifting north into southern China

- The storm will produce excessive rain over much of western and northern Luzon Island and a few neighboring areas

- A second tropical cyclone will form east of Taiwan in the next few days that could bring heavy rain to South Korea and western Japan during the weekend and early next week

- Argentina will remain quite dry in its wheat country during the next two weeks

- Winter wheat emergence and establishment is not expected to go very well without rain

- Far southern Brazil will receive additional waves of light rain over the next couple of weeks

- Drying farther to the north will support Safrinha crop maturation and harvest progress and is considered to be normal

- There is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks

- Mexico’s monsoonal rainfall will be good the west and north-central parts of the nation during the coming two weeks

- Northeastern Mexico drought relief may not occur without the help of a tropical cyclone

- The same may be true for far southern Texas

- Southeast Asia rainfall will continue abundant in many areas through the next two weeks

- Local flooding is possible

- East-central Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia

- West-central Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally

- Some needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days

- South Africa’s rain last week was great for wheat, barley and canola emergence and establishment

- Some disruption to fieldwork resulted, but this week’s weather will be much improved with better drying conditions for harvest progress

- Winter crops will continue to establish well.

- Central America rainfall will be abundant during the next ten days

- Torrential rain will bring flooding to Nicaragua and Costa Rica this weekend into early next week due to an approaching tropical cyclone

- El Salvador, Honduras and Guatemala might also be impacted, but with lighter rainfall

- Today’s Southern Oscillation Index was +15.42 and it will move erratically during the coming week

- New Zealand rainfall will be lighter than usual during the balance of this week and then wetter next week

Source: World Weather INC

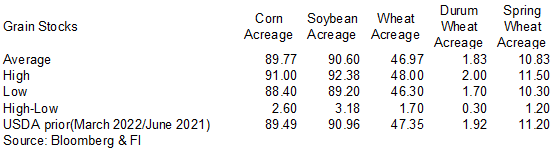

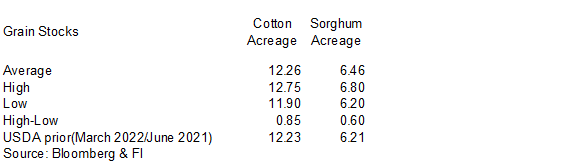

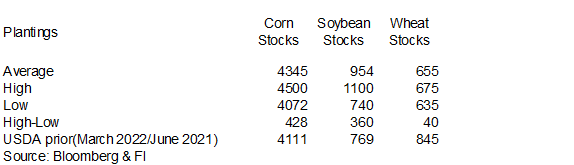

Bloomberg Estimates for USDA

Bloomberg Ag Calendar

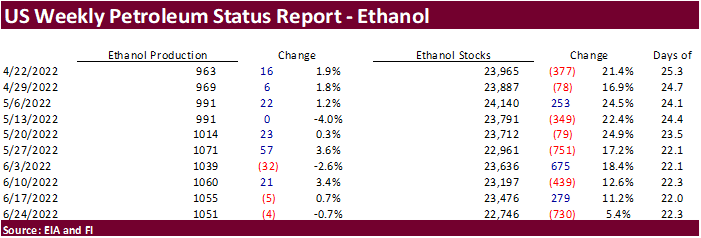

- EIA weekly U.S. ethanol inventories, production, 10:30am

- OECD-FAO agriculture outlook report

- Vietnam’s general statistics dept releases June coffee, rice, rubber export data

- USDA hogs & pigs inventory, 3pm

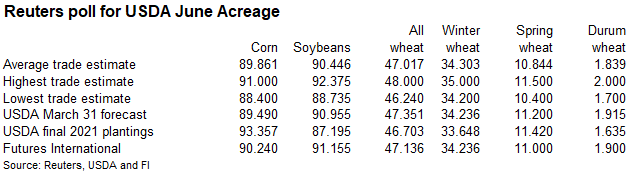

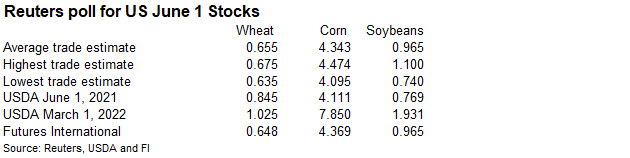

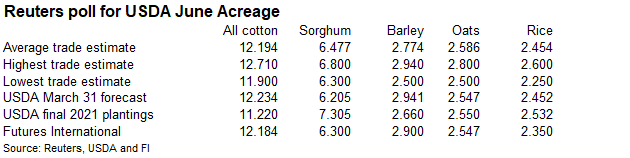

Thursday, June 30:

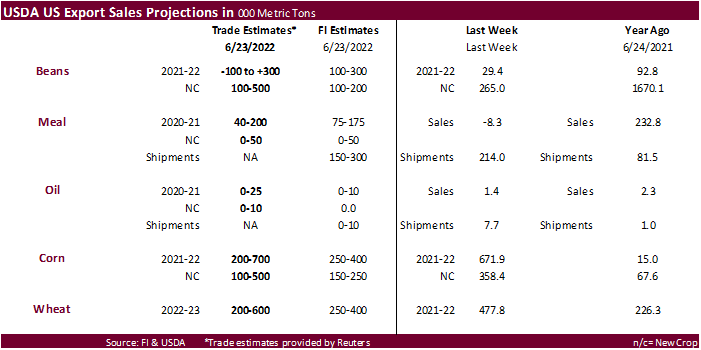

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- USDA’s quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon

- US acreage for corn, soybeans and wheat

- US agricultural prices paid, received, 3pm

- Malaysia’s June palm oil export data

Friday, July 1:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Monthly coffee exports from Costa Rica and Honduras

- International Cotton Advisory Committee releases monthly world outlook report

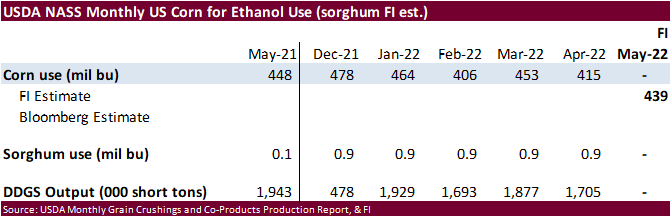

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- FranceAgriMer weekly update on crop conditions

- Australia commodity index

- HOLIDAY: Canada, Hong Kong

Source: Bloomberg and FI

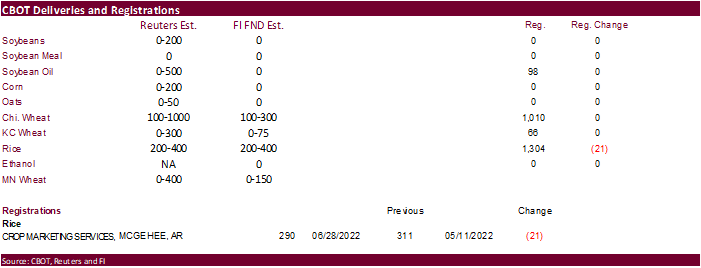

FI First Notice Day Delivery estimates

Macros

US GDP Annualized (Q/Q) Q1 T: -1.6% (est -1.5%; prev -1.5%)

US Personal Consumption Q1 T: 1.8% (est 3.1%; prev 3.1%)

US GDP Price Index Q1 T: 8.2% (est 8.1%; prev 8.1%)

US Core PCE (Q/Q) Q1 T: 5.2% (est 5.1%; prev 5.1%)

German CPI (Y/Y) Jun P: 7.6% (est 7.9%; prev 7.9%)

German CPI (M/M) Jun P: 0.1% (est 0.4%; prev 0.9%)

German CPI EU Harmonized (M/M) Jun P: -0.1% (est 0.4%; prev 1.1%)

German CPI EU Harmonized (Y/Y) Jun P: 8.2% (est 8.8%; prev 8.7%)

US DoE Crude Oil Inventories (W/W) 24-Jun: -2762K (est -950K)

– Distillate Inventories: 2559K (est -729K)

– Cushing OK Crude Inventories: -782K

– Gasoline Inventories: 2645K (est -100K)

– Refinery Utilization: 1.00% (est 0.45%)

98 Counterparties Take $2.227 Tln At Fed Reverse Repo Op (prev $2.214 Tln, 97 Bids)

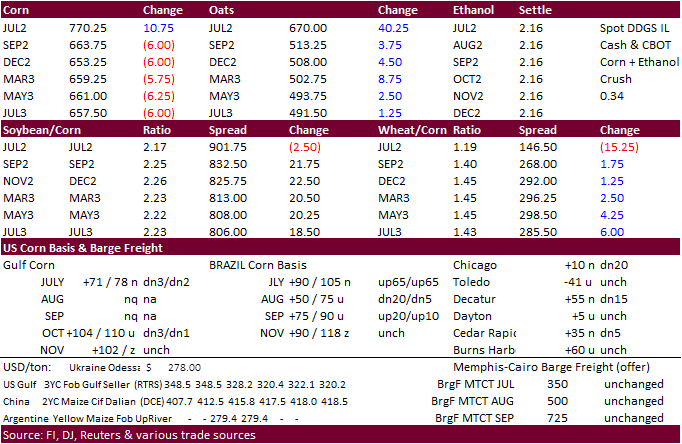

· Back month corn futures fell after trading higher this morning. The bullish sentiment earlier was in part to increasing Asian demand. July ended 10.75 cents higher, ahead of First Notice Day. There is rain in the forecast for parts of the Midwest, but temperatures will be warm. The Midday outlook did indicate warmer and less precipitation for the 6-10 and 11-15 day outlook. We will have to see if this verifies in the morning forecast. EIA ethanol report showed a draw in ethanol inventories.

· Funds bought an estimated net 11,000 corn contracts.

· WTI crude oil was down $2.07 at 1:42 pm CT.

· Agro consulting Datagro sees the Brazil total crop at 116.1 million tons versus 114.35 million tons previously, and second corn crop at 91.25 million tons versus 89.5 million previous. USDA is at 116 million tons.

· The USDA Broiler reported showed eggs set in the US up 2 percent from a year ago and chicks placed up 1 percent. Cumulative placements from the week ending January 8, 2022, through June 25, 2022, for the United States were 4.68 billion. Cumulative placements were up slightly from the same period a year earlier.

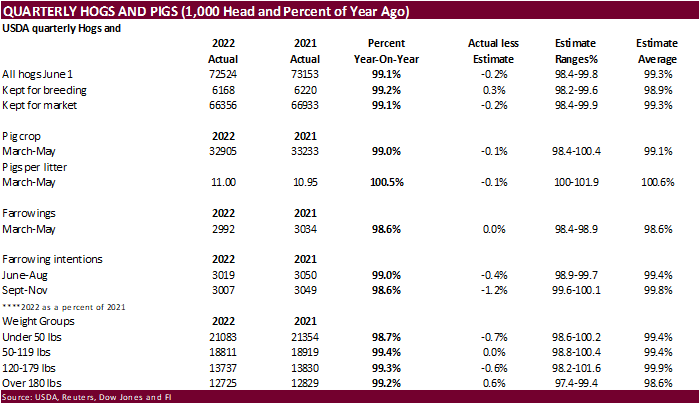

USDA Hog and Pig Report. – Showed another contraction and friendly for hog futures. All hogs did come in slightly below expectations. Highlights below.

United States inventory of all hogs and pigs on June 1, 2022, was 72.5 million head. This was down 1 percent from June 1, 2021, and down slightly from March 1, 2022. Breeding inventory, at 6.17 million head, was down 1 percent from last year, but up 1 percent from the previous quarter. Market hog inventory, at 66.4 million head, was down 1 percent from last year, and down slightly from last quarter. The March-May 2022 pig crop, at 32.9 million head, was down 1 percent from 2021. Sows farrowing during this period totaled 2.99 million head, down 1 percent from 2021. The sows farrowed during this quarter represented 49 percent of the breeding herd. The average pigs saved per litter was 11.00 for the March-May period, compared to 10.95 last year.

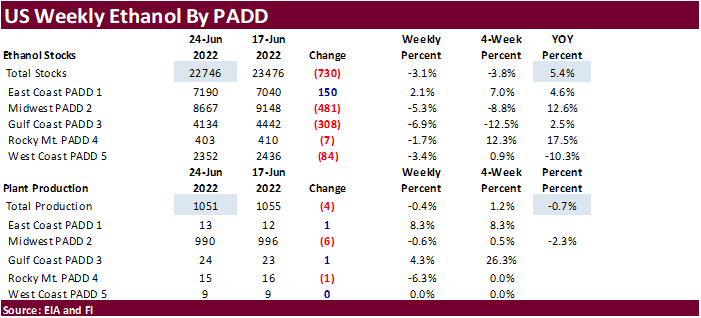

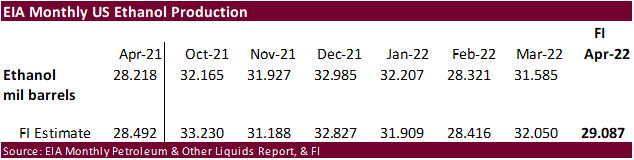

EIA’s Weekly Petroleum Status Report was released that included two weeks of data (technical delay). Over a two-week period, ethanol production fell 9,000 barrels to 1.051 million, and stocks decreased 451,000 barrels to 22.746 million, lowest level since December 31, 2021. Weekly production is off about 2 percent from a month ago and about flat from a year ago. Corn crop year to date (Sep through 6/24) ethanol production is up 7.5 percent from the same period a year ago. After falling 11 consecutive weeks, US gasoline stocks rose over the last two weeks to 221.6 million barrels, largest level since May 6. Gasoline demand slipped below 9 million barrels from 9.1 million at the beginning of June. Gasoline demand has been lagging year ago levels for the past three weeks.

US DoE Crude Oil Inventories (W/W) 24-Jun: -2762K (est -950K)

– Distillate Inventories: 2559K (est -729K)

– Cushing OK Crude Inventories: -782K

– Gasoline Inventories: 2645K (est -100K)

– Refinery Utilization: 1.00% (est 0.45%)

EIA: U.S. refinery capacity decreased during 2021 for second consecutive year

https://www.eia.gov/todayinenergy/detail.php?id=52939&src=email

· Taiwan’s MFIG bought 55,000 tons of corn from South Africa at 243.79 cents over the CBOT December contract for shipment between September 9 and September 28. The purchase was a couple cents premium over the lowest offer presented by Argentina. No US offers were reported.

· South Korea’s MFG bought 136,000 tons of South American corn at $349.99 c&f for FH October arrival.

Updated 6/27/22

September corn is seen in a $5.75 and $7.75 range

December corn is seen in a wide $5.75-$8.25 range

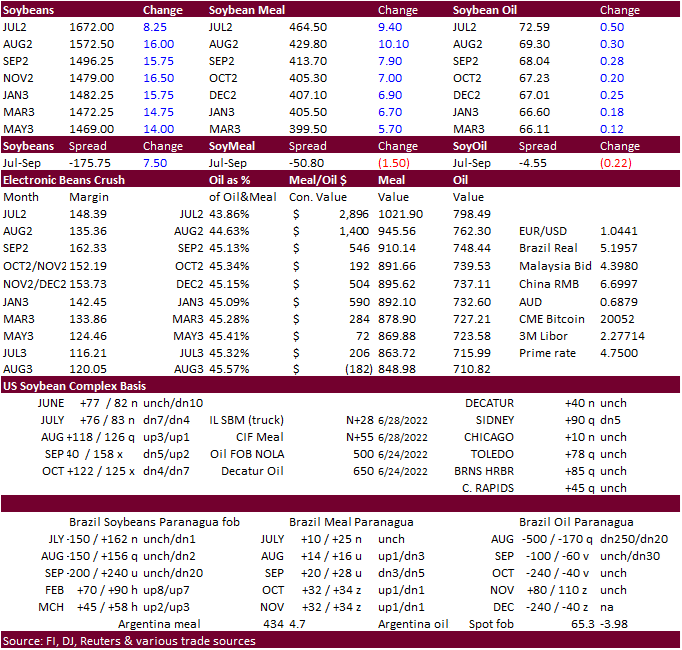

· CBOT soybeans were higher following a lead in soybean meal. US soybean meal interior premiums remain firm from tight spot soybean supplies, bias eastern Corn Belt. Soybean oil was mixed earlier but rallied mid-session pm higher energy prices, but as WTI crude broke, some of the gains in soybean oil were paired. Positioning was a feature today ahead of the USDA report. August crush was up 10.50 cents to 136.50, well off its lows if just below 90 cents made on June 22.

· Traders have been eyeing Midwest weather with warm temperatures potentially threatening early establishment of the soybean crop. But remember US soybeans are made in August. Corn is made in July.

· Funds bought an estimated net 13,000 soybeans, bought 5,000 meal and 5,000 soybean oil.

· A Reuters poll calls for the Brazil 2022-23 soybean harvest to end up near 148 million tons, with a 42.2 million hectare area (up 2.9% from 2021-22). USDA is at 149 million tons for 2022-23, up from 126 million tons for 2021-22.

· Malaysian palm oil futures were down 86 MYR and cash was up $10 to $1240. Yesterday at a Malaysian palm oil conference a research group estimated palm prices could dip below $1000/ton sometime during second half 2022.

Export Developments

· Turkey seeks 18,000 tons of sunflower oil on July 5 for delivery between July 20 and August 29.

· South Korea’s NOFI group seeks 120,000 tons of soybean meal, optional origin, for October 25-November 5 arrival.

· China will be back late this week selling a half a million tons of soybeans out of reserves

Updated 6/27/22

Soybeans – August $14.00-$16.50

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – August $380-$440

Soybean oil – August 66.00-70.00

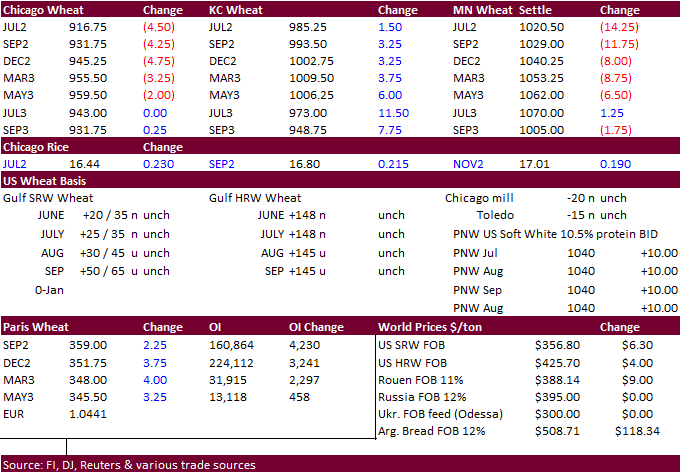

· US wheat futures stared the day higher on strong global import demand but ended mixed on positioning ahead of FND deliveries and the USDA report. We look for some wheat deliveries this evening. Chicago closed lower, KC higher and MN sharply lower in the front two months.

· Funds bought an estimated net 11,000 Chicago wheat contracts.

· Argentina is still too dry in parts of wheat country to kick off the growing season. We could see another cut in the area by the Exchanges soon if drought continues to hamper early crop development. One Exchange said this is one of the worst planting seasons in 12 years. USDA is at 20 million tons for Argentina. Other estimates are below that amount.

· There was talk Russia may have defaulted on 400,000 to 600,000 tons of wheat. We don’t know specific details of this. But recall Russia wants to change their export tax program, immediately, switching from USD to Rubles. One other thought we had is that new-crop wheat is much cheaper than old crop.

· The strong Ruble has slowed Russian producer selling.

· Russia said they are ready to export tens of millions of grain if the West lifts their bans.

· Russia’s wheat export duty will increase to $146.10 on June 29 from current $142.00 per ton set on June 22.

· SovEcon sees a record high 42.6 million tons of Russian wheat exports for 2022-23, up 300,000 tons from their previous estimate.

· Ukraine June to date grain exports are down 36.5 percent to 1.26 MMT from a year ago – AgMin.

· The World Bank loaned $130 million to Tunisia to finance wheat imports.

· Georgia banned wheat and barley exports for a year to protect their domestic market.

· Paris September wheat was up 2.25 or 0.5% at 358.50 euros per ton.

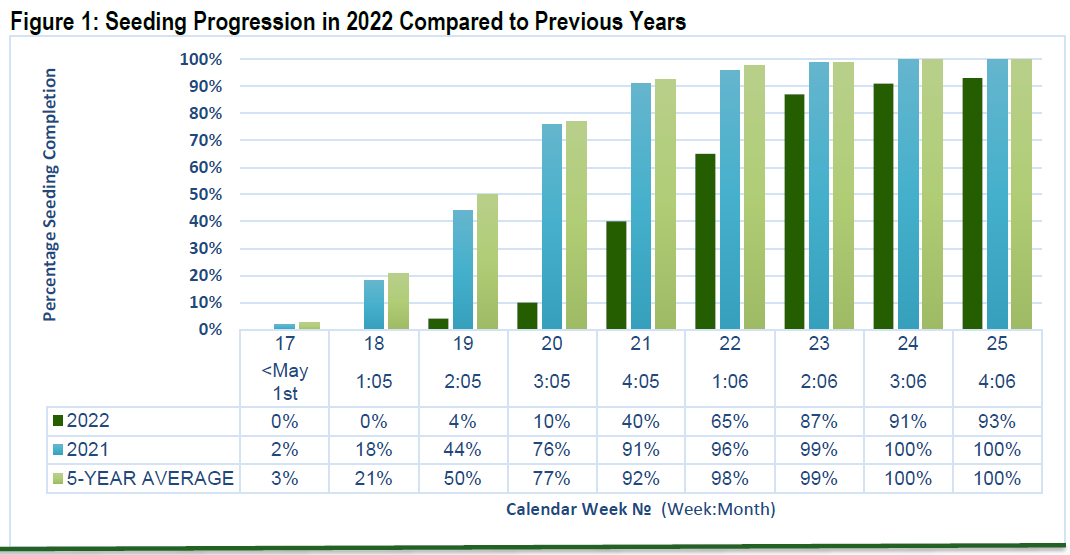

Manitoba planting progress

· Egypt seeks wheat for Aug/Sep/Oct shipment. Lowest offer was believed to be $397.47 a ton FOB sourced from France. The lineup is larger than usual due to the extended delivery period.

· Taiwan flour millers bought 40,000 tons of various class US PNW wheat for August 9-23 shipment. It included 28,620 tons of US dark northern spring wheat of 14.5% minimum protein content bought at $436.88 a ton FOB. Another 8,650 tons of hard red winter wheat of a minimum 12.5% protein bought at $430.38 a ton FOB and 2,730 tons of soft white wheat of a maximum 10.0% protein content bought at $400.13 a ton FOB. (Reuters)

· Jordan passed on barley. Earlier they saw 6 participants for their 120,000 ton barley import tender for Oct and/or Nov shipment.

· Jordan seeks 120,000 tons of wheat on July 5 for Oct/Nov shipment.

· Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

· Bangladesh seeks 50,000 tons of wheat on July 5 and again July 14 for shipment within 40 days (updated 6/27).

Rice/Other

· None reported

Updated 6/27/22

Chicago – September $8.75 to $10.00 range, December $8.50-$12.50

KC – September $9.00 to $11.00 range, December $8.75-$13.50

MN – September $9.75‐$11.25, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.