PDF Attached

CBOT

ags rallied earlier but many markets traded two-sided by mid-morning on easing inflation fears/recession concerns, sending some prices to fresh multi month lows. Contracts closed well off session lows. Wheat sipped by afternoon trading, in part to USDA reporting

an improvement in US wheat conditions, large prospects for Canadian wheat production, and an upward revision to Ukraine’s grain crop. Recent rains across the Midwest were seen as beneficial for corn and soybeans, but both of those markets closed higher. Soybean

oil was under pressure from weakness in global vegetable prices. Palm oil futures hit a 1-year low before pairing some losses. Soybeans meal ended higher on product spreading. Look for a volatile trade for the remainder of the week.

Last

24-hours

7-day

WEATHER

TO WATCH AROUND THE WORLD

- Western

Europe will be heating up and drying out over the next ten days with a few forecast models suggesting similar conditions for two weeks - Soil

moisture is rated favorably today, but it will decline quickly in the next ten days due to warming temperatures and no rain - Winter

grains will be rushed to maturation, but protein levels could rise - Corn,

sunseed and soybean development will occur aggressively this week, but will be slowed next week and crop stress is expected to increase as the ground dries out - Unirrigated

yield potentials could fall if improved rainfall does not occur in the second half of this month - Temperatures

will rise into the upper 80s and 90s and possibly over this weekend and especially next week - Eastern

Europe benefited from some rain Tuesday, although it was not uniformly distributed - Temperatures

were still quite warm to hot in parts of the south - Greater

rain is needed and “some” will occur, but not all areas will benefit - Russia’s

Southern Region will continue in need of rain, despite a few showers in the next ten days - Temperatures

will be warm, but not excessively hot - China

will continue to be abundantly to excessively wet - Crop

conditions vary widely across the nation - Some

crops in the northeast need more sunshine - Rice

and other crop damage in southern parts of the nation was significant in June - Central

parts of the Yellow River Basin and North China Plain crop have improved with greater rainfall noted earlier this season

- China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Some

cooler biased conditions may briefly evolve in northern parts of the region - India’s

monsoon will generate waves of rain across the central two-thirds of the nation during the next ten days to two weeks - The

region will be plenty wet - Additional

rain will reach into Gujarat and Rajasthan while being heavy at times in Madhya Pradesh and Maharashtra

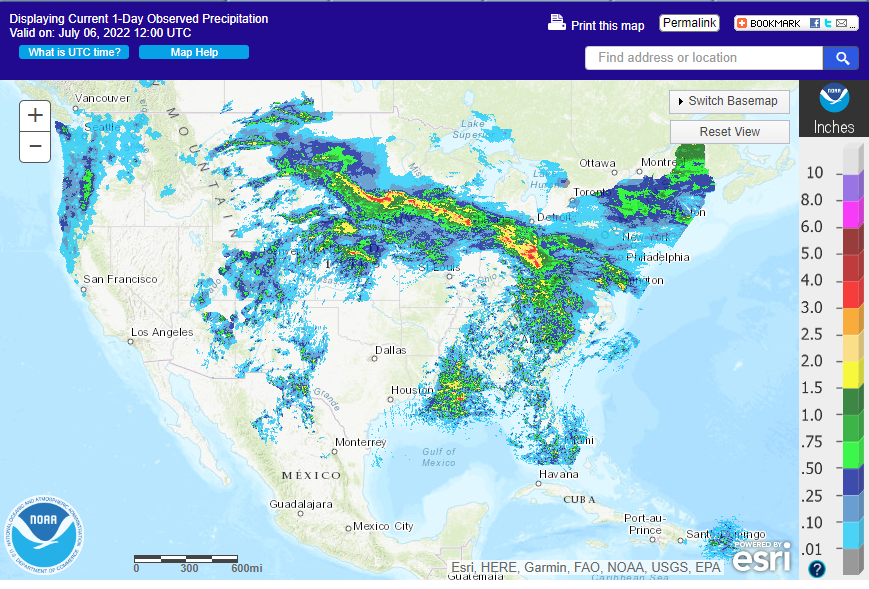

- U.S.

weather today is advertised a little drier in the second week of the outlook and there is some warming advertised briefly for late next week and into the following weekend in the Plains and western Corn Belt - No

excessive heat is expected in key crop areas - Southwestern

U.S. Corn Belt, northern and western Delta, Texas and Oklahoma as well as a few Kansas crop areas will be driest, although not completely dry, during the next ten days to two weeks - Most

of the rain will not counter evaporation very well - Hot

temperatures will continue in these areas through Friday with some cooling in the Delta and southwestern Corn Belt during the weekend while the heat continues in the southern Plains - Thunderstorms

producing significant rain and some damaging wind occurred Tuesday and early this morning from South Dakota to Ohio and more will occur tonight into Thursday from Nebraska through Iowa to Ohio and Kentucky with a few more storms Thursday night into Friday

from Nebraska to Kentucky - Rainfall

of 1.00 to 3.00 inches is expected - That

rain and the rain that occurred overnight will lead to improved soil moisture in many areas

- Crop

development improvement is likely in many areas excepting possibly the southwest

- U.S.

southern Plains will get some scattered showers over the next week to ten days, especially this weekend into next week; however, resulting rainfall will struggle to be enough to counter evaporation rates - Dryness

will continue to be an issue in all of Texas and parts of Oklahoma - U.S.

southeastern states will see a good mix of rain and sunshine during the next two weeks - Canada’s

Prairies weather may lighten up on some of the expected rainfall during the next two weeks - Southern

Alberta through western and northern Saskatchewan may see the least amount of rain while areas near the U.S. border and especially in western and northern Alberta will be wettest

- Too

much rain may impact a part of northern Alberta - Ontario

and Quebec weather has been mostly good, although southwestern Ontario is beginning to dry out and the need for greater rain is rising - Tropical

Depression Aere has moved out into the Pacific Ocean today after impacting western Japan the two previous days - The

storm poses no additional threat to land - Argentina

rainfall will be limited during the next ten days to two weeks - Some

showers will occur in this first week of the outlook over eastern parts of the nation benefiting “some” wheat areas, but more will be needed - Western

crop areas will be dry in this first week of the outlook - Week

two precipitation is not likely to bring much additional opportunity for rain to western crop areas - Recent

cold temperatures in Argentina may be limiting winter crop establishment and dryness could be doing the same - Brazil

periodic rainfall will be confined to Atlantic coastal areas and from Rio Grande do Sul to Parana and southern Paraguay during the next ten days - There

is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks - Dry

weather in Safrinha corn and cotton areas of Brazil will be good for maturation and harvest progress - Central

and eastern Queensland and parts of New South Wales, Australia received rain as expected during the long weekend with some showers lingering Tuesday

- Drier

weather is now expected for a while - Southern

Australia weather will trend a little wetter this week bringing back some welcome moisture to the region after a brief break - The

precipitation will be great for winter crop establishment - South

Korea rice areas are still dealing with a serious drought, despite some rain that fell last week.

- Some

rain is expected over the next couple of weeks, but resulting amounts will continue lighter than usual at least over the coming week to nearly ten days - Mexico’s

monsoonal rainfall will be good in the west, south and north-central parts of the nation during the coming two weeks - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for far southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding is possible in the Philippines, New Guinea and Myanmar - Mainland

areas of Southeast Asia will continue to get lighter than usual rainfall, but sufficient amounts will occur to support crops - There

is need for greater rain to improve water supply later in the year - Sumatra

rainfall and parts of peninsular Malaysia will experience lighter than usual precipitation in this coming week to ten days - East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normal dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - South

Africa’s crop moisture situation is favorable for winter crop emergence, although some additional rain might be welcome - Some

rain will fall in the southwestern crop areas into Wednesday followed by some drying until early next week at which time additional rain is expected - Winter

crops will continue to establish well. - Central

America rainfall will be abundant during the next ten days - Today’s

Southern Oscillation Index was +16.23 and it will move erratically lower during the coming week - New

Zealand rainfall will trend wetter this week

Source:

World Weather INC

Wednesday,

July 6:

- UN

annual state of food security report

Thursday,

July 7:

- EIA

weekly U.S. ethanol inventories, production, 11am - Vietnam’s

customs department releases coffee, rice and rubber export data for June - Brazil’s

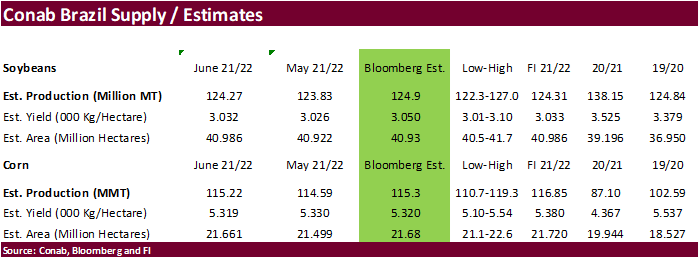

Conab releases data on area, yield and output of corn and soybeans

Friday,

July 8:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- FAO

world food price index, grains supply and demand outlook - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Due

out Thursday

Macros

96

Counterparties Take $2.168 Tln At Fed Reverse Repo Op (prev $2.138 Tln, 96 Bids)

Large

Crude Unit At Total’s Port Arthur Texas Refinery Restarted – RTRS Sources

POLL:

BoC To Raise Overnight Rate To 3.25% By End-2022 (Vs 2.50% In May Poll) – RTRS

Goldman

Sachs: Oil Selloff Driven By Growing Recession Fears In Face Of Low Trading Liquidity, Exacerbated By Technical

US

ISM Non-Mfg PMI Jun: 55.3 (est 54.3; prev 55.9)

–

Biz. Activity: 56.1 (est 54.0; prev 54.5)

–

Employment: 47.4 (prev 50.2)

–

New Orders: 55.6 (prev 57.6)

–

Prices Paid: 80.1 (prev 82.1)

US

JOLTs Job Openings May: 11.254M (est 11.000M; prev R 11.681M)

FOMC:

Fed Officials Saw 50bps Or 75bps Hike At Jul FOMC As Likely – Minutes

–

Officials ‘Highly Attentive’ To Inflation Risks

–

George Was The Only Official Not To Back 75Bps In Jun

–

Most Fed Officials Saw Growth Risks Skewed To Downside

–

Likely To Take Some Time For Inflation To Move Down To 2%

–

Officials Recognized Policy Could Slow Growth For A Time

–

Many Concerned Long-Run Price Expectations Could Drift Up

–

Almost All Officials Backed Raising Rates 75bps At Jun FOMC

–

‘Even More Restrictive’ Policy Possible In Time

–

Many Officials Saw Significant Risk Of Entrenched Inflation

·

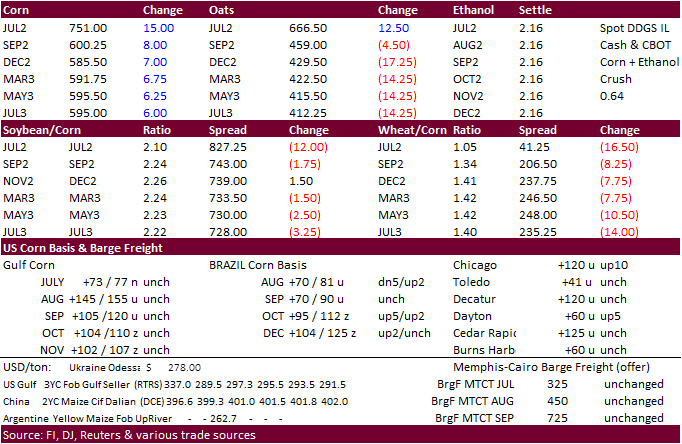

September corn traded tow-sided, touching it lowest level since February 4th before rallying to close 7.50 cents higher. Technical buying was noted. We heard China was in for US OND corn.

·

The USD is higher again. WTI crude oil turned lower. Brent crude fell below $100/barrel for the first time since late April.

·

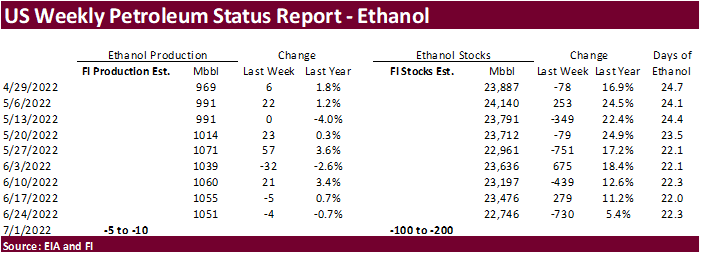

A Bloomberg poll looks for weekly US ethanol production to be down 4,000 barrels to 1047 thousand (1036-1058 range) from the previous week and stocks up 52,000 barrels to 22.798 million.

·

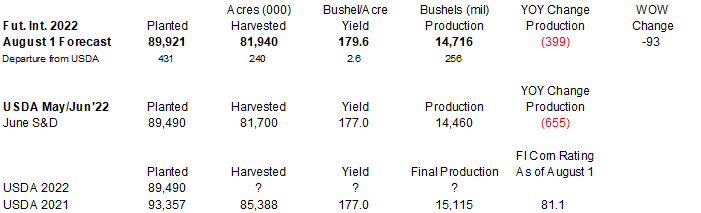

We lowered our US corn yield to 179.6 bushels per acre versus 180.1 previously. After adjusting to USDA’s June harvested area, we lowered our production by 93 million bushels to 14.716 billion, 256 million above USDA’s June S&D

estimate. There is a slight chance USDA could adjust their July US corn yield, but at this point we think they will leave their 177.0 estimate unchanged. The first NASS survey for the US yield will be the August report. In that report, they may adjust plantings

for MN, ND, and SD.

·

South Korea’s MFG bought 140,000 tons of corn for November arrival at $321.49 and 321.00 per ton.

The

2021 Crop Insurance Loss Performance

Schnitkey,

G., C. Zulauf, K. Swanson, N. Paulson and J. Baltz. “The 2021 Crop Insurance Loss Performance.” farmdoc daily (12):100, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 5, 2022.

https://farmdocdaily.illinois.edu/2022/07/the-2021-crop-insurance-loss-performance.html

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range (lowered 75 front end and 25 on back end)