PDF Attached

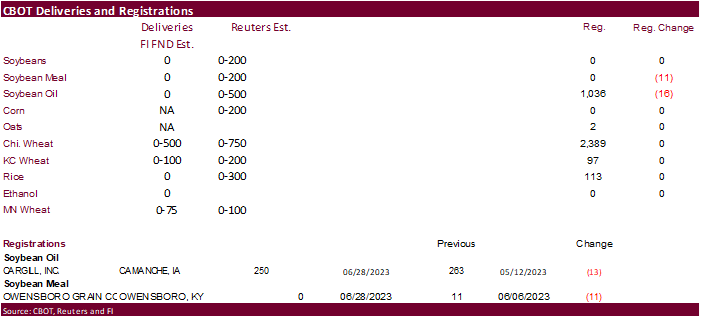

FND

day deliveries will be posted tonight. USD is higher and WTI crude slightly higher. FND deliveries are on Friday. USDA export sales were on the low end of expectations. Prices struggled to find some footing earlier ahead of the USDA grain stocks and updated

planting reports, but after soybeans caught a bid. US

weather forecast was wetter for the midday. Malaysia was on holiday today. Heart of the Midwest will see rain on and off over the next 5-6 days, heaviest during the 2-3 day period. The US Northern Plains, upper Midwest and eastern Canada’s Prairies will

see timely rain. Temperatures will be seasonable to warmer than average.

Fund

estimates as of June 29 (net in 000)

![]()

7-day

WEATHER

TO WATCH

- Hurricane

Adrian formed off the west Mexico coast Wednesday, but it will move away from land - Tropical

Depression 02E formed south of the Oaxaca/Guerrero, Mexico coast overnight and was expected to become a tropical storm.

- This

system will stay close enough to the Mexico coast to induce rain in some of the drought stricken areas in western parts of the nation over the next few days - Improved

corn, soybean and dry bean planting conditions will result - Sugarcane

and citrus conditions may improve as well - Other

areas in Mexico will continue quite dry through the weekend with “some” increase in northwestern and north-central Mexico rain next week

- Drought

remains serious in parts of central, southern and western Mexico, but the developing monsoon will bring relief in July - Southwest

U.S. monsoon pattern is not likely to evolve for at least another ten days limiting rain in the southwestern part of the United States - Thunderstorm

clusters that began in northeastern Colorado and southwestern Nebraska overnight will be the first to move across the Midwest today and tonight producing some needed rain - A

succession of thunderstorms will move from South Dakota and Nebraska through southern Iowa and northern Missouri to Illinois, Indiana, Ohio and Kentucky during the next week to possibly ten days - Sufficient

rain is expected to bolster topsoil moisture, reduce crop stress and begin to induce better corn and soybean development conditions - Rain

totals will vary 0.50 to 1.50 inches and local totals over 2.00 inches through the weekend with another 0.30 to 1.00 inch and locally more occurring - Excessive

heat that occurred from southeastern Nebraska and southwestern Iowa to Texas Wednesday will shift to the east today and Friday bringing 90-degree highs and some extremes over 100 to eastern Kansas, Missouri and southwestern Illinois as well as the Delta, but

readings will come back to a seasonable range after that - Crop

stress will be high over these next two days until the rain and cooling begins - U.S.

central and southern Plains heatwave this week has stressed livestock and some crops, but the extremes will go away this weekend

- Cooling

is likely in the U.S. southern Plains this weekend into next week and scattered showers and thunderstorms are expected in an erratic manner - West

Texas cotton, corn and sorghum areas will get some rain periodically Friday night and Saturday night with a few follow up showers next week - Rainfall

will vary greatly with some 1.00 to 2.00-inch plus amounts likely in the Texas Panhandle and a few northern counties in West Texas while 0.20 to 0.70 inch occurs in other areas.

- Most

of this rain is expected this weekend - U.S.

Delta will be heating up and drying out into Saturday and then some showers and thunderstorms may evolve with some cooling next week

- U.S.

southeastern states will experience a mostly good mix of weather during the next two weeks resulting in good crop development potential - U.S.

northern Plains will be drying out a bit for a while, but soil moisture is mostly good - Northwestern

North Dakota and northeastern Montana are driest and will dry out additionally raising the need for significant rain - U.S.

Pacific Northwest will be warmer than usual and dry biased for a while - Canada’s

Prairies will be wettest in western Alberta and in portions of Manitoba during the next two weeks - Drying

is expected in southern and easternmost Alberta and across most of Saskatchewan resulting in rising crop moisture stress and concern over production potentials - Drought

has already induced pockets of crop failures in a part of southern Alberta where this is the 7th year of drought - Ontario

and Quebec, Canada rainfall is expected to be favorably mixed over the next ten days supporting long term crop development potential - Southeastern

Argentina will experience a boost in rainfall Sunday into Monday, but relief in the west will be limited - Western

Argentina still needs rain for winter wheat crop planting and establishment - Eastern

Argentina winter crops are favorably rated - Southern

Brazil soil moisture is decreasing, but remains favorable - Brazil’s

Safrinha crops are maturing and being harvested in a favorable manner and the weather will continue to cooperate with that process - Summer

crop harvesting in both Brazil and Argentina should advance with little weather related delay.

- Europe

is expecting a favorable mix of showers and sunshine along with seasonable temperatures during the next ten days - Some

increase in rainfall is expected and will benefit recently stressed crops, but more rain will be needed - Pockets

of dryness will remain - Russia,

Ukraine, Belarus, Baltic States and northern Kazakhstan will experience a good mix of weather over the next ten days favoring normal crop development - A

boost in rainfall will be needed in Russia’s Southern Region and southeastern New Lands as well as northern Kazakhstan as time moves along - India’s

weather will be favorably mixed over the next two weeks, although the south will not receive as much rain as it needs - China

is expecting favorable weather in much of the nation - Moderate

to heavy rain is likely in east-central and northeastern parts of the nation - Light

rain is expected in north of the Yellow River, but the moisture will help to ease recent dryness and warm to hot temperatures - Much

more rain will be needed - Sugarbeet,

corn, sunseed and spring wheat north of the Yellow River – especially in Inner Mongolia will be stressed and threatened by summer heat and dryness - Xinjiang

weather will be seasonable during the next ten days with temperatures a little milder than usual initially and then warmer biased in the second week of the outlook - Recent

excessive rain in the south of China induced significant flooding in rice and sugarcane areas causing some decline in rice quality and delays in early rice harvesting - The

situation is improving with much drier weather under way now - Mainland

areas of Southeast Asia will experience more frequent rainfall next week that may finally bring some relief to the drier areas in western Thailand and Myanmar, although the situation will need to be closely monitored - Indonesia

and Malaysia rainfall will increase somewhat over the next ten days to two weeks offering some improvement to crop and field conditions after recent erratic rain and net drying - Philippines

rainfall will continue favorably mixed for a while - No

tropical cyclones are threatening the western Pacific Ocean, South China Sea or Indian Ocean today and none is expected for a while - Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual amounts - A

boost in rainfall is expected over the next ten days - Drought

continues to impact Gatlin lake and the Panama Canal shipments, but some increase in precipitation is forthcoming - Eastern

Australia is expecting rain early next week; including the dry areas of Queensland and northern New South Wales - Improved

wheat and barley planting and establishment in unirrigated areas is expected - Sugarcane

harvesting will be disrupted, but the moisture will be good for ongoing cane development - Southern

Australia winter crops are rated favorable and expected to remain that way over the next two weeks as periodic rain and mild to cool weather impact those areas.

- South

Africa wheat, barley and canola areas will get some timely rainfall during the next week further supporting well-established crops - Remnants

of Tropical Storm Cindy have “some” potential to redevelop over the western Atlantic Ocean, but the system will remain over open water and not threaten the United States - There

were no other areas of disturbed tropical weather in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico being monitored Sunday by the U.S. National Hurricane Center for the coming week - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks -

Today’s

Southern Oscillation Index was -4.74 and it will move erratically over the next few days with some weakening expected

Source:

World Weather, INC.

Thursday,

June 29:

- IGC

monthly grains report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

coffee, rice and rubber export data for June - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, 3pm - HOLIDAY:

Indonesia, Malaysia, Singapore, Pakistan

Friday,

June 30:

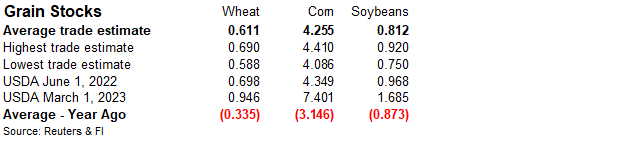

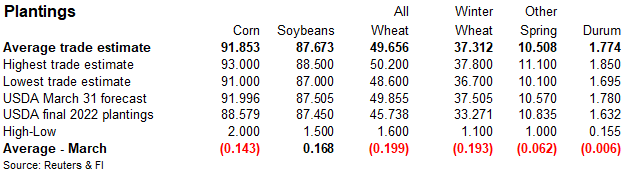

- USDA

quarterly stockpiles data for corn, soybeans, wheat, barley, oat and sorghum, noon - ICE

Futures Europe weekly commitments of traders report - US

annual acreage data for corn, cotton, wheat and soybeans - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Indonesia, Pakistan

Source:

Bloomberg and FI

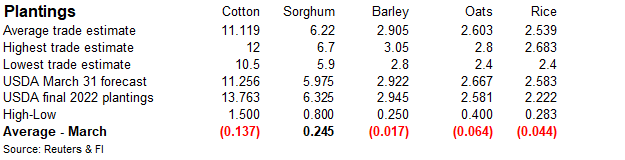

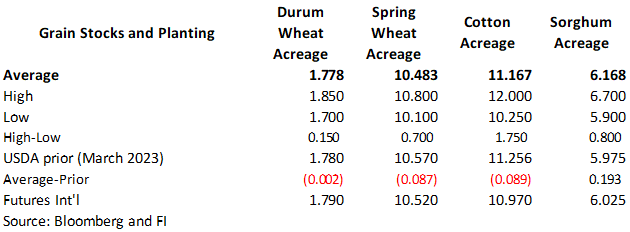

Reuters

estimates for June 30 USDA reports

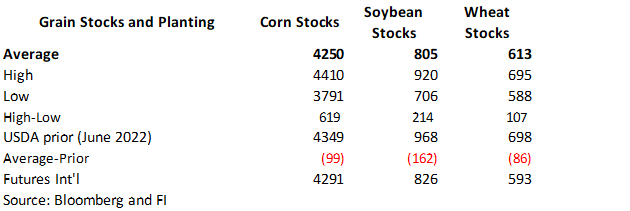

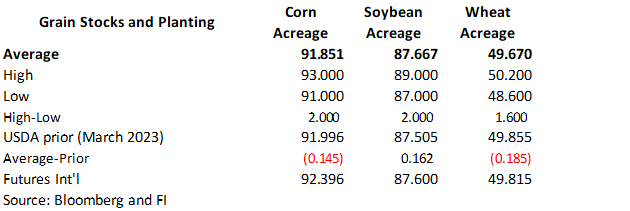

Bloomberg

Estimates

USDA

export sales

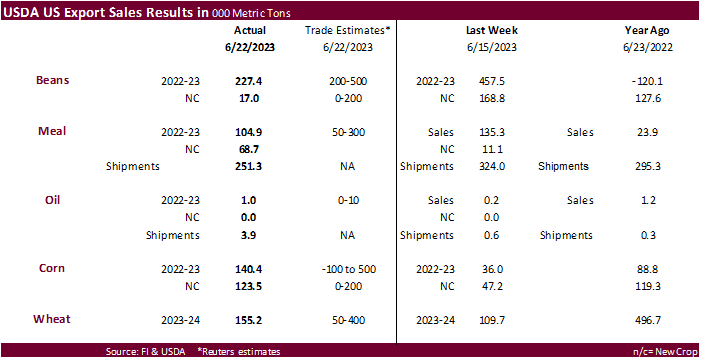

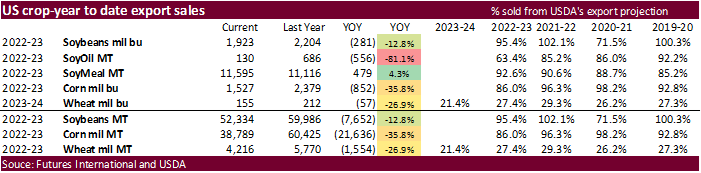

Another

week of 2022-23 weekly export sales reported near the lower end of the range, not surprising with the appreciation in prices for the week ending June 22. This may arm USDA to trim US soybean exports in the upcoming USDA report. Corn export could be left unchanged.

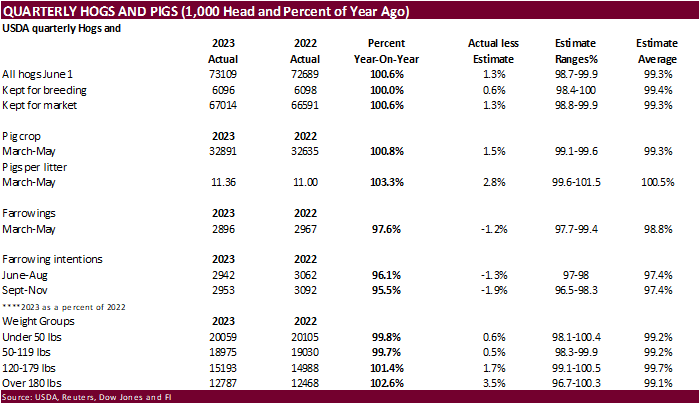

New crop soybean, corn and wheat commitments slowed with the absence of China. On the other hand, sorghum sales were good at 112,000 tons for 2022-23. Pork sales were 26,700 tons.

Macros

102

Counterparties Take $1.935 Tln At Fed Reverse Repo Op. (prev 101 Bids, $1.945 Tln)

US

GDP Annualized (Q/Q) Q1 T: 2.0% (est 1.4%; prev 1.3%)

US

Personal Consumption Q1 T: 4.2% (est 3.8%; prev 3.8%)

US

GDP Price Index Q1 T: 4.1% (est 4.2%; prev 4.2%)

US

Core PCE (Q/Q) Q1 T: 4.9% (est 5.0%; prev 5.0%)

US

Initial Jobless Claims Jun 24: 239K (est 265K; prev 264K)

US

Continuing Claims Jun 17: 1742K (est 1765K; prev 1759K)

US

Pending Home Sales (M/M) May: -2.7% (est -0.5%; prev 0.0%; prevR -0.4%)

–

Pending Home Sales (Y/Y) May: -20.8% (est -20.5%; prev -22.6%; prevR -22.8%)

US

Pending Home Sales Report, May 2023 – NAR

US

EIA NatGas Storage Change (BCF) 23-Jun: +76 (est +82; prev +95)

–

Salt Dome Cavern NatGas Stocks Change (BCF): UNCH (prev +6)

US

Weekly Natural Gas Storage Report, June 23 2023 – EIA

Corn

·

US corn futures were lower on light news, mostly unchanged weather forecast, and positioning ahead of the USDA reported and First Notice Day deliveries.

·

The International Grains Council (IGC) lowered their 2023-24 global corn production by six million tons to 1.211 billion tons. U.S. corn crop was pegged at 373.4 million tons, down from a previous projection of 381.8 million.

·

(Reuters) – “Brazil’s government is set to purchase 500,000 metric tons of corn as it looks to start rebuilding public food stocks, the head of food agency Conab said on Thursday.” No details were provided at the time this was

written. We think it might be from local producers.

·

We look for USDA to lower the US July corn yield by at least three bushels per acre. For the July report, there were few times USDA changed their yield estimates for corn and soybeans. Exceptions

are as follows since 2000:

Corn

July

2012 146.0 dn 20.0 bushels

July

2008 148.4 dn 0.5 bushels

July

2005 145.0 dn 3.0 bushels

July

2003 142.7 up 3.0 bushels

Soybeans

July

2019 48.5 dn 1.0 bushels

July

2012 40.5 dn 3.4 bushels

July

2008 42.1 dn 0.5 bushels

July

2004 39.9 dn 0.1 bushels

And

notable:

1993

– spring floods – July corn yield was 118.0, down 4.7 from June. The July 1993 soybean yield was 34.1, down 1.0 bushels from June.

Export

Developments

-

South

Korea’s NOFI Group bought an estimated 68,000 tons of feed corn out of 138,000 tons sought at $249.99/ton c&f, either from South America or South Africa.

-

South

Korea’s Major Feedmill Group (MFG) bought an estimated 68,000 tons of corn from South America or South Africa at an estimated $249.99 a ton c&f for arrival in South Korea around Nov. 18.

Export

developments.

-

None

reported

Price

outlook (6/28/23)

September

corn $5.00-$6.25

December

corn $480-$7.25

·

The US soybean complex traded lower earlier on positioning ahead of the USDA reports and improving weather for the US crop areas but managed to rebound led by the nearby contracts in soybeans and 2023 months in soybean meal. 2014

US soybean contracts ended lower for the January and March positions (large Brazil production prospects for new-crop).

·

Malaysia was on holiday today.

·

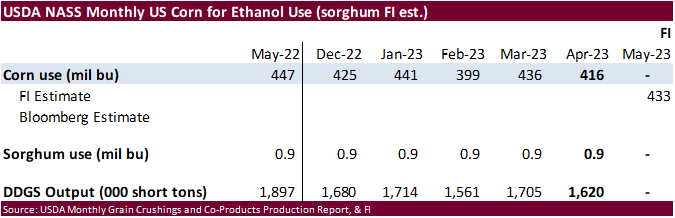

NASS will release corn and soybean use reports on Monday. A Reuters poll calls for the May Us crush to end up near 5.693 million short tons, or 189.8 million bushels, up from the 187.0 million bushels in April and 180.9 million

bushels May 2022. (188.0-191.0 range). Soybean oil stocks as of May 31 were estimated at 2.437 billion pounds, down 2.540 billion pounds at the end of April but above 2.384 billion pounds at the end of May 2022. (2.400-2.500 billion range).

-

Results

awaited: Iran’s SLAL seeks up to 120,000 tons of soybean meal from Brazil or Argentina, for July and August shipment. They passed on meal mid-June.

Price

outlook (6/28/23)

Soybeans

– September $13.00-$14.75, November $12.00-$15.25

Soybean

meal – September $350-$450, December $350-$500

Soybean

oil – September 51.00-58.00, December 48.00-58.00

·

Chicago and KC wheat were lower from follow through selling in US and Paris wheat futures from Black Sea competition and improving US spring wheat production prospects. MN ended higher. September Paris wheat futures were up 2.50

euro’s at 233.25 per ton.

·

The International Grains Council (IGC) raised their 2023-24 global wheat crop outlook by three million tons to 786 million tons, in part from an improved outlook for Ukraine (22.5 million, up from a previous 20.2 million).

·

Argentina’s AgMin sees the 2023-24 production for wheat at between 18 and 19 million tons. USDA is at 19.5MMT.

Export

Developments.

·

Morocco seeks up to 2.5 million tons of wheat between July 1 and September 30. Origins include Russia, Ukraine, France, Germany, Argentina, and the United States.

Rice/Other

-

(Reuters)

– Vietnam’s rice exports in the January-June period are estimated to have risen about 22.2% from a year earlier to 4.27 million tons, government data showed on Thursday. Revenue from rice exports in the same period is seen up 34.7% at $2.3 billion. June rice

exports from Vietnam, one of the world’s leading shippers of the grain, were estimated at 650,000 tons, worth $383 million.

Price

outlook (6/28/23)

Chicago

Wheat September $6.00-$7.75

KC – September $7.25-$9.00

MN – September $7.25-$9.00

Export Sales Highlights

This summary is

based on reports from exporters for the period June 16-22, 2023.

Wheat: Net sales of 155,200 metric tons (MT) for 2023/2024 primarily

for Japan (78,400 MT), Mexico (48,400 MT, including decreases of 11,000 MT), El Salvador (15,700 MT, including decreases of 100 MT), Ecuador (5,000 MT), and the Dominican Republic (4,500 MT), were offset by reductions for Colombia (2,500 MT), Guatemala (500

MT), and Jamaica (200 MT). Exports of 157,600 MT were primarily to Japan (49,400 MT), Taiwan (36,300 MT), Mexico (25,200 MT), Jamaica (21,800 MT), and Guatemala (17,300 MT).

Corn: Net sales of 140,400 MT for 2022/2023 were up noticeably from the previous week, but down 16 percent from the prior 4-week average. Increases

primarily for Japan (103,700 MT, including 112,900 MT switched from unknown destinations and decreases of 3,600 MT), Mexico (92,700 MT, including decreases of 900 MT), Taiwan (18,500 MT), Jamaica (18,100 MT), and El Salvador (8,300 MT, including 7,500 MT switched

from Honduras and decreases 900 MT), were offset by reductions for unknown destinations (87,500 MT), Colombia (14,500 MT), and Honduras (6,300 MT). Net sales of 123,500 MT for 2023/2024 were reported for Mexico (79,500 MT), Honduras (29,400 MT), and Canada

(14,600 MT). Exports of 605,300 MT were down 9 percent from the previous week and 47 percent from the prior 4-week average. The destinations were primarily to Mexico (315,600 MT), Japan (138,300 MT), Colombia (53,400 MT), El Salvador (24,400 MT), and Panama

(19,700 MT).

Barley: No net sales or exports were reported for the week.

Sorghum: Net sales of 112,000 MT for 2022/2023 were up 90 percent from the previous week and 21 percent from the prior 4-week average. Increases

reported for unknown destinations (118,000 MT), were offset by reductions for China (6,000 MT). Total net sales of 60,000 MT for 2023/2024 were for unknown destinations. Exports of 60,900 MT were up noticeably from the previous

week and up 74 percent from the prior 4-week average. The destinations were to China (60,000 MT) and Mexico (900 MT).

Rice: Net sales of 19,500 MT for 2022/2023 were up 47 percent from the previous week and 54 percent from the prior 4-week average. Increases

were primarily for Haiti (15,000 MT, including decreases of 3,800 MT), Canada (2,200 MT), Mexico (1,100 MT, including decreases of 600 MT), Saudi Arabia (700 MT), and Guatemala (100 MT). Exports of 33,500 MT were down 25 percent from the previous week and

30 percent from the prior 4-week average. The destinations were primarily to Haiti (15,100 MT), Guatemala (10,700 MT), Mexico (5,100 MT), Canada (1,500 MT), and El Salvador (500 MT).

Soybeans: Net sales of 227,400 MT for 2022/2023 were down 50 percent from the previous week and 28 percent from the prior 4-week average. Increases primarily

for Mexico (87,000 MT, including decreases of 2,500 MT), unknown destinations (52,800 MT), Japan (38,700 MT, including 39,200 MT switched from unknown destinations and decreases of 1,200 MT), Indonesia (31,000 MT), and Taiwan (9,400 MT), were offset by reductions

for the Philippines (100 MT). Net sales of 17,000 MT for 2023/2024 reported for Mexico (20,000 MT), were offset by reductions for China (3,000 MT). Exports of 191,000 MT were down 51 percent from the previous week and 24 percent from the prior 4-week average.

The destinations were primarily to Mexico (99,000 MT), Japan (44,700 MT), Indonesia (11,400 MT), Colombia (9,900 MT), and Taiwan (7,000 MT).

Optional Origin Sales: For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export for Own Account: For 2022/2023, the current exports for own account outstanding balance of 1,800 MT are for Canada (1,400 MT) and Taiwan

(400 MT).

Soybean Cake and Meal: Net sales of 104,800 MT for 2022/2023 were down 23 percent from the previous week and 55 percent from the prior 4-week

average. Increases primarily for the Dominican Republic (20,500 MT, including decreases of 800 MT), Mexico (18,000 MT), El Salvador (17,800 MT, including 12,000 MT switched from Nicaragua, 700 MT switched from Guatemala, and decreases of 1,000 MT), Colombia

(12,300 MT, including decreases of 14,600 MT), and Canada (9,300 MT), were offset by reductions for Nicaragua (12,000 MT) and Ecuador (100 MT). Net sales of 68,700 MT for 2023/2024 were primarily for Mexico (38,100 MT), Canada (17,100 MT), and El Salvador

(13,100 MT). Exports of 251,300 MT were down 22 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to the Philippines (49,500 MT), Colombia (43,500 MT), Mexico (33,700 MT), Ecuador (24,900 MT), and Canada

(20,800 MT).

Soybean Oil: Net sales of 1,000 MT for 2022/2023 were up noticeably from the previous week and up 5 percent from the prior 4-week average.

Increases were primarily for Canada (900 MT). Exports of 3,900 MT were up noticeably from the previous week, but down 36 percent from the prior 4-week average. The destinations were primarily to Jamaica (3,500 MT) and Canada (300 MT).

Cotton: Net sales of 125,600 RB for 2022/2023 were up noticeably

from the previous week, but down 44 percent from the prior 4-week average. Increases primarily for China (77,400 RB, including decreases of 4,400 RB), Vietnam (37,500 RB, including 400 RB switched from South Korea), Taiwan (4,400 RB), Pakistan (4,400 RB),

and Bangladesh (4,400 RB), were offset by reductions for Turkey (10,100 RB), Guatemala (1,900 RB), and South Korea (400 RB). Net sales of 158,700 RB for 2023/2024 primarily for El Salvador (72,200 RB), Honduras (30,800 RB), Turkey (19,600 RB), China (15,800

RB), and Bangladesh (13,900 RB), were offset by reductions for Vietnam (2,200 RB). Exports of 225,200 RB were down 5 percent from the previous week and 17 percent from the prior 4-week average. The destinations were primarily to China (56,300 RB), Turkey (46,600

RB), Vietnam (44,700 RB), Pakistan (28,300 RB), and Indonesia (13,100 RB). Net sales of Pima totaling 3,600 RB for 2022/2023 were up 74 percent from the previous week and 45 percent from the prior 4-week average. Increases reported for India (3,300 RB), Vietnam

(500 RB switched from Hong Kong), Japan (200 RB), and Thailand (100 RB), were offset by reductions for Hong Kong (500 RB). Total net sales of 100 RB for 2023/2024 were for Japan. Exports of 15,000 RB were up noticeably from the previous week and up 41 percent

from the prior 4-week average. The destinations were primarily to India (12,300 RB), Egypt (1,500 RB), Thailand (600 RB), and Vietnam (500 RB).

Optional Origin Sales: For 2022/2023, the current outstanding balance of 300 RB, all Malaysia.

Export for Own Account: For 2022/2023, the current exports for own account outstanding balance of 96,300 RB are for China (66,900 RB), Vietnam

(19,300 RB), Pakistan (5,000 RB), South Korea (2,400 RB), India (1,500 RB), and Turkey (1,200 RB).

Hides and Skins: Net sales of 352,300 pieces for 2023 were down

23 percent from the previous week and from the prior 4-week average. Increases were primarily for China (275,600 whole cattle hides, including decreases of 11,200 pieces), South Korea (29,700 whole cattle hides, including decreases of 800 pieces), Mexico (24,500

whole cattle hides, including decreases of 2,200 pieces), Thailand (8,300 whole cattle hides, including decreases of 200 pieces), and Brazil (6,500 whole cattle hides). Exports of 376,500 pieces were down 6 percent from the previous week and from the prior

4-week average. Whole cattle hides exports were primarily to China (281,000 pieces), Mexico (50,300 pieces), South Korea (26,700 pieces), Brazil (10,000 pieces), and Thailand (3,700 pieces).

Net sales of 181,400 wet blues for 2023 were up 66 percent from the previous week and 75 percent from the prior 4-week average. Increases were reported for Italy (114,500 unsplit), Brazil (16,500

unsplit), Vietnam (15,400 unsplit), China (15,300 unsplit), and Thailand (8,000 unsplit). Exports of 92,100 wet blues were down 26 percent from the previous week and 17 percent from the prior 4-week average. The destinations were primarily to China (35,600

unsplit), Vietnam (27,200 unsplit), Brazil (9,200 unsplit and 2,200 grain splits), Mexico (6,400 unsplit), and Hong Kong (5,000 unsplit). Total net sales of 42,000 splits were for China. No exports of splits were reported for the week.

Beef: Net sales of 12,000 MT for 2023 were down 9 percent from the previous week and 16 percent from the prior 4-week average. Increases were

primarily for China (2,500 MT, including decreases of 200 MT), Japan (2,500 MT, including decreases of 500 MT), Canada (1,400 MT, including decreases of 100 MT), Mexico (1,400 MT, including decreases of 100 MT), and Taiwan (1,200 MT, including decreases of

100 MT). Exports of 15,100 MT were down 15 percent from the previous week and 7 percent from the prior 4-week average. The destinations were primarily to Japan (4,200 MT), South Korea (3,600 MT), China (1,800 MT), Taiwan (1,600 MT), and Mexico (1,400 MT).

Pork: Net sales of 26,700 MT for 2023 were down 7 percent from the previous week, but up 3 percent from the prior 4-week average. Increases

were primarily for Mexico (15,100 MT, including decreases of 200 MT), South Korea (4,100 MT, including decreases of 300 MT), Japan (2,600 MT, including decreases of 300 MT), Colombia (1,300 MT, including decreases of 100 MT), and Canada (1,300 MT, including

decreases of 700 MT). Exports of 29,300 MT were down 3 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to Mexico (9,300 MT), China (3,900 MT), Japan (3,700 MT), South Korea (2,800 MT), and Australia

(1,900 MT).

U.S. EXPORT SALES FOR WEEK ENDING 6/22/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

99.1 |

730.8 |

1,342.9 |

25.1 |

183.3 |

339.7 |

0.0 |

0.0 |

|

SRW |

43.3 |

1,112.9 |

996.1 |

33.6 |

127.5 |

151.2 |

0.0 |

14.0 |

|

HRS |

5.3 |

1,025.1 |

1,267.8 |

62.9 |

250.5 |

402.6 |

0.0 |

0.2 |

|

WHITE |

7.6 |

500.9 |

899.2 |

36.0 |

190.4 |

248.4 |

0.0 |

0.0 |

|

DURUM |

0.0 |

92.9 |

104.4 |

0.0 |

1.7 |

18.0 |

0.0 |

0.0 |

|

TOTAL |

155.2 |

3,462.7 |

4,610.3 |

157.6 |

753.4 |

1,159.9 |

0.0 |

14.2 |

|

BARLEY |

0.0 |

16.3 |

11.5 |

0.0 |

0.0 |

2.2 |

0.0 |

0.0 |

|

CORN |

140.4 |

4,536.7 |

8,952.8 |

605.3 |

34,251.7 |

51,471.0 |

123.5 |

3,150.1 |

|

SORGHUM |

112.0 |

607.5 |

656.0 |

60.9 |

1,519.6 |

6,248.3 |

60.0 |

123.2 |

|

SOYBEANS |

227.4 |

3,236.0 |

8,389.4 |

191.0 |

49,097.9 |

51,596.5 |

17.0 |

3,351.6 |

|

SOY MEAL |

104.8 |

2,339.2 |

2,144.8 |

251.3 |

9,255.9 |

8,971.6 |

68.7 |

704.9 |

|

SOY OIL |

1.0 |

38.4 |

82.5 |

3.9 |

91.1 |

603.0 |

0.0 |

3.8 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

0.1 |

48.0 |

70.9 |

15.3 |

683.2 |

1,246.1 |

0.0 |

38.0 |

|

M S RGH |

0.0 |

32.1 |

6.8 |

0.0 |

26.0 |

14.1 |

0.0 |

5.0 |

|

L G BRN |

0.6 |

6.0 |

3.5 |

0.2 |

19.3 |

51.0 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

6.7 |

9.8 |

0.0 |

38.9 |

77.9 |

0.0 |

0.0 |

|

L G MLD |

16.8 |

100.4 |

67.3 |

16.8 |

650.0 |

750.4 |

0.0 |

40.0 |

|

M S MLD |

1.9 |

63.1 |

134.7 |

1.2 |

257.1 |

398.8 |

0.0 |

40.2 |

|

TOTAL |

19.5 |

256.2 |

293.0 |

33.5 |

1,674.5 |

2,538.4 |

0.0 |

123.1 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

125.6 |

3,290.5 |

4,092.2 |

225.2 |

10,487.7 |

11,510.9 |

158.7 |

2,127.9 |

|

PIMA |

3.6 |

29.2 |

58.0 |

15.0 |

291.6 |

421.8 |

0.1 |

4.8 |

#non-promo