PDF Attached

Report

day – Largest upward price move for end of June reports since 2015.

CME

margin changes:

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 11.1% TO $5,000 PER CONTRACT FROM $4,500 FOR JULY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON JULY 1, 2021

Soybean

meal was also adjusted higher.

https://www.cmegroup.com/notices/clearing/2021/06/Chadv21-232.html

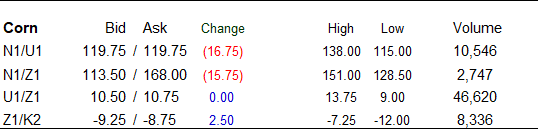

Corn

synthetics

CU1

600-603

CZ1

591.75 to 592.00

CH2

597-592.50

May

601

![]()

Much

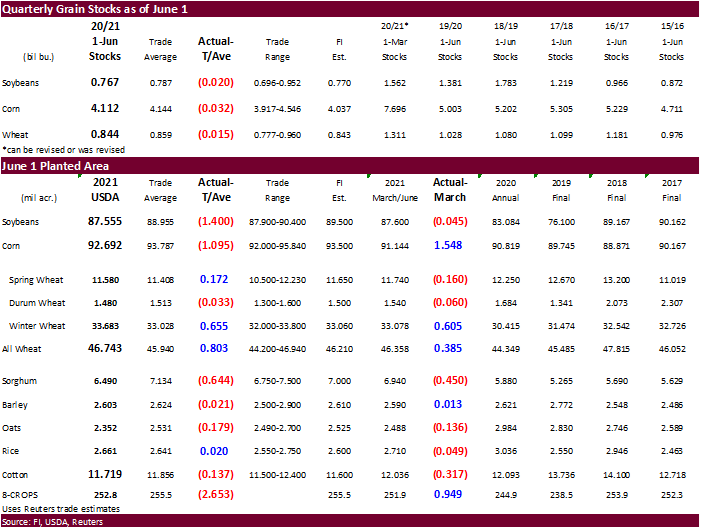

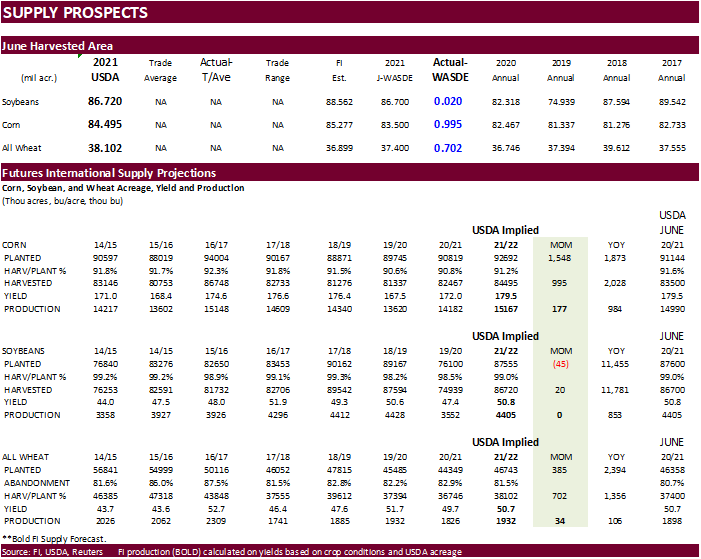

lower-than-expected US planted acres for soybeans and corn were reported this morning. Corn acres came in 1.095 million acres below expectations at 92.692 million, 1.55 million above March. Some estimates thought the US corn area would expand as much as

5.5 million acres. US soybean plantings were actually lowered from March by 45,000 acres to 87.555 million acres and were 1.4 million acres below expectations. The all-wheat area was taken up 385,000 acres to 46.743 million and were 803,000 acres below expectations.

USDA found an additional 605,000 winter wheat acres from March. Spring and durum were revised lower from March. The area for the three minor feedgrains were also reported less than expected. What was the most surprising that comes to mind for this report

was the net change for the total acres for the 8 major crops. The 8-crop area expanded only 949,000 acres from March to 252.8 million acres. The trade was looking for 255.5 million. For comparison there were 244.9 million in 2020, 238.5 million in 2019,

253.9 million in 2018 and 252.3 million in 2017.

State

by state acreage change attached for corn, soybeans and three classes of wheat.

US

soybean production in July may not be changed much by USDA if they use their current yield. Corn production could be revised up 177 million, and all-wheat up 34 million, using USDA’s current harvested area, and June yields. Note corn production may end up

only about 140 million bushels below our previous working estimate. But the fact remains implied US soybean and corn production will end up below trade expectations, and this is why some contracts traded limit higher post USDA report. An unfavorable weather

going forward may result in August corn and soybean yields coming in USDA’s current 179.5 and 50.8 projection. We are using 177.8 for corn and 51.2 for soybeans, based on the latest crop ratings. That puts corn around 15 billion and soybeans around 4.44

billion. For immediate balance adjustments, we will adjust corn demand and stocks (lower) and may leave soybean demand unchanged. For all-wheat, USDA is due to update winter wheat production (higher) in July. They will also report initial spring and durum

production (much lower than implied June estimate) next month. Look for USDA to revise lower their 2021-22 US all-wheat stocks estimate.

US

June 1 grain stocks

were reported below expectations, but not by a large amount for all three major commodities. Unlike other grain stocks reports, we did not see the large discrepancies. There were also very small revisions to March 1 stocks.

Price

limits (corn expands to 60)

https://www.cmegroup.com/trading/price-limits.html

USDA

NASS Executive Summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2021/06-30-2021.pdf

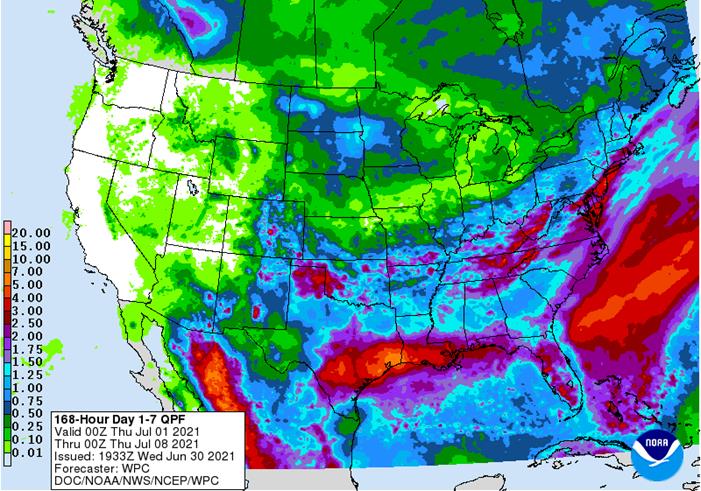

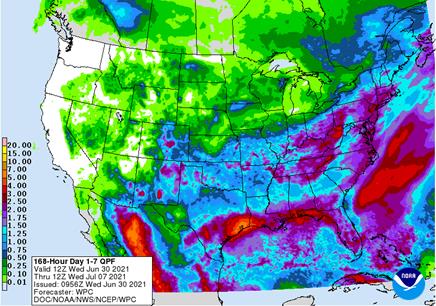

Weather

1-7

DAY now puts rain in for the Dakotas

Versus

this morning

MOST

IMPORTANT WEATHER OF THE DAY

- Lytton,

British Columbia reached 121 degrees Fahrenheit Tuesday afternoon setting a new record for the hottest temperature ever recorded in Canada

o

This temperature is just 1 degree away from the hottest temperature ever recorded at Phoenix, Arizona and was 4 degrees hotter than the 117 reported at Las Vegas, NV this week which was an all-time record high for that city

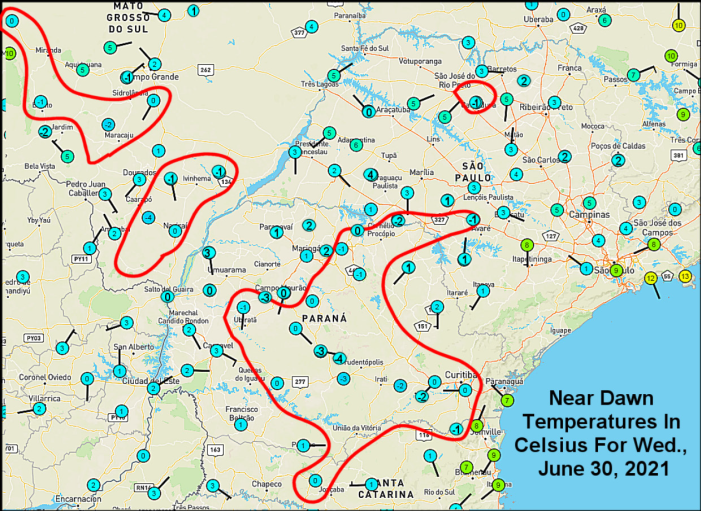

- Additional

frost and freezes occurred this morning in interior southern Brazil raising concern over immature Safrinha corn, wheat, sugarcane, citrus and coffee conditions

o

Temperatures slipped to 25 degrees Fahrenheit in central Parana wheat areas and in far southern Mato Grosso do Sul while most lows were in the 30s and a few upper 20s

- Frost

occurred in most areas from southern Mato Grosso do Sul and Parana into Sao Paulo with only patches of soft frost occurring in citrus areas - Sugarcane

and coffee areas experienced a little more frost in Sao Paulo, northern Parana and Mato Grosso do Sul, but the impact on crops was suspected of being low - Sul

de Minas coffee areas were not cold enough for frost or significance

o

Some of the immature corn crop may have been negatively impacted over the past two mornings by frost and light freezes, but most of the crop should not have been seriously affected

o

Wheat was likely burned back by the frost and freezes, but no permanent harm was suspected to most of the crop. There is a little concern over the more advanced wheat in areas where temperatures fell to 25F, but those were rare

- Warming

is likely in southern Brazil through Thursday into the weekend, although southern Sul de Minas coffee areas could be a degree cooler than today.

o

Damage to coffee is not expected and no further negative impact is expected in key corn, wheat, citrus or sugarcane areas, although temperatures will still be cool enough for patches for soft frost

- U.S.

weather will trend drier in this coming week with warming in the north-central states

o

Rain will end in the Ohio River Basin Thursday with several days of welcome drying to follow

- The

change will help improve winter wheat maturation and harvest conditions while giving corn and soybean a chance to fully utilize recent rainfall

- Warming

is needed in the Midwest

o

Net drying is expected over the coming six days in the northern and central Plains and northwestern Corn Belt while temperatures trend warmer

- Extreme

highs over 100 degrees Fahrenheit will expand from Montana today and Thursday into the Dakotas Friday and Saturday - Cooling

will be slow to come during the late weekend or early part of next week - Crop

moisture stress is expected to intensify across many of these areas, but especially in the northern Plains Minnesota, northwestern Iowa and Nebraska - West

Texas will receive more rain Friday and Saturday nights with sporadic showers popping up periodically at other times

- U.S.

Delta and Southeastern States will experience a good mix of rain and sunshine over the coming week - Pre-monsoonal

showers and thunderstorms will occur in the interior western U.S. - Lightning

strikes may increase the potential for forest fires - Excessive

heat in the Pacific Northwest and British Columbia will slowly abate over the next few days - Canada’s

western Prairies were hot Tuesday with extreme highs reaching 108 degrees Fahrenheit in western Alberta

o

High in the 90s occurred in most of Alberta while in the 80s and lower to a few middle 90s in Saskatchewan and a little cooler in Manitoba

o

Most of the Prairies were dry and the heat will expand to the east over the balance of this week

- Canada’s

Prairies and the northwestern U.S. Plains will experience excessive heat and dryness through the next few days with highs in the 90s to 108 degrees Fahrenheit

o

Some showers and thunderstorms will attempt to bring a little relief late this week and again next week

- Next

week’s rainfall coverage and amounts may be greater than this week, but it will be hard for a soaking rain to take place without a good moisture source

o

Canada’s Prairies weather outlook for next week does turn a little wetter for a little while, although a general soaking may not occur

- U.S.

week two weather is expected to continue bringing alternating periods of rain and sunshine to the Midwest, although below average precipitation is expected in the northern Plains, upper Midwest and immediate neighboring areas in the northwestern Corn Belt

o

Some model data brings rain to the drier areas during mid-week next week, but World Weather, Inc. believes the rain is overdone

o

A tropical cyclone may impact the eastern Gulf of Mexico Coast during the middle part of next week, although confidence is low

- Today’s

GFS forecast model brings the storm into northwestern Florida a week from now - Not

much rain will fall in South America over the next ten days – at least not in key grain, coffee, citrus or sugarcane areas

o

Some moisture is still needed in wheat areas, although Argentina’s crop is still rated much better than that of the past couple of years

- China’s

weather remains well mixed, despite some flooding rain during the past weekend

o

Dryness is not likely to be a problem in the nation during the next two weeks

o

Additional bouts of flooding are most likely in the south, but some central areas will get a little too wet too

o

Northeastern grain and oilseed areas will be favorably moist

- Xinjiang,

China cotton, corn and other crop areas will experience improving weather over the next week to ten days with mostly dry and warmer conditions likely

o

The improvement will be greatest in the northeast

- Russia’s

Southern Region and other areas in western Russia and Ukraine will receive welcome showers and thunderstorms later this week and into next week to help restore favorable soil moisture after the past week of very warm and dry conditions

o

A new ridge of high pressure is expected to evolve over western Russia a week from now bringing drier and warmer conditions late next week and into the following weekend to move of Ukraine and western Russia

- Kazakhstan

crop weather has been quite dry and hot recently along with some neighboring southern Russia New Lands locations

o

Extreme highs reached 100 to 110 Fahrenheit Tuesday in Kazakhstan while an extreme of 108 occurred over the border in northwestern Kazakhstan to Russia

o

The excessive heat will break down during the weekend and some showers may evolve next week

- A

general soaking of rain is needed, but not very likely - Most

other areas in Russia are expecting a good mix of weather preserving and protecting good production potentials - Europe

weather will be well remain well mixed over the next ten days except in the Mediterranean countries where dryness is expected

o

A part of the western Balkan Countries and areas northeast into Hungary and western Slovakia are trending too dry and rain is needed

- Not

much rain is expected in these areas for a while and stress will continue for unirrigated crops - North

Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- India’s

monsoon will continue to underperform in the interior west and north, over the coming week and northwestern areas will stay drier biased through July 15.

o

Concern over crop development conditions will be rising from Gujarat through Rajasthan and into Punjab and Haryana

- Australia

weather will continue well mixed over the next two weeks supporting improved winter crop establishment - Tropical

Storm Enrique continues to help bring moisture northward into western and some north-central Mexico crop areas this week

o

Landfall is expected in southern Baja California today as a tropical storm

o

The storm will become a depression this afternoon and then may dissipate later this week

o

Drought relief is expected in some areas, but much more rain will be needed to knock the drought out

- Two

tropical waves in the tropical Atlantic will be closely monitored over the next ten days with one expected to reach the Antilles soon and then move toward the Gulf of Mexico next week producing some heavy rainfall in the Antilles

o

The second wave is over the tropical Atlantic Ocean and it has a better potential to become a tropical cyclone later this week and it will enter the eastern Caribbean Sea Friday before moving toward The Gulf of Mexico this weekend

- Thailand,

Cambodia and Vietnam will continue drier biased this week with Vietnam getting greater rain July 2-8

o

A general boost in precipitation is possible in many mainland areas of Southeast Asia next week

- Thailand,

corn, rice, sugarcane and other crops are all becoming stressed because of dryness. The same may be occurring in some Cambodia and Vietnam locations - Thailand

rainfall will improve in the second week of the forecast - Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall will be near to below average for at a while, but a boost in rainfall is expected this weekend and next week

o

Some areas may experience net drying for a while this week

- Southeastern

Canada corn, soybean and wheat conditions are rated mostly good, although a greater boost in rainfall might be welcome near the U.S. border at some point into time over the next few weeks.

o

Some of that precipitation need is expected over the coming week as rain from the U.S. Midwest streams into the region

o

Recent rain bolstered soil moisture in many areas across Ontario and Quebec away from the U.S. border

- West

Africa rainfall in Ivory Coast and Ghana will be near average during the coming ten days

o

Nigeria and Cameroon will see a mix of precipitation during the next ten days with most crops benefiting well from the pattern

- A

part of Nigeria will receive less than usual rainfall during this period, but timely rain is still expected - Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and expected

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas - South

Africa will experience additional showers in the far west periodically this week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Mexico

rainfall will continue in southern parts and western of the nation over the coming week

o

The precipitation will bring some drought relief to Sonora, Baja California, western Chihuahua, Sinaloa, western Durango and parts of Zacatecas

o

Northeastern and north-central Mexico will have need for more rain

- Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at +0.04 and the index is expected to move erratically the remainder of this week with an upward bias. - New

Zealand rainfall during the coming week to ten days will be less than usual and temperatures will be a little cooler biased

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Wednesday,

June 30:

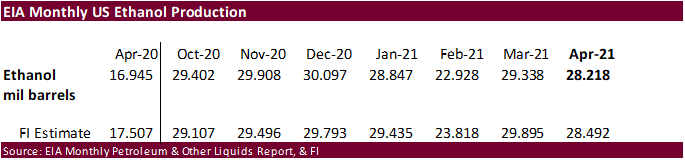

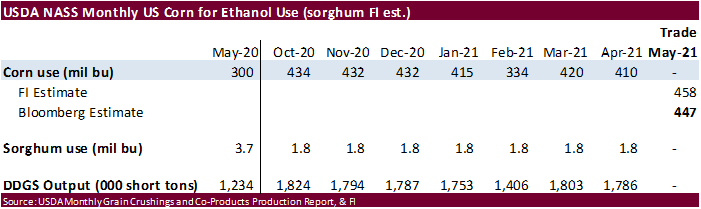

- EIA

weekly U.S. ethanol inventories, production - U.S.

acreage data for corn, wheat, soybeans and cotton; quarterly grain stockpiles - Bloomberg

New Economy Catalyst; climate and agriculture - Malaysia

June 1-30 palm oil export data - U.S.

agricultural prices paid, received

Thursday,

July 1:

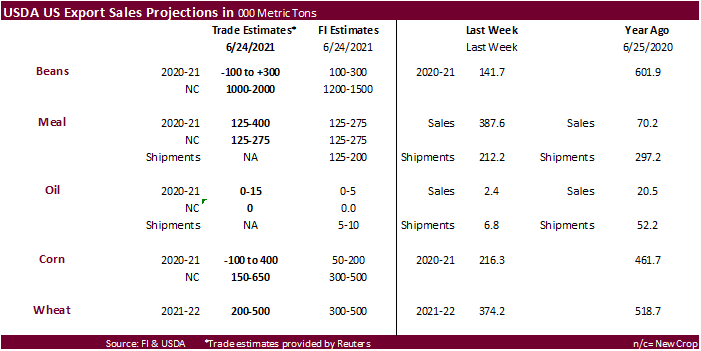

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - World

cotton outlook update from International Cotton Advisory Committee - Costa

Rica, Honduras monthly coffee exports - U.S.

corn for ethanol, DDGS production, 3pm - USDA

soybean crush, 3pm - Port

of Rouen data on French grain exports - Australia

Commodity Index - AB

Sugar trading update - HOLIDAY:

Canada, Hong Kong

Friday,

July 2:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Source:

Bloomberg and FI

Source:

Bloomberg and FI

90

Counterparties Take $991.939 Bln At Fed’s Fixed-Rate Reverse Repo (prev $841.246 Bln, 74 Bidders)

US

ADP Employment Change Jun: 692K (est 600K; prevR 886K; prev 978K)

Brent

Crude Oil Seen Averaging USD67.48/Barrel In 2021 Versus USD64.79 In May – RTRS Poll

US

Chicago PMI Jun: 66.1 (est 70.0; prev 75.2)

US

Pending Home Sales (M/M) May: 8.0% (est -1.0%; prev -4.4%)

–

Pending Home Sales NSA (Y/Y) May: 13.9% (prev R 53.7%)

US

DoE Crude Oil Inventories (W/W) 25-Jun: -6718K (est -3850K; prev -7614K)

–

Distillate: -869K (est 1000K; prev 1754K)

–

Cushing Crude: -1460K (prev -1833K)

–

Gasoline: 1522K (est -900K; prev -2930K)

–

Refinery Utilization: 0.70% (est 0.45%; prev -0.40%)

- US

corn futures

ended limit higher after USDA reported new crop US 2021 corn plantings revised up less than expected, with majority of expansion in the dry areas of the Dakota’s and Minnesota. Traders are lowering production prospects again based on lower area, after already

taking yields US corn yields down after conditions deteriorated in those key states over the past month. US carryout for 2021-22 is now expected to end up tighter than USDA. Funds bought an estimated 33,000 corn contracts. See our USDA report recap above.

- We

are already hearing arguments USDA is still too low on US acreage for the major crops. We agree but will have to wait until August when FSA prevented planting figures are released.

- Price

limits (corn expands to 60)

https://www.cmegroup.com/trading/price-limits.html

- July/December

corn spread took a hit today after corn stocks as of June 1 came in slightly below expectations. Remember last year they were well off from trade expectations, only to be revised later from 221 million bushels. Traders ignored this years June 1 grain stocks

an focused on new-crop.

- Ongoing

concerns over the US far WCB weather pattern should limit losses for the rest of the week. World Weather noted the first week of the US outlook is dry biased for the Corn Belt with exception to the Ohio River Basin. Net drying for the ECB should be good

for areas that have seen well above normal rainfall. - First

Notice Day corn deliveries were zero. - Brazil

weather concerns continue with cold temperatures recorded this morning impacted corn, coffee and sugarcane crops. Areas included northern Parana and southern MGDS. Thursday could be just as cold, according to Rural Clima. For Brazil corn we see light impact

from this cold event as the second corn crop already sustained damage and/or is already made.

- Argentina

sold 31.1 million tons of corn, about 3 million tons more than at the same time last year. - USDA’s

weekly Broiler Report showed eggs set in the United States Up 2 Percent and chicks placed down slightly. Cumulative placements from the week ending January 9, 2021 through June 26, 2021 for the United States were 4.68 billion. Cumulative placements were up

1 percent from the same period a year earlier.

U

of I: Historical Relationships Suggest Rising Corn Seed Costs for 2022

Export

developments.

- Taiwan’s

MFIG bought about 55,000 tons of South African corn at an estimated premium of 233.82 cents a bushel c&f over the Chicago December contract, for shipment between Sept. 21 and Oct. 10. - Results

awaited: Iran in for 60,000 tons of corn and 60,000 tons barley for Aug/Sep shipment.

- China

plans to auction off 155,000 tons of imported corn on July 2. - 123,977

tons of US - 31,539

tons of Ukraine origin

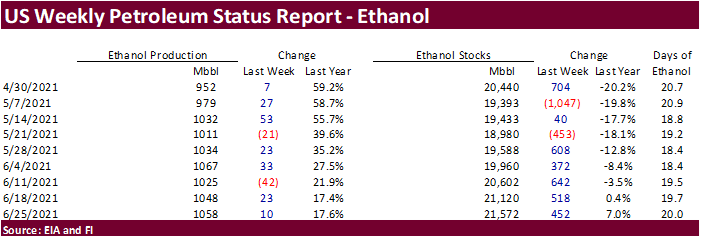

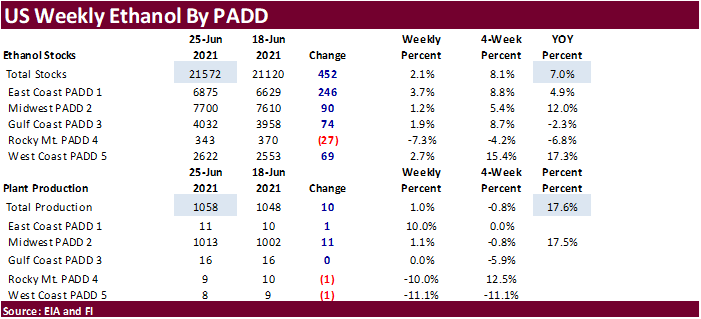

Weekly

US ethanol production

was up 10,000 barrels to 1.058, highest since 1.067 million a month ago. The trade was looking for a 4,000-barrel decrease. Stocks were up 452,000 barrels to 21.572 million, highest since 3/19/21. Ethanol blended to finished motor gasoline improved from

the previous week to 91.3% from 90.5%. Gasoline product supplied fell 267,000 barrels to 9.173 million. Report is viewed slightly friendly for corn.

Updated

6/30/21

September

corn $4.50 and $6.00

December

corn is seen in a $4.25-$6.00 range.

-

Soybean

complex traded sharply higher rafter US plantings were reported 1.4 million acres below trade expectations and revised down 45,000 from March. That caught traders off guard. What started as an already tight 2021-22 US soybean carryout projection, that became

more of a concern today. The US can not afford a major weather problem beyond what the Dakotas and Minnesota through parts of IA have already experienced. Soybean oil advanced as expected. Less soybeans to crush could equal less soybean oil to supply biofuel

producers. Soybean meal, which saw limited advances relative to soybeans and SBO during the recent rallies, surged today. Funds bought 24k soybeans, 15k meal, and 5k soybean oil. -

We

expect a tighter new-crop carryout by USDA later this summer for both corn and soybeans. The July S&D could paint a different picture if they leave the corn yield unchanged. The ending stocks in July could be upward revised for corn if demand is unchanged,

while soybeans left around unchanged. Today the harvested area was increased for corn and basically unchanged for soybeans. USDA is currently using 15 billion bushels for corn and 4.4 million for soybeans based on March intentions. We are using different

yields for the August report (USDA initial yield estimate), 177.8 for corn (lower than USDA) and 51.2 for soybeans (higher than USDA), based on the latest crop ratings. That puts our corn production around 15 billion and soybeans around 4.44 billion for August.

If this is the case, we see USDA eventually lowering corn stocks and keeping soybeans tight. We already had a tight carryout for both commodities headed into this report.

-

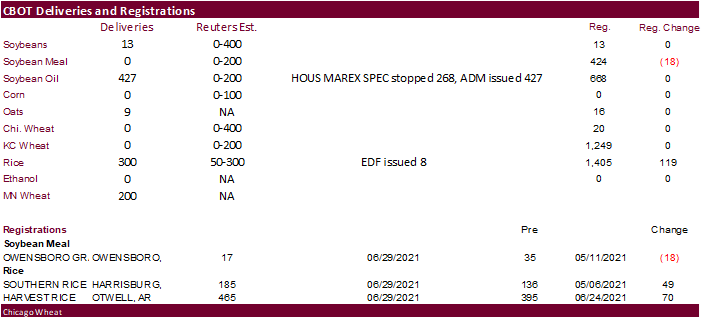

First

Notice Day deliveries were 427 for soybean oil, little higher than expected and included ADM issuing 427. Marx stopped 268. Soybean deliveries were 13 with no apparent commercial stoppers. There were no meal deliveries, as expected.

-

Argentina

producers sold 23 million tons of soybeans for the 2020-21 season (43.5MMT production), up 518,800 tons for the week, through June 23. This is down from 25.8 million tons year ago. Argentina sold 31.1 million tons of corn, about 3 million tons more than

at the same time last year. -

Yesterday

India cut their import tax on crude palm oil to 10% from 15% for three months, effective June 30. Palm oil futures settled 46MYR higher. Cash palm was up $15/ton to $3599.

-

AmSpec

estimated Malaysian palm oil exports at 1.546 million tons for the morning of June, up 8.6 percent from 1.423 million tons during May. ITS reported a 7.1% increase to 1.519 million tons. Malaysian palm production in June is pegged at around 7.5% higher

than the month before, according to one broker. -

On

Thursday NASS will release its May crush report.

- Results

awaited: Iran in for 60,000 tons of soybean meal for Aug/Sep shipment.

Soybean

oil for biofuel production during April was much lower than expected.

-

We

are starting to wonder if the delay in US soft wheat harvesting due to heavy rain across the ECB will push back second soybean crop plantings. Feedback welcome.

Updated

6/30/21

August

soybeans are seen in a $12.75-$15.00 range (up 60/50); November $11.75-$15.00 (up25/up50)

August

soybean meal – $330-$410 (up10/20); December $320-$425 (unch/up25)

August

soybean oil – 60-66; December 46-67 cent range (up 100 on back end)

- Despite

an upward revision of 385,000 acres for all-wheat plantings across the US from March intentions, US wheat ended sharply higher in all three markets, nearly equally higher (Chicago, KC, and MN), after USDA reported a less than expected June 1 all-wheat stocks

(15 million bushels below trade expectations) and sharply higher corn and soybean futures. Some weather models at midday verifies some rains projected for the northern Great Plains next week.

- We

found it interesting that USDA reported from March to June that 350,000 additional spring wheat acres were planted in North Dakota. Montana spring wheat plantings were down 300 and Minnesota off 160,000. This late in the crop season, USDA recognized 605,000

additional winter wheat plantings with largest jump in Montana, Texas, and Colorado.

- Funds

bought an estimated net 13,000 SRW wheat contracts. - Several

global export developments were reported overnight and this morning. - September

Paris wheat was up 6.50 euro at 209.25/ton.

- Turkey

saw offers for 395,000 tons of milling wheat. Shipment was sought between July 19 and Aug. 21. Reuters provided the following: - Derince

25,000 tons $264.90 11.5% - Derince

25,000 tons $265.00 11.5% - Iskenderun

2 x 25,000 tons $266.90 11.5% - Mersin

25,000 tons $264.90 11.5% - Mersin

25,000 tons $264.80 11.5% - Izmir

25,000 tons $262.80 11.5% - Izmir

25,000 tons $262.90 11.5% - Bandirma

25,000 tons $262.90 12.5% - Bandirma

25,000 tons $260.90 11.5% - Tekirdag

2 x 25,000 tons $259.15 11.5% - Samsun

2 x 25,000 tons $251.00 11.5% - Trabzon

20,000 tons $252.09 11.5% - Karasu

25,000 tons $252.90 11.5%

- South

Korean flour mills bought around 77,000 tons of milling wheat from the United States for shipment between Sept. 1 and Sept. 30. - 50,000

tons consisted of 25,760 tons of soft white wheat of 11% protein at an estimated $312.77 a ton, 1,210 tons of soft white wheat of 9% protein bought at $367.88 a ton, 5,430 tons of hard red winter of 11.5% protein bought at $283.65 a ton and 17,600 tons of

northern spring wheat of 14% minimum protein bought at $343.36 a ton. - Another

27,000 tons included 5,500 tons of soft white wheat of 11% protein, 1,100 tons of soft white wheat of 9% protein and 7,800 tons of hard red winter of 11.5% protein (same prices as above). 12,600 tons of northern spring wheat of 14% minimum protein at $345.20

a ton. - Tunisia

bought about 100,000 tons of soft wheat and 100,000 tons of barley on Wednesday, optional origin. One wheat consignment at $281.94 a ton c&f and one at $277.94 a ton c&f. Barley went for $269.98, $270.48, 271.48 a ton c&f and $271.94 a ton c&f.

- Thailand

passed on up to 197,700 tons of feed wheat, set for five consignments for shipment between Aug and Dec. Prices were regarded as too high. Lowest offer was estimated at $291 to $292 a ton c&f for about 58,000 tons for August/September shipment.

- Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. - Results

awaited: Iran seeks 60,000 tons of milling wheat on Wednesday for Aug/Sep shipment.

- Jordan

retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

- Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh

seeks 50,000 tons of rice from India.

September

Chicago wheat is seen in a $5.90-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $7.50-$9.00

(up50/up50)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.